|

|

市場調査レポート

商品コード

1208343

表面検査の世界市場:コンポーネント別 (カメラ、フレームグラバー、プロセッサ、ソフトウェア)・表面の種類別 (2D、3D)・システム別 (コンピュータベース、カメラベース)・展開方式別 (従来型システム、ロボットセル)・地域別の将来予測 (2028年まで)Surface Inspection Market by Component (Cameras, Frame Grabbers, Processors, Software), Surface Type (2D, 3D), System (Computer-based, Camera-based), Deployment Type (Traditional Systems, Robotic Cells), Vertical - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 表面検査の世界市場:コンポーネント別 (カメラ、フレームグラバー、プロセッサ、ソフトウェア)・表面の種類別 (2D、3D)・システム別 (コンピュータベース、カメラベース)・展開方式別 (従来型システム、ロボットセル)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年01月23日

発行: MarketsandMarkets

ページ情報: 英文 318 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の表面検査の市場規模は、2023年の40億米ドルから2028年には59億米ドルに拡大し、7.8%のCAGRで成長する、と予測されています。

スマートカメラや高度画像センサー、製品の表面検査を強化するプロセッサに対する、複数の業界にまたがる巨大な需要が、市場の成長を支えるものと予想されます。

コンポーネント別では、2022年にカメラ部品が最大シェアを占めています。パッケージの蓋・ラベルの検査や、自動車ドアのような大きな対象物の検査など、多くの活用領域では、広いエリアをカバーするために複数のカメラが必要になることがあります。また、カメラは定期的に解像度やフレームレートの更新が行われています。

地域別に見ると、2022年にアジア太平洋が最大の市場規模となっています。その要因として、中国、日本、韓国における高い工業化が挙げられます。アジア太平洋地域は世界の主要な製造拠点であり、表面検査企業に十分な成長機会を提供できると期待されています。

当レポートでは、世界の表面検査の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・表面の種類別・システム別・展開方式別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- エコシステムマッピング

- 顧客のビジネスに影響を与えるトレンド

- ケーススタディ

- ポーターのファイブフォース分析

- 技術動向

- 平均販売価格分析

- 貿易分析

- 特許分析

- 関税と規制の状況

第6章 表面検査システムで特定される欠陥

- イントロダクション

- 穴

- 引っかき傷

- 亀裂

- 摩耗

- 仕上げ

- 結合部

- その他

第7章 表面検査市場:コンポーネント別

- イントロダクション

- カメラ

- フレームレート

- フォーマット

- 検知技術

- インターフェース規格

- イメージング技術

- フレームグラバー

- 光学機器

- 照明器具

- プロセッサ

- ソフトウェア

- その他

第8章 表面検査市場:表面の種類別

- イントロダクション

- 2D

- 3D

第9章 表面検査市場:システム別

- イントロダクション

- コンピュータベース

- カメラベース

第10章 表面検査市場:展開方式別

- イントロダクション

- 従来型システム

- ロボット細胞

第11章 表面検査市場:業種別

- イントロダクション

- 半導体

- IRビジョンベース検査

- マクロ欠陥検査

- ロボットビジョンベース検査

- プリント回路基板 (PCB) 検査

- 半導体製造検査

- 自動車

- 組立検証

- 欠陥検出

- 印刷検証

- 塗装面検査

- CFRP・GFRPカーマット検査

- 溶接・ろう付けシーム検査

- 電気・電子機器

- ガラス・金属

- カットプレート検査

- ミラーガラス検査

- フロートガラス検査

- コーティングガラス検査

- 合わせガラス検査

- 未加工ガラス検査

- 構造化ソーラーガラス検査

- コーティング

- 冷間圧延

- 変換中

- 熱間圧延

- 食品・包装

- 品質保証

- 等級付け

- ラベル検証

- 安全検査

- ガラス容器検査

- 金属容器検査

- ペットボトル検査

- 製紙・木材

- 医薬品

- バイアル検査

- ブリスターパック検査

- 経皮パッチ検査

- インスリンペン検査

- プラスチック・ゴム

- 印刷

- 不織布

- 郵便・ロジスティクス

第12章 表面検査市場:地域別

- イントロダクション

- 南北アメリカ

- 米国

- カナダ

- メキシコ

- ブラジル

- 他の南北アメリカ諸国

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 主要企業が採用した戦略

- 製品ポートフォリオ

- 注力地域

- 製造フットプリント

- 有機的/無機的戦略

- 企業収益分析 (5年間分)

- 市場シェア分析 (2022年)

- 企業評価クアドラント

- スタートアップ/中小企業の評価マトリックス

- 企業のフットプリント (全40社分)

- 競合シナリオ

- 製品の発売

- 資本取引

- その他

第14章 企業プロファイル

- 主要企業

- ISRA VISION

- COGNEX

- OMRON

- TELEDYNE TECHNOLOGIES

- VITRONIC

- PANASONIC

- MATROX ELECTRONIC SYSTEMS

- IMS MESSSYSTEME

- KEYENCE

- DATALOGIC

- その他の企業

- AMETEK SURFACE VISION

- KITOV

- TELEDYNE FLIR

- SONY

- NATIONAL INSTRUMENTS

- SICK

- BASLER

- INDUSTRIAL VISION SYSTEMS

- ALLIED VISION TECHNOLOGIES

- BAUMER

- IN-CORE SYSTEMES

- DARK FIELD TECHNOLOGIES

- SIPOTEK

- MORITEX

- PIXARGUS

第15章 隣接市場

- マシンビジョン市場

- イントロダクション

- PCベースのマシンビジョンシステム

- スマートカメラベースのマシンビジョンシステム

第16章 付録

The global surface inspection market is projected to grow from USD 4.0 billion in 2023 to USD 5.9 billion by 2028, registering a CAGR of 7.8%. The significant demand for smart cameras, advanced image sensors, and processors offering enhanced surface inspection of products across several industries is expected to support the market growth.

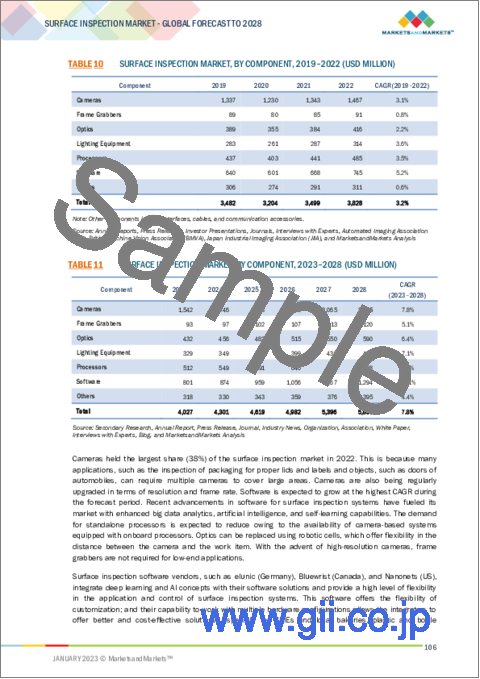

"Camera component accounted for largest share of surface inspection market in 2022"

Various types of cameras are available in the market. The parameters chosen to select a camera for an application are frame rate, area, line format, 2D or 3D technology, sensing technology, interface standard, and imaging technology supported by the camera. Imaging sensors capture light using CMOS or CCD technology and convert it to a set of pixels showing the presence of light in different areas of the observed part. Many applications, such as the inspection of packaging for proper lids and labels and large objects such as doors of automobiles, can require multiple cameras to cover large areas. Cameras are also being regularly upgraded in terms of resolution and frame rate.

"Asia Pacific to account for largest size of surface inspection market in 2022"

The market growth in Asia Pacific can be attributed to the high industrialization in China, Japan, and South Korea. The region consists of a diverse range of economies with varying levels of development and the presence of various manufacturers. Asia Pacific is considered a major global manufacturing hub and is expected to provide ample growth opportunities to the players in the surface inspection market.

The major players in the market are ISRA VISION (Germany), Cognex (US), OMRON (Japan), Teledyne Technologies (US), and Keyence (Japan).

Research Coverage:

The surface inspection market has been segmented into component, surface type, system, deployment type, vertical and region. The surface inspection market was studied for the Americas, Europe, Asia Pacific, and Rest of the World (RoW).

Reasons to buy the report:

- Illustrative segmentation, analysis, and forecast of the market based on component, surface type, system, deployment type, vertical, and region have been conducted to give an overall view of the market.

- A value chain analysis has been performed to provide in-depth insights into the surface inspection market.

- The key drivers, restraints, opportunities, and challenges pertaining to the surface inspection market have been detailed in this report.

- The report includes a detailed competitive landscape of the market, key players, and an in-depth analysis of their revenues.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 SURFACE INSPECTION MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 SURFACE INSPECTION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 SURFACE INSPECTION MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED FROM COMPANIES IN SURFACE INSPECTION MARKET

- FIGURE 5 SURFACE INSPECTION MARKET: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON SURFACE INSPECTION MARKET

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 7 CAMERAS ACCOUNTED FOR LARGEST SHARE OF SURFACE INSPECTION MARKET IN 2022

- FIGURE 8 COMPUTER-BASED SYSTEMS TO ACCOUNT FOR LARGER SHARE OF SURFACE INSPECTION MARKET THAN CAMERA-BASED SYSTEMS THROUGHOUT FORECAST PERIOD

- FIGURE 9 2D SYSTEMS HELD LARGER SHARE OF SURFACE INSPECTION MARKET THAN 3D SYSTEMS IN 2022

- FIGURE 10 TRADITIONAL SYSTEMS TO DOMINATE SURFACE INSPECTION MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 11 SURFACE INSPECTION MARKET FOR AUTOMOTIVE VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO RECORD HIGHEST CAGR IN GLOBAL SURFACE INSPECTION MARKET FROM 2022 TO 2027

- 3.1 ANALYSIS OF RECESSION IMPACT ON SURFACE INSPECTION MARKET

- FIGURE 13 GDP GROWTH PROJECTIONS TILL 2023 FOR MAJOR ECONOMIES (PERCENTAGE CHANGE)

- FIGURE 14 SURFACE INSPECTION MARKET: PRE- AND POST-RECESSION SCENARIO

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SURFACE INSPECTION MARKET

- FIGURE 15 ASIA PACIFIC TO PROVIDE LUCRATIVE OPPORTUNITIES TO MARKET PLAYERS

- 4.2 SURFACE INSPECTION MARKET, BY SYSTEM

- FIGURE 16 COMPUTER-BASED SURFACE INSPECTION SYSTEMS HELD LARGER MARKET SHARE IN 2022

- 4.3 SURFACE INSPECTION MARKET, BY SURFACE TYPE

- FIGURE 17 2D SURFACE INSPECTION SYSTEMS TO CAPTURE LARGER MARKET SHARE IN 2023

- 4.4 SURFACE INSPECTION MARKET, BY VERTICAL

- FIGURE 18 AUTOMOTIVE VERTICAL TO CAPTURE LARGEST MARKET SHARE DURING 2023-2028

- 4.5 SURFACE INSPECTION MARKET, BY REGION

- FIGURE 19 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL SURFACE INSPECTION MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

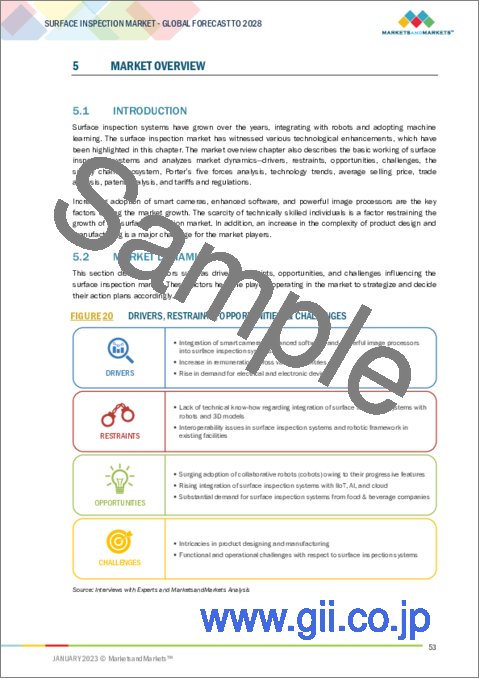

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, & CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Integration of smart cameras, advanced software, and powerful image processors into surface inspection systems

- 5.2.1.2 Increase in remuneration across various countries

- 5.2.1.3 Rise in demand for electrical and electronic devices

- FIGURE 21 IMPACT OF DRIVERS ON SURFACE INSPECTION MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of technical know-how regarding integration of surface inspection systems with robots and 3D models

- 5.2.2.2 Interoperability issues in surface inspection systems and robotic framework in existing facilities

- FIGURE 22 IMPACT OF RESTRAINTS ON SURFACE INSPECTION MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Surging adoption of collaborative robots (cobots) owing to their progressive features

- 5.2.3.2 Rising integration of surface inspection systems with IIoT, AI, and cloud

- 5.2.3.3 Substantial demand for surface inspection systems from food & beverage companies

- FIGURE 23 IMPACT OF OPPORTUNITIES ON SURFACE INSPECTION MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Intricacies in product designing and manufacturing

- 5.2.4.2 Functional and operational challenges with respect to surface inspection systems

- FIGURE 24 IMPACT OF CHALLENGES ON SURFACE INSPECTION MARKET

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS OF SURFACE INSPECTION ECOSYSTEM: R&D AND MANUFACTURING PHASES ADD MAXIMUM VALUE

- 5.3.1 PLANNING & REVISING FUND

- 5.3.2 RESEARCH & DEVELOPMENT

- 5.3.3 MANUFACTURING

- 5.3.4 ASSEMBLY, DISTRIBUTION, & AFTER-SALES SERVICES

- 5.4 ECOSYSTEM MAPPING

- FIGURE 26 SURFACE INSPECTION ECOSYSTEM

- TABLE 1 LIST OF COMPANIES AND THEIR ROLES IN SURFACE INSPECTION ECOSYSTEM

- 5.5 TRENDS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 SHIFT IN CLIENT'S REVENUE: LENS ON AUTOMOTIVE, ELECTRICAL & ELECTRONICS, SEMICONDUCTOR, AND MEDICAL & PHARMACEUTICAL INDUSTRIES

- 5.6 CASE STUDIES

- 5.6.1 AUTOMOTIVE

- 5.6.1.1 STEMMER IMAGING (Germany) integrated vision camera, processors, and software from Teledyne DALSA (Canada) into lighting equipment from Smart Vision Lights (US) to create vision solution for automotive assembly process

- 5.6.2 SEMICONDUCTOR

- 5.6.2.1 Detection of quality issues in low-volume PCB assemblies using FH series of vision-integrated cobot systems by OMRON (Japan)

- 5.6.2.2 Use of Allied Vision's Mako and Manta cameras in hard disk drives for quality control and inspection applications

- 5.6.3 FOOD & PACKAGING

- 5.6.3.1 Newbaze Ireland Nutrition employed vision solutions provided by Datalogic (Italy) and AIS (Spain) to ensure product quality and safety

- 5.6.3.2 Suntory PepsiCo (Vietnam) deployed Imaging OCR software and vision controller offered by Matrox Electronic Systems (Canada) for accurate identification and verification of manufacturing and expiration dates

- 5.6.1 AUTOMOTIVE

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 SURFACE INSPECTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 BARGAINING POWER OF SUPPLIERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 TECHNOLOGY TRENDS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Advancements in CMOS technology make it increasingly appealing for industrial machines

- 5.8.1.2 Emergence of mobile/portable vision systems

- 5.8.2 COMPLEMENTARY TECHNOLOGY

- 5.8.2.1 Rapid advancements in AI and deep learning enable new capabilities in vision systems

- 5.8.3 ADJACENT TECHNOLOGY

- 5.8.3.1 Modular smart camera designs offer flexibility in selecting lenses and lighting equipment for multipurpose applications

- 5.8.1 KEY TECHNOLOGIES

- 5.9 AVERAGE SELLING PRICE ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE OF KEY COMPONENTS OF SURFACE INSPECTION SYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF SURFACE INSPECTION SYSTEMS OFFERED BY ISRA VISION AND VITRONIC BASED ON NUMBER OF CAMERAS ADOPTED

- FIGURE 29 ASP TREND FOR SURFACE INSPECTION SYSTEMS BASED ON NUMBER OF CAMERAS

- FIGURE 30 ASP TREND FOR SURFACE INSPECTION SYSTEMS BASED ON SYSTEM

- FIGURE 31 ASP TREND FOR SURFACE INSPECTION SYSTEMS BASED ON SURFACE TYPE

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- 5.10.1.1 Import scenario for surface inspection systems

- TABLE 5 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 903180 (INSTRUMENTS, APPLIANCES, AND MACHINES FOR MEASURING OR CHECKING), 2011-2020 (USD MILLION)

- FIGURE 32 IMPORT DATA FOR INSTRUMENTS, APPLIANCES, AND MACHINES FOR MEASURING OR CHECKING (INCLUDING SURFACE INSPECTION SYSTEMS), 2016-2020

- 5.10.2 EXPORT SCENARIO

- 5.10.2.1 Export scenario for surface inspection systems

- TABLE 6 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 903180 (INSTRUMENTS, APPLIANCES, AND MACHINES FOR MEASURING OR CHECKING), 2011-2020 (USD MILLION)

- FIGURE 33 EXPORT DATA FOR INSTRUMENTS, APPLIANCES, AND MACHINES FOR MEASURING OR CHECKING (INCLUDING SURFACE INSPECTION SYSTEMS), 2016-2020

- 5.10.1 IMPORT SCENARIO

- 5.11 PATENT ANALYSIS

- TABLE 7 PATENTS FILED FOR VARIOUS TYPES OF SURFACE INSPECTION SYSTEMS, 2018-2020

- FIGURE 34 FILED PATENTS FOR SURFACE INSPECTION SYSTEMS, 2010-2020

- FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS, 2010-2020

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF

- TABLE 8 US: MFN TARIFF FOR INSTRUMENTS, APPLIANCES, AND MACHINES DESIGNED FOR MEASURING OR CHECKING (INCLUDING SURFACE INSPECTION SYSTEMS) EXPORTED, BY KEY COUNTRY

- TABLE 9 CHINA: MFN TARIFF FOR INSTRUMENTS, APPLIANCES, AND MACHINES DESIGNED FOR MEASURING OR CHECKING (INCLUDING SURFACE INSPECTION SYSTEMS) EXPORTED, BY KEY COUNTRY

- 5.12.1.1 Positive impact of tariff on surface inspection systems

- 5.12.1.2 Negative impact of tariff on surface inspection systems

- 5.12.2 REGULATIONS AND STANDARDS

- 5.12.2.1 Leading associations for machine vision-based inspection systems

6 DEFECTS IDENTIFIED BY SURFACE INSPECTION SYSTEMS

- 6.1 INTRODUCTION

- 6.2 HOLES

- 6.3 SCRATCHES

- 6.4 CRACKS

- 6.5 WEAR

- 6.6 FINISH

- 6.7 JOINTS

- 6.8 OTHERS

7 SURFACE INSPECTION MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 36 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR IN SURFACE INSPECTION MARKET, BY COMPONENT, FROM 2023 TO 2028

- TABLE 10 SURFACE INSPECTION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 11 SURFACE INSPECTION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 7.2 CAMERAS

- TABLE 12 CAMERAS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019-2022 (USD MILLION)

- TABLE 13 CAMERAS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023-2028 (USD MILLION)

- 7.2.1 FRAME RATES

- 7.2.1.1 Automobile industry to witness strong demand for cameras with higher frame rates

- FIGURE 37 CAMERAS WITH FRAME RATE OF >125 FPS TO EXHIBIT HIGHEST CAGR IN SURFACE INSPECTION MARKET DURING FORECAST PERIOD

- TABLE 14 CAMERAS: SURFACE INSPECTION MARKET, BY FRAME RATE, 2019-2022 (USD MILLION)

- TABLE 15 CAMERAS: SURFACE INSPECTION MARKET, BY FRAME RATE, 2023-2028 (USD MILLION)

- 7.2.2 FORMATS

- TABLE 16 CAMERAS: SURFACE INSPECTION MARKET, BY FORMAT, 2019-2022 (USD MILLION)

- TABLE 17 CAMERAS: SURFACE INSPECTION MARKET, BY FORMAT, 2023-2028 (USD MILLION)

- 7.2.2.1 Area scan cameras

- 7.2.2.1.1 Ability to capture 3D images in fast-moving scenes to drive demand

- 7.2.2.2 Line scan cameras

- 7.2.2.2.1 Capability to record data at rapid rate to boost demand

- 7.2.2.1 Area scan cameras

- 7.2.3 SENSING TECHNOLOGY

- FIGURE 38 CMOS SENSORS PROJECTED TO LEAD MARKET FOR CAMERAS THROUGHOUT FORECAST PERIOD

- TABLE 18 CAMERAS: SURFACE INSPECTION MARKET, BY SENSING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 19 CAMERAS: SURFACE INSPECTION MARKET, BY SENSING TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.2.3.1 CCD

- 7.2.3.1.1 High-quality images and advanced device designing and fabrication technology to accelerate demand

- 7.2.3.2 CMOS

- 7.2.3.2.1 Low fabrication cost and high power efficiency to boost requirement for CMOS sensors

- 7.2.3.3 CCD and CMOS

- 7.2.3.3.1 CMOS sensor-based cameras to register higher CAGR during forecast period

- 7.2.3.1 CCD

- TABLE 20 CCD VS. CMOS CAMERAS

- 7.2.4 INTERFACE STANDARDS

- TABLE 21 CAMERAS: SURFACE INSPECTION MARKET, BY INTERFACE STANDARD, 2019-2022 (USD MILLION)

- TABLE 22 CAMERAS: SURFACE INSPECTION MARKET, BY INTERFACE STANDARD, 2023-2028 (USD MILLION)

- 7.2.4.1 Camera link

- 7.2.4.1.1 High data transmission rate and compatibility with small-sized connectors and cables to propel growth

- 7.2.4.2 GigE

- 7.2.4.2.1 Need for interoperability between hardware and software across various vendors to drive demand

- 7.2.4.3 USB 3.0

- 7.2.4.3.1 Plug-and-play interface and power over cable features to stimulate demand

- 7.2.4.4 CoaXPress

- 7.2.4.4.1 Necessity for high-speed serial communication to transmit videos and images to increase adoption of CXP

- 7.2.4.5 Others

- 7.2.4.6 Comparison between various interface standards

- 7.2.4.1 Camera link

- TABLE 23 COMPARISON BETWEEN INTERFACE STANDARDS

- 7.2.5 IMAGING TECHNOLOGY

- FIGURE 39 MARKET FOR TIME-OF-FLIGHT CAMERAS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 24 CAMERAS: SURFACE INSPECTION MARKET, BY IMAGING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 25 CAMERAS: SURFACE INSPECTION MARKET, BY IMAGING TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.2.5.1 Structured light

- 7.2.5.1.1 High accuracy in depth, geometric construction, and surface information of objects offered by triangulation method to provide growth opportunities

- 7.2.5.2 Time-of-flight

- 7.2.5.2.1 Use of optical and non-contact methods to sense 3D shape of objects by ToF cameras to accelerate growth

- 7.2.5.3 Stereo vision

- 7.2.5.3.1 Full view offered by stereo vision systems for 3D measurement without using lasers or LEDs to stimulate demand

- 7.2.5.4 Comparison between various imaging technologies

- 7.2.5.1 Structured light

- TABLE 26 COMPARISON BETWEEN VARIOUS IMAGING TECHNOLOGIES

- 7.3 FRAME GRABBERS

- 7.3.1 ABILITY OF FRAME GRABBERS TO PROCESS, STORE, AND VISUALIZE MULTIPLE IMAGES AT ONCE AND PERFORM REAL-TIME COMPRESSION TO DRIVE DEMAND

- FIGURE 40 3D FRAME GRABBERS TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 27 FRAME GRABBERS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019-2022 (USD MILLION)

- TABLE 28 FRAME GRABBERS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023-2028 (USD MILLION)

- 7.4 OPTICS

- 7.4.1 USE OF LIQUID LENSES TO ENHANCE VISION CAMERA VIEW AND ADJUST FOCAL LENGTHS TO BOOST DEMAND

- TABLE 29 OPTICS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019-2022 (USD MILLION)

- TABLE 30 OPTICS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023-2028 (USD MILLION)

- 7.5 LIGHTING EQUIPMENT

- 7.5.1 LIGHTING EQUIPMENT HELP CAMERAS TO FUNCTION PROPERLY AND PRECISELY AND IMPROVE QUALITY OF IMAGES CAPTURED

- FIGURE 41 2D LIGHTING EQUIPMENT TO WITNESS HIGHER CAGR IN SURFACE INSPECTION MARKET DURING FORECAST PERIOD

- TABLE 31 LIGHTING EQUIPMENT: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019-2022 (USD MILLION)

- TABLE 32 LIGHTING EQUIPMENT: SURFACE INSPECTION MARKETS, BY SURFACE TYPE, 2023-2028 (USD MILLION)

- 7.6 PROCESSORS

- 7.6.1 PROCESSORS PERFORM ARITHMETIC ALGORITHMS TO GAIN HIGHEST PERFORMANCE IN SURFACE INSPECTION SYSTEMS

- TABLE 33 PROCESSORS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019-2022 (USD MILLION)

- TABLE 34 PROCESSORS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023-2028 (USD MILLION)

- 7.7 SOFTWARE

- 7.7.1 SOFTWARE DRIVES IMAGE ACQUISITION, PROCESSING, AND ANALYSIS FUNCTIONS THAT SIGNIFICANTLY INCREASE SYSTEM COST

- FIGURE 42 3D SEGMENT TO REGISTER HIGHER CAGR IN SURFACE INSPECTION MARKET FOR SOFTWARE DURING FORECAST PERIOD

- TABLE 35 SOFTWARE: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019-2022 (USD MILLION)

- TABLE 36 SOFTWARE: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023-2028 (USD MILLION)

- 7.8 OTHERS

- TABLE 37 OTHERS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019-2022 (USD MILLION)

- TABLE 38 OTHERS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023-2028 (USD MILLION)

8 SURFACE INSPECTION MARKET, BY SURFACE TYPE

- 8.1 INTRODUCTION

- TABLE 39 COMPARISON BETWEEN 3D AND 2D SURFACE INSPECTION SYSTEMS

- FIGURE 43 MARKET FOR 3D SYSTEMS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 40 SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019-2022 (USD MILLION)

- TABLE 41 SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023-2028 (USD MILLION)

- 8.2 2D

- 8.2.1 USE OF 2D SYSTEMS TO INCREASE PRODUCTIVITY AND ACCURACY BY DIMINISHING EFFECTS OF REFLECTIONS

- TABLE 42 COMPANIES MANUFACTURING 2D SURFACE INSPECTION SYSTEMS

- FIGURE 44 2D SURFACE INSPECTION MARKET FOR CAMERA-BASED SYSTEMS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 43 2D: SURFACE INSPECTION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 44 2D: SURFACE INSPECTION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 45 2D: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 46 2D: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 47 2D: SURFACE INSPECTION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 48 2D: SURFACE INSPECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3 3D

- 8.3.1 IMPLEMENTATION OF 3D SYSTEMS FOR QUALITY AND PRECISE INSPECTION APPLICATIONS IN VARIOUS INDUSTRIES

- TABLE 49 COMPANIES MANUFACTURING 3D SURFACE INSPECTION SYSTEMS

- FIGURE 45 MARKET FOR CAMERA-BASED 3D SURFACE INSPECTION SYSTEMS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 50 3D: SURFACE INSPECTION MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 51 3D: SURFACE INSPECTION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 52 3D: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 53 3D: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 54 3D: SURFACE INSPECTION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 55 3D: SURFACE INSPECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

9 SURFACE INSPECTION MARKET, BY SYSTEM

- 9.1 INTRODUCTION

- FIGURE 46 CAMERA-BASED SURFACE INSPECTION SYSTEMS TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 56 SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 57 SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- 9.2 COMPUTER-BASED

- 9.2.1 HIGH PROCESSING POWER OF COMPUTER-BASED SYSTEMS TO HANDLE COMPLEX ALGORITHMS TO DRIVE DEMAND

- TABLE 58 COMPUTER-BASED: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019-2022 (USD MILLION)

- TABLE 59 COMPUTER-BASED: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023-2028 (USD MILLION)

- TABLE 60 COMPUTER-BASED: SURFACE INSPECTION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 61 COMPUTER-BASED: SURFACE INSPECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3 CAMERA-BASED

- 9.3.1 QUICKER SETUP AND UTILIZATION OF INTELLIGENT PROCESSORS IN CAMERA-BASED SYSTEMS TO BOOST DEMAND

- FIGURE 47 3D CAMERA-BASED SYSTEMS TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 62 CAMERA-BASED: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019-2022 (USD MILLION)

- TABLE 63 CAMERA-BASED: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023-2028 (USD MILLION)

- TABLE 64 CAMERA-BASED: SURFACE INSPECTION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 65 CAMERA-BASED: SURFACE INSPECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

10 SURFACE INSPECTION MARKET, BY DEPLOYMENT TYPE

- 10.1 INTRODUCTION

- FIGURE 48 ROBOTIC CELL SEGMENT TO REGISTER HIGHER CAGR IN SURFACE INSPECTION MARKET DURING FORECAST PERIOD

- TABLE 66 SURFACE INSPECTION MARKET, BY DEPLOYMENT TYPE, 2019-2022 (USD MILLION)

- TABLE 67 SURFACE INSPECTION MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 10.2 TRADITIONAL SYSTEMS

- 10.2.1 LOWER MAINTENANCE AND IMPLEMENTATION COSTS AND REQUIREMENT FOR LESS SPACE TO BOOST DEMAND

- 10.3 ROBOTIC CELLS

- 10.3.1 INCREASING DEMAND FOR COBOTS WORLDWIDE TO DRIVE MARKET GROWTH

11 SURFACE INSPECTION MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- FIGURE 49 AUTOMOTIVE VERTICAL TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 68 SURFACE INSPECTION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 69 SURFACE INSPECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2 SEMICONDUCTOR

- TABLE 70 SEMICONDUCTOR: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 71 SEMICONDUCTOR: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 72 SEMICONDUCTOR: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 SEMICONDUCTOR: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2.1 IR VISION-BASED INSPECTION

- 11.2.1.1 Ability of IR cameras to identify cracks and broken traces in assembly line products

- 11.2.2 MACRO-DEFECT INSPECTION

- 11.2.2.1 Adoption of brightfield and darkfield inspection technologies to maximize all macro defects

- 11.2.3 ROBOT VISION-BASED INSPECTION

- 11.2.3.1 Implementation of robotic cells in manufacturing industry to handle complex assemblies and tiny parts

- 11.2.4 PRINTED CIRCUIT BOARD (PCB) INSPECTION

- 11.2.4.1 Use of bar code reading technology to inspect appropriate placement of PCB components

- 11.2.5 SEMICONDUCTOR FABRICATION INSPECTION

- 11.2.5.1 Deployment of semiconductor fabrication inspection systems for high-speed wafer inspection

- 11.3 AUTOMOTIVE

- TABLE 74 AUTOMOTIVE: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 75 AUTOMOTIVE: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 76 AUTOMOTIVE: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 AUTOMOTIVE: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.1 ASSEMBLY VERIFICATION

- 11.3.1.1 Necessity to inspect assembly line to ensure proper functioning of complex configuration of components

- 11.3.2 FLAW DETECTION

- 11.3.2.1 Deployment of vision-based surface inspection systems to detect flaws and inspect surface quality of objects

- 11.3.3 PRINT VERIFICATION

- 11.3.3.1 Need to detect pre-printing errors such as missing content, color variation, and text/print errors

- 11.3.4 INSPECTION OF PAINTED SURFACES

- 11.3.4.1 Requirement to detect defect dents, scratches, and flaking on painted surfaces

- 11.3.5 INSPECTION OF CFRP AND GFRP CAR MATS

- 11.3.5.1 Necessity to inspect surface structure of carbon-fiber webs

- 11.3.6 INSPECTION OF WELD AND BRAZED SEAMS

- 11.3.6.1 Necessity of welded seam inspection of axle carriers, vehicle body, steel wheels, and seats in car body

- 11.4 ELECTRICAL & ELECTRONICS

- 11.4.1 SUITABILITY OF ROBOT-BASED SURFACE INSPECTION SYSTEMS TO DETECT BENT PINS ON PORTS AND CONNECTORS, LOOSE SCREWS, AND MISSING COMPONENTS

- TABLE 78 ELECTRICAL & ELECTRONICS: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 79 ELECTRICAL & ELECTRONICS: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 80 ELECTRICAL & ELECTRONICS: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 ELECTRICAL & ELECTRONICS: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 GLASS & METAL

- TABLE 82 GLASS & METAL: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 83 GLASS & METAL: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 84 GLASS & METAL: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 85 GLASS & METAL: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5.1 CUT PLATE INSPECTION

- 11.5.1.1 Need for automatic inspection and rejection of glasses according to user-defined tolerance with minimum operator interventions

- 11.5.2 MIRRORED GLASS INSPECTION

- 11.5.2.1 Use of mirrored glass inspection for verification of glass identity, pinhole detection, and paint defect detection

- 11.5.3 FLOAT GLASS INSPECTION

- 11.5.3.1 Adoption of float glass inspection to detect inclusion, tin, and ream defects

- 11.5.4 COATED GLASS INSPECTION

- 11.5.4.1 Deployment of coated glass inspection systems in architectural and automotive industries

- 11.5.5 LAMINATED GLASS INSPECTION

- 11.5.5.1 Implementation of laminated glass inspection systems to detect bubbles, cracks, and scratches

- 11.5.6 PRISTINE GLASS INSPECTION

- 11.5.6.1 Employment of pristine glass inspection systems to detect strains, scratches, cracks, and fingerprints and provide crystal-clear images

- 11.5.7 STRUCTURED SOLAR GLASS INSPECTION

- 11.5.7.1 Adoption of structured solar glass inspection technique to detect round bubble and glass chip defects

- 11.5.8 COATING

- 11.5.8.1 Application of coating to prevent metal from rusting, as well as for cosmetic appeal

- 11.5.9 COLD ROLLING

- 11.5.9.1 Use of cold rolling to attain thinner sheets with roll speeds up to 7,000 ft per minute

- 11.5.10 CONVERTING

- 11.5.10.1 Adoption of conversion technique to convert metal sheets into smaller sizes for easy transportation

- 11.5.11 HOT ROLLING

- 11.5.11.1 Implementation of hot rolling technique to reduce metal thickness

- 11.6 FOOD & PACKAGING

- TABLE 86 FOOD & PACKAGING: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 87 FOOD & PACKAGING: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 88 FOOD & PACKAGING: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 89 FOOD & PACKAGING: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6.1 QUALITY ASSURANCE

- 11.6.1.1 Consistent quality assurance to encourage customer loyalty and maintain brand image

- 11.6.2 GRADING

- 11.6.2.1 Need to check quality grades based on size, shape, and color

- 11.6.3 LABEL VALIDATION

- 11.6.3.1 Adoption of label validation technique to detect tears, double labels, wrinkles, and incorrect dates on packages and containers

- 11.6.4 SAFETY INSPECTION

- 11.6.4.1 Utilization of safety inspection systems to check quality and safety of packages and containers

- 11.6.5 GLASS CONTAINERS INSPECTION

- 11.6.5.1 Deployment of surface inspection technique to check quality of bottles at faster rate

- 11.6.6 METAL CONTAINERS INSPECTION

- 11.6.6.1 Necessity to check correct usage of graphics and colors on metal containers

- 11.6.7 PLASTIC BOTTLE INSPECTION

- 11.6.7.1 Inspection of plastic bottles to check appropriate fill height, labels, registration details, and bottle caps

- 11.7 PAPER & WOOD

- 11.7.1 DEPLOYMENT OF SURFACE INSPECTION SYSTEMS IN PRINTING, SHEETING, WRAPPING, AND PULP DRYING PROCESSES IN PAPER MANUFACTURING

- TABLE 90 PAPER & WOOD: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 91 PAPER & WOOD: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 92 PAPER & WOOD: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 93 PAPER & WOOD: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.8 PHARMACEUTICAL

- FIGURE 50 COMPUTER-BASED SYSTEMS TO ACCOUNT FOR LARGER MARKET SHARE FOR PHARMACEUTICAL VERTICAL THROUGHOUT FORECAST PERIOD

- TABLE 94 PHARMACEUTICAL: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 95 PHARMACEUTICAL: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 96 PHARMACEUTICAL: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 97 PHARMACEUTICAL: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.8.1 VIAL INSPECTION

- 11.8.1.1 Necessity to inspect fill levels, stoppers, and containers and verify barcodes

- 11.8.2 BLISTER PACK INSPECTION

- 11.8.2.1 Use of blister pack inspection technique to remove defective capsules and tablets before reaching consumers

- 11.8.3 TRANSDERMAL PATCHES INSPECTION

- 11.8.3.1 Necessity to inspect transdermal patches for presence of active ingredients in medicine

- 11.8.4 INSULIN PEN INSPECTION

- 11.8.4.1 Importance of inspecting plastic sleeves, grease, dosage knobs, and angle of rotation of insulin pens

- 11.9 PLASTIC & RUBBER

- 11.9.1 ADOPTION OF SURFACE INSPECTION SYSTEMS IN RUBBER INDUSTRY FOR INSPECTING GELS, CARBON SPECS, HOLES, CONTAMINANTS, EDGE CRACKS, WRINKLES, AND SCRATCHES IN RUBBER PARTS

- TABLE 98 PLASTIC & RUBBER: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 99 PLASTIC & RUBBER: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 100 PLASTIC & RUBBER: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 101 PLASTIC & RUBBER: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.10 PRINTING

- 11.10.1 IMPLEMENTATION OF VISION-BASED SURFACE INSPECTION SYSTEMS TO CAPTURE DEFECTS RELATED TO CURRENCIES, BANKNOTES, STAMPS, LABELS, AND PACKAGING MATERIALS

- FIGURE 51 CAMERA-BASED SYSTEMS TO REGISTER HIGHER CAGR IN SURFACE INSPECTION MARKET FOR PRINTING VERTICAL DURING FORECAST PERIOD

- TABLE 102 PRINTING: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 103 PRINTING: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 104 PRINTING: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 105 PRINTING: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.11 NONWOVENS

- 11.11.1 NEED FOR ACCURATE SURFACE INSPECTION OF NONWOVEN FABRICS LAMINATED BY CHEMICALS, SOLVENTS, AND HOT GLUES

- TABLE 106 NONWOVENS: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 107 NONWOVENS: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 108 NONWOVENS: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 109 NONWOVENS: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.12 POSTAL & LOGISTICS

- 11.12.1 UTILIZATION OF SURFACE INSPECTION SYSTEMS IN POSTAL & LOGISTICS FOR CHECKING PACKAGING ESTHETICS AND PRINT QUALITY AND VERIFYING ADDRESS AND BARCODES

- FIGURE 52 COMPUTER-BASED SYSTEMS TO RECORD HIGHER CAGR IN SURFACE INSPECTION MARKET FOR POSTAL & LOGISTICS VERTICAL DURING FORECAST PERIOD

- TABLE 110 POSTAL & LOGISTICS: SURFACE INSPECTION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 111 POSTAL & LOGISTICS: SURFACE INSPECTION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 112 POSTAL & LOGISTICS: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 113 POSTAL & LOGISTICS: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

12 SURFACE INSPECTION MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 53 CHINA TO EXHIBIT HIGHEST CAGR IN SURFACE INSPECTION MARKET DURING 2023-2028

- TABLE 114 SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 115 SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 AMERICAS

- FIGURE 54 AMERICAS: SNAPSHOT OF SURFACE INSPECTION MARKET

- TABLE 116 AMERICAS: SURFACE INSPECTION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 117 AMERICAS: SURFACE INSPECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 118 AMERICAS: SURFACE INSPECTION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 119 AMERICAS: SURFACE INSPECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.1 US

- 12.2.1.1 Open investment policy, highly skilled workforce, and infrastructure to boost market

- 12.2.2 CANADA

- 12.2.2.1 Skilled workforce and low labor cost to propel growth

- 12.2.3 MEXICO

- 12.2.3.1 Increased use of automation and digitalization to drive growth

- 12.2.4 BRAZIL

- 12.2.4.1 Growing industrialization, low manufacturing costs, and availability of economical workforce to stimulate growth

- 12.2.5 REST OF AMERICAS

- 12.3 EUROPE

- FIGURE 55 EUROPE: SNAPSHOT OF SURFACE INSPECTION MARKET

- TABLE 120 EUROPE: SURFACE INSPECTION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 121 EUROPE: SURFACE INSPECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 122 EUROPE: SURFACE INSPECTION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 123 EUROPE: SURFACE INSPECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.1 GERMANY

- 12.3.1.1 Increasing use of surface inspection systems by several manufacturing firms to boost market

- 12.3.2 UK

- 12.3.2.1 Rising demand from food & packaging and pharmaceutical industries to boost market

- 12.3.3 FRANCE

- 12.3.3.1 Rapid industrial modernization with government incentives and funding to create opportunities for market players

- 12.3.4 ITALY

- 12.3.4.1 Surging adoption of surface inspection systems by small and medium-sized players to accelerate growth

- 12.3.5 SPAIN

- 12.3.5.1 Increasing focus of process industries on automation to boost market

- 12.3.6 REST OF EUROPE

- 12.4 ASIA PACIFIC

- FIGURE 56 ASIA PACIFIC: SNAPSHOT OF SURFACE INSPECTION MARKET

- TABLE 124 ASIA PACIFIC: SURFACE INSPECTION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: SURFACE INSPECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: SURFACE INSPECTION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: SURFACE INSPECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.1 CHINA

- 12.4.1.1 Rising adoption from automotive and electrical & electronics industries to drive market

- 12.4.2 JAPAN

- 12.4.2.1 Early adoption of robot-based 3D surface inspection systems to contribute to market growth

- 12.4.3 SOUTH KOREA

- 12.4.3.1 Rising inclination toward automation to create opportunities for vision-based surface inspection system providers

- 12.4.4 INDIA

- 12.4.4.1 Increasing requirement for surface inspection systems from warehousing and packaging industries to accelerate growth

- 12.4.5 REST OF ASIA PACIFIC

- 12.5 ROW

- TABLE 128 ROW: SURFACE INSPECTION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 129 ROW: SURFACE INSPECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 130 ROW: SURFACE INSPECTION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 131 ROW: SURFACE INSPECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.5.1 MIDDLE EAST

- 12.5.1.1 Increasing investment in manufacturing and automation sectors to fuel market growth

- 12.5.2 AFRICA

- 12.5.2.1 Thriving food & beverage and automotive industries to drive growth

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 132 OVERVIEW OF STRATEGIES DEPLOYED BY SURFACE INSPECTION COMPANIES

- 13.2.1 PRODUCT PORTFOLIO

- 13.2.2 REGIONAL FOCUS

- 13.2.3 MANUFACTURING FOOTPRINT

- 13.2.4 ORGANIC/INORGANIC PLAY

- 13.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

- FIGURE 57 FIVE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN SURFACE INSPECTION MARKET

- 13.4 MARKET SHARE ANALYSIS, 2022

- TABLE 133 DEGREE OF COMPETITION, SURFACE INSPECTION MARKET (2022)

- 13.5 COMPANY EVALUATION QUADRANT

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 58 SURFACE INSPECTION MARKET: COMPANY EVALUATION QUADRANT, 2022

- 13.6 STARTUPS/SMES EVALUATION MATRIX

- TABLE 134 STARTUPS/SMES IN SURFACE INSPECTION MARKET

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 59 SURFACE INSPECTION MARKET, STARTUPS/SMES EVALUATION MATRIX, 2022

- 13.7 COMPANY FOOTPRINT (40 COMPANIES)

- TABLE 135 COMPANY FOOTPRINT

- TABLE 136 COMPANY COMPONENT FOOTPRINT (40 COMPANIES)

- TABLE 137 COMPANY VERTICAL FOOTPRINT (40 COMPANIES)

- TABLE 138 COMPANY REGION FOOTPRINT (40 COMPANIES)

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 PRODUCT LAUNCHES

- TABLE 139 PRODUCT LAUNCHES, SEPTEMBER 2021-DECEMBER 2022

- 13.8.2 DEALS

- TABLE 140 DEALS, FEBRUARY 2020-SEPTEMBER 2022

- 13.8.3 OTHERS

- TABLE 141 EXPANSIONS, JANUARY 2020-OCTOBER 2022

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 14.1.1 ISRA VISION

- TABLE 142 ISRA VISION: BUSINESS OVERVIEW

- FIGURE 60 ISRA VISION: COMPANY SNAPSHOT

- TABLE 143 ISRA VISION: PRODUCT OFFERINGS

- TABLE 144 ISRA VISION: PRODUCT LAUNCHES

- TABLE 145 ISRA VISION: DEALS

- 14.1.2 COGNEX

- TABLE 146 COGNEX: BUSINESS OVERVIEW

- FIGURE 61 COGNEX: COMPANY SNAPSHOT

- TABLE 147 COGNEX: PRODUCT OFFERINGS

- TABLE 148 COGNEX: PRODUCT LAUNCHES

- 14.1.3 OMRON

- TABLE 149 OMRON: BUSINESS OVERVIEW

- FIGURE 62 OMRON: COMPANY SNAPSHOT

- TABLE 150 OMRON: PRODUCT OFFERINGS

- TABLE 151 OMRON: PRODUCT LAUNCHES

- TABLE 152 OMRON: DEALS

- TABLE 153 OMRON: OTHERS

- 14.1.4 TELEDYNE TECHNOLOGIES

- TABLE 154 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 63 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 155 TELEDYNE TECHNOLOGIES: PRODUCT OFFERINGS

- TABLE 156 TELEDYNE TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 157 TELEDYNE TECHNOLOGIES: DEALS

- 14.1.5 VITRONIC

- TABLE 158 VITRONIC: BUSINESS OVERVIEW

- TABLE 159 VITRONIC: PRODUCT OFFERINGS

- TABLE 160 VITRONIC: PRODUCT LAUNCHES

- TABLE 161 VITRONIC: DEALS

- TABLE 162 VITRONIC: OTHERS

- 14.1.6 PANASONIC

- TABLE 163 PANASONIC: BUSINESS OVERVIEW

- FIGURE 64 PANASONIC: COMPANY SNAPSHOT

- TABLE 164 PANASONIC: PRODUCT OFFERINGS

- TABLE 165 PANASONIC: DEALS

- 14.1.7 MATROX ELECTRONIC SYSTEMS

- TABLE 166 MATROX ELECTRONIC SYSTEMS: BUSINESS OVERVIEW

- TABLE 167 MATROX ELECTRONIC SYSTEMS: PRODUCT OFFERINGS

- TABLE 168 MATROX ELECTRONIC SYSTEMS: PRODUCT LAUNCHES

- TABLE 169 MATROX ELECTRONIC SYSTEMS: OTHERS

- 14.1.8 IMS MESSSYSTEME

- TABLE 170 IMS MESSSYSTEME: BUSINESS OVERVIEW

- TABLE 171 IMS MESSSYSTEME: PRODUCT OFFERINGS

- TABLE 172 IMS MESSSYSTEME: OTHERS

- 14.1.9 KEYENCE

- TABLE 173 KEYENCE: BUSINESS OVERVIEW

- FIGURE 65 KEYENCE: COMPANY SNAPSHOT

- TABLE 174 KEYENCE: PRODUCT OFFERINGS

- TABLE 175 KEYENCE: PRODUCT LAUNCHES

- 14.1.10 DATALOGIC

- TABLE 176 DATALOGIC: BUSINESS OVERVIEW

- FIGURE 66 DATALOGIC: COMPANY SNAPSHOT

- TABLE 177 DATALOGIC: PRODUCT OFFERINGS

- TABLE 178 DATALOGIC: PRODUCT LAUNCHES

- TABLE 179 DATALOGIC: DEALS

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 14.2 OTHER KEY PLAYERS

- 14.2.1 AMETEK SURFACE VISION

- 14.2.2 KITOV

- 14.2.3 TELEDYNE FLIR

- 14.2.4 SONY

- 14.2.5 NATIONAL INSTRUMENTS

- 14.2.6 SICK

- 14.2.7 BASLER

- 14.2.8 INDUSTRIAL VISION SYSTEMS

- 14.2.9 ALLIED VISION TECHNOLOGIES

- 14.2.10 BAUMER

- 14.2.11 IN-CORE SYSTEMES

- 14.2.12 DARK FIELD TECHNOLOGIES

- 14.2.13 SIPOTEK

- 14.2.14 MORITEX

- 14.2.15 PIXARGUS

15 ADJACENT MARKET

- 15.1 MACHINE VISION MARKET

- 15.2 INTRODUCTION

- FIGURE 67 SMART CAMERA-BASED MACHINE VISION SYSTEMS TO WITNESS HIGHER CAGR FROM 2022 TO 2027

- TABLE 180 MACHINE VISION MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 181 MACHINE VISION MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 15.3 PC-BASED MACHINE VISION SYSTEMS

- 15.3.1 PC-BASED MACHINE VISION SYSTEMS CAN DETECT UNEXPECTED VARIATIONS IN CERTAIN TASKS

- 15.4 SMART CAMERA-BASED MACHINE VISION SYSTEMS

- 15.4.1 SMART CAMERA-BASED MACHINE VISION SYSTEMS CONSIST OF EMBEDDED CONTROLLERS WITH INTEGRATED VISION SOFTWARE

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS