|

|

市場調査レポート

商品コード

1297936

除細動器の世界市場:製品別 (経静脈ICD、皮下、体外)・患者別・エンドユーザー別の将来予測 (2028年まで)Defibrillator Market by Product (Tranvenous ICD, Subcutaneous, External ), Patient, Enduser - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 除細動器の世界市場:製品別 (経静脈ICD、皮下、体外)・患者別・エンドユーザー別の将来予測 (2028年まで) |

|

出版日: 2023年06月12日

発行: MarketsandMarkets

ページ情報: 英文 211 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の除細動器の市場規模は、2023年の136億米ドルから、2028年には181億米ドルに達し、予測期間中に5.9%のCAGRで成長すると予測されています。

除細動器市場の需要増加は、心血管疾患に罹患する人口の割合の増加、除細動器の技術進歩、無料のトレーニング・プログラムを提供して公共アクセス除細動器 (PAD) の実装を進めるための公的・民間機関の取り組み強化が原動力となっています。しかし、植込み型除細動器 (ICD) や自動体外式除細動器 (AED) に関する問題や、頻繁な製品リコールが市場の成長を阻害しています。

"植込み型除細動器 (ICD) のセグメントが、2022年に最大シェアを占める"

除細動器市場は、製品別に植込み型除細動器 (ICD) と体外式除細動器に大別されます。ICDはさらに、経静脈ICDと皮下ICDに分けられ、体外式除細動器は手動AED、全自動AED、ウェアラブル除細動器に分けられます。2022年の世界除細動器市場シェアは、ICD分野が最大でした。その背景には、ICDの技術進歩、皮下ICDの利点に関する循環器専門医の意識の高まり、技術的に先進的なICDの発売などがあります。

"患者の種類別では、2022年には成人患者向けが優勢"

2022年の除細動器市場は、成人患者分野が世界を席巻しました。成人における心血管疾患の罹患率の増加、突然の心停止に罹患しやすい高齢者人口の急速な増加、成人患者へのICDの植え込み件数の増加が、このセグメントの成長を促進すると考えられます。

"北米が予測期間中に最も高い市場シェアを占める"

世界の除細動器市場を地域別に見ると、北米が予測期間中に高い市場シェアが見込まれます。これは、高度な除細動器の採用が増加していること、心停止患者に必要なケアを提供するための政府による取り組みが増加していること、市場参入企業の足場が強固であること、有利な償還プログラム、冠動脈疾患の発生率の増加などの要因によるものと考えられます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 償還シナリオ

- 規制状況

- 価格傾向分析

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 貿易分析

- 技術分析

- 主要な会議とイベント

- ケーススタディ分析

- 利害関係者と購入基準

- 主な購入基準

第6章 除細動器市場:製品別

- イントロダクション

- 植込み型除細動器 (ICD)

- 経静脈ICD

- 皮下ICD

- 体外式除細動器

- 半自動体外式除細動器

- 全自動体外式除細動器

- ウェアラブル除細動器

第7章 除細動器市場:患者の種類別

- イントロダクション

- 成人患者

- 小児患者

第8章 除細動器市場:エンドユーザー別

- イントロダクション

- 病院・診療所・心臓センター

- 入院前処置

- 公共アクセス市場

- 在宅医療

- 代替介護施設

- その他のエンドユーザー

第9章 除細動器市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 収益シェア分析

- 市場シェア分析

- 除細動器市場:企業評価マトリックス (2022年)

- 除細動器市場:スタートアップ/中小企業の企業評価マトリックス (2022年)

- 競合ベンチマーキング:有力企業のフットプリント分析

第11章 企業プロファイル

- 主要企業

- MEDTRONIC

- STRYKER

- KONINKLIJKE PHILIPS N.V.

- ASAHI KASEI CORPORATION

- BOSTON SCIENTIFIC CORPORATION

- ABBOTT

- MICROPORT SCIENTIFIC CORPORATION

- NIHON KOHDEN CORPORATION

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- BIOTRONIK

- CU MEDICAL SYSTEMS CO., LTD.

- METSIS MEDIKAL LTD.

- MEDIANA CO. LTD.

- PROGETTI SRL

- SCHILLER AG

- BPL MEDICAL TECHNOLOGIES

- METRAX GMBH

- MS WESTFALIA GMBH

- BEXEN CARDIO

- SHENZHEN COMEN MEDICAL INSTRUMENTS LTD.

- その他の企業

- AVIVE SOLUTIONS INC.

- AMI ITALIA

- CORPULS

- ALLIED MEDICAL LTD.

- AXION CONCERN LLC

第12章 付録

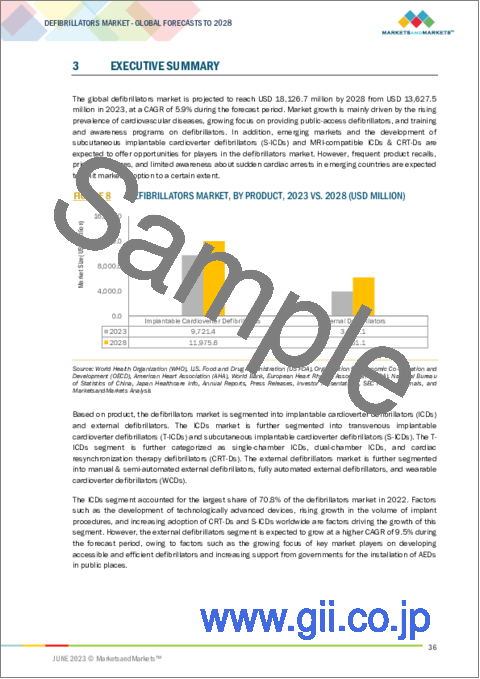

The global defibrillators market is expected to reach USD 18.1 billion by 2028 from USD 13.6 billion in 2023, at a CAGR of 5.9% during the forecast period. The increase in the demand for defibrillators market is driven by the increasing population proportion with cardiovascular diseases, technological advancements in defibrillators, and rising initiatives by public & private organizations to provide free training & programs and enhance the implementation of public access defibrillators (PADs). However, issues related to implantable and automated external defibrillators and frequent product recalls impeded market growth.

"Implantable Cardioverter Defibrillator segment accounted for the largest share of global defibrillator market in 2022"

Based on product , the defibrillators market is broadly segmented into implantable cardioverter defibrillators (ICDs) and external defibrillators. ICDs are further divided into transvenous implantable cardioverter defibrillators and subcutaneous implantable cardioverter defibrillators, whereas external defibrillators are divided into manual AED, fully automated AED, and wearable defibrillator. The ICDs segment accounted for the largest global defibrillators market share in 2022. The technological advancements in implantable defibrillators, rising awareness among cardiologists about the benefits pertaining to subcutaneous ICDs, and the launch of technologically advanced ICDs.

"Adult patients segment dominated the of the defibrillator market based on patients type in 2022"

The defibrillator market is segmented into adult and pediatric patients based on patient type. The adult patients segment dominated the global defibrillators in 2022. The increasing incidence of cardiovascular disease in the adult population, rapid growth in the geriatric population highly susceptible to sudden cardiac arrest, and the increasing number of implantation of ICDs in adult patients are likely to fuel the growth of the segment.

"North America accounted for the highest market share in the defibrillators market during the forecast period"

Based on the region, the global defibrillators market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America is expected to witness a high market share during the forecast period. This can be attributed to the factors such as the rising adoption of advanced defibrillators, increasing efforts by governments to provide the necessary care to cardiac arrest patients, the strong foothold of market players, favorable reimbursement programs, and an increase in the incidence of coronary artery diseases.

Breakdown of supply-side primary interviews by company type, designation, and region:

- By Company Type: Tier 1 (30%), Tier 2 (45%), and Tier 3 (25%)

- By Designation: C-level (20%), Director-level (20%), and Others (45%)

- By Region: North America (40%), Asia- Pacific (30%), Europe (20%), Latin America (7%) and Middle East & Africa(3%)

Prominent companies include Medtronic (Ireland), Stryker (US), Koninklijke Philips N.V. (Netherlands), Asahi Kasei Corporation (Japan), Boston Scientific Corporation (US), Abbott (US), Nihon Kohden (Japan) and MicroPort (China).

Research Coverage

This research report categorizes the defibrillators market by Product (Implantable cardioverter defibrillators (transvenous implantable cardioverter defibrillators {biventricular ICDS/cardiac resynchronization therapy defibrillators, dual-chamber ICDS, and single-chamber ICDS}, Subcutaneous implantable cardioverter defibrillators) External defibrillators (manual & semi-automated external defibrillators, fully automated external defibrillators, wearable cardioverter defibrillators), Patients type (Adult, Pediatrics), End Users (Hospitals, Clinics and Cardiac centres, Pre-hospital care settings,Public access markets, Home care settings, Alternate care facilities, and Other end users), and region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the defibrillators market.

A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the defibrillators market. Competitive analysis of upcoming startups in the defibrillators market ecosystem is covered in this report.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall defibrillators market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising prevalence of cardiovascular disease, increase in geriatric patient population, a strong focus of government to boost the installation of public access defibrillators, rising defibrillators training & programs, and expanding healthcare infrastructure), restraints (frequent product recalls, issues related to implantable and automated external defibrillators), opportunities (emerging countries, ongoing developments in ICDs/CRT-Ds, mergers and acquisitions among market players), and challenges (frequent product recalls and lack of awareness about the cardiac arrest in emerging countries) influencing the growth of the defibrillators market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the defibrillators market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the defibrillators market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the defibrillators market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Medtronic (Ireland), Stryker (US), Koninklijke Philips N.V. (Netherlands), Asahi Kasei Corporation (Japan), Boston Scientific Corporation (US, Abbott (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- FIGURE 1 MARKETS COVERED

- 1.3.1 GEOGRAPHIC SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key data from primary sources

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 DEFIBRILLATORS MARKET: BREAKDOWN OF PRIMARIES

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 PRODUCT-BASED MARKET ESTIMATION

- 2.2.2 END USER-BASED MARKET ESTIMATION

- FIGURE 6 DEFIBRILLATORS MARKET: MARKET SIZE ESTIMATION

- 2.2.3 PRIMARY RESEARCH VALIDATION

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.4.1 RESEARCH ASSUMPTIONS

- 2.4.2 RESEARCH LIMITATIONS

- 2.5 RECESSION IMPACT

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021-2027 (% GROWTH)

3 EXECUTIVE SUMMARY

- FIGURE 8 DEFIBRILLATORS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 DEFIBRILLATORS MARKET, BY END USER, 2023 VS. 2028

- FIGURE 10 DEFIBRILLATORS MARKET, BY PATIENT TYPE, 2023 VS. 2028

- FIGURE 11 GEOGRAPHICAL SNAPSHOT OF DEFIBRILLATORS MARKET

4 PREMIUM INSIGHTS

- 4.1 DEFIBRILLATORS MARKET OVERVIEW

- FIGURE 12 RISING INCIDENCE OF CVD TO DRIVE MARKET

- 4.2 DEFIBRILLATORS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 IMPLANTABLE DEFIBRILLATORS TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.3 DEFIBRILLATORS MARKET, BY REGION AND END USER

- FIGURE 14 HOSPITALS, CLINICS, AND CARDIAC CENTERS SEGMENT IN ASIA PACIFIC REGION ACCOUNTED FOR LARGEST SHARE IN 2022

- 4.4 GEOGRAPHIC SNAPSHOT OF DEFIBRILLATORS MARKET

- FIGURE 15 CHINA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 DEFIBRILLATORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising prevalence of cardiovascular diseases

- TABLE 2 PERCENTAGE OF POPULATION AGED 65 YEARS, BY REGION

- 5.2.1.2 Growing focus on providing public-access defibrillators

- 5.2.1.3 Training and awareness programs on defibrillators

- 5.2.2 RESTRAINTS

- 5.2.2.1 Frequent product recalls

- TABLE 3 RECENT PRODUCT RECALLS BY US FDA (2018-2023)

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging markets

- 5.2.3.2 Development of S-ICDs and MRI-compatible ICDs & CRT-Ds

- 5.2.4 CHALLENGES

- 5.2.4.1 Inadequate awareness of sudden cardiac arrests in emerging markets

- 5.2.4.2 Challenges associated with pricing pressure

- 5.3 REIMBURSEMENT SCENARIO

- TABLE 4 MEDICAL REIMBURSEMENT CODES FOR DEFIBRILLATOR PROCEDURES IN US

- TABLE 5 MEDICARE OUTPATIENT: NATIONAL AVERAGE PAYMENT IN US (2023)

- 5.4 REGULATORY LANDSCAPE

- 5.4.1 US

- TABLE 6 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 7 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.4.1.1 Canada

- TABLE 8 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.4.2 EUROPE

- 5.4.3 ASIA PACIFIC

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- TABLE 9 KEY REGULATORY BODIES AND GOVERNMENT AGENCIES

- 5.5 PRICING TREND ANALYSIS

- TABLE 10 AVERAGE SELLING PRICE OF DEFIBRILLATORS, BY KEY PLAYER (2021) (USD)

- TABLE 11 AVERAGE SELLING PRICE OF DEFIBRILLATORS, BY COUNTRY (USD) (2021)

- 5.6 PATENT ANALYSIS

- FIGURE 17 TOP PATENT APPLICANTS FOR DEFIBRILLATORS DEVICES, JANUARY 2012-MAY 2023

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 RESEARCH & DEVELOPMENT

- 5.7.2 MANUFACTURING & ASSEMBLY

- 5.7.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

- FIGURE 18 DEFIBRILLATORS MARKET: VALUE CHAIN ANALYSIS

- 5.8 SUPPLY CHAIN ANALYSIS

- FIGURE 19 DEFIBRILLATORS MARKET: SUPPLY CHAIN ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 OVERVIEW

- TABLE 12 DEFIBRILLATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.2 THREAT OF NEW ENTRANTS

- 5.9.3 THREAT OF SUBSTITUTES

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 BARGAINING POWER OF BUYERS

- 5.9.6 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 TRADE ANALYSIS

- TABLE 13 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 14 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.11 TECHNOLOGY ANALYSIS

- FIGURE 20 ECOSYSTEM COVERAGE

- 5.12 KEY CONFERENCES AND EVENTS

- TABLE 15 DEFIBRILLATORS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS (2022-2023)

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 IDENTIFY IMPACT OF 4-LAYER RIGID-FLEX BOARD PCB IN DEFIBRILLATORS

- TABLE 16 CASE 1: IDENTIFY IMPACT OF THIN-LAYERED PCBS IN IMPLANTABLE CARDIOVERTER DEFIBRILLATORS

- 5.14 STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY PRODUCTS

- 5.15 KEY BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR DEFIBRILLATORS

6 DEFIBRILLATORS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 17 DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS

- TABLE 18 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 19 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 20 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY PATIENT TYPE, 2021-2028 (USD MILLION)

- TABLE 21 IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 6.2.1 TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS

- TABLE 22 TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 23 TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.1.1 Biventricular ICDs/Cardiac resynchronization therapy defibrillators

- 6.2.1.1.1 Launch of technologically advanced CRT-D devices to drive market

- 6.2.1.1 Biventricular ICDs/Cardiac resynchronization therapy defibrillators

- TABLE 24 BIVENTRICULAR ICDS/CARDIAC RESYNCHRONIZATION THERAPY DEFIBRILLATORS MARKET, BY REGION, 2021-2028 (USD MILLION)

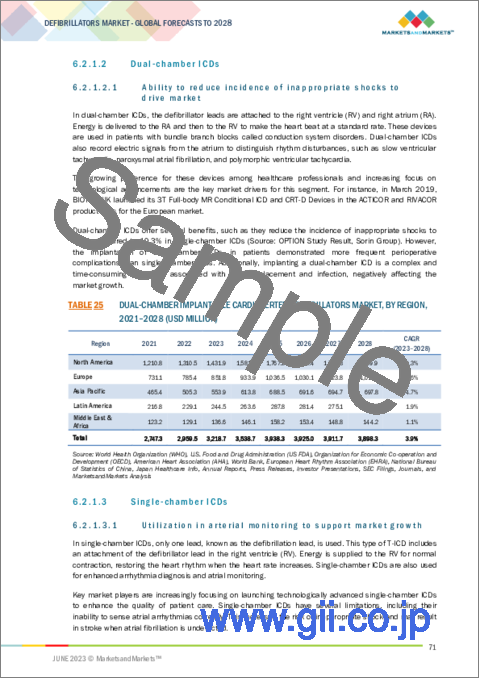

- 6.2.1.2 Dual-chamber ICDs

- 6.2.1.2.1 Ability to reduce incidence of inappropriate shocks to drive market

- 6.2.1.2 Dual-chamber ICDs

- TABLE 25 DUAL-CHAMBER IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.1.3 Single-chamber ICDs

- 6.2.1.3.1 Utilization in arterial monitoring to support market growth

- 6.2.1.3 Single-chamber ICDs

- TABLE 26 SINGLE-CHAMBER IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2 SUBCUTANEOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS

- 6.2.2.1 Benefits of eliminating cardiac leads to drive market

- TABLE 27 SUBCUTANEOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 EXTERNAL DEFIBRILLATORS

- TABLE 28 EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 29 EXTERNAL DEFIBRILLATORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 30 EXTERNAL DEFIBRILLATORS MARKET, BY PATIENT TYPE, 2021-2028 (USD MILLION)

- TABLE 31 EXTERNAL DEFIBRILLATORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 6.3.1 SEMI-AUTOMATED EXTERNAL DEFIBRILLATORS

- 6.3.1.1 Initiatives for emergency medical services to support market growth

- TABLE 32 SEMI-AUTOMATED EXTERNAL DEFIBRILLATORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.2 FULLY AUTOMATED EXTERNAL DEFIBRILLATORS

- 6.3.2.1 Rising installation in public places to propel market

- TABLE 33 FULLY AUTOMATED EXTERNAL DEFIBRILLATORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.3 WEARABLE CARDIOVERTER DEFIBRILLATORS

- 6.3.3.1 Operational difficulties and false alarms to restrain market adoption

- TABLE 34 WEARABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY REGION, 2021-2028 (USD MILLION)

7 DEFIBRILLATORS MARKET, BY PATIENT TYPE

- 7.1 INTRODUCTION

- TABLE 35 DEFIBRILLATORS MARKET, BY PATIENT TYPE, 2021-2028 (USD MILLION)

- 7.2 ADULT PATIENTS

- 7.2.1 INCREASING UTILIZATION OF PUBLIC-ACCESS DEFIBRILLATORS TO DRIVE MARKET

- TABLE 36 DEFIBRILLATORS MARKET FOR ADULT PATIENTS, BY REGION, 2021-2028 (USD MILLION)

- 7.3 PEDIATRIC PATIENTS

- 7.3.1 INCREASING INCIDENCE OF PEDIATRIC HEART AILMENTS TO SUPPORT MARKET GROWTH

- TABLE 37 DEFIBRILLATORS MARKET FOR PEDIATRIC PATIENTS, BY REGION, 2021-2028 (USD MILLION)

8 DEFIBRILLATORS MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 38 DEFIBRILLATORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 HOSPITALS, CLINICS, AND CARDIAC CENTERS

- 8.2.1 HIGH VOLUME OF ICD PROCEDURES TO DRIVE MARKET

- TABLE 39 DEFIBRILLATORS MARKET FOR HOSPITALS, CLINICS, AND CARDIAC CENTERS, BY REGION, 2021-2028 (USD MILLION)

- 8.3 PREHOSPITAL SETTINGS

- 8.3.1 RISING FUNDING FOR EMERGENCY AMBULANCE SERVICES TO DRIVE MARKET

- TABLE 40 DEFIBRILLATORS MARKET FOR PREHOSPITAL SETTINGS, BY REGION, 2021-2028 (USD MILLION)

- 8.4 PUBLIC-ACCESS MARKETS

- 8.4.1 RISING INCIDENCE OF SUDDEN CARDIAC ARRESTS TO PROPEL MARKET

- TABLE 41 DEFIBRILLATORS MARKET FOR PUBLIC-ACCESS MARKETS, BY REGION, 2021-2028 (USD MILLION)

- 8.5 HOME CARE SETTINGS

- 8.5.1 RISING ADOPTION OF HOME-AUTOMATED EXTERNAL DEFIBRILLATORS TO DRIVE MARKET

- TABLE 42 DEFIBRILLATORS MARKET FOR HOME CARE SETTINGS, BY REGION, 2021-2028 (USD MILLION)

- 8.6 ALTERNATE CARE FACILITIES

- 8.6.1 INADEQUATE HEALTHCARE INFRASTRUCTURE TO LIMIT ADOPTION

- TABLE 43 DEFIBRILLATORS MARKET FOR ALTERNATE CARE FACILITIES, BY REGION, 2021-2028 (USD MILLION)

- 8.7 OTHER END USERS

- TABLE 44 DEFIBRILLATORS MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

9 DEFIBRILLATORS MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 45 DEFIBRILLATORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 23 NORTH AMERICA: DEFIBRILLATORS MARKET SNAPSHOT

- TABLE 46 NORTH AMERICA: DEFIBRILLATORS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: DEFIBRILLATORS MARKET, BY PATIENT TYPE, 2021-2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: DEFIBRILLATORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 High implant rates of ICDS to drive market

- TABLE 53 US: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 54 US: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 55 US: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 56 US: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 High burden of CVDs to support market growth

- TABLE 57 CANADA: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 58 CANADA: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 59 CANADA: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 60 CANADA: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.2.3 NORTH AMERICA: RECESSION IMPACT

- 9.3 EUROPE

- TABLE 61 EUROPE: DEFIBRILLATORS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 62 EUROPE: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 63 EUROPE: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 64 EUROPE: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 65 EUROPE: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 66 EUROPE: DEFIBRILLATORS MARKET, BY PATIENT TYPE, 2021-2028 (USD MILLION)

- TABLE 67 EUROPE: DEFIBRILLATORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Established healthcare system equipped with advanced cardiology devices to drive market

- TABLE 68 GERMANY: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 69 GERMANY: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 70 GERMANY: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 71 GERMANY: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Rising support from government & private organizations for accessibility of defibrillators to drive market

- TABLE 72 UK: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 73 UK: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 74 UK: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 USD MILLION)

- TABLE 75 UK: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Favorable government initiatives to support market growth

- TABLE 76 FRANCE: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 77 FRANCE: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 78 FRANCE: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 79 FRANCE: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 High prevalence of OHCA to drive market

- TABLE 80 ITALY: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 81 ITALY: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 82 ITALY: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 83 ITALY: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Rising awareness initiatives on defibrillators to propel market

- TABLE 84 SPAIN: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 85 SPAIN: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 86 SPAIN: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 87 SPAIN: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 88 REST OF EUROPE: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 REST OF EUROPE: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 91 REST OF EUROPE: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.7 EUROPE: RECESSION IMPACT

- 9.4 ASIA PACIFIC

- FIGURE 24 ASIA PACIFIC: DEFIBRILLATORS MARKET SNAPSHOT

- TABLE 92 ASIA PACIFIC: DEFIBRILLATORS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: DEFIBRILLATORS MARKET, BY PATIENT TYPE, 2021-2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: DEFIBRILLATORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.1 JAPAN

- 9.4.1.1 Presence of universal insurance scheme in Japan to support market growth

- TABLE 99 JAPAN: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 100 JAPAN: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 JAPAN: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 JAPAN: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Rising incidence of strokes to drive market

- TABLE 103 CHINA: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 104 CHINA: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 CHINA: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 CHINA: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Growing acceptance of defibrillators and innovative product launches to drive market

- TABLE 107 INDIA: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 108 INDIA: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 109 INDIA: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 110 INDIA: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.4 AUSTRALIA

- 9.4.4.1 Initiatives by government & private bodies for installation of PADs to support market growth

- TABLE 111 AUSTRALIA: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 112 AUSTRALIA: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 AUSTRALIA: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 114 AUSTRALIA: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Launch of innovative products by local players to propel market

- TABLE 115 SOUTH KOREA: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 116 SOUTH KOREA: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 117 SOUTH KOREA: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 118 SOUTH KOREA: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.6 REST OF ASIA PACIFIC (ROAPAC)

- TABLE 119 REST OF ASIA PACIFIC: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.7 ASIA PACIFIC: RECESSION IMPACT

- 9.5 LATIN AMERICA

- TABLE 123 LATIN AMERICA: DEFIBRILLATORS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 124 LATIN AMERICA: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 125 LATIN AMERICA: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 LATIN AMERICA: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: DEFIBRILLATORS MARKET, BY PATIENT TYPE, 2021-2028 (USD MILLION)

- TABLE 129 LATIN AMERICA: DEFIBRILLATORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.1 BRAZIL

- 9.5.1.1 Increasing obesity cases to support market growth

- TABLE 130 BRAZIL: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 131 BRAZIL: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 BRAZIL: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 BRAZIL: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.5.2 MEXICO

- 9.5.2.1 High prevalence of target diseases to support market growth

- TABLE 134 MEXICO: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 135 MEXICO: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 MEXICO: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 MEXICO: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.5.3 REST OF LATIN AMERICA

- TABLE 138 REST OF LATIN AMERICA: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 139 REST OF LATIN AMERICA: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 REST OF LATIN AMERICA: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 REST OF LATIN AMERICA: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.5.4 LATIN AMERICA: RECESSION IMPACT

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWING AWARENESS INITIATIVES ON ADVANTAGES OF DEFIBRILLATORS TO SUPPORT MARKET GROWTH

- TABLE 142 MIDDLE EAST & AFRICA: DEFIBRILLATORS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: TRANSVENOUS IMPLANTABLE CARDIOVERTER DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: EXTERNAL DEFIBRILLATORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: DEFIBRILLATORS MARKET, BY PATIENT TYPE, 2021-2028 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: DEFIBRILLATORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.1.1 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 148 STRATEGIES ADOPTED BY KEY PLAYERS (2019-2023)

- 10.2 REVENUE SHARE ANALYSIS

- FIGURE 25 DEFIBRILLATORS MARKET: REVENUE SHARE ANALYSIS OF PLAYERS

- 10.3 MARKET SHARE ANALYSIS

- FIGURE 26 DEFIBRILLATORS MARKET SHARE, BY KEY PLAYER (2022)

- TABLE 149 IMPLANTABLE CARDIOVERTER-DEFIBRILLATORS (ICD) MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 150 AUTOMATED DEFIBRILLATORS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 10.4 DEFIBRILLATORS MARKET: COMPANY EVALUATION MATRIX (2022)

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- FIGURE 27 DEFIBRILLATORS MARKET: COMPANY EVALUATION MATRIX (2022)

- 10.5 DEFIBRILLATORS MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- FIGURE 28 DEFIBRILLATORS MARKET: COMPANY EVALUATION MATRIX FOR SMES/STARTUPS (2022)

- 10.6 COMPETITIVE BENCHMARKING: FOOTPRINT ANALYSIS OF LEADING PLAYERS

- TABLE 151 DEFIBRILLATORS MARKET: COMPANY FOOTPRINT ANALYSIS

- TABLE 152 DEFIBRILLATORS MARKET: PRODUCT FOOTPRINT ANALYSIS

- TABLE 153 DEFIBRILLATORS MARKET: REGIONAL FOOTPRINT ANALYSIS

- 10.6.1 PRODUCT LAUNCHES & APPROVALS

- TABLE 154 DEFIBRILLATORS MARKET: PRODUCT LAUNCHES & APPROVALS (JANUARY 2019-APRIL 2023)

- 10.6.2 DEALS

- TABLE 155 DEFIBRILLATORS MARKET: KEY DEALS (JANUARY 2019-APRIL 2023)

- 10.6.3 OTHER DEVELOPMENTS

- TABLE 156 DEFIBRILLATORS MARKET: OTHER DEVELOPMENTS (JANUARY 2019-APRIL 2023)

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View)**

- 11.1.1 MEDTRONIC

- TABLE 157 MEDTRONIC: BUSINESS OVERVIEW

- FIGURE 29 MEDTRONIC: COMPANY SNAPSHOT (2022)

- 11.1.2 STRYKER

- TABLE 158 STRYKER: BUSINESS OVERVIEW

- FIGURE 30 STRYKER: COMPANY SNAPSHOT (2022)

- 11.1.3 KONINKLIJKE PHILIPS N.V.

- TABLE 159 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- FIGURE 31 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- 11.1.4 ASAHI KASEI CORPORATION

- TABLE 160 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

- FIGURE 32 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.5 BOSTON SCIENTIFIC CORPORATION

- TABLE 161 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

- FIGURE 33 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.6 ABBOTT

- TABLE 162 ABBOTT: BUSINESS OVERVIEW

- FIGURE 34 ABBOTT: COMPANY SNAPSHOT (2022)

- TABLE 163 PRODUCT APPROVALS

- 11.1.7 MICROPORT SCIENTIFIC CORPORATION

- TABLE 164 MICROPORT SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

- FIGURE 35 MICROPORT SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2022)

- TABLE 165 PRODUCT APPROVALS

- 11.1.8 NIHON KOHDEN CORPORATION

- TABLE 166 NIHON KOHDEN CORPORATION: BUSINESS OVERVIEW

- FIGURE 36 NIHON KOHDEN CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.9 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- TABLE 167 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: BUSINESS OVERVIEW

- FIGURE 37 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY SNAPSHOT (2021)

- TABLE 168 PRODUCT LAUNCHES & APPROVALS

- 11.1.10 BIOTRONIK

- TABLE 169 BIOTRONIK: BUSINESS OVERVIEW

- 11.1.11 CU MEDICAL SYSTEMS CO., LTD.

- TABLE 170 CU MEDICAL SYSTEMS CO., LTD.: BUSINESS OVERVIEW

- 11.1.12 METSIS MEDIKAL LTD.

- TABLE 171 METSIS MEDIKAL LTD: BUSINESS OVERVIEW

- 11.1.13 MEDIANA CO. LTD.

- TABLE 172 MEDIANA CO. LTD.: BUSINESS OVERVIEW

- 11.1.14 PROGETTI SRL

- TABLE 173 PROGETTI SRL: BUSINESS OVERVIEW

- 11.1.15 SCHILLER AG

- TABLE 174 SCHILLER AG: BUSINESS OVERVIEW

- 11.1.16 BPL MEDICAL TECHNOLOGIES

- TABLE 175 BPL MEDICAL TECHNOLOGIES: BUSINESS OVERVIEW

- 11.1.17 METRAX GMBH

- TABLE 176 METRAX GMBH: BUSINESS OVERVIEW

- 11.1.18 MS WESTFALIA GMBH

- TABLE 177 MS WESTFALIA GMBH: BUSINESS OVERVIEW

- 11.1.19 BEXEN CARDIO

- TABLE 178 BEXEN CARDIO: BUSINESS OVERVIEW

- 11.1.20 SHENZHEN COMEN MEDICAL INSTRUMENTS LTD.

- TABLE 179 SHENZHEN COMEN MEDICAL INSTRUMENTS LTD.: BUSINESS OVERVIEW

- * Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 AVIVE SOLUTIONS INC.

- 11.2.2 AMI ITALIA

- 11.2.3 CORPULS

- 11.2.4 ALLIED MEDICAL LTD.

- 11.2.5 AXION CONCERN LLC

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS