|

|

市場調査レポート

商品コード

1298015

難燃性生地の世界市場:種類別 (防炎加工、耐火特性)・用途別 (アパレル、非アパレル)・最終用途産業別 (産業用、防衛・公共安全サービス、輸送)・地域別の将来予測 (2028年まで)Fire-Resistant Fabrics Market by Type (Treated and Inherent), Application (Apparel and Non-apparel), End-Use Industry (Industrial, Defense and Public Safety Services, Transport), and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 難燃性生地の世界市場:種類別 (防炎加工、耐火特性)・用途別 (アパレル、非アパレル)・最終用途産業別 (産業用、防衛・公共安全サービス、輸送)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月20日

発行: MarketsandMarkets

ページ情報: 英文 247 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の難燃性生地の市場規模は、予測期間中に6.6%のCAGRで成長し、2023年の35億米ドルから2028年には49億米ドルに達すると予測されています。

難燃性生地は、火にさらされると自己消火し、発火に抵抗し、炎の広がりを止めることを目的としています。火災の安全性が問題となる場合、これらの生地は様々な用途で広く使用されます。その一例として、保護具、椅子用生地、カーテン・ドレープ、ベッド、テント・日よけ、自動車内装剤、航空機などが挙げられます。難燃性生地は、火災の安全性が懸念される様々な用途で利用されており、火災の危険から人や財産を守る上で極めて重要です。

"種類別では、防炎加工のセグメントが最大の市場になる"

防炎加工繊維の普及は、天然繊維に比べて低コストであることに起因しています。また、アパレル用途で加工生地が提供する高い快適性も、防炎加工分野の市場を牽引しています。中国とインドが防炎加工繊維向けコットン繊維の市場を独占します。市場を牽引する主な要因は、アジア太平洋における綿繊維生産量の増加です。同地域の建築・建設分野では、難燃性生地が幅広く使用されています。建築・建設、石油・ガス業界で防護具のニーズが高まっていることから、中東・アフリカは防炎加工生地の有望市場となっています。さらに、予測期間中は耐火特性繊維の市場が最も急成長すると予測されています。

"アパレル分野:難燃性生地で最も急成長する市場"

最新技術・発明の普及や、手頃な価格の土地への容易なアクセス、低コストの労働力、この地域の人口拡大などが、外国投資の増加やアパレル用途のブームにつながっています。さらに、自動車・化学・建設・インフラ・鉱業・エネルギー・医療などの部門の拡大がテキスタイルと安全装置の需要を押し上げ、保護生地や難燃性材料の使用を促進しています。

"最終用途産業別では、産業用分野が最大市場になる"

様々な最終用途分野 (特に石油・ガス産業や化学産業) における難燃性生地の使用に関する政府規則が、産業用最終用途分野における難燃性生地の需要の主な促進要因となっています。予測期間を通じて、産業部門は難燃性生地市場における優位性を維持すると予想されます。

"アジア太平洋は難燃性生地市場で最も急成長する市場"

中間層の可処分所得の増加と相まって人口が増加していることが、アジア太平洋の難燃性生地市場の主要な促進要因となっています。中国やインドのような国々は、消費者が西洋のファッション動向を取り入れようとしているため、難燃性生地の巨大市場を提供しています。原材料の入手可能性と安価な労働力のため、多くの難燃性生地のブランドは、中国・インド・バングラデシュ・カンボジアのような国に製造施設を移しています。これらすべての要因がアジア太平洋の難燃性生地市場の需要を牽引しています。さらに、アジア太平洋地域は2022年の難燃性生地市場で最大の市場シェアを占めています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 業界動向

- サプライチェーン分析

- 主要な利害関係者と購入基準

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- エコシステム分析

- 技術分析

- ケーススタディ

- 貿易データ統計

- 関税と規制状況

- 主要な会議とイベント

- 特許分析

第7章 難燃性生地市場:種類別

- イントロダクション

- 防炎加工

- 難燃性コットン

- 難燃性ビスコース

- 難燃性ポリエステル

- 難燃性ナイロン6

- 耐火特性

- アラミド

- PBI (ポリベンズイミダゾール)

- モダアクリル

- ポリアミド

- PI (ポリイミド)

第8章 難燃性生地市場:用途別

- イントロダクション

- アパレル

- 防護服

- 非アパレル

- 輸送機械用内装生地

- 家庭用・産業用

第9章 難燃性生地市場:最終用途産業別

- イントロダクション

- 産業用

- 建設・製造

- 石油・ガス

- その他

- 防衛・公共安全サービス

- 軍隊

- 消防・法執行機関

- 輸送

- 鉄道

- 航空宇宙

- 船舶

- 自動車

- その他

第10章 難燃性生地市場:地域別

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 南米

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 主要企業のランキング

- 市場シェア分析

- 主要企業の競合の程度

- 主要企業の収益分析

- 企業フットプリント分析

- 企業評価クアドラント (ティア1企業)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- 競争状況と動向

第12章 企業プロファイル

- 主要企業

- DUPONT DE NEMOURS, INC.

- LENZING AG

- TEIJIN LTD.

- TENCATE PROTECTIVE FABRICS

- PBI PERFORMANCE PRODUCTS INC.

- SOLVAY SA

- KANEKA CORPORATION

- GUN-EI CHEMICAL INDUSTRY CO., LTD.

- HUNTSMAN CORPORATION

- MILLIKEN & COMPANY

- W.L. GORE & ASSOCIATES INC.

- その他の主な企業

- GLEN RAVEN TECHNICAL FABRICS LLC

- CHARLES PARSONS

- BANSWARA SYNTEX LTD.

- TRIVERA GMBH

- AUBURN MANUFACTURING INC.

- TAIWAN K.K. CORPORATION

- ADA & INA LTD. NATURAL FABRICS AND CURTAINS

- KERMEL INDUSTRIES

- NEWTEX INDUSTRIES, INC.

- XM TEXTILES

- TOYOBO CO., LTD.

- DRAPER KNITTING COMPANY

- ARVIND LTD.

- SAINT-GOBAIN

- AGRU AMERICA INC.

第13章 隣接・関連市場

- イントロダクション

- 制限

- メタアラミド繊維市場

- メタアラミド繊維市場:地域別

第14章 付録

The fire-resistant fabrics market is projected to grow from USD 3.5 Billion in 2023 to USD 4.9 Billion by 2028, at a CAGR of 6.6% during the forecast period. When exposed to fire, fire-resistant fabrics are intended to self-extinguish, resist ignition, and stop the spread of flames. When fire safety is an issue, these fabrics are frequently employed in a range of applications. Protective gear, upholstery, curtains and drapes, beds, tents and awnings, car interiors, and aircraft are a few examples of applications for fire-resistant fabrics. All things considered, fire-resistant fabrics are utilized in a variety of applications where fire safety is a concern, and they are crucial in safeguarding persons and property from the risks of fire.

Treated segment is expected to be the largest market in the fire-resistant fabrics market

The prevalence of treated segment is mostly a result of their lower cost as compared to naturally occurring fabrics. The market for treated segment is also being driven by the high level of comfort that treated fabrics offer in apparel applications. According to estimates, China and India will dominate the market for cotton fibers used in treated fire-resistant fabrics. The main factor driving the market is the rise in cotton fiber output in the Asia Pacific area. The building and construction sector in the area makes extensive use of fabrics that are fire resistant. Due to the rising need for protective gear in the building and construction, as well as oil and gas sectors, the Middle East and Africa represent promising markets for treated fire-resistant fabrics. Moreover, the inherent segment is projected to be the fastest growing market in fire-resistant fabrics during the forecast period.

Apparel segment is projected to be the fastest growing market in the fire-resistant fabrics

Increased acceptance of contemporary technology, inventions, easy access to affordable land, low-cost labor, and the region's expanding population have all contributed to a rise in foreign investment and a boom in apparel applications. Additionally, the expansion of sectors including the automotive, chemical, construction, infrastructure, mining, energy, and healthcare is boosting demand for textiles and safety equipment, which is propelling the use of protective fabrics and materials that resist fire.

Industrial segment is expected to be the largest market in the fire-resistant fabrics market

Government rules regarding the use of fire-resistant fabrics in various end-use sectors, particularly in the oil & gas and chemical industries, are a major driver of the demand for fire-resistant fabrics in the industrial end-use segment. Throughout the forecast period, the industrial sector is expected to maintain its dominance in the market for fire-resistant fabrics.

Asia Pacific is projected to be the fastest-growing market in the fire-resistant fabrics market

The growing population coupled with increasing disposable income of the middle-class population is a key driver for fire-resistant fabrics market in Asia Pacific. Countries like China and India offers huge market for fire-resistant fabrics as the consumers seek to adopt western fashion trends. Due to availability of raw material and cheap labor many brands of fire-resistant fabrics have shifted their manufacturing facilities to the countries like China, India, Bangladesh, and Cambodia. All these factors are driving the demand for fire-resistant fabrics market in Asia Pacific. Moreover, Asia Pacific held the largest market share in the fire-resistant fabrics market in 2022.

The break-up of the profile of primary participants in the fire-resistant fabrics market:

- By Company Type: Tier 1- 35%, Tier 2- 45%, and Tier 3- 20%

- By Designation: C Level- 35%, Director Level- 25%, Others- 40%

- By Region: North America- 40%, Asia Pacific- 30%, Europe- 20%, Middle East- 5%, and South America- 5%

The key players profiled in the report include DuPont de Nemours, Inc. (US), Teijin Ltd. (Japan), Royal TenCate N.V. (Netherlands), Kaneka Corporation (Japan), PBI Performance Products Inc. (US), Milliken & Company (US), Gun-Ei Chemical Industry Co., Ltd. (Japan), Huntsman Corporation (US), Lenzing AG (Austria), Solvay SA (Belgium), and W.L. Gore & Associates Inc. (US) among others.

Research Coverage

According to type (treated and inherent), application (apparel and non-apparel), end-use industry (industrial, defense & public safety services, transport, and others), and region (Asia Pacific, North America, Europe, Middle East & Africa, and South America), the market for fire-resistant fabrics is segmented in this research report. The scope of the study includes specific information on the key elements-such as drivers, restraints, opportunities, and challenges-that have a significant impact on the market for fire-resistant fabrics. The major players in the market for fire-resistant fabrics have undergone a thorough analysis to provide information on their business overview, services, and solutions, as well as their key strategies, partnerships, contracts, agreements, mergers and acquisitions, new product and service launches, and recent market developments. This research covers a competitive analysis of up-and-coming startups in the ecosystem of the market for fire-resistant fabrics.

Reasons to Buy this Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall fire-resistant fabrics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increased demand from end-use industries, stringent regulations & standardization pertaining to safety at the workplace, and urbanization & infrastructure development), restraints (high cost of production and huge investment for R&D, and lack of safety compliance in developing regions), opportunities (technological innovations in product development), and challenges (fluctuating raw material costs) influencing the growth of the fire-resistant fabrics market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the fire-resistant fabrics market

- Market Development: Comprehensive information about lucrative markets - the report analyses the fire-resistant fabrics market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the fire-resistant fabrics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like DuPont de Nemours, Inc. (US), Teijin Ltd. (Japan), Royal TenCate N.V. (Netherlands), Kaneka Corporation (Japan), PBI Performance Products Inc. (US), Milliken & Company (US), Gun-Ei Chemical Industry Co., Ltd. (Japan), Huntsman Corporation (US), Lenzing AG (Austria), Solvay SA (Belgium), and W.L. Gore & Associates Inc. (US) among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 FIRE-RESISTANT FABRICS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.2.2 FIRE-RESISTANT FABRICS MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- 1.2.3 FIRE-RESISTANT FABRICS MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.2.4 FIRE-RESISTANT FABRICS MARKET: DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- 1.3 MARKET SCOPE

- FIGURE 1 FIRE-RESISTANT FABRICS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 FIRE-RESISTANT FABRICS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND-SIDE)

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 - TOP-DOWN

- 2.3 DATA TRIANGULATION

- FIGURE 7 FIRE-RESISTANT FABRICS MARKET: DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

- 2.5 ASSUMPTIONS

- 2.6 IMPACT OF RECESSION

- 2.7 LIMITATIONS

- 2.8 RISK ASSESSMENT

- TABLE 1 FIRE-RESISTANT FABRICS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 10 TREATED SEGMENT TO ACCOUNT FOR LARGER SHARE IN FIRE-RESISTANT FABRICS MARKET

- FIGURE 11 APPAREL SEGMENT TO BE DOMINANT APPLICATION OF FIRE-RESISTANT FABRICS

- FIGURE 12 INDUSTRIAL SEGMENT TO BE LARGEST END USER OF FIRE-RESISTANT FABRICS

- FIGURE 13 ASIA PACIFIC DOMINATES FIRE-RESISTANT FABRICS MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FIRE-RESISTANT FABRICS MARKET

- FIGURE 14 ASIA PACIFIC TO LEAD FIRE-RESISTANT FABRICS MARKET DURING FORECAST PERIOD

- 4.2 FIRE-RESISTANT FABRICS MARKET, BY REGION

- FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 16 CHINA LED FIRE-RESISTANT FABRICS MARKET IN ASIA PACIFIC

- 4.4 FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION VS. APPLICATION

- FIGURE 17 APPAREL APPLICATION DOMINATED OVERALL MARKET IN ALL REGIONS IN 2022

- 4.5 FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION VS. TYPE

- FIGURE 18 TREATED FIRE-RESISTANT FABRICS DOMINATED OVERALL MARKET IN 2022

- 4.6 FIRE-RESISTANT FABRICS MARKET, BY KEY COUNTRIES

- FIGURE 19 INDIA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FIRE-RESISTANT FABRICS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent workplace safety regulations in developed countries

- TABLE 2 REGULATIONS IN FIRE-RESISTANT FABRICS MARKET

- 5.2.1.2 Increasing use of fire-resistant fabrics in oil & gas industry

- 5.2.1.3 Increasing urbanization & infrastructure development

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of production and huge investment in R&D

- 5.2.2.2 Lack of safety regulations in developing regions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological innovations in product development

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuating raw material costs

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 FIRE-RESTRAINT FABRICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 FIRE RESISTANT FABRICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- TABLE 4 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020-2027 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 22 FIRE RESISTANT FABRICS MARKET: SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIALS

- 6.1.2 MANUFACTURING

- 6.1.3 DISTRIBUTION

- 6.1.4 END-USE INDUSTRIES

- 6.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES (%)

- 6.2.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE FOR TOP 3 END-USE INDUSTRIES, BY KEY PLAYERS

- FIGURE 25 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP 3 END-USE INDUSTRIES

- TABLE 7 AVERAGE SELLING PRICE IN TOP 3 END-USE INDUSTRIES, BY KEY PLAYERS (USD/SQ. METER)

- 6.3.2 AVERAGE SELLING PRICE, BY REGION

- FIGURE 26 AVERAGE SELLING PRICE OF FIRE-RESISTANT FABRICS, BY REGION (USD/SQ. METER)

- TABLE 8 AVERAGE SELLING PRICE OF FIRE-RESISTANT FABRICS, BY REGION (USD/SQ. METER)

- 6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4.1 REVENUE SHIFTS AND NEW REVENUE POCKETS IN FIRE-RESISTANT FABRICS MARKET

- FIGURE 27 REVENUE SHIFT FOR PLAYERS IN FIRE-RESISTANT FABRICS MARKET

- 6.5 ECOSYSTEM ANALYSIS

- TABLE 9 FIRE-RESISTANT FABRICS MARKET: ROLE IN ECOSYSTEM

- FIGURE 28 FIRE-RESISTANT FABRICS MARKET: ECOSYSTEM MAPPING

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 RADIANT BARRIER TECHNOLOGY

- 6.7 CASE STUDIES

- 6.7.1 CASE STUDY ON MCR SAFETY

- 6.7.2 CASE STUDY ON G.D. INTERNATIONAL

- 6.8 TRADE DATA STATISTICS

- 6.8.1 IMPORT SCENARIO OF FIRE-RESISTANT FABRICS

- FIGURE 29 IMPORT OF FIRE-RESISTANT FABRICS, BY KEY COUNTRIES (2017-2022)

- TABLE 10 IMPORT OF FIRE-RESISTANT FABRICS, BY REGION, 2017-2022 (USD MILLION)

- 6.8.2 EXPORT SCENARIO OF FIRE-RESISTANT FABRICS

- FIGURE 30 EXPORT OF FIRE-RESISTANT FABRICS, BY KEY COUNTRIES (2017-2022)

- TABLE 11 EXPORT OF FIRE-RESISTANT FABRICS, BY REGION, 2017-2022 (USD MILLION)

- 6.9 TARIFF AND REGULATORY LANDSCAPE

- 6.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9.2 REGULATIONS FOR FIRE-RESISTANT FABRICS, BY COUNTRY/REGION

- 6.10 KEY CONFERENCES AND EVENTS

- TABLE 12 FIRE-RESISTANT FABRICS MARKET: KEY CONFERENCES & EVENTS (2023-2024)

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPE

- TABLE 13 NUMBER OF PATENTS REGISTERED, BY STATUS

- FIGURE 31 PATENTS REGISTERED IN FIRE-RESISTANT FABRICS MARKET, 2012-2022

- FIGURE 32 PATENT PUBLICATION TRENDS, 2012-2022

- FIGURE 33 LEGAL STATUS OF PATENTS FILED IN FIRE-RESISTANT FABRICS MARKET

- 6.11.3 JURISDICTION ANALYSIS

- FIGURE 34 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- 6.11.4 TOP APPLICANTS

- FIGURE 35 BASF SE REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2012 AND 2022

- TABLE 14 PATENTS BY BASF SE

- TABLE 15 PATENTS BY LG CHEMICAL LTD.

- TABLE 16 PATENTS BY TORAY INDUSTRIES, INC.

- TABLE 17 TOP 10 PATENT OWNERS IN US, 2012-2022

7 FIRE-RESISTANT FABRICS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 36 TREATED SEGMENT TO ACCOUNT FOR LARGER SHARE OF FIRE-RESISTANT FABRICS MARKET

- TABLE 18 FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 19 FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 20 FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (MILLION SQ. METER)

- TABLE 21 FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (MILLION SQ. METER)

- 7.2 TREATED

- 7.2.1 RELATIVELY LOW COST TO DRIVE DEMAND FOR TREATED FIRE-RESISTANT FABRICS

- 7.2.2 FIRE-RESISTANT COTTON

- 7.2.3 FIRE-RESISTANT VISCOSE

- 7.2.4 FIRE-RESISTANT POLYESTER

- 7.2.5 FIRE-RESISTANT NYLON 6

- TABLE 22 TREATED FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 23 TREATED FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2022-2028 (USD MILLION)

- TABLE 24 TREATED FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 25 TREATED FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2022-2028 (MILLION SQ. METER)

- 7.3 INHERENT

- 7.3.1 INHERENT FIRE-RESISTANT FABRICS SEGMENT TO REGISTER HIGHER GROWTH RATE

- 7.3.2 ARAMID

- 7.3.3 PBI (POLYBENZIMIDAZOLE)

- 7.3.4 MODACRYLIC

- 7.3.5 POLYAMIDE

- 7.3.6 PI (POLYIMIDE)

- TABLE 26 INHERENT FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

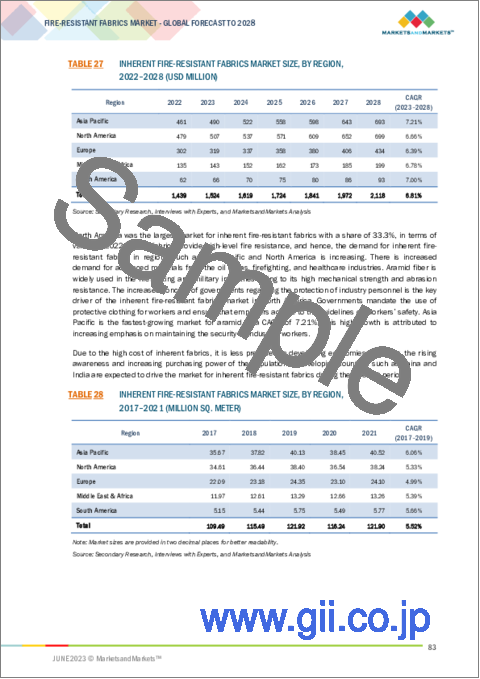

- TABLE 27 INHERENT FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2022-2028 (USD MILLION)

- TABLE 28 INHERENT FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 29 INHERENT FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2022-2028 (MILLION SQ. METER)

8 FIRE-RESISTANT FABRICS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 37 APPAREL SEGMENT TO BE DOMINANT APPLICATION OF FIRE-RESISTANT FABRICS MARKET

- TABLE 30 FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 31 FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 32 FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (MILLION SQ. METER)

- TABLE 33 FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (MILLION SQ. METER)

- 8.2 APPAREL

- 8.2.1 STRINGENT REGULATIONS FOR WORKPLACE SAFETY TO DRIVE DEMAND IN APPAREL APPLICATION

- 8.2.2 PROTECTIVE CLOTHING

- TABLE 34 FIRE-RESISTANT FABRICS MARKET SIZE IN APPAREL APPLICATION, BY REGION, 2017-2021 (USD MILLION)

- TABLE 35 FIRE-RESISTANT FABRICS MARKET SIZE IN APPAREL APPLICATION, BY REGION, 2022-2028 (USD MILLION)

- TABLE 36 FIRE-RESISTANT FABRICS MARKET SIZE IN APPAREL APPLICATION, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 37 FIRE-RESISTANT FABRICS MARKET SIZE IN APPAREL APPLICATION, BY REGION, 2022-2028 (MILLION SQ. METER)

- 8.3 NON-APPAREL

- 8.3.1 RISING AWARENESS ABOUT FIRE-RESISTANT MATERIAL IN AUTOMOTIVE AND FURNITURE APPLICATIONS TO DRIVE DEMAND

- 8.3.2 INTERIOR FABRIC FOR TRANSPORTATION

- 8.3.3 HOUSEHOLD & INDUSTRIAL

- TABLE 38 FIRE-RESISTANT FABRICS MARKET SIZE IN NON-APPAREL APPLICATION, BY REGION, 2017-2021 (USD MILLION)

- TABLE 39 FIRE-RESISTANT FABRICS MARKET SIZE IN NON-APPAREL APPLICATION, BY REGION, 2022-2028 (USD MILLION)

- TABLE 40 FIRE-RESISTANT FABRICS MARKET SIZE IN NON-APPAREL APPLICATION, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 41 FIRE-RESISTANT FABRICS MARKET SIZE IN NON-APPAREL APPLICATION, BY REGION, 2022-2028 (MILLION SQ. METER)

9 FIRE-RESISTANT FABRICS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 38 INDUSTRIAL SEGMENT TO BE LARGEST END USER OF FIRE-RESISTANT FABRICS DURING FORECAST PERIOD

- TABLE 42 FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 43 FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 44 FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 45 FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 9.2 INDUSTRIAL

- 9.2.1 HIGH DEMAND FROM OIL & GAS AND CHEMICAL INDUSTRIES TO DRIVE MARKET

- 9.2.2 CONSTRUCTION & MANUFACTURING

- 9.2.3 OIL & GAS

- 9.2.4 OTHERS

- TABLE 46 FIRE-RESISTANT FABRICS MARKET SIZE IN INDUSTRIAL, BY REGION, 2017-2021 (USD MILLION)

- TABLE 47 FIRE-RESISTANT FABRICS MARKET SIZE IN INDUSTRIAL, BY REGION, 2022-2028 (USD MILLION)

- TABLE 48 FIRE-RESISTANT FABRICS MARKET SIZE IN INDUSTRIAL, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 49 FIRE-RESISTANT FABRICS MARKET SIZE IN INDUSTRIAL, BY REGION, 2022-2028 (MILLION SQ. METER)

- 9.3 DEFENSE & PUBLIC SAFETY SERVICES

- 9.3.1 INCREASING INCIDENTS OF FIRE BREAKOUT DRIVING DEMAND FOR FIRE-RESISTANT FABRICS

- 9.3.2 MILITARY

- 9.3.3 FIREFIGHTING & LAW ENFORCEMENT

- TABLE 50 FIRE-RESISTANT FABRICS MARKET SIZE IN DEFENSE & PUBLIC SAFETY SERVICES, BY REGION, 2017-2021 (USD MILLION)

- TABLE 51 FIRE-RESISTANT FABRICS MARKET SIZE IN DEFENSE & PUBLIC SAFETY SERVICES, BY REGION, 2022-2028 (USD MILLION)

- TABLE 52 FIRE-RESISTANT FABRICS MARKET SIZE IN DEFENSE & PUBLIC SAFETY SERVICES, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 53 FIRE-RESISTANT FABRICS MARKET SIZE IN DEFENSE & PUBLIC SAFETY SERVICES, BY REGION, 2022-2028 (MILLION SQ. METER)

- 9.4 TRANSPORT

- 9.4.1 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 54 FIRE-RESISTANT FABRICS MARKET SIZE IN TRANSPORT, BY REGION, 2017-2021 (USD MILLION)

- TABLE 55 FIRE-RESISTANT FABRICS MARKET SIZE IN TRANSPORT, BY REGION, 2022-2028 (USD MILLION)

- TABLE 56 FIRE-RESISTANT FABRICS MARKET SIZE IN TRANSPORT, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 57 FIRE-RESISTANT FABRICS MARKET SIZE IN TRANSPORT, BY REGION, 2022-2028 (MILLION SQ. METER)

- 9.4.2 RAILWAYS

- TABLE 58 FIRE-RESISTANT FABRICS MARKET SIZE IN RAILWAYS, BY REGION, 2017-2021 (USD MILLION)

- TABLE 59 FIRE-RESISTANT FABRICS MARKET SIZE IN RAILWAYS, BY REGION, 2022-2028 (USD MILLION)

- TABLE 60 FIRE-RESISTANT FABRICS MARKET SIZE IN RAILWAYS, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 61 FIRE-RESISTANT FABRICS MARKET SIZE IN RAILWAYS, BY REGION, 2022-2028 (MILLION SQ. METER)

- 9.4.3 AEROSPACE

- TABLE 62 FIRE-RESISTANT FABRICS MARKET SIZE IN AEROSPACE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 63 FIRE-RESISTANT FABRICS MARKET SIZE IN AEROSPACE, BY REGION, 2022-2028 (USD MILLION)

- TABLE 64 FIRE-RESISTANT FABRICS MARKET SIZE IN AEROSPACE, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 65 FIRE-RESISTANT FABRICS MARKET SIZE IN AEROSPACE, BY REGION, 2022-2028 (MILLION SQ. METER)

- 9.4.4 MARINE

- TABLE 66 FIRE-RESISTANT FABRICS MARKET SIZE IN MARINE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 67 FIRE-RESISTANT FABRICS MARKET SIZE IN MARINE, BY REGION, 2022-2028 (USD MILLION)

- TABLE 68 FIRE-RESISTANT FABRICS MARKET SIZE IN MARINE, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 69 FIRE-RESISTANT FABRICS MARKET SIZE IN MARINE, BY REGION, 2022-2028 (MILLION SQ. METER)

- 9.4.5 AUTOMOTIVE

- TABLE 70 FIRE-RESISTANT FABRICS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 71 FIRE-RESISTANT FABRICS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022-2028 (USD MILLION)

- TABLE 72 FIRE-RESISTANT FABRICS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 73 FIRE-RESISTANT FABRICS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022-2028 (MILLION SQ. METER)

- 9.5 OTHERS

- TABLE 74 FIRE-RESISTANT FABRICS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017-2021 (USD MILLION)

- TABLE 75 FIRE-RESISTANT FABRICS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022-2028 (USD MILLION)

- TABLE 76 FIRE-RESISTANT FABRICS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 77 FIRE-RESISTANT FABRICS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022-2028 (MILLION SQ. METER)

10 FIRE-RESISTANT FABRICS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 39 ASIA PACIFIC TO BE FASTEST-GROWING FIRE-RESISTANT FABRICS MARKET BETWEEN 2023 AND 2028

- TABLE 78 FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2017-2021 (USD MILLION)

- TABLE 79 FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2022-2028 (USD MILLION)

- TABLE 80 FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2017-2021 (MILLION SQ. METER)

- TABLE 81 FIRE-RESISTANT FABRICS MARKET SIZE, BY REGION, 2022-2028 (MILLION SQ. METER)

- 10.2 ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SNAPSHOT

- 10.2.1 IMPACT OF RECESSION

- 10.2.2 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET, BY APPLICATION

- TABLE 82 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 83 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (MILLION SQ. METER)

- TABLE 85 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (MILLION SQ. METER)

- 10.2.3 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET, BY TYPE

- TABLE 86 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 87 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (MILLION SQ. METER)

- TABLE 89 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (MILLION SQ. METER)

- 10.2.4 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET, BY END-USE INDUSTRY

- TABLE 90 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 91 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 93 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.2.5 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET, BY COUNTRY

- TABLE 94 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 95 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 97 ASIA PACIFIC: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2022-2028 (MILLION SQ. METER)

- 10.2.5.1 China

- 10.2.5.1.1 Growing manufacturing sector to drive market

- 10.2.5.1 China

- TABLE 98 CHINA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 99 CHINA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 100 CHINA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 101 CHINA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.2.5.2 Japan

- 10.2.5.2.1 Automotive and marine sectors to drive fire-resistant fabrics market

- 10.2.5.2 Japan

- TABLE 102 JAPAN: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 103 JAPAN: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 104 JAPAN: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 105 JAPAN: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.2.5.3 India

- 10.2.5.3.1 Industrial segment to be largest and fastest-growing end user of fire-resistant fabrics

- 10.2.5.3 India

- TABLE 106 INDIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 107 INDIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 108 INDIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 109 INDIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.2.5.4 South Korea

- 10.2.5.4.1 Government initiatives in industrial sector to drive demand

- 10.2.5.4 South Korea

- TABLE 110 SOUTH KOREA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 111 SOUTH KOREA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 112 SOUTH KOREA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 113 SOUTH KOREA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.2.5.5 Australia & New Zealand

- 10.2.5.5.1 High demand from building & construction and electronics industries to drive market

- 10.2.5.5 Australia & New Zealand

- TABLE 114 AUSTRALIA & NEW ZEALAND: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 115 AUSTRALIA & NEW ZEALAND: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 116 AUSTRALIA & NEW ZEALAND: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 117 AUSTRALIA & NEW ZEALAND: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.3 NORTH AMERICA

- FIGURE 41 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SNAPSHOT

- 10.3.1 IMPACT OF RECESSION

- 10.3.2 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET, BY APPLICATION

- TABLE 118 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 119 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (MILLION SQ. METER)

- TABLE 121 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (MILLION SQ. METER)

- 10.3.3 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET, BY TYPE

- TABLE 122 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 123 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 124 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (MILLION SQ. METER)

- TABLE 125 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (MILLION SQ. METER)

- 10.3.4 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET, BY END-USE INDUSTRY

- TABLE 126 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 127 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 129 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.3.5 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET, BY COUNTRY

- TABLE 130 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 131 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 133 NORTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2022-2028 (MILLION SQ. METER)

- 10.3.5.1 US

- 10.3.5.1.1 High demand from defense and firefighting sectors to drive market

- 10.3.5.1 US

- TABLE 134 US: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 135 US: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 136 US: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 137 US: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.3.5.2 Mexico

- 10.3.5.2.1 Increasing foreign investments to fuel growth of market

- 10.3.5.2 Mexico

- TABLE 138 MEXICO: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 139 MEXICO: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 140 MEXICO: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 141 MEXICO: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.3.5.3 Canada

- 10.3.5.3.1 High technical knowledge and expertise to support market growth

- 10.3.5.3 Canada

- TABLE 142 CANADA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 143 CANADA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 144 CANADA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 145 CANADA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.4 EUROPE

- FIGURE 42 EUROPE: FIRE-RESISTANT FABRICS MARKET SNAPSHOT

- 10.4.1 IMPACT OF RECESSION

- 10.4.2 EUROPE: FIRE-RESISTANT FABRICS MARKET, BY APPLICATION

- TABLE 146 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 147 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 148 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (MILLION SQ. METER)

- TABLE 149 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (MILLION SQ. METER)

- 10.4.3 EUROPE: FIRE-RESISTANT FABRICS MARKET, BY TYPE

- TABLE 150 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 151 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 152 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (MILLION SQ. METER)

- TABLE 153 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (MILLION SQ. METER)

- 10.4.4 EUROPE: FIRE-RESISTANT FABRICS MARKET, BY END-USE INDUSTRY

- TABLE 154 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 155 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 156 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 157 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.4.5 EUROPE: FIRE-RESISTANT FABRICS MARKET, BY COUNTRY

- TABLE 158 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 159 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 160 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 161 EUROPE: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2022-2028 (MILLION SQ. METER)

- 10.4.5.1 Germany

- 10.4.5.1.1 Increasing domestic demand to drive market

- 10.4.5.1 Germany

- TABLE 162 GERMANY: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 163 GERMANY: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 164 GERMANY: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 165 GERMANY: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.4.5.2 France

- 10.4.5.2.1 Presence of domestic apparel manufacturers and increased industrial production to drive market

- 10.4.5.2 France

- TABLE 166 FRANCE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 167 FRANCE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 168 FRANCE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 169 FRANCE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.4.5.3 UK

- 10.4.5.3.1 Rise in construction activities to fuel demand for fire-resistant fabrics

- 10.4.5.3 UK

- TABLE 170 UK: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 171 UK: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 172 UK: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 173 UK: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.4.5.4 Italy

- 10.4.5.4.1 High level of innovation in end-use products to support market growth

- 10.4.5.4 Italy

- TABLE 174 ITALY: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 175 ITALY: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 176 ITALY: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 177 ITALY: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.4.5.5 Russia

- 10.4.5.5.1 Strong oil & gas industry to drive demand for fire-resistant fabrics

- 10.4.5.5 Russia

- TABLE 178 RUSSIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 179 RUSSIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 180 RUSSIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 181 RUSSIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.5 SOUTH AMERICA

- 10.5.1 IMPACT OF RECESSION

- 10.5.2 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET, BY APPLICATION

- TABLE 182 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 183 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 184 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (MILLION SQ. METER)

- TABLE 185 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (MILLION SQ. METER)

- 10.5.3 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET, BY TYPE

- TABLE 186 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 187 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 188 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (MILLION SQ. METER)

- TABLE 189 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (MILLION SQ. METER)

- 10.5.4 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET, BY END-USE INDUSTRY

- TABLE 190 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 191 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 192 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 193 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.5.5 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET, BY COUNTRY

- TABLE 194 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 195 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 196 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 197 SOUTH AMERICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2022-2028 (MILLION SQ. METER)

- 10.5.5.1 Brazil

- 10.5.5.1.1 Implementation of stringent regulations to drive market

- 10.5.5.1 Brazil

- TABLE 198 BRAZIL: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 199 BRAZIL: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 200 BRAZIL: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 201 BRAZIL: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.5.5.2 Argentina

- 10.5.5.2.1 Rising demand from protective apparel application to fuel market

- 10.5.5.2 Argentina

- TABLE 202 ARGENTINA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 203 ARGENTINA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 204 ARGENTINA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 205 ARGENTINA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 IMPACT OF RECESSION

- 10.6.2 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET, BY APPLICATION

- TABLE 206 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2017-2021 (MILLION SQ. METER)

- TABLE 209 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY APPLICATION, 2022-2028 (MILLION SQ. METER)

- 10.6.3 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET, BY TYPE

- TABLE 210 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2017-2021 (MILLION SQ. METER)

- TABLE 213 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY TYPE, 2022-2028 (MILLION SQ. METER)

- 10.6.4 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET, BY END-USE INDUSTRY

- TABLE 214 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 217 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.6.5 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET, BY COUNTRY

- TABLE 218 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 221 MIDDLE EAST & AFRICA: FIRE-RESISTANT FABRICS MARKET SIZE, BY COUNTRY, 2022-2028 (MILLION SQ. METER)

- 10.6.5.1 Saudi Arabia

- 10.6.5.1.1 Demand from oil & gas industry to drive market during forecast period

- 10.6.5.1 Saudi Arabia

- TABLE 222 SAUDI ARABIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 223 SAUDI ARABIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 224 SAUDI ARABIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 225 SAUDI ARABIA: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.6.5.2 UAE

- 10.6.5.2.1 Potential foreign investments and rapid urbanization to positively influence market

- 10.6.5.2 UAE

- TABLE 226 UAE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 227 UAE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 228 UAE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 229 UAE: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

- 10.6.5.3 Iran

- 10.6.5.3.1 Industrial sector to be largest consumer of fire-resistant fabrics

- 10.6.5.3 Iran

- TABLE 230 IRAN: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (USD MILLION)

- TABLE 231 IRAN: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 232 IRAN: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2017-2021 (MILLION SQ. METER)

- TABLE 233 IRAN: FIRE-RESISTANT FABRICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2028 (MILLION SQ. METER)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 234 OVERVIEW OF STRATEGIES ADOPTED BY KEY FIRE-RESISTANT FABRIC MANUFACTURERS

- 11.3 RANKING OF KEY MARKET PLAYERS

- FIGURE 43 RANKING OF TOP 5 PLAYERS IN FIRE-RESISTANT FABRICS MARKET, 2022

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 44 DUPONT DE NEMOURS, INC. LED FIRE-RESISTANT FABRICS MARKET IN 2022

- 11.4.1 DUPONT DE NEMOURS, INC.

- 11.4.2 LENZING AG

- 11.4.3 TEIJIN LTD.

- 11.4.4 TENCATE PROTECTIVE FABRICS

- 11.4.5 PBI PERFORMANCE PRODUCTS INC.

- 11.5 DEGREE OF COMPETITION OF KEY PLAYERS

- TABLE 235 FIRE-RESISTANT FABRICS MARKET: DEGREE OF COMPETITION

- 11.6 REVENUE ANALYSIS OF KEY MARKET PLAYERS

- FIGURE 45 REVENUE ANALYSIS OF KEY COMPANIES (2018-2022)

- 11.7 COMPANY FOOTPRINT ANALYSIS

- FIGURE 46 FIRE-RESISTANT FABRICS MARKET: COMPANY OVERALL FOOTPRINT

- TABLE 236 FIRE-RESISTANT FABRICS MARKET: COMPANY TYPE FOOTPRINT

- TABLE 237 FIRE-RESISTANT FABRICS MARKET: COMPANY APPLICATION FOOTPRINT

- TABLE 238 FIRE-RESISTANT FABRICS MARKET: COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 239 FIRE-RESISTANT FABRICS MARKET: COMPANY REGION FOOTPRINT

- 11.8 COMPANY EVALUATION QUADRANT (TIER-1 PLAYERS)

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PARTICIPANTS

- 11.8.4 PERVASIVE PLAYERS

- FIGURE 47 FIRE-RESISTANT FABRICS MARKET: COMPANY EVALUATION MATRIX (TIER-1 PLAYERS)

- 11.9 COMPETITIVE BENCHMARKING

- TABLE 240 FIRE-RESISTANT FABRICS MARKET: KEY STARTUPS/SMES

- TABLE 241 FIRE-RESISTANT FABRICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.10 STARTUP/SME EVALUATION QUADRANT

- 11.10.1 PROGRESSIVE COMPANIES

- 11.10.2 RESPONSIVE COMPANIES

- 11.10.3 STARTING BLOCKS

- 11.10.4 DYNAMIC COMPANIES

- FIGURE 48 FIRE-RESISTANT FABRICS MARKET: STARTUPS/SMES EVALUATION MATRIX

- 11.11 COMPETITIVE SITUATION AND TRENDS

- 11.11.1 DEALS

- TABLE 242 FIRE-RESISTANT FABRICS MARKET: DEALS (2019-2023)

- 11.11.2 PRODUCT LAUNCHES

- TABLE 243 FIRE-RESISTANT FABRICS MARKET: PRODUCT LAUNCHES (2019-2023)

12 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 12.1 MAJOR PLAYERS

- 12.1.1 DUPONT DE NEMOURS, INC.

- TABLE 244 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

- FIGURE 49 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

- 12.1.2 LENZING AG

- TABLE 245 LENZING AG: COMPANY OVERVIEW

- FIGURE 50 LENZING AG: COMPANY SNAPSHOT

- 12.1.3 TEIJIN LTD.

- TABLE 246 TEIJIN LTD.: COMPANY OVERVIEW

- FIGURE 51 TEIJIN LTD.: COMPANY SNAPSHOT

- 12.1.4 TENCATE PROTECTIVE FABRICS

- TABLE 247 TENCATE PROTECTIVE FABRICS: COMPANY OVERVIEW

- 12.1.5 PBI PERFORMANCE PRODUCTS INC.

- TABLE 248 PBI PERFORMANCE PRODUCTS INC.: COMPANY OVERVIEW

- 12.1.6 SOLVAY SA

- TABLE 249 SOLVAY SA: COMPANY OVERVIEW

- FIGURE 52 SOLVAY SA: COMPANY SNAPSHOT

- 12.1.7 KANEKA CORPORATION

- TABLE 250 KANEKA CORPORATION: COMPANY OVERVIEW

- FIGURE 53 KANEKA CORPORATION: COMPANY SNAPSHOT

- 12.1.8 GUN-EI CHEMICAL INDUSTRY CO., LTD.

- TABLE 251 GUN-EI CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- FIGURE 54 GUN-EI CHEMICAL INDUSTRIES CO., LTD.: COMPANY SNAPSHOT

- 12.1.9 HUNTSMAN CORPORATION

- TABLE 252 HUNTSMAN CORPORATION: COMPANY OVERVIEW

- FIGURE 55 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

- 12.1.10 MILLIKEN & COMPANY

- TABLE 253 MILLIKEN & COMPANY: COMPANY OVERVIEW

- 12.1.11 W.L. GORE & ASSOCIATES INC.

- TABLE 254 W.L. GORE & ASSOCIATES INC.: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER KEY PLAYERS

- 12.2.1 GLEN RAVEN TECHNICAL FABRICS LLC

- TABLE 255 GLEN RAVEN TECHNICAL FABRICS LLC: COMPANY OVERVIEW

- 12.2.2 CHARLES PARSONS

- TABLE 256 CHARLES PARSONS: COMPANY OVERVIEW

- 12.2.3 BANSWARA SYNTEX LTD.

- TABLE 257 BANSWARA SYNTEX LTD.: COMPANY OVERVIEW

- 12.2.4 TRIVERA GMBH

- TABLE 258 TRIVERA GMBH: COMPANY OVERVIEW

- 12.2.5 AUBURN MANUFACTURING INC.

- TABLE 259 AUBURN MANUFACTURING INC.: COMPANY OVERVIEW

- 12.2.6 TAIWAN K.K. CORPORATION

- TABLE 260 TAIWAN K.K. CORPORATION: COMPANY OVERVIEW

- 12.2.7 ADA & INA LTD. NATURAL FABRICS AND CURTAINS

- TABLE 261 ADA & INA LTD. NATURAL FABRICS AND CURTAINS: COMPANY OVERVIEW

- 12.2.8 KERMEL INDUSTRIES

- TABLE 262 KERMEL INDUSTRIES: COMPANY OVERVIEW

- 12.2.9 NEWTEX INDUSTRIES, INC.

- TABLE 263 NEWTEX INDUSTRIES, INC.: COMPANY OVERVIEW

- 12.2.10 XM TEXTILES

- TABLE 264 XM TEXTILES: COMPANY OVERVIEW

- 12.2.11 TOYOBO CO., LTD.

- TABLE 265 TOYOBO CO., LTD.: COMPANY OVERVIEW

- 12.2.12 DRAPER KNITTING COMPANY

- TABLE 266 DRAPER KNITTING COMPANY: COMPANY OVERVIEW

- 12.2.13 ARVIND LTD.

- TABLE 267 ARVIND LTD.: COMPANY OVERVIEW

- 12.2.14 SAINT-GOBAIN

- TABLE 268 SAINT-GOBAIN: COMPANY OVERVIEW

- 12.2.15 AGRU AMERICA INC.

- TABLE 269 AGRU AMERICA INC.: COMPANY OVERVIEW

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATION

- 13.3 META-ARAMID FIBER MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 META-ARAMID FIBER MARKET, BY REGION

- TABLE 270 META-ARAMID FIBER MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 271 META-ARAMID FIBER MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 272 META-ARAMID FIBER MARKET SIZE, BY REGION, 2017-2020 (TON)

- TABLE 273 META-ARAMID FIBER MARKET SIZE, BY REGION, 2021-2027 (TON)

- 13.4.1 ASIA PACIFIC

- 13.4.1.1 Asia Pacific: Meta-aramid fiber market, by country

- TABLE 274 ASIA PACIFIC: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 275 ASIA PACIFIC: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 276 ASIA PACIFIC: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2017-2020 (TON)

- TABLE 277 ASIA PACIFIC: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2021-2027 (TON)

- 13.4.2 EUROPE

- 13.4.2.1 Europe: Meta-aramid fiber market, by country

- TABLE 278 EUROPE: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 279 EUROPE: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 280 EUROPE: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2017-2020 (TON)

- TABLE 281 EUROPE: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2021-2027 (TON)

- 13.4.3 NORTH AMERICA

- 13.4.3.1 North America: Meta-aramid fiber market, by country

- TABLE 282 NORTH AMERICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 283 NORTH AMERICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION

- TABLE 284 NORTH AMERICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2017-2020 (TON)

- TABLE 285 NORTH AMERICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2021-2027 (TON)

- 13.4.4 MIDDLE EAST & AFRICA

- 13.4.4.1 Middle East & Africa: Meta-aramid fiber market, by country

- TABLE 286 MIDDLE EAST & AFRICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 287 MIDDLE EAST & AFRICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 288 MIDDLE EAST & AFRICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2017-2020 (TON)

- TABLE 289 MIDDLE EAST & AFRICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2021-2027 (TON)

- 13.4.5 SOUTH AMERICA

- 13.4.5.1 South America: Meta-aramid fiber market, by country

- TABLE 290 SOUTH AMERICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 291 SOUTH AMERICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 292 SOUTH AMERICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2017-2020 (TON)

- TABLE 293 SOUTH AMERICA: META-ARAMID FIBER MARKET SIZE, BY COUNTRY, 2021-2027 (TON)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS