|

|

市場調査レポート

商品コード

1182435

サプライチェーンセキュリティの世界市場:コンポーネント別 (ハードウェア、ソフトウェア、サービス)・セキュリティの種類別 (データの局所性・保護、データの可視性・ガバナンス)・組織規模別・用途別 (医療・製薬、FMCG)・地域別の将来予測 (2027年まで)Supply Chain Security Market by Component (Hardware, Software, Services), Security Type (Data Locality & Protection, Data Visibility & Governance), Organization Size, Application (Healthcare & Pharmaceuticals, FMCG) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| サプライチェーンセキュリティの世界市場:コンポーネント別 (ハードウェア、ソフトウェア、サービス)・セキュリティの種類別 (データの局所性・保護、データの可視性・ガバナンス)・組織規模別・用途別 (医療・製薬、FMCG)・地域別の将来予測 (2027年まで) |

|

出版日: 2023年01月06日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のサプライチェーンセキュリティの市場規模は、2022年の20億米ドルから、2027年には35億米ドルへと、11.0%のCAGRで成長する、と予測されています。

市場の成長要因の1つとして、サプライチェーンの透明性に対するニーズが高まっていることが挙げられます。

コンポーネント別では、サービス分野が予測期間中に最も高いCAGRで成長すると見込まれています。サプライチェーンセキュリティの導入が進むにつれて、関連サービス (サポート・整備、トレーニング、教育など) の需要が高まり、市場の成長をさらに後押ししています。

サービス分野の中でも、インテグレーション・展開サービスが予測期間中に最も高いCAGRで成長します。

当レポートでは、世界のサプライチェーンセキュリティの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・セキュリティの種類・組織規模別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン

- エコシステム:サプライチェーンセキュリティ

- 技術分析

- IoT (モノのインターネット)

- ビッグデータ

- ブロックチェーン

- 人工知能 (AI)

- ユースケース

- 特許分析

- 主な利害関係者と購入基準

- 収益シフト:サプライチェーンセキュリティ市場のYC/YCCシフト

- ポーターのファイブフォース分析

- 規制状況

- 規制機関、政府機関、およびその他の組織

- 主な会議とイベント (2022年~2023年)

第6章 サプライチェーンセキュリティ市場:コンポーネント別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

- 訓練・コンサルティング

- インテグレーション・展開

- サポート・整備

第7章 サプライチェーンセキュリティ市場:セキュリティの種類別

- イントロダクション

- データの局所性・保護

- データの可視性・ガバナンス

- その他の種類のセキュリティ

第8章 サプライチェーンセキュリティ市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第9章 サプライチェーンセキュリティ市場:用途別

- イントロダクション

- 医療・製薬

- ワクチン

- バイオバンク

- 医薬品

- 日用消費財 (FMCG)

- 化学品

- 小売業・eコマース

- 自動車

- その他の用途

第10章 サプライチェーンセキュリティ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 他のアジア太平洋諸国

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第11章 競合情勢

- イントロダクション

- 市場評価フレームワーク

- 過去の収益分析

- 主要企業の市場シェア分析

- 市場構造

- 主要企業のランキング

- 主要企業の評価マトリックス

- 競合ベンチマーキング

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

- 製品/ソリューションの発売

- 資本取引

第12章 企業プロファイル

- イントロダクション

- 主要企業

- IBM

- EMERSON

- ORACLE

- NXP SEMICONDUCTORS

- TESTO

- ORBCOMM

- SENSITECH

- ELPRO

- ROTRONIC

- BERLINGER & CO. AG

- その他の企業

- MONNIT

- COLD CHAIN TECHNOLOGIES

- LOGTAG RECORDERS

- DICKSON

- SIGNATROL

- HANWELL SOLUTIONS

- CONTROLANT

- ROAMBEE

- OMEGA COMPLIANCE

- TAGBOX SOLUTIONS

- C2A SECURITY

- SAFETRACES

- TIVE

- ALTANA AI

- FOURKITES

第13章 隣接市場

- イントロダクション市場の紹介

- 制限事項

- 隣接市場

- サプライチェーン管理市場

- コールドチェーン監視市場

第14章 付録

MarketsandMarkets forecasts that the global supply chain security market will grow from an estimated USD 2.0 billion in 2022 to USD 3.5 billion by 2027 at a compound annual growth rate (CAGR) of 11.0%. One of the factors driving the market growth is the increasing need for supply chain transparency.

By components, services segment to grow at highest CAGR during forecast period

Supply chain security is an important supply chain management (SCM) segment. It primarily manages the risks of transportation, logistics, vendors, and suppliers. Professional security analysts ensure support with incident response and remote client assistance during suspicious activities. Professional services such as support and maintenance, training, and education are a part of this segment. With the increased adoption of supply chain security, there is an increased demand for these services, further boosting the market growth. The services segment includes numerous services required to deploy, execute, and maintain supply chain security solutions in organizations. This supply chain security market segment is classified into training and consultation, integration and deployment, and support and maintenance.

By services, integration and deployment services to grow at highest CAGR during forecast period

Tailored supply chain security deployment and integration services are offered by integration and deployment service providers. These services are used by highly qualified industry experts, domain experts, and security professionals that assist organizations in formulating and implementing supply chain security strategies, preventing revenue losses, minimizing risks, understanding cybersecurity solutions, and enhancing security in the existing information system.

In system integration, the vendor's security services are integrated with the client's security system without hampering the existing client's system. Benefits, such as reduced risks and complexity, are offered by design and integration services. This enhances security and enables resiliency to cyberattacks by identifying vulnerable or potentially exploited components at all supply chain stages.

Breakdown of primary participants:

- By Company Type: Tier 1 = 40%, Tier 2 = 30%, and Tier 3 = 30%

- By Designation: C-Level Executives = 40%, Directors = 40%, and Others = 20%

- By Region: North America = 40%, Asia Pacific = 30%, Europe = 20%, Rest of the World = 10%

Major vendors in the global supply chain security market include IBM (US), Emerson (US), Oracle (US), NXP Semiconductors (the Netherlands), Testo (Germany), ORBCOMM (US), Sensitech (US), ELPRO (Switzerland), Rotronic (Switzerland), Monnit (US), Cold Chain Technologies (US), LogTag Recorders (New Zealand), Dickson (US), Signatrol (UK), Hanwell Solutions (UK), Controlant (Iceland), Roambee (US), Omega Compliance (Hong Kong), Tagbox Solutions (India), C2A Security (Israel), SafeTraces (US), Tive (US), Altana (US), FourKites (US).

The study includes an in-depth competitive analysis of the key players in the supply chain security market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the supply chain security by component (hardware, software, and services), security type, organization size, application, and region (North America, Europe, Asia Pacific, Middle East and Africa, and Latin America).

The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key benefits of buying the report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall supply chain security market and the subsegments. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 SUPPLY CHAIN SECURITY MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 SUPPLY CHAIN SECURITY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- FIGURE 2 SUPPLY CHAIN SECURITY MARKET: RESEARCH FLOW

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 REVENUE ESTIMATES

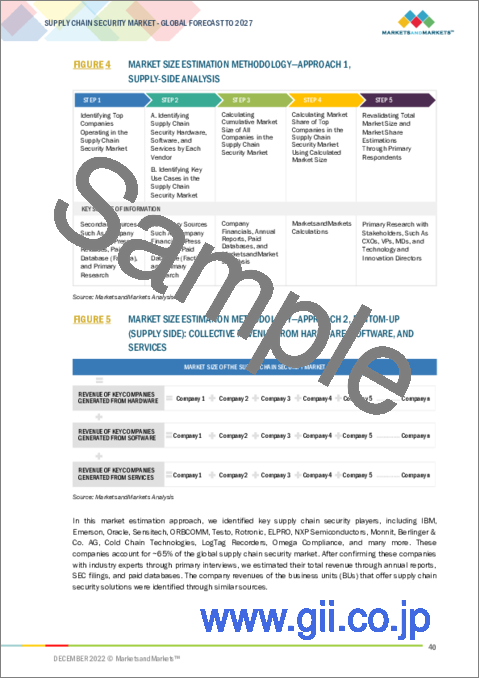

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE OF HARDWARE/SOFTWARE/SERVICES OF SUPPLY CHAIN SECURITY VENDORS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM HARDWARE, SOFTWARE, AND SERVICES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY APPROACH-TOP-DOWN (DEMAND SIDE) FOR APPLICATIONS

- 2.4 COMPANY EVALUATION QUADRANT METHODOLOGY

- FIGURE 7 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- 2.5 STARTUP EVALUATION QUADRANT METHODOLOGY

- FIGURE 8 STARTUP EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- 2.6 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.7 ASSUMPTIONS

- 2.8 LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 RECESSION IMPACT

- TABLE 3 SUPPLY CHAIN SECURITY MARKET GROWTH, 2022-2027 (USD MILLION, Y-O-Y GROWTH)

- FIGURE 9 GLOBAL SUPPLY CHAIN SECURITY MARKET SIZE AND Y-O-Y GROWTH RATE

- FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 FASTEST-GROWING SEGMENTS OF SUPPLY CHAIN SECURITY MARKET

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF SUPPLY CHAIN SECURITY MARKET

- FIGURE 12 INCREASING CYBERATTACKS AND NEED FOR SUPPLY CHAIN TRANSPARENCY TO DRIVE MARKET GROWTH

- 4.2 SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022

- FIGURE 13 HARDWARE SEGMENT TO DOMINATE DURING FORECAST PERIOD

- 4.3 SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022

- FIGURE 14 DATA LOCALITY & PROTECTION SEGMENT TO ACQUIRE LARGEST MARKET SHARE

- 4.4 SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022

- FIGURE 15 LARGE ENTERPRISES TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022

- FIGURE 16 HEALTHCARE & PHARMACEUTICALS SEGMENT TO DOMINATE MARKET

- 4.6 MARKET INVESTMENT SCENARIO

- FIGURE 17 ASIA PACIFIC TO EMERGE AS MOST LUCRATIVE MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SUPPLY CHAIN SECURITY MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rising incidences of cyberattacks across supply chains

- 5.2.1.2 Growing need for supply chain transparency

- 5.2.1.3 Increasing demand for enhanced security of supply chain transactions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Budgetary constraints among small and emerging startups in developing economies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Improving risk prediction and management

- 5.2.3.2 Widespread adoption of automation technology across value chain

- 5.2.3.3 Increasing IoT devices in supply chain

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited awareness about supply chain security among organizations

- 5.3 VALUE CHAIN

- FIGURE 19 VALUE CHAIN: SUPPLY CHAIN SECURITY MARKET

- 5.4 ECOSYSTEM: SUPPLY CHAIN SECURITY

- FIGURE 20 ECOSYSTEM: SUPPLY CHAIN SECURITY MARKET

- TABLE 4 ECOSYSTEM ANALYSIS: SUPPLY CHAIN SECURITY MARKET

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 INTERNET OF THINGS

- 5.5.2 BIG DATA

- 5.5.3 BLOCKCHAIN

- 5.5.4 ARTIFICIAL INTELLIGENCE

- 5.6 USE CASES

- 5.6.1 USE CASE 1: CORNERSTONE LOGISTICS TO PROCURE SENSITECH'S CARGO MONITORING SOLUTION

- 5.6.2 USE CASE 2: ENDOCYTE TO USE ELPRO'S CENTRAL MONITORING SYSTEM TO PROTECT ITS CRITICAL ASSETS

- 5.6.3 USE CASE 3: ACCELERATION OF GLOBAL GROWTH WITH EFFICIENT AND COST-EFFECTIVE IBM STERLING SUPPLY CHAIN BUSINESS NETWORK

- 5.6.4 USE CASE 4: MOTAT TO PROCURE HANWELL SOLUTION'S COMPREHENSIVE ENVIRONMENTAL MONITORING SOLUTION

- 5.6.5 USE CASE 5: OCEASOFT'S DATA LOGGER TO ADDRESS EUROPEAN HOSPITAL'S NEED FOR TEMPERATURE MONITORING AND COMPLIANCE

- 5.7 PATENT ANALYSIS

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 5 KEY STAKEHOLDERS IN SUPPLY CHAIN SECURITY MARKET

- 5.9 REVENUE SHIFT: YC/YCC SHIFT FOR SUPPLY CHAIN SECURITY MARKET

- FIGURE 22 YC/YCC SHIFT: SUPPLY CHAIN SECURITY MARKET

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS: SUPPLY CHAIN SECURITY MARKET

- TABLE 6 IMPACT OF PORTER'S FIVE FORCES ON SUPPLY CHAIN SECURITY MARKET

- 5.10.1 THREAT FROM NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 8 SUPPLY CHAIN SECURITY MARKET: CONFERENCES AND EVENTS, 2022-2023

6 SUPPLY CHAIN SECURITY MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 24 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 9 SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 10 SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2 HARDWARE

- 6.2.1 HARDWARE DEVICES TO ENSURE REAL-TIME TRACKING AND TRACING OF ASSETS IN SUPPLY CHAIN

- 6.2.2 HARDWARE: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 11 HARDWARE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 12 HARDWARE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 SOFTWARE

- 6.3.1 ACTIONABLE INTELLIGENCE TO DRIVE DEMAND FOR SUPPLY CHAIN SECURITY SOFTWARE

- 6.3.2 SOFTWARE: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 13 SOFTWARE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 14 SOFTWARE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 SERVICES

- 6.4.1 INCREASED DEMAND FOR SERVICES TO EFFECTIVELY IMPLEMENT SUPPLY CHAIN SECURITY SOLUTIONS

- 6.4.2 SERVICES: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 15 SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 16 SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 17 SERVICES: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 18 SERVICES: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4.3 TRAINING & CONSULTING

- 6.4.3.1 Training services to help users adopt supply chain security solutions efficiently

- TABLE 19 TRAINING & CONSULTING: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 20 TRAINING & CONSULTING: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4.4 INTEGRATION & DEPLOYMENT

- 6.4.4.1 Integration & deployment service providers to offer tailored supply chain security solutions

- TABLE 21 INTEGRATION & DEPLOYMENT: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 22 INTEGRATION & DEPLOYMENT: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4.5 SUPPORT & MAINTENANCE

- 6.4.5.1 Need for technical assistance and post-maintenance services to solve critical issues

- TABLE 23 SUPPORT & MAINTENANCE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 24 SUPPORT & MAINTENANCE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

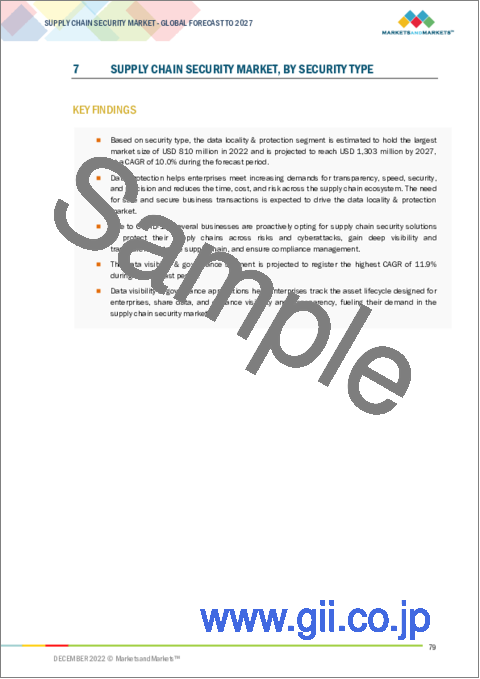

7 SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE

- 7.1 INTRODUCTION

- FIGURE 25 DATA VISIBILITY & GOVERNANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 25 SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 26 SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- 7.2 DATA LOCALITY & PROTECTION

- 7.2.1 DATA LOCALITY & PROTECTION TO ENSURE SAFE, SECURE, AND TRANSPARENT SUPPLY CHAINS

- 7.2.2 DATA LOCALITY & PROTECTION: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 27 DATA LOCALITY & PROTECTION: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 DATA LOCALITY & PROTECTION: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 DATA VISIBILITY & GOVERNANCE

- 7.3.1 DATA GOVERNANCE TO ENHANCE VISIBILITY AND TRANSPARENCY FOR INCREASED SECURITY

- 7.3.2 DATA VISIBILITY & GOVERNANCE: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 29 DATA VISIBILITY & GOVERNANCE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 DATA VISIBILITY & GOVERNANCE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 OTHER SECURITY TYPES

- TABLE 31 OTHER SECURITY TYPES: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 32 OTHER SECURITY TYPES: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

8 SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- FIGURE 26 SMES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 33 SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 34 SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 8.2.1 GOVERNMENT TO PROMOTE SUPPLY CHAIN SECURITY SOLUTIONS AMONG SMES

- 8.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 35 SMALL AND MEDIUM-SIZED ENTERPRISES: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 SMALL AND MEDIUM-SIZED ENTERPRISES: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 LARGE ENTERPRISES

- 8.3.1 SUPPLY CHAIN SECURITY SOLUTIONS TO PREVENT CYBERATTACKS, DATA THEFTS, AND UNAUTHORIZED ACCESS

- 8.3.2 LARGE ENTERPRISES: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 37 LARGE ENTERPRISES: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 LARGE ENTERPRISES: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

9 SUPPLY CHAIN SECURITY MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 27 HEALTHCARE & PHARMACEUTICALS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 39 SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 40 SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2 HEALTHCARE & PHARMACEUTICALS

- 9.2.1 MISSED DELIVERY DUE TO WEAK SUPPLY CHAIN SECURITY TO BE LIFE-THREATENING

- 9.2.2 HEALTHCARE & PHARMACEUTICALS: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 41 HEALTHCARE & PHARMACEUTICALS: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 HEALTHCARE & PHARMACEUTICALS: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2.3 VACCINES

- 9.2.3.1 Increasing vaccine shipments during pandemic

- 9.2.4 BIOBANKS

- 9.2.4.1 Biobanks to require cold chain monitoring solutions with strict security measures

- 9.2.5 MEDICINES & DRUGS

- 9.2.5.1 Supply chain security to combat threat of drug counterfeits

- 9.3 FMCG

- 9.3.1 SUPPLY CHAIN SECURITY SOLUTIONS TO PROVIDE REAL-TIME VISIBILITY AND PREVENT CYBERATTACKS

- 9.3.2 FMCG: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 43 FMCG: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 FMCG: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 CHEMICALS

- 9.4.1 LOGISTICS TO REPRESENT HIGH COSTS DUE TO DISTANT LOCATIONS

- 9.4.2 CHEMICALS: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 45 CHEMICALS: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 46 CHEMICALS: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 RETAIL & ECOMMERCE

- 9.5.1 ECOMMERCE TO FUEL NEED FOR STRONG SUPPLY CHAIN SECURITY

- 9.5.2 RETAIL & ECOMMERCE: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 47 RETAIL & ECOMMERCE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 RETAIL & ECOMMERCE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.6 AUTOMOTIVE

- 9.6.1 AUTOMOTIVE SUPPLY CHAIN TO HAVE MAJOR CYBERSECURITY VULNERABILITIES

- 9.6.2 AUTOMOTIVE: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 49 AUTOMOTIVE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 50 AUTOMOTIVE: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.7 OTHER APPLICATIONS

- 9.7.1 OTHER APPLICATIONS: SUPPLY CHAIN SECURITY MARKET DRIVERS

- TABLE 51 OTHER APPLICATIONS: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 52 OTHER APPLICATIONS: SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

10 SUPPLY CHAIN SECURITY MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 28 NORTH AMERICA PROJECTED TO HOLD DOMINANT MARKET SIZE DURING FORECAST PERIOD

- TABLE 53 SUPPLY CHAIN SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 54 SUPPLY CHAIN SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- 10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 55 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 64 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 66 NORTH AMERICA: SUPPLY CHAIN SECURITY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.2.4 US

- 10.2.4.1 Government to promote ideal environment for supply chain security

- TABLE 67 US: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 68 US: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 69 US: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 70 US: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 71 US: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 72 US: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 73 US: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 74 US: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.2.5 CANADA

- 10.2.5.1 Supply chain to contribute significantly to GDP and employment

- TABLE 75 CANADA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 76 CANADA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 77 CANADA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 78 CANADA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 79 CANADA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 80 CANADA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 81 CANADA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 82 CANADA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: SUPPLY CHAIN SECURITY MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- 10.3.3 EUROPE: REGULATORY LANDSCAPE

- TABLE 83 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 84 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 85 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 86 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 87 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 88 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 89 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 90 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 91 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 92 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 93 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 94 EUROPE: SUPPLY CHAIN SECURITY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.3.4 UK

- 10.3.4.1 Various initiatives underway to boost cyber security of digital supply chains

- TABLE 95 UK: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 96 UK: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 97 UK: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 98 UK: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 99 UK: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 100 UK: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 101 UK: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 102 UK: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.3.5 GERMANY

- 10.3.5.1 Increased supply chain breaches to drive demand for supply chain security solutions

- TABLE 103 GERMANY: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 104 GERMANY: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 105 GERMANY: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 106 GERMANY: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 107 GERMANY: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 108 GERMANY: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 109 GERMANY: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 110 GERMANY: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.3.6 FRANCE

- 10.3.6.1 Industrial and logistics projects to increase need for supply chain security solutions

- TABLE 111 FRANCE: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 112 FRANCE: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 113 FRANCE: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 114 FRANCE: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 115 FRANCE: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 116 FRANCE: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 117 FRANCE: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 118 FRANCE: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 119 REST OF EUROPE: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 120 REST OF EUROPE: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 121 REST OF EUROPE: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 122 REST OF EUROPE: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 123 REST OF EUROPE: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 124 REST OF EUROPE: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 125 REST OF EUROPE: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 126 REST OF EUROPE: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- 10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 127 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 128 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 129 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 130 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 131 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 132 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 133 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 134 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 135 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 136 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 137 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 138 ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.4.4 CHINA

- 10.4.4.1 Demand for security solutions to increase with evolving threats to supply chain network

- TABLE 139 CHINA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 140 CHINA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 141 CHINA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 142 CHINA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 143 CHINA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 144 CHINA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 145 CHINA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 146 CHINA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.4.5 JAPAN

- 10.4.5.1 New management culture to be termed Supply Chain Management 4.0

- TABLE 147 JAPAN: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 148 JAPAN: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 149 JAPAN: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 150 JAPAN: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 151 JAPAN: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 152 JAPAN: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 153 JAPAN: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 154 JAPAN: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.4.6 INDIA

- 10.4.6.1 Manufacturing and logistics sectors to integrate IoT, cloud computing, and AI/ML to secure supply chains

- TABLE 155 INDIA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 156 INDIA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 157 INDIA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 158 INDIA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 159 INDIA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 160 INDIA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 161 INDIA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 162 INDIA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 163 REST OF ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- TABLE 171 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: SUPPLY CHAIN SECURITY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.5.4 MIDDLE EAST

- 10.5.4.1 Increased online purchases to intensify management and security of supply chains

- TABLE 183 MIDDLE EAST: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 184 MIDDLE EAST: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 185 MIDDLE EAST: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 186 MIDDLE EAST: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 187 MIDDLE EAST: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 188 MIDDLE EAST: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 189 MIDDLE EAST: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 190 MIDDLE EAST: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.5.5 AFRICA

- 10.5.5.1 Increased cyberattacks to generate awareness about supply chain security solutions

- TABLE 191 AFRICA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 192 AFRICA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 193 AFRICA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 194 AFRICA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 195 AFRICA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 196 AFRICA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 197 AFRICA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 198 AFRICA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET DRIVERS

- 10.6.2 ASIA PACIFIC: RECESSION IMPACT

- 10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

- TABLE 199 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 200 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 201 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 202 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 203 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 204 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 205 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 206 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 207 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 208 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 209 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 210 LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.6.4 BRAZIL

- 10.6.4.1 Food and medical supply chain to witness more cyberattacks

- TABLE 211 BRAZIL: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 212 BRAZIL: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 213 BRAZIL: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 214 BRAZIL: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 215 BRAZIL: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 216 BRAZIL: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 217 BRAZIL: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 218 BRAZIL: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.6.5 MEXICO

- 10.6.5.1 Adverse consequences of COVID-19 pandemic on supply chain

- TABLE 219 MEXICO: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 220 MEXICO: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 221 MEXICO: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 222 MEXICO: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 223 MEXICO: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 224 MEXICO: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 225 MEXICO: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 226 MEXICO: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.6.6 REST OF LATIN AMERICA

- TABLE 227 REST OF LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 228 REST OF LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 229 REST OF LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2018-2021 (USD MILLION)

- TABLE 230 REST OF LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY SECURITY TYPE, 2022-2027 (USD MILLION)

- TABLE 231 REST OF LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 232 REST OF LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 233 REST OF LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 234 REST OF LATIN AMERICA: SUPPLY CHAIN SECURITY MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 MARKET EVALUATION FRAMEWORK

- FIGURE 31 MARKET EVALUATION FRAMEWORK, 2019-2022

- 11.3 HISTORIC REVENUE ANALYSIS

- FIGURE 32 REVENUE ANALYSIS OF LEADING SUPPLY CHAIN SECURITY VENDORS

- 11.4 MARKET SHARE ANALYSIS OF LEADING PLAYERS

- FIGURE 33 REVENUE SHARE ANALYSIS OF SUPPLY CHAIN SECURITY MARKET, 2022

- 11.5 MARKET STRUCTURE

- TABLE 235 SUPPLY CHAIN SECURITY MARKET: DEGREE OF COMPETITION

- 11.6 RANKING OF KEY PLAYERS

- FIGURE 34 RANKING OF KEY SUPPLY CHAIN SECURITY PLAYERS, 2022

- 11.7 KEY COMPANY EVALUATION MATRIX

- 11.7.1 KEY COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

- TABLE 236 EVALUATION CRITERIA

- FIGURE 35 SUPPLY CHAIN SECURITY MARKET, KEY COMPANY EVALUATION MATRIX, 2022

- 11.7.2 STARS

- 11.7.3 EMERGING LEADERS

- 11.7.4 PERVASIVE PLAYERS

- 11.7.5 PARTICIPANTS

- 11.8 COMPETITIVE BENCHMARKING

- 11.8.1 EVALUATION CRITERIA OF KEY COMPANIES

- FIGURE 36 COMPANY FOOTPRINT OF KEY PLAYERS IN SUPPLY CHAIN SECURITY MARKET

- TABLE 237 LIST OF KEY PLAYERS

- TABLE 238 REGIONAL FOOTPRINT OF KEY PLAYERS

- 11.8.2 EVALUATION CRITERIA OF STARTUPS

- TABLE 239 LIST OF STARTUPS

- TABLE 240 REGIONAL FOOTPRINT OF STARTUP PLAYERS

- 11.9 STARTUP/SME EVALUATION MATRIX

- FIGURE 37 SUPPLY CHAIN SECURITY MARKET, STARTUP/SME EVALUATION MATRIX, 2022

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT/SOLUTION LAUNCHES

- TABLE 241 SUPPLY CHAIN SECURITY MARKET: PRODUCT/SOLUTION LAUNCHES, 2019-2022

- 11.10.2 DEALS

- TABLE 242 SUPPLY CHAIN SECURITY MARKET: DEALS, 2019-2022

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 IBM

- TABLE 243 IBM: BUSINESS OVERVIEW

- FIGURE 38 IBM: COMPANY SNAPSHOT

- TABLE 244 IBM: SOLUTIONS OFFERED

- TABLE 245 IBM: SERVICES OFFERED

- TABLE 246 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 247 IBM: DEALS

- 12.2.2 EMERSON

- TABLE 248 EMERSON: BUSINESS OVERVIEW

- FIGURE 39 EMERSON: COMPANY SNAPSHOT

- TABLE 249 EMERSON: SOLUTIONS OFFERED

- TABLE 250 EMERSON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 251 EMERSON: DEALS

- 12.2.3 ORACLE

- TABLE 252 ORACLE: BUSINESS OVERVIEW

- FIGURE 40 ORACLE: COMPANY SNAPSHOT

- TABLE 253 ORACLE: SOLUTIONS OFFERED

- TABLE 254 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.2.4 NXP SEMICONDUCTORS

- TABLE 255 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

- FIGURE 41 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- TABLE 256 NXP SEMICONDUCTORS: SOLUTIONS OFFERED

- TABLE 257 NXP SEMICONDUCTORS: SERVICES OFFERED

- TABLE 258 NXP SEMICONDUCTORS: DEALS

- 12.2.5 TESTO

- TABLE 259 TESTO: BUSINESS OVERVIEW

- TABLE 260 TESTO: SOLUTIONS OFFERED

- TABLE 261 TESTO: SERVICES OFFERED

- TABLE 262 TESTO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 263 TESTO: DEALS

- 12.2.6 ORBCOMM

- TABLE 264 ORBCOMM: BUSINESS OVERVIEW

- TABLE 265 ORBCOMM: SOLUTIONS OFFERED

- TABLE 266 ORBCOMM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 267 ORBCOMM: DEALS

- 12.2.7 SENSITECH

- TABLE 268 SENSITECH: BUSINESS OVERVIEW

- TABLE 269 SENSITECH: SOLUTIONS OFFERED

- TABLE 270 SENSITECH: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 271 SENSITECH: DEALS

- 12.2.8 ELPRO

- TABLE 272 ELPRO: BUSINESS OVERVIEW

- TABLE 273 ELPRO: SOLUTIONS OFFERED

- TABLE 274 ELPRO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 275 ELPRO: DEALS

- 12.2.9 ROTRONIC

- TABLE 276 ROTRONIC: BUSINESS OVERVIEW

- TABLE 277 ROTRONIC: SOLUTIONS OFFERED

- 12.2.10 BERLINGER & CO. AG

- TABLE 278 BERLINGER & CO. AG: BUSINESS OVERVIEW

- TABLE 279 BERLINGER & CO. AG: SOLUTIONS OFFERED

- TABLE 280 BERLINGER & CO. AG: DEALS

- 12.3 OTHER PLAYERS

- 12.3.1 MONNIT

- 12.3.2 COLD CHAIN TECHNOLOGIES

- 12.3.3 LOGTAG RECORDERS

- 12.3.4 DICKSON

- 12.3.5 SIGNATROL

- 12.3.6 HANWELL SOLUTIONS

- 12.3.7 CONTROLANT

- 12.3.8 ROAMBEE

- 12.3.9 OMEGA COMPLIANCE

- 12.3.10 TAGBOX SOLUTIONS

- 12.3.11 C2A SECURITY

- 12.3.12 SAFETRACES

- 12.3.13 TIVE

- 12.3.14 ALTANA AI

- 12.3.15 FOURKITES

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 ADJACENT MARKETS

- 13.1 INTRODUCTION TO ADJACENT MARKETS

- TABLE 281 ADJACENT MARKETS AND FORECASTS

- 13.2 LIMITATIONS

- 13.3 ADJACENT MARKETS

- 13.3.1 SUPPLY CHAIN MANAGEMENT MARKET

- TABLE 282 SUPPLY CHAIN MANAGEMENT MARKET, BY COMPONENT, 2014-2019 (USD MILLION)

- TABLE 283 SUPPLY CHAIN MANAGEMENT MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 284 SUPPLY CHAIN MANAGEMENT MARKET, BY VERTICAL, 2014-2019 (USD MILLION)

- TABLE 285 SUPPLY CHAIN MANAGEMENT MARKET, BY VERTICAL, 2020-2027 (USD MILLION)

- 13.3.2 COLD CHAIN MONITORING MARKET

- TABLE 286 COLD CHAIN MONITORING MARKET, BY OFFERING, 2017-2020 (USD MILLION)

- TABLE 287 COLD CHAIN MONITORING MARKET, BY OFFERING, 2021-2026 (USD MILLION)

- TABLE 288 COLD CHAIN MONITORING MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 289 COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS