|

|

市場調査レポート

商品コード

1223634

ドローン検査・監視の世界市場:ソリューション別 (プラットフォーム、ソフトウェア、インフラ、サービス)・種類別 (固定翼、マルチローター、ハイブリッド)・用途別 (建設・インフラ、農業)・操作モード別・地域別の将来予測 (2027年まで)Drone Inspection and Monitoring Market by Solution (Platform, Software, Infrastructure And Service), Type (Fixed Wing, Multirotor, Hybrid), Applications (Constructions & Infrastructure, Agriculture), Mode Of Operations & Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ドローン検査・監視の世界市場:ソリューション別 (プラットフォーム、ソフトウェア、インフラ、サービス)・種類別 (固定翼、マルチローター、ハイブリッド)・用途別 (建設・インフラ、農業)・操作モード別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年02月06日

発行: MarketsandMarkets

ページ情報: 英文 330 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のドローン検査・監視の市場規模は、2022年の105億米ドルから、2027年には213億米ドルに達し、2022年から2027年までの間に15.1%のCAGRで成長すると予測されます。

検査・監視用ドローンは、費用対効果や時間、データ取得のメリットから、物流、鉱業、農業、不動産、石油・ガスなど様々な産業で利用が進んでいます。

用途別では、建設・インフラ分野が今後 (2022年~2027年) 急速な成長を遂げると考えられています。

地域別に見ると、2022年には北米地域が最大のシェアを占める見通しです。資産監視や石油・ガス用途でのドローンの利用が増加しており、その調達が同地域のドローン検査・監視市場の成長に寄与すると見られています。

当レポートでは、世界のドローン検査・監視の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、ソリューション別・種類別・用途別・操作モード別・流通チャネル別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 平均販売価格

- バリューチェーン分析

- 市場エコシステムマップ

- 顧客のビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- 貿易データ統計

- 関税と規制の状況

- 主な利害関係者と購入基準

- 主な会議とイベント (2022年~2023年)

第6章 業界動向

- イントロダクション

- 技術動向

- ポイントクラウドで作成されたドローンデータ

- AI検査

- スワームドローン

- 自動ドローン

- 技術分析

- 水素動力

- 改良型コンピュータービジョンとモーションプランニング

- ドローンの休息と再充電のための新しい範囲

- 使用事例の分析

- メガトレンドの影響

- 環境・生態学の変化を監視するためのドローン

- IoT対応ドローン

- 急速な都市化

- イノベーションと特許登録

第7章 ドローン検査・監視市場:ソリューション別

- イントロダクション

- プラットホーム

- 機体

- アビオニクス

- 推進装置

- ソフトウェア

- ペイロード

- ソフトウェア

- ルート計画・最適化

- 在庫管理

- ライブトラッキング

- フリート管理

- コンピュータビジョン・物体検出

- インフラ

- 地上管制局

- 充電ステーション

- 起動・回復システム

- サービス

- ドローンプラットフォームサービス

第8章 ドローン検査・監視市場:種類別

- イントロダクション

- 固定翼機

- マルチローター

- ハイブリッド

第9章 ドローン検査・監視市場:用途別

- イントロダクション

- 建設・インフラ

- 橋梁

- 不動産

- 鉄道

- 農業

- 土壌・作物

- 健康評価

- 石油・ガス

- 上流工程

- 中流工程

- ユーティリティ

- 送電塔検査

- 送電

- 風力タービン

- 鉱業

- 備蓄

- 鉱滓ダム・採石場の検査

- その他

- 航空

- 野生生物・林業

- 保険

- ロジスティクス

第10章 ドローン検査・監視市場:操作モード別

- イントロダクション

- 遠隔操作

- 手動操作オプション

- 完全自律型

第11章 ドローン検査・監視市場:流通チャネル別

- イントロダクション

- オンライン

- オフライン

第12章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- イタリア

- ロシア

- スウェーデン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- 中東

- イスラエル

- トルコ

- アラブ首長国連邦

- 他の中東諸国

- 他の国々 (RoW)

- ラテンアメリカ

- アフリカ

第13章 競合情勢

- イントロダクション

- 企業概要

- ドローン検査・監視市場における主要企業の主な動向 (2018年~2021年)

- 主要企業のランキング分析 (2021年)

- 収益分析 (2021年)

- 市場シェア分析 (2021年)

- 競合評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合ベンチマーキング

第14章 企業プロファイル

- イントロダクション

- 主要企業

- INSITU

- DJI

- NORTHROP GRUMMAN CORPORATION

- TELEDYNE FLIR LLC

- PARROT DRONE SAS

- EHANG HOLDINGS LIMITED

- INTEL CORPORATION

- YUNEEC HOLDING LTD.

- ECA GROUP

- PRECISIONHAWK

- MICRODRONES

- SKYDIO

- AERIALTRONICS

- IDEAFORGE

- LOCKHEED MARTIN CORPORATION

- VIPER DRONES

- AGEAGLE AERIAL SYSTEMS INC.

- TERRA DRONE CORPORATION

- THYSSENKRUPP INDUSTRIAL SOLUTIONS AG

- DRONEGENUITY

- FORCE TECHNOLOGY

- WIPRO

- MISTRAS GROUP, INC.

- INTERTEK GROUP PLC

- AERODYNE GROUP

- その他の企業

- DRONEDEPLOY, INC.

- DRONEFLIGHT LTD.

- RELIABILITY MAINTENANCE SOLUTIONS LTD.

- DJM AERIAL SOLUTIONS LIMITED

- CANADIAN UAVS

- MAVERICK INSPECTION LTD.

- GARUDAUAV SOFT SOLUTIONS PVT. LTD.

- HEMAV

- RAPTOR MAPS, INC.

- AIRPIX

第15章 付録

The drone inspection and monitoring market is projected to grow from USD 10.5 Billion in 2022 to USD 21.3 Billion by 2027, at a CAGR of 15.1% from 2022 to 2027. Increasing demand for safe and accurate inspection & monitoring to drive the market growth during the forecast period.

Drones for inspection and monitoring have been increasingly used by various industries, such as logistics, mining, agriculture, real estate, oil & gas due to their cost-effective, timeless and data acquisition benefits. The conventional data acquisition and inspection methods are constrained by safety and time, often resulting in a shortage of detailed information for evaluation and monitoring. Extraordinary time efficiency, cost-effectiveness and high precision make drones a reliable data acquisition solution that can offer accurate results and synchronous monitoring for various end-use industry applications. The effective monitoring area of drones is nearly 100-10,0000 m2, and the corresponding error is about 2-20 cm.

Drones showcase significant potential in mining inspection and monitoring application at medium or large scales. Drones equipped with different payloads such as camera or sensor depending on application need. Such payloads gathered basic data which can help to perform various monitoring operations and, hence, are largely used in various applications, including ecological restoration assessment, pollution monitoring, land damage calculation, ecological & geological hazards monitoring, land reclamation activities, and terrain surveying and 3D modeling. Some of the popular drones currently available in the market for inspection and monitoring are DJI Matrice 300 RTK, DJI Matrice 210 v2, Flyability Elios 2, AceCore Zoe, DJI M600 containing PhaseOne imaging technology, DJI Mavic Enterprise, and Parrot Anafi.

In 2020, as per the National Safety council, construction sites had face high risks due to the human intervention in inspection process. So now, after the use of drone LiDAR to inspect fill levels, the risk has been reduced.

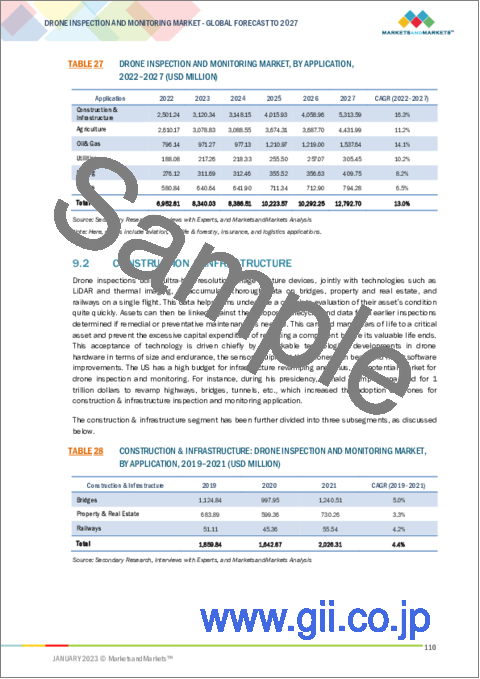

Based on application, construction & infrastructure to witness high growth during 2022-2027

Based on application, the drone inspection and monitoring market has been segmented into construction & infrastructure, agriculture, oil & gas, utilities, mining, and others. Among these construction & infrastructure is expected to grow at higher CAGR during the forecast period. Drone inspections utilize ultra-high-resolution image capture devices, jointly with technologies such as LiDAR and thermal imaging, to accumulate thorough data of bridges, property and real estate, and railways on a single flight. This data helps firms undertake a complete evaluation of their asset's condition quite quickly. Assets can then be linked against their proposed lifecycle, and data from earlier inspections determined if remedial or preventative maintenance is needed. This can add many years of life to a critical asset and prevent the excessive capital expenditure of replacing a component before its valuable life ends. This acceptance of technology is driven chiefly by remarkable technological developments in drone hardware in terms of size and endurance, the sensor equipment that drones can bear, and major software improvements. The US has a high budget for infrastructure revamping and, thus, is a potential market for drone inspection and monitoring. For instance, during his presidency, Donald Trump campaigned for 1 trillion dollars to revamp highways, bridges, tunnels, etc., which increased the adoption of drones for construction & infrastructure inspection and monitoring application.

The North America region dominated the market with largest share in 2022

North America is estimated to account for largest share in 2022. With the increased use of drones for asset monitoring and oil and gas applications, their procurement is expected to contribute to the growth of the drone inspection and monitoring market in this region. The US and Canada are increasingly investing in the development of drones owing to their surging demand for various applications.

Major players in the drone inspection and monitoring market are Intel Corporation (US), Lockheed Martin Corporation (US), Wipro (India), Intertek Group plc (UK), and MISTRAS Group, Inc. (US). These companies adopted strategies including product and service launches, contracts, partnerships, agreements, and expansions to sustain their position in the market. Also focusing on expanding distribution networks in North America, Europe, Asia Pacific, Middle East and Rest of the World in turn driving the demand for drone inspection and monitoring market.

Research Coverage

This research report categorizes classified the drone inspection and monitoring market into solution, type, application, mode of operation, distribution channel, and region. The drone inspection and monitoring market has been studied for North America, Europe, Asia Pacific, Middle and Rest of the World.

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the drone inspection and monitoring market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches associated with the drone inspection and monitoring market. Competitive analysis of upcoming startups in the drone inspection and monitoring market ecosystem is covered in this report.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall drone inspection and monitoring market and its segments. This study is also expected to provide application-wise information about the end-use industrial sectors, wherein fixed-wing, multirotor, and hybrid drones are used for various industry inspection and monitoring. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on drone inspection and monitoring system offered by the top players in the market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product and services launches in the drone inspection and monitoring market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the drone inspection and monitoring market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the drone inspection and monitoring market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the drone inspection and monitoring market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DRONE INSPECTION AND MONITORING MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 REGIONAL SCOPE

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 DRONE INSPECTION AND MONITORING MARKET: INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 MARKET STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 DRONE INSPECTION AND MONITORING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Primary sources

- 2.1.2.4 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 RECESSION IMPACT ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- FIGURE 5 GLOBAL DRONE INVESTMENT VALUE (USD MILLION), 2015-2021

- 2.2.2 SUPPLY-SIDE INDICATORS

- FIGURE 6 HALF-YEAR RESULT OF TOP FIVE PLAYERS, 2019-2022

- 2.3 FACTOR ANALYSIS

- 2.3.1 INTRODUCTION

- 2.3.2 DEMAND-SIDE INDICATORS

- 2.3.3 SUPPLY-SIDE INDICATORS

- 2.4 MARKET SIZE ESTIMATION

- 2.5 RESEARCH APPROACH AND METHODOLOGY

- 2.5.1 BOTTOM-UP APPROACH

- 2.5.1.1 Platform market approach

- 2.5.1.2 Software market approach

- 2.5.1.3 Infrastructure market approach

- 2.5.1.4 Services market approach

- 2.5.1.5 Regional split of drone inspection and monitoring market

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.5.2 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.5.1 BOTTOM-UP APPROACH

- 2.6 TRIANGULATION AND VALIDATION

- 2.6.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- FIGURE 9 DATA TRIANGULATION

- 2.7 RESEARCH ASSUMPTIONS

- FIGURE 10 ASSUMPTIONS FOR RESEARCH STUDY

- 2.7.1 ASSUMPTIONS USED IN MARKET SIZING AND FORECAST

- 2.8 LIMITATIONS

- 2.9 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 11 BY TYPE, HYBRID SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 BY MODE OF OPERATION, OPTIONALLY PILOTED SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 13 BY APPLICATION, AGRICULTURE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

- FIGURE 14 DRONE INSPECTION AND MONITORING MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN DRONE INSPECTION AND MONITORING MARKET

- FIGURE 15 IMPROVEMENT IN REGULATORY FRAMEWORK TO DRIVE MARKET GROWTH FROM 2022 TO 2027

- 4.2 DRONE INSPECTION AND MONITORING MARKET, BY TYPE

- FIGURE 16 BY TYPE, MULTIROTOR SEGMENT EXPECTED TO LEAD DRONE INSPECTION AND MONITORING MARKET FROM 2022 TO 2027

- 4.3 DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION

- FIGURE 17 BY APPLICATION, CONSTRUCTION & INFRASTRUCTURE SEGMENT PROJECTED TO DRIVE MARKET FROM 2022 TO 2027

- 4.4 DRONE INSPECTION AND MONITORING MARKET, BY MODE OF OPERATION

- FIGURE 18 BY MODE OF OPERATION, OPTIONALLY PILOTED DRONE SEGMENT FORECASTED TO ACCOUNT FOR MOST SIGNIFICANT MARKET SHARE FROM 2022 TO 2027

- 4.5 DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION

- FIGURE 19 BY SOLUTION, SERVICES SEGMENT FORECASTED TO LEAD MARKET FROM 2022 TO 2027

- 4.6 DRONE INSPECTION AND MONITORING MARKET, BY DISTRIBUTION CHANNEL

- FIGURE 20 BY DISTRIBUTION CHANNEL, OFFLINE SEGMENT ESTIMATED TO BOOST MARKET FROM 2022 TO 2027

- 4.7 DRONE INSPECTION AND MONITORING MARKET, BY REGION

- FIGURE 21 NORTH AMERICA ESTIMATED TO LEAD MARKET IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DRONE INSPECTION AND MONITORING MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in demand for safe and accurate inspection & monitoring

- 5.2.1.2 Increased cost-saving and human safety

- 5.2.1.3 Rise in usage of drones as remote visual inspection (RVI) tools for critical infrastructure applications

- TABLE 3 COST COMPARISON: DRONE VS. UNDER-BRIDGE INSPECTION VEHICLES

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of skilled personnel to operate drones for inspection & monitoring applications

- 5.2.2.2 Issues with drone safety and security

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technology advancements in drones

- 5.2.3.2 Advancements in LiDAR technology for commercial drones

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory hurdles and budgetary & other constraints

- 5.2.4.2 Limited flight endurance & payload capacity

- 5.3 AVERAGE SELLING PRICE

- TABLE 4 AVERAGE SELLING PRICE OF DRONES, BY APPLICATION

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN: DRONE INSPECTION AND MONITORING MARKET

- 5.5 MARKET ECOSYSTEM MAP

- FIGURE 24 DRONE INSPECTION AND MONITORING MARKET ECOSYSTEM MAP

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DRONE INSPECTION AND MONITORING MARKET

- FIGURE 25 REVENUE SHIFT CURVE FOR DRONE INSPECTION AND MONITORING MARKET

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 PORTER'S FIVE FORCES ANALYSIS FOR DRONE INSPECTION AND MONITORING MARKET

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 TRADE DATA STATISTICS

- TABLE 5 LIST OF IMPORTERS FOR PRODUCT: 880211 HELICOPTERS OF AN UNLADEN WEIGHT <= 2,000 KG

- TABLE 6 LIST OF EXPORTERS FOR PRODUCT: 880211 HELICOPTERS OF AN UNLADEN WEIGHT <= 2,000 KG

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- TABLE 7 HSN CODE AND GST RATE FOR AIRCRAFT AND UAV DRONES-HSN CHAPTER 88

- TABLE 8 2019 DUTY RATES FOR DRONES AND THEIR ACCESSORIES IN NORTH AMERICA

- TABLE 9 US: RULES AND GUIDELINES BY FAA FOR OPERATION OF DRONES

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SOLUTIONS

- TABLE 10 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE SOLUTIONS (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE SOLUTIONS

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE SOLUTIONS

- 5.11 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 12 CONFERENCES & EVENTS: 2022-2024

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 DRONE DATA CREATED WITH POINT CLOUD

- 6.2.2 AI INSPECTION

- 6.2.3 SWARM DRONES

- 6.2.4 AUTOMATED DRONES

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 HYDROGEN POWER

- 6.3.2 IMPROVED COMPUTER VISION AND MOTION PLANNING

- 6.3.3 NEW SCOPE FOR DRONE REST AND RECHARGE

- 6.4 USE CASE ANALYSIS

- 6.4.1 USE OF DRONES FOR ROOF INSPECTION

- 6.4.2 TUV NORD USES DRONES FOR INSPECTION OF WIND TURBINES

- 6.4.3 NEW YORK (US) STATE POWER USES DRONES FOR POWER LINE INSPECTION

- 6.5 IMPACT OF MEGATRENDS

- 6.5.1 DRONES FOR MONITORING ENVIRONMENTAL AND ECOLOGICAL CHANGES

- 6.5.2 IOT-ENABLED DRONES

- 6.5.3 RAPID URBANIZATION

- FIGURE 29 NDT-UAV APPLICATIONS IN BRIDGE CONDITION MONITORING

- 6.6 INNOVATION & PATENT REGISTRATIONS

- TABLE 13 IMPORTANT INNOVATIONS & PATENT REGISTRATIONS, 2015-2022

7 DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION

- 7.1 INTRODUCTION

- FIGURE 30 SERVICES SEGMENT TO LEAD MARKET SHARE DURING FORECAST PERIOD

- TABLE 14 DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 15 DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- 7.2 PLATFORM

- TABLE 16 DRONE INSPECTION AND MONITORING MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 17 DRONE INSPECTION AND MONITORING MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 7.2.1 AIRFRAME

- 7.2.1.1 Usage of composite materials for lightweight airframes with better flight time to drive market

- 7.2.2 AVIONICS

- 7.2.2.1 Multi-function capabilities of avionics systems to drive market

- 7.2.3 PROPULSION

- 7.2.3.1 Extensive R&D on drone propulsion systems to drive market

- 7.2.4 SOFTWARE

- 7.2.4.1 Rapid data processing with drone software to drive market

- 7.2.5 PAYLOAD

- 7.2.5.1 Rising demand for drones in commercial and military sectors to drive segment

- TABLE 18 DRONE INSPECTION AND MONITORING MARKET, BY PAYLOAD, 2019-2021 (USD MILLION)

- TABLE 19 DRONE INSPECTION AND MONITORING MARKET, BY PAYLOAD, 2022-2027 (USD MILLION)

- 7.2.5.2 Photogrammetry

- 7.2.5.2.1 High-resolution cameras

- 7.2.5.2.2 Thermal cameras

- 7.2.5.2.3 Multispectral cameras

- 7.2.5.3 LiDAR

- 7.2.5.2 Photogrammetry

- 7.3 SOFTWARE

- 7.3.1 ROUTE PLANNING & OPTIMIZATION

- 7.3.1.1 Innovations in route planning software, self-learning algorithms, & auto-flight systems to boost demand for software

- 7.3.2 INVENTORY MANAGEMENT

- 7.3.2.1 Use of machine learning algorithms to process results

- 7.3.3 LIVE TRACKING

- 7.3.3.1 Real-time tracking enables accuracy in data analysis

- 7.3.4 FLEET MANAGEMENT

- 7.3.4.1 Diligent monitoring of inventory, assets, and productivity requires single software platform

- 7.3.5 COMPUTER VISION & OBJECT DETECTION

- 7.3.5.1 Computer vision backed with machine learning and deep learning algorithms to enhance drone industry

- 7.3.1 ROUTE PLANNING & OPTIMIZATION

- 7.4 INFRASTRUCTURE

- TABLE 20 DRONE INSPECTION AND MONITORING MARKET, BY INFRASTRUCTURE, 2019-2021 (USD MILLION)

- TABLE 21 DRONE INSPECTION AND MONITORING MARKET, BY INFRASTRUCTURE, 2022-2027 (USD MILLION)

- 7.4.1 GROUND CONTROL STATIONS

- 7.4.1.1 Efficiency of GCS in controlling drones and their payloads to drive market

- 7.4.2 CHARGING STATIONS

- 7.4.2.1 Vital for uninterrupted drone operations

- 7.4.3 LAUNCH & RECOVERY SYSTEMS

- 7.4.3.1 Ability to provide extra support to drone users during takeoff and landing to drive market

- 7.5 SERVICES

- 7.5.1 DRONE PLATFORM SERVICES

- 7.5.1.1 Rapid urbanization and industrialization to drive market

- TABLE 22 DRONE INSPECTION AND MONITORING MARKET, BY DRONE PLATFORM SERVICES, 2019-2021 (USD MILLION)

- TABLE 23 DRONE INSPECTION AND MONITORING MARKET, BY DRONE PLATFORM SERVICES, 2022-2027 (USD MILLION)

- 7.5.1.2 Flights (piloting & operations)

- 7.5.1.3 Data analysis

- 7.5.1.4 Data processing (deliverables)

- 7.5.1.4.1 Thermal mapping & modeling

- 7.5.1.4.2 3D models

- 7.5.1.4.3 2D models & imagery (digital terrain, contour maps, point clouds, and elevation models)

- 7.5.1 DRONE PLATFORM SERVICES

8 DRONE INSPECTION AND MONITORING MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 31 HYBRID TYPE TO RECORD HIGHEST GROWTH DURING 2022-2027

- TABLE 24 DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 25 DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.2 FIXED-WING

- 8.2.1 GROWING DEMAND IN MINING SECTOR OWING TO LONGER FLIGHT TIME TO DRIVE MARKET

- 8.3 MULTIROTOR

- 8.3.1 CONTRIBUTES TO LARGEST MARKET SHARE DURING FORECAST PERIOD

- 8.4 HYBRID

- 8.4.1 BETTER PAYLOAD CAPACITY AND ENDURANCE THAN NON-HYBRID DRONES TO DRIVE MARKET GROWTH

9 DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 32 CONSTRUCTION & INFRASTRUCTURE TO WITNESS HIGH GROWTH DURING 2022-2027

- TABLE 26 DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 27 DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2 CONSTRUCTION & INFRASTRUCTURE

- TABLE 28 CONSTRUCTION & INFRASTRUCTURE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 29 CONSTRUCTION & INFRASTRUCTURE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2.1 BRIDGES

- 9.2.1.1 High-quality 3D images obtained from drones to help in bridge maintenance and rehabilitation

- 9.2.2 PROPERTY & REAL ESTATE

- 9.2.2.1 Thorough and rapid assessment with drones significantly helps save money and time

- 9.2.3 RAILWAYS

- 9.2.3.1 Rising demand in Asia Pacific and North America to drive market

- 9.3 AGRICULTURE

- TABLE 30 DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE, 2019-2021 (USD MILLION)

- TABLE 31 DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE, 2022-2027 (USD MILLION)

- 9.3.1 SOIL & CROP

- 9.3.1.1 High-quality drone data and photogrammetry to provide farmers with all advantages accessible

- 9.3.2 HEALTH ASSESSMENT

- 9.3.2.1 Usage of multispectral and infrared thermal sensors boosts tree disease inspection and prevention

- 9.4 OIL & GAS

- TABLE 32 DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS, 2019-2021 (USD MILLION)

- TABLE 33 DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS, 2022-2027 (USD MILLION)

- 9.4.1 UPSTREAM

- 9.4.1.1 Advanced drone technology leads to faster inspection and reduced downtime

- 9.4.2 MIDSTREAM

- 9.4.2.1 Cost-effective and accurate inspection possible with drones

- 9.5 UTILITIES

- TABLE 34 DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES, 2019-2021 (USD MILLION)

- TABLE 35 DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES, 2022-2027 (USD MILLION)

- 9.5.1 TOWER INSPECTION

- 9.5.1.1 Drones outfitted with thermal and UV cameras to drive market

- 9.5.2 POWER TRANSMISSION

- 9.5.2.1 Close-up photography/videography using drone-based inspection & monitoring to drive segment

- 9.5.3 WIND TURBINE

- 9.5.3.1 Timeliness, cost-effectiveness, and accuracy of drones in inspecting and monitoring wind turbines to boost market

- 9.6 MINING

- TABLE 36 DRONE INSPECTION AND MONITORING MARKET, BY MINING, 2019-2021 (USD MILLION)

- TABLE 37 DRONE INSPECTION AND MONITORING MARKET, BY MINING, 2022-2027 (USD MILLION)

- 9.6.1 STOCKPILE

- 9.6.1.1 Accurate and rapid inspection possible with drones

- 9.6.2 TAILING DAMS & QUARRY INSPECTION

- 9.6.2.1 Cost-effective, quick, and high-quality orthoimages captured with drones to drive this segment

- 9.7 OTHERS

- TABLE 38 DRONE INSPECTION AND MONITORING MARKET, BY OTHERS, 2019-2021 (USD MILLION)

- TABLE 39 DRONE INSPECTION AND MONITORING MARKET, BY OTHERS, 2022-2027 (USD MILLION)

- 9.7.1 AVIATION

- 9.7.1.1 Use of high-level technologies for inspection and monitoring aircraft to boost market growth

- 9.7.2 WILDLIFE & FORESTRY

- 9.7.2.1 Cost-effective and rapid inspection & monitoring with drones to drive this segment

- 9.7.3 INSURANCE

- 9.7.3.1 Increasing demand for drones in commercial sector to boost market growth

- 9.7.4 LOGISTICS

- 9.7.4.1 Easy approval for indoor drones compared with outdoor ones and rising demand in warehouse and logistics industries

10 DRONE INSPECTION AND MONITORING MARKET, BY MODE OF OPERATION

- 10.1 INTRODUCTION

- FIGURE 33 OPTIONALLY PILOTED SEGMENT PROJECTED TO HOLD LEADING SHARE DURING FORECAST PERIOD

- TABLE 40 DRONE INSPECTION AND MONITORING MARKET, BY MODE OF OPERATION, 2019-2021 (USD MILLION)

- TABLE 41 DRONE INSPECTION AND MONITORING MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- 10.2 REMOTELY PILOTED

- 10.2.1 DEMAND FOR REMOTELY PILOTED DRONES IN CONSTRUCTION SECTOR TO DRIVE GROWTH

- 10.3 OPTIONALLY PILOTED

- 10.3.1 OPTIONALLY PILOTED DRONES WIDELY USED IN AGRICULTURAL SECTOR

- 10.4 FULLY AUTONOMOUS

- 10.4.1 FULLY AUTONOMOUS DRONES EXPECTED TO WITNESS HIGH DEMAND

11 DRONE INSPECTION AND MONITORING MARKET, BY DISTRIBUTION CHANNEL

- 11.1 INTRODUCTION

- FIGURE 34 OFFLINE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 42 DRONE INSPECTION AND MONITORING MARKET, BY DISTRIBUTION CHANNEL, 2019-2021 (USD MILLION)

- TABLE 43 DRONE INSPECTION AND MONITORING MARKET, BY DISTRIBUTION CHANNEL, 2022-2027 (USD MILLION)

- 11.2 ONLINE

- 11.2.1 ONLINE DISTRIBUTION CHANNELS TO DRIVE SALE OF DRONES

- 11.3 OFFLINE

- 11.3.1 OFFLINE DISTRIBUTION CHANNELS TO NULLIFY WAITING TIME FOR DELIVERY OF PRODUCTS

12 REGIONAL ANALYSIS

- 12.1 INTRODUCTION

- FIGURE 35 DRONE INSPECTION AND MONITORING MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 44 REVENUE IMPACT ANALYSIS

- TABLE 45 DRONE INSPECTION AND MONITORING MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 46 DRONE INSPECTION AND MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 36 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET SNAPSHOT

- TABLE 47 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 48 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 50 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 52 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2019-2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2022-2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICE, 2019-2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY CONSTRUCTION & INFRASTRUCTURE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY CONSTRUCTION & INFRASTRUCTURE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 64 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES APPLICATION, 2019-2021 (USD MILLION)

- TABLE 66 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES APPLICATION, 2022-2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS APPLICATION, 2019-2021 (USD MILLION)

- TABLE 68 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS APPLICATION, 2022-2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY MINING APPLICATION, 2019-2021 (USD MILLION)

- TABLE 70 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY MINING APPLICATION, 2022-2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY OTHER APPLICATIONS, 2019-2021 (USD MILLION)

- TABLE 72 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY OTHER APPLICATIONS, 2022-2027 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Increase in investment in development of inspection drones to drive market in US

- TABLE 73 US: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 74 US: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 75 US: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 76 US: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Increase in demand for inspection services for commercial and defense applications to boost market in Canada

- TABLE 77 CANADA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 78 CANADA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 79 CANADA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 80 CANADA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 PESTLE ANALYSIS: EUROPE

- FIGURE 37 EUROPE: DRONE INSPECTION AND MONITORING MARKET SNAPSHOT

- TABLE 81 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 82 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 83 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 84 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 85 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 86 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 87 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2019-2021 (USD MILLION)

- TABLE 88 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2022-2027 (USD MILLION)

- TABLE 89 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2019-2021 (USD MILLION)

- TABLE 90 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 91 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 92 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 93 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 94 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 95 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY CONSTRUCTION & INFRASTRUCTURE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 96 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY CONSTRUCTION & INFRASTRUCTURE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 97 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 98 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE APPLICATION, 2022-2027 (USD MILLION)

- TABLE 99 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES APPLICATION, 2019-2021 (USD MILLION)

- TABLE 100 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES APPLICATION, 2022-2027 (USD MILLION)

- TABLE 101 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS APPLICATION, 2019-2021 (USD MILLION)

- TABLE 102 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS APPLICATION, 2022-2027 (USD MILLION)

- TABLE 103 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY MINING APPLICATION, 2019-2021 (USD MILLION)

- TABLE 104 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY MINING APPLICATION, 2022-2027 (USD MILLION)

- TABLE 105 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY OTHER APPLICATIONS, 2019-2021 (USD MILLION)

- TABLE 106 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY OTHER APPLICATIONS, 2022-2027 (USD MILLION)

- 12.3.2 UK

- 12.3.2.1 Technological advancements and changing regulatory policies to drive market in UK

- TABLE 107 UK: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 108 UK: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 109 UK: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 110 UK: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Rising adoption of drones for inspection and monitoring to boost market growth in France

- TABLE 111 FRANCE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 112 FRANCE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 113 FRANCE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 114 FRANCE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.4 GERMANY

- 12.3.4.1 Drone Innovation Hub to promote drone industry in Germany

- TABLE 115 GERMANY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 116 GERMANY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 117 GERMANY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 118 GERMANY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Rising instances of PV monitoring and oil & gas inspection to drive demand

- TABLE 119 ITALY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 120 ITALY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 121 ITALY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 122 ITALY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.6 RUSSIA

- 12.3.6.1 Increased use of monitoring and inspection services to drive demand

- TABLE 123 RUSSIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 124 RUSSIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 125 RUSSIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 126 RUSSIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.7 SWEDEN

- 12.3.7.1 Growing procurement of UAVs for military applications in Sweden

- TABLE 127 SWEDEN: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 128 SWEDEN: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 129 SWEDEN: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 130 SWEDEN: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.3.8 REST OF EUROPE

- TABLE 131 REST OF EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 132 REST OF EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 133 REST OF EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 134 REST OF EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- 12.4.1.1 Environmental

- FIGURE 38 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET SNAPSHOT

- TABLE 135 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 136 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 137 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 138 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 139 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 140 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 141 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2019-2021 (USD MILLION)

- TABLE 142 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2022-2027 (USD MILLION)

- TABLE 143 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2019-2021 (USD MILLION)

- TABLE 144 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 145 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 146 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 148 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR AGRICULTURE, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 152 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR AGRICULTURE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 153 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR UTILITIES, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 154 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR UTILITIES, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 155 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR OIL & GAS, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 156 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR OIL & GAS, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 157 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR MINING, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 158 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR MINING, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 159 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR OTHERS, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 160 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR OTHERS, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Presence of major drone manufacturers to drive market in China

- TABLE 161 CHINA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 162 CHINA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 163 CHINA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 164 CHINA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.3 JAPAN

- 12.4.3.1 Increasing use of agricultural drones for monitoring, spraying, and surveying applications in Japan

- TABLE 165 JAPAN: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 166 JAPAN: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 167 JAPAN: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 168 JAPAN: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.4 INDIA

- 12.4.4.1 Increasing demand for drone monitoring services leading to indigenous development of drones in India

- TABLE 169 INDIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 170 INDIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 171 INDIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 172 INDIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.5 AUSTRALIA

- 12.4.5.1 Growing use of UAVs for inspection and monitoring of mines and oilfields in Australia

- TABLE 173 AUSTRALIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 174 AUSTRALIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 175 AUSTRALIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 176 AUSTRALIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Growing use of drones for monitoring assets and remote inspection in South Korea

- TABLE 177 SOUTH KOREA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 178 SOUTH KOREA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 179 SOUTH KOREA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 180 SOUTH KOREA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.7 REST OF ASIA PACIFIC

- TABLE 181 REST OF ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- 12.5 MIDDLE EAST

- 12.5.1 PESTLE ANALYSIS: MIDDLE EAST

- TABLE 185 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 186 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 187 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 188 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 189 MIDDLE EAST: DRONE INSPECTION AND MONITORING FOR SOLUTIONS MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 190 MIDDLE EAST: DRONE INSPECTION AND MONITORING FOR SOLUTIONS MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 191 MIDDLE EAST: DRONE INSPECTION AND MONITORING FOR SOLUTIONS MARKET, BY INFRASTRUCTURE, 2019-2021 (USD MILLION)

- TABLE 192 MIDDLE EAST: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2022-2027 (USD MILLION)

- TABLE 193 MIDDLE EAST: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2019-2021 (USD MILLION)

- TABLE 194 MIDDLE EAST: DRONE INSPECTION AND MONITORING FOR SOLUTIONS MARKET, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 195 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 196 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 197 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 198 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 199 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY CONSTRUCTION & INFRASTRUCTURE, 2019-2021 (USD MILLION)

- TABLE 200 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY CONSTRUCTION & INFRASTRUCTURE, 2022-2027 (USD MILLION)

- TABLE 201 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY AGRICULTURE, 2019-2021 (USD MILLION)

- TABLE 202 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY AGRICULTURE, 2022-2027 (USD MILLION)

- TABLE 203 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY UTILITIES, 2019-2021 (USD MILLION)

- TABLE 204 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY UTILITIES, 2022-2027 (USD MILLION)

- TABLE 205 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY OIL & GAS, 2019-2021 (USD MILLION)

- TABLE 206 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY OIL & GAS, 2022-2027 (USD MILLION)

- TABLE 207 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY MINING, 2019-2021 (USD MILLION)

- TABLE 208 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, MINING, 2022-2027 (USD MILLION)

- TABLE 209 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY OTHERS, 2019-2021 (USD MILLION)

- TABLE 210 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, OTHERS, 2022-2027 (USD MILLION)

- 12.5.2 ISRAEL

- 12.5.2.1 Drone inspection services to focus on oil & gas industry

- TABLE 211 ISRAEL: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 212 ISRAEL: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 213 ISRAEL: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 214 ISRAEL: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5.3 TURKEY

- 12.5.3.1 Focus on indigenization of UAVs and subsystems expected to boost market in Turkey

- TABLE 215 TURKEY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 216 TURKEY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 217 TURKEY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 218 TURKEY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5.4 UAE

- 12.5.4.1 Increased demand for remote monitoring of assets from oil & gas industry to drive market

- TABLE 219 UAE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 220 UAE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 221 UAE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 222 UAE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.5.5 REST OF MIDDLE EAST

- TABLE 223 REST OF MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 224 REST OF MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 225 REST OF MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 226 REST OF MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.6 REST OF THE WORLD

- 12.6.1 PESTLE ANALYSIS: REST OF THE WORLD

- TABLE 227 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 228 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 229 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 230 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 231 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2019-2021 (USD MILLION)

- TABLE 232 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 233 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2019-2021 (USD MILLION)

- TABLE 234 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2022-2027 (USD MILLION)

- TABLE 235 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2019-2021 (USD MILLION)

- TABLE 236 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2022-2027 (USD MILLION)

- TABLE 237 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 238 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 239 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 240 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 241 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 242 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 243 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR AGRICULTURE, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 244 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR AGRICULTURE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 245 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR UTILITIES, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 246 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR UTILITIES, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 247 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR OIL & GAS, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 248 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR OIL & GAS, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 249 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR MINING, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 250 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR MINING, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 251 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR OTHERS, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 252 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR OTHERS, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.6.2 LATIN AMERICA

- 12.6.2.1 Use of UAVs in agriculture and for data collection to contribute to market growth

- TABLE 253 LATIN AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 254 LATIN AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 255 LATIN AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 256 LATIN AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.6.3 AFRICA

- 12.6.3.1 Adoption of drones for dense forest and mining monitoring to drive market growth

- TABLE 257 AFRICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 258 AFRICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 259 AFRICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019-2021 (USD MILLION)

- TABLE 260 AFRICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 COMPANY OVERVIEW

- 13.2.1 KEY DEVELOPMENTS OF LEADING PLAYERS IN DRONE INSPECTION AND MONITORING MARKET (2018-2021)

- 13.3 RANKING ANALYSIS OF KEY PLAYERS IN DRONE INSPECTION AND MONITORING MARKET, 2021

- FIGURE 39 RANKING OF KEY PLAYERS IN DRONE INSPECTION AND MONITORING MARKET, 2021

- 13.4 REVENUE ANALYSIS, 2021

- FIGURE 40 REVENUE ANALYSIS OF KEY COMPANIES IN DRONE INSPECTION AND MONITORING MARKET, 2021

- 13.5 MARKET SHARE ANALYSIS, 2021

- FIGURE 41 DRONE INSPECTION AND MONITORING MARKET SHARE ANALYSIS OF KEY COMPANIES, 2021

- TABLE 261 DRONE INSPECTION AND MONITORING MARKET: DEGREE OF COMPETITION

- 13.6 COMPETITIVE EVALUATION QUADRANT

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- FIGURE 42 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- 13.7 START-UP/SME EVALUATION QUADRANT

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 STARTING BLOCKS

- 13.7.4 DYNAMIC COMPANIES

- FIGURE 43 DRONE INSPECTION AND MONITORING MARKET (START-UP/SME) COMPETITIVE LEADERSHIP MAPPING, 2021

- 13.8 COMPETITIVE BENCHMARKING

- TABLE 262 COMPANY PRODUCT FOOTPRINT

- TABLE 263 COMPANY SOLUTION FOOTPRINT

- TABLE 264 COMPANY APPLICATION FOOTPRINT

- TABLE 265 COMPANY REGIONAL FOOTPRINT

- TABLE 266 PRODUCT LAUNCHES, FEBRUARY 2018-DECEMBER 2022

- TABLE 267 DEALS, AUGUST 2018-JUNE 2022

- TABLE 268 OTHERS, OCTOBER 2018-JUNE 2022

14 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 INSITU

- TABLE 269 INSITU: BUSINESS OVERVIEW

- ABLE 270 INSITU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.2 DJI

- TABLE 271 DJI: BUSINESS OVERVIEW

- TABLE 272 DJI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 DJI: PRODUCT/SERVICE LAUNCHES

- TABLE 274 DJI: DEALS

- TABLE 275 DJI: OTHERS

- 14.2.3 NORTHROP GRUMMAN CORPORATION

- TABLE 276 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- FIGURE 44 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 277 NORTHROP GRUMMAN CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 278 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 279 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 280 NORTHROP GRUMMAN CORPORATION: OTHERS

- 14.2.4 TELEDYNE FLIR LLC

- TABLE 281 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

- FIGURE 45 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- TABLE 282 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 284 TELEDYNE FLIR LLC: DEALS

- TABLE 285 TELEDYNE FLIR LLC: OTHERS

- 14.2.5 PARROT DRONE SAS

- TABLE 286 PARROT DRONE SAS: BUSINESS OVERVIEW

- FIGURE 46 PARROT DRONE SAS: COMPANY SNAPSHOT

- TABLE 287 PARROT DRONE SAS: PRODUCTS/SERVICES OFFERED

- TABLE 288 PARROT DRONE SAS: PRODUCT LAUNCHES

- TABLE 289 PARROT DRONE SAS: DEALS

- 14.2.6 EHANG HOLDINGS LIMITED

- TABLE 290 EHANG HOLDINGS LIMITED: BUSINESS OVERVIEW

- FIGURE 47 EHANG HOLDINGS LIMITED: COMPANY SNAPSHOT

- TABLE 291 EHANG HOLDINGS LIMITED: PRODUCTS/SERVICES OFFERED

- TABLE 292 EHANG HOLDINGS LIMITED: PRODUCT LAUNCHES

- TABLE 293 EHANG HOLDINGS LIMITED: DEALS

- TABLE 294 EHANG HOLDINGS LIMITED: OTHERS

- 14.2.7 INTEL CORPORATION

- TABLE 295 INTEL CORPORATION: BUSINESS OVERVIEW

- FIGURE 48 INTEL CORPORATION: COMPANY SNAPSHOT

- TABLE 296 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 INTEL CORPORATION: DEAL

- 14.2.8 YUNEEC HOLDING LTD.

- TABLE 298 YUNEEC HOLDING LTD.: BUSINESS OVERVIEW

- TABLE 299 YUNEEC HOLDING LTD.: PRODUCTS/SERVICES OFFERED

- TABLE 300 YUNEEC HOLDING LTD.: PRODUCT LAUNCHES

- TABLE 301 YUNEEC HOLDING LTD.: DEALS

- 14.2.9 ECA GROUP

- TABLE 302 ECA GROUP: BUSINESS OVERVIEW

- FIGURE 49 ECA GROUP: COMPANY SNAPSHOT

- TABLE 303 ECA GROUP: PRODUCTS/SERVICES OFFERED

- TABLE 304 ECA GROUP: DEALS

- 14.2.10 PRECISIONHAWK

- TABLE 305 PRECISIONHAWK: BUSINESS OVERVIEW

- TABLE 306 PRECISIONHAWK: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 307 PRECISIONHAWK: DEALS

- TABLE 308 PRECISIONHAWK: OTHERS

- 14.2.11 MICRODRONES

- TABLE 309 MICRODRONES: BUSINESS OVERVIEW

- TABLE 310 MICRODRONES: PRODUCTS/SERVICES OFFERED

- TABLE 311 MICRODRONES: DEALS

- TABLE 312 MICRODRONES: OTHERS

- 14.2.12 SKYDIO

- TABLE 313 SKYDIO: BUSINESS OVERVIEW

- TABLE 314 SKYDIO: PRODUCTS/SERVICES OFFERED

- TABLE 315 SKYDIO: DEALS

- TABLE 316 SKYDIO: OTHERS

- 14.2.13 AERIALTRONICS

- TABLE 317 AERIALTRONICS: BUSINESS OVERVIEW

- TABLE 318 AERIALTRONICS: PRODUCTS/SERVICES OFFERED

- 14.2.14 IDEAFORGE

- TABLE 319 IDEAFORGE: BUSINESS OVERVIEW

- TABLE 320 IDEAFORGE: PRODUCTS/SERVICES OFFERED

- TABLE 321 IDEAFORGE: DEALS

- 14.2.15 LOCKHEED MARTIN CORPORATION

- TABLE 322 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- FIGURE 50 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 323 LOCKHEED MARTIN CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 324 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 325 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 326 LOCKHEED MARTIN CORPORATION: OTHERS

- 14.2.16 VIPER DRONES

- TABLE 327 VIPER DRONES: BUSINESS OVERVIEW

- TABLE 328 VIPER DRONES: PRODUCTS/SERVICES OFFERED

- 14.2.17 AGEAGLE AERIAL SYSTEMS INC.

- TABLE 329 AGEAGLE AERIAL SYSTEMS INC: BUSINESS OVERVIEW

- TABLE 330 AGEAGLE AERIAL SYSTEMS INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 331 AGEAGLE AERIAL SYSTEMS INC.: DEALS

- 14.2.18 TERRA DRONE CORPORATION

- TABLE 332 TERRA DRONE CORPORATION: BUSINESS OVERVIEW

- TABLE 333 TERRA DRONE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 TERRA DRONE CORPORATION: DEALS

- TABLE 335 TERRA DRONE CORPORATION: OTHERS

- 14.2.19 THYSSENKRUPP INDUSTRIAL SOLUTIONS AG

- TABLE 336 THYSSENKRUPP INDUSTRIAL SOLUTIONS AG: BUSINESS OVERVIEW

- TABLE 337 THYSSENKRUPP INDUSTRIAL SOLUTIONS AG: PRODUCTS/SERVICES OFFERED

- 14.2.20 DRONEGENUITY

- TABLE 338 DRONEGENUITY: BUSINESS OVERVIEW

- TABLE 339 DRONEGENUITY: PRODUCTS/SERVICES OFFERED

- 14.2.21 FORCE TECHNOLOGY

- TABLE 340 FORCE TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 341 FORCE TECHNOLOGY: PRODUCTS/SERVICES OFFERED

- 14.2.22 WIPRO

- TABLE 342 WIPRO: BUSINESS OVERVIEW

- FIGURE 51 WIPRO: COMPANY SNAPSHOT

- TABLE 343 WIPRO: PRODUCTS/SERVICES OFFERED

- 14.2.23 MISTRAS GROUP, INC.

- TABLE 344 MISTRAS GROUP, INC.: BUSINESS OVERVIEW

- FIGURE 52 MISTRAS GROUP, INC.: COMPANY SNAPSHOT

- TABLE 345 MISTRAS GROUP, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 346 MISTRAS GROUP, INC.: PRODUCT/SERVICE LAUNCHES

- 14.2.24 INTERTEK GROUP PLC

- TABLE 347 INTERTEK GROUP PLC: BUSINESS OVERVIEW

- FIGURE 53 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- TABLE 348 INTERTEK GROUP PLC: PRODUCTS/SERVICES OFFERED

- TABLE 349 INTERTEK GROUP PLC: PRODUCT/SERVICE LAUNCH

- 14.2.25 AERODYNE GROUP

- TABLE 350 AERODYNE GROUP: BUSINESS OVERVIEW

- TABLE 351 AERODYNE GROUP: PRODUCTS/SERVICES OFFERED

- TABLE 352 AERODYNE GROUP: DEALS

- TABLE 353 AERODYNE GROUP: OTHERS

- 14.3 OTHER PLAYERS

- 14.3.1 DRONEDEPLOY, INC.

- TABLE 354 DRONEDEPLOY, INC.: COMPANY OVERVIEW

- 14.3.2 DRONEFLIGHT LTD.

- TABLE 355 DRONEFLIGHT LTD.: COMPANY OVERVIEW

- 14.3.3 RELIABILITY MAINTENANCE SOLUTIONS LTD.

- TABLE 356 RELIABILITY MAINTENANCE SOLUTIONS LTD.: COMPANY OVERVIEW

- 14.3.4 DJM AERIAL SOLUTIONS LIMITED

- TABLE 357 DJM AERIAL SOLUTIONS LIMITED: COMPANY OVERVIEW

- 14.3.5 CANADIAN UAVS

- TABLE 358 CANADIAN UAVS: COMPANY OVERVIEW

- 14.3.6 MAVERICK INSPECTION LTD.

- TABLE 359 MAVERICK INSPECTION LTD.: COMPANY OVERVIEW

- 14.3.7 GARUDAUAV SOFT SOLUTIONS PVT. LTD.

- TABLE 360 GARUDAUAV SOFT SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- 14.3.8 HEMAV

- TABLE 361 HEMAV: COMPANY OVERVIEW

- 14.3.9 RAPTOR MAPS, INC.

- TABLE 362 RAPTOR MAPS, INC.: COMPANY OVERVIEW

- 14.3.10 AIRPIX

- TABLE 363 AIRPIX: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS