|

|

市場調査レポート

商品コード

1166390

機載ISR (諜報・監視・偵察) の世界市場:ソリューション別 (システム、ソフトウェア、サービス)・プラットフォーム別 (軍用機、軍用ヘリコプター、無人システム)・エンドユーザー別 (防衛、国土安全保障)・用途別・地域別の将来予測 (2027年まで)Airborne ISR Market by Solution (Systems, Software, Services), Platform (Military Aircraft, Military Helicopters, Unmanned Systems), End-user (Defense, Homeland Security), Application and Region- Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 機載ISR (諜報・監視・偵察) の世界市場:ソリューション別 (システム、ソフトウェア、サービス)・プラットフォーム別 (軍用機、軍用ヘリコプター、無人システム)・エンドユーザー別 (防衛、国土安全保障)・用途別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月29日

発行: MarketsandMarkets

ページ情報: 英文 255 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の機載ISRの市場規模は、2022年の124億米ドルから2027年には156億米ドルに成長し、2022年から2027年までのCAGRは4.8%と予測されています。

機載ISR市場は世界中で大きく成長しており、予測期間中に継続すると予想されます。市場成長の主な要因は、空中ISR用途のUAVの需要増加や、ISR用の哨戒機や戦闘機に使用される人工知能・ビッグデータアナリティクス・ロボット工学の進歩などが挙げられます。

用途別に見ると、国境や海上を通過するテロリストの侵入事件が繰り返されていることから、予測期間中に国境・海上警備システムの展開が促進されると考えられています。

プラットフォーム別に見ると、無人システム部門が予測期間中に最も高いCAGRを記録すると予測されます。その要因として、主要国の軍隊において小型・戦術UAVの採用が増加していることが挙げられます。

2021年の機載ISR市場では、北米が最大のシェアを占めています。特に米国では、優位性を維持し、コンピュータネットワーク上の潜在的な脅威のリスクを克服するために、ISR技術への投資が拡大しています。小型の無人偵察システムの利用が拡大し、ISRミッションにおける電子部品の需要が増加すると予測されます。データの精度と管理を向上させるためのマルチレベルの比較分析と組み合わせた高度なデータ統合は、航空ISR業界に新たな市場の展望を開くと予想されます。

当レポートでは、世界の機載ISR (諜報・監視・偵察) の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、用途別・ソリューション別・プラットフォーム別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 機載ISR市場のエコシステム

- 著名な企業

- 個人および小規模企業

- 利用者

- 使用事例の分析

- 技術分析

- 自動従属監視ブロードキャスト (ADS-B)

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 貿易分析

- 価格分析

- 市場規模データ (数量ベース)

- 規制状況

- 主な会議とイベント (2022年~2023年)

第6章 産業動向

- イントロダクション

- サプライチェーン分析

- 技術動向

- ソフトウェア定義機載ISRシステム

- MIMO (複数入力/複数出力)

- ISAR (逆合成開口レーダー)

- LiDAR技術

- 次世代センサーシステム

- TAWS (地形認識・警告システム)

- EVS (エンハンストビジョンシステム)

- メガトレンドの影響

- 人工知能 (AI) と認知アプリケーション

- 機械学習 (ML)

- 深層学習 (DL)

- ビッグデータ

- イノベーションと特許登録

第7章 機載ISR市場:用途別

- イントロダクション

- 捜索救助活動

- 国境・海上警備

- 目標補足・追跡

- 重要インフラ保護

- 戦術支援

- その他

第8章 機載ISR市場:ソリューション別

- イントロダクション

- システム

- 目標設定・監視システム

- 通信システム

- 偵察・諜報システム

- その他

- サービス

- マネージドサービス/ISRaaS (サービスとしてのISR)

- サポートサービス

- 運用サービス

- ソフトウェア

- ミッションコントロールソフトウェア

- シギント (無線諜報) ソフトウェアスイート

- 脅威検出ソフトウェア

- その他

第9章 機載ISR市場:プラットフォーム別

- イントロダクション

- 軍用機

- 戦闘機

- 輸送機

- 練習機

- 特殊任務機

- 軍用ヘリコプター

- 無人システム

- 小型無人機

- 戦術無人機

- 戦略無人機

- 特殊目的無人機

- エアロスタット

第10章 機載ISR市場:エンドユーザー別

- イントロダクション

- 防衛

- 防衛省

- 情報組織

- その他

- 国土安全保障

第11章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- ロシア

- イタリア

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- 中東・アフリカ

- イスラエル

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- 他の中東・アフリカ諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第12章 競合情勢

- イントロダクション

- 主要企業の収益分析

- 市場シェア分析

- 企業評価クアドラント

- 競合ベンチマーキング

- 競合シナリオと動向

- 製品の発売

- 資本取引

第13章 企業プロファイル

- イントロダクション

- 主要企業

- BAE SYSTEMS PLC

- LOCKHEED MARTIN CORPORATION

- NORTHROP GRUMMAN CORPORATION

- RAYTHEON TECHNOLOGIES CORPORATION

- TELEDYNE TECHNOLOGIES

- THALES GROUP

- L3HARRIS TECHNOLOGIES

- ELBIT SYSTEMS LTD.

- LEONARDO S.P.A.

- ISRAEL AEROSPACE INDUSTRIES LTD.

- ASELSAN A.S.

- RHEINMETALL AG

- SAAB AB

- CURTISS-WRIGHT CORPORATION

- INDRA SISTEMAS S.A.

- TEXTRON INC.

- HENSOLDT AG

- IABG

- BOOZ ALLEN HAMILTON

- HR SMITH GROUP OF COMPANIES

- その他の企業

- OCTOPUS ISR SYSTEMS

- TRAKKA SYSTEMS

- UKRSPECSYSTEMS

- KAPPA OPTRONICS

- MAG AEROSPACE

第14章 付録

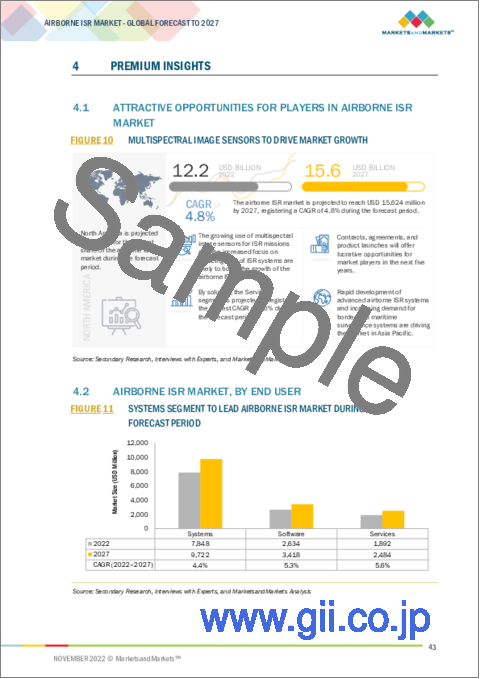

The airborne ISR market is projected to grow from USD 12.4 Billion in 2022 to USD 15.6 Billion by 2027, at a CAGR of 4.8% from 2022 to 2027. The airborne ISR market has been growing significantly across the globe, and this growth is also expected to continue during the forecast period. The major drivers for the market's growth include rising demand for UAVs for airborne ISR applications and advancements in artificial intelligence, big data analytics, and robotics used in patrol and fighter aircraft for ISR.

Based on application, the airborne ISR market has been segmented into search and rescue operations, border and maritime patrol, target acquisition and tracking, critical infrastructure protection, tactical support, and others. The repeated incidents of terrorist infiltration through borders and sea lines are also anticipated to emerge as a major factor driving the deployment of maritime and border security systems over the forecast period.

Based on the platform, the airborne ISR market is segmented into military aircraft, military helicopters, and unmanned systems. The unmanned systems segment is projected to register the highest CAGR during the forecast period. This projected high growth rate is attributed to the rising adoption of small and tactical UAVs by the defense forces of several countries.

North America is expected to account for the largest share in 2021

North America accounted for the largest share of the airborne ISR market in 2021. This market is led by the US, which is increasingly investing in ISR technology to maintain its superiority and overcome the risk of potential threats on computer networks. In the defense sector, rapid technological advancements are spawning disruptive innovations. The growing use of small, unmanned surveillance systems is projected to increase the demand for electronic components in ISR missions. Advanced data integration combined with multi-level comparison analysis to improve data accuracy and management is expected to open new market prospects for the airborne ISR industry.

The break-up of the profile of primary participants in the airborne ISR market:

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: C Level - 75%, Director Level - 25%

- By Region: North America - 20%, Europe - 25%, Asia Pacific - 30%, Middle East - 10%, and the Rest of the World - 15%

Research Coverage:

The report segments the airborne ISR market based on solution, platform, application, end-user, and Region. The airborne ISR market is segmented into military aircraft, military helicopters, and unmanned systems. The airborne ISR is segmented into systems, services, and software based on the solution. By application, the market is segmented into search and rescue operations, border and maritime patrol, target acquisition and tracking, critical infrastructure protection, tactical support, and others. By end user, the market is segmented into defense and homeland security. The airborne ISR market has been studied in North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. The scope of the study includes thorough information on the important aspects impacting the growth of the airborne ISR market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, as well as key strategies such as contracts, partnerships, agreements, new product and service launches, mergers and acquisitions, and recent developments in the airborne ISR market. This research includes a competitive analysis of upcoming startups in the airborne ISR market ecosystem.

Reasons to buy this report:

The research will provide industry leaders and potential entrants with information on the closest estimations of revenue figures for the airborne ISR market. This study will assist stakeholders in better understanding the competitive environment and gaining new insights to position their businesses better and develop appropriate go-to-market strategies. The study also assists stakeholders in understanding the pulse of the industry and offers data on major market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: The market's leading companies provide comprehensive information about airborne ISR.

- Product Development/Innovation: In-depth information on future technologies, R&D efforts, and new product and service launches in the airborne ISR market.

- Market Development: In-depth information on profitable markets - the study examines the airborne ISR market in several areas.

- Market Diversification: Comprehensive data on new goods and services, new geographies, current advancements, and investments in the airborne ISR market.

- Competitive Assessment: An in-depth examination of the airborne ISR industry's major companies' market shares, growth strategies, and service offerings is provided.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 AIRBORNE ISR MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.4.1 USD EXCHANGE RATES

- 1.5 INCLUSIONS AND EXCLUSIONS

- TABLE 1 AIRBORNE ISR MARKET: INCLUSIONS AND EXCLUSIONS

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 AIRBORNE ISR MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Insights from industry experts

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.3 Key data from primary sources

- TABLE 2 KEY PRIMARY SOURCES

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Increased military spending of emerging countries

- 2.2.2.2 Growth of military expenditure on sensor-based autonomous defense systems

- 2.2.2.3 Rising incidence of regional disputes, terrorism, and political conflicts

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.3.1 Financial trends of major defense contracts in US

- 2.3 MARKET SIZE ESTIMATION

- 2.4 RESEARCH APPROACH & METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.6 ASSUMPTIONS

- FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY ON AIRBORNE ISR MARKET

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 UNMANNED SYSTEMS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 NORTH AMERICA DOMINATES AIRBORNE ISR MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRBORNE ISR MARKET

- FIGURE 10 MULTISPECTRAL IMAGE SENSORS TO DRIVE MARKET GROWTH

- 4.2 AIRBORNE ISR MARKET, BY END USER

- FIGURE 11 SYSTEMS SEGMENT TO LEAD AIRBORNE ISR MARKET DURING FORECAST PERIOD

- 4.3 AIRBORNE ISR MARKET, BY APPLICATION

- FIGURE 12 TARGET ACQUISITION AND TRACKING SEGMENT TO FUEL MARKET GROWTH

- 4.4 AIRBORNE ISR MARKET, BY SOLUTION

- FIGURE 13 SYSTEMS SEGMENT PROJECTED TO DOMINATE AIRBORNE ISR MARKET FROM 2022 TO 2027

- 4.5 AIRBORNE ISR MARKET, BY SOLUTION AND SYSTEM

- FIGURE 14 TARGETING AND SURVEILLANCE SYSTEMS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 AIRBORNE ISR MARKET, BY COUNTRY

- FIGURE 15 AIRBORNE ISR MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 AIRBORNE ISR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising UAV demand for airborne ISR applications

- 5.2.1.2 Increasing procurement of airborne ISR systems due to growing transnational and regional instability

- 5.2.1.3 Growing threats of terror attacks and increasing international border clashes

- 5.2.1.4 Increasing use of airborne ISR-based geological survey for scientific research

- 5.2.1.5 Increasing need for missile detection systems

- 5.2.1.6 Rapid advancements in artificial intelligence, big data analytics, and robotics

- 5.2.1.7 Increasing preference for modern warfare techniques

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of accuracy and operational complexities in airborne ISR technology

- 5.2.2.2 High development and maintenance costs

- 5.2.2.3 Concerns over error possibilities in complex combat situations

- 5.2.2.4 Regulatory constraints in technology transfer

- 5.2.2.5 Declining defense budgets of North American and European countries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in ISR ecosystem

- 5.2.3.2 Modernization of reconnaissance equipment by defense forces of several countries

- 5.2.4 CHALLENGES

- 5.2.4.1 Integrating existing systems with new technologies

- 5.2.4.2 Complexity in designs of airborne ISR systems

- 5.2.4.3 High system complexity, requiring proper pilot training for optimum usage

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRBORNE ISR SYSTEM MANUFACTURERS

- FIGURE 18 REVENUE SHIFT FOR AIRBORNE ISR MARKET

- 5.5 AIRBORNE ISR MARKET ECOSYSTEM

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- FIGURE 19 AIRBORNE ISR ECOSYSTEM MAPPING

- TABLE 3 AIRBORNE ISR: MARKET ECOSYSTEM

- 5.6 USE CASE ANALYSIS

- 5.6.1 USE CASE: UAS SENSOR

- 5.6.2 USE CASE: ELECTRONICALLY SCANNED ARRAY

- 5.6.3 USE CASE: UAV RADARS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 AUTOMATIC DEPENDENT SURVEILLANCE-BROADCAST (ADS-B)

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 AIRBORNE ISR: PORTER'S FIVE FORCE ANALYSIS

- FIGURE 20 AIRBORNE ISR MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING AIRBORNE ISR SYSTEMS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR AIRBORNE ISR SYSTEMS

- TABLE 6 KEY BUYING CRITERIA FOR AIRBORNE ISR

- 5.10 TRADE ANALYSIS

- TABLE 7 IMPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, 2017-2021 (USD MILLION)

- TABLE 8 EXPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, 2017-2021 (USD MILLION)

- 5.11 PRICING ANALYSIS

- TABLE 9 AVERAGE SELLING PRICE OF AIRBORNE ISR SUBSYSTEMS (USD)

- 5.12 VOLUME DATA IN UNITS

- TABLE 10 MILITARY UAV, BY COUNTRY

- TABLE 11 MILITARY UAV, BY TYPE

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 NORTH AMERICA

- 5.13.2 EUROPE

- 5.14 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 12 AIRBORNE ISR MARKET: CONFERENCES AND EVENTS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 23 SUPPLY CHAIN ANALYSIS OF AIRBORNE ISR MARKET

- 6.3 TECHNOLOGY TRENDS

- 6.3.1 SOFTWARE-DEFINED AIRBORNE ISR SYSTEM

- 6.3.2 MULTIPLE-INPUTS/MULTIPLE-OUTPUTS (MIMO)

- 6.3.3 INVERSE SYNTHETIC APERTURE RADAR (ISAR)

- 6.3.4 LIDAR TECHNOLOGY

- 6.3.5 NEXT-GENERATION SENSOR SYSTEMS

- 6.3.6 TERRAIN AWARENESS AND WARNING SYSTEMS (TAWS)

- 6.3.7 ENHANCED VISION SYSTEMS (EVS)

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 ARTIFICIAL INTELLIGENCE AND COGNITIVE APPLICATIONS

- 6.4.2 MACHINE LEARNING

- 6.4.3 DEEP LEARNING

- 6.4.4 BIG DATA

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

7 AIRBORNE ISR MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 24 AIRBORNE ISR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 13 AIRBORNE ISR MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 14 AIRBORNE ISR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.2 SEARCH AND RESCUE OPERATIONS

- 7.2.1 NEED TO ACESS ISOLATED AREAS DURING SEARCH AND RESCUE OPERATIONS TO STIMULATE DEMAND

- 7.3 BORDER AND MARITIME PATROL

- 7.3.1 URGENCY TO SECURE BORDERS FROM UNLAWFUL ACTIVITIES TO DRIVE MARKET

- 7.4 TARGET ACQUISITION AND TRACKING

- 7.4.1 PRECISE TARGETING BY UNMANNED COMBAT AERIAL VEHICLES TO FUEL GLOBAL DEMAND

- 7.5 CRITICAL INFRASTRUCTURE PROTECTION

- 7.5.1 QUICK INSPECTIONS AND MONITORING ACTIVITIES

- 7.6 TACTICAL SUPPORT

- 7.6.1 NECESSITY TO ACCESS MISSION-CRITICAL DATA TO SUPPORT MARKET GROWTH

- 7.7 OTHERS

8 AIRBORNE ISR MARKET, BY SOLUTION

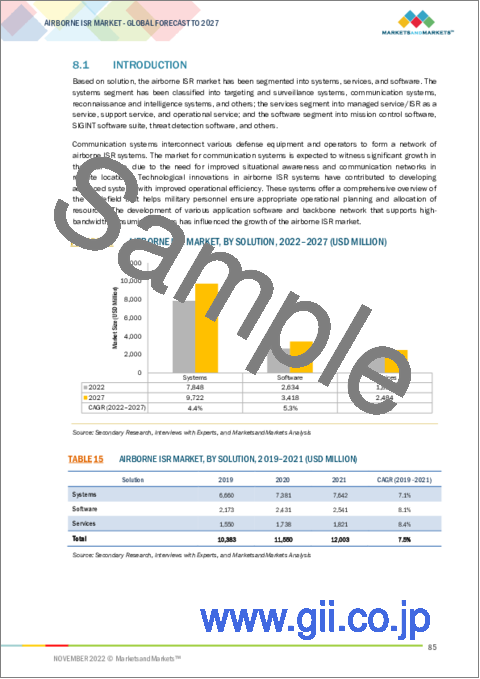

- 8.1 INTRODUCTION

- FIGURE 25 AIRBORNE ISR MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 15 AIRBORNE ISR MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 16 AIRBORNE ISR MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- 8.2 SYSTEMS

- TABLE 17 AIRBORNE ISR SYSTEMS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 18 AIRBORNE ISR SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.2.1 TARGETING AND SURVEILLANCE SYSTEMS

- 8.2.1.1 Day and night sensors, radar sensors, and laser rangefinders/designators

- TABLE 19 AIRBORNE ISR MARKET FOR TARGETING AND SURVEILLANCE SYSTEMS, BY SUBSYSTEM, 2019-2021 (USD MILLION)

- TABLE 20 AIRBORNE ISR MARKET FOR TARGETING AND SURVEILLANCE SYSTEMS, BY SUBSYSTEM, 2022-2027 (USD MILLION)

- 8.2.1.2 Electro-optical infrared (EO/IR) full-motion video (FMV)

- 8.2.1.3 Imagery sensors (multispectral, hyperspectral imaging)

- 8.2.1.4 Radar sensors

- 8.2.1.5 Spectrum systems

- 8.2.1.6 LiDAR

- 8.2.1.7 Others

- 8.2.2 COMMUNICATION SYSTEMS

- 8.2.2.1 Use of wireless communication devices to transmit information to command and control centers

- TABLE 21 AIRBORNE ISR MARKET FOR COMMUNICATION SYSTEMS, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 22 AIRBORNE ISR MARKET FOR COMMUNICATION SYSTEMS, BY TYPE, 2022-2027 (USD MILLION)

- 8.2.2.2 Datalinks

- 8.2.2.3 SATCOM

- 8.2.2.4 Antenna

- 8.2.3 RECONNAISSANCE AND INTELLIGENCE SYSTEMS

- 8.2.3.1 Reconnaissance and intelligence systems for aerial reconnaissance activities

- 8.2.3.2 Signals intelligence

- 8.2.3.3 Electronic intelligence

- 8.2.3.4 Communications intelligence

- 8.2.4 OTHERS

- 8.3 SERVICES

- 8.3.1 MANAGED SERVICE/ISR AS A SERVICE

- 8.3.1.1 Need for managed services to reduce cost and requirement for tailor systems for specific applications

- 8.3.2 SUPPORT SERVICE

- 8.3.2.1 Requirement of support service to optimize ISR systems

- 8.3.2.2 Maintenance

- 8.3.2.3 Simulation and training

- 8.3.2.4 Technical support

- 8.3.3 OPERATIONAL SERVICE

- 8.3.3.1 Operational service to support flight operations for ISR aircraft

- 8.3.1 MANAGED SERVICE/ISR AS A SERVICE

- 8.4 SOFTWARE

- 8.4.1 MISSION CONTROL SOFTWARE

- 8.4.1.1 Mission control software to offer centralized venue for managing airborne ISR operations

- 8.4.2 SIGINT SOFTWARE SUITE

- 8.4.2.1 SIGINT used by government and defense sectors for ISR operations

- 8.4.3 THREAT DETECTION SOFTWARE

- 8.4.3.1 Threat detection software to provide timely, accurate view of threats in RF spectrum

- 8.4.4 OTHERS

- 8.4.4.1 Improving data feed quality

- 8.4.1 MISSION CONTROL SOFTWARE

9 AIRBORNE ISR MARKET, BY PLATFORM

- 9.1 INTRODUCTION

- FIGURE 26 AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 23 AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 24 AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 9.2 MILITARY AIRCRAFT

- 9.2.1 FIGHTER AIRCRAFT

- 9.2.1.1 Radar in fighter aircraft to acquire targets

- 9.2.2 TRANSPORT AIRCRAFT

- 9.2.2.1 ISR systems in transport aircraft to enhance situational awareness

- 9.2.3 TRAINER AIRCRAFT

- 9.2.3.1 Trainer aircraft fitted with ISR systems to offer student pilots hands-on experience

- 9.2.4 SPECIAL MISSION AIRCRAFT

- 9.2.4.1 Increasing need to detect cross-border infiltrations to fuel market growth

- 9.2.1 FIGHTER AIRCRAFT

- 9.3 MILITARY HELICOPTERS

- 9.3.1 USE OF MILITARY HELICOPTERS FOR AIR-TO-AIR AND AIR-TO-GROUND SURVEILLANCE

- 9.4 UNMANNED SYSTEMS

- 9.4.1 SMALL UAV

- 9.4.1.1 Adoption of small UAVs to monitor hard-to-reach areas by humans

- 9.4.2 TACTICAL UAV

- 9.4.2.1 Technological advancement in unmanned battlefield surveillance systems to fuel market

- 9.4.3 STRATEGIC UAV

- 9.4.3.1 Strategic UAVs to offer ISR and combat capabilities

- 9.4.3.2 Medium-altitude long-endurance (MALE) UAVs

- 9.4.3.3 High-altitude long-endurance (HALE) UAVs

- 9.4.4 SPECIAL-PURPOSE UAV

- 9.4.4.1 Special purpose UAVs in reconnaissance, operations, and battle damage assessment

- 9.4.5 AEROSTATS

- 9.4.5.1 Surveillance monitoring border disputes and drug trafficking to fuel market

- 9.4.1 SMALL UAV

10 AIRBORNE ISR MARKET, BY END USER

- 10.1 INTRODUCTION

- FIGURE 27 AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 25 AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 26 AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.2 DEFENSE

- TABLE 27 DEFENSE: AIRBORNE ISR MARKET, BY AGENCY, 2019-2021 (USD MILLION)

- TABLE 28 DEFENSE: AIRBORNE ISR MARKET, BY AGENCY, 2022-2027 (USD MILLION)

- 10.2.1 DEPARTMENT OF DEFENSE

- 10.2.1.1 Advanced airborne ISR capabilities to offer better situational awareness and safety

- 10.2.2 INTELLIGENCE ORGANIZATIONS

- 10.2.2.1 Real-time critical military intelligence to fuel market growth

- 10.2.3 OTHERS

- 10.3 HOMELAND SECURITY

- 10.3.1 HOMELAND SECURITY AGENCIES TO EMPLOY ADVANCED AIRBORNE ISR SYSTEMS

11 REGIONAL ANALYSIS

- 11.1 INTRODUCTION

- FIGURE 28 AIRBORNE ISR MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 29 AIRBORNE ISR MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 30 AIRBORNE ISR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 29 NORTH AMERICA: AIRBORNE ISR MARKET SNAPSHOT

- TABLE 31 NORTH AMERICA: AIRBORNE ISR MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 32 NORTH AMERICA: AIRBORNE ISR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 33 NORTH AMERICA: AIRBORNE ISR MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 34 NORTH AMERICA: AIRBORNE ISR MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 35 NORTH AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 36 NORTH AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 37 NORTH AMERICA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 38 NORTH AMERICA: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Development programs related to unmanned systems to increase airborne ISR demand

- TABLE 39 US: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 40 US: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 41 US: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 42 US: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Increasing R&D investments to drive market

- TABLE 43 CANADA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 44 CANADA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 45 CANADA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 46 CANADA: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS: EUROPE

- FIGURE 30 EUROPE: AIRBORNE ISR MARKET SNAPSHOT

- TABLE 47 EUROPE: AIRBORNE ISR MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 48 EUROPE: AIRBORNE ISR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 49 EUROPE: AIRBORNE ISR MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 50 EUROPE: AIRBORNE ISR MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 51 EUROPE: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 52 EUROPE: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 53 EUROPE: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 54 EUROPE: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Upgrading existing fleets to fuel market

- TABLE 55 UK: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 56 UK: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 57 UK: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 58 UK: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Technological advancements in unmanned aerial vehicle platforms to trigger market growth

- TABLE 59 FRANCE: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 60 FRANCE: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 61 FRANCE: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 62 FRANCE: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 Integration of airborne platform with ISR system to drive market

- TABLE 63 GERMANY: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 64 GERMANY: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 65 GERMANY: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 66 GERMANY: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.3.5 RUSSIA

- 11.3.5.1 Growing investments in digitizing VHF and UHF radar systems to improve counter-stealth capability

- TABLE 67 RUSSIA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 68 RUSSIA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 69 RUSSIA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 70 RUSSIA AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.3.6 ITALY

- 11.3.6.1 Airborne fleet renewal to propel market

- TABLE 71 ITALY: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 72 ITALY: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 73 ITALY: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 74 ITALY: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.3.7 REST OF EUROPE

- 11.3.7.1 Rising procurement of military helicopters to fuel market growth

- TABLE 75 REST OF EUROPE: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 76 REST OF EUROPE: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 77 REST OF EUROPE: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 78 REST OF EUROPE: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 31 ASIA PACIFIC: AIRBORNE ISR MARKET SNAPSHOT

- TABLE 79 ASIA PACIFIC: AIRBORNE ISR MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 80 ASIA PACIFIC: AIRBORNE ISR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: AIRBORNE ISR MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 82 ASIA PACIFIC: AIRBORNE ISR MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 83 ASIA PACIFIC: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 84 ASIA PACIFIC: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 85 ASIA PACIFIC: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 86 ASIA PACIFIC: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Increasing R&D expenditure for airborne early warning and related airborne ISR systems

- TABLE 87 CHINA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 88 CHINA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 89 CHINA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 90 CHINA: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Ongoing modernization of defense capabilities to fuel market growth

- TABLE 91 INDIA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 92 INDIA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 93 INDIA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 94 INDIA: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Uplifting of self-imposed defense equipment export ban to trigger growth opportunities

- TABLE 95 JAPAN: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 96 JAPAN: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 97 JAPAN: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 98 JAPAN: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.4.5 AUSTRALIA

- 11.4.5.1 High demand for advanced technologies in military equipment to create opportunities

- TABLE 99 AUSTRALIA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 100 AUSTRALIA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 101 AUSTRALIA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 102 AUSTRALIA: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Need for stronger ISR activities to drive market

- TABLE 103 SOUTH KOREA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 104 SOUTH KOREA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 105 SOUTH KOREA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 106 SOUTH KOREA: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.4.7 REST OF ASIA PACIFIC

- 11.4.7.1 Increased demand for border surveillance to fuel market

- TABLE 107 REST OF ASIA PACIFIC: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 PESTLE ANALYSIS

- FIGURE 32 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET SNAPSHOT

- TABLE 111 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.5.2 ISRAEL

- 11.5.2.1 Strong bilateral relationship with US to help technology transfer and sale

- TABLE 119 ISRAEL: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 120 ISRAEL: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 121 ISRAEL: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 122 ISRAEL: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.5.3 UAE

- 11.5.3.1 Focus on strengthening defense capability to fuel market growth

- TABLE 123 UAE: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 124 UAE: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 125 UAE: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 126 UAE: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.5.4 SAUDI ARABIA

- 11.5.4.1 Increased military expenditure to fuel market

- TABLE 127 SAUDI ARABIA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 128 SAUDI ARABIA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 129 SAUDI ARABIA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 130 SAUDI ARABIA AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Need for enhanced military organization to fuel demand

- TABLE 131 SOUTH AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 132 SOUTH AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 133 SOUTH AFRICA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 134 SOUTH AFRICA AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.5.6 REST OF THE MIDDLE EAST & AFRICA

- 11.5.6.1 Strengthening combat capabilities

- TABLE 135 REST OF MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 136 REST OF MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 137 REST OF MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 138 REST OF MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 PESTLE ANALYSIS: LATIN AMERICA

- FIGURE 33 LATIN AMERICA: AIRBORNE ISR MARKET SNAPSHOT

- TABLE 139 LATIN AMERICA: AIRBORNE ISR MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 140 LATIN AMERICA: AIRBORNE ISR MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 141 LATIN AMERICA: AIRBORNE ISR MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 142 LATIN AMERICA: AIRBORNE ISR MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 143 LATIN AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 144 LATIN AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 145 LATIN AMERICA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 146 LATIN AMERICA: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.6.2 BRAZIL

- 11.6.2.1 Modernization of armed forces to propel market

- TABLE 147 BRAZIL: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 148 BRAZIL: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 149 BRAZIL: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 150 BRAZIL: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.6.3 MEXICO

- 11.6.3.1 Strengthening ISR capabilities to fuel market growth

- TABLE 151 MEXICO: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 152 MEXICO: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 153 MEXICO: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 154 MEXICO: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.6.4 REST OF LATIN AMERICA

- 11.6.4.1 Digital transformation of defense sector to boost market

- TABLE 155 REST OF LATIN AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 156 REST OF LATIN AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 157 REST OF LATIN AMERICA: AIRBORNE ISR MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 158 REST OF LATIN AMERICA: AIRBORNE ISR MARKET, BY END USER, 2022-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- TABLE 159 KEY DEVELOPMENTS BY LEADING MARKET PLAYERS BETWEEN 2019 AND 2022

- 12.2 REVENUE ANALYSIS OF KEY MARKET PLAYERS

- FIGURE 34 REVENUE ANALYSIS FOR KEY COMPANIES IN LAST FIVE YEARS

- 12.3 MARKET SHARE ANALYSIS

- FIGURE 35 AIRBORNE ISR MARKET SHARE ANALYSIS, 2021

- TABLE 160 AIRBORNE ISR MARKET: DEGREE OF COMPETITION

- 12.4 COMPANY EVALUATION QUADRANT

- 12.4.1 AIRBORNE ISR MARKET COMPETITIVE LEADERSHIP MAPPING

- FIGURE 36 AIRBORNE ISR MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

- 12.4.1.1 Stars

- 12.4.1.2 Pervasive players

- 12.4.1.3 Emerging leaders

- 12.4.1.4 Participants

- 12.4.2 AIRBORNE ISR MARKET COMPETITIVE LEADERSHIP MAPPING (SME)

- FIGURE 37 AIRBORNE ISR MARKET (SME) COMPETITIVE LEADERSHIP MAPPING, 2021

- 12.4.2.1 Progressive companies

- 12.4.2.2 Responsive companies

- 12.4.2.3 Starting blocks

- 12.4.2.4 Dynamic companies

- 12.5 COMPETITIVE BENCHMARKING

- TABLE 161 COMPANY FOOTPRINT

- TABLE 162 COMPANY END-USER FOOTPRINT

- TABLE 163 COMPANY OFFERING FOOTPRINT

- TABLE 164 COMPANY REGION FOOTPRINT

- 12.6 COMPETITIVE SCENARIO AND TRENDS

- 12.6.1 PRODUCT LAUNCHES

- TABLE 165 AIRBORNE ISR MARKET: PRODUCT LAUNCHES, 2018-2022

- 12.6.2 DEALS

- TABLE 166 AIRBORNE ISR MARKET: DEALS, 2018-2022

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- (Business overview Products/solutions/services offered, Recent Developments, MNM view)**

- 13.2 KEY PLAYERS

- 13.2.1 BAE SYSTEMS PLC

- TABLE 167 BAE SYSTEMS PLC: BUSINESS OVERVIEW

- FIGURE 38 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- TABLE 168 BAE SYSTEMS PLC: PRODUCT LAUNCHES

- TABLE 169 BAE SYSTEMS PLC: DEALS

- 13.2.2 LOCKHEED MARTIN CORPORATION

- TABLE 170 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- FIGURE 39 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 171 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 172 LOCKHEED MARTIN CORPORATION: DEALS

- 13.2.3 NORTHROP GRUMMAN CORPORATION

- TABLE 173 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- FIGURE 40 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 174 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 175 NORTHROP GRUMMAN CORPORATION: DEALS

- 13.2.4 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 176 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 41 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 177 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- 13.2.5 TELEDYNE TECHNOLOGIES

- TABLE 178 TELEDYNE TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 42 TELEDYNE TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 179 TELEDYNE TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 180 TELEDYNE TECHNOLOGIES, INC.: DEALS

- 13.2.6 THALES GROUP

- TABLE 181 THALES GROUP: BUSINESS OVERVIEW

- FIGURE 43 THALES GROUP: COMPANY SNAPSHOT

- TABLE 182 THALES GROUP: DEALS

- 13.2.7 L3HARRIS TECHNOLOGIES

- TABLE 183 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 44 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 184 L3HARRIS TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 185 L3HARRIS TECHNOLOGIES: DEALS

- 13.2.8 ELBIT SYSTEMS LTD.

- TABLE 186 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- FIGURE 45 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 187 ELBIT SYSTEMS LTD.: DEALS

- 13.2.9 LEONARDO S.P.A.

- TABLE 188 LEONARDO S.P.A.: BUSINESS OVERVIEW

- FIGURE 46 LEONARDO S.P.A.: COMPANY SNAPSHOT

- 13.2.10 ISRAEL AEROSPACE INDUSTRIES LTD.

- TABLE 189 ISRAEL AEROSPACE INDUSTRIES LTD.: BUSINESS OVERVIEW

- FIGURE 47 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 190 ISRAEL AEROSPACE INDUSTRIES: PRODUCT LAUNCHES

- TABLE 191 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

- 13.2.11 ASELSAN A.S.

- TABLE 192 ASELSAN A.S.: BUSINESS OVERVIEW

- TABLE 193 ASELSAN A.S.: DEALS

- 13.2.12 RHEINMETALL AG

- TABLE 194 RHEINMETALL AG: BUSINESS OVERVIEW

- FIGURE 48 RHEINMETALL AG: COMPANY SNAPSHOT

- TABLE 195 RHEINMETALL AG: DEALS

- 13.2.13 SAAB AB

- TABLE 196 SAAB AB: BUSINESS OVERVIEW

- FIGURE 49 SAAB AB: COMPANY SNAPSHOT

- TABLE 197 SAAB AB: PRODUCT LAUNCHES

- TABLE 198 SAAB AB: DEALS

- 13.2.14 CURTISS-WRIGHT CORPORATION

- TABLE 199 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

- FIGURE 50 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- TABLE 200 CURTISS-WRIGHT CORPORATION: PRODUCT LAUNCHES

- TABLE 201 CURTISS-WRIGHT CORPORATION: DEALS

- 13.2.15 INDRA SISTEMAS S.A.

- TABLE 202 INDRA SISTEMAS S.A.: BUSINESS OVERVIEW

- FIGURE 51 INDRA SISTEMAS S.A.: COMPANY SNAPSHOT

- TABLE 203 INDRA SISTEMAS S.A.: DEALS

- 13.2.16 TEXTRON INC.

- TABLE 204 TEXTRON INC.: BUSINESS OVERVIEW

- FIGURE 52 TEXTRON INC.: COMPANY SNAPSHOT

- 13.2.17 HENSOLDT AG

- TABLE 205 HENSOLDT AG: BUSINESS OVERVIEW

- FIGURE 53 HENSOLDT AG: COMPANY SNAPSHOT

- 13.2.18 IABG

- TABLE 206 IABG: BUSINESS OVERVIEW

- 13.2.19 BOOZ ALLEN HAMILTON

- TABLE 207 BOOZ ALLEN HAMILTON: BUSINESS OVERVIEW

- TABLE 208 BOOZ ALLEN HAMILTON: DEALS

- 13.2.20 HR SMITH GROUP OF COMPANIES

- TABLE 209 HR SMITH GROUP OF COMPANIES: BUSINESS OVERVIEW

- 13.3 OTHER PLAYERS

- 13.3.1 OCTOPUS ISR SYSTEMS

- TABLE 210 OCTOPUS ISR SYSTEMS: COMPANY OVERVIEW

- 13.3.2 TRAKKA SYSTEMS

- TABLE 211 TRAKKA SYSTEMS: COMPANY OVERVIEW

- 13.3.3 UKRSPECSYSTEMS

- TABLE 212 UKRSPECSYSTEMS: COMPANY OVERVIEW

- 13.3.4 KAPPA OPTRONICS

- TABLE 213 KAPPA OPTRONICS: COMPANY OVERVIEW

- 13.3.5 MAG AEROSPACE

- TABLE 214 MAG AEROSPACE: COMPANY OVERVIEW

- *Details on Business overview Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS