|

|

市場調査レポート

商品コード

1261028

SASEの世界市場:提供別 (Network as a Service、Security as a Service)・組織規模別 (中小企業、大企業)・業種別 (政府、BFSI、小売業・eコマース、IT・ITES)・地域別 (北米、欧州、アジア太平洋、その他の地域) の将来予測 (2028年まで)SASE Market by Offering (Network as a Service, Security as a Service), Organization size (SMEs, Large Enterprises), Vertical (Government, BFSI, Retail and eCommerce, IT and ITeS), and Region (North America, Europe, APAC, RoW) - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| SASEの世界市場:提供別 (Network as a Service、Security as a Service)・組織規模別 (中小企業、大企業)・業種別 (政府、BFSI、小売業・eコマース、IT・ITES)・地域別 (北米、欧州、アジア太平洋、その他の地域) の将来予測 (2028年まで) |

|

出版日: 2023年04月14日

発行: MarketsandMarkets

ページ情報: 英文 196 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のSASE (Secure Access Service Edge) の市場規模は、2023年の19億米ドルから2028年には59億米ドルに達し、予測期間中に25.0%のCAGRで成長する、と予測されます。

企業のデジタル変革に伴い、セキュリティはクラウドに移行しつつあります。そのため、複雑性の軽減、スピードと俊敏性の向上、マルチクラウドネットワーキングの実現、SASEアーキテクチャの安全性確保を目的としたコンバージドサービスへのニーズが高まっています。

SaaSセグメントは、予測期間中に高いCAGRで成長する

SaaS (Secrity as a Serivce) は、SASEアーキテクチャの重要な構成要素です。SaaSとは、サービスとして提供されるクラウドベースのセキュリティソリューションのことです。SaaSを利用すれば、ユーザーは高価なハードウェアやソフトウェアに投資することなく、インターネット上のどこからでもセキュリティサービスにアクセスすることができます。規制要件、ポリシー、義務を分析する必要性の高まりが、このセグメントの成長を促進すると予想されます。

予測期間中は中小企業のセグメントが、最も高いCAGRで成長する

各国政府は、中小企業を保護するためのイニシアチブをとっています。例えば、英国政府は、中小企業をサイバー攻撃から守るために、中小企業向けのサイバーセキュリティイニシアチブを立ち上げています。こうした中小企業向けの取り組みが、中小企業向けセグメントの成長を促進すると予測されます。

北米地域は、2023年にSASE市場で最も高い市場シェアを占める

北米は、インフラが整備され、技術的に先進的な国々で構成されています。その中でも、米国とカナダは経済力が強く、北米のSASEソリューションの貢献度が高い国です。技術は日を追うごとに進歩しており、米国とカナダの経済成長により、これらの新技術に巨額の投資を行うことができます。この地域の官民組織は、SD-WAN、ZTNA、SWG、CASBなどのクラウドセキュリティソリューションに注力しています。この地域には、消費者のアイデンティティを保護することが最大の目的である大企業や急成長中の中小企業がいくつかあります。この地域の企業は、データを保護するために、AI・ML・ブロックチェーン・ビッグデータ・クラウドなどの様々な技術の導入を開始しています。この地域のサービスプロバイダは、LTEやLTE-Advanced (LTE-A) ネットワーク、SD-WAN、ネットワークセキュリティ、WLAN、エンタープライズコラボレーションポートフォリオの拡張と更新に一貫して投資を行っています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界の動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 促進要因と機会

- 抑制要因と課題

- 累積成長分析

- SASE市場の歴史と進化

- エコシステム分析

- 技術分析

- ケーススタディ分析

- バリューチェーン分析

- 特許分析

- 価格分析

- 主な会議とイベント (2022年~2023年)

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- SASEのベストプラクティス

- 隣接技術に対するSASEの影響

- SASEの採用

第6章 SASE市場:提供製品/サービス別

- イントロダクション

- NaaS (Network as a Service)

- SaaS (Security as a Service)

第7章 SASE市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第8章 SASE市場:業種別

- イントロダクション

- 政府

- 銀行・金融サービス・保険 (BFSI)

- 小売業・eコマース

- IT・ITES

- その他の業種

第9章 SASE市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- その他の欧州

- アジア太平洋

- 日本

- シンガポール

- その他のアジア太平洋

- その他の地域 (ROW)

第10章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 過去の収益分析

- 競合ベンチマーキング

- 競合シナリオ

- 上位企業の市場シェア分析

- 主要企業のランキング

- 企業評価マトリックスの調査手法

- スタートアップ/中小企業の競合評価マトリックスの調査手法

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

第11章 企業プロファイル

- 主要企業

- CISCO

- VMWARE

- FORTINET

- PALO ALTO NETWORKS

- AKAMAI

- ZSCALER

- CLOUDFLARE

- FORCEPOINT

- BROADCOM

- CHECK POINT

- NETSKOPE

- MCAFEE

- CITRIX

- PROOFPOINT

- ARUBA NETWORKS

- JUNIPER NETWORKS

- VERIZON

- SONICWALL

- BARRACUDA NETWORKS

- スタートアップ/中小企業

- PERIMETER 81

- OPEN SYSTEMS

- ARYAKA

- TWINGATE

- CLARO ENTERPRISE SOLUTION

- NORDLAYER

- EXIUM

- CATO NETWORKS

- VERSA NETWORKS

第12章 隣接市場

- イントロダクション

- 制限事項

- NaaS (Network as a Service) 市場

- SaaS (Security as a Service) 市場

第13章 付録

MarketsandMarkets forecasts The global SASE market size is projected to grow from USD 1.9 billion in 2023 to USD 5.9 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 25.0% during the forecast period.

With the digital transformation of businesses, security is moving to the cloud. This is driving a need for converged services to reduce complexity, improve speed and agility, enable multi-cloud networking and secure SASE architecture.

Security as a service segment to grow at a higher CAGR during the forecast period.,

Security as a Service (SaaS) is a key component of Secure Access Service Edge (SASE) architecture. SaaS refers to a cloud-based security solution that is delivered as a service. With SaaS, users can access security services from anywhere over the internet, without investing in expensive hardware or software. The growing need to analyze regulatory requirements, policies, and obligations is expected to drive the growth of the segment.

SMEs segment to grow at the highest CAGR during the forecast period.

Governments of various countries take initiatives to protect SMEs. For instance, the UK government has launched cybersecurity initiatives for SMEs to protect their businesses from cyberattacks. These initiatives for SMEs are projected to drive the growth of the SMEs segment.

North America region to record the highest market share in the SASE market in 2023

North America consists of developed countries that are technologically advanced with well-developed infrastructure. Being the strongest economies, the US and Canada are the top contributing countries in North America in SASE solutions. Technology is getting more advanced with each passing day, and the growing economies of the US and Canada enable them to invest in these new technologies in huge amounts. Public and private organizations in the region are focused on cloud security solutions, such as SD-WAN, ZTNA, SWG, and CASB. The region has several large enterprises and rapidly growing SMEs where protecting the consumers' identities is the prime objective. Enterprises in this area have started implementing various technologies, such as AI, ML, blockchain, big data, and cloud, for securing data. Service providers in this region consistently invest in expanding and upgrading their LTE and LTE-Advanced (LTE-A) networks, SD-WAN, network security, WLAN, and enterprise collaboration portfolios.

- By Company Type: Tier 1 - 35%, Tier 2 - 39%, and Tier 3 - 26%

- By Designation: C-level - 55%, Directors - 40%, and Others - 5%

- By Region: North America - 38, Europe - 40%, Asia Pacific - 21%, and Rest of the World (RoW)- 1%

This research study outlines the market potential, market dynamics, and major vendors operating in the SASE market. Key and innovative vendors in the SASE market include Cisco (US), VMware (US), Fortinet (US), Palo Alto Networks (US), Akamai (US), Zscaler (US), Cloudfare (US), Forcepoint (US), Check Point (US), Netskope (US), Mcafee (US), Citrix (US), Proofpoint (US), Aruba Networks (US), Juniper Networks (US), Verizon (US), SonicWall (US), Barracuda Networks, (US) Broadcom (US), Perimeter 81 (Israel), Open Systems (Switzerland), Aryaka (US), Twingate (US), Claro Enterprise Solutions (US), NordLayer, (US) Exium (US), Cato Networks (Israel), Versa Networks (US). These vendors have adopted many organic as well as inorganic growth strategies, such as new product launches, and partnerships and collaborations, to expand their offerings and market shares in the SASE market.

Research coverage

The market study covers the SASE market across different segments. It aims at estimating the market size and the growth potential of this market across different segments based on component, application, end-user and regions. The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the global SASE market and its subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and to plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (rising need for a unified network security architecture with the capabilities of SD-WAN, SWG, ZTNA, and FWaaS, lack of security tools and processes, mandate to follow regulatory and data protection laws restraints (lack of awareness about cloud resources, cloud security architecture, and SD-WAN strategy), opportunities (increase in adoption of cloud-based services, growing mobile workforce), and challenges (lack of awareness among enterprises about the benefits of SASE solutions) influencing the growth of the SASE market. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the SASE market. Market Development: Comprehensive information about lucrative markets - the report analyses the SASE market across varied regions Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the SASE market. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Cisco (US), VMware (US), Fortinet (US), Palo Alto Networks (US), Akamai (US), Zscaler (US), Cloudfare (US), Forcepoint (US), Check Point (US), Netskope (US), Mcafee (US), Citrix (US), Proofpoint (US), Aruba Networks (US), Juniper Networks (US), Verizon (US), SonicWall (US), Barracuda Networks, (US) Broadcom (US), Perimeter 81 (Israel), Open Systems (Switzerland), Aryaka (US), Twingate (US), Claro Enterprise Solutions (US), NordLayer, (US) Exium (US), Cato Networks (Israel), Versa Networks (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 SASE MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- FIGURE 2 SASE MARKET: GEOGRAPHIC SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 SASE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Primary sources

- 2.1.2.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 RESEARCH METHODOLOGY: APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1: SUPPLY-SIDE ANALYSIS OF REVENUE FROM OFFERINGS IN SASE MARKET

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 6 BOTTOM-UP APPROACH

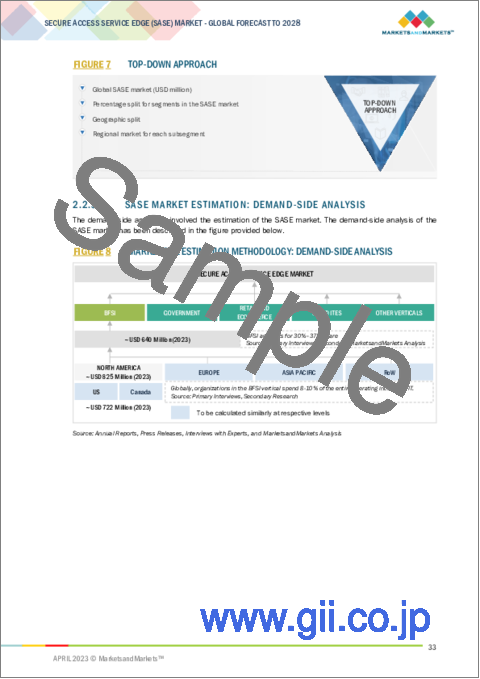

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- 2.2.3 SASE MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- TABLE 2 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPLICATION OF RECESSION ON SASE MARKET

- FIGURE 10 SASE MARKET TO WITNESS SLIGHT DIP IN Y-O-Y IN 2022

3 EXECUTIVE SUMMARY

- FIGURE 11 SASE MARKET, REGIONAL AND COUNTRY-WISE SHARE, 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN SASE MARKET

- FIGURE 12 INCREASING NUMBER OF CLOUD SECURITY MEASURES ACROSS VERTICALS TO FUEL GROWTH

- 4.2 SASE MARKET, BY OFFERING

- FIGURE 13 NETWORK AS A SERVICE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 SASE MARKET, BY ORGANIZATION SIZE

- FIGURE 14 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.4 SASE MARKET, BY VERTICAL

- FIGURE 15 BFSI SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.5 NORTH AMERICA: SASE MARKET, BY OFFERING AND ORGANIZATION SIZE

- FIGURE 16 NETWORK AS A SERVICE AND LARGE ENTERPRISES TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2023

- 4.6 EUROPE: SASE MARKET, BY OFFERING AND ORGANIZATION SIZE

- FIGURE 17 NETWORK AS A SERVICE AND LARGE ENTERPRISES TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2023

- 4.7 ASIA PACIFIC: SASE MARKET, BY OFFERING AND ORGANIZATION SIZE

- FIGURE 18 NETWORK AS A SERVICE AND LARGE ENTERPRISES TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SASE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need for unified network security architecture

- 5.2.1.2 Lack of security tools and processes

- 5.2.1.3 Mandate to follow regulatory and data protection laws

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness about cloud resources, cloud security architecture, and SD-WAN strategy

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in adoption of cloud-based services among SMEs

- 5.2.3.2 Growing mobile workforce

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness among enterprises about benefits of SASE solutions

- 5.2.5 DRIVERS AND OPPORTUNITIES

- 5.2.6 RESTRAINTS AND CHALLENGES

- 5.2.7 CUMULATIVE GROWTH ANALYSIS

- 5.3 BRIEF HISTORY/EVOLUTION OF SASE MARKET

- FIGURE 20 BRIEF HISTORY OF SASE MARKET

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 SASE COMPONENT PROVIDERS

- 5.4.2 SASE PLANNING AND DESIGNING

- 5.4.3 SASE SYSTEM INTEGRATORS

- 5.4.4 SASE END USERS

- FIGURE 21 SASE MARKET: ECOSYSTEM

- TABLE 3 SASE MARKET: ECOSYSTEM

- 5.5 TECHNOLOGY ANALYSIS

- FIGURE 22 SASE MARKET: TECHNOLOGY ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- TABLE 4 USE CASE 1: PERIMETER 81

- TABLE 5 USE CASE 2: TWINGATE

- TABLE 6 USE CASE 3: FORTINET

- TABLE 7 USE CASE 4: ARYAKA

- TABLE 8 USE CASE 5: ZSCALAR

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 23 SASE MARKET: VALUE CHAIN

- 5.8 PATENT ANALYSIS

- TABLE 9 TOP 20 PATENTS OWNERS (US) IN LAST 10 YEARS

- FIGURE 24 NUMBER OF PATENTS GRANTED, 2013-2022

- FIGURE 25 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- 5.9 PRICING ANALYSIS

- TABLE 10 MONTHLY PRICING STRUCTURE OF FEW SASE MARKET VENDORS

- 5.10 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 11 DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 GENERAL DATA PROTECTION REGULATION

- 5.11.2 PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACT

- 5.11.3 CLOUD SECURITY ALLIANCE SECURITY TRUST ASSURANCE AND RISK

- 5.11.4 CALIFORNIA CONSUMER PRIVACY ACT

- 5.11.5 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 IMPACT OF EACH FORCE ON SASE MARKET

- FIGURE 26 PORTER'S FIVE FORCES ANALYSIS: SASE MARKET

- 5.12.1 THREAT FROM NEW ENTRANTS

- 5.12.2 THREAT FROM SUBSTITUTES

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 BARGAINING POWER OF SUPPLIERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- 5.13.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE END USERS

- 5.14 BEST PRACTICES IN SASE

- 5.14.1 DEPLOYMENT OF RIGHT INTEGRATION PLAN

- 5.14.2 FOLLOWING ZERO TRUST PRINCIPLES

- 5.14.3 SECURING REMOTE ACCESS

- 5.14.4 IMPLEMENTATION OF WEB FILTERING AND MALWARE PROTECTION

- 5.15 IMPACT OF SASE ON ADJACENT TECHNOLOGIES

- 5.15.1 NETWORK SECURITY

- 5.15.2 IDENTITY AND ACCESS MANAGEMENT

- 5.15.3 CLOUD SECURITY

- 5.15.4 REMOTE WORK SOLUTIONS

- 5.16 ADOPTION OF SASE

- 5.16.1 SINGLE VENDOR OFFERING

- 5.16.2 EXPLICIT PAIRING

- 5.16.3 MANAGED SASE

6 SASE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 29 SECURITY AS A SERVICE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 15 SECURE ACCESS SERVICE EDGE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 16 SECURE ACCESS SERVICE EDGE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 NETWORK AS A SERVICE

- 6.2.1 SASE TO INTEGRATE NETWORKING AND SECURITY FUNCTIONS INTO UNIFIED CLOUD-NATIVE SOLUTION OR SERVICE

- 6.2.2 NETWORK AS A SERVICE: SECURE ACCESS SERVICE EDGE MARKET DRIVERS

- TABLE 17 NETWORK AS A SERVICE: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 18 NETWORK AS A SERVICE: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SECURITY AS A SERVICE

- 6.3.1 SASE TO DELIVER CONVERGED NETWORK AND SAAS CAPABILITIES

- 6.3.2 SECURITY AS A SERVICE: SECURE ACCESS SERVICE EDGE MARKET DRIVERS

- TABLE 19 SECURITY AS A SERVICE: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 20 SECURITY AS A SERVICE: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2023-2028 (USD MILLION)

7 SECURE ACCESS SERVICE EDGE MARKET, BY ORGANIZATION SIZE

- 7.1 INTRODUCTION

- FIGURE 30 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 21 SECURE ACCESS SERVICE EDGE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 22 SECURE ACCESS SERVICE EDGE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 7.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 7.2.1 INCREASING ADOPTION OF SD-WAN TECHNOLOGY

- 7.2.2 SMALL AND MEDIUM-SIZED BUSINESSES: SECURE ACCESS SERVICE EDGE DRIVERS

- TABLE 23 SMES: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 SMES: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 LARGE ENTERPRISES

- 7.3.1 ENTERPRISES TO MANAGE NETWORK SECURITY

- 7.3.2 LARGE ENTERPRISES: SECURE ACCESS SERVICE EDGE MARKET DRIVERS

- TABLE 25 LARGE ENTERPRISES: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 LARGE ENTERPRISES: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2023-2028 (USD MILLION)

8 SECURE ACCESS SERVICE EDGE MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- FIGURE 31 IT AND ITES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 27 SECURE ACCESS SERVICE EDGE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 28 SECURE ACCESS SERVICE EDGE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2 GOVERNMENT

- 8.2.1 SASE TO IMPROVE OPERATIONS AND SECURE GOVERNMENT AND PUBLIC SECTORS

- 8.2.2 GOVERNMENT: SECURE ACCESS SERVICE EDGE USE CASES

- 8.2.2.1 Secure remote access

- 8.2.2.2 Network segmentation

- 8.2.2.3 Secure cloud access

- 8.2.3 GOVERNMENT: SECURE ACCESS SERVICE EDGE MARKET DRIVERS

- TABLE 29 GOVERNMENT: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 GOVERNMENT: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 8.3.1 INCREASING NEED FOR CYBERSECURITY SOLUTIONS AND SERVICES

- 8.3.2 BFSI: SECURE ACCESS SERVICE EDGE USE CASES

- 8.3.2.1 Comprehensive security control and monitoring

- 8.3.2.2 Secure remote access

- 8.3.2.3 Secure mobile access

- 8.3.3 BFSI: SECURE ACCESS SERVICE EDGE MARKET DRIVERS

- TABLE 31 BFSI: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 BFSI: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 RETAIL AND E-COMMERCE

- 8.4.1 CHANGING MARKET CONDITIONS AND CUSTOMER DEMANDS

- 8.4.2 RETAIL AND E-COMMERCE: SECURE ACCESS SERVICE EDGE USE CASES

- 8.4.2.1 Protection of customer data

- 8.4.2.2 Secure point-of-sale

- 8.4.2.3 Secure remote access

- 8.4.3 RETAIL AND E-COMMERCE: SECURE ACCESS SERVICE EDGE MARKET DRIVERS

- TABLE 33 RETAIL AND E-COMMERCE: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 RETAIL AND E-COMMERCE: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 IT AND ITES

- 8.5.1 RISE IN PENETRATION OF CLOUD COMPUTING

- 8.5.2 IT AND ITES: SECURE ACCESS SERVICE EDGE USE CASES

- 8.5.2.1 Secure cloud access

- 8.5.2.2 Secure remote access

- 8.5.2.3 Protection of sensitive data

- 8.5.3 IT AND ITES: SECURE ACCESS SERVICE EDGE MARKET DRIVERS

- TABLE 35 IT AND ITES: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 IT AND ITES: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 OTHER VERTICALS

- TABLE 37 OTHER VERTICALS: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 OTHER VERTICALS: SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2023-2028 (USD MILLION)

9 SECURE ACCESS SERVICE EDGE MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 39 SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 SECURE ACCESS SERVICE EDGE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- 9.2.2 NORTH AMERICA: SECURE ACCESS SERVICE EDGE MARKET DRIVERS

- 9.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 41 NORTH AMERICA: SECURE ACCESS SERVICE EDGE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 42 NORTH AMERICA: SECURE ACCESS SERVICE EDGE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: SECURE ACCESS SERVICE EDGE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: SECURE ACCESS SERVICE EDGE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: SECURE ACCESS SERVICE EDGE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: SECURE ACCESS SERVICE EDGE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: SECURE ACCESS SERVICE EDGE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: SECURE ACCESS SERVICE EDGE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.4 US

- 9.2.4.1 Increasing investments in SASE solutions to drive market

- 9.2.5 CANADA

- 9.2.5.1 Need to improve network infrastructure to drive market

- 9.3 EUROPE

- 9.3.1 EUROPE: RECESSION IMPACT

- 9.3.2 EUROPE: SECURE ACCESS SERVICE EDGE MARKET DRIVERS

- 9.3.3 EUROPE: REGULATORY LANDSCAPE

- TABLE 49 EUROPE: SECURE ACCESS SERVICE EDGE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 50 EUROPE: SECURE ACCESS SERVICE EDGE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 51 EUROPE: SECURE ACCESS SERVICE EDGE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 52 EUROPE: SECURE ACCESS SERVICE EDGE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 53 EUROPE: SECURE ACCESS SERVICE EDGE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 54 EUROPE: SECURE ACCESS SERVICE EDGE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 55 EUROPE: SECURE ACCESS SERVICE EDGE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 56 EUROPE: SECURE ACCESS SERVICE EDGE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3.4 UK

- 9.3.4.1 Government initiatives to drive growth

- 9.3.5 GERMANY

- 9.3.5.1 Rapid technical development in security application to drive market

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC (APAC)

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- 9.4.2 ASIA PACIFIC: SECURE ACCESS SERVICE EDGE MARKET DRIVERS

- FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

- 9.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- TABLE 57 ASIA PACIFIC: SECURE ACCESS SERVICE EDGE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 58 ASIA PACIFIC: SECURE ACCESS SERVICE EDGE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: SECURE ACCESS SERVICE EDGE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 60 ASIA PACIFIC: SECURE ACCESS SERVICE EDGE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: SECURE ACCESS SERVICE EDGE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 62 ASIA PACIFIC: SECURE ACCESS SERVICE EDGE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: SECURE ACCESS SERVICE EDGE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 64 ASIA PACIFIC: SECURE ACCESS SERVICE EDGE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.4 JAPAN

- 9.4.4.1 Increasing demand for SASE across enterprises to drive market

- 9.4.5 SINGAPORE

- 9.4.5.1 Network breaches and ongoing security challenges to drive market

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 ROW: RECESSION IMPACT

- 9.5.2 ROW: SECURE ACCESS SERVICE EDGE MARKET DRIVERS

- 9.5.3 ROW: REGULATORY LANDSCAPE

- TABLE 65 ROW: SECURE ACCESS SERVICE EDGE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 66 ROW: SECURE ACCESS SERVICE EDGE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 67 ROW: SECURE ACCESS SERVICE EDGE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 68 ROW: SECURE ACCESS SERVICE EDGE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 69 ROW: SECURE ACCESS SERVICE EDGE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 70 ROW: SECURE ACCESS SERVICE EDGE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 71 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SASE MARKET

- 10.3 HISTORICAL REVENUE ANALYSIS

- FIGURE 35 HISTORICAL REVENUE ANALYSIS OF PLAYERS, 2020-2022 (USD MILLION)

- 10.4 COMPETITIVE BENCHMARKING

- TABLE 72 SASE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 73 SASE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 74 SASE MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 75 SASE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 10.5 COMPETITIVE SCENARIO

- 10.5.1 PRODUCT LAUNCHES

- TABLE 76 PRODUCT LAUNCHES, 2021-2023

- 10.5.2 DEALS

- TABLE 77 DEALS, 2021-2023

- 10.6 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 78 SASE MARKET: DEGREE OF COMPETITION

- FIGURE 36 SECURE ACCESS SERVICE EDGE MARKET: REVENUE ANALYSIS

- 10.7 RANKING OF KEY PLAYERS

- FIGURE 37 RANKING OF KEY SECURE ACCESS SERVICE EDGE MARKET PLAYERS

- 10.8 COMPANY EVALUATION MATRIX METHODOLOGY

- FIGURE 38 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.9 STARTUPS/SMES COMPETITIVE EVALUATION MATRIX METHODOLOGY

- FIGURE 39 STARTUPS/SMES COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.10 COMPANY EVALUATION QUADRANT

- 10.10.1 STARS

- 10.10.2 EMERGING LEADERS

- 10.10.3 PERVASIVE PLAYERS

- 10.10.4 PARTICIPANTS

- FIGURE 40 KEY SASE MARKET PLAYERS: COMPANY EVALUATION MATRIX, 2022

- 10.11 STARTUPS/SMES EVALUATION QUADRANT

- 10.11.1 PROGRESSIVE COMPANIES

- 10.11.2 RESPONSIVE COMPANIES

- 10.11.3 DYNAMIC COMPANIES

- 10.11.4 STARTING BLOCKS

- FIGURE 41 SASE MARKET STARTUPS/SMES: COMPANY EVALUATION MATRIX, 2022

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 11.1.1 CISCO

- TABLE 79 CISCO: BUSINESS OVERVIEW

- FIGURE 42 CISCO: COMPANY SNAPSHOT

- TABLE 80 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 81 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 82 CISCO: DEALS

- 11.1.2 VMWARE

- TABLE 83 VMWARE: BUSINESS OVERVIEW

- FIGURE 43 VMWARE: COMPANY SNAPSHOT

- TABLE 84 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 85 VMWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 86 VMWARE: DEALS

- 11.1.3 FORTINET

- TABLE 87 FORTINET: BUSINESS OVERVIEW

- FIGURE 44 FORTINET: COMPANY SNAPSHOT

- TABLE 88 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 89 FORTINET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 90 FORTINET: DEALS

- 11.1.4 PALO ALTO NETWORKS

- TABLE 91 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- FIGURE 45 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- TABLE 92 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 93 PALO ALTO NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 94 PALO ALTO NETWORKS: DEALS

- 11.1.5 AKAMAI

- TABLE 95 AKAMAI: BUSINESS OVERVIEW

- FIGURE 46 AKAMAI: COMPANY SNAPSHOT

- TABLE 96 AKAMAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 97 AKAMAI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 98 AKAMAI: DEALS

- 11.1.6 ZSCALER

- TABLE 99 ZSCALER: BUSINESS OVERVIEW

- FIGURE 47 ZSCALER: COMPANY SNAPSHOT

- TABLE 100 ZSCALER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 101 ZSCALER: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 102 ZSCALER: DEALS

- 11.1.7 CLOUDFLARE

- TABLE 103 CLOUDFLARE: BUSINESS OVERVIEW

- FIGURE 48 CLOUDFLARE: COMPANY SNAPSHOT

- TABLE 104 CLOUDFLARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 105 CLOUDFLARE: DEALS

- 11.1.8 FORCEPOINT

- TABLE 106 FORCEPOINT: BUSINESS OVERVIEW

- TABLE 107 FORCEPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 108 FORCEPOINT: DEALS

- 11.1.9 BROADCOM

- TABLE 109 BROADCOM: BUSINESS OVERVIEW

- FIGURE 49 BROADCOM: COMPANY SNAPSHOT

- TABLE 110 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 111 BROADCOM: DEALS

- 11.1.10 CHECK POINT

- TABLE 112 CHECK POINT: BUSINESS OVERVIEW

- FIGURE 50 CHECK POINT: COMPANY SNAPSHOT

- TABLE 113 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 114 CHECK POINT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 115 CHECK POINT: DEALS

- 11.1.11 NETSKOPE

- 11.1.12 MCAFEE

- 11.1.13 CITRIX

- 11.1.14 PROOFPOINT

- 11.1.15 ARUBA NETWORKS

- 11.1.16 JUNIPER NETWORKS

- 11.1.17 VERIZON

- 11.1.18 SONICWALL

- 11.1.19 BARRACUDA NETWORKS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 11.2 STARUPS/SMES

- 11.2.1 PERIMETER 81

- 11.2.2 OPEN SYSTEMS

- 11.2.3 ARYAKA

- 11.2.4 TWINGATE

- 11.2.5 CLARO ENTERPRISE SOLUTION

- 11.2.6 NORDLAYER

- 11.2.7 EXIUM

- 11.2.8 CATO NETWORKS

- 11.2.9 VERSA NETWORKS

12 ADJACENT MARKETS

- 12.1 INTRODUCTION

- TABLE 116 ADJACENT MARKETS AND FORECASTS

- 12.2 LIMITATIONS

- 12.3 NETWORK AS A SERVICE MARKET

- TABLE 117 LOCAL AREA NETWORK AND WIRELESS LOCAL AREA NETWORK: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 118 LOCAL AREA NETWORK AND WIRELESS LOCAL AREA NETWORK: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 119 WIDE AREA NETWORK: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 120 WIDE AREA NETWORK: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 121 COMMUNICATION AND COLLABORATION: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 122 COMMUNICATION AND COLLABORATION: NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 123 NETWORK SECURITY: NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- 12.4 SECURITY AS A SERVICE MARKET

- TABLE 124 BUSINESS CONTINUITY AND DISASTER MANAGEMENT: SECURITY AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 125 BUSINESS CONTINUITY AND DISASTER MANAGEMENT: SECURITY AS A SERVICE MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 126 CONTINUOUS MONITORING: SECURITY AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 127 CONTINUOUS MONITORING: SECURITY AS A SERVICE MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 128 DATA LOSS PREVENTION: SECURITY AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 129 DATA LOSS PREVENTION: SECURITY AS A SERVICE MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 130 ENCRYPTION: SECURITY AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 131 ENCRYPTION: SECURITY AS A SERVICE MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 132 IDENTITY AND ACCESS MANAGEMENT: SECURITY AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 133 IDENTITY AND ACCESS MANAGEMENT: SECURITY AS A SERVICE MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 134 INTRUSION MANAGEMENT: SECURITY AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 135 INTRUSION MANAGEMENT: SECURITY AS A SERVICE MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 136 SECURITY INFORMATION AND EVENT MANAGEMENT: SECURITY AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 137 SECURITY INFORMATION AND EVENT MANAGEMENT: SECURITY AS A SERVICE MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 138 VULNERABILITY SCANNING: SECURITY AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 139 VULNERABILITY SCANNING: SECURITY AS A SERVICE MARKET, BY REGION, 2021-2026 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS