|

|

市場調査レポート

商品コード

1301539

近赤外イメージングの世界市場:製品別 (イメージングシステム、プローブ、色素 (有機、ナノ粒子))・処置別 (がん、CVD、消化器、産婦人科)・用途別 (前臨床、臨床、医療)・エンドユーザー別 (病院、製薬企業、研究機関)・地域別の将来予測 (2028年まで)Near-infrared Imaging Market by Product (Imaging System, Probe, Dye (Organic, Nanoparticle)), Procedure (Cancer, CVD, GI, OB/GYN), Application (Preclinical, Clinical, Medical), End User (Hospital, Pharma, Research Lab) & Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 近赤外イメージングの世界市場:製品別 (イメージングシステム、プローブ、色素 (有機、ナノ粒子))・処置別 (がん、CVD、消化器、産婦人科)・用途別 (前臨床、臨床、医療)・エンドユーザー別 (病院、製薬企業、研究機関)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月29日

発行: MarketsandMarkets

ページ情報: 英文 233 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の近赤外イメージング市場は、2023年の10億米ドルから2028年には19億米ドルに達し、2023年から2028年までの間に14.0%のCAGRで成長すると予測されています。

対象疾患の罹患率/有病率の高さ、画像診断センター/処置件数の増加、疾患の早期診断の利点に関する意識の高まり、技術的に先進的なNIRモダリティの急速な採用などの要因が、この市場の成長拡大の要因となっています。

"近赤外蛍光イメージングシステムが、2022年に最大の市場シェアを占める"

製品別に見ると、近赤外蛍光イメージングシステムが大きなシェアを占めています。近赤外蛍光イメージングシステムが提供する高感度、高解像度、手術中のリアルタイム画像ガイダンスなどの利点が、この製品セグメントの成長を牽引しています。

"用途別では、前臨床イメージングのセグメントが、予測期間中に最も高いCAGRで成長する"

前臨床イメージングとは、薬剤開発などの研究目的で生きた動物を可視化することを指します。科学者が生物学的メカニズムを検出・監視し、体内の治療反応を正確に測定・提供するのに役立ちます。がん・炎症・血管新生・感染症・血管疾患などの疾患/病態に対する新たな治療法の開発に注目が集まっていることが、予測期間中にこの応用分野の成長を促進すると予想されています。

"がん手術セグメントが予測期間中に最大のCAGRで成長する"

世界中でがんの有病率が上昇していることが、がん手術のセグメントの成長を促進する主な要因です。

"北米市場は予測期間中に最も高い成長が見込まれる"

北米地域の近赤外イメージング市場は、予測期間中に最大のCAGRで成長すると予測されています。その主な理由は、同地域の医療費の大きさ、対象疾患の有病率の上昇、研究活動の増加、美容整形手術の増加、イメージングシステムの技術進歩などです。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 規制分析

- 償還シナリオ分析

- エコシステムマッピング

- バリューチェーン分析

- サプライチェーン分析

- 特許分析

- 貿易分析

- 主要な会議とイベント (2023年~2025年)

- 技術分析

- ケーススタディ分析

- 価格分析

第6章 近赤外イメージング市場:製品別

- イントロダクション

- デバイス

- 蛍光イメージングシステム

- 蛍光・生物発光イメージングシステム

- NIR造影剤/イメージングプローブ

- インドシアニングリーン

- その他の造影剤

- 近赤外線色素

- 有機色素

- ナノ粒子色素

第7章 近赤外イメージング市場:処置別

- イントロダクション

- がん手術

- 脳がん/腫瘍手術

- その他のがん手術

- 消化器手術

- 結腸直腸手術

- その他の消化器手術

- 心血管疾患 (CVD)

- 形成外科/再建手術

- 産婦人科手術

- その他の処置

第8章 近赤外イメージング市場:用途別

- イントロダクション

- 前臨床イメージング

- 臨床画像処理

- 医療画像処理

第9章 近赤外イメージング市場:エンドユーザー別

- イントロダクション

- 病院・外科クリニック

- 製薬・バイオテクノロジー企業

- 研究・学術機関

- その他のエンドユーザー

第10章 近赤外イメージング市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- 収益シェア分析

- 市場シェア分析

- 企業評価マトリックス:主要企業 (2022年)

- 企業評価マトリックス:スタートアップ/中小企業 (2022年)

- 競合ベンチマーキング

- 競争シナリオと動向

第12章 企業プロファイル

- 主要企業

- STRYKER

- KARL STORZ SE & CO. KG

- CARL ZEISS MEDITEC AG

- LEICA MICROSYSTEMS

- OLYMPUS CORPORATION

- SHIMADZU CORPORATION

- PERKINELMER, INC.

- LI-COR, INC.

- HAMAMATSU PHOTONICS K.K.

- QUEST MEDICAL IMAGING B.V.

- SIGMA-ALDRICH (MERCK)

- MIZUHO MEDICAL CO., LTD.

- TELEDYNE PRINCETON INSTRUMENTS

- THERMO FISHER SCIENTIFIC INC.

- FLUOPTICS

- MEDTRONIC

- CAYMAN CHEMICAL

- MP BIOMEDICALS

- CRYSTA-LYN CHEMICAL COMPANY

- GOWERLABS LTD.

- その他の企業

- NIRX MEDICAL TECHNOLOGIES, LLC

- XENICS NV

- BIOTIUM

- TOKYO CHEMICAL INDUSTRY (INDIA) PVT. LTD.

- AAT BIOQUEST, INC.

第13章 付録

The global near infrared imaging market is projected to reach USD 1.9 billion by 2028 from USD 1.0 billion in 2023, at a CAGR of 14.0% from 2023 to 2028. Factors such as the high incidence/prevalence of target diseases, growing number of diagnostic imaging centers/procedures, increasing awareness about the benefits of early diagnosis of diseases, and the rapid adoption of technologically advanced NIR modalities are responsible for the increasing growth of this market.

"The near-infrared fluorescence imaging sub-systems segment of NIR devices segment held the largest share of the market in 2022"

Based on product, the near-infrared imaging market is segmented into NIR devices, NIR imaging agents/probes and NIR dyes. The NIR devices segment of the market is further divided into near-infrared fluorescence imaging systems and near-infrared fluorescence & bioluminescence imaging systems. The near-infrared fluorescence imaging systems subsegment held a major share in the market. Advantages offered by near-infrared fluorescence imaging systems, such as high sensitivity, high-image resolution, and real-time image guidance during surgeries, are driving the growth of this product segment.

"The preclinical applications segment is projected to register the highest CAGR during the forecast period"

Based on application, the near infrared imaging market is broadly categorized into preclinical, clinical and medical. Preclinical imaging refers to the visualization of living animals for research purposes, such as for drug development. It helps scientists to detect and monitor biological mechanisms and to accurately measure and provide therapeutic responses within the body. The growing focus on developing new treatments for diseases/conditions such as cancer, inflammation, angiogenesis, infections, and vascular diseases is expected to drive the growth of this application segment during the forecast period.

"The cancer surgeries segment is projected to register the highest CAGR during the forecast period"

Based on procedure, the near infrared imaging market is broadly categorized into cancer surgeries, gastrointestinal surgeries, cardiovascular surgeries, plastic/reconstructive surgeries, and brain tumor surgeries. The rising prevalence of cancer across the globe is the major factor driving the growth of this segment.

"The market in the North America region is expected to witness the highest growth during the forecast period."

The near infrared imaging market in the North America region is expected to register a CAGR during the forecast period, primarily due to the high healthcare spending in the region, rising prevalence of target diseases, increasing research activities, growing number of cosmetic surgeries, and technological advancements in imaging systems.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-48%, Tier 2-36%, and Tier 3- 16%

- By Designation: Director-level-14%, C-level-10%, and Others-76%

- By Region: North America-40%, Europe-32%, Asia Pacific-20%, Latin America-5%, and the Middle East & Africa-3%

The prominent players in the near infrared imaging market are Stryker (US), KARL STORZ SE & Co. KG (Germany), Carl Zeiss Meditec AG (Germany), Leica Microsystems (US), Olympus Corporation (Japan), PerkinElmer, Inc. (US), LI-COR, Inc. (US), Medtronic (Ireland) among others.

Research Coverage

This report studies the near infrared imaging market based on product, procedure, application, enduser, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall near infrared imaging market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights on the following pointers:

- Analysis of key drivers (rising target patient population, growing adoption of multimodal PET imaging devices, technological advancement, and increasing investment, funds, and grants by public-private organizations), restraints (high capital and operational cost, unfavorable regulatory guidelines), opportunities (improving healthcare infrastructure across emerging countries, PET utilization for breast imaging, promising product pipeline), and challenges (availability of alternate imaging technologies) influencing the growth of the near infrared imaging market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the near infrared imaging market

- Market Development: Comprehensive information about lucrative markets-the report analyses the near infrared imaging market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the near infrared imaging market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Stryker (US), KARL STORZ SE & Co. KG (Germany), Carl Zeiss Meditec AG (Germany), Leica Microsystems (US), Olympus Corporation (Japan), PerkinElmer, Inc. (US), LI-COR, Inc. (US), and Medtronic (Ireland).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKETS COVERED

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SEGMENTATION

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 RESEARCH LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 NEAR INFRARED IMAGING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY AND DEMAND SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- FIGURE 5 APPROACH 1: MARKET SIZE ESTIMATION (COMPANY REVENUE ESTIMATION)

- FIGURE 6 REVENUE SHARE ANALYSIS: ILLUSTRATIVE EXAMPLE OF STRYKER

- 2.2.1.2 Approach 2: Customer-based market estimation

- FIGURE 7 NEAR-INFRARED IMAGING MARKET: BOTTOM-UP APPROACH

- 2.2.1.3 CAGR projections

- FIGURE 8 CAGR PROJECTION: SUPPLY SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ASSESSMENT

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.6.1 NEAR-INFRARED IMAGING MARKET: RISK ASSESSMENT

- 2.7 GROWTH RATE ASSUMPTIONS

- 2.8 NEAR-INFRARED IMAGING MARKET: RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 10 NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 NEAR-INFRARED IMAGING MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 NEAR-INFRARED IMAGING MARKET, BY PROCEDURE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 NEAR-INFRARED IMAGING MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT: NEAR-INFRARED IMAGING MARKET

4 PREMIUM INSIGHTS

- 4.1 NEAR-INFRARED IMAGING MARKET OVERVIEW

- FIGURE 15 RISING PREVALENCE OF TARGET DISEASES TO DRIVE MARKET

- 4.2 NORTH AMERICA: NEAR-INFRARED IMAGING MARKET, BY PRODUCT (2023 VS. 2028)

- FIGURE 16 DEVICES SEGMENT TO DOMINATE NORTH AMERICAN NEAR-INFRARED IMAGING MARKET DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET, BY END USER (2023 VS. 2028)

- FIGURE 17 HOSPITALS & SURGICAL CLINICS TO FORM LARGEST END USER SEGMENT IN ASIA PACIFIC MARKET

- 4.4 GLOBAL: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE (2023 VS. 2028)

- FIGURE 18 FLUORESCENCE IMAGING SYSTEMS SEGMENT TO HOLD LARGEST SHARE DURING STUDY PERIOD

- 4.5 GEOGRAPHICAL SNAPSHOT OF NEAR-INFRARED IMAGING MARKET

- FIGURE 19 CHINA TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 NEAR-INFRARED IMAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of surgical procedures globally

- 5.2.1.2 Advantages of near-infrared imaging over conventional visualization methods

- TABLE 1 ADVANTAGES OF NEAR-INFRARED IMAGING OVER CONVENTIONAL VISUALIZATION METHODS

- 5.2.1.3 Technological advancements in near-infrared imaging modalities

- 5.2.1.4 Adoption of hybrid near-infrared imaging modalities for surgical guidance and molecular imaging

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lengthy approval process of near-infrared fluorophores

- 5.2.2.2 High initial capital and operational costs of near-infrared systems

- 5.2.2.3 Availability of alternate technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth potential for major players in emerging economies

- 5.2.3.2 Use of blockchain for distribution and storage of medical images

- 5.2.4 CHALLENGES

- 5.2.4.1 Hospital budget cuts

- 5.2.4.2 Dearth of trained professionals in emerging economies

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 NEAR-INFRARED IMAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 REGULATORY ANALYSIS

- 5.4.1 NORTH AMERICA

- 5.4.1.1 US

- TABLE 3 US: APPROVED IMAGING DEVICES BY FDA

- TABLE 4 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 5 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.4.1.2 Canada

- TABLE 6 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.4.2 EUROPE

- 5.4.3 ASIA PACIFIC

- 5.4.3.1 Japan

- TABLE 7 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- 5.4.3.2 China

- TABLE 8 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- 5.4.3.3 India

- 5.4.1 NORTH AMERICA

- 5.5 REIMBURSEMENT SCENARIO ANALYSIS

- TABLE 9 MEDICAL REIMBURSEMENT CPT CODES FOR NEAR-INFRARED PROCEDURES IN US (AS OF 2021)

- 5.6 ECOSYSTEM MAPPING

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 RESEARCH & PRODUCT DEVELOPMENT

- 5.7.2 RAW MATERIAL AND MANUFACTURING

- 5.7.3 MARKETING & SALES, SHIPMENT, AND POST-SALES SERVICES

- FIGURE 21 VALUE CHAIN ANALYSIS-MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

- 5.8 SUPPLY CHAIN ANALYSIS

- 5.8.1 PROMINENT COMPANIES

- 5.8.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.8.3 END USERS

- TABLE 10 SUPPLY CHAIN ECOSYSTEM OF NEAR-INFRARED IMAGING MARKET

- FIGURE 22 NEAR-INFRARED IMAGING MARKET: SUPPLY CHAIN ANALYSIS

- 5.9 PATENT ANALYSIS

- FIGURE 23 PATENT DETAILS FOR NEAR-INFRARED IMAGING (JANUARY 2013-MAY 2023)

- FIGURE 24 PATENT DETAILS FOR NEAR-INFRARED FLUORESCENCE IMAGING SYSTEMS (JANUARY 2013-MAY 2023)

- FIGURE 25 PATENT DETAILS FOR NEAR-INFRARED DYES (JANUARY 2013-MAY 2023)

- 5.10 TRADE ANALYSIS

- 5.10.1 TRADE ANALYSIS: NEAR-INFRARED IMAGING MARKET

- TABLE 11 IMPORT DATA FOR NEAR-INFRARED IMAGING (HS CODE 902750), BY COUNTRY, 2018-2022 (USD)

- TABLE 12 EXPORT DATA FOR NEAR-INFRARED IMAGING (HS CODE 902750), BY COUNTRY, 2018-2022 (USD)

- 5.11 KEY CONFERENCES AND EVENTS (2023-2025)

- TABLE 13 NEAR-INFRARED IMAGING MARKET: LIST OF KEY CONFERENCES AND EVENTS (2023-2025)

- 5.12 TECHNOLOGY ANALYSIS

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 TECHNOLOGICAL CHALLENGES

- TABLE 14 CASE STUDY 1: MAINTAINING STRONG FOCUS ON TECHNOLOGICAL INNOVATION AND ADDRESSING REGULATORY COMPLIANCE

- 5.13.2 LOWERING DEPENDENCE ON CONTRACT MANUFACTURING

- TABLE 15 CASE STUDY 2: PROVIDING TRAINING AND EDUCATION AND KEEPING UP WITH EVOLVING SURGICAL TECHNIQUES

- 5.14 PRICING ANALYSIS

- TABLE 16 REGION-WISE PRICE RANGE FOR NEAR-INFRARED IMAGING SYSTEMS

6 NEAR-INFRARED IMAGING MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 17 NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 DEVICES

- TABLE 18 NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 19 NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 20 NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY APPLICATION, 2021-2028 (USD MILLION)

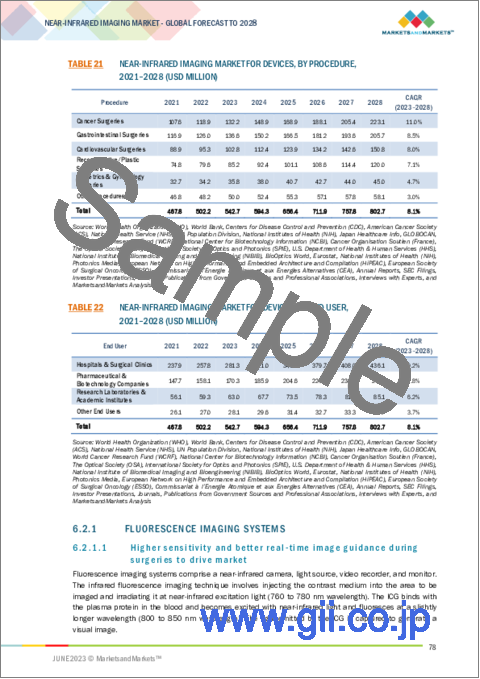

- TABLE 21 NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY PROCEDURE, 2021-2028 (USD MILLION)

- TABLE 22 NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY END USER, 2021-2028 (USD MILLION)

- 6.2.1 FLUORESCENCE IMAGING SYSTEMS

- 6.2.1.1 Higher sensitivity and better real-time image guidance during surgeries to drive market

- TABLE 23 FLUORESCENCE IMAGING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2 FLUORESCENCE & BIOLUMINESCENCE IMAGING SYSTEMS

- 6.2.2.1 Better sensitivity and higher efficiency at lower costs to drive market

- TABLE 24 FLUORESCENCE & BIOLUMINESCENCE IMAGING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 NIR IMAGING AGENTS/PROBES

- TABLE 25 NEAR-INFRARED IMAGING MARKET FOR NIR IMAGING AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 26 NEAR-INFRARED IMAGING MARKET FOR NIR IMAGING AGENTS/PROBES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 27 NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 28 NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY PROCEDURE, 2021-2028 (USD MILLION)

- TABLE 29 NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY END USER, 2021-2028 (USD MILLION)

- 6.3.1 INDOCYANINE GREEN

- 6.3.1.1 Increasing utilization of small organic probes in near-infrared imaging to drive segment

- TABLE 30 INDOCYANINE GREEN MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.2 OTHER REAGENTS

- 6.3.2.1 Other reagents to provide specific functionalities and properties for better imaging process

- TABLE 31 OTHER REAGENTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.4 NIR DYES

- TABLE 32 NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 33 NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 34 NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 35 NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY PROCEDURE, 2021-2028 (USD MILLION)

- TABLE 36 NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY END USER, 2021-2028 (USD MILLION)

- 6.4.1 ORGANIC DYES

- 6.4.1.1 Unique molecular structure and better compatibility with biological systems to drive segment

- TABLE 37 ORGANIC DYES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.4.2 NANOPARTICLE DYES

- 6.4.2.1 Better brightness and enhanced signal intensity compared to organic dyes to drive segment

- TABLE 38 NANOPARTICLE DYES MARKET, BY REGION, 2021-2028 (USD MILLION)

7 NEAR-INFRARED IMAGING MARKET, BY PROCEDURE

- 7.1 INTRODUCTION

- TABLE 39 NEAR-INFRARED IMAGING MARKET, BY PROCEDURE, 2021-2028 (USD MILLION)

- 7.2 CANCER SURGERIES

- TABLE 40 NEAR-INFRARED IMAGING MARKET FOR CANCER SURGERIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 41 NEAR-INFRARED IMAGING MARKET FOR CANCER SURGERIES, BY REGION, 2021-2028 (USD MILLION)

- 7.2.1 BRAIN CANCER/TUMOR SURGERIES

- 7.2.1.1 Advancements in surgical navigation using NIR-I/II fluorescence imaging to drive market

- TABLE 42 BRAIN CANCER/TUMOR SURGERIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2 OTHER CANCER SURGERIES

- 7.2.2.1 Better tissue penetration and lower autofluorescence levels to drive market

- TABLE 43 OTHER CANCER SURGERIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3 GASTROINTESTINAL SURGERIES

- TABLE 44 NEAR-INFRARED IMAGING MARKET FOR GASTROINTESTINAL SURGERIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 45 NEAR-INFRARED IMAGING MARKET FOR GASTROINTESTINAL SURGERIES, BY REGION, 2021-2028 (USD MILLION)

- 7.3.1 COLORECTAL SURGERIES

- 7.3.1.1 Advancements in treatment strategies and procedures to drive market

- TABLE 46 COLORECTAL SURGERIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2 OTHER GASTROINTESTINAL SURGERIES

- 7.3.2.1 Precise visualization of near-infrared imaging to drive market

- TABLE 47 OTHER GASTROINTESTINAL SURGERIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.4 CARDIOVASCULAR DISEASES

- 7.4.1 RISING PREVALENCE OF CARDIOVASCULAR DISEASES AMONG ALL AGE GROUPS TO DRIVE MARKET

- TABLE 48 NEAR-INFRARED IMAGING MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2021-2028 (USD MILLION)

- 7.5 PLASTIC/RECONSTRUCTIVE SURGERIES

- 7.5.1 RISING NUMBER OF RECONSTRUCTIVE SURGERIES GLOBALLY TO DRIVE MARKET

- TABLE 49 NEAR-INFRARED IMAGING MARKET FOR PLASTIC/RECONSTRUCTIVE SURGERIES, BY REGION, 2021-2028 (USD MILLION)

- 7.6 OBSTETRICS & GYNECOLOGY SURGERIES

- 7.6.1 INCREASED NUMBER OF CLINICAL TRIALS AND IMPROVED TISSUE CONTRAST DURING SURGERIES TO DRIVE MARKET

- TABLE 50 NEAR-INFRARED IMAGING MARKET FOR OBSTETRICS & GYNECOLOGY SURGERIES, BY REGION, 2021-2028 (USD MILLION)

- 7.7 OTHER PROCEDURES

- TABLE 51 NEAR-INFRARED IMAGING MARKET FOR OTHER PROCEDURES, BY REGION, 2021-2028 (USD MILLION)

8 NEAR-INFRARED IMAGING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 52 NEAR-INFRARED IMAGING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2 PRECLINICAL IMAGING

- 8.2.1 GROWING FOCUS ON DEVELOPING NEW TREATMENTS FOR CHRONIC DISEASES TO DRIVE MARKET

- TABLE 53 NEAR-INFRARED IMAGING MARKET FOR PRECLINICAL IMAGING, BY REGION, 2021-2028 (USD MILLION)

- 8.3 CLINICAL IMAGING

- 8.3.1 INCREASING USE OF NEAR-INFRARED IMAGING FOR REAL-TIME VISUALIZATION DURING SURGERIES TO DRIVE MARKET

- TABLE 54 NEAR-INFRARED IMAGING MARKET FOR CLINICAL IMAGING, BY REGION, 2021-2028 (USD MILLION)

- 8.4 MEDICAL IMAGING

- 8.4.1 APPLICATIONS OF FLUORESCENCE IMAGING SINGLE-CELL TRACKING FOR STUDYING IMMUNE SYSTEM TO DRIVE MARKET

- TABLE 55 NEAR-INFRARED IMAGING MARKET FOR MEDICAL IMAGING, BY REGION, 2021-2028 (USD MILLION)

9 NEAR-INFRARED IMAGING MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 56 NEAR-INFRARED IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 HOSPITALS & SURGICAL CLINICS

- 9.2.1 RISING NUMBER OF CANCER AND RECONSTRUCTIVE SURGERIES TO DRIVE MARKET

- TABLE 57 NEAR-INFRARED IMAGING MARKET FOR HOSPITALS & SURGICAL CLINICS, BY REGION, 2021-2028 (USD MILLION)

- 9.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 9.3.1 GROWING PRECLINICAL RESEARCH AND DRUG DISCOVERY TO DRIVE MARKET

- TABLE 58 NEAR-INFRARED IMAGING MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- 9.4 RESEARCH LABORATORIES & ACADEMIC INSTITUTES

- 9.4.1 FUNDING FROM GOVERNMENT ORGANIZATIONS FOR BIOMEDICAL RESEARCH TO DRIVE MARKET

- TABLE 59 NEAR-INFRARED IMAGING MARKET FOR RESEARCH LABORATORIES & ACADEMIC INSTITUTES, BY REGION, 2021-2028 (USD MILLION)

- 9.5 OTHER END USERS

- TABLE 60 NEAR-INFRARED IMAGING MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

10 NEAR-INFRARED IMAGING MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 61 NEAR-INFRARED IMAGING MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 26 NORTH AMERICA: NEAR-INFRARED IMAGING MARKET SNAPSHOT

- TABLE 62 NORTH AMERICA: NEAR-INFRARED IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: NEAR-INFRARED IMAGING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: NEAR-INFRARED IMAGING MARKET, BY PROCEDURE, 2021-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: NEAR-INFRARED IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Advanced healthcare infrastructure and favorable regulations to drive market

- TABLE 70 US: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 71 US: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 72 US: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 73 US: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Increased availability of research funding to drive market

- TABLE 74 CANADA: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 75 CANADA: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 76 CANADA: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 77 CANADA: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- TABLE 78 EUROPE: NEAR-INFRARED IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 79 EUROPE: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 80 EUROPE: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 81 EUROPE: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 82 EUROPE: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 83 EUROPE: NEAR-INFRARED IMAGING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 84 EUROPE: NEAR-INFRARED IMAGING MARKET, BY PROCEDURE, 2021-2028 (USD MILLION)

- TABLE 85 EUROPE: NEAR-INFRARED IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Increasing healthcare expenditure and government spending to drive market

- TABLE 86 GERMANY: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 87 GERMANY: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 88 GERMANY: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 89 GERMANY: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.2 FRANCE

- 10.3.2.1 Increasing target patient population and rising number of diagnostic tests for chronic diseases to drive market

- TABLE 90 FRANCE: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 91 FRANCE: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 92 FRANCE: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 FRANCE: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Growing government initiatives and increasing incidences of chronic diseases to drive market

- TABLE 94 UK: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 95 UK: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 96 UK: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 UK: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Increased availability of reimbursement coverage for diagnostic procedures to drive market

- TABLE 98 ITALY: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 99 ITALY: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 ITALY: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 ITALY: NEAR-INFRARED IMAGING MARKET FOR NIR DYE, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 Increasing prevalence of cancer and growing private-public funding to drive market

- TABLE 102 SPAIN: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 103 SPAIN: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 104 SPAIN: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 SPAIN: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 106 REST OF EUROPE: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 27 ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET SNAPSHOT

- TABLE 110 ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET, BY PROCEDURE, 2021-2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Increasing healthcare reforms and government investments to drive market

- TABLE 118 CHINA: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 119 CHINA: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 CHINA: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 121 CHINA: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Fast adoption of advanced technologies and growth in geriatric population to drive market

- TABLE 122 JAPAN: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 123 JAPAN: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 JAPAN: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 JAPAN: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Increasing number of diagnostic procedures and improving healthcare infrastructure to drive market

- TABLE 126 INDIA: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 127 INDIA: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 128 INDIA: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 129 INDIA: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.4 AUSTRALIA

- 10.4.4.1 Growing healthcare spending and increasing investments in research to drive market

- TABLE 130 AUSTRALIA: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 131 AUSTRALIA: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 AUSTRALIA: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 AUSTRALIA: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Presence of advanced healthcare system and increased awareness about diseases to drive market

- TABLE 134 SOUTH KOREA: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 135 SOUTH KOREA: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 SOUTH KOREA: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 SOUTH KOREA: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 138 REST OF ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- TABLE 142 LATIN AMERICA: NEAR-INFRARED IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 143 LATIN AMERICA: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 144 LATIN AMERICA: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 145 LATIN AMERICA: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 LATIN AMERICA: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 147 LATIN AMERICA: NEAR-INFRARED IMAGING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 148 LATIN AMERICA: NEAR-INFRARED IMAGING MARKET, BY PROCEDURE, 2021-2028 (USD MILLION)

- TABLE 149 LATIN AMERICA: NEAR-INFRARED IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.1 BRAZIL

- 10.5.1.1 Greater purchasing power and more favorable demographic conditions to drive market

- TABLE 150 BRAZIL: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 151 BRAZIL: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 152 BRAZIL: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 153 BRAZIL: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.5.2 MEXICO

- 10.5.2.1 Increased medical tourism and better government healthcare initiatives to drive market

- TABLE 154 MEXICO: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 155 MEXICO: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 MEXICO: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 MEXICO: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.5.3 REST OF LATIN AMERICA

- TABLE 158 REST OF LATIN AMERICA: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 159 REST OF LATIN AMERICA: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 160 REST OF LATIN AMERICA: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 161 REST OF LATIN AMERICA: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GROWING MEDICAL TOURISM TO DRIVE MARKET

- TABLE 162 MIDDLE EAST & AFRICA: NEAR-INFRARED IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: NEAR-INFRARED IMAGING MARKET FOR DEVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: NEAR-INFRARED IMAGING MARKET FOR NIR AGENTS/PROBES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: NEAR-INFRARED IMAGING MARKET FOR NIR DYES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: NEAR-INFRARED IMAGING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: NEAR-INFRARED IMAGING MARKET, BY PROCEDURE, 2021-2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: NEAR-INFRARED IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2.1 OVERVIEW OF KEY STRATEGIES ADOPTED BY PLAYERS IN NEAR-INFRARED IMAGING MARKET

- 11.3 REVENUE SHARE ANALYSIS

- FIGURE 28 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN NEAR-INFRARED IMAGING MARKET, 2022

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 29 MARKET SHARE ANALYSIS OF TOP PLAYERS IN NEAR-INFRARED IMAGING MARKET, 2022

- TABLE 169 NEAR-INFRARED IMAGING MARKET: DEGREE OF COMPETITION

- 11.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 30 NEAR-INFRARED IMAGING MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 11.6 COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 31 NEAR-INFRARED IMAGING MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 170 PRODUCT AND GEOGRAPHICAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 171 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 172 GEOGRAPHICAL FOOTPRINT OF COMPANIES

- 11.8 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 173 KEY PRODUCT LAUNCHES

- TABLE 174 KEY DEALS

- TABLE 175 OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 12.1 KEY PLAYERS

- 12.1.1 STRYKER

- TABLE 176 STRYKER: COMPANY OVERVIEW

- FIGURE 32 STRYKER: COMPANY SNAPSHOT (2022)

- 12.1.2 KARL STORZ SE & CO. KG

- TABLE 177 KARL STORZ SE & CO. KG: COMPANY OVERVIEW

- 12.1.3 CARL ZEISS MEDITEC AG

- TABLE 178 CARL ZEISS MEDITEC GROUP: COMPANY OVERVIEW

- FIGURE 33 CARL ZEISS MEDITEC GROUP: COMPANY SNAPSHOT (2022)

- 12.1.4 LEICA MICROSYSTEMS

- TABLE 179 LEICA MICROSYSTEMS: COMPANY OVERVIEW

- FIGURE 34 LEICA MICROSYSTEMS (DANAHER CORPORATION): COMPANY SNAPSHOT (2022)

- 12.1.5 OLYMPUS CORPORATION

- TABLE 180 OLYMPUS CORPORATION: COMPANY OVERVIEW

- FIGURE 35 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.6 SHIMADZU CORPORATION

- TABLE 181 SHIMADZU CORPORATION: COMPANY OVERVIEW

- FIGURE 36 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2021)

- 12.1.7 PERKINELMER, INC.

- TABLE 182 PERKINELMER, INC.: COMPANY OVERVIEW

- FIGURE 37 PERKINELMER, INC.: COMPANY SNAPSHOT (2021)

- 12.1.8 LI-COR, INC.

- TABLE 183 LI-COR, INC.: COMPANY OVERVIEW

- 12.1.9 HAMAMATSU PHOTONICS K.K.

- TABLE 184 HAMAMATSU PHOTONICS K.K.: COMPANY OVERVIEW

- FIGURE 38 HAMAMATSU PHOTONICS K.K.: COMPANY SNAPSHOT (2022)

- 12.1.10 QUEST MEDICAL IMAGING B.V.

- TABLE 185 QUEST MEDICAL IMAGING B.V.: COMPANY OVERVIEW

- 12.1.11 SIGMA-ALDRICH (MERCK)

- TABLE 186 SIGMA-ALDRICH: COMPANY OVERVIEW

- FIGURE 39 SIGMA-ALDRICH: COMPANY SNAPSHOT (2022)

- 12.1.12 MIZUHO MEDICAL CO., LTD.

- TABLE 187 MIZUHO MEDICAL CO., LTD.: COMPANY OVERVIEW

- 12.1.13 TELEDYNE PRINCETON INSTRUMENTS

- TABLE 188 TELEDYNE PRINCETON INSTRUMENTS: COMPANY OVERVIEW

- FIGURE 40 TELEDYNE PRINCETON INSTRUMENTS: COMPANY SNAPSHOT (2022)

- 12.1.14 THERMO FISHER SCIENTIFIC INC.

- TABLE 189 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 41 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- 12.1.15 FLUOPTICS

- TABLE 190 FLUOPTICS: COMPANY OVERVIEW

- 12.1.16 MEDTRONIC

- TABLE 191 MEDTRONIC: COMPANY OVERVIEW

- 12.1.17 CAYMAN CHEMICAL

- TABLE 192 CAYMAN CHEMICAL: COMPANY OVERVIEW

- 12.1.18 MP BIOMEDICALS

- TABLE 193 MP BIOMEDICALS: COMPANY OVERVIEW

- 12.1.19 CRYSTA-LYN CHEMICAL COMPANY

- TABLE 194 CRYSTA-LYN CHEMICAL COMPANY: COMPANY OVERVIEW

- 12.1.20 GOWERLABS LTD.

- TABLE 195 GOWERLABS LTD.: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER COMPANIES

- 12.2.1 NIRX MEDICAL TECHNOLOGIES, LLC

- 12.2.2 XENICS NV

- 12.2.3 BIOTIUM

- 12.2.4 TOKYO CHEMICAL INDUSTRY (INDIA) PVT. LTD.

- 12.2.5 AAT BIOQUEST, INC.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS