|

|

市場調査レポート

商品コード

1141972

DC-DCコンバーターの世界市場:産業別・フォームファクタ別 (SIP、DIP、DINレール、ボックス、シャーシ搭載、ディスクリート、ブリック)・入力電圧別・出力電圧別・出力電力別・出力数別・製品種類別・絶縁/作業電圧別・地域別の将来予測 (2027年まで)DC-DC Converter Market by Vertical, Form Factor (SIP, DIP, DIN Rail, Box, Chassis Mount, Discreter, Brick), Input Voltage, Output Voltage, Output Power, Output Number, Product Type, Isolation Working Voltage and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| DC-DCコンバーターの世界市場:産業別・フォームファクタ別 (SIP、DIP、DINレール、ボックス、シャーシ搭載、ディスクリート、ブリック)・入力電圧別・出力電圧別・出力電力別・出力数別・製品種類別・絶縁/作業電圧別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年10月19日

発行: MarketsandMarkets

ページ情報: 英文 267 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のDC-DCコンバーターの市場規模は、2022年の49億米ドルから2027年には64億米ドルに達し、2022年から2027年までの間に5.1%のCAGRで成長すると予測されています。

この市場は、産業ロボットの需要増加や産業オートメーションの台頭、代替エネルギー源への投資、通信産業の拡大、医療分野の成長など、さまざまな要因によって牽引されています。

出力数別では、マルチ出力型が予測期間中に最も高いCAGR率で成長すると予測されます。電気機器は、適切に動作するために、入力電圧を変化させた安定した環境で動作することが求められます。そのため、複数の出力を持つDC-DCコンバーターは、様々な入力電圧レベルに対応し、正確な複数の出力を生成するために効率的です。

フォームファクター別では、DINレール型DC-DCコンバーターが予測期間中に最も高いCAGRで成長すると予測されます。DINレールは標準的な金属製のレールで、サーキットブレーカーの取り付けや産業用制御機器に最も一般的で広く使用されています。これらのシリーズのDC-DCコンバーターは、より広い入力電圧を持つ機能を持ち、その柔軟な仕様により、互換性のない電圧のデバイスを産業用システムに容易に統合することができます。

アジア太平洋のDC-DCコンバーター市場は、世界最大のDC-DCコンバーター市場です。特に、中国が2022年時点で市場をリードすると予想されています。

当レポートでは、世界のDC-DCコンバーターの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、産業別・製品種類別・出力電圧別・出力電力別・入力電圧別・フォームファクタ別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 範囲とシナリオ

- 技術分析

- 医療向け用途の台頭

- 成長する通信産業

- 顧客のビジネスに影響を与える動向/混乱

- 市場エコシステム

- バリューチェーン分析

- 貿易データ分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 関税・規制の状況

第6章 産業動向

- イントロダクション

- 新たな動向

- ロボティクスの開発

- 産業用途の拡大

- 高出力DC-DCコンバーターの需要の増加

- 低電力DC-DCコンバーター

- 自動車用途の台頭

- コンパクトDC-DCコンバーター

- 技術進歩と継続的な改善

- サプライチェーン分析

- メガトレンドの影響

- イノベーションと特許登録 (2012年~2020年)

第7章 DC-DCコンバーター市場:業種別

- イントロダクション

- 通信

- 携帯電話

- 通信塔

- データセンター

- 自動車

- 非電動自転車

- 電動自転車

- 商用車

- eモビリティ充電ステーション

- 産業ロボット

- 製造ロボット

- サービスロボット

- 航空宇宙・防衛

- 航空機

- 陸上車両

- 衛星

- 医療

- CTスキャナー

- マンモグラフィーシステム

- PETシステム

- MRIシステム

- 鉄道

- 機関車

- 高速鉄道

- エネルギー・電力

- 石油・ガス

- 再生可能エネルギー

- 低電圧直流 (LVDC)

- 民生用電子機器

- AR・VRデバイス

- ウェアラブルデバイス

- 家庭用品

- サーバー・ストレージ・ネットワーク

- 海洋

- 船舶

- 港湾設備

第8章 DC-DCコンバーター市場:製品種類別

- イントロダクション

- 絶縁型DC-DCコンバーター

- 絶縁/作業電圧別

- 非絶縁型DC-DCコンバーター

- 10A以下

- 10~20A

- 20~50A

- 50~100A

第9章 DC-DCコンバーター市場:出力電圧別

- イントロダクション

- 2V以下

- 3.3V

- 5V

- 12V

- 15V

- 24V

- 24V以上

第10章 DC-DCコンバーター市場:出力電力別

- イントロダクション

- 0.5~9W

- 10~29W

- 30~99W

- 100~250W

- 250~500W

- 500~1,000W

- 1,000W以上

第11章 DC-DCコンバーター市場:入力電圧別

- イントロダクション

- 12V以下

- 9~36V

- 18~75V

- 40~160V

- 200V以上

第12章 DC-DCコンバーター市場:フォームファクタ別

- イントロダクション

- SIP

- DIP

- DINレール

- ボックス

- シャーシ搭載

- ディスクリート

- ブリック

- フルブリック

- ハーフ (1/2) ブリック

- クォーター (1/4) ブリック

- 1/8ブリック

- 1/16ブリック

第13章 DC-DCコンバーター市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- ロシア

- ノルウェー

- イタリア

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 台湾

- オーストラリア

- シンガポール

- 他のアジア太平洋諸国

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- 他の中東諸国

- 他の国々 (RoW)

- ラテンアメリカ

- アフリカ

第14章 競合情勢

- イントロダクション

- 主要企業の市場シェア分析 (2021年)

- 収益分析 (2019年~2021年)

- ランク分析 (2021年)

- 上位5社の収益分析 (2021年)

- 企業評価クアドラント

- 競合ベンチマーキング

- 競合シナリオ

- 製品の発売/開発

第15章 企業プロファイル

- 主要企業

- TDK-LAMBDA CORPORATION

- TRACO ELECTRONIC AG

- MURATA MANUFACTURING CO., LTD.

- INFINEON TECHNOLOGIES AG

- ADVANCED ENERGY INDUSTRIES INC.

- ABB LTD.

- TEXAS INSTRUMENTS INCORPORATED

- FLEX LTD.

- VICOR CORPORATION

- FDK CORPORATION

- RECOM POWER GMBH

- CRANE CO.

- STMICROELECTRONICS

- CINCON ELECTRONICS

- MEAN WELL ENTERPRISES

- DELTA ELECTRONICS

- XP POWER

- BEL FUSE INC.

- KGS ELECTRONICS

- ASTRONICS CORPORATION

- MEGGITT PLC

- その他の企業

- SYNQOR

- AIMTEC

- COSEL

- AJ'S POWER SOURCE

- VPT POWER

- SG MICRO CORP.

- POWER PRODUCTS INTERNATIONAL

第16章 付録

The global DC-DC converter market size is projected to grow from USD 4.9 billion in 2022 to USD 6.4 billion by 2027, at a CAGR of 5.1% from 2022 to 2027. The market is driven by various factors, such as rise in demand industrial robots, rising industrial automation, investments in alternative sources of energy, expanding telecommunications industry, and a growing healthcare sector.

The DC-DC converter market includes major players TDK Lambda Corporation (Japan), Texas Instruments Incorporated (US), Delta Electronics (Taipei), Flex Ltd. (Singapore) and Infineon Technologies AG (Germany).

"Multiple Power Output: The fastest-growing segment of the DC-DC Converter market, by Output Number. "

Based on the output number, the multiple output DC-DC converters are projected to grow at the highest CAGR rate for the DC-DC converter market during the forecast period. With the increasing demand for power application product throughout the industry, the demand for DC-DC converters is also increasing. The electrical devices are required to work in a regulated environment with varied input voltage in order to work properly. Hence, DC-DC converter with multiple outputs do have varied input voltage levels and are efficient to produce accurate multiple outputs as well.

"DIN Rail: The fastest-growing segment of the DC-DC converter market, by Form Factor. "

Based on the form factor, the DIN Rail DC-DC converter is projected to grow at the highest CAGR for the DC-DC converter market during the forecast period. DIN rail is a standard metal rail, which is most commonly and widely used for circuit breaker mounting and industrial control equipment. These series of DC-DC converters have the capability of having a wider input voltage and their flexible specification allows devices with incompatible voltages to be easily integrated into industrial systems.

Asia Pacific: The largest contributing region in the DC-DC Converter market."

The Asia Pacific DC-DC converter market is expected to be driven by rising industrial automation, investments in alternative sources of energy, expanding telecommunications industry, and a growing healthcare sector. The major countries considered under this region are China, Taiwan, India, Australia, Singapore, and Rest of Asia Pacific. China is expected to lead the Asia Pacific DC-DC converter market in 2022. The growth of the Chinese market is attributed to the presence of several major power electronics manufacturers such as TDK-Lambda Corporation, Murata Manufacturing Co. Ltd., Flex Ltd., and Cincon Electronics. These major market players have wide product portfolios that cover almost every industrial application related to power electronics. They also have a wide network of global supply chains, allowing them to engage with customers worldwide and understand their needs. These players regularly invest in R&D to develop new products in the DC-DC converter market.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-39%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level-35%; Directors-25%; and Others-40%

- By Region: North America-25%; Europe-15%; Asia Pacific-45%; and Rest of the World-15%

TDK Lambda Corporation (Japan), Texas Instruments Incorporated (US), Delta Electronics (Taipei), Flex Ltd. (Singapore) and Infineon Technologies AG (Germany) are some of the leading players operating in the DC-DC converter market report.

Research Coverage

The study covers the DC-DC converter market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on vertical, form factor, input voltage, output voltage, output power, output number, product type, isolation working voltage and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall DC-DC converter Market and its segments. This study is also expected to provide region wise information about the end use, and wherein DC-DC converter are used. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on tactical data link offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the DC-DC converter market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the DC-DC converter market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the DC-DC converter market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the DC-DC converter market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DC-DC CONVERTER MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN DC-DC CONVERTER MARKET

- 1.5 CURRENCY CONSIDERED

- 1.6 USD EXCHANGE RATES

- 1.7 LIMITATIONS

- 1.8 MARKET STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET DEFINITION AND SCOPE

- TABLE 2 SEGMENTS AND SUBSEGMENTS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- TABLE 3 DC-DC CONVERTER MARKET FOR VERTICALS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 TRIANGULATION AND VALIDATION

- FIGURE 6 DATA TRIANGULATION

- 2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.5 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISKS

3 EXECUTIVE SUMMARY

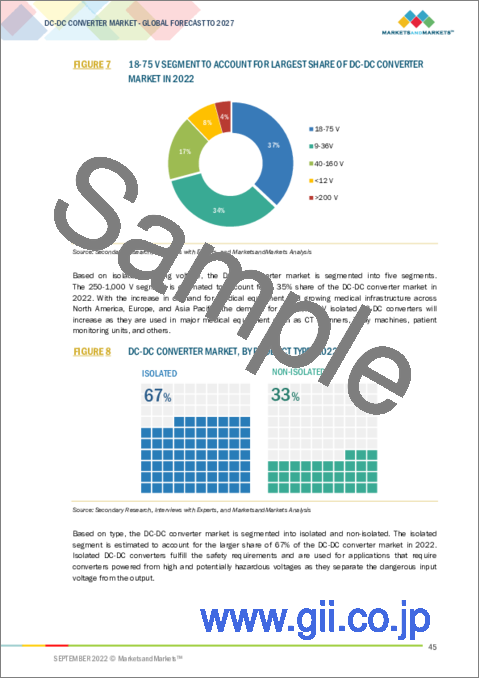

- FIGURE 7 18-75 V SEGMENT TO ACCOUNT FOR LARGEST SHARE OF DC-DC CONVERTER MARKET IN 2022

- FIGURE 8 DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2022

- FIGURE 9 BRICK SEGMENT TO DOMINATE DC-DC CONVERTER MARKET IN 2022

- FIGURE 10 MIDDLE EAST TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN DC-DC CONVERTER MARKET

- FIGURE 11 RISE IN DEMAND FOR INDUSTRIAL ROBOTS EXPECTED TO DRIVE MARKET

- 4.2 DC-DC CONVERTER MARKET, BY OUTPUT NUMBER

- FIGURE 12 DUAL SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- 4.3 DC-DC CONVERTER MARKET, BY INPUT VOLTAGE

- FIGURE 13 18-75 V SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- 4.4 DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE

- FIGURE 14 12 V SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 DC-DC CONVERTER MARKET, BY COUNTRY

- FIGURE 15 INDIA PROJECTED TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 DC-DC CONVERTER MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for industrial robots in manufacturing and service sectors

- 5.2.1.2 Growing healthcare industry across regions

- 5.2.1.3 Rising adoption of DC-DC converters in hybrid and electric vehicles

- FIGURE 17 GLOBAL EV SALES, BY TYPE, 2011-2030, IN THOUSANDS OF UNITS

- 5.2.1.4 Increasing demand for power consumption

- 5.2.2 RESTRAINTS

- 5.2.2.1 Functionality of DC-DC converters in low-power mode

- 5.2.2.2 Product manufacturing challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing IoT applications in various industries

- 5.2.3.2 Increasing demand for UAVs and satellites

- 5.2.3.3 Increasing military COTS applications

- 5.2.3.4 High power demand for 5G base stations

- TABLE 4 5G CELL TYPES

- 5.2.3.4.1 5G communications use cases, by region

- TABLE 5 5G USE CASES, BY REGION

- 5.2.4 CHALLENGES

- 5.2.4.1 Global shortage of semiconductors

- 5.2.4.2 Maintaining high performance with compact size

- 5.3 RANGES AND SCENARIOS

- FIGURE 18 RANGES AND SCENARIOS

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 RISING HEALTHCARE APPLICATIONS

- 5.4.2 GROWING COMMUNICATION INDUSTRY

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DC-DC CONVERTER MARKET

- FIGURE 19 REVENUE SHIFT IN DC-DC CONVERTER MARKET

- 5.6 MARKET ECOSYSTEM

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 PRIVATE AND SMALL ENTERPRISES

- 5.6.3 END USERS

- FIGURE 20 MARKET ECOSYSTEM MAP: DC-DC CONVERTER MARKET

- TABLE 6 DC-DC CONVERTER MARKET ECOSYSTEM

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS: DC-DC CONVERTER MARKET

- 5.8 TRADE DATA ANALYSIS

- TABLE 7 TRADE DATA FOR DC-DC CONVERTER MARKET

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 LOW NOISE AND COMPACT DESIGN

- 5.11 TARIFF AND REGULATORY LANDSCAPE

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 EMERGING TRENDS

- FIGURE 23 EMERGING TRENDS

- 6.2.1 DEVELOPMENT IN ROBOTICS

- 6.2.2 INCREASING INDUSTRIAL APPLICATIONS

- 6.2.3 INCREASING DEMAND FOR HIGH-POWER DC-DC CONVERTERS

- 6.2.4 LOW-POWER DC-DC CONVERTERS

- 6.2.5 RISING AUTOMOTIVE APPLICATIONS

- 6.2.6 COMPACT DC-DC CONVERTERS

- 6.2.7 TECHNOLOGICAL ADVANCEMENTS AND CONTINUOUS IMPROVEMENT

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 24 SUPPLY CHAIN ANALYSIS

- 6.4 IMPACT OF MEGATRENDS

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS, 2012-2020

- TABLE 9 INNOVATIONS AND PATENT REGISTRATIONS

7 DC-DC CONVERTER MARKET, BY VERTICAL

- 7.1 INTRODUCTION

- FIGURE 25 AUTOMOTIVE SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 10 DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 11 DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 7.2 TELECOMMUNICATION

- TABLE 12 TELECOMMUNICATION DC-DC CONVERTER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 13 TELECOMMUNICATION DC-DC CONVERTER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 14 TELECOMMUNICATION DC-DC CONVERTER MARKET, BY SUBSEGMENT, 2018-2021 (USD MILLION)

- TABLE 15 TELECOMMUNICATION DC-DC CONVERTER MARKET, BY SUBSEGMENT, 2022-2027 (USD MILLION)

- 7.2.1 CELLULAR PHONE

- 7.2.1.1 5G to increase smartphone usage

- 7.2.2 COMMUNICATION TOWERS

- 7.2.2.1 Increasing signal strength to provide 5G services

- 7.2.3 DATA CENTERS

- 7.2.3.1 Rising infrastructure and data security laws

- 7.3 AUTOMOTIVE

- TABLE 16 AUTOMOTIVE DC-DC CONVERTER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 17 AUTOMOTIVE DC-DC CONVERTER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 18 AUTOMOTIVE DC-DC CONVERTER MARKET, BY SUBSEGMENT, 2018-2021 (USD MILLION)

- TABLE 19 AUTOMOTIVE DC-DC CONVERTER MARKET, BY SUBSEGMENT, 2022-2027 (USD MILLION)

- 7.3.1 NON-ELECTRIC VEHICLES

- TABLE 20 NON-ELECTRIC VEHICLE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 21 NON-ELECTRIC VEHICLE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 7.3.1.1 Passenger vehicles

- 7.3.1.1.1 Improving standards of living and increase in disposable income

- 7.3.1.2 Commercial vehicles

- 7.3.1.2.1 Increasing demand from logistics and transportation industry

- 7.3.1.3 Construction vehicles

- 7.3.1.3.1 Advanced DC/DC converters based on latest semiconductor technology to displace alternators powering auxiliary components

- 7.3.1.1 Passenger vehicles

- 7.3.2 ELECTRIC VEHICLES

- TABLE 22 ELECTRIC VEHICLE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 23 ELECTRIC VEHICLE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 7.3.2.1 Passenger vehicles

- 7.3.2.1.1 Fuel-cell vehicles

- 7.3.2.1.1.1 Increasing need for emission-free vehicles

- 7.3.2.1.2 Hybrid electric vehicles

- 7.3.2.1.2.1 Need for better performance eco-friendly vehicles

- 7.3.2.1.3 Battery electric vehicles

- 7.3.2.1.3.1 Government support for zero-emission vehicles

- 7.3.2.1.4 Plug-in hybrid electric vehicles

- 7.3.2.1.4.1 Increasing need for long-range electric vehicles

- 7.3.2.1.1 Fuel-cell vehicles

- 7.3.2.1 Passenger vehicles

- 7.3.3 COMMERCIAL VEHICLES

- 7.3.3.1 Rising demand for electric vehicles from logistics industry

- 7.3.4 E-MOBILITY CHARGING STATIONS

- 7.3.4.1 Rising usage of electric vehicles

- 7.4 INDUSTRIAL ROBOTS

- TABLE 24 INDUSTRIAL ROBOTS DC-DC CONVERTER MARKET, BY SUBSEGMENT, 2018-2021 (USD MILLION)

- TABLE 25 INDUSTRIAL ROBOTS DC-DC CONVERTER MARKET, BY SUBSEGMENT, 2022-2027 (USD MILLION)

- 7.4.1 MANUFACTURING ROBOTS

- TABLE 26 MANUFACTURING ROBOTS DC-DC CONVERTER MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 27 MANUFACTURING ROBOTS DC-DC CONVERTER MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.4.1.1 Metals

- 7.4.1.1.1 Requirement of robust actuators in mining industry

- 7.4.1.2 Chemicals, paper, and plastics

- 7.4.1.2.1 Increasing industrialization and stringent environmental regulations to drive segment

- 7.4.1.3 Automotive

- 7.4.1.3.1 Increased demand for industrial robots in automotive sector to drive market

- 7.4.1.4 Electronics & electricals

- 7.4.1.4.1 Increasing demand for batteries, chips, and displays to drive market

- 7.4.1.5 Food & beverages

- 7.4.1.5.1 Need to increase automation and enhance capacity of existing plants to drive segment

- 7.4.1.1 Metals

- 7.4.2 SERVICE ROBOTS

- 7.4.2.1 Automated guided vehicles

- 7.4.2.1.1 Increased demand for automated handling in industrial facilities

- 7.4.2.2 Cleaning robots

- 7.4.2.2.1 Requirement for automated cleaning services in commercial spaces

- 7.4.2.3 Inspection robots

- 7.4.2.3.1 Rising need for automated inspection in difficult-to-reach areas

- 7.4.2.4 Humanoid robots

- 7.4.2.4.1 Need to replicate human touch for various sectors

- 7.4.2.5 Warehousing robots

- 7.4.2.5.1 Robotics arms

- 7.4.2.5.1.1 Robotic arms generally used to handle huge payloads at arm wrist

- 7.4.2.5.2 Collaborative robots

- 7.4.2.5.2.1 Introduction of 5G technology projected to accelerate deployment of collaborative robots in manufacturing industry

- 7.4.2.5.3 Articulated robots

- 7.4.2.5.3.1 Manufacturers in countries such as Brazil, Indonesia, and Malaysia expected to integrate robotic automation into their operations

- 7.4.2.5.1 Robotics arms

- 7.4.2.1 Automated guided vehicles

- 7.5 AEROSPACE & DEFENSE

- TABLE 28 AEROSPACE & DEFENSE DC-DC CONVERTER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 29 AEROSPACE & DEFENSE DC-DC CONVERTER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 30 AEROSPACE & DEFENSE DC-DC CONVERTER MARKET, BY PLATFORM TYPE, 2018-2021 (USD MILLION)

- TABLE 31 AEROSPACE & DEFENSE DC-DC CONVERTER MARKET, BY PLATFORM TYPE, 2022-2027 (USD MILLION)

- 7.5.1 AIRCRAFT

- 7.5.1.1 More electric aircraft expected to drive demand for DC-DC converters

- TABLE 32 AIRCRAFT DC-DC CONVERTER MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

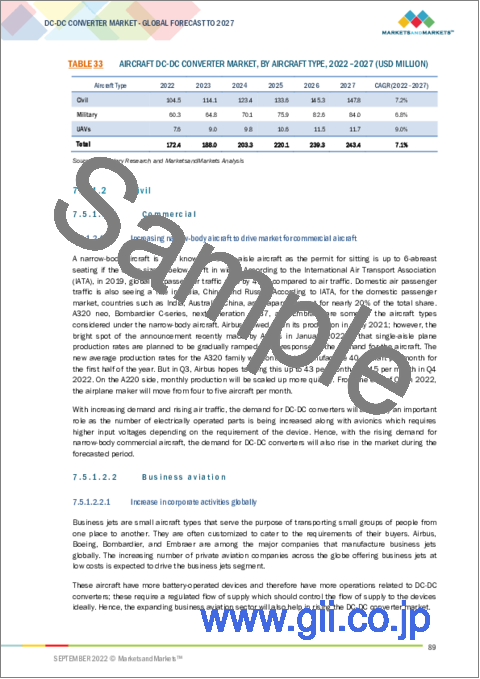

- TABLE 33 AIRCRAFT DC-DC CONVERTER MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 7.5.1.2 Civil

- 7.5.1.2.1 Commercial

- 7.5.1.2.1.1 Increasing narrow-body aircraft to drive market for commercial aircraft

- 7.5.1.2.2 Business aviation

- 7.5.1.2.2.1 Increase in corporate activities globally

- 7.5.1.2.3 Helicopters

- 7.5.1.2.3.1 Expanding applications of commercial helicopters

- 7.5.1.2.1 Commercial

- 7.5.1.3 Military

- 7.5.1.3.1 Growing national security and special mission aircraft to drive market

- 7.5.1.3.2 Fighter aircraft

- 7.5.1.3.3 Special mission aircraft

- 7.5.1.3.4 Transport aircraft

- 7.5.1.3.5 Rotorcraft

- 7.5.1.4 Unmanned aerial vehicles

- 7.5.1.4.1 Fixed-wing UAVs

- 7.5.1.4.1.1 Increase in flying hours to drive market

- 7.5.1.4.2 Rotary wing UAVs

- 7.5.1.4.2.1 Increasing application of rotary-wing UAVs for commercial and military purposes

- 7.5.1.4.1 Fixed-wing UAVs

- 7.5.1.2 Civil

- 7.5.2 LAND VEHICLES

- 7.5.2.1 Armored vehicles

- 7.5.2.1.1 Rising demand for AVs for use in cross-border conflicts

- 7.5.2.2 Ground support equipment (GSE)

- 7.5.2.2.1 Rising number of airports

- 7.5.2.1 Armored vehicles

- 7.5.3 SATELLITES

- 7.5.3.1 Rising demand for high output voltage for satellite communication

- 7.5.3.2 Small satellites

- 7.5.3.2.1 Growing national security concerns along with geographic operations

- 7.5.3.3 Medium satellites

- 7.5.3.3.1 Increasing demand for LEO-based services

- 7.5.3.4 Large satellites

- 7.5.3.4.1 Rising demand for telecom services

- 7.6 MEDICAL

- 7.6.1 HEALTHCARE SYSTEMS THROUGHOUT REGIONS EXPANDING AT HIGH PACE

- 7.6.2 COMPUTED TOMOGRAPHY SCANNERS

- 7.6.3 MAMMOGRAPHY SYSTEMS

- 7.6.4 POSITRON EMISSION TOMOGRAPHY SYSTEMS

- 7.6.5 MAGNETIC RESONANCE IMAGING SYSTEMS

- 7.7 RAILWAY

- 7.7.1 GROWING TRANSPORT INFRASTRUCTURE TO DRIVE MARKET

- 7.7.2 LOCOMOTIVE

- 7.7.3 RAPID TRANSIT

- 7.8 ENERGY AND POWER

- 7.8.1 OIL AND GAS

- 7.8.1.1 Rising Middle East oil and gas industry

- 7.8.2 RENEWABLE ENERGY

- 7.8.2.1 Increasing demand for alternative sources of energy

- 7.8.3 LOW VOLTAGE DIRECT CURRENT (LVDC)

- 7.8.3.1 Increasing urbanization to drive segment

- 7.8.1 OIL AND GAS

- 7.9 CONSUMER ELECTRONICS

- 7.9.1 INCREASING NUMBER OF NEW ELECTRONIC GADGETS AND DIFFERENT ELECTRONIC INSTRUMENTS

- TABLE 34 CONSUMER ELECTRONICS DC-DC CONVERTER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 CONSUMER ELECTRONICS DC-DC CONVERTER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.9.2 AR & VR DEVICES

- 7.9.3 WEARABLE DEVICES

- 7.9.4 HOUSEHOLD APPLIANCES

- 7.10 SERVER, STORAGE, AND NETWORK

- 7.10.1 RISE IN DATA CENTERS EXPECTED TO BOOST GROWTH

- TABLE 36 SERVER, STORAGE, AND NETWORK DC-DC CONVERTER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 37 SERVER, STORAGE, AND NETWORK DC-DC CONVERTER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.11 MARINE

- TABLE 38 MARINE DC-DC CONVERTER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 MARINE DC-DC CONVERTER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 40 MARINE DC-DC CONVERTER MARKET, BY SUBSEGMENT, 2018-2021 (USD MILLION)

- TABLE 41 MARINE DC-DC CONVERTER MARKET, BY SUBSEGMENT, 2022-2027 (USD MILLION)

- 7.11.1 SHIPS

- 7.11.1.1 Commercial

- 7.11.1.1.1 Increasing use of electric ships for commercial purposes

- 7.11.1.2 Military

- 7.11.1.2.1 Rising technological developments in marine propulsion systems

- 7.11.1.1 Commercial

- 7.11.2 PORT EQUIPMENT

- 7.11.2.1 Growing demand for advanced cargo handling

8 DC-DC CONVERTER MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- FIGURE 26 ISOLATED SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 42 DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2018-2021 (USD MILLION)

- TABLE 43 DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2022-2027 (USD MILLION)

- 8.2 ISOLATED DC-DC CONVERTER

- 8.2.1 ISOLATION WORKING VOLTAGE

- 8.2.1.1 50-150 V

- 8.2.1.2 150-250 V

- 8.2.1.3 250-1,000 V

- 8.2.1.4 1,001-2,500 V

- 8.2.1.5 >2,500 V

- 8.2.1 ISOLATION WORKING VOLTAGE

- 8.3 NON-ISOLATED DC-DC CONVERTER

- 8.3.1 <10 A

- 8.3.2 10-20 A

- 8.3.3 20-50 A

- 8.3.4 50-100 A

9 DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE

- 9.1 INTRODUCTION

- FIGURE 27 12 V SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 44 DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2018-2021 (USD MILLION)

- TABLE 45 DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2022-2027 (USD MILLION)

- 9.2 <2 V

- 9.3 3.3 V

- 9.4 5 V

- 9.5 12 V

- 9.6 15 V

- 9.7 24 V

- 9.8 >24 V

10 DC-DC CONVERTER MARKET, BY OUTPUT POWER

- 10.1 INTRODUCTION

- FIGURE 28 30-99 W SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 46 DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2018-2021 (USD MILLION)

- TABLE 47 DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2022-2027 (USD MILLION)

- 10.2 0.5-9 W

- 10.3 10-29 W

- 10.4 30-99 W

- 10.5 100-250 W

- 10.6 250-500 W

- 10.7 500-1,000 W

- 10.8 >1,000 W

11 DC-DC CONVERTER MARKET, BY INPUT VOLTAGE

- 11.1 INTRODUCTION

- FIGURE 29 18-75 V SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 48 DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2018-2021 (USD MILLION)

- TABLE 49 DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2022-2027 (USD MILLION)

- 11.2 <12 V

- 11.3 9-36 V

- 11.4 18-75 V

- 11.5 40-160 V

- 11.6 >200 V

12 DC-DC CONVERTER MARKET, BY FORM FACTOR

- 12.1 INTRODUCTION

- FIGURE 30 DIN RAIL SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 50 DC-DC CONVERTER MARKET, BY FORM FACTOR, 2018-2021 (USD MILLION)

- TABLE 51 DC-DC CONVERTER MARKET, BY FORM FACTOR, 2022-2027 (USD MILLION)

- 12.2 SIP

- 12.3 DIP

- 12.4 DIN RAIL

- 12.5 BOX TYPE

- 12.6 CHASSIS MOUNT

- 12.7 DISCRETE

- 12.8 BRICK

- 12.8.1 FULL BRICK

- 12.8.2 HALF BRICK

- 12.8.3 QUARTER BRICK

- 12.8.4 EIGHTH BRICK

- 12.8.5 SIXTEENTH BRICK

13 DC-DC CONVERTER MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 31 DC-DC CONVERTER MARKET: REGIONAL SNAPSHOT

- 13.1.1 IMPACT OF COVID-19 ON DC-DC CONVERTER MARKET, BY REGION

- TABLE 52 DC-DC CONVERTER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 53 DC-DC CONVERTER MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.2 NORTH AMERICA

- FIGURE 32 NORTH AMERICA: DC-DC CONVERTER MARKET SNAPSHOT

- TABLE 54 NORTH AMERICA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 55 NORTH AMERICA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: DC-DC CONVERTER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 57 NORTH AMERICA: DC-DC CONVERTER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 58 NORTH AMERICA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 59 NORTH AMERICA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- TABLE 60 NORTH AMERICA: DC-DC CONVERTER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 61 NORTH AMERICA: DC-DC CONVERTER MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 13.2.1 US

- 13.2.1.1 Growing industrial automation and expanding defense sector

- 13.2.1.2 Increasing demand for hybrid and electric cars

- FIGURE 33 US: EV CARS SALES PROJECTION

- TABLE 62 US: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 63 US: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 64 US: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 65 US: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.2.2 CANADA

- 13.2.2.1 Investments in alternate energy sources

- TABLE 66 CANADA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 67 CANADA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 68 CANADA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 69 CANADA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.3 EUROPE

- FIGURE 34 EUROPE: DC-DC CONVERTER MARKET SNAPSHOT

- TABLE 70 EUROPE: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 71 EUROPE: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 72 EUROPE: DC-DC CONVERTER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 73 EUROPE: DC-DC CONVERTER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 74 EUROPE: DC-DC CONVERTER MARKET, BY ISOLATION WORKING VOLTAGE, 2018-2021 (USD MILLION)

- TABLE 75 EUROPE: DC-DC CONVERTER MARKET, BY ISOLATION WORKING VOLTAGE, 2022-2027 (USD MILLION)

- TABLE 76 EUROPE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 77 EUROPE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- TABLE 78 EUROPE: DC-DC CONVERTER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 79 EUROPE: DC-DC CONVERTER MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 13.3.1 GERMANY

- 13.3.1.1 Growing industrial automation with rapid rise in manufacturing robotics

- TABLE 80 GERMANY: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 81 GERMANY: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 82 GERMANY: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 83 GERMANY: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.3.2 RUSSIA

- 13.3.2.1 Growing telecommunications industry

- TABLE 84 RUSSIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 85 RUSSIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 86 RUSSIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 87 RUSSIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.3.3 NORWAY

- 13.3.3.1 Expanding transportation industry

- TABLE 88 NORWAY: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 89 NORWAY: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 90 NORWAY: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 91 NORWAY: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.3.4 ITALY

- 13.3.4.1 Growing automotive industry

- TABLE 92 ITALY: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 93 ITALY: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 94 ITALY: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 95 ITALY: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.3.5 FRANCE

- 13.3.5.1 Investments in transportation and growing healthcare sector

- TABLE 96 FRANCE: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 97 FRANCE: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 98 FRANCE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 99 FRANCE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.3.6 REST OF EUROPE

- 13.3.6.1 Telecom market to push demand for DC-DC converters

- TABLE 100 REST OF EUROPE: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 101 REST OF EUROPE: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 102 REST OF EUROPE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 103 REST OF EUROPE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.4 ASIA PACIFIC

- FIGURE 35 ASIA PACIFIC: DC-DC CONVERTER MARKET SNAPSHOT

- TABLE 104 ASIA PACIFIC: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 105 ASIA PACIFIC: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 106 ASIA PACIFIC: DC-DC CONVERTER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 107 ASIA PACIFIC: DC-DC CONVERTER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 108 ASIA PACIFIC: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 109 ASIA PACIFIC: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.4.1 CHINA

- 13.4.1.1 Expanding manufacturing industry and regular investments in renewable energy

- FIGURE 36 CHINA: EV SALES PER UNIT

- TABLE 110 CHINA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 111 CHINA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 112 CHINA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 113 CHINA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.4.2 INDIA

- 13.4.2.1 Growing IT and 5G infrastructure

- FIGURE 37 INDIA: EV SALES PER UNIT

- TABLE 114 INDIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 115 INDIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 116 INDIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 117 INDIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.4.3 TAIWAN

- 13.4.3.1 Growing semiconductor industry and rise in demand for power electronics

- TABLE 118 TAIWAN: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 119 TAIWAN: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 120 TAIWAN: DC-DC CONVERTER MARKET, BY ISOLATION WORKING VOLTAGE, 2018-2021 (USD MILLION)

- TABLE 121 TAIWAN: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 122 TAIWAN: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.4.4 AUSTRALIA

- 13.4.4.1 Growing healthcare industry and strict emission standards

- TABLE 123 AUSTRALIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 124 AUSTRALIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 125 AUSTRALIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 126 AUSTRALIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.4.5 SINGAPORE

- 13.4.5.1 Growing industrial, automobile, and telecommunications sectors

- TABLE 127 SINGAPORE: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 128 SINGAPORE: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 129 SINGAPORE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 130 SINGAPORE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.4.6 REST OF ASIA PACIFIC

- TABLE 131 REST OF ASIA PACIFIC: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.5 MIDDLE EAST

- TABLE 135 MIDDLE EAST: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 136 MIDDLE EAST: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 137 MIDDLE EAST: DC-DC CONVERTER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 138 MIDDLE EAST: DC-DC CONVERTER MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 139 MIDDLE EAST: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 140 MIDDLE EAST: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.5.1 UAE

- 13.5.1.1 Growing industrial and healthcare sectors

- TABLE 141 UAE: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 142 UAE: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 143 UAE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 144 UAE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.5.2 SAUDI ARABIA

- 13.5.2.1 Growing IT and energy & power sectors

- TABLE 145 SAUDI ARABIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 146 SAUDI ARABIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 147 SAUDI ARABIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 148 SAUDI ARABIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.5.3 TURKEY

- 13.5.3.1 Growing defense investments

- TABLE 149 TURKEY: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 150 TURKEY: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 151 TURKEY: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 152 TURKEY: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.5.4 REST OF MIDDLE EAST

- TABLE 153 REST OF MIDDLE EAST: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 154 REST OF MIDDLE EAST: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 155 REST OF MIDDLE EAST: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.6 REST OF THE WORLD

- TABLE 157 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 158 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 159 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 160 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 161 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 162 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.6.1 LATIN AMERICA

- 13.6.1.1 Growing investments in alternative energy sources

- TABLE 163 LATIN AMERICA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 164 LATIN AMERICA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 165 LATIN AMERICA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 166 LATIN AMERICA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

- 13.6.2 AFRICA

- 13.6.2.1 Growing industrial and telecommunications sectors

- TABLE 167 AFRICA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 168 AFRICA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 169 AFRICA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018-2021 (USD MILLION)

- TABLE 170 AFRICA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022-2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2021

- TABLE 171 DEGREE OF COMPETITION

- 14.3 REVENUE ANALYSIS, 2019-2021

- FIGURE 38 COLLECTIVE REVENUE SHARE OF TOP 5 PLAYERS

- 14.4 RANK ANALYSIS, 2021

- FIGURE 39 REVENUE GENERATED BY TOP FIVE PLAYERS, 2021

- 14.5 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2021

- FIGURE 40 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- 14.6 COMPANY EVALUATION QUADRANT

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- FIGURE 41 DC-DC CONVERTER MARKET COMPANY EVALUATION QUADRANT, 2021

- TABLE 172 COMPANY FOOTPRINT

- TABLE 173 COMPANY VERTICAL FOOTPRINT (1/2)

- TABLE 174 COMPANY VERTICAL FOOTPRINT (2/2)

- TABLE 175 COMPANY PRODUCT TYPE FOOTPRINT

- TABLE 176 COMPANY REGION FOOTPRINT

- 14.7 COMPETITIVE BENCHMARKING

- FIGURE 42 DC-DC CONVERTER MARKET COMPETITIVE LEADERSHIP MAPPING (SME), 2021

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 STARTING BLOCKS

- 14.7.4 DYNAMIC COMPANIES

- 14.8 COMPETITIVE SCENARIO

- 14.8.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 177 PRODUCT LAUNCHES/DEVELOPMENTS, 2018-2022

15 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 15.1 KEY PLAYERS

- 15.1.1 TDK-LAMBDA CORPORATION

- TABLE 178 TDK-LAMBDA CORPORATION: BUSINESS OVERVIEW

- FIGURE 43 TDK-LAMBDA CORPORATION: COMPANY SNAPSHOT

- TABLE 179 TDK-LAMBDA CORPORATION: NEW PRODUCT DEVELOPMENTS

- 15.1.2 TRACO ELECTRONIC AG

- TABLE 180 TRACO ELECTRONIC AG: BUSINESS OVERVIEW

- TABLE 181 TRACO ELECTRONIC AG: NEW PRODUCT DEVELOPMENTS

- 15.1.3 MURATA MANUFACTURING CO., LTD.

- TABLE 182 MURATA MANUFACTURING CO., LTD.: BUSINESS OVERVIEW

- FIGURE 44 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

- TABLE 183 MURATA MANUFACTURING CO., LTD.: NEW PRODUCT DEVELOPMENTS

- 15.1.4 INFINEON TECHNOLOGIES AG

- TABLE 184 INFINEON TECHNOLOGIES AG: BUSINESS OVERVIEW

- FIGURE 45 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 185 INFINEON TECHNOLOGIES AG: NEW PRODUCT DEVELOPMENTS

- 15.1.5 ADVANCED ENERGY INDUSTRIES INC.

- TABLE 186 ADVANCED ENERGY INDUSTRIES INC.: BUSINESS OVERVIEW

- FIGURE 46 ADVANCED ENERGY INDUSTRIES INC.: COMPANY SNAPSHOT

- TABLE 187 ADVANCED ENERGY INDUSTRIES INC.: NEW PRODUCT DEVELOPMENTS

- 15.1.6 ABB LTD.

- TABLE 188 ABB LTD.: BUSINESS OVERVIEW

- FIGURE 47 ABB LTD.: COMPANY SNAPSHOT

- TABLE 189 ABB LTD.: NEW PRODUCT DEVELOPMENTS

- 15.1.7 TEXAS INSTRUMENTS INCORPORATED

- TABLE 190 TEXAS INSTRUMENTS INCORPORATED: BUSINESS OVERVIEW

- FIGURE 48 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- TABLE 191 TEXAS INSTRUMENTS INCORPORATED: NEW PRODUCT DEVELOPMENTS

- 15.1.8 FLEX LTD.

- TABLE 192 FLEX LTD.: BUSINESS OVERVIEW

- FIGURE 49 FLEX LTD.: COMPANY SNAPSHOT

- TABLE 193 FLEX LTD.: NEW PRODUCT DEVELOPMENTS

- 15.1.9 VICOR CORPORATION

- TABLE 194 VICOR CORPORATION: BUSINESS OVERVIEW

- FIGURE 50 VICOR CORPORATION: COMPANY SNAPSHOT

- TABLE 195 VICOR CORPORATION: NEW PRODUCT DEVELOPMENTS

- 15.1.10 FDK CORPORATION

- TABLE 196 FDK CORPORATION: BUSINESS OVERVIEW

- FIGURE 51 FDK CORPORATION: COMPANY SNAPSHOT

- 15.1.11 RECOM POWER GMBH

- TABLE 197 RECOM POWER GMBH: BUSINESS OVERVIEW

- 15.1.12 CRANE CO.

- TABLE 198 CRANE CO.: BUSINESS OVERVIEW

- FIGURE 52 CRANE CO.: COMPANY SNAPSHOT

- TABLE 199 CRANE CO.: NEW PRODUCT DEVELOPMENTS

- 15.1.13 STMICROELECTRONICS

- TABLE 200 STMICROELECTRONICS: BUSINESS OVERVIEW

- FIGURE 53 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 201 STMICROELECTRONICS: NEW PRODUCT DEVELOPMENTS

- 15.1.14 CINCON ELECTRONICS

- TABLE 202 CINCON ELECTRONICS: BUSINESS OVERVIEW

- TABLE 203 CINCON ELECTRONICS: NEW PRODUCT DEVELOPMENTS

- 15.1.15 MEAN WELL ENTERPRISES

- TABLE 204 MEAN WELL ENTERPRISES: BUSINESS OVERVIEW

- 15.1.16 DELTA ELECTRONICS

- TABLE 205 DELTA ELECTRONICS: BUSINESS OVERVIEW

- FIGURE 54 DELTA ELECTRONICS: COMPANY SNAPSHOT

- 15.1.17 XP POWER

- TABLE 206 XP POWER: BUSINESS OVERVIEW

- FIGURE 55 XP POWER: COMPANY SNAPSHOT

- TABLE 207 XP POWER: NEW PRODUCT DEVELOPMENTS

- 15.1.18 BEL FUSE INC.

- TABLE 208 BEL FUSE INC.: BUSINESS OVERVIEW

- FIGURE 56 BEL FUSE INC.: COMPANY SNAPSHOT

- TABLE 209 BEL FUSE INC.: NEW PRODUCT DEVELOPMENTS

- 15.1.19 KGS ELECTRONICS

- TABLE 210 KGS ELECTRONICS: BUSINESS OVERVIEW

- 15.1.20 ASTRONICS CORPORATION

- TABLE 211 ASTRONICS CORPORATION: BUSINESS OVERVIEW

- FIGURE 57 ASTRONICS CORPORATION: COMPANY SNAPSHOT

- TABLE 212 ASTRONICS CORPORATION: NEW PRODUCT DEVELOPMENTS

- 15.1.21 MEGGITT PLC

- TABLE 213 MEGGITT PLC: BUSINESS OVERVIEW

- FIGURE 58 MEGGITT PLC: COMPANY SNAPSHOT

- 15.2 OTHER PLAYERS

- 15.2.1 SYNQOR

- TABLE 214 SYNQOR: BUSINESS OVERVIEW

- 15.2.2 AIMTEC

- TABLE 215 AIMTEC: BUSINESS OVERVIEW

- 15.2.3 COSEL

- TABLE 216 COSEL: BUSINESS OVERVIEW

- 15.2.4 AJ'S POWER SOURCE

- TABLE 217 AJ'S POWER SOURCE: BUSINESS OVERVIEW

- 15.2.5 VPT POWER

- TABLE 218 VPT POWER: BUSINESS OVERVIEW

- 15.2.6 SG MICRO CORP.

- TABLE 219 SG MICRO CORP.: BUSINESS OVERVIEW

- 15.2.7 POWER PRODUCTS INTERNATIONAL

- TABLE 220 POWER PRODUCTS INTERNATIONAL: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS