|

|

市場調査レポート

商品コード

1132166

産業制御・工場自動化の世界市場:コンポーネント別・ソリューション別 (SCADA、PLC、DCS、MES、産業安全、PAM)・産業別 (プロセス産業、ディスクリート産業)・地域別 (北米、欧州、アジア太平洋、他の国々 (RoW)) の将来予測 (2027年まで)Industrial Control & Factory Automation Market by Component, Solution (SCADA, PLC, DCS, MES, Industrial Safety, PAM), Industry (Process Industry and Discrete Industry) and Region (North America, Europe, APAC, RoW) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 産業制御・工場自動化の世界市場:コンポーネント別・ソリューション別 (SCADA、PLC、DCS、MES、産業安全、PAM)・産業別 (プロセス産業、ディスクリート産業)・地域別 (北米、欧州、アジア太平洋、他の国々 (RoW)) の将来予測 (2027年まで) |

|

出版日: 2022年09月27日

発行: MarketsandMarkets

ページ情報: 英文 330 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の産業制御・工場自動化の市場規模は、2022年の1,479億米ドルから、2027年には2,188億米ドルに成長すると予測されており、2022年から2027年までのCAGRは8.2%と予想されています。

市場成長を促す主な要因は、産業自動化を推進する政府の取り組みが増加していることと、IoTやAIなどのテクノロジーとさまざまな産業制御・工場自動化ソリューションとの統合が進んでいることです。また、プロセス産業やディスクリート産業における自動化の利用が拡大していることも、産業制御&ファクトリーオートメーション市場の成長に寄与する主要な要因となっています。

"2021年、産業用センサーが最大のシェアを有し、産業ロボットが第2位を占める"

センサー技術は過去10年間で驚異的な発展を遂げました。製造工場における接続性の要求の高まりを受けて、メーカー各社は様々なデータポイントでデータを取得するための高度なセンサーの導入を進めています。また、産業用ロボットは、肉体労働の必要性を減らすことで、製造業を再構築しています。

"2021年には、DCSが圧倒的なシェアを占め、PLCが2位のシェアを占めている"

DCSは、製造工場におけるプロセスの自動化と制御を可能にします。それは、意思決定の完全性、操作の簡素化、生産性の向上を促進します。この分野の成長は、変化する市場要件に対応するための厳格な基準の導入と遵守に起因すると考えられます。

"プロセス産業セグメントでは、金属・鉱業が予測期間中に最も高い成長率で成長する"

金属加工に使用される機械には、迅速、正確、かつ効率的な金属の移動が必要であり、これにはドライブとPLCが使用されます。鉱業・金属産業における自動化の導入は、生産性の向上、安全性の向上、摩耗の最小化、製品の信頼性と品質の向上をもたらしています。一方、採掘作業では労働者の安全が常に最優先されます。それゆえ、世界中の規制当局は、鉱山の安全性を確保するために、鉱山の所有者に厳しい規則や規制を設けています。このような厳しい規制により、鉱業会社は、災難を事前に予測し、防止しようとするのに役立つ産業制御・工場自動化技術の導入を余儀なくされています。

"地域別では、2021年にアジア太平洋が最大のシェアを占め、北米が2番目のシェアを占めた"

アジア太平洋地域の人口密度と一人当たりの所得の増加、および大規模な工業化・都市化が、同地域の産業制御・工場自動化市場の成長を促進しています。

当レポートでは、世界の産業制御および工場自動化 (ファクトリーオートメーション、FA) の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・ソリューション別・産業別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- 人工知能 (AI)

- 拡張現実 (AR)

- ブロックチェーン

- 5G

- 予知保全

- スマートエネルギー管理

- エッジコンピューティング

- 予測可能なサプライチェーン

- サイバーセキュリティ

- デジタルツイン

- IoT

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ

- 貿易分析

- 特許分析

- 主な会議とイベント (2022年~2023年)

- 産業制御におけるデジタル化

- 関税と規制の状況

第6章 産業制御・工場自動化市場:コンポーネント別

- イントロダクション

- 産業ロボット

- 従来型産業用ロボット

- 協働ロボット

- マシンビジョンシステム

- カメラ

- フレームグラバー・光学機器・LED照明

- プロセスアナライザー

- フィールド機器

- 流量計

- 送信機

- ヒューマンマシンインターフェース (HMI)

- 産業用パソコン

- 産業用センサー

- 工業用3Dプリント

- 振動モニタリング

第7章 産業制御・工場自動化市場:ソリューション別

- イントロダクション

- SCADA (監視制御・データ取得)

- PLC (プログラマブルロジックコントローラ)

- DCS (分散制御システム)

- MES (製造実行システム)

- 産業安全

- PAM (プラント資産管理)

第8章 産業制御・工場自動化市場:産業別

- イントロダクション

- プロセス産業

- 石油・ガス

- 化学

- パルプ・紙

- 医薬品

- 金属・鉱業

- 食品・飲料

- エネルギー・電力

- その他

- ディスクリート産業

- 自動車

- 機械製造

- 半導体・エレクトロニクス

- 航空宇宙・防衛

- 医療機器

- その他

第9章 産業制御・工場自動化市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- 他の欧州諸国

- アジア太平洋

- 日本

- 中国

- インド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 南米

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 大手企業の収益分析

- 市場シェア分析

- 企業評価クアドラント (2021年)

- 中小企業の評価クアドラント (2021年)

- 産業安全市場:企業のフットプリント

- 競合ベンチマーキング

- 競合シナリオと動向

- 製品の発売

- 資本取引

- その他

第11章 企業プロファイル

- 主要企業

- ABB

- EMERSON

- SIEMENS

- SCHNEIDER ELECTRIC

- MITSUBISHI ELECTRIC

- GENERAL ELECTRIC CO.

- ROCKWELL AUTOMATION

- HONEYWELL

- YOKOGAWA ELECTRIC CORPORATION

- OMRON CORPORATION

- ENDRESS+HAUSER

- FANUC CORPORATION

- WIKA GMBH

- DWYER INSTRUMENTS

- STRATASYS

- 3D SYSTEMS CORPORATION

- その他の主要企業

- FUJI ELECTRIC

- HITACHI

- KROHNE

- AZBIL CORPORATION

- VEGA GRIESHABER

- DANFOSS

- その他の企業

- TEGAN INNOVATIONS

- WIN-911 SOFTWARE

- PINPOINT INFORMATION SYSTEMS

- PROGEA

- CHAOS PRIME

- INXPECT S.P.A.

- ALGOLUX

- INUITIVE

- EAVE

- CANARIA

- FUELICS

- ULTIMAKER

- NANO DIMENSION

- DEEP LEARNING ROBOTICS

- PICK-IT 3D

- ONROBOT

- TRIVISION

- CLEVEST

第12章 隣接・関連市場

- イントロダクション

- 制限事項

- デジタルツイン市場:用途別

- 製品設計と開発

- 性能モニタリング

- 予知保全

- 在庫管理

- 業務最適化

- その他の用途

第13章 付録

The industrial control & factory automation market size is expected to grow from USD 147.9 billion in 2022 to USD 218.8 billion by 2027; it is expected to grow at a CAGR of 8.2% from 2022 to 2027. The key factors driving the growth of the industrial control & factory automation market are increasing number of government initiatives to promote industrial automation and increasing integration of technologies such as IoT and AI with various industrial control & factory automation solutions. Growing use of automation in process and discrete industries is another major factor contributing to the growth of the industrial control & factory automation market.

"Industrial sensors held the largest share and industrial robots held the second largest share in 2021"

Sensor technology has developed tremendously over the past decade. The increasing requirement for connectivity in manufacturing plants has encouraged manufacturers to adopt advanced sensors to capture data at various data points. Sensor manufacturers are continuously focusing on developing advanced solutions to help end users improve production efficiency. Industrial robots are reshaping the manufacturing industry by decreasing the need for physical work. They are used in industrial plants to increase productivity and eliminate errors. These robots are suitable for use in remote locations. Using automated robots in the industrial production line reduces time, cost, and wastage and leads to the development of high-quality and precise products.

"DCS accounted for the dominating share and PLC accounted for the second largest share of the industrial control & factory automation market in 2021"

DCS enables process automation and control in industrial manufacturing plants. it facilitates decision integrity, simplified operations, and increased productivity. The major application areas of DCS are in the oil & gas, automotive, chemical, food & beverage, and pharmaceutical industries. Among process industries, the food & beverage industry is projected to account for the largest size of the industrial control & factory automation market for PLC during the forecast period. The growth of this segment can be attributed to the implementation and adherence to strict standards to respond to changing market requirements.

"Metals & mining industry is expected to register the highest growth rate in the process industry segment of the industrial control & factory automation market during forecast period"

The metal industry includes various metalworking processes, such as grinding, milling, spinning, and forging. The machinery used in metal processing requires quick, accurate, and efficient movement of metals, which is carried out by drives and PLCs. The adoption of automation in the mining & metals industry has improved productivity, increased safety, minimized wear, and enhanced reliability and quality of products. The safety of the workforce is always the top priority in mining operations. Hence, regulatory authorities across the world have set stringent rules and regulations for mine owners to ensure the safety of mines. These strict regulations force mining companies to adopt industrial control & factory automation technologies, which can help them predict and try to prevent a mishap in advance.

"Asia Pacific accounted for the largest share and North America held the second largest share of the industrial control & factory automation market in 2021"

The dense population and the growth in per capita income in Asia Pacific, along with large-scale industrialization and urbanization, are driving the growth of the industrial control & factory automation market in this region. Asia Pacific has emerged as a global automotive manufacturing hub. Hence, motor vehicle suppliers such as Volkswagen, Toyota Motor Corporation, Renault-Nissan Alliance, Daimler, and local manufacturers such as Tata Motors and Mahindra and Mahindra have invested in automating their automobile production sites. Increasing potential of automotive industry has promoted increasing adoption of industrial control & factory automation solutions in the region. Rising demand for industrial control and factory automation solutions in the region can be attributed to the adoption of automation solutions in the pharmaceutical, chemical, food & beverage, automotive, and aerospace & defense industries. The requirement for tracking real-time data related to different industrial processes, ensuring their visibility, and enabling control over them is driving the adoption of automated solutions in the region.

The break-up of the profiles of primary participants for the report has been given below:

- By Company Type: Tier 1 = 40%, Tier 2 = 35%, and Tier 3 = 25%

- By Designation: C-Level Executives = 48%, Directors = 33%, and Others= 19%

- By Region: North America = 35%, Europe = 18%, Asia Pacific = 40%, and RoW = 7%

Major players operating in the industrial control & factory automation market include ABB (Switzerland), Emerson (US), Siemens (Germany), Schneider Electric (France), Mitsubishi Electric (Japan), Yokogawa Electric Corporation (Japan), Endress+Hauser (Switzerland), Honeywell (US), Rockwell Automation (US), and General Electric (US), among others.

Research Coverage:

The research report on the global industrial control & factory automation market covers the market based on component, solution, industry, and region. Based on component, the industrial control & factory automation market has been segmented into industrial robots, machine vision systems, process analyzers, human-machine interface, field instruments, industrial PC, industrial sensors, industrial 3D printing, and vibration monitoring. Based on solution, the industrial control & factory automation market has been segmented into supervisory control and data acquisition (SCADA), programmable logic controller (PLC), distributed control system (DCS), manufacturing execution system (MES), industrial safety, and plant asset management (PAM). Based on industry, the industrial control & factory automation market has been segmented into process industry (oil & gas, chemicals, pulp & paper, pharmaceuticals, metals & mining, food & beverage, energy & power, and others which included fast-moving consumer goods (FMCG), HVAC, recycling, plastics, printing, cement, glass, rubber, furniture & wood, textile, and water and wastewater industries) and discrete industry (automotive, aerospace, semiconductor & electronics, machine manufacturing, medical device, and others which included ceramics, fabricating, and packaging industries). The report covers four major regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW).

Key Benefits of Buying the Report:

This report segments the industrial control & factory automation market comprehensively and provides the closest approximations of the overall market size, as well as that of the subsegments across different component, solution, industry, and region.

The report helps stakeholders understand the pulse of the market, and expected market scenario and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: SEGMENTATION

- FIGURE 2 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: REGIONAL SCOPE

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE): REVENUE GENERATED BY COMPANIES FROM INDUSTRIAL SAFETY MARKET

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Arriving at market size through bottom-up approach (demand-side)

- FIGURE 5 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Arriving at market size through top-down approach (supply-side)

- FIGURE 6 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- FIGURE 9 KEY STAGES IN ADOPTION OF INDUSTRIAL CONTROL & FACTORY AUTOMATION

- FIGURE 10 INDUSTRIAL SENSORS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 DCS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 12 PROCESS INDUSTRY SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC MARKET TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET

- FIGURE 14 GROWING EMPHASIS ON INDUSTRIAL AUTOMATION AND OPTIMUM UTILIZATION OF RESOURCES TO DRIVE GROWTH OF INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET

- 4.2 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT

- FIGURE 15 INDUSTRIAL 3D PRINTING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION

- FIGURE 16 PAM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY INDUSTRY

- FIGURE 17 DISCRETE INDUSTRY SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- 4.5 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION

- FIGURE 18 US ACCOUNTED FOR LARGEST SHARE OF INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

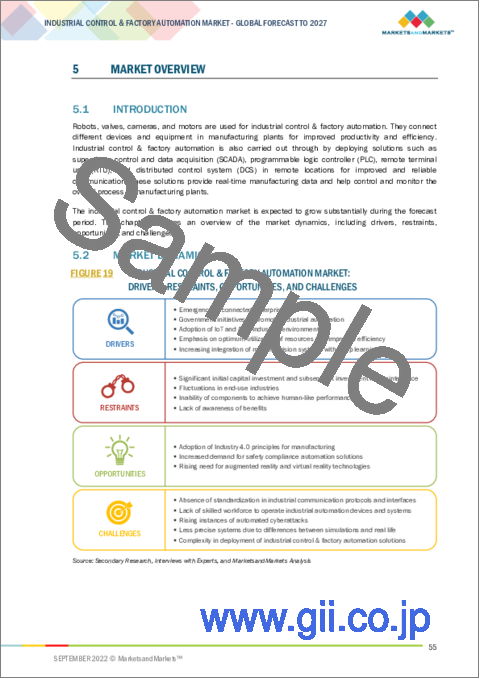

- 5.2 MARKET DYNAMICS

- FIGURE 19 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Emergence of connected enterprises

- 5.2.1.2 Government initiatives to promote industrial automation

- 5.2.1.3 Adoption of IoT and AI in industrial environments

- 5.2.1.4 Emphasis on optimum utilization of resources and improved efficiency

- 5.2.1.5 Increasing integration of machine vision systems with deep learning

- FIGURE 20 DRIVERS FOR INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET AND THEIR IMPACT

- 5.2.2 RESTRAINTS

- 5.2.2.1 Significant initial capital investment and subsequent investment for maintenance

- 5.2.2.2 Fluctuations in end-use industries

- 5.2.2.3 Inability of components to achieve human-like performance

- 5.2.2.4 Lack of awareness of benefits

- FIGURE 21 RESTRAINTS FOR INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET AND THEIR IMPACT

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of Industry 4.0 principles for manufacturing

- 5.2.3.2 Increased demand for safety compliance automation solutions

- 5.2.3.3 Rising need for augmented reality and virtual reality technologies

- FIGURE 22 OPPORTUNITIES FOR INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET AND THEIR IMPACT

- 5.2.4 CHALLENGES

- 5.2.4.1 Absence of standardization in industrial communication protocols and interfaces

- 5.2.4.2 Lack of skilled workforce to operate industrial automation devices and systems

- 5.2.4.3 Rising instances of automated cyberattacks

- 5.2.4.4 Less precise systems due to differences between simulations and real life

- 5.2.4.5 Complexity in deployment of industrial control & factory automation solutions

- FIGURE 23 CHALLENGES FOR INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET AND THEIR IMPACT

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 25 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: ECOSYSTEM

- TABLE 3 COMPANIES AND THEIR ROLE IN INDUSTRIAL CONTROL & FACTORY AUTOMATION ECOSYSTEM

- 5.5 PRICING ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE OF COMPONENTS OF INDUSTRIAL SAFETY SYSTEMS OFFERED BY TOP COMPANIES, 2021

- TABLE 5 INDICATIVE PRICES OF COMPONENTS OF INDUSTRIAL SAFETY SYSTEMS

- 5.5.1 AVERAGE SELLING PRICE OF COMPONENTS OFFERED BY KEY PLAYERS

- FIGURE 26 AVERAGE SELLING PRICE OF COMPONENTS OFFERED BY KEY PLAYERS

- TABLE 6 AVERAGE SELLING PRICE OF COMPONENTS OFFERED BY KEY PLAYERS (USD)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 ARTIFICIAL INTELLIGENCE

- 5.7.2 AUGMENTED REALITY

- 5.7.3 BLOCKCHAIN

- 5.7.4 5G

- 5.7.5 PREDICTIVE MAINTENANCE

- 5.7.6 SMART ENERGY MANAGEMENT

- 5.7.7 EDGE COMPUTING

- 5.7.8 PREDICTIVE SUPPLY CHAIN

- 5.7.9 CYBERSECURITY

- 5.7.10 DIGITAL TWIN

- 5.7.11 IOT

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- 5.9.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- TABLE 9 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- 5.10 CASE STUDY

- 5.10.1 WORLD WIDE FITTINGS, INC. ADOPTS MITSUBISHI ELECTRIC'S INDUSTRIAL ROBOTICS TO STREAMLINE OPERATIONS

- 5.10.2 BOMBARDIER TRANSPORTATION SELECTS ABB TO PROVIDE SCADA SYSTEM FOR BANGKOK'S MONORAIL PROJECT

- 5.10.3 COOPER TIRE ADOPTS ROCKWELL AUTOMATION'S MES SOLUTION FOR GREATER EFFICIENCY

- 5.10.4 RIO TINTO USES ROCKWELL AUTOMATION'S PROCESS CONTROL SYSTEM (PCS) FOR SEAMLESS INTEGRATION OF CRITICAL MINE PROCESSES

- 5.10.5 ARKEMA GROUP UPGRADES SYSTEMS WITH ABB'S SYSTEM 800XA ARCHITECTURE

- 5.11 TRADE ANALYSIS

- FIGURE 29 IMPORT DATA FOR INDUSTRIAL ROBOTS, 2017-2021 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR INDUSTRIAL ROBOTS, 2017-2021 (USD MILLION)

- 5.12 PATENTS ANALYSIS

- FIGURE 31 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

- FIGURE 32 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 10 TOP PATENT OWNERS IN LAST 10 YEARS (US)

- 5.12.1 MAJOR PATENTS

- 5.13 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 11 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: CONFERENCES & EVENTS

- 5.14 DIGITALIZATION IN INDUSTRIAL CONTROL

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS

- TABLE 16 MAJOR COMMUNICATION STANDARDS FOR SCADA SYSTEMS

- TABLE 17 INDUSTRIAL SAFETY STANDARDS

6 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 33 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT

- FIGURE 34 INDUSTRIAL 3D PRINTING TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 18 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 19 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2 INDUSTRIAL ROBOTS

- 6.2.1 RISING NEED FOR ROBOTS TO IMPROVE PRODUCTIVITY AND EFFICIENCY

- 6.2.2 TRADITIONAL INDUSTRIAL ROBOTS

- 6.2.2.1 Articulated robot

- 6.2.2.1.1 High payload capacity and reliability

- 6.2.2.2 Cartesian robot

- 6.2.2.2.1 Simple to control and easy to program

- 6.2.2.3 Selective compliance assembly robot arm (SCARA)

- 6.2.2.3.1 Best price-to-performance ratio

- 6.2.2.4 Parallel robot

- 6.2.2.4.1 Well-suited to high-speed applications

- 6.2.2.5 Other robots

- 6.2.2.1 Articulated robot

- 6.2.3 COLLABORATIVE ROBOTS

- 6.2.3.1 Designed to safely work alongside humans

- TABLE 20 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 21 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 22 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 23 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 24 TRADITIONAL INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 25 TRADITIONAL INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 26 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 27 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PAYLOAD, 2022-2027 (USD MILLION)

- TABLE 28 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 29 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 30 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 31 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 32 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 33 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 34 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 INDUSTRIAL ROBOTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 MACHINE VISION SYSTEMS

- 6.3.1 GROWING NEED FOR INSPECTION OF MANUFACTURED PARTS

- TABLE 36 MACHINE VISION SYSTEMS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 37 MACHINE VISION SYSTEMS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- TABLE 38 MACHINE VISION SYSTEMS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 39 MACHINE VISION SYSTEMS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 40 MACHINE VISION SYSTEMS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY HARDWARE, 2018-2021 (USD MILLION)

- TABLE 41 MACHINE VISION SYSTEMS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- TABLE 42 MACHINE VISION SYSTEMS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 43 MACHINE VISION SYSTEMS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 44 MACHINE VISION SYSTEMS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 45 MACHINE VISION SYSTEM: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 46 MACHINE VISION SYSTEM: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 MACHINE VISION SYSTEM: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.2 CAMERAS

- 6.3.2.1 Analog camera

- 6.3.2.1.1 Growing demand for security and surveillance

- 6.3.2.2 Digital camera

- 6.3.2.2.1 Increasing need for high-resolution cameras

- 6.3.2.3 Smart camera

- 6.3.2.3.1 Provides simultaneous image capturing and real-time information

- 6.3.2.1 Analog camera

- 6.3.3 FRAME GRABBERS, OPTICS, AND LED LIGHTING

- 6.3.3.1 Processors and software

- 6.3.3.1.1 Integral parts of machine vision systems

- 6.3.3.1 Processors and software

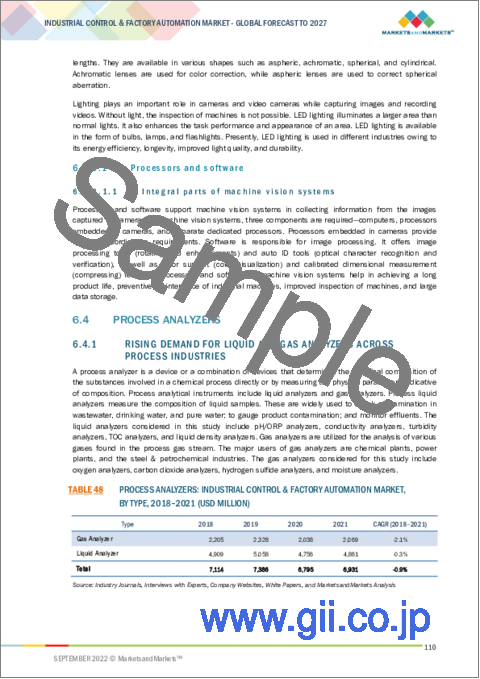

- 6.4 PROCESS ANALYZERS

- 6.4.1 RISING DEMAND FOR LIQUID AND GAS ANALYZERS ACROSS PROCESS INDUSTRIES

- TABLE 48 PROCESS ANALYZERS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 49 PROCESS ANALYZERS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 50 LIQUID ANALYZER: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 51 LIQUID ANALYZER: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 52 GAS ANALYZER: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 53 GAS ANALYZER: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 54 PROCESS ANALYZERS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 55 PROCESS ANALYZERS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 56 PROCESS ANALYZERS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 57 PROCESS ANALYZERS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 58 PROCESS ANALYZERS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 59 PROCESS ANALYZERS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 FIELD INSTRUMENTS

- 6.5.1 GROWING NEED TO MONITOR PARAMETERS

- 6.5.2 FLOWMETER

- 6.5.2.1 Increasing use in water & wastewater and chemical industries

- 6.5.3 TRANSMITTER

- 6.5.3.1 Facilitates quick response time and efficient communication

- TABLE 60 TYPES OF TRANSMITTERS USED IN FIELD INSTRUMENTS

- 6.5.3.2 Pressure transmitter

- 6.5.3.2.1 Growing use in chemicals and pharmaceutical industries

- 6.5.3.3 Temperature transmitter

- 6.5.3.3.1 Versatile field instrument for use across industries

- 6.5.3.4 Level transmitter

- 6.5.3.4.1 Increasing adoption in oil & gas and chemical industries

- 6.5.3.2 Pressure transmitter

- TABLE 61 FIELD INSTRUMENTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 62 FIELD INSTRUMENTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 63 FIELD INSTRUMENTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 64 FIELD INSTRUMENTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 65 FIELD INSTRUMENTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 66 FIELD INSTRUMENTS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.6 HUMAN-MACHINE INTERFACE (HMI)

- 6.6.1 ENHANCES EFFICIENCY AND IMPROVES RELIABILITY OF MACHINES

- TABLE 67 HMI: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 68 HMI: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 69 HMI: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 70 HMI: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 71 HMI: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 72 HMI: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.7 INDUSTRIAL PC

- 6.7.1 RISING DEMAND DUE TO EXPANDIBILITY

- TABLE 73 INDUSTRIAL PC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 74 INDUSTRIAL PC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 75 INDUSTRIAL PC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 76 INDUSTRIAL PC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 77 INDUSTRIAL PC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 78 INDUSTRIAL PC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.8 INDUSTRIAL SENSORS

- 6.8.1 ENSURE CONNECTIVITY IN MANUFACTURING PLANTS

- 6.8.2 INDUSTRIAL SENSORS, BY TYPE

- 6.8.2.1 Wired industrial sensors

- 6.8.2.2 Wireless industrial sensors

- TABLE 79 INDUSTRIAL SENSORS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SENSOR TYPE, 2018-2021 (USD MILLION)

- TABLE 80 INDUSTRIAL SENSORS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SENSOR TYPE, 2022-2027 (USD MILLION)

- TABLE 81 INDUSTRIAL SENSORS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 82 INDUSTRIAL SENSORS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 83 INDUSTRIAL SENSORS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 84 INDUSTRIAL SENSORS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 85 INDUSTRIAL SENSORS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 86 INDUSTRIAL SENSORS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 87 INDUSTRIAL SENSORS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 88 INDUSTRIAL SENSORS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.9 INDUSTRIAL 3D PRINTING

- 6.9.1 IDEAL FOR MANUFACTURING PARTS WITH COMPLEX DESIGNS

- TABLE 89 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 90 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 91 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 92 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 93 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS, 2018-2021 (USD MILLION)

- TABLE 94 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS, 2022-2027 (USD MILLION)

- TABLE 95 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 96 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 97 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 98 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 99 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 100 INDUSTRIAL 3D PRINTING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.10 VIBRATION MONITORING

- 6.10.1 HIGH DEMAND IN OIL & GAS INDUSTRY TO MONITOR CRITICAL EQUIPMENT

- TABLE 101 VIBRATION MONITORING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 102 VIBRATION MONITORING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 103 VIBRATION MONITORING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY MONITORING PROCESS, 2018-2021 (USD MILLION)

- TABLE 104 VIBRATION MONITORING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY MONITORING PROCESS, 2022-2027 (USD MILLION)

- TABLE 105 VIBRATION MONITORING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 106 VIBRATION MONITORING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 107 VIBRATION MONITORING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 108 VIBRATION MONITORING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 109 VIBRATION MONITORING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 110 VIBRATION MONITORING: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

7 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION

- 7.1 INTRODUCTION

- FIGURE 35 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION

- FIGURE 36 PAM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 111 FUNCTIONS OF SOLUTIONS USED IN MANUFACTURING INDUSTRIES

- TABLE 112 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION, 2018-2021 (USD MILLION)

- TABLE 113 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- 7.2 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

- 7.2.1 RISING ADOPTION FOR REMOTE CONTROL OF OPERATIONS

- FIGURE 37 SCOPE OF SCADA IN INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET

- TABLE 114 SCADA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 115 SCADA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 116 SCADA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 117 SCADA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 118 SCADA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 119 SCADA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 120 SCADA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 121 SCADA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 PROGRAMMABLE LOGIC CONTROLLER (PLC)

- 7.3.1 GROWING INTEGRATION OF FUNCTIONS WITH PLC PLATFORMS

- FIGURE 38 ADVANTAGES OF PLC

- TABLE 122 PLC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 123 PLC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 124 PLC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 125 PLC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 126 PLC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 127 PLC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 DISTRIBUTED CONTROL SYSTEM (DCS)

- 7.4.1 RISING DEMAND FOR DCS TO INCREASE PRODUCTION EFFICIENCY ACROSS INDUSTRIES

- FIGURE 39 BENEFITS OF DCS IN INDUSTRIAL PLANTS

- TABLE 128 DCS SYSTEMS OFFERED BY VARIOUS COMPANIES

- TABLE 129 BENCHMARKING OF TOP 3 COMPANIES IN DCS MARKET

- TABLE 130 DCS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 131 DCS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 132 DCS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 133 DCS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 134 DCS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 135 DCS: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5 MANUFACTURING EXECUTION SYSTEM (MES)

- 7.5.1 OFFERS COST SAVINGS AND OPTIMIZATION OF OPERATIONS

- TABLE 136 MES: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 137 MES: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 138 MES: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DEPLOYMENT, 2018-2021 (USD MILLION)

- TABLE 139 MES: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DEPLOYMENT, 2022-2027 (USD MILLION)

- TABLE 140 MES: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 141 MES: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 142 MES: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 143 MES: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 144 MES: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 145 MES: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.6 INDUSTRIAL SAFETY

- 7.6.1 RISING NEED TO PREVENT HAZARDS AND RISKS ACROSS INDUSTRIES

- TABLE 146 SAFETY-RELATED STANDARDS

- TABLE 147 INDUSTRIAL SAFETY: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 148 INDUSTRIAL SAFETY: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 149 INDUSTRIAL SAFETY: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 150 INDUSTRIAL SAFETY: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 151 INDUSTRIAL SAFETY: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 152 INDUSTRIAL SAFETY: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 153 INDUSTRIAL SAFETY: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 154 INDUSTRIAL SAFETY: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.7 PLANT ASSET MANAGEMENT (PAM)

- 7.7.1 INCREASED ADOPTION TO REDUCE DOWNTIME AND WASTAGE IN MANUFACTURING PLANTS

- TABLE 155 PAM: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 156 PAM: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 157 PAM: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 158 PAM: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 159 PAM: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET FOR PAM, BY REGION, 2018-2021 (USD MILLION)

- TABLE 160 PAM: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET FOR PAM, BY REGION, 2022-2027 (USD MILLION)

8 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 40 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY INDUSTRY

- FIGURE 41 DISCRETE INDUSTRY SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 161 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 162 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 8.2 PROCESS INDUSTRY

- FIGURE 42 METALS & MINING INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 163 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 164 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY PROCESS INDUSTRY, 2022-2027 (USD MILLION)

- 8.2.1 OIL & GAS

- 8.2.1.1 Growing adoption of automation solutions at offshore locations

- 8.2.2 CHEMICAL

- 8.2.2.1 Need for enhanced safety and efficiency in production process

- 8.2.3 PULP & PAPER

- 8.2.3.1 Surging demand to optimize processes

- 8.2.4 PHARMACEUTICAL

- 8.2.4.1 Growing need to standardize manufacturing processes

- 8.2.5 METALS & MINING

- 8.2.5.1 Increasing deployment of automation to boost productivity and enhance workforce safety

- 8.2.6 FOOD & BEVERAGE

- 8.2.6.1 Growing need for improved material handling and lower production costs

- 8.2.7 ENERGY & POWER

- 8.2.7.1 Increasing adoption of automation for greater efficiency

- 8.2.8 OTHERS

- 8.3 DISCRETE INDUSTRY

- FIGURE 43 MEDICAL DEVICE INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 165 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 166 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY DISCRETE INDUSTRY, 2022-2027 (USD MILLION)

- 8.3.1 AUTOMOTIVE

- 8.3.1.1 Increasing demand for automation to enhance safety

- 8.3.2 MACHINE MANUFACTURING

- 8.3.2.1 Use of automated processes to reduce manufacturing time

- 8.3.3 SEMICONDUCTOR & ELECTRONICS

- 8.3.3.1 Demand for smart manufacturing techniques to meet diverse customer requirements

- 8.3.4 AEROSPACE & DEFENSE

- 8.3.4.1 Growing need for real-time visibility of manufacturing processes

- 8.3.5 MEDICAL DEVICE

- 8.3.5.1 Rising preference for innovative industrial control & factory automation solutions

- 8.3.6 OTHERS

9 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 44 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 167 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 168 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 46 SNAPSHOT: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET IN NORTH AMERICA

- TABLE 169 NORTH AMERICA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 170 NORTH AMERICA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 171 NORTH AMERICA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION, 2018-2021 (USD MILLION)

- TABLE 172 NORTH AMERICA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 173 NORTH AMERICA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 174 NORTH AMERICA: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Product launches by key players to drive market

- 9.2.2 CANADA

- 9.2.2.1 Growth in process industries to boost market

- 9.2.3 MEXICO

- 9.2.3.1 Increasing deployment of SCADA systems to modernize grids

- 9.3 EUROPE

- FIGURE 47 SNAPSHOT: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET IN EUROPE

- TABLE 175 EUROPE: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 176 EUROPE: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 177 EUROPE: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION, 2018-2021 (USD MILLION)

- TABLE 178 EUROPE: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 179 EUROPE: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 180 EUROPE: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.3.1 UK

- 9.3.1.1 Government support for development of IoT technologies

- 9.3.2 GERMANY

- 9.3.2.1 Growing technological innovation to facilitate market growth

- 9.3.3 FRANCE

- 9.3.3.1 Increasing government initiatives to promote industrial automation

- 9.3.4 ITALY

- 9.3.4.1 Rising adoption of automation solutions in industries

- 9.3.5 REST OF EUROPE

- 9.4 ASIA PACIFIC

- FIGURE 48 SNAPSHOT: INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET IN ASIA PACIFIC

- TABLE 181 ASIA PACIFIC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 182 ASIA PACIFIC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 183 ASIA PACIFIC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION, 2018-2021 (USD MILLION)

- TABLE 184 ASIA PACIFIC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 185 ASIA PACIFIC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 186 ASIA PACIFIC: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.4.1 JAPAN

- 9.4.1.1 Development of smart manufacturing processes to boost market

- 9.4.2 CHINA

- 9.4.2.1 Growing demand for automation to reduce costs

- 9.4.3 INDIA

- 9.4.3.1 Growing government initiatives for automation of industries

- 9.4.4 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD (ROW)

- FIGURE 49 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET IN ROW

- TABLE 187 ROW: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 188 ROW: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 189 ROW: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION, 2018-2021 (USD MILLION)

- TABLE 190 ROW: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 191 ROW: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 192 ROW: INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5.1 SOUTH AMERICA

- 9.5.1.1 Growing demand for automation in pharmaceutical industry

- 9.5.2 MIDDLE EAST & AFRICA

- 9.5.2.1 Mining operations in Africa offer potential for digitalization

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- TABLE 193 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET

- 10.2 REVENUE ANALYSIS OF TOP PLAYERS

- FIGURE 50 TOP PLAYERS IN INDUSTRIAL SAFETY MARKET, 2017-2021

- 10.3 MARKET SHARE ANALYSIS

- TABLE 194 INDUSTRIAL SAFETY MARKET: MARKET SHARE OF KEY COMPANIES

- 10.4 COMPANY EVALUATION QUADRANT, 2021

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- FIGURE 51 INDUSTRIAL SAFETY MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

- 10.5 SME EVALUATION QUADRANT, 2021

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- FIGURE 52 INDUSTRIAL SAFETY MARKET (GLOBAL): SME EVALUATION QUADRANT, 2021

- 10.6 INDUSTRIAL SAFETY MARKET: COMPANY FOOTPRINT

- TABLE 195 PRODUCT FOOTPRINT

- TABLE 196 INDUSTRY FOOTPRINT

- TABLE 197 REGIONAL FOOTPRINT

- TABLE 198 COMPANY FOOTPRINT

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 199 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: KEY START-UPS/SMES

- TABLE 200 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 10.8 COMPETITIVE SCENARIOS AND TRENDS

- 10.8.1 PRODUCT LAUNCHES

- TABLE 201 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2022

- 10.8.2 DEALS

- TABLE 202 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: DEALS, JANUARY 2021- JUNE 2022

- 10.8.3 OTHERS

- TABLE 203 INDUSTRIAL CONTROL & FACTORY AUTOMATION MARKET: OTHERS, APRIL 2021- JUNE 2022

11 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 11.1 KEY PLAYERS

- 11.1.1 ABB

- TABLE 204 ABB: BUSINESS OVERVIEW

- FIGURE 53 ABB: COMPANY SNAPSHOT

- TABLE 205 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 ABB: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 207 ABB: DEALS

- 11.1.2 EMERSON

- TABLE 208 EMERSON: BUSINESS OVERVIEW

- FIGURE 54 EMERSON: COMPANY SNAPSHOT

- TABLE 209 EMERSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 EMERSON: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 211 EMERSON: DEALS

- 11.1.3 SIEMENS

- TABLE 212 SIEMENS: BUSINESS OVERVIEW

- FIGURE 55 SIEMENS: COMPANY SNAPSHOT

- TABLE 213 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 SIEMENS: DEALS

- 11.1.4 SCHNEIDER ELECTRIC

- TABLE 215 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- FIGURE 56 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 216 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 218 SCHNEIDER ELECTRIC: DEALS

- 11.1.5 MITSUBISHI ELECTRIC

- TABLE 219 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

- FIGURE 57 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

- TABLE 220 MITSUBISHI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 MITSUBISHI ELECTRIC: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 222 MITSUBISHI ELECTRIC: OTHERS

- 11.1.6 GENERAL ELECTRIC CO.

- TABLE 223 GENERAL ELECTRIC CO.: BUSINESS OVERVIEW

- FIGURE 58 GENERAL ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 224 GENERAL ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 GENERAL ELECTRIC CO.: PRODUCT LAUNCHES

- 11.1.7 ROCKWELL AUTOMATION

- TABLE 226 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

- FIGURE 59 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- TABLE 227 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 ROCKWELL AUTOMATION: DEALS

- TABLE 229 ROCKWELL AUTOMATION: OTHERS

- 11.1.8 HONEYWELL

- TABLE 230 HONEYWELL: BUSINESS OVERVIEW

- FIGURE 60 HONEYWELL.: COMPANY SNAPSHOT

- TABLE 231 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 HONEYWELL: DEALS

- 11.1.9 YOKOGAWA ELECTRIC CORPORATION

- TABLE 233 YOKOGAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

- FIGURE 61 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 234 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 236 YOKOGAWA ELECTRIC CORPORATION: DEALS

- 11.1.10 OMRON CORPORATION

- TABLE 237 OMRON CORPORATION: BUSINESS OVERVIEW

- FIGURE 62 OMRON CORPORATION: COMPANY SNAPSHOT

- TABLE 238 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 OMRON CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 240 OMRON CORPORATION: DEALS

- TABLE 241 OMRON CORPORATION: OTHERS

- 11.1.11 ENDRESS+HAUSER

- TABLE 242 ENDRESS+HAUSER: BUSINESS OVERVIEW

- FIGURE 63 ENDRESS+HAUSER: COMPANY SNAPSHOT

- TABLE 243 ENDRESS+HAUSER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 ENDRESS+HAUSER: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 245 ENDRESS+HAUSER: OTHERS

- 11.1.12 FANUC CORPORATION

- TABLE 246 FANUC CORPORATION: BUSINESS OVERVIEW

- FIGURE 64 FANUC CORPORATION: COMPANY SNAPSHOT

- TABLE 247 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.13 WIKA GMBH

- TABLE 248 WIKA GMBH: BUSINESS OVERVIEW

- TABLE 249 WIKA GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 WIKA GMBH: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 251 WIKA GMBH: OTHERS

- 11.1.14 DWYER INSTRUMENTS

- TABLE 252 DWYER CORPORATION: BUSINESS OVERVIEW

- TABLE 253 DWYER INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 DWYER INSTRUMENTS: PRODUCT LAUNCHES AND DEVELOPMENTS

- 11.1.15 STRATASYS

- TABLE 255 STRATASYS: BUSINESS OVERVIEW

- FIGURE 65 STRATASYS: COMPANY SNAPSHOT

- TABLE 256 STRATASYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 STRATASYS: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 258 STRATASYS: DEALS

- 11.1.16 3D SYSTEMS CORPORATION

- TABLE 259 3D SYSTEMS CORPORATION: BUSINESS OVERVIEW

- FIGURE 66 3D SYSTEMS CORPORATION: COMPANY SNAPSHOT

- TABLE 260 3D SYSTEMS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 3D SYSTEMS CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 262 3D SYSTEMS CORPORATION: DEALS

- 11.2 OTHER KEY PLAYERS

- 11.2.1 FUJI ELECTRIC

- TABLE 263 FUJI ELECTRIC: COMPANY OVERVIEW

- 11.2.2 HITACHI

- TABLE 264 HITACHI: COMPANY OVERVIEW

- 11.2.3 KROHNE

- TABLE 265 KROHNE: COMPANY OVERVIEW

- 11.2.4 AZBIL CORPORATION

- TABLE 266 AZBIL CORPORATION: COMPANY OVERVIEW

- 11.2.5 VEGA GRIESHABER

- TABLE 267 VEGA GRIESHABER: COMPANY OVERVIEW

- 11.2.6 DANFOSS

- TABLE 268 DANFOSS: COMPANY OVERVIEW

- 11.3 OTHER PLAYERS

- 11.3.1 TEGAN INNOVATIONS

- TABLE 269 TEGAN INNOVATIONS: COMPANY OVERVIEW

- 11.3.2 WIN-911 SOFTWARE

- TABLE 270 WIN-911 SOFTWARE: COMPANY OVERVIEW

- 11.3.3 PINPOINT INFORMATION SYSTEMS

- TABLE 271 PINPOINT INFORMATION SYSTEMS: COMPANY OVERVIEW

- 11.3.4 PROGEA

- TABLE 272 PROGEA: COMPANY OVERVIEW

- 11.3.5 CHAOS PRIME

- TABLE 273 CHAOS PRIME: COMPANY OVERVIEW

- 11.3.6 INXPECT S.P.A.

- TABLE 274 INXPECT S.P.A.: COMPANY OVERVIEW

- 11.3.7 ALGOLUX

- TABLE 275 ALGOLUX: COMPANY OVERVIEW

- 11.3.8 INUITIVE

- TABLE 276 INUITIVE: COMPANY OVERVIEW

- 11.3.9 EAVE

- TABLE 277 EAVE: COMPANY OVERVIEW

- 11.3.10 CANARIA

- TABLE 278 CANARIA: COMPANY OVERVIEW

- 11.3.11 FUELICS

- TABLE 279 FUELICS: COMPANY OVERVIEW

- 11.3.12 ULTIMAKER

- TABLE 280 ULTIMAKER: COMPANY OVERVIEW

- 11.3.13 NANO DIMENSION

- TABLE 281 NANO DIMENSION: COMPANY OVERVIEW

- 11.3.14 DEEP LEARNING ROBOTICS

- TABLE 282 DEEP LEARNING ROBOTICS: COMPANY OVERVIEW

- 11.3.15 PICK-IT 3D

- TABLE 283 PICK-IT 3D: COMPANY OVERVIEW

- 11.3.16 ONROBOT

- TABLE 284 ONROBOT: COMPANY OVERVIEW

- 11.3.17 TRIVISION

- TABLE 285 TRIVISION: COMPANY OVERVIEW

- 11.3.18 CLEVEST

- TABLE 286 CLEVEST: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 DIGITAL TWIN MARKET, BY APPLICATION

- 12.3.1 INTRODUCTION

- TABLE 287 DIGITAL TWIN MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 288 DIGITAL TWIN MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4 PRODUCT DESIGN & DEVELOPMENT

- 12.4.1 USE OF DIGITAL TWINS TO MONITOR KEY PERFORMANCE INDICATORS IN REAL TIME

- TABLE 289 PRODUCT DESIGN & DEVELOPMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 290 PRODUCT DESIGN & DEVELOPMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 12.5 PERFORMANCE MONITORING

- 12.5.1 OPTIMIZES OPERATIONAL DOWNTIME AND MITIGATES COSTLY FAILURES

- TABLE 291 PERFORMANCE MONITORING: DIGITAL TWIN MARKET, 2018-2021 (USD MILLION)

- TABLE 292 PERFORMANCE MONITORING: DIGITAL TWIN MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 12.6 PREDICTIVE MAINTENANCE

- 12.6.1 DIGITAL TWINS PREDICT FAILURES BASED ON REAL-TIME DATA COLLECTION

- TABLE 293 PREDICTIVE MAINTENANCE: DIGITAL TWIN MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 294 PREDICTIVE MAINTENANCE: DIGITAL TWIN MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 12.7 INVENTORY MANAGEMENT

- 12.7.1 USE OF DIGITAL TWINS FOR INVENTORY OPTIMIZATION ACROSS NETWORKS

- TABLE 295 INVENTORY MANAGEMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 296 INVENTORY MANAGEMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 12.8 BUSINESS OPTIMIZATION

- 12.8.1 EXPECTED TO REGISTER HIGHEST GROWTH IN DIGITAL TWIN MARKET DURING FORECAST PERIOD

- TABLE 297 BUSINESS OPTIMIZATION: DIGITAL TWIN MARKET, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 298 BUSINESS OPTIMIZATION: DIGITAL TWIN MARKET, BY INDUSTRY, 2022-2027 (USD MILLION)

- 12.9 OTHER APPLICATIONS

- TABLE 299 OTHER APPLICATIONS: DIGITAL TWIN MARKET, BY INDUSTRY 2018-2021 (USD MILLION)

- TABLE 300 OTHER APPLICATIONS: DIGITAL TWIN MARKET, BY INDUSTRY 2022-2027 (USD MILLION)

13 APPENDIX

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS