|

|

市場調査レポート

商品コード

1292339

動物飼料用プロバイオティクスの世界市場:家畜別 (家禽、豚、反芻動物、水産養殖、ペット)・供給源別 (細菌、酵母、菌類)・形状別 (乾燥、液体)・機能別 (定性:栄養、腸内健康、免疫、生産性)・地域別の将来予測 (2028年まで)Probiotics in Animal Feed Market by Livestock (Poultry, Swine, Ruminants, Aquaculture, Pets), Source (Bacteria, Yeast, Fungi), Form (Dry, Liquid), Function (Qualitative) (Nutrition, Gut Health, Immunity, Productivity) & Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 動物飼料用プロバイオティクスの世界市場:家畜別 (家禽、豚、反芻動物、水産養殖、ペット)・供給源別 (細菌、酵母、菌類)・形状別 (乾燥、液体)・機能別 (定性:栄養、腸内健康、免疫、生産性)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月12日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の動物飼料用プロバイオティクスの市場規模は、2023年の46億米ドルから2028年には71億米ドルに達すると予測され、予測期間中のCAGR (金額ベース) は9.1%となる見通しです。

動物飼料用プロバイオティクス市場には、形状別では乾燥の方が市場シェアは高い一方、動物飼料用液体プロバイオティクスは、プロバイオティクス菌株の生存率の向上や飼料の食感などの要因によって牽引されています。動物飼料用の乾燥型プロバイオティクスの需要は、主に費用対効果、保存期間の長さ、便利な包装といった要因によるものです。主な制約と課題は、飼料用プロバイオティクスの国際品質規制が標準化されていないこと、新しいプロバイオティクス株の新興国市場開拓のための研究開発にかかるコストが高いこと、他の飼料添加物の人気が高いことであり、これが飼料用プロバイオティクス市場の成長を妨げています。

"家畜別では、家禽向け需要が予測期間中に高くなる"

抗生物質成長促進剤の禁止に関する家禽飼育者の懸念の高まりが、動物飼料用プロバイオティクスの活用機会であることが証明されています。これが抗生物質耐性の発達を促しています。食肉や乳製品の消費に関連する利益に対する消費者の意識の高まりは、消費する食肉の品質に対する消費者の懸念も生んでいます。

畜産業の工業化も、世界的に需要が高い家禽類を中心とした動物飼料におけるプロバイオティクスの需要増加の一因となっています。プロバイオティクスは飼料の効率を改善し、家禽の飼料摂取量の拡大に役立っています。ブロイラーの飼料にプロバイオティクスを補充することで、飼料要求率が改善され、体重が増加します。また、ブロイラーの死亡率の低下も促します。従って、鶏肉の急速な需要と成長が市場を牽引すると予想されます。

"形状別では、乾燥タイプが市場を独占する"

動物飼料には濃厚飼料と粗飼料が含まれます。粗飼料は繊維質の多い飼料です。そのため、粗飼料はほとんどが乾燥形態です。乾燥形態のプロバイオティクスに含まれる高繊維は、動物の消化器系の健康増進に役立ちます。食物繊維はプレバイオティクスとして働き、有益な腸内細菌の餌となります。これにより、プロバイオティクスの成長と活性がサポートされ、消化、栄養吸収、腸全体の健康状態が改善されます。食物繊維が豊富なドライタイプのプロバイオティクスは、複合炭水化物の分解を助け、家畜が飼料からより多くの栄養素を取り出せるようにします。栄養利用が改善されることで、飼料効率が向上し、酪農家の飼料コストが削減される可能性があります。プロバイオティック微生物の乾燥形態の調製には、凍結乾燥や噴霧乾燥法が利用されています。

さらに、乾燥または粉末状のプロバイオティクスを含む飼料原料の一般的な利点には、保存期間の延長、便利な包装、使いやすさ、他の成分との混合能力などがあります。これらの要因が相俟って、乾燥セグメントの成長が促進されるでしょう。

"アジア太平洋地域が予測期間中、市場成長に大きく貢献する"

アジア太平洋 (中国、インド、日本、オーストラリア、ニュージーランドなど) の飼料用プロバイオティクス市場は、人口の増加、アジア太平洋地域の急速な都市化、可処分所得の増加、高品質の食肉製品への需要の増加などの要因により、主に成長しており、高品質の飼料添加物への需要を後押ししています。

人口の購買力の上昇とタンパク質が豊富な肉食への需要により、インド、中国、日本で大幅な成長が見られます。アジア太平洋地域では鶏肉と豚肉が広く消費されています。この地域は異質であり、所得水準、技術、家畜により良い品質の飼料を供給するという最終消費者の要求が多様であるため、将来の成長の展望が広がっています。日本、韓国、マレーシアは成熟し安定した市場であり、プロバイオティクスの生産に近代的な技術を使用しています。この地域における畜産業の継続的な近代化は、飼料産業におけるプロバイオティクス・メーカーに機会を提供します。アジア太平洋市場は、家畜の健康と生産性に関する政府間の懸念の高まりにより、動物飼料用プロバイオティクス製品に絶大な機会を提供しています。これらの要因は、動物飼料におけるプロバイオティクスの需要を促進すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- 技術分析

- 価格分析:動物飼料市場におけるプロバイオティクス

- エコシステム/市場マップ

- 顧客のビジネスに影響を与える動向/混乱

- 特許分析

- 貿易分析

- 主要な会議とイベント

- 関税・規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ

第7章 動物飼料用プロバイオティクス市場:供給源別

- イントロダクション

- 細菌

- 乳酸菌

- ビフィズス菌

- 連鎖球菌サーモフィルス

- 酵母・菌類

- サッカロマイセス・セレヴィシエ

- サッカロマイセス・ブラウディ

- その他の酵母・菌類の供給源

第8章 動物飼料用プロバイオティクス市場:家畜別

- イントロダクション

- 家禽

- 豚

- 反芻動物

- 水産養殖

- ペット

- その他の家畜

第9章 動物飼料用プロバイオティクス市場:形状別

- イントロダクション

- 乾燥

- 液体

第10章 動物飼料用プロバイオティクス市場:機能別

- イントロダクション

- 栄養

- 腸内健康

- 収量

- 免疫

- 生産性

第11章 動物飼料用プロバイオティクス市場:流通チャネル別

- イントロダクション

- 代理店への直接販売

- 畜産農家・飼料インテグレーターへの直接販売

- 他の販売チャネル

第12章 動物飼料用プロバイオティクス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- その他の地域

- アフリカ

- 中東

第13章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の収益分析:セグメント別

- 主要企業の年間収益と成長率

- 主要企業のEBIDTA

- 主要企業の戦略

- 主要企業の世界スナップショット

- 企業評価クアドラント:主要企業

- 動物飼料用プロバイオティクス市場の製品のフットプリント:主要企業

- 企業評価クアドラント:スタートアップ/中小企業

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- ADM

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- CHR. HANSEN HOLDING A/S

- EVONIK INDUSTRIES AG

- LAND O'LAKES, INC.

- DSM

- OHLY

- NOVOZYMES

- ALLTECH

- KEMIN INDUSTRIES, INC.

- PROVITA ANIMAL HEALTH

- ORFFA

- LESAFFRE

- LALLEMAND INC.

- ADVANCE AQUA BIO TECHNOLOGIES INDIA PRIVATE LIMITED

- SANZYME BIOLOGICS PVT. LTD.

- AGRIHEALTH

- ARM & HAMMER ANIMAL AND FOOD PRODUCTION

- UNIQUE BIOTECH

- PLANET BIOTECH INDIA

- その他の企業

- INDOGULF COMPANY

- PELLUCID LIFESCIENCES PVT. LTD.

- PURE CULTURES

- BL BIO LAB, LLC

- VIRBAC

第15章 隣接・関連市場

- イントロダクション

- 調査の限界

- 飼料添加物市場

- プロバイオティクス市場

第16章 付録

According to MarketsandMarkets, the probiotics in animal feed market is projected to reach USD 7.1 billion by 2028 from USD 4.6 billion by 2023, at a CAGR of 9.1% during the forecast period in terms of value. The probiotics in animal feed market comprises of both dry and liquid form; although dry form hold a larger market share, liquid probiotics for animal feed is driven by factors such as enhanced probiotic strains viability and feed texture. The demand for dry form of probiotics in animal feed is mainly due to factors such as cost-effectiveness, longer shelf lives, and convenient packaging. The major constraints and challenges are the non-standardized international quality regulations for probiotics in animal feed products, high costs associated with R&D for development of new probiotic strains, high popularity of other feed additives which, in turn, hinders the growth of probiotics in animal feed market.

"By livestock, poultry is projected in high demand during the forecast period."

The growing concern among poultry breeders regarding the ban on antibiotic growth promoters has proven to be an opportunity for the application of probiotics in animal feed. It aids in the development of antibiotic resistance. Rising awareness among consumers about the benefits associated with the consumption of meat and dairy products has also given rise to their concern about the quality of the meat they consume.

The industrialization of the animal industry is one of the reasons for the increasing demand for probiotics in animal feed specially in poultry owing to its high demand worldwide. Probiotics help improve the efficiency of feed and enhance the feed intake among poultry. Supplementing the diet of broilers with probiotics has resulted in improved feed conversion rates and an increase in weight. It also helps in reducing the mortality rate of broilers. Thus, the rapid demand and growth in poultry meat is expected to drive the market.

"By form, the dry format is expected to dominate the market for probiotics in animal feed"

Animal feed contains concentrates and roughage. Roughages are feed that are high in fiber. They are thus mostly in dry form. High fiber present in dry form of probiotics helps promote better digestive health in animals. Fiber acts as a prebiotic, providing a food source for beneficial gut bacteria. This supports the growth and activity of probiotics, leading to improved digestion, nutrient absorption, and overall gut health. Fiber-rich dry form probiotics aid in the breakdown of complex carbohydrates, allowing animals to extract more nutrients from their feed. This improved nutrient utilization results in better feed efficiency and potentially reduced feed costs for farmers. Freeze-drying and spray-drying methods are utilized for the preparation of the dry form of probiotic microorganisms.

Moreover, general benefits of feed ingredients, including probiotics in dry or powdered forms, include extended shelf life, convenient packaging, ease of use, and ability to blend with other components. These factors together would bolster the growth of the dry segment.

Asia Pacific will significantly contribute towards market growth during the forecast period

Geographically, the region is segmented as China, India, Japan, Australia, and New Zealand along with Rest of Asia-Pacific. The probiotics in animal feed market in Asia-Pacific is growing primarily due to factors such as growth in population, rapid urbanization in the Asia Pacific region, rise in disposable incomes, and an increase in demand for quality meat products have encouraged the demand for quality feed additives.

Substantial growth is witnessed in India, China, and Japan owing to the rise in the purchasing power of the population and demand for protein-rich meat diets. Poultry and pork are widely consumed in the Asia Pacific region. The region is heterogeneous, with diversity in income levels, technology, and demands of the end consumers to provide better-quality feed to livestock, leading to enhanced scope for future growth. Japan, South Korea, and Malaysia are mature and stable markets and use modern techniques to produce probiotics The continuous modernization of animal production in this region provides opportunities for probiotic manufacturers in the animal feed industry. The Asia Pacific market presents immense opportunities for animal feed probiotic products owing to the rising concerns among the governments about the health and productivity of farm animals. These factors are expected to drive demand for probiotics in animal feed.

Break-up of Primaries:

By Company Type: Tier1-40%, Tier 2-32%, Tier 3- 28%

By Designation: C-level-45%, D-level - 33%, and Others- 22%

By Region: North America - 15%, Europe - 20%, South America-12%, Asia Pacific - 40%,

RoW - 13%,

Others include sales managers, territory managers, and product managers.

Leading players profiled in this report:

- ADM (US)

- International Flavors & Fragrances Inc. (US)

- CHR. HANSEN HOLDING A/S (Denmark)

- Evonik Industries AG (Germany)

- Land O'Lakes (US)

- DSM (Netherlands)

- Ohly (Germany)

- Novozymes (Denmark)

- Alltech (US)

- Kemin Industries, Inc. (US)

- Provita Animal Health (UK)

- Orffa (Netherlands)

- Lesaffre (France)

- Lallemand Inc. (Canada)

- Advance Aqua Bio Technologies India Private Limited (India)

- SANZYME BIOLOGICS PVT. LTD. (India)

- AgriHealth (Ireland)

- Arm & Hammer Animal and Food Production (US)

- Unique Biotech (India)

- Planet biotech India (India)

- Indogulf Company (India)

- Pellucid Lifesciences Pvt. Ltd. (India)

- Pure Cultures (US)

- BL BIO LAB, LLC (US)

- VIRBAC (France)

The study includes an in-depth competitive analysis of these key players in the probiotics in animal feed market with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the probiotics in animal feed market on the basis of Source, Livestock, Form, Function (qualitative), Distribution Channel (Qualitative), and Region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global probiotics in animal feed market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall probiotics in animal feed market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increased demand for animal protein and other livestock products), restraints (non-standardized international quality regulations for probiotics in animal feed products), opportunity (Abolition of Antibiotic Growth Promoters (AGPs)), and challenges (High popularity of other feed additives) influencing the growth of the probiotics in animal feed market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the probiotics in animal feed market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the probiotics in animal feed market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the probiotics in animal feed market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players ADM (US), Chr. Hansen Holding A/S (Denmark), Evonik Industries AG (Germany), Land O'Lakes Inc. (US), DSM (US), and Novozymes (Denmark) are among others in the probiotics in animal feed market strategies. The report also helps stakeholders understand the probiotics and feed additives market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.6.1 CURRENCY (VALUE UNIT)

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2022

- 1.6.2 VOLUME UNIT

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PROBIOTICS IN ANIMAL FEED MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION - IDENTIFICATION OF TOP SUPPLIERS

- FIGURE 5 PROBIOTICS IN ANIMAL FEED MARKET: SUPPLY SIDE CALCULATION

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION - REVENUE FROM SUPPLIERS

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RECESSION IMPACT ON PROBIOTICS IN ANIMAL FEED MARKET

- 2.4.1 MACRO INDICATORS OF RECESSION

- FIGURE 8 INDICATORS OF RECESSION

- FIGURE 9 GLOBAL INFLATION RATE, 2011-2021

- FIGURE 10 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 11 RECESSION INDICATORS AND THEIR IMPACT ON PROBIOTICS IN ANIMAL FEED MARKET

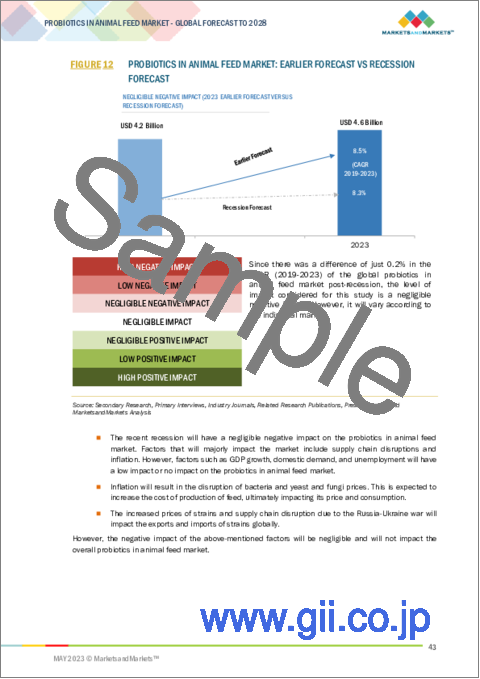

- FIGURE 12 PROBIOTICS IN ANIMAL FEED MARKET: EARLIER FORECAST VS RECESSION FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 2 PROBIOTICS IN ANIMAL FEED MARKET SNAPSHOT, 2022 VS. 2028

- FIGURE 13 PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 PROBIOTICS IN ANIMAL FEED MARKET SHARE, BY REGION, 2022 (VALUE)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PROBIOTICS IN ANIMAL FEED MARKET

- FIGURE 17 RISE AWARENESS REGARDING ANIMAL HEALTH TO DRIVE PROBIOTICS IN ANIMAL FEED MARKET

- 4.2 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE AND COUNTRY

- FIGURE 18 BACTERIA SEGMENT AND CHINA ACCOUNTED FOR SIGNIFICANT SHARE IN 2022

- 4.3 PROBIOTICS IN ANIMAL FEED MARKET, BY FORM

- FIGURE 19 DRY SEGMENT TO LEAD MARKET BY 2028

- 4.4 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK

- FIGURE 20 POULTRY SEGMENT TO DOMINATE MARKET BY 2028

- 4.5 PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE

- FIGURE 21 BACTERIA SEGMENT TO DOMINATE MARKET BY 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISE IN PRODUCTION OF COMPOUND FEED

- FIGURE 22 COMPOUND FEED PRODUCTION, 2012-2022 (MILLION METRIC TONNES)

- 5.2.2 GROWTH OPPORTUNITIES IN EMERGING ECONOMIES

- FIGURE 23 GROSS DOMESTIC PRODUCT GROWTH RATE IN ASIAN COUNTRIES, 2020-2021

- 5.3 MARKET DYNAMICS

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PROBIOTICS IN ANIMAL FEED MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Increased demand for animal protein and other livestock products

- TABLE 3 PER CAPITA CONSUMPTION OF LIVESTOCK PRODUCTS

- 5.3.1.2 Pressure on feed productivity and feed conversion rate

- 5.3.1.3 Greater prevalence of disease outbreaks

- 5.3.2 RESTRAINTS

- 5.3.2.1 Non-standardized international quality regulations

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Abolition of antibiotic growth promoters (AGPs)

- 5.3.3.2 Innovations and technological advancements in feed industry

- 5.3.4 CHALLENGES

- 5.3.4.1 High R&D costs for developing new probiotic strains

- 5.3.4.2 High popularity of other feed additives

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.2.2 RAW MATERIAL SOURCING

- 6.2.3 PRODUCTION & PROCESSING

- 6.2.4 DISTRIBUTION

- 6.2.5 MARKETING & SALES

- FIGURE 25 VALUE CHAIN ANALYSIS OF PROBIOTICS IN ANIMAL FEED MARKET

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 BACTERIOPHAGES AS NEW SOURCE OF PROBIOTICS

- 6.3.2 PROBIOTICS IN FORM OF EFFERVESCENT TABLETS

- 6.4 PRICING ANALYSIS: PROBIOTICS IN ANIMAL FEED MARKET

- 6.4.1 AVERAGE SELLING PRICE, BY SOURCE

- FIGURE 26 AVERAGE SELLING PRICES, BY SOURCE, 2020-2022 (USD/TON)

- TABLE 4 PROBIOTICS IN ANIMAL FEED MARKET: AVERAGE SELLING PRICE, BY SOURCE, 2020-2022 (USD/TON)

- TABLE 5 BACTERIA-BASED PROBIOTICS: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD/TON)

- TABLE 6 YEAST/FUNGI-BASED PROBIOTICS: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD/TON)

- 6.5 ECOSYSTEM/MARKET MAP

- 6.5.1 DEMAND SIDE

- 6.5.2 SUPPLY SIDE

- FIGURE 27 PROBIOTICS IN ANIMAL FEED MARKET MAP

- TABLE 7 PROBIOTICS IN ANIMAL FEED MARKET: SUPPLY CHAIN (ECOSYSTEM)

- FIGURE 28 PROBIOTICS IN ANIMAL FEED: ECOSYSTEM

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 29 REVENUE SHIFT FOR PROBIOTICS IN ANIMAL FEED MARKET

- 6.7 PATENT ANALYSIS

- FIGURE 30 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2022

- FIGURE 31 TOP TEN INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 32 LEADING APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- TABLE 8 PATENTS PERTAINING TO PROBIOTICS IN ANIMAL FEED, 2021-2023

- 6.8 TRADE ANALYSIS

- TABLE 9 TOP TEN IMPORTERS AND EXPORTERS OF LACTOBACILLUS, 2021 (KG)

- 6.9 KEY CONFERENCES AND EVENTS

- TABLE 10 KEY CONFERENCES AND EVENTS, 2023-2024

- 6.10 TARIFFS AND REGULATORY LANDSCAPE

- 6.10.1 NORTH AMERICA

- 6.10.1.1 US

- 6.10.1.2 Canada

- 6.10.2 EUROPEAN UNION

- 6.10.3 ASIA PACIFIC

- 6.10.3.1 China

- 6.10.3.2 Japan

- 6.10.3.3 India

- 6.10.4 SOUTH AMERICA

- 6.10.4.1 Brazil

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.1 NORTH AMERICA

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 PROBIOTICS IN ANIMAL FEED MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.11.2 BARGAINING POWER OF SUPPLIERS

- 6.11.3 BARGAINING POWER OF BUYERS

- 6.11.4 THREAT OF SUBSTITUTES

- 6.11.5 THREAT OF NEW ENTRANTS

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SOURCES

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SOURCES OF PROBIOTICS IN ANIMAL FEED

- 6.12.2 BUYING CRITERIA

- TABLE 16 PROBIOTICS IN ANIMAL FEED MARKET: KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 34 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- 6.13 CASE STUDIES

- 6.13.1 ACQUISITION OF PROBIOTICS INTERNATIONAL LIMITED HELPED ADM EXPAND ITS OFFERINGS

- 6.13.2 LAUNCH OF ECOBIL FIZZ FOR CHICKENS HELPED EVONIK INDUSTRIES AG BROADEN POULTRY PRODUCT PORTFOLIO

7 PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE

- 7.1 INTRODUCTION

- TABLE 17 PROBIOTICS COMMONLY USED IN ANIMAL FEED

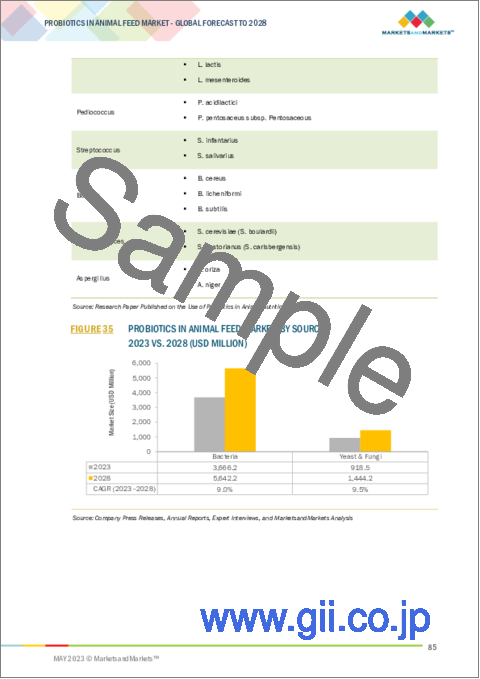

- FIGURE 35 PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- TABLE 18 PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 19 PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 20 PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (KT)

- TABLE 21 PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (KT)

- 7.2 BACTERIA

- 7.2.1 HIGH COMMERCIALIZATION AND BETTER BILE RESISTANCE AS COMPARED TO YEAST

- TABLE 22 BACTERIA: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 BACTERIA: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 24 BACTERIA: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (KT)

- TABLE 25 BACTERIA: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (KT)

- TABLE 26 BACTERIA: PROBIOTICS IN ANIMAL FEED MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 27 BACTERIA: PROBIOTICS IN ANIMAL FEED MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2.2 LACTOBACILLI

- 7.2.3 BIFIDOBACTERIUM

- 7.2.4 STREPTOCOCCUS THERMOPHILUS

- 7.3 YEAST & FUNGI

- 7.3.1 HIGH RATE OF PRODUCT INNOVATIONS AND ONGOING RESEARCH

- TABLE 28 YEAST & FUNGI: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 YEAST & FUNGI: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 30 YEAST & FUNGI: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (KT)

- TABLE 31 YEAST & FUNGI: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (KT)

- TABLE 32 YEAST & FUNGI: PROBIOTICS IN ANIMAL FEED MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 33 YEAST & FUNGI: PROBIOTICS IN ANIMAL FEED MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.3.2 SACCHAROMYCES CEREVISIAE

- 7.3.3 SACCHAROMYCES BOULARDII

- 7.3.4 OTHER YEAST & FUNGI SOURCES

8 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK

- 8.1 INTRODUCTION

- TABLE 34 BENEFITS ASSOCIATED WITH ADMINISTRATION OF PROBIOTICS IN ANIMAL FEED

- FIGURE 36 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2023 VS. 2028 (USD MILLION)

- TABLE 35 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2019-2022 (USD MILLION)

- TABLE 36 PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2023-2028 (USD MILLION)

- 8.2 POULTRY

- 8.2.1 RAPID DEMAND AND GROWTH OF POULTRY MEAT

- TABLE 37 BACTERIAL STRAINS USED IN MANUFACTURE OF PROBIOTICS FOR POULTRY

- TABLE 38 POULTRY: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 POULTRY: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 SWINE

- 8.3.1 HIGH PORK CONSUMPTION IN ASIAN COUNTRIES

- TABLE 40 PROBIOTIC MICROORGANISMS COMMONLY USED IN SWINE FEED

- TABLE 41 SWINE: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 SWINE: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 RUMINANTS

- 8.4.1 HIGH PER CAPITA CONSUMPTION OF BEEF AND GLOBAL RISE IN DEMAND FOR DAIRY PRODUCTS

- TABLE 43 RUMINANTS: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 RUMINANTS: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 AQUACULTURE

- 8.5.1 SUBSTANTIAL RISE IN GLOBAL AQUACULTURE FEED TONNAGE

- TABLE 45 APPLICATION OF PROBIOTICS IN AQUACULTURE

- TABLE 46 AQUACULTURE: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 AQUACULTURE: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 PETS

- 8.6.1 SURGE IN PET OWNERSHIP IN NORTH AMERICA AND EUROPE

- TABLE 48 PETS: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 49 PETS: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 OTHER LIVESTOCK

- TABLE 50 OTHER LIVESTOCK: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 OTHER LIVESTOCK: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

9 PROBIOTICS IN ANIMAL FEED MARKET, BY FORM

- 9.1 INTRODUCTION

- FIGURE 37 DRY FORM TO DOMINATE MARKET DURING FORECAST YEAR (USD MILLION)

- TABLE 52 PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 53 PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 9.2 DRY

- 9.2.1 BETTER FEED EFFICIENCY AND COST OPTIMIZATION

- TABLE 54 DRY: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 DRY: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 LIQUID

- 9.3.1 ENHANCED PROBIOTIC STRAINS VIABILITY AND FEED TEXTURE UNIFORMITY

- TABLE 56 LIQUID: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 LIQUID: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

10 PROBIOTICS IN ANIMAL FEED MARKET, BY FUNCTION

- 10.1 INTRODUCTION

- 10.2 NUTRITION

- 10.3 GUT HEALTH

- 10.4 YIELD

- 10.5 IMMUNITY

- 10.6 PRODUCTIVITY

11 PROBIOTICS IN ANIMAL FEED MARKET, BY DISTRIBUTION CHANNEL

- 11.1 INTRODUCTION

- 11.2 DIRECT SALES TO DISTRIBUTORS

- 11.3 DIRECT SALES TO LIVESTOCK GROWERS AND FEED INTEGRATORS

- 11.4 OTHER DISTRIBUTION CHANNELS

12 PROBIOTICS IN ANIMAL FEED MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 38 PROBIOTICS IN ANIMAL FEED MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 58 PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (KT)

- TABLE 61 PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (KT)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 39 NORTH AMERICA: INFLATION RATE, BY KEY COUNTRY, 2018-2021

- FIGURE 40 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 62 NORTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (KT)

- TABLE 67 NORTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (KT)

- TABLE 68 NORTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2019-2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2023-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 High demand for animal-based protein and rise in pet ownership

- TABLE 72 US: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 73 US: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 74 US: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 75 US: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Modernization of dairy industry and rise in layer feed production

- TABLE 76 CANADA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 77 CANADA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 78 CANADA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 79 CANADA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.2.4 MEXICO

- 12.2.4.1 Strengthening feed industry, surging meat exports, and high demand for poultry products

- TABLE 80 MEXICO: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 81 MEXICO: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 82 MEXICO: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 83 MEXICO: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 42 EUROPE: INFLATION RATE, BY KEY COUNTRY, 2018-2021

- FIGURE 43 EUROPE: RECESSION IMPACT ANALYSIS

- TABLE 84 EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 85 EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 86 EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 87 EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 88 EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (KT)

- TABLE 89 EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (KT)

- TABLE 90 EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2019-2022 (USD MILLION)

- TABLE 91 EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2023-2028 (USD MILLION)

- TABLE 92 EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 93 EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Higher meat production in commercial slaughterhouses

- TABLE 94 GERMANY: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 95 GERMANY: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 96 GERMANY: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 97 GERMANY: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Increased health awareness and consumption of dairy products

- TABLE 98 UK: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 99 UK: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 100 UK: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 101 UK: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3.4 FRANCE

- 12.3.4.1 High compound feed production and strong regulations

- TABLE 102 FRANCE: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 103 FRANCE: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 104 FRANCE: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 105 FRANCE: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Growth of pet food premium products and high animal feed consumption

- TABLE 106 ITALY: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 107 ITALY: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 108 ITALY: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 109 ITALY: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3.6 SPAIN

- 12.3.6.1 Greater demand for meat and dairy products

- TABLE 110 SPAIN: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 111 SPAIN: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 112 SPAIN: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 113 SPAIN: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3.7 RUSSIA

- 12.3.7.1 Robust feed industry coupled with rise in demand for poultry and dairy products

- TABLE 114 RUSSIA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 115 RUSSIA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 116 RUSSIA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 117 RUSSIA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.3.8 REST OF EUROPE

- TABLE 118 REST OF EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 119 REST OF EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 121 REST OF EUROPE: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 44 ASIA PACIFIC: INFLATION RATE, BY KEY COUNTRY, 2018-2021

- FIGURE 45 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 122 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY/REGION, 2019-2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (KT)

- TABLE 127 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (KT)

- TABLE 128 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2019-2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2023-2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Rapid urbanization and rising demand for livestock

- TABLE 132 CHINA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 133 CHINA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 134 CHINA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 135 CHINA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Large cattle population and demand for feed additives

- TABLE 136 INDIA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 137 INDIA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 138 INDIA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 139 INDIA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Increase in demand for premium-quality animal products

- TABLE 140 JAPAN: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 141 JAPAN: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 142 JAPAN: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 143 JAPAN: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 Growth in demand for organic and free-range products

- TABLE 144 AUSTRALIA & NEW ZEALAND: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 145 AUSTRALIA & NEW ZEALAND: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 146 AUSTRALIA & NEW ZEALAND: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 147 AUSTRALIA & NEW ZEALAND: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.4.6 REST OF ASIA PACIFIC

- TABLE 148 REST OF ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.5 SOUTH AMERICA

- 12.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 47 SOUTH AMERICA: INFLATION RATE, BY KEY COUNTRY, 2018-2021

- FIGURE 48 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 152 SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 153 SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 155 SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 156 SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (KT)

- TABLE 157 SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (KT)

- TABLE 158 SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2019-2022 (USD MILLION)

- TABLE 159 SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2023-2028 (USD MILLION)

- TABLE 160 SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 161 SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.5.2 BRAZIL

- 12.5.2.1 Substantial demand for good quality meat in domestic and international markets

- TABLE 162 BRAZIL: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 163 BRAZIL: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 164 BRAZIL: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 165 BRAZIL: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.5.3 ARGENTINA

- 12.5.3.1 High per capita beef consumption and thriving livestock industry

- TABLE 166 ARGENTINA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 167 ARGENTINA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 168 ARGENTINA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 169 ARGENTINA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.5.4 REST OF SOUTH AMERICA

- TABLE 170 REST OF SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 171 REST OF SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 172 REST OF SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 173 REST OF SOUTH AMERICA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.6 REST OF THE WORLD

- 12.6.1 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- FIGURE 49 REST OF THE WORLD: INFLATION RATE, BY SUBREGION, 2018-2021

- FIGURE 50 REST OF THE WORLD PROBIOTICS IN ANIMAL FEED MARKET: RECESSION IMPACT ANALYSIS

- TABLE 174 REST OF THE WORLD: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 175 REST OF THE WORLD: PROBIOTICS IN ANIMAL FEED MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 176 REST OF THE WORLD: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 177 REST OF THE WORLD: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 178 REST OF THE WORLD: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (KT)

- TABLE 179 REST OF THE WORLD: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (KT)

- TABLE 180 REST OF THE WORLD: PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2019-2022 (USD MILLION)

- TABLE 181 REST OF THE WORLD: PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK, 2023-2028 (USD MILLION)

- TABLE 182 REST OF THE WORLD: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 183 REST OF THE WORLD: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.6.2 AFRICA

- 12.6.2.1 Well-developed livestock industry coupled with growing meat consumption

- TABLE 184 AFRICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 185 AFRICA: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 186 AFRICA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 187 AFRICA: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

- 12.6.3 MIDDLE EAST

- 12.6.3.1 High consumption of beef to fuel market

- TABLE 188 MIDDLE EAST: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 189 MIDDLE EAST: PROBIOTICS IN ANIMAL FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 190 MIDDLE EAST: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 191 MIDDLE EAST: PROBIOTICS IN ANIMAL FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS

- TABLE 192 PROBIOTICS IN ANIMAL FEED MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- 13.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 51 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018-2022 (USD BILLION)

- 13.4 KEY PLAYERS ANNUAL REVENUE VS GROWTH

- FIGURE 52 ANNUAL REVENUE, 2022 (USD BILLION) VS REVENUE GROWTH, 2020-2022

- 13.5 KEY PLAYERS EBIDTA

- FIGURE 53 EBIDTA, 2022 (USD BILLION)

- 13.6 KEY PLAYER STRATEGIES

- TABLE 193 STRATEGIES ADOPTED BY KEY PLAYERS IN PROBIOTICS IN ANIMAL FEED MARKET

- 13.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 54 GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- 13.8 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- FIGURE 55 PROBIOTICS IN ANIMAL FEED MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 13.9 PROBIOTICS IN ANIMAL FEED MARKET: PRODUCT FOOTPRINT (KEY PLAYERS)

- TABLE 194 COMPANY FOOTPRINT, BY SOURCE

- TABLE 195 COMPANY FOOTPRINT, BY LIVESTOCK

- TABLE 196 COMPANY FOOTPRINT, BY REGION

- TABLE 197 OVERALL COMPANY FOOTPRINT

- 13.10 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)

- 13.10.1 PROGRESSIVE COMPANIES

- 13.10.2 STARTING BLOCKS

- 13.10.3 RESPONSIVE COMPANIES

- 13.10.4 DYNAMIC COMPANIES

- FIGURE 56 PROBIOTICS IN ANIMAL FEED MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- 13.10.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 198 PROBIOTICS IN ANIMAL FEED MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 199 PROBIOTICS IN ANIMAL FEED MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.11 COMPETITIVE SCENARIO

- 13.11.1 NEW PRODUCT LAUNCHES

- TABLE 200 PROBIOTICS IN ANIMAL FEED MARKET: NEW PRODUCT LAUNCHES, 2019-2021

- 13.11.2 DEALS

- TABLE 201 PROBIOTICS IN ANIMAL FEED MARKET: DEALS, 2018-2021

- 13.11.3 OTHERS

- TABLE 202 PROBIOTICS IN ANIMAL FEED MARKET: OTHERS, 2019

14 COMPANY PROFILES

- 14.1 KEY COMPANIES

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 14.1.1 ADM

- TABLE 203 ADM: BUSINESS OVERVIEW

- FIGURE 57 ADM: COMPANY SNAPSHOT

- TABLE 204 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 ADM: DEALS

- 14.1.2 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- TABLE 206 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- FIGURE 58 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- TABLE 207 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 INTERNATIONAL FLAVORS & FRAGRANCES INC.: NEW PRODUCT LAUNCHES

- TABLE 209 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- 14.1.3 CHR. HANSEN HOLDING A/S

- TABLE 210 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

- FIGURE 59 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

- TABLE 211 CHR. HANSEN HOLDING A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 CHR. HANSEN HOLDING A/S: NEW PRODUCT LAUNCHES

- TABLE 213 CHR. HANSEN HOLDING A/S: DEALS

- 14.1.4 EVONIK INDUSTRIES AG

- TABLE 214 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

- FIGURE 60 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- TABLE 215 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 EVONIK INDUSTRIES AG: NEW PRODUCT LAUNCHES

- 14.1.5 LAND O'LAKES, INC.

- TABLE 217 LAND O'LAKES, INC.: BUSINESS OVERVIEW

- FIGURE 61 LAND O'LAKES, INC.: COMPANY SNAPSHOT

- TABLE 218 LAND O'LAKES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 LAND O'LAKES, INC.: OTHERS

- 14.1.6 DSM

- TABLE 220 DSM: BUSINESS OVERVIEW

- FIGURE 62 DSM: COMPANY SNAPSHOT

- TABLE 221 DSM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 DSM: DEALS

- 14.1.7 OHLY

- TABLE 223 OHLY: BUSINESS OVERVIEW

- FIGURE 63 OHLY: COMPANY SNAPSHOT

- TABLE 224 OHLY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 OHLY: NEW PRODUCT LAUNCHES

- 14.1.8 NOVOZYMES

- TABLE 226 NOVOZYMES: BUSINESS OVERVIEW

- FIGURE 64 NOVOZYMES: COMPANY SNAPSHOT

- TABLE 227 NOVOZYMES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 NOVOZYMES: DEALS

- 14.1.9 ALLTECH

- TABLE 229 ALLTECH: BUSINESS OVERVIEW

- TABLE 230 ALLTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.10 KEMIN INDUSTRIES, INC.

- TABLE 231 KEMIN INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 232 KEMIN INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 KEMIN INDUSTRIES, INC.: NEW PRODUCT LAUNCHES

- 14.1.11 PROVITA ANIMAL HEALTH

- TABLE 234 PROVITA ANIMAL HEALTH: BUSINESS OVERVIEW

- TABLE 235 PROVITA ANIMAL HEALTH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.12 ORFFA

- TABLE 236 ORFFA: BUSINESS OVERVIEW

- TABLE 237 ORFFA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.13 LESAFFRE

- TABLE 238 LESAFFRE: BUSINESS OVERVIEW

- TABLE 239 LESAFFRE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.14 LALLEMAND INC.

- TABLE 240 LALLEMAND INC.: BUSINESS OVERVIEW

- TABLE 241 LALLEMAND INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.15 ADVANCE AQUA BIO TECHNOLOGIES INDIA PRIVATE LIMITED

- TABLE 242 ADVANCE AQUA BIO TECHNOLOGIES INDIA PRIVATE LIMITED: BUSINESS OVERVIEW

- TABLE 243 ADVANCE AQUA BIO TECHNOLOGIES INDIA PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.16 SANZYME BIOLOGICS PVT. LTD.

- TABLE 244 SANZYME BIOLOGICS PVT. LTD.: BUSINESS OVERVIEW

- TABLE 245 SANZYME BIOLOGICS PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.17 AGRIHEALTH

- TABLE 246 AGRIHEALTH: BUSINESS OVERVIEW

- TABLE 247 AGRIHEALTH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.18 ARM & HAMMER ANIMAL AND FOOD PRODUCTION

- TABLE 248 ARM & HAMMER ANIMAL AND FOOD PRODUCTION: BUSINESS OVERVIEW

- TABLE 249 ARM & HAMMER ANIMAL AND FOOD PRODUCTION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.19 UNIQUE BIOTECH

- TABLE 250 UNIQUE BIOTECH: BUSINESS OVERVIEW

- TABLE 251 UNIQUE BIOTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.20 PLANET BIOTECH INDIA

- TABLE 252 PLANET BIOTECH INDIA: BUSINESS OVERVIEW

- TABLE 253 PLANET BIOTECH INDIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2 OTHER PLAYERS

- 14.2.1 INDOGULF COMPANY

- TABLE 254 INDOGULF COMPANY: COMPANY OVERVIEW

- 14.2.2 PELLUCID LIFESCIENCES PVT. LTD.

- TABLE 255 PELLUCID LIFESCIENCES PVT. LTD.: COMPANY OVERVIEW

- 14.2.3 PURE CULTURES

- TABLE 256 PURE CULTURES: COMPANY OVERVIEW

- 14.2.4 BL BIO LAB, LLC

- TABLE 257 BL BIO LAB, LLC: COMPANY OVERVIEW

- 14.2.5 VIRBAC

- TABLE 258 VIRBAC: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 259 ADJACENT MARKETS

- 15.2 RESEARCH LIMITATIONS

- 15.3 FEED ADDITIVES MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 260 FEED ADDITIVES MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 15.4 PROBIOTICS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- TABLE 261 PROBIOTICS MARKET, BY PRODUCT TYPE, 2022-2027 (USD BILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS