|

|

市場調査レポート

商品コード

1147399

クラウドマネージドサービスの世界市場:サービスの種類別 (マネージドビジネス、マネージドネットワーク、マネージドセキュリティ、マネージドインフラ、マネージドモビリティ)・組織規模別・業種別 (BFSI、通信、小売業・消費財、IT)・地域別の将来予測 (2027年まで)Cloud Managed Services Market by Service Type (Managed Business, Managed Network, Managed Security, Managed Infrastructure, Managed Mobility), Organization Size, Vertical (BFSI, Telecom, Retail & Consumer Goods, IT) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| クラウドマネージドサービスの世界市場:サービスの種類別 (マネージドビジネス、マネージドネットワーク、マネージドセキュリティ、マネージドインフラ、マネージドモビリティ)・組織規模別・業種別 (BFSI、通信、小売業・消費財、IT)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年10月21日

発行: MarketsandMarkets

ページ情報: 英文 293 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のクラウドマネージドサービスの市場規模は、2022年の990億米ドルから2027年には1,640億米ドルへと、予測期間中に10.6%のCAGRで拡大すると予測されています。

リモートワーク環境を備えたクラウドサービスへの技術革新と投資の拡大が、クラウドマネージドサービス市場の成長を後押ししています。

"予測期間中、マネージドインフラサービスがより大きな市場規模を占める"

AI、IoT、アナリティクス、クラウド、コグニティブコンピューティングなどの技術動向が、新しいビジネスモデル、市場投入までの時間短縮、個別化された顧客体験を提供するためのビジネスプロセスの最適化に対する需要を促進しています。企業のITインフラをビジネス要件に整合させることは、デジタル化における大きなステップです。ITインフラの管理は、機動的なインフラや従業員の生産性向上、顧客体験の改善、セキュリティ・コンプライアンスの強化につながります。

"2022年、業界別では銀行・金融サービス・保険 (BFSI) が最大の市場シェアを占める"

クラウドコンピューティングは、DXに不可欠な要素です。当初はDXの選択を躊躇していたBFSI業界は、現在、クラウドサービスのメリットを受け入れています。クラウドサービスは、顧客関係管理、規制遵守、オムニチャネルバンキング、オープンバンキング業務などのメリットを提供します。これらの利点により、BFSI企業はクラウドへの移行をデジタル変革戦略に取り入れるようになっています。技術革新の進展により、クラウドマネージドサービスプロバイダーがBFSI業界にカスタム型サービスを提供する機会が生まれるものと思われます。

"2022年、北米がクラウドマネージドサービス市場で最大の市場シェアを占める"

北米では、クラウドマネージドサービスの採用をサポートする、よく整備された高度なインフラを備えています。また、この地域は革新的な技術をいち早く採用しています。インターネットの普及率が高いことが、同地域のクラウドベースのアプリケーションの需要を促進しています。

当レポートでは、世界のクラウドマネージドサービスの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、サービスの種類別・組織規模別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- COVID-19が市場力学に与える影響

- 促進要因と機会

- 抑制要因と課題

- サプライチェーン分析

- エコシステム

- 技術分析

- ビッグデータ・アナリティクス

- 人工知能 (AI)

- 機械学習 (ML)

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 主な会議とイベント (2022年~2023年)

- 関税・規制の状況

- 顧客に影響を与えるトレンド/混乱

- 主な利害関係者と購入基準

第6章 クラウドマネージドサービス市場:サービスの種類別

- イントロダクション

- マネージドセキュリティサービス

- マネージドネットワークサービス

- マネージドネットワークプロビジョニング

- マネージドネットワーク監視・管理

- マネージドインフラサービス

- マネージドC&C (コミュニケーション・コラボレーション) サービス

- マネージドモビリティサービス

- マネージドビジネスサービス

第7章 クラウドマネージドサービス市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第8章 クラウドマネージドサービス市場:業種別

- イントロダクション

- 銀行・金融サービス・保険 (BFSI)

- 通信

- IT (情報技術)

- 政府・公共部門

- 医療・ライフサイエンス

- 小売業・消費財

- 製造業

- エネルギー・ユーティリティ

- その他の業種

第9章 クラウドマネージドサービス市場:地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 他のアジア太平洋諸国

- 中東・アフリカ

- サウジアラビア

- 他の中東・アフリカ諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第10章 競合情勢

- 概要

- 市場評価フレームワーク

- 主要企業が採用した戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業評価クアドラント

- 主要企業のランキング

- スタートアップ/中小企業の評価マトリックス

- 主な市場動向

- 製品リリース・機能強化

- 資本取引

- その他

第11章 企業プロファイル

- 主要企業

- IBM

- ERICSSON

- CISCO

- FUJITSU

- ACCENTURE

- AWS

- NTT DATA

- INFOSYS

- HPE

- NEC

- ATOS

- TCS

- WIPRO

- DATACOM

- AT&T

- HCL TECHNOLOGIES

- CDW CORPORATION

- HUAWEI

- NOKIA

- RACKSPACE

- CONNECTRIA

- DLT SOLUTIONS

- SOFTCHOICE

- CLOUDNEXA

- 中小企業/スタートアップ

- BESPIN GLOBAL

- CLOUDTICITY

- 2ND WATCH

- ISMILE TECHNOLOGIES

- CLOUD4C

- MISSION CLOUD SERVICES

- CLOUDNOW

- ZEDEDA

- HAZELCAST

第12章 隣接市場

- イントロダクション

- マネージドサービス市場

第13章 付録

The Cloud managed services market size is expected to grow from USD 99.0 billion in 2022 to USD 164.0 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 10.6% during the forecast period. Growing innovation and investment in cloud services with the remote working environment is boosting the growth of the cloud managed services market.

Managed infrastructure services to account for a larger market size during the forecast period.

Technology trends such AI, IoT, analytics, cloud, and cognitive computing are driving the demand for new business models, reduced time to market, and optimizing businesses processes to deliver personalized customer experiences. Aligning enterprise IT infrastructure with business requirements is a major step in digitalization. IT infrastructure management results in agile infrastructure, higher employee productivity, enhanced customer experience, and greater security and compliance.

BFSI industry vertical to hold largest market share in 2022

Cloud computing is a critical element of digital transformation. The BFSI vertical, which was initially hesitant to opt for digital transformation, is now embracing the benefits of cloud services. It is offering benefits such as customer relationship management, regulatory compliance, omnichannel banking, and open banking operations. These benefits are driving BFSI ¬firms to incorporate cloud migration into their digital transformation strategies. Banks specializing in cards, wealth management, and investment services are introducing features like digital identity, behavioral biometrics, push notifications, e-wallets, and QR payments using the IaaS and PaaS models on private cloud. For instance, a leading Norwegian bank adopted the PaaS model on public cloud to transform its peer-to-peer mobile payment application. Thus, the growing technological revolution will create several opportunities for cloud managed service providers to offer customized services to the BFSI vertical.

North America to hold largest market share of cloud managed services market in 2022

North America comprises the US and Canada. The region has a well-developed and advanced infrastructure that supports the adoption of cloud managed services. It is also an early adopter of innovative technologies. The high internet penetration is driving the demand for cloud-based applications in the region. According to Statista, in 2021, North America had approximately 417 million internet users and this figure is expected to reach 448.55 million by 2026. Further, MSPs in the region will be able to utilize other emerging growth opportunities such as cyber security, IT infrastructure, business applications, communication and collaboration services by enhancing their service portfolios and offering end to end ICT services. This is likely to boost the cloud managed services market in North America.

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews were conducted with the key people. The breakup of the profiles of the primary participants is as follows:

- By Company Type: Tier I: 42%, Tier II: 24%, and Tier III: 34%

- By Designation: C-Level: 28%, D-Level: 38%, and Others: 34%

- By Region: North America: 41%, Europe: 22%, Asia Pacific: 19%, Row: 18%

The report profiles the various key players including IBM (US), Ericsson (Sweden), Cisco (US), Fujitsu (Japan), Accenture (Ireland), AWS (US), NTT DATA (Japan), Infosys (India), HPE (US), NEC (Japan), Atos (France), TCS (India), Wipro (India), Datacom (New Zealand), AT&T (US), HCL Technologies (India), CDW Corporation (US), Huawei (China), Nokia (Finland), Rackspace (US), Connectria (US), DLT Solutions (US), Softchoice (Canada), Cloudnexa (US), Bespin Global (South Korea), Cloudticity (US), 2 nd Watch (US), iSmile Technologies(US), Cloud4C(Singapore), Mission Cloud Services (US), and CloudNow (India).

Research Coverage

The report segments the Cloud managed services market by service type, (SMEs, large enterprises), vertical, and regions. The service type segment includes managed security services, managed network services, managed infrastructure services, managed communication & collaboration services, managed mobility services, and managed business services.

Based on managed security services the market is segmented as managed identity & access management, managed antivirus/anti-malware, managed firewall, managed risk & compliance management, managed vulnerability management, managed security information & event management, managed intrusion detection system/intrusion prevention system, managed data loss prevention, and other managed security services (DDoS mitigation, managed encryption, and managed Unified Threat Management (UTM)).

Managed network services are further segmented into managed network provisioning, and network monitoring & management. Managed infrastructure services are further segmented into server management, storage management, and managed print services.

This report classifies the managed communication & collaboration services segment into managed voice over internet protocol (VoIP), and managed unified communication as a service (UCaaS). Managed mobility services are segmented into device management services and application management services. Managed business services is segmented into considers business process services, continuity & disaster recovery services, and other managed business services(desktop, and OSS/BSS).

The market is segmented based on organization sizes as SMEs and large enterprises. Different industry verticals using cloud managed services include BFSI, telecom, IT, government & public sector, healthcare & life sciences, retail & consumer goods, manufacturing, energy & utilities, and other verticals.

The geographic analysis of the cloud managed services market is spread across five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in the cloud managed services market with information on the closest approximations of the revenue numbers for the overall cloud managed services market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 CLOUD MANAGED SERVICES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary interviews

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- TABLE 2 PRIMARY RESPONDENTS: CLOUD MANAGED SERVICES MARKET

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 CLOUD MANAGED SERVICES MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF CLOUD MANAGED SERVICES FROM VENDORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF CLOUD MANAGED SERVICE VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY ̶ BOTTOM-UP APPROACH: REVENUE GENERATED BY CLOUD MANAGED SERVICE VENDORS FROM EACH SERVICE TYPE

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM DIFFERENT SERVICE TYPES

- 2.4 MARKET FORECAST

- TABLE 3 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 GLOBAL CLOUD MANAGED SERVICES MARKET, 2019-2027 (USD MILLION)

- FIGURE 10 FASTEST-GROWING SEGMENTS IN CLOUD MANAGED SERVICES MARKET, 2022-2027

- FIGURE 11 MANAGED INFRASTRUCTURE SERVICES SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 12 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 13 TOP VERTICALS IN CLOUD MANAGED SERVICES MARKET

- FIGURE 14 CLOUD MANAGED SERVICES MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF CLOUD MANAGED SERVICES MARKET

- FIGURE 15 NEED TO FOCUS ON CORE BUSINESS AND INCREASING RETURN ON INVESTMENT TO DRIVE ADOPTION OF CLOUD MANAGED SERVICES

- 4.2 CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2022 VS. 2027

- FIGURE 16 MANAGED INFRASTRUCTURE SERVICES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

- FIGURE 17 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.4 CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2022 VS. 2027

- FIGURE 18 BFSI SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 CLOUD MANAGED SERVICES MARKET: REGIONAL SCENARIO, 2022-2027

- FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 MARKET DYNAMICS: CLOUD MANAGED SERVICES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increased cloud adoption during COVID-19 pandemic

- FIGURE 21 YEAR-ON-YEAR SPENDING OF OVER USD 1.2 MILLION FOR SMALL AND MEDIUM-SIZED BUSINESSES

- 5.2.1.2 Growing demand for cloud managed services among enterprises

- FIGURE 22 BENEFITS OF CLOUD SERVICE PROVIDERS

- 5.2.1.3 Inadequate cloud expertise among IT professionals

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of infrastructure in developing and underdeveloped economies

- FIGURE 23 STATE OF MOBILE INTERNET CONNECTIVITY, BY REGION, 2020

- 5.2.2.2 Data security and privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption of cloud managed services by SMEs

- 5.2.3.2 Growth in Anything-as-a-Service technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Increase in regulations and compliances

- 5.2.4.2 Integration with third-party applications

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: ERICSSON HELPS NEWPORT UTILITIES BRING HIGH-SPEED BROADBAND TO RURAL COMMUNITIES

- 5.3.2 CASE STUDY 2: INFOSYS CLOUD MANAGED SERVICES INCREASE GLOBAL FOOTPRINT OF RETAIL ENTERPRISE

- 5.3.3 CASE STUDY 3: AWS MANAGED SERVICES HELP FIELDCORE DRIVE INNOVATION IN BUSINESS OPERATIONS

- 5.3.4 CASE STUDY 4: COGNIZANT CLOUD SERVICES FACILITATE DIGITAL TRANSFORMATION FOR OXFORD UNIVERSITY PRESS

- 5.4 IMPACT OF COVID-19 ON MARKET DYNAMICS

- 5.4.1 DRIVERS AND OPPORTUNITIES

- 5.4.2 RESTRAINTS AND CHALLENGES

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 24 CLOUD MANAGED SERVICES MARKET: SUPPLY CHAIN

- 5.6 ECOSYSTEM

- FIGURE 25 CLOUD MANAGED SERVICES MARKET: ECOSYSTEM

- 5.7 TECHNOLOGICAL ANALYSIS

- 5.7.1 BIG DATA AND ANALYTICS

- 5.7.2 ARTIFICIAL INTELLIGENCE

- 5.7.3 MACHINE LEARNING

- 5.8 PRICING ANALYSIS

- TABLE 4 PRICING ANALYSIS OF VENDORS IN CLOUD MANAGED SERVICES MARKET: FILECLOUD

- TABLE 5 PRICING ANALYSIS OF VENDORS IN CLOUD MANAGED SERVICES MARKET: EARLYDOG

- 5.9 PATENT ANALYSIS

- FIGURE 26 NUMBER OF PATENTS PUBLISHED, 2012-2022

- FIGURE 27 TOP FIVE PATENT OWNERS (GLOBAL)

- TABLE 6 TOP TEN PATENT APPLICANTS (UNITED STATES)

- TABLE 7 CLOUD MANAGED SERVICES MARKET: PATENTS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 CLOUD MANAGED SERVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 CLOUD MANAGED SERVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 DEGREE OF COMPETITION

- 5.10.2 BARGAINING POWER OF SUPPLIERS

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 THREAT OF NEW ENTRANTS

- 5.10.5 THREAT OF SUBSTITUTES

- 5.11 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 9 CLOUD MANAGED SERVICES MARKET: KEY CONFERENCES AND EVENTS

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATIONS

- 5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 29 CLOUD MANAGED SERVICES MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR END USERS

- TABLE 15 KEY BUYING CRITERIA FOR END USERS

6 CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- 6.1.1 SERVICE TYPE: CLOUD MANAGED SERVICES MARKET DRIVERS

- 6.1.2 SERVICE TYPE: COVID-19 IMPACT

- FIGURE 32 MANAGED COMMUNICATION & COLLABORATION SERVICES SEGMENT EXPECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 CLOUD MANAGED SERVICES MARKET SIZE, BY SERVICE TYPE, 2018-2021 (USD MILLION)

- TABLE 17 CLOUD MANAGED SERVICES MARKET SIZE, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- 6.2 MANAGED SECURITY SERVICES

- 6.2.1 GROWING NEED FOR THREAT MANAGEMENT AND DATA PROTECTION

- FIGURE 33 MANAGED IDENTITY & ACCESS MANAGEMENT SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 18 CLOUD MANAGED SERVICES MARKET SIZE, BY MANAGED SECURITY SERVICE, 2018-2021 (USD MILLION)

- TABLE 19 CLOUD MANAGED SERVICES MARKET SIZE, BY MANAGED SECURITY SERVICE, 2022-2027 (USD MILLION)

- 6.2.1.1 Managed Identity & Access Management

- TABLE 20 MANAGED IDENTITY & ACCESS MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 21 MANAGED IDENTITY & ACCESS MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1.2 Managed Antivirus/Anti-malware

- TABLE 22 MANAGED ANTIVIRUS/ANTI-MALWARE: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 23 MANAGED ANTIVIRUS/ANTI-MALWARE: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1.3 Managed Firewall

- TABLE 24 MANAGED FIREWALL: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 25 MANAGED FIREWALL: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1.4 Managed Risk & Compliance Management

- TABLE 26 MANAGED RISK & COMPLIANCE MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 27 MANAGED RISK & COMPLIANCE MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1.5 Managed Vulnerability Management

- TABLE 28 MANAGED VULNERABILITY MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 29 MANAGED VULNERABILITY MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1.6 Managed Security Information & Event Management

- TABLE 30 MANAGED SECURITY INFORMATION & EVENT MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 MANAGED SECURITY INFORMATION & EVENT MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1.7 Managed Intrusion Detection System/Intrusion Prevention System

- TABLE 32 MANAGED INTRUSION DETECTION SYSTEM/INTRUSION PREVENTION SYSTEM: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 33 MANAGED INTRUSION DETECTION SYSTEM/INTRUSION PREVENTION SYSTEM: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1.8 Managed Data Loss Prevention

- TABLE 34 MANAGED DATA LOSS PREVENTION: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 MANAGED DATA LOSS PREVENTION: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1.9 Other Managed Security Services

- TABLE 36 OTHER MANAGED SECURITY SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 37 OTHER MANAGED SECURITY SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 MANAGED NETWORK SERVICES

- 6.3.1 NEED TO OPTIMIZE NETWORK PERFORMANCE TO MEET INDUSTRY STANDARDS

- FIGURE 34 MANAGED NETWORK MONITORING & MANAGEMENT SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 38 CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2018-2021 (USD MILLION)

- TABLE 39 CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2022-2027 (USD MILLION)

- 6.3.2 MANAGED NETWORK PROVISIONING

- TABLE 40 MANAGED NETWORK PROVISIONING: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 41 MANAGED NETWORK PROVISIONING: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.3 MANAGED NETWORK MONITORING & MANAGEMENT

- TABLE 42 MANAGED NETWORK MONITORING & MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 MANAGED NETWORK MONITORING & MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 MANAGED INFRASTRUCTURE SERVICES

- 6.4.1 GROWTH IN DIGITAL TECHNOLOGIES TO BUILD NEW BUSINESS MODELS

- FIGURE 35 SERVER MANAGEMENT SERVICES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 44 CLOUD MANAGED SERVICES MARKET SIZE, BY MANAGED INFRASTRUCTURE SERVICES, 2018-2021 (USD MILLION)

- TABLE 45 CLOUD MANAGED SERVICES MARKET SIZE, BY MANAGED INFRASTRUCTURE SERVICES, 2022-2027 (USD MILLION)

- TABLE 46 MANAGED INFRASTRUCTURE SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 MANAGED INFRASTRUCTURE SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

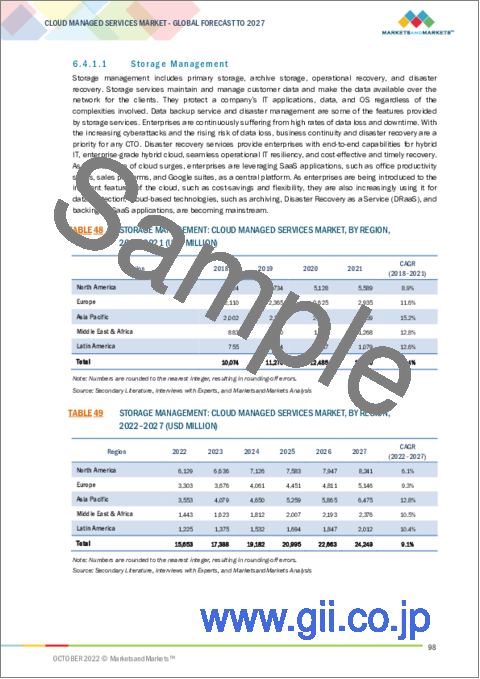

- 6.4.1.1 Storage Management

- TABLE 48 STORAGE MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 49 STORAGE MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4.1.2 Server Management

- TABLE 50 SERVER MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 SERVER MANAGEMENT: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4.1.3 Managed Print Services

- TABLE 52 MANAGED PRINT SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 53 MANAGED PRINT SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 MANAGED COMMUNICATION & COLLABORATION SERVICES

- 6.5.1 NEED FOR INTERCONNECTED SYSTEMS TO SUPPORT COLLABORATIVE WORKING

- FIGURE 36 MANAGED UNIFIED COMMUNICATION AS A SERVICE SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 54 CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2018-2021 (USD MILLION)

- TABLE 55 CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2022-2027 (USD MILLION)

- 6.5.1.1 Managed Voice Over Internet Protocol

- TABLE 56 MANAGED VOICE OVER INTERNET PROTOCOL: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 57 MANAGED VOICE OVER INTERNET PROTOCOL: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5.1.2 Managed Unified Communication as a Service

- TABLE 58 MANAGED UNIFIED COMMUNICATION AS A SERVICE: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 59 MANAGED UNIFIED COMMUNICATION AS A SERVICE: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.6 MANAGED MOBILITY SERVICES

- 6.6.1 GROWING ADOPTION OF MOBILE DEVICES TO ENHANCE BUSINESS PRODUCTIVITY

- FIGURE 37 APPLICATION MANAGEMENT SERVICES TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 60 CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2018-2021 (USD MILLION)

- TABLE 61 CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2022-2027 (USD MILLION)

- 6.6.1.1 Device Management Services

- TABLE 62 DEVICE MANAGEMENT SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 63 DEVICE MANAGEMENT SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.6.1.2 Application Management Services

- TABLE 64 APPLICATION MANAGEMENT SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 65 APPLICATION MANAGEMENT SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.7 MANAGED BUSINESS SERVICES

- 6.7.1 NEED TO IMPROVE EFFICIENCY AND EFFECTIVENESS OF BUSINESS OPERATIONS

- FIGURE 38 CONTINUITY & DISASTER RECOVERY SERVICES TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 66 CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2018-2021 (USD MILLION)

- TABLE 67 CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2022-2027 (USD MILLION)

- 6.7.1.1 Business Process Services

- TABLE 68 BUSINESS PROCESS SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 69 BUSINESS PROCESS SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.7.1.2 Continuity & Disaster Recovery Services

- TABLE 70 CONTINUITY & DISASTER RECOVERY SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 71 CONTINUITY & DISASTER RECOVERY SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.7.1.3 Other Managed Business Services

- TABLE 72 OTHER MANAGED BUSINESS SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 73 OTHER MANAGED BUSINESS SERVICES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

7 CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE

- 7.1 INTRODUCTION

- 7.1.1 ORGANIZATION SIZE: CLOUD MANAGED SERVICES MARKET DRIVERS

- 7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

- TABLE 74 CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 75 CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 7.2 LARGE ENTERPRISES

- 7.2.1 GROWING NEED TO DIGITALIZE AND UPGRADE BUSINESS PROCESSES

- TABLE 76 LARGE ENTERPRISES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 77 LARGE ENTERPRISES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 7.3.1 INCREASING IT SPEND TO MANAGE BUSINESS OPERATIONS

- TABLE 78 SMALL AND MEDIUM-SIZED ENTERPRISES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 79 SMALL AND MEDIUM-SIZED ENTERPRISES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

8 CLOUD MANAGED SERVICES MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: CLOUD MANAGED SERVICES MARKET DRIVERS

- 8.1.2 VERTICAL: COVID-19 IMPACT

- TABLE 80 CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 81 CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 8.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 8.2.1 RISING NEED FOR DIGITAL TRANSFORMATION AND IMPROVED CUSTOMER EXPERIENCE

- TABLE 82 BFSI: CLOUD MANAGED SERVICES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 83 BFSI: CLOUD MANAGED SERVICES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 8.3 TELECOM

- 8.3.1 DEMAND FOR TECHNOLOGICAL INNOVATION TO PROVIDE PERSONALIZED SERVICES

- TABLE 84 TELECOM: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 85 TELECOM: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 INFORMATION TECHNOLOGY

- 8.4.1 NEED FOR COMPETITIVE SOLUTIONS TO INCREASE MARKET PRESENCE

- TABLE 86 INFORMATION TECHNOLOGY: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 87 INFORMATION TECHNOLOGY: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.5 GOVERNMENT & PUBLIC SECTOR

- 8.5.1 RISING REQUIREMENT FOR TRANSFORMATION OF PUBLIC SECTOR INFRASTRUCTURE

- TABLE 88 GOVERNMENT & PUBLIC SECTOR: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 89 GOVERNMENT & PUBLIC SECTOR: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.6 HEALTHCARE & LIFE SCIENCES

- 8.6.1 USE OF CLOUD COMPUTING TO MANAGE PATIENT RECORDS

- TABLE 90 HEALTHCARE & LIFE SCIENCES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 91 HEALTHCARE & LIFE SCIENCES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.7 RETAIL & CONSUMER GOODS

- 8.7.1 DEMAND FOR IMPROVED END USER EXPERIENCE

- TABLE 92 RETAIL & CONSUMER GOODS: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 93 RETAIL & CONSUMER GOODS: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.8 MANUFACTURING

- 8.8.1 GROWING USE OF CLOUD SERVICES TO MANAGE CRITICAL BUSINESS OPERATIONS

- TABLE 94 MANUFACTURING: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 95 MANUFACTURING: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.9 ENERGY & UTILITIES

- 8.9.1 INCREASING NEED TO REDUCE COMPLEXITY OF TECHNOLOGIES

- TABLE 96 ENERGY & UTILITIES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 97 ENERGY & UTILITIES: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.10 OTHER VERTICALS

- TABLE 98 OTHER VERTICALS: CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 99 OTHER VERTICALS: CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

9 CLOUD MANAGED SERVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.1.1 CLOUD MANAGED SERVICES MARKET: COVID-19 IMPACT

- FIGURE 41 NORTH AMERICA EXPECTED TO LEAD CLOUD MANAGED SERVICES MARKET IN 2022

- FIGURE 42 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 100 CLOUD MANAGED SERVICES MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 101 CLOUD MANAGED SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- TABLE 102 NORTH AMERICA: PESTLE ANALYSIS

- 9.2.1 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET DRIVERS

- FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 103 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2018-2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 105 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED SECURITY SERVICES, 2018-2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED SECURITY SERVICES, 2022-2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2018-2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2022-2027 (USD MILLION)

- TABLE 109 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED INFRASTRUCTURE SERVICES, 2018-2021 (USD MILLION)

- TABLE 110 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED INFRASTRUCTURE SERVICES, 2022-2027 (USD MILLION)

- TABLE 111 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2018-2021 (USD MILLION)

- TABLE 112 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2022-2027 (USD MILLION)

- TABLE 113 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2018-2021 (USD MILLION)

- TABLE 114 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2022-2027 (USD MILLION)

- TABLE 115 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2018-2021 (USD MILLION)

- TABLE 116 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2022-2027 (USD MILLION)

- TABLE 117 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 118 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 119 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 120 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 121 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 122 NORTH AMERICA: CLOUD MANAGED SERVICES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Presence of cloud managed service providers to drive market growth

- TABLE 123 US: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 124 US: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Technological advancements to fuel adoption of cloud managed services

- TABLE 125 CANADA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 126 CANADA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.3 EUROPE

- TABLE 127 EUROPE: PESTLE ANALYSIS

- 9.3.1 EUROPE: CLOUD MANAGED SERVICES MARKET DRIVERS

- TABLE 128 EUROPE: CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2018-2021 (USD MILLION)

- TABLE 129 EUROPE: CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 130 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED SECURITY SERVICES, 2018-2021 (USD MILLION)

- TABLE 131 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED SECURITY SERVICES, 2022-2027 (USD MILLION)

- TABLE 132 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2018-2021 (USD MILLION)

- TABLE 133 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2022-2027 (USD MILLION)

- TABLE 134 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED INFRASTRUCTURE SERVICES, 2018-2021 (USD MILLION)

- TABLE 135 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED INFRASTRUCTURE SERVICES, 2022-2027 (USD MILLION)

- TABLE 136 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2018-2021 (USD MILLION)

- TABLE 137 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2022-2027 (USD MILLION)

- TABLE 138 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2018-2021 (USD MILLION)

- TABLE 139 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2022-2027 (USD MILLION)

- TABLE 140 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2018-2021 (USD MILLION)

- TABLE 141 EUROPE: CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2022-2027 (USD MILLION)

- TABLE 142 EUROPE: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 143 EUROPE: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 144 EUROPE: CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 145 EUROPE: CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 146 EUROPE: CLOUD MANAGED SERVICES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 147 EUROPE: CLOUD MANAGED SERVICES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Growing adoption of cloud and AI technologies to boost demand for cloud managed services

- TABLE 148 UK: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 149 UK: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.3.3 GERMANY

- 9.3.3.1 High demand for cloud managed services among startups

- TABLE 150 GERMANY: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 151 GERMANY: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.3.4 REST OF EUROPE

- TABLE 152 REST OF EUROPE: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 153 REST OF EUROPE: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- TABLE 154 ASIA PACIFIC: PESTLE ANALYSIS

- 9.4.1 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET DRIVERS

- FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 155 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2018-2021 (USD MILLION)

- TABLE 156 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 157 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED SECURITY SERVICES, 2018-2021 (USD MILLION)

- TABLE 158 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED SECURITY SERVICES, 2022-2027 (USD MILLION)

- TABLE 159 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2018-2021 (USD MILLION)

- TABLE 160 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2022-2027 (USD MILLION)

- TABLE 161 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED INFRASTRUCTURE SERVICES, 2018-2021 (USD MILLION)

- TABLE 162 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED INFRASTRUCTURE SERVICES, 2022-2027 (USD MILLION)

- TABLE 163 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2018-2021 (USD MILLION)

- TABLE 164 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2022-2027 (USD MILLION)

- TABLE 165 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2018-2021 (USD MILLION)

- TABLE 166 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2022-2027 (USD MILLION)

- TABLE 167 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2018-2021 (USD MILLION)

- TABLE 168 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2022-2027 (USD MILLION)

- TABLE 169 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 170 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 171 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 172 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 173 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 174 ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Rising need across organizations to secure data on cloud platforms

- TABLE 175 CHINA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 176 CHINA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Migration to cloud by enterprises expected to boost market

- TABLE 177 JAPAN: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 178 JAPAN: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.4.4 REST OF ASIA PACIFIC

- TABLE 179 REST OF ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.5 MIDDLE EAST & AFRICA

- TABLE 181 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

- 9.5.1 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET DRIVERS

- TABLE 182 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2018-2021 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED SECURITY SERVICES, 2018-2021 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED SECURITY SERVICES, 2022-2027 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2018-2021 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2022-2027 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED INFRASTRUCTURE SERVICES, 2018-2021 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED INFRASTRUCTURE SERVICES, 2022-2027 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2018-2021 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2022-2027 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2018-2021 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2022-2027 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2018-2021 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2022-2027 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.5.2 KSA

- 9.5.2.1 Government initiatives expected to boost market

- TABLE 202 KSA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 203 KSA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- TABLE 204 REST OF MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.6 LATIN AMERICA

- TABLE 206 LATIN AMERICA: PESTLE ANALYSIS

- 9.6.1 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET DRIVERS

- TABLE 207 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2018-2021 (USD MILLION)

- TABLE 208 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 209 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED SECURITY SERVICES, 2018-2021 (USD MILLION)

- TABLE 210 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED SECURITY SERVICES, 2022-2027 (USD MILLION)

- TABLE 211 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2018-2021 (USD MILLION)

- TABLE 212 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED NETWORK SERVICES, 2022-2027 (USD MILLION)

- TABLE 213 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED INFRASTRUCTURE SERVICES, 2018-2021 (USD MILLION)

- TABLE 214 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED INFRASTRUCTURE SERVICES, 2022-2027 (USD MILLION)

- TABLE 215 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2018-2021 (USD MILLION)

- TABLE 216 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED COMMUNICATION & COLLABORATION SERVICES, 2022-2027 (USD MILLION)

- TABLE 217 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2018-2021 (USD MILLION)

- TABLE 218 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED MOBILITY SERVICES, 2022-2027 (USD MILLION)

- TABLE 219 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2018-2021 (USD MILLION)

- TABLE 220 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY MANAGED BUSINESS SERVICES, 2022-2027 (USD MILLION)

- TABLE 221 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 222 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 223 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 224 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 225 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 226 LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.6.2 BRAZIL

- 9.6.2.1 Expanding cloud computing market to drive spending on cloud managed services

- TABLE 227 BRAZIL: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 228 BRAZIL: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.6.3 MEXICO

- 9.6.3.1 Expansion plans of global cloud managed service vendors to drive market

- TABLE 229 MEXICO: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 230 MEXICO: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.6.4 REST OF LATIN AMERICA

- TABLE 231 REST OF LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 232 REST OF LATIN AMERICA: CLOUD MANAGED SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 MARKET EVALUATION FRAMEWORK

- FIGURE 45 MARKET EVALUATION FRAMEWORK, 2020-2022

- 10.3 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- TABLE 233 OVERVIEW OF STRATEGIES ADOPTED BY KEY CLOUD MANAGED SERVICE VENDORS

- 10.4 REVENUE ANALYSIS

- FIGURE 46 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019-2021 (USD MILLION)

- 10.5 MARKET SHARE ANALYSIS

- FIGURE 47 CLOUD MANAGED SERVICES MARKET: MARKET SHARE ANALYSIS, 2021

- TABLE 234 CLOUD MANAGED SERVICES MARKET: DEGREE OF COMPETITION

- 10.6 COMPANY EVALUATION QUADRANT

- TABLE 235 COMPANY EVALUATION QUADRANT: CRITERIA

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 48 CLOUD MANAGED SERVICES MARKET, KEY COMPANY EVALUATION QUADRANT, 2022

- 10.6.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 236 COMPANY PRODUCT FOOTPRINT

- TABLE 237 COMPANY SERVICE TYPE FOOTPRINT

- TABLE 238 COMPANY VERTICAL FOOTPRINT

- TABLE 239 COMPANY REGION FOOTPRINT

- 10.7 RANKING OF KEY PLAYERS

- FIGURE 49 RANKING OF KEY PLAYERS IN CLOUD MANAGED SERVICES MARKET, 2021

- 10.8 STARTUP/SME EVALUATION MATRIX

- FIGURE 50 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- FIGURE 51 CLOUD MANAGED SERVICES MARKET (GLOBAL) STARTUP/SME COMPANY EVALUATION QUADRANT, 2022

- 10.8.5 COMPETITIVE BENCHMARKING

- TABLE 240 CLOUD MANAGED SERVICES MARKET: KEY STARTUPS/SMES

- TABLE 241 SME PRODUCT FOOTPRINT

- TABLE 242 SME SERVICE TYPE FOOTPRINT

- TABLE 243 SMES VERTICAL FOOTPRINT

- TABLE 244 SME REGION FOOTPRINT

- 10.9 KEY MARKET DEVELOPMENTS

- 10.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 245 PRODUCT LAUNCHES & ENHANCEMENTS, 2020-2022

- 10.9.2 DEALS

- TABLE 246 DEALS, 2020-2022

- 10.9.3 OTHERS

- TABLE 247 OTHERS, 2022-2021

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 IBM

- (Business Overview, Solutions, Products & Services, Recent Developments, MnM View)** TABLE 248 IBM: BUSINESS OVERVIEW

- FIGURE 52 IBM: COMPANY SNAPSHOT

- TABLE 249 IBM: SERVICES OFFERED

- TABLE 250 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 251 IBM: DEALS

- 11.1.2 ERICSSON

- TABLE 252 ERICSSON: BUSINESS OVERVIEW

- FIGURE 53 ERICSSON: COMPANY SNAPSHOT

- TABLE 253 ERICSSON: SERVICES OFFERED

- TABLE 254 ERICSSON: SERVICE LAUNCHES

- TABLE 255 ERICSSON: DEALS

- 11.1.3 CISCO

- TABLE 256 CISCO: BUSINESS OVERVIEW

- FIGURE 54 CISCO: COMPANY SNAPSHOT

- TABLE 257 CISCO: SERVICES OFFERED

- TABLE 258 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 259 CISCO: DEALS

- 11.1.4 FUJITSU

- TABLE 260 FUJITSU: BUSINESS OVERVIEW

- FIGURE 55 FUJITSU: COMPANY SNAPSHOT

- TABLE 261 FUJITSU: SERVICES OFFERED

- TABLE 262 FUJITSU: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 263 FUJITSU: DEALS

- 11.1.5 ACCENTURE

- TABLE 264 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 56 ACCENTURE: COMPANY SNAPSHOT

- TABLE 265 ACCENTURE: SERVICES OFFERED

- TABLE 266 ACCENTURE: DEALS

- 11.1.6 AWS

- TABLE 267 AWS: BUSINESS OVERVIEW

- FIGURE 57 AWS: COMPANY SNAPSHOT

- TABLE 268 AWS: SERVICES OFFERED

- TABLE 269 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 270 AWS: DEALS

- TABLE 271 AWS: OTHERS

- 11.1.7 NTT DATA

- TABLE 272 NTT DATA: BUSINESS OVERVIEW

- FIGURE 58 NTT DATA: COMPANY SNAPSHOT

- TABLE 273 NTT DATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 NTT DATA: DEALS

- 11.1.8 INFOSYS

- TABLE 275 INFOSYS: BUSINESS OVERVIEW

- FIGURE 59 INFOSYS: COMPANY SNAPSHOT

- TABLE 276 INFOSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 INFOSYS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 278 INFOSYS: DEALS

- 11.1.9 HPE

- TABLE 279 HPE: BUSINESS OVERVIEW

- FIGURE 60 HPE: COMPANY SNAPSHOT

- TABLE 280 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 HPE: PRODUCT LAUNCHES

- TABLE 282 HPE: DEALS

- 11.1.10 NEC

- TABLE 283 NEC: BUSINESS OVERVIEW

- FIGURE 61 NEC: COMPANY SNAPSHOT

- TABLE 284 NEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 NEC: DEALS

- 11.1.11 ATOS

- 11.1.12 TCS

- 11.1.13 WIPRO

- 11.1.14 DATACOM

- 11.1.15 AT&T

- 11.1.16 HCL TECHNOLOGIES

- 11.1.17 CDW CORPORATION

- 11.1.18 HUAWEI

- 11.1.19 NOKIA

- 11.1.20 RACKSPACE

- 11.1.21 CONNECTRIA

- 11.1.22 DLT SOLUTIONS

- 11.1.23 SOFTCHOICE

- 11.1.24 CLOUDNEXA

- *Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 11.2 SMES/STARTUPS

- 11.2.1 BESPIN GLOBAL

- 11.2.2 CLOUDTICITY

- 11.2.3 2ND WATCH

- 11.2.4 ISMILE TECHNOLOGIES

- 11.2.5 CLOUD4C

- 11.2.6 MISSION CLOUD SERVICES

- 11.2.7 CLOUDNOW

- 11.2.8 ZEDEDA

- 11.2.9 HAZELCAST

12 ADJACENT MARKET

- 12.1 INTRODUCTION

- 12.1.1 RELATED MARKETS

- 12.2 MANAGED SERVICES MARKET

- TABLE 286 MANAGED SERVICES MARKET SIZE, BY SERVICE TYPE, 2016-2020 (USD MILLION)

- TABLE 287 MANAGED SERVICES MARKET SIZE, BY SERVICE TYPE, 2021-2026 (USD MILLION)

- TABLE 288 MANAGED SECURITY SERVICES MARKET SIZE, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 289 MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 290 MANAGED NETWORK SERVICES MARKET SIZE, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 291 MANAGED DATA CENTER AND IT INFRASTRUCTURE SERVICES MARKET SIZE, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 292 MANAGED DATA CENTER AND IT INFRASTRUCTURE SERVICES MARKET SIZE, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 293 MANAGED COMMUNICATION AND COLLABORATION SERVICES MARKET SIZE, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 294 MANAGED COMMUNICATION AND COLLABORATION SERVICES MARKET SIZE, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 295 MANAGED MOBILITY SERVICES MARKET SIZE, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 296 MANAGED MOBILITY SERVICES MARKET SIZE, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 297 MANAGED INFORMATION SERVICES MARKET SIZE, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 298 MANAGED INFORMATION SERVICES MARKET SIZE, BY TYPE, 2021-2026 (USD MILLION)

- TABLE 299 MANAGED SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 300 MANAGED SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- TABLE 301 MANAGED SERVICES MARKET SIZE, BY DEPLOYMENT TYPE, 2016-2020 (USD MILLION)

- TABLE 302 MANAGED SERVICES MARKET SIZE, BY DEPLOYMENT TYPE, 2021-2026 (USD MILLION)

- TABLE 303 MANAGED SERVICES MARKET SIZE, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 304 MANAGED SERVICES MARKET SIZE, BY VERTICAL, 2021-2026 (USD MILLION)

- TABLE 305 MANAGED SERVICES MARKET SIZE, BY REGION, 2016-2020 (USD MILLION)

- TABLE 306 MANAGED SERVICES MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

- TABLE 307 MANAGED SECURITY SERVICES MARKET SIZE, BY TYPE, 2021-2026 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS