|

|

市場調査レポート

商品コード

1075375

ポリメチルメタクリレート(PMMA)の世界市場:グレード(汎用、光学)、形態(押出シート、キャストアクリルシート、ペレット、ビーズ)、最終用途業界、地域別 - 2027年までの予測Polymethyl Methacrylate (PMMA) Market by Grade (General Purpose, Optical), Form(Extruded Sheet, Cast Acrylic Sheet, Pellets, Beads),End-Use Industry & Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ポリメチルメタクリレート(PMMA)の世界市場:グレード(汎用、光学)、形態(押出シート、キャストアクリルシート、ペレット、ビーズ)、最終用途業界、地域別 - 2027年までの予測 |

|

出版日: 2022年05月10日

発行: MarketsandMarkets

ページ情報: 英文 308 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のポリメチルメタクリレート(PMMA)の市場規模は、予測期間中に5.4%のCAGRで推移する見通しで、2022年の48億米ドルから、2027年までに63億米ドルに達すると予測されています。

建設、自動車、エレクトロニクスなどにおけるPMMAの使用量の増加が、予測期間中のPMMAの需要を促進する見通しです。また、PMMAの優れた特性と、欧州グリーンディールなどの政府政策の変化により、世界市場の成長が予想されます。しかし、低コストの代替品の入手可能性が、市場成長の妨げになると予想されます。

当レポートでは、世界のポリメチルメタクリレート(PMMA)市場について調査しており、市場力学、ケーススタディ分析、エコシステム、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

- バリューチェーン分析

- 規制状況

- エコシステム市場マップ

- 顧客のビジネスに影響を与える動向/ディスラプション

- PMMA市場のシナリオ分析

- 価格分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 隣接市場

- 貿易分析

- テクノロジー分析

- 成長予測とCOVID-19の影響に影響を与える要因

- 主な会議とイベント(2022-2023)

- 特許分析

第6章 グレード別:PMMA市場

- 汎用目的

- 光学

第7章 形態別:PMMA市場

- 押出シート

- キャストアクリルシート

- ペレット

- ビーズ

第8章 最終用途業界別:PMMA市場

- 看板・ディスプレイ

- 建設

- 自動車

- 照明器具

- エレクトロニクス

- 船舶

- ヘルスケア

- 農業

- 消費財

- その他

第9章 地域別:PMMA市場

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリアとニュージーランド

- マレーシア

- その他

- 欧州

- ドイツ

- フランス

- イタリア

- スペイン

- 英国

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他

第10章 競合情勢

- 市場シェア分析

- 主要企業の戦略

- 企業の評価マトリックスの定義とテクノロジー

- 新興企業および中小企業の評価マトリックス

- 主要企業の収益分析

- 企業の製品のフットプリント

- 主な市場開発

第11章 企業プロファイル

- 主要企業

- TRINSEO S.A.

- ASAHI KASEI CORPORATION

- SABIC

- MITSUBISHI CHEMICAL HOLDINGS CORPORATION

- LG CHEM LTD.

- ROHM GMBH

- KURARAY CO., LTD

- KOLON INDUSTRIES INC.

- SUMITOMO CHEMICAL CO., LTD

- CHIMEI CORPORATION

- LOTTE CHEMICAL CORPORATION

- PLASKOLITE, LLC

- その他の企業

- TORAY INDUSTRIES, INC

- GEHR PLASTICS INC.

- RTP COMPANY

- UNIGEL S.A.

- MAKEVALE GROUP LTD.

- 3A COMPOSITES

- SPARTECH LLC

- COSSA POLIMERI S.R.L.

- INEOS GROUP LTD

- SAMYANG CORPORATION

- GO YEN CHEMICAL INDUSTRIAL CO LTD

- CELANESE CORPORATION

- PARKER CHOMERICS

- RABIGH REFINING AND PETROCHEMICAL COMPANY

第12章 付録

The global Polymethyl Methacrylate (PMMA) market is projected to grow from USD 4.8 Billion in 2022 to USD 6.3 Billion by 2027, at a CAGR of 5.4% during the forecast period. Increasing usage of PMMA in construction, automotive, electronics, and other end-use industries are driving the demand for PMMA during the forecast period. However, availability of low-cost substitutes is expected to hamper market growth. PMMA is a versatile, recyclable, sustainable, and durable material, owing to which it is gaining traction across several industrial applications. Due to its superior properties and the changing government policies such as European Green Deals, the global market for PMMA is expected to grow

"Automotive is projected to be the fastest-growing segment by end-use industry in PMMA market"

Based on end-use industry, automotive is estimated to be the fastest-growing segment of PMMA during the forecast period. PMMA is widely used in the automotive industry as it is light in weight and weather resistant. It is used in taillights, windshields, windscreens, side windows, instrument panels, headlamps and rear lights, lenses of exterior lights, meter panels, sun visors, car sculptures, tail lamp covers, speedometer covers, and signal lamps. PMMA is used in electric vehicles (EVs) due to their high-performance characteristics compared to traditional polymer and other materials. The changing regulatory scenario and government policies to support EVs boost the growth of the PMMA market.

"Extruded Sheets is projected to be the fastest-growing segment by form in PMMA market"

Extruded Sheets is estimated to be the fastest-growing segment by form in the PMMA market during the forecast period. This is due to its advantages, which include clarity, good surface quality, range of colors, easy maintenance, surface hardness, lightweight, and easy fabrication. Moreover, These are cost effective option compared to others.

"Asia Pacific is projected to be the fastest growing segment in PMMA market by region"

Asia Pacific is the fastest growing PMMA market in forecast period. The major end users of PMMA in Asia pacific includes construction, automotive, lighting fixtures, electronics, signage & display, and others. China dominates the PMMA market in Asia Pacific in terms of value and volume. The market growth in this region can be attributed to the improving socio-economic conditions in emerging economies such as China and India. The demand for PMMA in the Middle East is expected to increase. It is propelled by the increasing demand for lightweight, durable, and weather-resistant substitute to glass. The rising demand for durable and advanced products in the sign & display, construction, and electronics applications is driving the market for PMMA in the region.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub segments and information gathered through secondary research.

The break-up of primary interviews is given below:

By Company Type: Tier 1: 52%, Tier 2: 26%, and Tier 3: 22%

By Designation: C-level Executives: 48%, Directors: 23%, and Others: 29%

By Region: North America: 21%, Europe: 25%, Asia Pacific: 44%, ROW: 10%

Notes: Others include sales, marketing, and product managers.

Tier 1: > USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: < USD 500 million

The companies profiled in this market research report include are Rohm GmbH (Germany), ChiMei Corporation (Taiwan), Mitsubishi Chemical Holdings Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), SABIC (Saudi Arabia), LG Chem Ltd. (South Korea), Trinseo S.A. (US), Kuraray Co., Ltd (Japan), Kolon Industries Inc. (South Korea), Toray Industries, Inc. (Japan), Lotte Chemical Corporation (South Korea), Plaskolite LLC (US), and others.

Research Coverage:

This research report categorizes the PMMA market on the basis of form, grade, end-use industry and region. The report includes detailed information regarding the major factors influencing the growth of the PMMA market, such as drivers, restraints, challenges, and opportunities. A detailed analysis of the key industry players has been done to provide insights into business overviews, products & services, key strategies, expansions, new product developments, and recent developments associated with the market.

Reasons to Buy the Report

The report will help market leaders/new entrants in this market in the following ways:

1. This report segments the PMMA market comprehensively and provides the closest approximations of market sizes for the overall market and subsegments across verticals and regions.

2. The report will help stakeholders understand the pulse of the market and provide them information on the key market drivers, restraints, challenges, and opportunities.

3. This report will help stakeholders understand the major competitors and gain insights to enhance their position in the business. The competitive landscape section includes expansions, new product developments, and joint ventures.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 RESEARCH SCOPE: INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKET SCOPE

- FIGURE 1 PMMA: MARKET SEGMENTATION

- FIGURE 2 PMMA: END-USE INDUSTRY

- 1.2.3 REGIONS AND COUNTRIES COVERED

- 1.2.4 YEARS CONSIDERED FOR THE STUDY

- 1.3 CURRENCY

- 1.4 UNIT CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 PMMA MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Critical secondary inputs

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 List of participating industry experts

- 2.2 MARKET SIZE ESTIMATION APPROACH

- 2.2.1 DEMAND-SIDE: ASCERTAINING CONSUMPTION OF PMMA IN AUTOMOTIVE APPLICATION

- FIGURE 4 MARKET SIZE ESTIMATION: DEMAND-SIDE

- 2.2.2 SUPPLY-SIDE: FROM OVERALL CONSUMPTION OF EXTRUDED SHEETS

- 2.2.3 TOP-DOWN APPROACH: PMMA MARKET

- FIGURE 5 MARKET SIZE ESTIMATION - SUPPLY-SIDE AND TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 PMMA MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.5.1 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 EXTRUDED SHEETS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

- FIGURE 8 CONSTRUCTION SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

- FIGURE 9 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN PMMA MARKET

- FIGURE 10 INCREASING USE OF PMMA IN AUTOMOTIVE AND BUILDING & CONSTRUCTION MATERIALS IN EMERGING ECONOMIES TO DRIVE DEMAND

- 4.2 PMMA MARKET IN ASIA PACIFIC, BY GRADE

- FIGURE 11 GENERAL PURPOSE GRADE TO LEAD PMMA MARKET IN ASIA PACIFIC

- 4.3 PMMA MARKET, BY COUNTRY

- FIGURE 12 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 13 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Recovery from impact of COVID-19 and rising penetration of EVs expected to drive market

- TABLE 1 COUNTRY-WISE AUTOMOTIVE PRODUCTION, 2018-2020 (UNIT)

- FIGURE 14 GLOBAL PROVISIONAL PRODUCTION DATA FOR ALL VEHICLES

- 5.2.1.2 Rising demand for LED flat screens

- 5.2.1.3 Rising demand from electronics industry

- FIGURE 15 DURABLE GOODS MANUFACTURING INDEX, 2016 TO 2021

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of low-cost substitutes expected to hamper market growth

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Bio-based PMMA

- 5.2.4 CHALLENGES

- 5.2.4.1 Negative impact on environment

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 POLYMETHYL METHACRYLATE (PMMA) MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 PMMA: PORTER'S FIVE FORCES ANALYSIS

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP GROWTH PROJECTION WORLDWIDE

- TABLE 3 GDP GROWTH PROJECTION WORLDWIDE

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS OF POLYMETHYL METHACRYLATE (PMMA) MARKET

- 5.5.1 DISRUPTIONS DUE TO COVID-19

- 5.6 REGULATORY LANDSCAPE

- 5.7 ECOSYSTEM MARKET MAP

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- FIGURE 18 SHIFT IN IMPERATIVES & OUTCOMES IN APPLICATIONS SUCH AS AUTOMOTIVE INDUSTRY ARE EXPECTED TO LEAD TO CHANGE IN FUTURE REVENUE MIX!!

- 5.9 SCENARIO ANALYSIS OF PMMA MARKET

- FIGURE 19 PMMA MARKET, IN TERMS OF VALUE, BASED ON SCENARIO ANALYSIS, 2020-2027 (USD MILLION)

- 5.10 PRICING ANALYSIS

- 5.10.1 FACTORS AFFECTING PRICES OF PMMA

- FIGURE 20 AVERAGE PRICING OF PMMA

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR DIFFERENT GRADES

- TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR DIFFERENT GRADES (%)

- 5.11.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR DIFFERENT GRADES

- TABLE 5 KEY BUYING CRITERIA FOR DIFFERENT GRADES

- 5.12 CASE STUDY ANALYSIS

- 5.13 ADJACENT MARKETS

- 5.13.1 INTRODUCTION

- 5.13.2 LIMITATIONS

- 5.13.3 ACRYLIC RESINS MARKET

- 5.13.3.1 Market definition

- 5.13.3.2 Acrylic resins market, by chemistry

- TABLE 6 ACRYLIC RESINS MARKET SIZE, BY CHEMISTRY, 2016-2019 (KILOTON)

- TABLE 7 ACRYLIC RESINS MARKET SIZE, BY CHEMISTRY, 2020-2025 (KILOTON)

- TABLE 8 ACRYLIC RESINS MARKET SIZE, BY CHEMISTRY, 2016-2019 (USD MILLION)

- TABLE 9 ACRYLIC RESINS MARKET SIZE, BY CHEMISTRY, 2020-2025 (USD MILLION)

- 5.13.3.3 Acrylic resins market, by solvency

- TABLE 10 ACRYLIC RESINS MARKET SIZE, BY SOLVENCY, 2016-2019 (KILOTON)

- TABLE 11 ACRYLIC RESINS MARKET SIZE, BY SOLVENCY, 2020-2025 (KILOTON)

- TABLE 12 ACRYLIC RESINS MARKET SIZE, BY SOLVENCY, 2016-2019 (USD MILLION)

- TABLE 13 ACRYLIC RESINS MARKET SIZE, BY SOLVENCY, 2020-2025 (USD MILLION)

- 5.13.3.4 Acrylic resins market, by application

- TABLE 14 ACRYLIC RESINS MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

- TABLE 15 ACRYLIC RESINS MARKET SIZE, BY APPLICATION, 2020-2025 (KILOTON)

- TABLE 16 ACRYLIC RESINS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 17 ACRYLIC RESINS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

- 5.13.3.5 Acrylic resins market, by end-use industry

- TABLE 18 ACRYLIC RESINS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

- TABLE 19 ACRYLIC RESINS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (KILOTON)

- TABLE 20 ACRYLIC RESINS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

- TABLE 21 ACRYLIC RESINS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

- 5.13.3.6 Acrylic resins market, by region

- TABLE 22 ACRYLIC RESINS MARKET SIZE, BY REGION, 2016-2019 (KILOTON)

- TABLE 23 ACRYLIC RESINS MARKET SIZE, BY REGION, 2020-2025 (KILOTON)

- TABLE 24 ACRYLIC RESINS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

- TABLE 25 ACRYLIC RESINS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

- 5.13.4 METHYL METHACRYLATE ADHESIVES MARKET

- 5.13.4.1 Market definition

- 5.13.4.2 MMA adhesives market, by substrate

- TABLE 26 MMA ADHESIVES MARKET SIZE, BY SUBSTRATE, 2016-2023 (USD MILLION)

- TABLE 27 MMA ADHESIVES MARKET SIZE, BY SUBSTRATE, 2016-2023 (KILOTON)

- 5.13.4.3 MMA adhesives market, by end-use industry

- TABLE 28 MMA ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2016-2023 (USD MILLION)

- TABLE 29 MMA ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2016-2023 (KILOTON)

- 5.13.4.4 MMA adhesives market, by region

- TABLE 30 MMA ADHESIVES MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

- TABLE 31 MMA ADHESIVES MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

- 5.14 TRADE ANALYSIS

- 5.14.1 MAJOR IMPORTERS

- TABLE 32 MAJOR IMPORTERS OF PMMA IN PRIMARY FORMS, 2018-2020 (USD THOUSAND)

- TABLE 33 MAJOR IMPORTERS OF PMMA IN PRIMARY FORMS (USD THOUSAND), (Q1-2020 TO Q1-2021)

- 5.14.2 MAJOR EXPORTERS

- TABLE 34 MAJOR EXPORTERS OF PMMA IN PRIMARY FORMS, 2018-2020 (USD THOUSAND)

- TABLE 35 MAJOR EXPORTERS OF PMMA IN PRIMARY FORMS (USD THOUSAND), (Q1-2020 TO Q1-2021)

- 5.15 TECHNOLOGY ANALYSIS

- 5.16 FACTORS AFFECTING GROWTH FORECAST AND IMPACT OF COVID-19

- FIGURE 23 FACTORS AFFECTING GROWTH FORECAST AND IMPACT OF COVID-19

- 5.17 KEY CONFERENCES & EVENTS IN 2022-2023

- 5.18 PATENT ANALYSIS

- 5.18.1 INTRODUCTION

- 5.18.2 METHODOLOGY

- 5.18.3 DOCUMENT TYPE

- FIGURE 24 NUMBER OF PATENTS FILED DURING LAST TEN YEARS

- 5.18.4 PUBLICATION TRENDS - LAST TEN YEARS

- FIGURE 25 YEAR-WISE DATA FOR NUMBER OF PATENTS PUBLISHED, 2011-2021

- 5.18.5 INSIGHTS

- 5.18.6 LEGAL STATUS OF PATENTS

- FIGURE 26 LEGAL STATUS

- 5.18.7 JURISDICTION ANALYSIS

- FIGURE 27 PATENT ANALYSIS FOR TOP TEN JURISDICTIONS BY DOCUMENT

- 5.18.8 TOP COMPANIES/APPLICANTS

- FIGURE 28 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2011-2021

- TABLE 36 LIST OF PATENTS BY EVONIK ROHM GMBH

- TABLE 37 LIST OF PATENTS BY HERAEUS MEDICAL GMBH

- TABLE 38 LIST OF PATENTS BY LG CHEMICAL LTD.

- TABLE 39 TOP TEN PATENT OWNERS (US) DURING LAST TEN YEARS

6 PMMA MARKET, BY GRADE

- 6.1 INTRODUCTION

- FIGURE 29 OPTICAL GRADE SEGMENT TO LEAD

- TABLE 40 PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 41 PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 42 PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 43 PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 6.2 GENERAL PURPOSE GRADE

- 6.2.1 SUITABILITY IN WIDE RANGE OF APPLICATIONS EXPECTED TO SUPPORT MARKET GROWTH

- TABLE 44 GENERAL PURPOSE PMMA MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

- TABLE 45 GENERAL PURPOSE PMMA MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 46 GENERAL PURPOSE PMMA MARKET SIZE, BY REGION, 2017-2019 (KILOTON)

- TABLE 47 GENERAL PURPOSE PMMA MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 6.3 OPTICAL GRADE

- 6.3.1 TRANSPARENCY PROPERTY MAKES IT SUITABLE FOR USE IN VARIOUS INDUSTRIAL APPLICATIONS

- TABLE 48 OPTICAL GRADE PMMA MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

- TABLE 49 OPTICAL GRADE PMMA MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 50 OPTICAL GRADE PMMA MARKET SIZE, BY REGION, 2017-2019 (KILOTON)

- TABLE 51 OPTICAL GRADE PMMA MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

7 PMMA MARKET, BY FORM

- 7.1 INTRODUCTION

- FIGURE 30 EXTRUDED SHEETS FORM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 52 PMMA MARKET SIZE, BY FORM, 2017-2019 (USD MILLION)

- TABLE 53 PMMA MARKET SIZE, BY FORM, 2020-2027 (USD MILLION)

- TABLE 54 PMMA MARKET SIZE, BY FORM, 2017-2019 (KILOTON)

- TABLE 55 PMMA MARKET SIZE, BY FORM, 2020-2027 (KILOTON)

- 7.2 EXTRUDED SHEETS

- 7.2.1 RISING PENETRATION IN INTRICATE SHAPE APPLICATIONS TO DRIVE MARKET

- TABLE 56 EXTRUDED SHEETS MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

- TABLE 57 EXTRUDED SHEETS MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 58 EXTRUDED SHEETS MARKET SIZE, BY REGION, 2017-2019 (KILOTON)

- TABLE 59 EXTRUDED SHEETS MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 7.3 CAST ACRYLIC SHEETS

- 7.3.1 ENHANCED SURFACE FINISHING AND OPTICAL CLARITY CHARACTERISTICS SUPPORT MARKET GROWTH

- TABLE 60 CAST ACRYLIC SHEETS MARKET SIZE, BY TYPE, 2017-2019 (USD MILLION)

- TABLE 61 CAST ACRYLIC SHEETS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 62 CAST ACRYLIC SHEETS MARKET SIZE, BY TYPE, 2017-2019 (KILOTON)

- TABLE 63 CAST ACRYLIC SHEETS MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 64 CAST ACRYLIC SHEETS MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

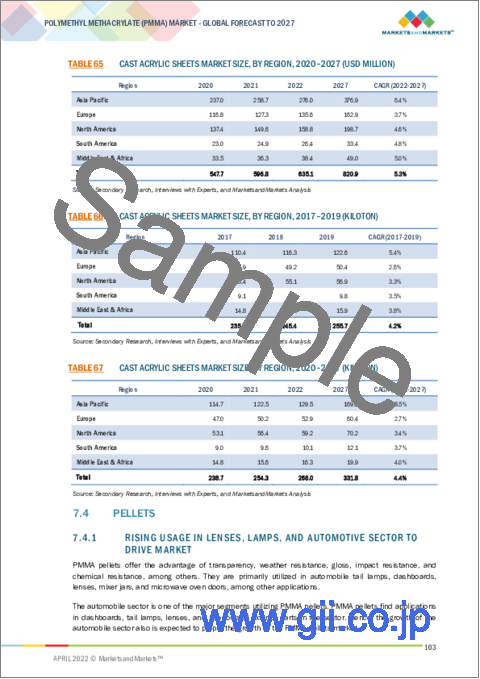

- TABLE 65 CAST ACRYLIC SHEETS MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 66 CAST ACRYLIC SHEETS MARKET SIZE, BY REGION, 2017-2019 (KILOTON)

- TABLE 67 CAST ACRYLIC SHEETS MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 7.4 PELLETS

- 7.4.1 RISING USAGE IN LENSES, LAMPS, AND AUTOMOTIVE SECTOR TO DRIVE MARKET

- TABLE 68 PELLETS MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

- TABLE 69 PELLETS MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 70 PELLETS MARKET SIZE, BY REGION, 2017-2019 (KILOTON)

- TABLE 71 PELLETS MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 7.5 BEADS

- 7.5.1 PRODUCED THROUGH SUSPENSION POLYMERIZATION

- TABLE 72 BEADS MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

- TABLE 73 BEADS MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 74 BEADS MARKET SIZE, BY REGION, 2017-2019 (KILOTON)

- TABLE 75 BEADS MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

8 PMMA MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 31 CONSTRUCTION SEGMENT TO LEAD PMMA MARKET DURING FORECAST PERIOD

- TABLE 76 PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 77 PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 78 PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 79 PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 8.2 SIGNS & DISPLAYS

- 8.2.1 DEVELOPMENT OF INFRASTRUCTURE DRIVES DEMAND FOR PMMA

- 8.2.2 SIGNAGE

- 8.2.3 DISPLAY BOARDS

- 8.2.4 POINT OF SALE BOARDS

- TABLE 80 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY TYPE, 2017-2019 (USD MILLION)

- TABLE 81 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 82 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY TYPE 2017-2019 (KILOTON)

- TABLE 83 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY TYPE, 2020-2027 (KILOTON)

- TABLE 84 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY REGION, 2017-2019 (USD MILLION)

- TABLE 85 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 86 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY REGION 2017-2019 (KILOTON)

- TABLE 87 PMMA MARKET SIZE IN SIGNS & DISPLAYS, BY REGION, 2020-2027 (KILOTON)

- 8.3 CONSTRUCTION

- 8.3.1 RISE IN GLOBAL CONSTRUCTION OUTPUT TO INCREASE DEMAND FOR PMMA

- 8.3.2 BY END-USE

- 8.3.2.1 Residential

- 8.3.2.2 Multi-family

- 8.3.2.3 Commercial

- 8.3.2.4 Industrial

- TABLE 88 PMMA MARKET SIZE IN CONSTRUCTION, BY END-USE, 2017-2019 (USD MILLION)

- TABLE 89 PMMA MARKET SIZE IN CONSTRUCTION, BY END-USE, 2020-2027 (USD MILLION)

- TABLE 90 PMMA MARKET SIZE IN CONSTRUCTION, BY END-USE 2017-2019 (KILOTON)

- TABLE 91 PMMA MARKET SIZE IN CONSTRUCTION, BY END-USE, 2020-2027 (KILOTON)

- 8.3.3 BY TYPE

- 8.3.3.1 Barriers

- 8.3.3.1.1 Shatterproof glass

- 8.3.3.1.2 Noise barriers

- 8.3.3.1 Barriers

- TABLE 92 PMMA MARKET SIZE IN CONSTRUCTION, BY BARRIERS, 2017-2019 (USD MILLION)

- TABLE 93 PMMA MARKET SIZE IN CONSTRUCTION, BY BARRIERS, 2020-2027 (USD MILLION)

- TABLE 94 PMMA MARKET SIZE IN CONSTRUCTION, BY BARRIERS 2017-2019 (KILOTON)

- TABLE 95 PMMA MARKET SIZE IN CONSTRUCTION, BY BARRIERS, 2020-2027 (KILOTON)

- 8.3.3.2 Flooring

- 8.3.3.2.1 PMMA resin flooring

- 8.3.3.2.2 High-end decorative flooring

- 8.3.3.2 Flooring

- TABLE 96 PMMA MARKET SIZE IN CONSTRUCTION, BY FLOORING, 2017-2019 (USD MILLION)

- TABLE 97 PMMA MARKET SIZE IN CONSTRUCTION, BY FLOORING, 2020-2027 (USD MILLION)

- TABLE 98 PMMA MARKET SIZE IN CONSTRUCTION, BY FLOORING 2017-2019 (KILOTON)

- TABLE 99 PMMA MARKET SIZE IN CONSTRUCTION, BY FLOORING, 2020-2027 (KILOTON)

- 8.3.4 PAINTS & COATINGS

- TABLE 100 PMMA MARKET SIZE IN CONSTRUCTION, BY TYPE, 2017-2019 (USD MILLION)

- TABLE 101 PMMA MARKET SIZE IN CONSTRUCTION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 102 PMMA MARKET SIZE IN CONSTRUCTION, BY TYPE 2017-2019 (KILOTON)

- TABLE 103 PMMA MARKET SIZE IN CONSTRUCTION, BY TYPE, 2020-2027 (KILOTON)

- TABLE 104 PMMA MARKET SIZE IN CONSTRUCTION, BY REGION, 2017-2019 (USD MILLION)

- TABLE 105 PMMA MARKET SIZE IN CONSTRUCTION, BY REGION, 2020-2027 (USD MILLION)

- TABLE 106 PMMA MARKET SIZE IN CONSTRUCTION, BY REGION 2017-2019 (KILOTON)

- TABLE 107 PMMA MARKET SIZE IN CONSTRUCTION, BY REGION, 2020-2027 (KILOTON)

- 8.4 AUTOMOTIVE

- 8.4.1 HIGH USAGE IN AUTOMOTIVE INDUSTRY AS AN ALTERNATIVE TO GLASS

- 8.4.2 AUTOMOTIVE PARTS & ACCESSORIES

- 8.4.2.1 Body parts

- 8.4.2.2 Lamp covers

- 8.4.2.3 Interior and exterior trim

- TABLE 108 PMMA MARKET SIZE IN AUTOMOTIVE, BY AUTOMOTIVE PARTS & ACCESSORIES, 2017-2019 (USD MILLION)

- TABLE 109 PMMA MARKET SIZE IN AUTOMOTIVE, BY AUTOMOTIVE PARTS & ACCESSORIES, 2020-2027 (USD MILLION)

- TABLE 110 PMMA MARKET SIZE IN AUTOMOTIVE, BY AUTOMOTIVE PARTS & ACCESSORIES 2017-2019 (KILOTON)

- TABLE 111 PMMA MARKET SIZE IN AUTOMOTIVE, BY AUTOMOTIVE PARTS & ACCESSORIES, 2020-2027 (KILOTON)

- 8.4.3 VEHICLE TYPE

- 8.4.3.1 Passenger cars

- 8.4.3.2 Light commercial vehicles

- 8.4.3.3 Heavy commercial vehicles

- 8.4.3.4 Quad/ATV & side by side

- 8.4.3.5 Snowmobiles

- 8.4.3.6 Recreation vehicles

- TABLE 112 PMMA MARKET SIZE IN AUTOMOTIVE, BY VEHICLE TYPE, 2017-2019 (USD MILLION)

- TABLE 113 PMMA MARKET SIZE IN AUTOMOTIVE, BY VEHICLE TYPE, 2020-2027 (USD MILLION)

- TABLE 114 PMMA MARKET SIZE IN AUTOMOTIVE, BY VEHICLE TYPE, 2017-2019 (KILOTON)

- TABLE 115 PMMA MARKET SIZE IN AUTOMOTIVE, BY VEHICLE TYPE, 2020-2027 (KILOTON)

- 8.4.4 FUEL TYPE

- 8.4.4.1 ICE vehicles (petrol, diesel, other)

- 8.4.4.2 Electric vehicles

- TABLE 116 PMMA MARKET SIZE IN AUTOMOTIVE, BY FUEL TYPE, 2017-2019 (USD MILLION)

- TABLE 117 PMMA MARKET SIZE IN AUTOMOTIVE, BY FUEL TYPE, 2020-2027 (USD MILLION)

- TABLE 118 PMMA MARKET SIZE IN AUTOMOTIVE, BY FUEL TYPE, 2017-2019 (KILOTON)

- TABLE 119 PMMA MARKET SIZE IN AUTOMOTIVE, BY FUEL TYPE, 2020-2027 (KILOTON)

- TABLE 120 PMMA MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017-2019 (USD MILLION)

- TABLE 121 PMMA MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 122 PMMA MARKET SIZE IN AUTOMOTIVE, BY REGION 2017-2019 (KILOTON)

- TABLE 123 PMMA MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020-2027 (KILOTON)

- 8.5 LIGHTING FIXTURES

- 8.5.1 RISING DEMAND FOR LIGHTING IN VEHICLES

- 8.5.2 LIGHT GUIDE PANELS

- 8.5.3 SOLAR EQUIPMENT

- TABLE 124 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY TYPE, 2017-2019 (USD MILLION)

- TABLE 125 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 126 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY TYPE 2017-2019 (KILOTON)

- TABLE 127 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY TYPE, 2020-2027 (KILOTON)

- TABLE 128 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY REGION, 2017-2019 (USD MILLION)

- TABLE 129 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 130 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY REGION 2017-2019 (KILOTON)

- TABLE 131 PMMA MARKET SIZE IN LIGHTING FIXTURES, BY REGION, 2020-2027 (KILOTON)

- 8.6 ELECTRONICS

- 8.6.1 CHANGING LIFESTYLES INCREASE DEMAND IN ELECTRONICS

- 8.6.2 MOBILE PHONES, TABLETS, AND LCD SCREENS

- 8.6.3 OTHERS

- TABLE 132 PMMA MARKET SIZE IN ELECTRONICS, BY TYPE, 2017-2019 (USD MILLION)

- TABLE 133 PMMA MARKET SIZE IN ELECTRONICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 134 PMMA MARKET SIZE IN ELECTRONICS, BY TYPE 2017-2019 (KILOTON)

- TABLE 135 PMMA MARKET SIZE IN ELECTRONICS, BY TYPE, 2020-2027 (KILOTON)

- TABLE 136 PMMA MARKET SIZE IN ELECTRONICS, BY REGION, 2017-2019 (USD MILLION)

- TABLE 137 PMMA MARKET SIZE IN ELECTRONICS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 138 PMMA MARKET SIZE IN ELECTRONICS, BY REGION 2017-2019 (KILOTON)

- TABLE 139 PMMA MARKET SIZE IN ELECTRONICS, BY REGION, 2020-2027 (KILOTON)

- 8.7 MARINE

- 8.7.1 INCREASED UTILIZATION IN WINDOW/GLAZING APPLICATIONS

- 8.7.2 ACCESSORIES AND PARTS

- 8.7.2.1 Interior surfacing

- 8.7.2.2 Consoles

- 8.7.2.3 Glazing/windows

- 8.7.2.4 Sinks

- 8.7.2.5 Shower pans

- 8.7.2.6 Counter tops

- 8.7.2.7 Wall cladding

- 8.7.2.8 Outboard engine covers

- 8.7.2.9 Portable tables

- 8.7.2.10 Others

- TABLE 140 PMMA MARKET SIZE IN MARINE, BY ACCESSORIES & PARTS, 2017-2019 (USD MILLION)

- TABLE 141 PMMA MARKET SIZE IN MARINE, BY ACCESSORIES & PARTS, 2020-2027 (USD MILLION)

- TABLE 142 PMMA MARKET SIZE IN MARINE, BY ACCESSORIES & PARTS, 2017-2019 (KILOTON)

- TABLE 143 PMMA MARKET SIZE IN MARINE, BY ACCESSORIES & PARTS, 2020-2027 (KILOTON)

- 8.7.3 TYPE

- 8.7.3.1 Personal watercraft

- 8.7.3.2 Commercial

- 8.7.3.3 Sports watercraft/ jet skis

- TABLE 144 PMMA MARKET SIZE IN MARINE, BY TYPE, 2017-2019 (USD MILLION)

- TABLE 145 PMMA MARKET SIZE IN MARINE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 146 PMMA MARKET SIZE IN MARINE, BY TYPE 2017-2019 (KILOTON)

- TABLE 147 PMMA MARKET SIZE IN MARINE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 148 PMMA MARKET SIZE IN MARINE, BY REGION, 2017-2019 (USD MILLION)

- TABLE 149 PMMA MARKET SIZE IN MARINE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 150 PMMA MARKET SIZE IN MARINE, BY REGION 2017-2019 (KILOTON)

- TABLE 151 PMMA MARKET SIZE IN MARINE, BY REGION, 2020-2027 (KILOTON)

- 8.8 HEALTHCARE

- 8.8.1 STEADY INCREASE IN HEALTHCARE DEVICES TO INCREASE DEMAND

- 8.8.2 HEALTHCARE DEVICES

- 8.8.3 FURNITURE

- 8.8.4 WALL CLADDING

- 8.8.5 SANITARYWARE

- 8.8.6 OTHERS

- TABLE 152 PMMA MARKET SIZE IN HEALTHCARE, BY TYPE, 2017-2019 (USD MILLION)

- TABLE 153 PMMA MARKET SIZE IN HEALTHCARE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 154 PMMA MARKET SIZE IN HEALTHCARE, BY TYPE 2017-2019 (KILOTON)

- TABLE 155 PMMA MARKET SIZE IN HEALTHCARE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 156 PMMA MARKET SIZE IN HEALTHCARE, BY REGION, 2017-2019 (USD MILLION)

- TABLE 157 PMMA MARKET SIZE IN HEALTHCARE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 158 PMMA MARKET SIZE IN HEALTHCARE, BY REGION 2017-2019 (KILOTON)

- TABLE 159 PMMA MARKET SIZE IN HEALTHCARE, BY REGION, 2020-2027 (KILOTON)

- 8.9 AGRICULTURE

- 8.9.1 STEADY INCREASE IN GREENHOUSES TO DRIVE DEMAND

- 8.9.2 GLAZING/WINDOWS

- 8.9.3 AGRICULTURE MACHINERY & VEHICLES

- TABLE 160 PMMA MARKET SIZE IN AGRICULTURE, BY TYPE, 2017-2019 (USD MILLION)

- TABLE 161 PMMA MARKET SIZE IN AGRICULTURE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 162 PMMA MARKET SIZE IN AGRICULTURE, BY TYPE 2017-2019 (KILOTON)

- TABLE 163 PMMA MARKET SIZE IN AGRICULTURE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 164 PMMA MARKET SIZE IN AGRICULTURE, BY REGION, 2017-2019 (USD MILLION)

- TABLE 165 PMMA MARKET SIZE IN AGRICULTURE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 166 PMMA MARKET SIZE IN AGRICULTURE, BY REGION 2017-2019 (KILOTON)

- TABLE 167 PMMA MARKET SIZE IN AGRICULTURE, BY REGION, 2020-2027 (KILOTON)

- 8.10 CONSUMER GOODS

- 8.10.1 INCREASED UTILIZATION IN HOMEWARE APPLICATION

- 8.10.2 EXERCISE EQUIPMENT

- 8.10.3 HOMEWARE

- 8.10.4 OTHERS

- TABLE 168 PMMA MARKET SIZE IN CONSUMER GOODS, BY TYPE, 2017-2019 (USD MILLION)

- TABLE 169 PMMA MARKET SIZE IN CONSUMER GOODS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 170 PMMA MARKET SIZE IN CONSUMER GOODS, BY TYPE 2017-2019 (KILOTON)

- TABLE 171 PMMA MARKET SIZE IN CONSUMER GOODS, BY TYPE, 2020-2027 (KILOTON)

- TABLE 172 PMMA MARKET SIZE IN CONSUMER GOODS, BY REGION, 2017-2019 (USD MILLION)

- TABLE 173 PMMA MARKET SIZE IN CONSUMER GOODS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 174 PMMA MARKET SIZE IN CONSUMER GOODS, BY REGION 2017-2019 (KILOTON)

- TABLE 175 PMMA MARKET SIZE IN CONSUMER GOODS, BY REGION, 2020-2027 (KILOTON)

- 8.11 OTHERS

- TABLE 176 PMMA MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017-2019 (USD MILLION)

- TABLE 177 PMMA MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 178 PMMA MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION 2017-2019 (KILOTON)

- TABLE 179 PMMA MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2027 (KILOTON)

9 PMMA MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 32 CHINA AND INDIA ARE EMERGING AS STRATEGIC LEADERS IN PMMA MARKET

- TABLE 180 PMMA MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

- TABLE 181 PMMA MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 182 PMMA MARKET SIZE, BY REGION, 2017-2019 (KILOTON)

- TABLE 183 PMMA MARKET SIZE, BY REGION, 2020-2027 KILOTON)

- 9.2 ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: PMMA MARKET SNAPSHOT

- TABLE 184 ASIA PACIFIC: PMMA MARKET SIZE, BY COUNTRY, 2017-2019 (USD MILLION)

- TABLE 185 ASIA PACIFIC: PMMA MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 186 ASIA PACIFIC: PMMA MARKET SIZE, BY COUNTRY, 2017-2019 (KILOTON)

- TABLE 187 ASIA PACIFIC: PMMA MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 188 ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 189 ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 190 ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 191 ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 192 ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 193 ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 194 ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 195 ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- TABLE 196 ASIA PACIFIC: PMMA MARKET SIZE, BY FORM, 2017-2019 (USD MILLION)

- TABLE 197 ASIA PACIFIC: PMMA MARKET SIZE, BY FORM, 2020-2027 (USD MILLION)

- TABLE 198 ASIA PACIFIC: PMMA MARKET SIZE, BY FORM, 2017-2019 (KILOTON)

- TABLE 199 ASIA PACIFIC: PMMA MARKET SIZE, BY FORM, 2020-2027 (KILOTON)

- 9.2.1 CHINA

- 9.2.1.1 Growth of manufacturing sector and upcoming government policies are key drivers

- FIGURE 34 AUTOMOTIVE PRODUCTION (MILLION UNITS), 2019-2021

- TABLE 200 CHINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 201 CHINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 202 CHINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 203 CHINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 204 CHINA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 205 CHINA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 206 CHINA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 207 CHINA: PMMA MARKET SIZE BY GRADE, 2020-2027 (KILOTON)

- 9.2.2 INDIA

- 9.2.2.1 Attractiveness of construction and automotive markets drives demand for PMMA

- FIGURE 35 AUTOMOTIVE PRODUCTION (MILLION UNIT), 2019-2021

- TABLE 208 INDIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 209 INDIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 210 INDIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 211 INDIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 212 INDIA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 213 INDIA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 214 INDIA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 215 INDIA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.2.3 JAPAN

- 9.2.3.1 Government support to boost industry growth helping drive market

- TABLE 216 JAPAN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 217 JAPAN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 218 JAPAN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 219 JAPAN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 220 JAPAN: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 221 JAPAN: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 222 JAPAN: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 223 JAPAN: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Growth of automotive manufacturing industry to drive market

- TABLE 224 SOUTH KOREA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 225 SOUTH KOREA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 226 SOUTH KOREA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 227 SOUTH KOREA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 228 SOUTH KOREA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 229 SOUTH KOREA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 230 SOUTH KOREA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 231 SOUTH KOREA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.2.5 AUSTRALIA & NEW ZEALAND

- 9.2.5.1 Market growth driven by increasing demand in automotive industry

- TABLE 232 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 233 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 234 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 235 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 236 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 237 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 238 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 239 AUSTRALIA & NEW ZEALAND: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.2.6 MALAYSIA

- 9.2.6.1 National Automotive Policy (NAP)2020 to support automotive industry and fuel PMMA market

- TABLE 240 MALAYSIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 241 MALAYSIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 242 MALAYSIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 243 MALAYSIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 244 MALAYSIA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 245 MALAYSIA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 246 MALAYSIA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 247 MALAYSIA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.2.7 REST OF ASIA PACIFIC

- TABLE 248 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 249 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 250 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 251 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 252 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 253 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 254 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 255 REST OF ASIA PACIFIC: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.3 EUROPE

- FIGURE 36 EUROPE: PMMA MARKET SNAPSHOT

- TABLE 256 EUROPE: PMMA MARKET SIZE, BY COUNTRY, 2017-2019 (USD MILLION)

- TABLE 257 EUROPE: PMMA MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 258 EUROPE: PMMA MARKET SIZE, BY COUNTRY, 2017-2019 (KILOTON)

- TABLE 259 EUROPE: PMMA MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 260 EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 261 EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 262 EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 263 EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 264 EUROPE: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 265 EUROPE: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 266 EUROPE: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 267 EUROPE: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- TABLE 268 EUROPE: PMMA MARKET SIZE, BY FORM, 2017-2019 (USD MILLION)

- TABLE 269 EUROPE: PMMA MARKET SIZE, BY FORM, 2020-2027 (USD MILLION)

- TABLE 270 EUROPE: PMMA MARKET SIZE, BY FORM, 2017-2019 (KILOTON)

- TABLE 271 EUROPE: PMMA MARKET SIZE, BY FORM, 2020-2027 (KILOTON)

- 9.3.1 GERMANY

- 9.3.1.1 Increasing demand from automobile sector is a key driver

- FIGURE 37 GERMANY AUTOMOTIVE PRODUCTION & SALES (MILLION UNIT), 2019 - 2021

- TABLE 272 GERMANY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 273 GERMANY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 274 GERMANY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 275 GERMANY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 276 GERMANY: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 277 GERMANY: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 278 GERMANY: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 279 GERMANY: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.3.2 FRANCE

- 9.3.2.1 Rising automobile production and output from construction drive market

- FIGURE 38 FRANCE: CONSTRUCTION OUTPUT, 2020-2021

- TABLE 280 FRANCE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 281 FRANCE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 282 FRANCE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 283 FRANCE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 284 FRANCE: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 285 FRANCE: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 286 FRANCE: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 287 FRANCE: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.3.3 ITALY

- 9.3.3.1 Growth of automotive industry in Italy is a key driver for PMMA market

- TABLE 288 ITALY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 289 ITALY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 290 ITALY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 291 ITALY: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 292 ITALY: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 293 ITALY: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 294 ITALY: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 295 ITALY: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.3.4 SPAIN

- 9.3.4.1 Rise in automobile production and increase in construction output to drive demand

- TABLE 296 SPAIN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 297 SPAIN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 298 SPAIN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 299 SPAIN: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 300 SPAIN: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 301 SPAIN: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 302 SPAIN: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 303 SPAIN: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- FIGURE 39 SPAIN: CONSTRUCTION OUTPUT, 2020-2021 (PERCENTAGE)

- 9.3.5 UK

- 9.3.5.1 Increase in demand from construction industry to drive PMMA market

- FIGURE 40 UK: CONSTRUCTION OUTPUT, 2020-2021 (PERCENTAGE)

- FIGURE 41 UK: CAR PRODUCTION, 2020-2021 (UNITS)

- TABLE 304 UK: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 305 UK: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 306 UK: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 307 UK: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 308 UK: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 309 UK: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 310 UK: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 311 UK: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.3.6 REST OF EUROPE

- TABLE 312 REST OF EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 313 REST OF EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 314 REST OF EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 315 REST OF EUROPE: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 316 REST OF EUROPE: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 317 REST OF EUROPE: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 318 REST OF EUROPE: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 319 REST OF EUROPE: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.4 NORTH AMERICA

- FIGURE 42 NORTH AMERICA: PMMA MARKET SNAPSHOT

- TABLE 320 NORTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2017-2019 (USD MILLION)

- TABLE 321 NORTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 322 NORTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2017-2019 (KILOTON)

- TABLE 323 NORTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 324 NORTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 325 NORTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 326 NORTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 327 NORTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 328 NORTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 329 NORTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 330 NORTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 331 NORTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- TABLE 332 NORTH AMERICA: PMMA MARKET SIZE, BY FORM, 2017-2019 (USD MILLION)

- TABLE 333 NORTH AMERICA: PMMA MARKET SIZE, BY FORM, 2020-2027 (USD MILLION)

- TABLE 334 NORTH AMERICA: PMMA MARKET SIZE, BY FORM, 2017-2019 (KILOTON)

- TABLE 335 NORTH AMERICA: PMMA MARKET SIZE, BY FORM, 2020-2027 (KILOTON)

- 9.4.1 US

- 9.4.1.1 Increasing usage in automotive and building & construction industries to drive market

- FIGURE 43 US AUTOMOTIVE PRODUCTION AND SALES ('000 UNIT), 2019-2021

- TABLE 336 US: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 337 US: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 338 US: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 339 US: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 340 US: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 341 US: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 342 US: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 343 US: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.4.2 CANADA

- 9.4.2.1 Steady growth in automotive production and increasing usage in building & construction and signs & displays applications support market growth

- TABLE 344 CANADA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 345 CANADA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 346 CANADA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 347 CANADA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 348 CANADA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 349 CANADA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 350 CANADA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 351 CANADA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.4.3 MEXICO

- 9.4.3.1 Rise in automobile production is expected to surge demand for PMMA

- TABLE 352 MEXICO: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2021-2022 (UNITS)

- TABLE 353 MEXICO: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 354 MEXICO: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 355 MEXICO: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 356 MEXICO: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 357 MEXICO: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 358 MEXICO: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 359 MEXICO: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 360 MEXICO: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.5 SOUTH AMERICA

- TABLE 361 SOUTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2017-2019 (USD MILLION)

- TABLE 362 SOUTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 363 SOUTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2017-2019 (KILOTON)

- TABLE 364 SOUTH AMERICA: PMMA MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 365 SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 366 SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 367 SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 368 SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 369 SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 370 SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 371 SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 372 SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- TABLE 373 SOUTH AMERICA: PMMA MARKET SIZE, BY FORM, 2017-2019 (USD MILLION)

- TABLE 374 SOUTH AMERICA: PMMA MARKET SIZE, BY FORM, 2020-2027 (USD MILLION)

- TABLE 375 SOUTH AMERICA: PMMA MARKET SIZE, BY FORM, 2017-2019 (KILOTON)

- TABLE 376 SOUTH AMERICA: PMMA MARKET SIZE, BY FORM, 2020-2027 (KILOTON)

- 9.5.1 BRAZIL

- 9.5.1.1 Rising demand from automotive and construction sectors to support market growth

- TABLE 377 BRAZIL: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 378 BRAZIL: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 379 BRAZIL: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 380 BRAZIL: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 381 BRAZIL: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 382 BRAZIL: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 383 BRAZIL: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 384 BRAZIL: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.5.2 ARGENTINA

- 9.5.2.1 Domestic production of automobiles to increase demand for PMMA

- TABLE 385 ARGENTINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 386 ARGENTINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 387 ARGENTINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 388 ARGENTINA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 389 ARGENTINA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 390 ARGENTINA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 391 ARGENTINA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 392 ARGENTINA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.5.3 REST OF SOUTH AMERICA

- TABLE 393 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 394 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 395 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 396 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 397 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 398 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 399 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 400 REST OF SOUTH AMERICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.6 MIDDLE EAST & AFRICA

- TABLE 401 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY COUNTRY, 2017-2019 (USD MILLION)

- TABLE 402 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 403 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY COUNTRY, 2017-2019 (KILOTON)

- TABLE 404 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 405 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 406 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 407 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 408 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 409 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 410 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 411 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 412 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- TABLE 413 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY FORM, 2017-2019 (USD MILLION)

- TABLE 414 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY FORM, 2020-2027 (USD MILLION)

- TABLE 415 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY FORM, 2017-2019 (KILOTON)

- TABLE 416 MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY FORM, 2020-2027 (KILOTON)

- 9.6.1 SAUDI ARABIA

- 9.6.1.1 Vision 2030 and other government plans to boost construction industries to fuel market growth

- TABLE 417 SAUDI ARABIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 418 SAUDI ARABIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 419 SAUDI ARABIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 420 SAUDI ARABIA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 421 SAUDI ARABIA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 422 SAUDI ARABIA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 423 SAUDI ARABIA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 424 SAUDI ARABIA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.6.2 SOUTH AFRICA

- 9.6.2.1 Growth of automotive industry to drive market

- TABLE 425 SOUTH AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 426 SOUTH AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 427 SOUTH AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 428 SOUTH AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 429 SOUTH AFRICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 430 SOUTH AFRICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 431 SOUTH AFRICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 432 SOUTH AFRICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

- 9.6.3 REST OF THE MIDDLE EAST & AFRICA

- TABLE 433 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD MILLION)

- TABLE 434 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 435 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (KILOTON)

- TABLE 436 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- TABLE 437 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (USD MILLION)

- TABLE 438 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 439 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2017-2019 (KILOTON)

- TABLE 440 REST OF MIDDLE EAST & AFRICA: PMMA MARKET SIZE, BY GRADE, 2020-2027 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- FIGURE 44 EXPANSIONS KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2018 AND 2021

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 45 MARKET SHARE OF KEY PLAYERS, 2021

- 10.3 STRATEGIES OF KEY PLAYERS

- TABLE 441 STRATEGIC POSITIONING OF KEY PLAYERS

- 10.4 COMPANY EVALUATION MATRIX DEFINITION AND TECHNOLOGY

- 10.4.1 STAR

- 10.4.2 PERVASIVE

- 10.4.3 EMERGING LEADER

- 10.4.4 PARTICIPANT

- FIGURE 46 PMMA MARKET: COMPANY EVALUATION MATRIX, 2020

- 10.5 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 10.5.1 RESPONSIVE COMPANIES

- 10.5.2 DYNAMIC COMPANIES

- 10.5.3 STARTING BLOCKS

- FIGURE 47 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2020

- 10.6 REVENUE ANALYSIS OF TOP PLAYERS

- TABLE 442 REVENUE ANALYSIS OF KEY PLAYERS

- 10.7 COMPANY PRODUCT FOOTPRINT

- TABLE 443 COMPANY FOOTPRINT, BY END-USE INDUSTRY

- TABLE 444 COMPANY FOOTPRINT, BY REGION

- 10.7.1 COMPETITIVE BENCHMARKING

- TABLE 445 PMMA MARKET: DETAILED LIST OF KEY MANUFACTURERS

- 10.8 KEY MARKET DEVELOPMENTS

- 10.8.1 DEALS

- 10.8.2 OTHERS

- 10.8.3 NEW PRODUCT LAUNCHES

11 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 11.1 KEY PLAYERS

- 11.1.1 TRINSEO S.A.

- TABLE 446 TRINSEO S.A.: BUSINESS OVERVIEW

- FIGURE 48 TRINSEO S.A.: COMPANY SNAPSHOT

- TABLE 447 TRINSEO S.A.: PRODUCT OFFERINGS

- TABLE 448 TRINSEO S.A.: DEALS

- TABLE 449 TRINSEO S.A.: OTHERS

- 11.1.2 ASAHI KASEI CORPORATION

- TABLE 450 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

- FIGURE 49 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- TABLE 451 ASAHI KASEI CORPORATION: PRODUCT OFFERINGS

- 11.1.3 SABIC

- TABLE 452 SABIC: BUSINESS OVERVIEW

- FIGURE 50 SABIC: COMPANY SNAPSHOT

- TABLE 453 SABIC: PRODUCT OFFERINGS

- TABLE 454 SABIC: DEALS

- 11.1.4 MITSUBISHI CHEMICAL HOLDINGS CORPORATION

- TABLE 455 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 51 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 456 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: PRODUCT OFFERINGS

- TABLE 457 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: DEALS

- TABLE 458 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: OTHERS

- 11.1.5 LG CHEM LTD.

- TABLE 459 LG CHEM LTD.: BUSINESS OVERVIEW

- FIGURE 52 LG CHEM LTD.: COMPANY SNAPSHOT

- TABLE 460 LG CHEM LTD.: PRODUCT OFFERINGS

- TABLE 461 LG CHEM LTD.: DEALS

- 11.1.6 ROHM GMBH

- TABLE 462 ROHM GMBH: BUSINESS OVERVIEW

- TABLE 463 ROHM GMBH: PRODUCT OFFERINGS

- TABLE 464 ROHM GMBH: OTHERS

- 11.1.7 KURARAY CO., LTD

- TABLE 465 KURARAY CO., LTD: BUSINESS OVERVIEW

- FIGURE 53 KURARAY CO., LTD: COMPANY SNAPSHOT

- TABLE 466 KURARAY CO., LTD: PRODUCT OFFERINGS

- 11.1.8 KOLON INDUSTRIES INC.

- TABLE 467 KOLON INDUSTRIES INC.: BUSINESS OVERVIEW

- FIGURE 54 KOLON INDUSTRIES INC.: COMPANY SNAPSHOT

- TABLE 468 KOLON INDUSTRIES INC.: PRODUCT OFFERINGS

- 11.1.9 SUMITOMO CHEMICAL CO., LTD

- TABLE 469 SUMITOMO CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- FIGURE 55 SUMITOMO CHEMICALS CO., LTD: COMPANY SNAPSHOT

- TABLE 470 SUMITOMO CHEMICAL CO., LTD.: PRODUCT OFFERINGS

- TABLE 471 SUMITOMO CHEMICAL CO., LTD.: OTHERS

- 11.1.10 CHIMEI CORPORATION

- TABLE 472 CHIMEI CORPORATION: BUSINESS OVERVIEW

- TABLE 473 CHIMEI CORPORATION: PRODUCT OFFERINGS

- TABLE 474 CHIMEI CORPORATION: PRODUCT LAUNCHES

- 11.1.11 LOTTE CHEMICAL CORPORATION

- TABLE 475 LOTTE CHEMICAL CORPORATION: COMPANY OVERVIEW

- FIGURE 56 LOTTE CHEMICAL CORPORATION: COMPANY SNAPSHOT

- 11.1.12 PLASKOLITE, LLC

- TABLE 476 PLASKOLITE LLC: COMPANY OVERVIEW

- TABLE 477 PLASKOLITE, LLC: DEALS

- 11.2 OTHER PLAYERS

- 11.2.1 TORAY INDUSTRIES, INC

- TABLE 478 TORAY INDUSTRIES, INC: COMPANY OVERVIEW

- 11.2.2 GEHR PLASTICS INC.

- TABLE 479 GEHR PLASTICS INC: COMPANY OVERVIEW

- 11.2.3 RTP COMPANY

- TABLE 480 RTP COMPANY: COMPANY OVERVIEW

- 11.2.4 UNIGEL S.A.

- TABLE 481 UNIGEL S.A.: COMPANY OVERVIEW

- 11.2.5 MAKEVALE GROUP LTD.

- TABLE 482 MAKEVALE GROUP LTD.: COMPANY OVERVIEW

- 11.2.6 3A COMPOSITES

- TABLE 483 3A COMPOSITES: COMPANY OVERVIEW

- 11.2.7 SPARTECH LLC

- TABLE 484 SPARTECH LLC: COMPANY OVERVIEW

- 11.2.8 COSSA POLIMERI S.R.L.

- TABLE 485 COSSA POLIMERI S.R.L.: COMPANY OVERVIEW

- 11.2.9 INEOS GROUP LTD

- TABLE 486 INEOS GROUP LTD: COMPANY OVERVIEW

- 11.2.10 SAMYANG CORPORATION

- TABLE 487 SAMYANG CORPORATION: COMPANY OVERVIEW

- 11.2.11 GO YEN CHEMICAL INDUSTRIAL CO LTD

- TABLE 488 GO YEN CHEMICAL INDUSTRIAL CO LTD: COMPANY OVERVIEW

- 11.2.12 CELANESE CORPORATION

- TABLE 489 CELANESE CORPORATION: COMPANY OVERVIEW

- 11.2.13 PARKER CHOMERICS

- TABLE 490 PARKER CHOMERICS: COMPANY OVERVIEW

- 11.2.14 RABIGH REFINING AND PETROCHEMICAL COMPANY

- TABLE 491 RABIGH REFINING AND PETROCHEMICAL COMPANY: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 AVAILABLE CUSTOMIZATIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS