|

|

市場調査レポート

商品コード

1230247

電気トラックの世界市場:推進方式別 (BEV、PHEV、FCEV)・種類別 (小型トラック、中型トラック、大型トラック)・航続距離別・バッテリーの種類別・バッテリー容量別・自動化レベル別・エンドユーザー別・GVWR別・地域別の将来予測 (2030年まで)Electric Trucks Market by Propulsion (BEV, PHEV & FCEV), Type (Light-Duty Trucks, Medium-Duty Trucks & Heavy-Duty Trucks), Range, Battery Type, Battery Capacity, Level of Automation, End User, GVWR & Region - Global Forecast to 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 電気トラックの世界市場:推進方式別 (BEV、PHEV、FCEV)・種類別 (小型トラック、中型トラック、大型トラック)・航続距離別・バッテリーの種類別・バッテリー容量別・自動化レベル別・エンドユーザー別・GVWR別・地域別の将来予測 (2030年まで) |

|

出版日: 2023年02月23日

発行: MarketsandMarkets

ページ情報: 英文 247 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の電気トラックの市場規模は、2022年から2030年にかけて34.2%のCAGRで成長し、2022年の101,499台から、2030年には1,067,985台に達すると予測されます。

公害に対する懸念の高まりから、大量輸送ソリューションの電動化推進に注力する国の増加や、補助金や助成金といった政府の支援が、電気トラック市場の成長を後押ししています。

EV用電池のコストは、技術の進歩やEV用電池の大量生産により、過去10年間で低下しています。これによりEVトラックの価格が下がり、従来のICEトラックと同様の価格となることが予想されます。

昨今では、ガソリン価格の高騰や資源枯渇の問題から、自動車メーカー各社は代替燃料を検討するようになりました。電気トラックの運転コストは、ガソリンや他の代替燃料よりも低くなっています。そうした要因が、環境保全とともに市場における電気自動車の需要拡大の大きな要因となっています。

EV用バッテリー技術の向上に伴い、さまざまなOEMが、より航続距離の長い電気トラックの開発に取り組んでいます。そのため将来的には、商用車部門の一部としての電気トラックがより現実的なものとなるでしょう。

当レポートでは、世界の電気トラックの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、バッテリー容量別・バッテリーの種類別・エンドユーザー別・GVWR別・自動化レベル別・推進方式別・航続距離別・種類別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース

- マクロ経済指標

- 主要国のGDPの動向と予測

- 電気トラック市場のエコシステム

- バリューチェーン分析

- 価格分析

- ケーススタディ

- 技術分析

- 部品表

- OEMの調達戦略

- 規制の概要

- 会議とイベント (2023年~2024年)

- 特許分析

- 主な利害関係者と購入基準

- 不況の影響分析

- 電気トラック市場:シナリオ(2022年~2030年)

- 最も可能性の高いシナリオ

- 楽観的シナリオ

- 悲観的なシナリオ

第6章 電気トラック市場:バッテリー容量別

- イントロダクション

- 50kWh以下

- 50~250kWh

- 250kWh以上

- 主な業界考察

第7章 電気トラック市場:バッテリーの種類別

- イントロダクション

- リチウムニッケルマンガンコバルト酸化物

- リン酸鉄リチウム

- その他

- 主な業界考察

第8章 電気トラック市場:エンドユーザー別

- イントロダクション

- ラストマイル配達

- フィールドサービス

- 流通サービス

- 長距離輸送

- ごみ収集サービス

- 主な業界考察

第9章 電気トラック市場:GVWR (車両総重量) 別

- イントロダクション

- 10,000ポンド以下

- 10,001~26,000ポンド

- 26,000ポンド以上

第10章 電気トラック市場:自動化レベル別

- イントロダクション

- レベル1

- レベル2・3

- レベル4

- レベル5

- 主な業界考察

第11章 電気トラック市場:推進方式別

- イントロダクション

- BEV (バッテリー式電気自動車)

- FCEV (燃料電池車)

- PHEV (プラグリンハイブリッド車)

- 主な業界考察

第12章 電気トラック市場:航続距離別

- イントロダクション

- 200マイル以下

- 200マイル以上

- 主な業界考察

第13章 電気トラック市場:種類別

- イントロダクション

- 小型トラック

- 中型トラック

- 大型トラック

- 主な業界考察

第14章 電気トラック市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- 欧州

- フランス

- ドイツ

- オランダ

- ノルウェー

- スウェーデン

- 英国

- 北米

- カナダ

- 米国

第15章 競合情勢

- 概要

- OEM車両モデルの発売計画 (2023年~2026年)

- 電気トラック市場:市場シェア分析

- 主要企業の戦略

- 主な上場企業の収益分析

- 競合シナリオ

- 新製品の発売

- 資本取引

- その他

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

第16章 企業プロファイル

- 主要企業

- AB VOLVO

- BYD

- RIVIAN

- MERCEDES BENZ GROUP AG

- FORD MOTOR COMPANY

- PACCAR INC.

- SCANIA AB

- NAVISTAR INC.

- DONGFENG MOTOR CORPORATION

- PROTERRA

- VDL GROEP

- TESLA, INC.

- その他の企業

- TATA MOTORS LIMITED

- WORKHORSE GROUP

- NIKOLA CORPORATION

- ASHOK LEYLAND

- ISUZU MOTORS LTD.

- IRIZAR GROUP

- IVECO

- TRITON EV

- BOLLINGER MOTORS

- XOS TRUCKS, INC.

- ATLIS MOTOR VEHICLES

- KAIYUN MOTORS

- GEELY AUTOMOBILE HOLDINGS LIMITED

- MAN SE

- ORANGE EV

- TEVVA MOTORS LIMITED

- HINO MOTORS

第17章 MarketsandMarketsの提言

第18章 付録

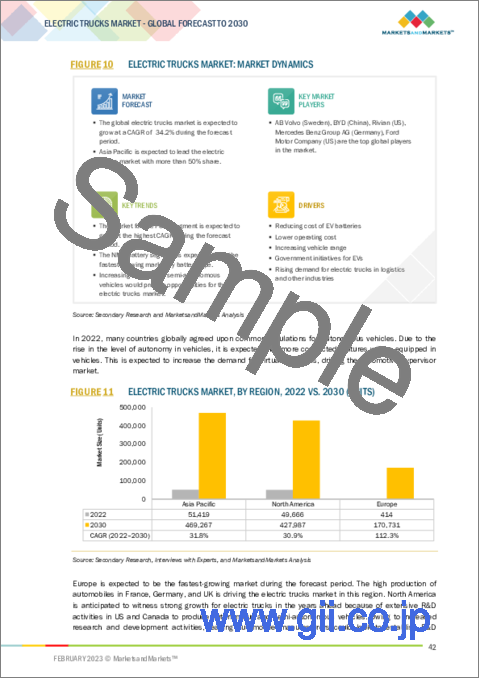

Electric truck market, is projected to grow at a CAGR of 34.2% from 2022 to 2030, to reach 1,067,985 units by 2030 from 101,499 units in 2022. Increasing focus of countries on promoting electrification of mass transit solutions due to increased concerns over pollution and government support in terms of subsidies and grants are propelling the growth of the electric truck market.

"Reducing cost of EV batteries"

The cost of EV batteries has been decreasing over the past decade due to technological advancements and the production of EV batteries on a mass scale. In 2010, the price of an EV battery was USD 1,100 per kWh. According to Bloomberg, the price fell to USD 138 per kWh in 2022 and as low as USD 100 per kWh in China. This is due to the reduced manufacturing costs, cathode material prices, and increased production volume. Prices of EV batteries are expected to be USD 40-60 per kWh by 2030, which will reduce the price of EV trucks, making them priced similarly to conventional ICE trucks. Other top battery manufacturers like Samsung SDI, Panasonic, LG Chem, SK Innovation, and CATL have been working with top EV manufacturers to achieve this goal in the next 4-5 years. In April 2022, Samsung SDI announced the development of cobalt-free batteries to secure the price competitiveness of its EV batteries.

"Lower operating cost"

According to the US Energy Information Administration (EIA), 94.1 million barrels of gasoline per day were consumed in 2021 around the world. According to Forbes, petrol prices in the international market have been rising over the years. The demand for petrol and diesel in the world is high as they are non-renewable resources, which may get exhausted in the next few decades. Even though many treaties have been made to control the price of petrol in the international market, prices have been rising over the years. As most countries import petrol, its usage contributes to lowering the balance of trade in the economy. The limited petroleum reserves and rising prices of fuel have led automakers to consider alternative fuel sources for their vehicles. The operating cost of electric trucks is lower than petrol and some other fuel alternatives. Along with environment conservation, this is a major factor in the growing demand for EVs in the market.

"Increasing vehicle range"

The major area of development in electric trucks is their driving range on a single charge. With improvements in EV battery technology, various OEMs are working on developing longer-ranged electric trucks. This will make electric trucks more viable as part of the commercial vehicle sector in the coming years. In February 2022, BYD launched Q1 for heavy-duty operations 25 with a 5 kWh lithium iron phosphate battery. It delivers a range of around 200 km while the top-speed is restricted at 85 km/h. In October 2022, PepsiCo (US) announced the delivery of 100 electric truck Semi with a range of 500 miles to be used in its fleet for delivery purposes. The logistics sector is the most contributing source of greenhouse gas emissions. Governments across the globe are constantly introducing new initiatives and policies to endorse long-range electric trucks for the logistics sector. These are expected to have a large market across major European countries such as Germany, UK, and France. US and China will also have a large market for upcoming long-range electric trucks due to strong government support.

The study contains insights from various industry experts, ranging from component suppliers to tier 1 companies and OEMs. The break-up of the primaries is as follows:

By Company Type: Tier 1 - 29%, Tier 2 - 14%, OEMs - 57%

By Designation: CXOs - 54%, Directors - 32%, Others - 14%

By Region: North America - 32%, Europe - 36%, Asia Pacific- 32%

The electric truck market is dominated by players such as BYD(China), Mercedes Benz Group AG (Germany), AB Volvo (Sweden), Ford Motor Company(US), Rivian(US) and others.

Research Coverage

The report segments the electric trucks market and forecasts its size, by volume, on the basis of propulsion type (BEV, PHEV, FCEV) vehicle type (light-duty trucks, medium-duty trucks, heavy-duty trucks), battery type (lithium-nickel-manganese-cobalt Oxide, lithium-iron-phosphate, others), end user (last mile delivery, long haul transportation, distribution services, refuse services, field services), by range (upto 200 miles, above 200 miles), GVWR (upto 10,000 lbs, 10,001-26,000 lbs, above 26,000 lbs), level of automation (semi-autonomous trucks and autonomous trucks), battery capacity (< 50 kWh, 50-250 kWh, above 250 kWh) & Region. It also covers the competitive landscape and company profiles of the major players in the electric truck market ecosystem.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants in this market with information on the closest approximations of revenue and volume for electric truck market and its sub segments.

This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies.

The report also helps stakeholders understand the pulse of the market and provides them information on key market drivers, restraints, challenges, and opportunities.

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 ELECTRIC TRUCKS MARKET DEFINITION, BY TYPE

- 1.2.2 ELECTRIC TRUCKS MARKET DEFINITION, BY END USER

- 1.2.3 ELECTRIC TRUCKS MARKET DEFINITION, BY BATTERY TYPE

- 1.2.4 ELECTRIC TRUCKS MARKET DEFINITION, BY PROPULSION TYPE

- 1.2.5 ELECTRIC TRUCKS MARKET DEFINITION, BY LEVEL OF AUTOMATION

- 1.3 ELECTRIC TRUCKS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 MARKET SEGMENTATION: ELECTRIC TRUCKS MARKET

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 CURRENCY EXCHANGE RATES (PER USD)

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 ELECTRIC TRUCKS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of participating companies for primary research

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 RECESSION IMPACT ANALYSIS

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY FOR ELECTRIC TRUCKS MARKET: BOTTOM-UP APPROACH

- 2.2.3 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR ELECTRIC TRUCKS MARKET: TOP-DOWN APPROACH

- FIGURE 6 NORTH AMERICA: ELECTRIC TRUCKS MARKET, BY MEDIUM AND HEAVY-DUTY TRUCK TYPE, 2022 VS. 2030 (UNITS)

- FIGURE 7 EUROPE: ELECTRIC TRUCKS MARKET, BY MEDIUM AND HEAVY-DUTY TRUCK TYPE, 2022 VS. 2030 (UNITS)

- FIGURE 8 ASIA PACIFIC: ELECTRIC TRUCKS MARKET, BY MEDIUM AND HEAVY-DUTY TRUCK TYPE, 2022 VS. 2030 (UNITS)

- 2.3 FACTOR ANALYSIS

- 2.3.1 RECESSION IMPACT ANALYSIS

- 2.3.2 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND- AND SUPPLY-SIDE

- 2.4 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 ELECTRIC TRUCKS MARKET: MARKET DYNAMICS

- FIGURE 11 ELECTRIC TRUCKS MARKET, BY REGION, 2022 VS. 2030 (UNITS)

- FIGURE 12 ELECTRIC TRUCKS MARKET, BY BATTERY TYPE, 2022 VS. 2030 (UNITS)

- FIGURE 13 NORTH AMERICA: ELECTRIC TRUCKS MARKET, BY FUEL TYPE, 2022 VS. 2030 (UNITS)

- FIGURE 14 ASIA PACIFIC: ELECTRIC TRUCKS MARKET, BY FUEL TYPE, 2022 VS. 2030 (UNITS)

- FIGURE 15 EUROPE: ELECTRIC TRUCKS MARKET, BY FUEL TYPE, 2022 VS. 2030 (UNITS)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN ELECTRIC TRUCKS MARKET

- FIGURE 16 INCREASED FUEL-EFFICIENT VEHICLE OWNERSHIP TO DRIVE DEMAND FOR ELECTRIC TRUCKS

- 4.2 ELECTRIC TRUCKS MARKET, BY REGION

- FIGURE 17 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.3 ELECTRIC TRUCKS MARKET, BY BATTERY CAPACITY

- FIGURE 18 50-250 KWH PROJECTED TO BE LARGEST MARKET (2022-2030) (UNITS)

- 4.4 ELECTRIC TRUCKS MARKET, BY BATTERY TYPE

- FIGURE 19 LITHIUM-IRON-PHOSPHATE SEGMENT TO BE DOMINANT SEGMENT DURING FORECAST PERIOD (UNITS)

- 4.5 ELECTRIC TRUCKS MARKET, BY END USER

- FIGURE 20 LAST MILE DELIVERY TO BE LARGER SEGMENT DURING FORECAST PERIOD

- 4.6 ELECTRIC TRUCKS MARKET, BY RANGE

- FIGURE 21 UPTO 200 MILES SEGMENT TO WITNESS HIGHER GROWTH (2022- 2030)

- 4.7 ELECTRIC TRUCKS MARKET, BY PROPULSION TYPE

- FIGURE 22 FCEV SEGMENT TO HAVE HIGHER GROWTH DURING FORECAST PERIOD

- 4.8 ELECTRIC TRUCKS MARKET, BY LEVEL OF AUTOMATION

- FIGURE 23 SEMI-AUTONOMOUS TRUCKS SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.9 ELECTRIC TRUCKS MARKET, BY TYPE

- FIGURE 24 LIGHT-DUTY TRUCKS TO HAVE HIGH GROWTH DURING FROM 2022 TO 2030 (UNITS)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 ELECTRIC TRUCKS MARKET: MARKET DYNAMICS

- TABLE 2 ELECTRIC TRUCKS MARKET: IMPACT OF MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Reducing cost of EV batteries

- FIGURE 26 EV BATTERY PRICING ANALYSIS

- 5.2.1.2 Lower operating cost

- FIGURE 27 OPERATING COST: ELECTRIC TRUCKS VS. ICE TRUCKS (2022)

- TABLE 3 AVERAGE GASOLINE PRICES IN US (2016-2022)

- TABLE 4 AVERAGE DIESEL PRICES IN US (2016-2022)

- 5.2.1.3 Increasing vehicle range

- TABLE 5 NEW EV TRUCK MODELS, BY RANGE, BY BATTERY CAPACITY, AND AVERAGE PRICE (2022)

- 5.2.1.4 Rising demand for electric trucks in logistics and other industries

- TABLE 6 MAJOR PURCHASE ORDER/SUPPLY CONTRACT FOR ELECTRIC TRUCKS

- 5.2.1.5 Government initiatives for EVs

- TABLE 7 GOVERNMENT PROGRAMS FOR PROMOTION OF ELECTRIC COMMERCIAL VEHICLE SALES

- FIGURE 28 ELECTRIFICATION TARGET, BY COUNTRY

- FIGURE 29 REGULATORY COMPARISON FOR EVS WORLDWIDE

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment for production

- 5.2.2.2 Lack of EV charging infrastructure

- FIGURE 30 EV CHARGER DENSITY COMPARISON (2021)

- FIGURE 31 PRIVATE, SEMI-PUBLIC, AND PUBLIC CHARGING

- 5.2.2.3 Longer charging time

- FIGURE 32 CHARGING TIME REQUIRED USING DIFFERENT TYPES

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of self-driving truck technology

- 5.2.3.2 Development of wireless EV charging technology

- 5.2.3.3 Rapid development in fuel cell technology

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of existing electric trucks

- 5.2.4.2 Insufficient standardization of EV charging infrastructure

- FIGURE 33 EV CHARGERS USED GLOBALLY

- 5.3 PORTER'S FIVE FORCES

- FIGURE 34 PORTER'S FIVE FORCES: ELECTRIC TRUCKS MARKET

- TABLE 8 ELECTRIC TRUCKS MARKET: IMPACT OF PORTERS 5 FORCES

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- TABLE 9 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2019-2026 (USD BILLION)

- 5.5 ELECTRIC TRUCKS MARKET ECOSYSTEM

- FIGURE 35 ELECTRIC TRUCKS MARKET: ECOSYSTEM ANALYSIS

- 5.5.1 EV CHARGING PROVIDERS

- 5.5.2 RAW MATERIAL SUPPLIERS

- 5.5.3 OEMS

- 5.5.4 BATTERY MANUFACTURER/COMPONENT MANUFACTURER

- 5.5.5 ELECTRIC VEHICLE STARTUP ECOSYSTEM ANALYSIS

- FIGURE 36 EV STARTUP ECOSYSTEM ANALYSIS

- 5.5.6 EV ROADMAP, BY BATTERY CAPACITY AND RANGE

- FIGURE 37 EV ROADMAP, BY BATTERY CAPACITY AND RANGE

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 38 VALUE CHAIN ANALYSIS

- FIGURE 39 TRENDS AND DISRUPTIONS IN ELECTRIC TRUCKS MARKET

- 5.7 PRICING ANALYSIS

- TABLE 10 DIESEL/PETROL TRUCKS: AVERAGE PRICE COMPARISON (2022)

- TABLE 11 ELECTRIC TRUCKS: AVERAGE PRICE COMPARISON

- 5.8 CASE STUDIES

- 5.8.1 USER EXPERIENCE OF BATTERY-ELECTRIC TRUCKS IN NORWAY

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 SMART CHARGING SYSTEM

- FIGURE 40 SMART EV CHARGING SYSTEM

- 5.9.2 SOLID-STATE BATTERIES (SSB)

- 5.9.3 IOT IN ELECTRIC VEHICLES

- 5.9.4 RANGE EXTENDERS IN ELECTRIC TRUCKS

- 5.9.5 BATTERY TECHNOLOGY ANALYSIS, BY BATTERY CHEMISTRY

- FIGURE 41 BATTERY MANUFACTURER ROADMAP, BY BATTERY CHEMISTRY WRT BATTERY TYPE

- 5.9.6 BATTERY TECHNOLOGY ANALYSIS, BY BATTERY SIZE IN ASIA PACIFIC

- FIGURE 42 AVERAGE BATTERY SIZE IN TOP LCVS IN ASIA PACIFIC

- 5.9.7 CELL TO PACK TECHNOLOGY

- 5.9.8 MEGAWATT CHARGING SYSTEM FOR HEAVY-DUTY TRUCKS

- 5.9.9 WIRELESS ROAD CHARGING FOR EVS

- 5.10 BILL OF MATERIAL

- FIGURE 43 ELECTRIC TRUCKS MARKET: BILL OF MATERIALS FOR LCV

- FIGURE 44 ELECTRIC TRUCKS MARKET BILL OF MATERIAL, BATTERY VS. NON-BATTERY

- 5.11 OEMS SOURCING STRATEGIES

- 5.11.1 FUTURE INTENDED SOURCING STRATEGIES OF OEMS IN ELECTRIC TRUCKS MARKET

- FIGURE 45 ELECTRIC TRUCKS MARKET: FUTURE STRATEGIES

- 5.11.2 OEMS MOTOR RATING ANALYSIS, BY RANGE

- FIGURE 46 ELECTRIC TRUCKS MARKET: BY RANGE

- 5.11.3 COMPETITIVE MARKET ASSESSMENT, BY PAYLOAD CAPACITY

- FIGURE 47 ELECTRIC TRUCKS COMPETITIVE ASSESSMENT, BY PAYLOAD CAPACITY

- FIGURE 48 ELECTRIC TRUCKS CARGO DELIVERY VS. PAYLOAD CAPACITY

- 5.12 REGULATORY OVERVIEW

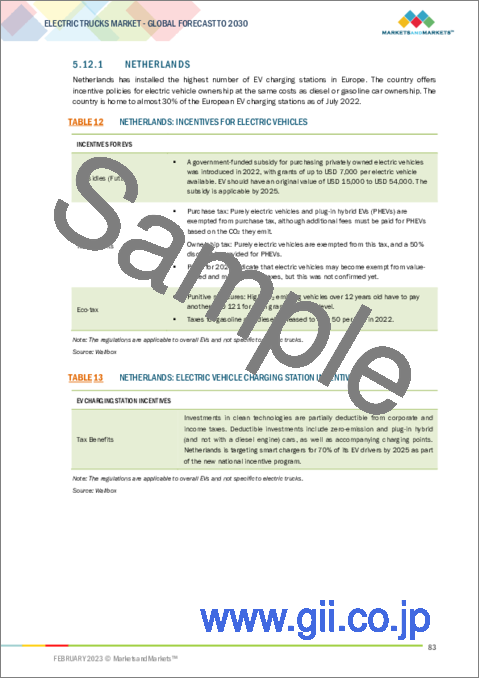

- 5.12.1 NETHERLANDS

- TABLE 12 NETHERLANDS: INCENTIVES FOR ELECTRIC VEHICLES

- TABLE 13 NETHERLANDS: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- 5.12.2 GERMANY

- TABLE 14 GERMANY: ELECTRIC VEHICLE INCENTIVES

- TABLE 15 GERMANY: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- 5.12.3 FRANCE

- TABLE 16 FRANCE: ELECTRIC VEHICLE INCENTIVES

- TABLE 17 FRANCE: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- 5.12.4 UK

- TABLE 18 UK: ELECTRIC VEHICLE INCENTIVES

- TABLE 19 UK: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- 5.12.5 CHINA

- TABLE 20 CHINA: ELECTRIC VEHICLE INCENTIVES

- TABLE 21 CHINA: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- 5.12.6 US

- TABLE 22 US: ELECTRIC VEHICLE INCENTIVES

- TABLE 23 US: ELECTRIC VEHICLE CHARGING STATION INCENTIVES

- 5.13 CONFERENCES AND EVENTS, 2023-2024

- TABLE 24 ELECTRIC TRUCKS MARKET: CONFERENCES AND EVENTS, 2023-2024

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PATENT ANALYSIS

- TABLE 29 IMPORTANT PATENT REGISTRATIONS RELATED TO ELECTRIC TRUCKS MARKET

- TABLE 30 ELECTRIC TRUCKS MARKET: PATENTED DOCUMENTS ANALYSIS, BY PUBLISHED, FILED, AND GRANTED (2016-2021)

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 31 INFLUENCE OF INSTITUTIONAL BUYERS FOR PURCHASE OF ELECTRIC TRUCKS

- 5.15.2 BUYING CRITERIA

- 5.16 RECESSION IMPACT ANALYSIS

- TABLE 32 INFLUENCE OF RECESSION ON SALES OF ELECTRIC TRUCKS

- 5.17 ELECTRIC TRUCKS MARKET, SCENARIOS (2022-2030)

- 5.17.1 MOST LIKELY SCENARIO

- TABLE 33 ELECTRIC TRUCKS MARKET (MOST LIKELY), BY REGION, 2022-2030 (UNITS)

- 5.17.2 OPTIMISTIC SCENARIO

- TABLE 34 ELECTRIC TRUCKS MARKET (OPTIMISTIC), BY REGION, 2022-2030 (UNITS)

- 5.17.3 PESSIMISTIC SCENARIO

- TABLE 35 ELECTRIC TRUCKS MARKET (PESSIMISTIC), BY REGION, 2022-2030 (UNITS)

6 ELECTRIC TRUCKS MARKET, BY BATTERY CAPACITY

- 6.1 INTRODUCTION

- FIGURE 49 50-250 KWH SEGMENT TO DOMINATE ELECTRIC TRUCKS MARKET, 2022-2030 (UNITS)

- TABLE 36 ELECTRIC TRUCKS MARKET, BY BATTERY CAPACITY, 2019-2021 (UNITS)

- TABLE 37 ELECTRIC TRUCKS MARKET, BY BATTERY CAPACITY, 2022-2030 (UNITS)

- 6.1.1 OPERATIONAL DATA

- TABLE 38 ELECTRIC TRUCKS: BY BATTERY CAPACITY

- 6.1.2 ASSUMPTIONS

- 6.1.3 RESEARCH METHODOLOGY

- 6.2 <50 KWH

- 6.2.1 HIGH ADOPTION RATE IN ELECTRIC PICKUP TRUCKS

- TABLE 39 <50 KWH: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 40 <50 KWH: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 6.3 50-250 KWH

- 6.3.1 INCREASED USE IN LIGHT COMMERCIAL VEHICLES IN NORTH AMERICA

- TABLE 41 50-250 KWH: ELECTRIC TRUCK MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 42 50-250 KWH: ELECTRIC TRUCK MARKET, BY REGION, 2022-2030 (UNITS)

- 6.4 ABOVE 250 KWH

- 6.4.1 USED FOR TRANSPORTATION OF HEAVY LOGISTICS

- TABLE 43 ABOVE 250 KWH: ELECTRIC TRUCK MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 44 ABOVE 250 KWH: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 6.5 KEY INDUSTRY INSIGHTS

7 ELECTRIC TRUCKS MARKET, BY BATTERY TYPE

- 7.1 INTRODUCTION

- FIGURE 50 ELECTRIC TRUCKS MARKET, BY BATTERY TYPE, 2022-2030 (UNITS)

- TABLE 45 ELECTRIC TRUCKS MARKET, BY BATTERY TYPE, 2019-2021 (UNITS)

- TABLE 46 ELECTRIC TRUCKS MARKET, BY BATTERY TYPE, 2022-2030 (UNITS)

- 7.1.1 OPERATIONAL DATA

- TABLE 47 ELECTRIC TRUCKS: BY BATTERY TYPE

- 7.1.2 ASSUMPTIONS

- 7.1.3 RESEARCH METHODOLOGY

- 7.2 LITHIUM-NICKEL-MANGANESE-COBALT OXIDE

- 7.2.1 ADVANCEMENTS IN BATTERY TECHNOLOGY

- TABLE 48 LITHIUM-NICKEL-MANGANESE-COBALT OXIDE: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 49 LITHIUM-NICKEL-MANGANESE-COBALT OXIDE: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 7.3 LITHIUM-IRON-PHOSPHATE

- 7.3.1 LOWER PRICES THAN OTHER BATTERIES

- TABLE 50 LITHIUM-IRON-PHOSPHATE: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 51 LITHIUM-IRON-PHOSPHATE: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 7.4 OTHERS

- 7.4.1 R&D INVESTMENTS BY OEMS TO DEVELOP BATTERIES

- TABLE 52 OTHERS: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 53 OTHERS: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 7.5 KEY INDUSTRY INSIGHTS

8 ELECTRIC TRUCKS MARKET, BY END USER

- 8.1 INTRODUCTION

- FIGURE 51 ELECTRIC TRUCKS MARKET, BY END USER, 2022-2030 (UNITS)

- TABLE 54 ELECTRIC TRUCKS MARKET, BY END USER, 2019-2021 (UNITS)

- TABLE 55 ELECTRIC TRUCKS MARKET, BY END USER, 2022-2030 (UNITS)

- 8.1.1 OPERATIONAL DATA

- TABLE 56 ELECTRIC TRUCKS: BY END USER

- 8.1.2 ASSUMPTIONS

- 8.1.3 RESEARCH METHODOLOGY

- 8.2 LAST MILE DELIVERY

- 8.2.1 INCREASED USE IN E-COMMERCE SECTOR

- 8.3 FIELD SERVICES

- 8.3.1 RISING USE IN FIELD MAINTENANCE

- 8.4 DISTRIBUTION SERVICES

- 8.4.1 USED FOR DELIVERY SERVICES

- 8.5 LONG HAUL TRANSPORTATION

- 8.5.1 MANAGES LOGISTICS

- 8.6 REFUSE SERVICES

- 8.6.1 HANDLES GLOBAL WASTE MANAGEMENT

- 8.7 KEY INDUSTRY INSIGHTS

9 ELECTRIC TRUCKS MARKET, BY GVWR

- 9.1 INTRODUCTION

- 9.1.1 OPERATIONAL DATA

- TABLE 57 OPERATIONAL DATA: ELECTRIC TRUCKS DATA BASED ON GVWR

- 9.2 UPTO 10,000 LBS

- 9.2.1 USED FOR DELIVERY AND REFUSE SERVICES

- 9.3 10,001-26,000 LBS

- 9.3.1 INCREASED USE FOR DISTRIBUTION, CONSTRUCTION, AND FIELD SERVICES

- 9.4 ABOVE 26,000 LBS

- 9.4.1 CARRIES HEAVY GOODS

10 ELECTRIC TRUCKS MARKET, BY LEVEL OF AUTOMATION

- 10.1 INTRODUCTION

- FIGURE 52 ELECTRIC TRUCKS MARKET, BY LEVEL OF AUTOMATION, 2022-2030 (UNITS)

- TABLE 58 ELECTRIC TRUCKS MARKET, BY LEVEL OF AUTOMATION, 2019-2021 (UNITS)

- TABLE 59 ELECTRIC TRUCKS MARKET, BY LEVEL OF AUTOMATION, 2022-2030 (UNITS)

- 10.1.1 ASSUMPTIONS

- 10.1.2 RESEARCH METHODOLOGY

- 10.2 LEVEL 1

- 10.2.1 LANE ASSIST FEATURES IN ELECTRIC TRUCKS

- 10.3 LEVEL 2 & 3

- 10.3.1 INCREASING INVESTMENTS BY OEMS TO PROMOTE LEVEL 2 & 3 SEMI-AUTONOMOUS TRUCKS

- 10.4 LEVEL 4

- 10.4.1 INCREASING SUBSIDIES BY GOVERNMENTS

- 10.5 LEVEL 5

- 10.5.1 PROVIDES IMPROVED VEHICLE SAFETY AND REDUCED TRAFFIC CONGESTION

- 10.6 KEY INDUSTRY INSIGHTS

11 ELECTRIC TRUCKS MARKET, BY PROPULSION TYPE

- 11.1 INTRODUCTION

- FIGURE 53 ELECTRIC TRUCKS MARKET, BY PROPULSION TYPE, 2022-2030 (UNITS)

- TABLE 60 ELECTRIC TRUCKS MARKET, BY PROPULSION TYPE, 2019-2021 (UNITS)

- TABLE 61 ELECTRIC TRUCKS MARKET, BY PROPULSION TYPE, 2022-2030 (UNITS)

- 11.1.1 OPERATIONAL DATA

- TABLE 62 ELECTRIC TRUCKS: BY PROPULSION TYPE

- 11.1.2 ASSUMPTIONS

- 11.1.3 RESEARCH METHODOLOGY

- 11.2 BEV

- 11.2.1 GOVERNMENT INCENTIVES AND SUBSIDIES OFFERED WORLDWIDE

- TABLE 63 BEV: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 64 BEV: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 11.3 FCEV

- 11.3.1 ONGOING DEVELOPMENTS BY OEMS

- TABLE 65 FCEV: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 66 FCEV: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 11.4 PHEV

- 11.4.1 RECHARGEABLE BATTERIES WITH LESS FUEL CONSUMPTION

- TABLE 67 PHEV: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 68 PHEV: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 11.5 KEY INDUSTRY INSIGHTS

12 ELECTRIC TRUCKS MARKET, BY RANGE

- 12.1 INTRODUCTION

- FIGURE 54 ELECTRIC TRUCKS MARKET, BY RANGE, 2022-2030 (UNITS)

- TABLE 69 ELECTRIC TRUCKS MARKET, BY RANGE, 2019-2021 (UNITS)

- TABLE 70 ELECTRIC TRUCKS MARKET, BY RANGE, 2022-2030 (UNITS)

- 12.1.1 OPERATIONAL DATA

- TABLE 71 ELECTRIC TRUCKS: BY RANGE

- 12.1.2 ASSUMPTIONS

- 12.1.3 RESEARCH METHODOLOGY

- 12.2 UPTO 200 MILES

- 12.2.1 AFFORDABLE AND LOW-COST BATTERIES

- TABLE 72 UPTO 200 MILES: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 73 UPTO 200 MILES: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 12.3 ABOVE 200 MILES

- 12.3.1 USED FOR LONG HAUL TRANSPORTATION

- TABLE 74 ABOVE 200 MILES: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 75 ABOVE 200 MILES: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 12.4 KEY INDUSTRY INSIGHTS

13 ELECTRIC TRUCKS MARKET, BY TYPE

- 13.1 INTRODUCTION

- FIGURE 55 ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- TABLE 76 ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 77 ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- 13.1.1 OPERATIONAL DATA

- TABLE 78 ELECTRIC TRUCKS: BY TYPE

- 13.1.2 ASSUMPTIONS

- 13.1.3 RESEARCH METHODOLOGY

- 13.2 LIGHT-DUTY TRUCKS

- 13.2.1 USED FOR COMMERCIAL LAST MILE DELIVERY

- TABLE 79 LIGHT-DUTY TRUCKS: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 80 LIGHT-DUTY TRUCK: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 13.3 MEDIUM-DUTY TRUCKS

- 13.3.1 MANAGES E-COMMERCE AND INTRA-STATE LOGISTICS

- TABLE 81 MEDIUM-DUTY TRUCKS: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 82 MEDIUM-DUTY TRUCKS: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 13.4 HEAVY-DUTY TRUCKS

- 13.4.1 INCLUDES INTER-STATE DELIVERY AND SPECIALIZED VEHICLES

- TABLE 83 HEAVY-DUTY TRUCKS: ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 84 HEAVY-DUTY TRUCKS: ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- 13.5 KEY INDUSTRY INSIGHTS

14 ELECTRIC TRUCKS MARKET, BY REGION

- 14.1 INTRODUCTION

- FIGURE 56 ELECTRIC TRUCKS MARKET, BY REGION, 2022 VS. 2030 (UNITS)

- TABLE 85 ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (UNITS)

- TABLE 86 ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (UNITS)

- TABLE 87 ELECTRIC TRUCKS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 88 ELECTRIC TRUCKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- 14.2 ASIA PACIFIC

- FIGURE 57 ASIA PACIFIC: ELECTRIC TRUCKS MARKET SNAPSHOT

- TABLE 89 ASIA PACIFIC: ELECTRIC TRUCKS MARKET, BY COUNTRY, 2019-2021 (UNITS)

- TABLE 90 ASIA PACIFIC: ELECTRIC TRUCKS MARKET, BY COUNTRY, 2022-2030 (UNITS)

- 14.2.1 CHINA

- 14.2.1.1 Increased investments in charging infrastructure

- TABLE 91 CHINA: ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 92 CHINA: ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- 14.2.2 INDIA

- 14.2.2.1 Government initiatives for electric trucks

- TABLE 93 INDIA: ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 94 INDIA: ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- 14.2.3 JAPAN

- 14.2.3.1 Advancements in battery technology

- TABLE 95 JAPAN: ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 96 JAPAN: ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Increased investments in commercial electric vehicles

- TABLE 97 SOUTH KOREA: ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 98 SOUTH KOREA: ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- 14.3 EUROPE

- 14.3.1 EUROPE: RECESSION IMPACT

- FIGURE 58 EUROPE: ELECTRIC TRUCKS MARKET SNAPSHOT, 2022 VS. 2030 (UNITS)

- TABLE 99 EUROPE: ELECTRIC TRUCKS MARKET, BY COUNTRY, 2019-2021 (UNITS)

- TABLE 100 EUROPE: ELECTRIC TRUCKS MARKET, BY COUNTRY, 2022-2030 (UNITS)

- 14.3.2 FRANCE

- 14.3.2.1 Government offers purchase grants

- TABLE 101 FRANCE: ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 102 FRANCE: ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- 14.3.3 GERMANY

- 14.3.3.1 E-highway program

- TABLE 103 GERMANY: ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 104 GERMANY: ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- 14.3.4 NETHERLANDS

- 14.3.4.1 Focus on greener vehicles

- TABLE 105 NETHERLANDS: ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 106 NETHERLANDS: ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- 14.3.5 NORWAY

- 14.3.5.1 Tax incentives for electric vehicles

- TABLE 107 NORWAY: ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 108 NORWAY: ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- 14.3.6 SWEDEN

- 14.3.6.1 Presence of top OEMs

- TABLE 109 SWEDEN: ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 110 SWEDEN: ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- 14.3.7 UK

- 14.3.7.1 Investment in ultra-low emission vehicles

- TABLE 111 UK: ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 112 UK: ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

- 14.4 NORTH AMERICA

- FIGURE 59 NORTH AMERICA: ELECTRIC TRUCKS MARKET SNAPSHOT

- TABLE 113 NORTH AMERICA: ELECTRIC TRUCKS MARKET, BY COUNTRY, 2019-2021 (UNITS)

- TABLE 114 NORTH AMERICA: ELECTRIC TRUCKS MARKET, BY COUNTRY, 2022-2030 (UNITS)

- 14.4.1 CANADA

- 14.4.1.1 Increasing development in electric vehicles infrastructure

- TABLE 115 CANADA: ELECTRIC TRUCK MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 116 CANADA: ELECTRIC TRUCK MARKET, BY TYPE, 2022-2030 (UNITS)

- 14.4.2 US

- 14.4.2.1 Increasing developments in electric truck technology

- TABLE 117 US: ELECTRIC TRUCKS MARKET, BY TYPE, 2019-2021 (UNITS)

- TABLE 118 US: ELECTRIC TRUCKS MARKET, BY TYPE, 2022-2030 (UNITS)

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.1.1 OEMS VEHICLE MODELS LAUNCH PLANS, 2023-2026

- FIGURE 60 ELECTRIC TRUCKS MARKET: OEMS VEHICLE MODEL LAUNCH PLANS

- 15.2 MARKET SHARE ANALYSIS FOR ELECTRIC TRUCKS MARKET

- TABLE 119 MARKET SHARE ANALYSIS, 2022

- FIGURE 61 MARKET SHARE ANALYSIS, 2022

- 15.3 KEY PLAYER STRATEGIES

- TABLE 120 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ELECTRIC TRUCKS MARKET

- 15.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- FIGURE 62 TOP PUBLIC/LISTED PLAYERS DOMINATING ELECTRIC TRUCKS MARKET DURING LAST FIVE YEARS

- 15.5 COMPETITIVE SCENARIO

- 15.5.1 NEW PRODUCT LAUNCHES

- TABLE 121 NEW PRODUCT LAUNCHES, 2020-2023

- 15.5.2 DEALS

- TABLE 122 DEALS, 2020-2023

- 15.5.3 OTHERS

- TABLE 123 OTHERS, 2020-2023

- 15.6 COMPANY EVALUATION QUADRANT

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE PLAYERS

- 15.6.4 PARTICIPANTS

- FIGURE 63 ELECTRIC TRUCKS MARKET: COMPANY EVALUATION QUADRANT, 2023

- TABLE 124 ELECTRIC TRUCKS MARKET: COMPANY FOOTPRINT, 2023

- TABLE 125 ELECTRIC TRUCKS MARKET: PRODUCT FOOTPRINT, 2022

- TABLE 126 ELECTRIC TRUCKS MARKET: REGIONAL FOOTPRINT, 2022

- 15.7 STARTUP/SME EVALUATION QUADRANT

- 15.7.1 PROGRESSIVE COMPANIES

- 15.7.2 RESPONSIVE COMPANIES

- 15.7.3 DYNAMIC COMPANIES

- 15.7.4 STARTING BLOCKS

- FIGURE 64 ELECTRIC TRUCKS MARKET: STARTUP/SME EVALUATION QUADRANT, 2023

- TABLE 127 ELECTRIC TRUCKS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 128 ELECTRIC TRUCKS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

- 16.1.1 AB VOLVO

- TABLE 129 AB VOLVO: BUSINESS OVERVIEW

- FIGURE 65 AB VOLVO: COMPANY SNAPSHOT

- FIGURE 66 AB VOLVO: SALES, BY REVENUE (2021)

- TABLE 130 AB VOLVO: PRODUCTS OFFERED

- TABLE 131 AB VOLVO: NEW PRODUCT DEVELOPMENTS

- TABLE 132 AB VOLVO: DEALS

- TABLE 133 AB VOLVO: OTHERS

- 16.1.2 BYD

- TABLE 134 BYD: BUSINESS OVERVIEW

- FIGURE 67 BYD: COMPANY SNAPSHOT

- TABLE 135 BYD: PRODUCTS OFFERED

- TABLE 136 BYD: NEW PRODUCT DEVELOPMENTS

- TABLE 137 BYD: DEALS

- TABLE 138 BYD: OTHERS

- 16.1.3 RIVIAN

- TABLE 139 RIVIAN: BUSINESS OVERVIEW

- TABLE 140 RIVIAN: PRODUCTS OFFERED

- TABLE 141 RIVIAN: NEW PRODUCT DEVELOPMENTS

- TABLE 142 RIVIAN: DEALS

- TABLE 143 RIVIAN: OTHERS

- 16.1.4 MERCEDES BENZ GROUP AG

- TABLE 144 MERCEDES BENZ GROUP AG: BUSINESS OVERVIEW

- FIGURE 68 MERCEDES BENZ GROUP AG: COMPANY SNAPSHOT

- TABLE 145 MERCEDES BENZ GROUP AG: PRODUCTS OFFERED

- TABLE 146 MERCEDES BENZ GROUP AG: NEW PRODUCT DEVELOPMENTS

- TABLE 147 MERCEDES BENZ GROUP AG: DEALS

- TABLE 148 MERCEDES BENZ GROUP AG: OTHERS

- 16.1.5 FORD MOTOR COMPANY

- TABLE 149 FORD MOTOR COMPANY: BUSINESS OVERVIEW

- FIGURE 69 FORD MOTOR COMPANY: COMPANY SNAPSHOT

- TABLE 150 FORD MOTOR COMPANY: PRODUCTS OFFERED

- TABLE 151 FORD MOTOR COMPANY: NEW PRODUCT DEVELOPMENTS

- TABLE 152 FORD MOTOR COMPANY: DEALS

- TABLE 153 FORD MOTOR COMPANY: OTHERS

- 16.1.6 PACCAR INC.

- TABLE 154 PACCAR INC.: BUSINESS OVERVIEW

- FIGURE 70 PACCAR INC.: COMPANY SNAPSHOT

- TABLE 155 PACCAR INC.: PRODUCTS OFFERED

- TABLE 156 PACCAR INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 157 PACCAR INC.: DEALS

- TABLE 158 PACCAR INC.: OTHERS

- 16.1.7 SCANIA AB

- TABLE 159 SCANIA AB: BUSINESS OVERVIEW

- FIGURE 71 SCANIA AB: COMPANY SNAPSHOT

- TABLE 160 SCANIA AB: PRODUCTS OFFERED

- TABLE 161 SCANIA AB: NEW PRODUCT DEVELOPMENTS

- TABLE 162 SCANIA AB: DEALS

- TABLE 163 SCANIA AB: OTHERS

- 16.1.8 NAVISTAR INC.

- TABLE 164 NAVISTAR INC.: BUSINESS OVERVIEW

- FIGURE 72 NAVISTAR INC.: COMPANY SNAPSHOT

- TABLE 165 NAVISTAR INC.: PRODUCTS OFFERED

- TABLE 166 NAVISTAR INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 167 NAVISTAR INC.: DEALS

- TABLE 168 NAVISTAR INC.: OTHERS

- 16.1.9 DONGFENG MOTOR CORPORATION

- TABLE 169 DONGFENG MOTOR CORPORATION: BUSINESS OVERVIEW

- FIGURE 73 DONGFENG MOTOR CORPORATION: COMPANY SNAPSHOT

- TABLE 170 DONGFENG MOTOR CORPORATION: PRODUCTS OFFERED

- TABLE 171 DONGFENG MOTOR CORPORATION: DEALS

- TABLE 172 DONGFENG MOTOR CORPORATION: OTHERS

- 16.1.10 PROTERRA

- TABLE 173 PROTERRA: BUSINESS OVERVIEW

- FIGURE 74 PROTERRA: COMPANY SNAPSHOT

- TABLE 174 PROTERRA: PRODUCTS OFFERED

- TABLE 175 PROTERRA: DEALS

- TABLE 176 PROTERRA: OTHERS

- 16.1.11 VDL GROEP

- TABLE 177 VDL GROEP: BUSINESS OVERVIEW

- FIGURE 75 VDL GROEP: COMPANY SNAPSHOT

- TABLE 178 VDL GROEP: PRODUCTS OFFERED

- TABLE 179 VDL GROEP: DEALS

- TABLE 180 VDL GROEP: OTHERS

- 16.1.12 TESLA, INC.

- TABLE 181 TESLA, INC.: BUSINESS OVERVIEW

- FIGURE 76 TESLA, INC.: COMPANY SNAPSHOT

- TABLE 182 TESLA, INC.: PRODUCTS OFFERED

- TABLE 183 TESLA, INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 184 TESLA, INC: DEALS

- TABLE 185 TESLA, INC: OTHERS

- Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 16.2 OTHER KEY PLAYERS

- 16.2.1 TATA MOTORS LIMITED

- 16.2.2 WORKHORSE GROUP

- 16.2.3 NIKOLA CORPORATION

- 16.2.4 ASHOK LEYLAND

- 16.2.5 ISUZU MOTORS LTD.

- 16.2.6 IRIZAR GROUP

- 16.2.7 IVECO

- 16.2.8 TRITON EV

- 16.2.9 BOLLINGER MOTORS

- 16.2.10 XOS TRUCKS, INC.

- 16.2.11 ATLIS MOTOR VEHICLES

- 16.2.12 KAIYUN MOTORS

- 16.2.13 GEELY AUTOMOBILE HOLDINGS LIMITED

- 16.2.14 MAN SE

- 16.2.15 ORANGE EV

- 16.2.16 TEVVA MOTORS LIMITED

- 16.2.17 HINO MOTORS

17 RECOMMENDATIONS BY MARKETSANDMARKETS

- 17.1 NORTH AMERICA AND ASIA PACIFIC TO BE KEY MARKETS FOR ELECTRIC TRUCKS

- 17.2 ADOPTION OF LIGHT-DUTY ELECTRIC TRUCKS

- 17.3 KEY GROWTH OPPORTUNITIES

- 17.3.1 IMPROVEMENTS IN EV BATTERY TECHNOLOGY

- 17.3.2 DEMAND FOR HIGHER RANGE VEHICLES

- 17.4 CONCLUSION

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS