|

|

市場調査レポート

商品コード

1163987

ネットワークプローブの世界市場:コンポーネント別 (ソリューション、サービス (コンサルティング、訓練・サポート、インテグレーション・展開))・展開方法別・組織規模別・エンドユーザー別 (サービスプロバイダー、企業)・地域別の将来予測 (2027年まで)Network Probe Market by Component (Solution and Services (Consulting, Training and Support, and Integration and Deployment), Deployment Mode, Organization Size, End User (Service Providers and Enterprises) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ネットワークプローブの世界市場:コンポーネント別 (ソリューション、サービス (コンサルティング、訓練・サポート、インテグレーション・展開))・展開方法別・組織規模別・エンドユーザー別 (サービスプロバイダー、企業)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年11月24日

発行: MarketsandMarkets

ページ情報: 英文 235 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のネットワークプローブの市場規模は、2022年の5億4,900万米ドルから2027年には9億800万米ドルへと、予測期間中に10.6%のCAGRで成長すると予測されています。

ダウンタイム回避のためのスムーズなネットワーク移行や、監視環境下での機敏なネットワーク運用のニーズが、ネットワークプローブ・ソリューションの採用を促進すると予測されます。

"展開方法別では、クラウドベースのソリューションが予測期間中に高いCAGRを記録する"

クラウドベースのソリューションは、企業のコスト管理を可能にするだけでなく、ビジネスの俊敏性を向上させるのにも役立っています。クラウドベースのサービスは爆発的に伸びており、中小企業のクラウドへの依存度は比較的高いです。

"組織規模別では、大企業が予測期間中に最大の市場シェアを占める"

ネットワークプローブにより、大企業はデータやネットワーク管理の問題をより良い方法で解決できるようになります。ネットワークプローブ・ソリューションを利用すれば、大企業はITインフラ環境全体をリアルタイムで活用・監視・管理し、ネットワーク・トラフィックを監視して、ネットワークの速度低下を引き起こす原因を瞬時に発見することができます。

"地域別では、アジア太平洋市場が予測期間中に最も高いCAGRを記録する"

アジア太平洋のネットワークプローブ市場の成長は、地域全体の技術進歩によって大きく後押しされています。域内の市場成長には、大規模な人口の存在と、インフラや技術の発展が大きく寄与しています。

当レポートでは、世界のネットワークプローブの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・展開方法別・組織規模別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 累積成長分析

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 技術分析

- イントロダクション

- ネットワークタップ

- 人工知能

- SDN (ソフトウェア定義ネットワーキング)

- IoT (モノのインターネット)

- 顧客に影響を与える傾向と混乱

- 特許分析

- 価格分析

- ケーススタディ分析

- 主な会議とイベント

- 関税と規制の影響

第6章 ネットワークプローブ市場:コンポーネント別

- イントロダクション

- ソリューション

- サービス

- コンサルティング

- トレーニングとサポート

- インテグレーション・展開

第7章 ネットワークプローブ市場:展開方式別

- イントロダクション

- オンプレミス

- クラウド

第8章 ネットワークプローブ市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第9章 ネットワークプローブ市場:エンドユーザー別

- イントロダクション

- サービスプロバイダー

- 通信サービスプロバイダー

- クラウドサービスプロバイダー

- その他のサービスプロバイダー

- 企業

- 銀行・金融サービス・保険 (BFSI)

- IT・ITeS

- 政府

- その他の企業

第10章 ネットワークプローブ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- 北欧諸国

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- 東南アジア

- 他のアジア太平洋諸国

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第11章 競合情勢

- 概要

- 市場評価フレームワーク

- 競合シナリオと動向

- 製品の発売

- 資本取引

- 上位企業のシェア分析

- 過去の収益分析

- 企業評価マトリックス:概要

- 企業評価マトリックス:調査手法と定義

- 企業の製品フットプリント分析

- 企業の市場ランキング分析

- スタートアップ/中小企業の評価マトリックス:調査手法と定義

- スタートアップ/中小企業の競合ベンチマーク

第12章 企業プロファイル

- 主要企業

- SOLARWINDS

- NETSCOUT

- BROADCOM

- IBM

- CISCO

- NOKIA

- NEC

- APPNETA

- CATCHPOINT

- ACCEDIAN

- PAESSLER

- MANAGEENGINE

- PROGRESS

- DYNATRACE

- HELPSYSTEMS

- RIVERBED

- MICRO FOCUS

- PLIXER

- OBJECTPLANET

- FIRSTWAVE

- RADCOM

- スタートアップ/中小企業

- KENTIK

- FLOWMON

- QOSMOS

- NAGIOS

- EXTRAHOP

- CUBRO

- 3COLUMNS

第13章 隣接/関連市場

- イントロダクション

- ネットワーク分析:世界市場の予測 (2025年まで)

- ネットワーク自動化:世界市場の予測 (2025年まで)

- ネットワーク監視:世界市場の予測 (2025年まで)

第14章 付録

The network probe market is projected to grow from USD 549 million in 2022 to USD 908 million by 2027, at a CAGR of 10.6% during the forecast period. The need for smooth network transitions to avoid downtime and agile networking operations under monitored environments is expected to drive the adoption of network probe solutions.

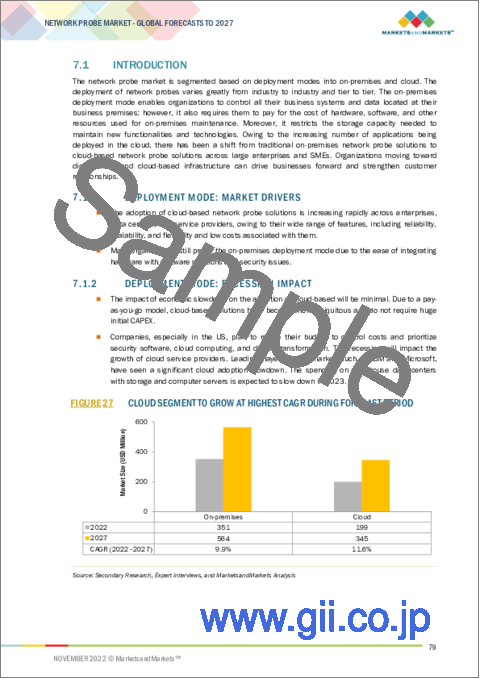

By deployment mode, cloud-based solution to register higher CAGR during forecast period

Cloud-based solution is not only enabling organizations to manage their costs but also helping them in improving business agility. There has been explosive growth in cloud-based services, and the dependency of SMEs on the cloud is relatively higher. With the cloud-based deployment of network probe solutions, small enterprises can collect and analyze data, thus improving their customer services. Cloud-based deployment is growing at a higher rate than that on-premises deployment, as cloud-based network monitoring solutions provide real-time data filtering and storage over the cloud rather than physical devices. Moreover, the cloud segment is expected to grow as cloud technology would enable firewall solutions to cost-effectively identify threats to sensitive data.

By organization size, large enterprises to account for largest market share during forecast period

Network probe enables large enterprises to solve their data and network management problems in a better manner. Enterprises, service providers, and data center operators have started to deploy network probe tools on a large scale to manage and analyze network traffic and protect it from security attacks. Network probe solutions can enable large organizations to manage the entire IT infrastructure environment with real-time application monitoring, monitor network traffic, and find sources causing networks to slow down in seconds.

Among regions, market in Asia Pacific to register highest CAGR during forecast period

The growth of the network probe market in the Asia Pacific is highly driven by technological advancements across the region. The existence of a large population and developing infrastructure and technology are major factors contributing to the growth of the network probe market in the Asia Pacific. It is expected to be the fastest-growing global network probe market, owing to the expansion of the customer base for network monitoring software and the emerging trend of network probe hybrid deployment. APAC is projected to witness enhanced growth opportunities during the forecast period. Countries in APAC are contributing toward the market's growth, owing to the rapid adoption of various network probe solutions by enterprises in the region.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the network probe market.

- By Company Type: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and others: 40%

- By Region: North America: 45%, Europe: 20%, Asia Pacific: 30%, RoW: 5%

The report includes the study of key players offering network probe solutions and services. It profiles major vendors in the network probe market. The major vendors in the network probe market include SolarWinds (US), NETSCOUT (US), Broadcom (US), IBM (US), Cisco (US), Nokia (Finland), NEC (Japan), AppNeta (US), Catchpoint (US), Accedian (Canada), Paessler (Germany), ManageEngine (US), Progress (US), Nagios (US), Dynatrace (US), HelpSystems (US), Riverbed (US), ExtraHop (US), Micro Focus (UK), Cubro (Austria), Plixer (US), Kentik (US), ObjectPlanet (Norway), Flowmon (Czech Republic), Qosmos (France), Radcom (Israel), Firstwave (Australia), and 3Columns (Australia).

Research Coverage

The market study covers the network probe market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as by component, organization size, deployment mode, end users and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall network probe market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 UNITED STATES DOLLAR, EXCHANGE RATES, 2018-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 NETWORK PROBE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 RESEARCH METHODOLOGY: APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1: SUPPLY SIDE ANALYSIS OF REVENUE FROM SOLUTIONS AND SERVICES IN NETWORK PROBE MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF NETWORK PROBE VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF COMPANY NETWORK PROBE REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2, (DEMAND SIDE): DEMAND SIZE MARKET ESTIMATIONS THROUGH END USERS

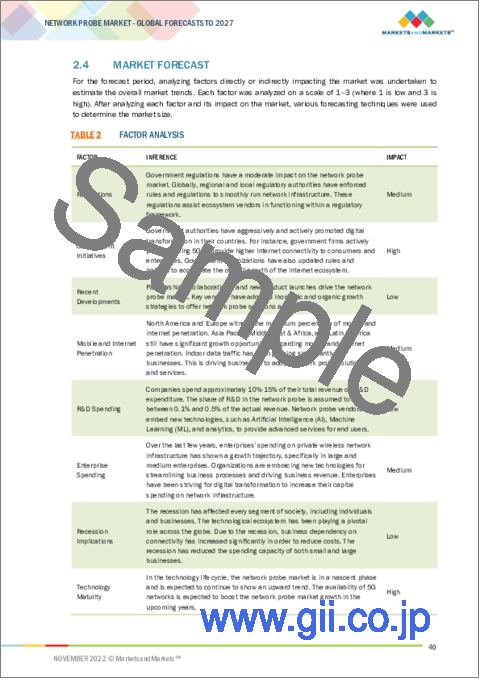

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 COMPANY EVALUATION MATRIX METHODOLOGY

- FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

- FIGURE 9 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 2.7 ASSUMPTIONS

- 2.8 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 NETWORK PROBE MARKET, 2020-2027 (USD MILLION)

- FIGURE 11 NETWORK PROBE MARKET, REGIONAL AND COUNTRY-WISE SHARES, 2022

- FIGURE 12 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR NETWORK PROBE MARKET PLAYERS

- FIGURE 13 INCREASE IN NETWORK STRESS, HIGHER ADOPTION OF CLOUD AND IOT, AND SECURITY CONCERNS TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICA: NETWORK PROBE MARKET, BY COMPONENT & ORGANIZATION SIZE

- FIGURE 14 SOLUTIONS & LARGE ENTERPRISES TO ACCOUNT FOR LARGEST RESPECTIVE SHARES IN NETWORK PROBE MARKET IN 2022

- 4.3 ASIA PACIFIC: NETWORK PROBE MARKET

- FIGURE 15 SOLUTIONS & LARGE ENTERPRISES TO ACCOUNT FOR HIGH MARKET SHARES IN ASIA PACIFIC IN 2022

- 4.4 NETWORK PROBE MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 NETWORK PROBE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Demand for continuous network probe due to rise in network complexities and security concerns

- FIGURE 18 NUMBER OF DATA BREACHES, BY INDUSTRY, 2019

- 5.2.1.2 Increase in network stress due to exponential rise in IP traffic and complex IT infrastructure

- 5.2.1.3 Need to resolve network downtime issues and optimize business operations

- 5.2.1.4 Growth in adoption of cloud and IoT

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of technical granularity

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Need to handle massive network performance data

- 5.2.3.2 Growth in demand for network monitoring tools among SMEs

- 5.2.3.3 Monitoring advanced internet and cloud data traffic

- 5.2.4 CHALLENGES

- 5.2.4.1 Strong preference of end users for bundled solutions

- 5.2.4.2 High cost of equipment

- 5.2.5 CUMULATIVE GROWTH ANALYSIS

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN

- 5.3.1 HARDWARE AND INFRASTRUCTURE SERVICE PROVIDERS

- 5.3.2 SOFTWARE PROVIDERS

- 5.3.3 SERVICE PROVIDERS

- 5.3.4 END USERS

- 5.4 ECOSYSTEM ANALYSIS

- TABLE 3 NETWORK PROBE MARKET: ECOSYSTEM ANALYSIS

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 NETWORK PROBE MARKET: PORTER'S FIVE FORCES MODEL

- 5.5.1 THREAT FROM NEW ENTRANTS

- 5.5.2 THREAT FROM SUBSTITUTES

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISE END USERS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISE END USERS (%)

- 5.6.2 BUYING CRITERIA

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE END USERS

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 INTRODUCTION

- 5.7.2 NETWORK TAPS

- 5.7.2.1 Passive TAPs

- 5.7.2.2 Active TAPs

- 5.7.3 ARTIFICIAL INTELLIGENCE

- 5.7.4 SOFTWARE-DEFINED NETWORKING

- 5.7.5 INTERNET OF THINGS

- 5.7.6 TRENDS AND DISRUPTIONS IMPACTING BUYERS

- FIGURE 22 REVENUE SHIFT FOR NETWORK PROBE MARKET

- 5.7.7 PATENT ANALYSIS

- 5.7.7.1 Methodology

- 5.7.7.2 Document type

- TABLE 7 PATENTS FILED, 2019-2022

- 5.7.7.3 Innovation and patent application

- FIGURE 23 TOTAL NUMBER OF PATENTS GRANTED ANNUALLY, 2019-2022

- 5.7.7.4 Top applicants

- FIGURE 24 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019-2022

- 5.8 PRICING ANALYSIS

- TABLE 8 PRICING ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 GROUPE MORNAY CHOSE RIVERBED TO IMPROVE USER PRODUCTIVITY AND REDUCE BANDWIDTH COSTS

- 5.9.2 PROGRESS HELPED IDRAS S.P.A. PROVIDE VISIBILITY INTO NETWORK SECURITY

- 5.9.3 PAESSLER PROVIDED ENHANCED NETWORK MONITORING FOR WESTGATE SCHOOL

- 5.9.4 FLOWMON HELPED SEGA IMPROVE NETWORK PERFORMANCE

- 5.9.5 KENTIK PROVIDED DREAMHOST WITH POWERFUL TROUBLESHOOTING CAPABILITIES

- 5.9.6 MICRO FOCUS IMPROVED VISIBILITY FOR BRITISH TELECOMMUNICATIONS GROUP'S LARGE NETWORK

- 5.10 KEY CONFERENCES & EVENTS

- 5.10.1 NETWORK PROBE MARKET: CONFERENCES & EVENTS, 2023

- 5.11 TARIFF AND REGULATORY IMPACT

- 5.11.1 SOC2

- 5.11.2 DIGITAL MILLENNIUM COPYRIGHT ACT

- 5.11.3 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

- 5.11.3.1 North America

- 5.11.3.2 Europe

- 5.11.3.3 Asia Pacific

- 5.11.3.4 Middle East and South Africa

- 5.11.3.5 Latin America

6 NETWORK PROBE MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: MARKET DRIVERS

- 6.1.2 COMPONENT: RECESSION IMPACT

- FIGURE 25 SOLUTIONS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

- TABLE 9 NETWORK PROBE MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 NEED FOR SEAMLESS NETWORK OPERATION OFFERED BY PROBE SOLUTIONS

- TABLE 10 NETWORK PROBE SOLUTIONS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 INCREASED DEPLOYMENT OF NETWORK PROBE SOLUTIONS TO FUEL NEED FOR SERVICES

- FIGURE 26 CONSULTING SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 11 NETWORK PROBE SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.2 CONSULTING

- TABLE 12 NETWORK PROBE CONSULTING SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.3 TRAINING & SUPPORT

- TABLE 13 NETWORK PROBE TRAINING & SUPPORT SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.4 INTEGRATION & DEPLOYMENT

- TABLE 14 NETWORK PROBE INTEGRATION & DEPLOYMENT SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

7 NETWORK PROBE MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

- 7.1.2 DEPLOYMENT MODE: RECESSION IMPACT

- FIGURE 27 CLOUD SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 15 NETWORK PROBE MARKET, BY DEPLOYMENT MODE, 2020-2027 (USD MILLION)

- 7.2 ON-PREMISES

- 7.2.1 RISE IN SECURITY CONCERNS DRIVE ON-PREMISE NETWORK PROBE MEASURES

- TABLE 16 ON-PREMISE NETWORK PROBE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 CLOUD

- 7.3.1 INCREASED NEED FOR EFFICIENT AND COST-EFFECTIVE SOLUTIONS TO DRIVE CLOUD DEPLOYMENT

- TABLE 17 CLOUD-BASED NETWORK PROBE MARKET, BY REGION, 2020-2027 (USD MILLION)

8 NETWORK PROBE MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

- 8.1.2 ORGANIZATION SIZE: RECESSION IMPACT

- FIGURE 28 SMALL & MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 18 NETWORK PROBE MARKET, BY ORGANIZATION SIZE, 2020-2027 (USD MILLION)

- 8.2 LARGE ENTERPRISES

- 8.2.1 ADOPTION OF ADVANCED TECHNOLOGIES SUCH AS IOT AND CLOUD COMPUTING

- TABLE 19 LARGE ENTERPRISES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.3 SMALL & MEDIUM-SIZED ENTERPRISES

- 8.3.1 ADVANCEMENTS IN NETWORK MONITORING TOOLS AMONG SMES

- TABLE 20 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2020-2027 (USD MILLION)

9 NETWORK PROBE MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 END USER: MARKET DRIVERS

- 9.1.2 END USER: RECESSION IMPACT

- FIGURE 29 ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 21 NETWORK PROBE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2 SERVICE PROVIDERS

- 9.2.1 DEMAND FOR REAL-TIME NETWORK ANALYSIS AMONG END USERS

- TABLE 22 NETWORK PROBE SERVICE PROVIDERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2.2 TELECOM SERVICE PROVIDERS

- 9.2.3 CLOUD SERVICE PROVIDERS

- 9.2.4 OTHER SERVICE PROVIDERS

- 9.3 ENTERPRISES

- 9.3.1 DEMAND FOR MONITORING TO ADD VALUE ACROSS ENTERPRISES

- FIGURE 30 IT & ITES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 23 NETWORK PROBE ENTERPRISES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 24 NETWORK PROBE ENTERPRISES MARKET, BY VERTICAL, 2020-2027 (USD MILLION)

- 9.3.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- TABLE 25 BANKING, FINANCIAL SERVICES, AND INSURANCE ENTERPRISES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.3.3 IT & ITES

- TABLE 26 IT & ITES ENTERPRISES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.3.4 GOVERNMENT

- TABLE 27 GOVERNMENT ENTERPRISES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.3.5 OTHER ENTERPRISES

- TABLE 28 OTHER ENTERPRISES MARKET, BY REGION, 2020-2027 (USD MILLION)

10 NETWORK PROBE MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 31 NORTH AMERICA TO LEAD NETWORK PROBE MARKET FROM 2022 TO 2027

- FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 29 NETWORK PROBE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- 10.2.2 NORTH AMERICA: PESTLE ANALYSIS

- FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 30 NORTH AMERICA: NETWORK PROBE MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 31 NORTH AMERICA: NETWORK PROBE MARKET, BY SERVICE, 2020-2027 (USD MILLION)

- TABLE 32 NORTH AMERICA: NETWORK PROBE MARKET, BY DEPLOYMENT MODE, 2020-2027 (USD MILLION)

- TABLE 33 NORTH AMERICA: NETWORK PROBE MARKET, BY ORGANIZATION SIZE, 2020-2027 (USD MILLION)

- TABLE 34 NORTH AMERICA: NETWORK PROBE MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 35 NORTH AMERICA: NETWORK PROBE ENTERPRISES MARKET, BY VERTICAL, 2020-2027 (USD MILLION)

- TABLE 36 NORTH AMERICA: NETWORK PROBE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Rapid emergence and deployment of 5G, IoT, and virtualized networks

- TABLE 37 US: NETWORK PROBE MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 38 US: NETWORK PROBE MARKET, BY SERVICE, 2020-2027 (USD MILLION)

- TABLE 39 US: NETWORK PROBE MARKET, BY DEPLOYMENT MODE, 2020-2027 (USD MILLION)

- TABLE 40 US: NETWORK PROBE MARKET, BY ORGANIZATION SIZE, 2020-2027 (USD MILLION)

- TABLE 41 US: NETWORK PROBE MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 42 US: NETWORK PROBE ENTERPRISES MARKET, BY VERTICAL, 2020-2027 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Security attacks on network infrastructure to pressurize enterprises

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- 10.3.2 EUROPE: PESTLE ANALYSIS

- TABLE 43 EUROPE: NETWORK PROBE MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 44 EUROPE: NETWORK PROBE MARKET, BY SERVICE, 2020-2027 (USD MILLION)

- TABLE 45 EUROPE: NETWORK PROBE MARKET, BY DEPLOYMENT MODE, 2020-2027 (USD MILLION)

- TABLE 46 EUROPE: NETWORK PROBE MARKET, BY ORGANIZATION SIZE, 2020-2027 (USD MILLION)

- TABLE 47 EUROPE: NETWORK PROBE MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 48 EUROPE: NETWORK PROBE MARKET, BY VERTICAL, 2020-2027 (USD MILLION)

- TABLE 49 EUROPE: NETWORK PROBE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Increase in demand for monitoring solutions among SMEs

- TABLE 50 UK: NETWORK PROBE MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 51 UK: NETWORK PROBE MARKET, BY SERVICE, 2020-2027 (USD MILLION)

- TABLE 52 UK: NETWORK PROBE MARKET, BY DEPLOYMENT MODE, 2020-2027 (USD MILLION)

- TABLE 53 UK: NETWORK PROBE MARKET, BY ORGANIZATION SIZE, 2020-2027 (USD MILLION)

- TABLE 54 UK: NETWORK PROBE MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 55 UK: NETWORK PROBE ENTERPRISES MARKET, BY VERTICAL, 2020-2027 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 High adoption of technologies and favorable business environment

- 10.3.5 FRANCE

- 10.3.5.1 Robust economic infrastructure and high internet penetration

- 10.3.6 SPAIN

- 10.3.6.1 Booming telecom sector to positively impact market growth

- 10.3.7 ITALY

- 10.3.7.1 Need for high-speed internet connection and focus on building digital economy

- 10.3.8 NORDICS

- 10.3.8.1 Cloud migration and increasing importance of user experience

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- 10.4.2 ASIA PACIFIC: PESTLE ANALYSIS

- FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 56 ASIA PACIFIC: NETWORK PROBE MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 57 ASIA PACIFIC: NETWORK PROBE MARKET, BY SERVICE, 2020-2027 (USD MILLION)

- TABLE 58 ASIA PACIFIC: NETWORK PROBE MARKET, BY DEPLOYMENT MODE, 2020-2027 (USD MILLION)

- TABLE 59 ASIA PACIFIC: NETWORK PROBE MARKET, BY ORGANIZATION SIZE, 2020-2027 (USD MILLION)

- TABLE 60 ASIA PACIFIC: NETWORK PROBE MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 61 ASIA PACIFIC: NETWORK PROBE ENTERPRISES MARKET, BY VERTICAL, 2020-2027 (USD MILLION)

- TABLE 62 ASIA PACIFIC: NETWORK PROBE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 High investments in network infrastructure and presence of major telecom companies

- TABLE 63 CHINA: NETWORK PROBE MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 64 CHINA: NETWORK PROBE MARKET, BY SERVICE, 2020-2027 (USD MILLION)

- TABLE 65 CHINA: NETWORK PROBE MARKET, BY DEPLOYMENT MODE, 2020-2027 (USD MILLION)

- TABLE 66 CHINA: NETWORK PROBE MARKET, BY ORGANIZATION SIZE, 2020-2027 (USD MILLION)

- TABLE 67 CHINA: NETWORK PROBE MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 68 CHINA: NETWORK PROBE ENTERPRISES MARKET, BY VERTICAL, 2020-2027 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Increased adoption of new technologies to drive market

- 10.4.5 INDIA

- 10.4.5.1 Unprecedented increase in data consumption to fuel demand for network probe solutions

- 10.4.6 AUSTRALIA NEW ZEALAND

- 10.4.6.1 Government initiatives and upcoming supportive policies to promote secure networking experience

- 10.4.7 SOUTHEAST ASIA

- 10.4.7.1 Industrial automation in South Korea and surrounding areas to open new technological opportunities

- 10.4.8 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.5.2 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

- TABLE 69 MIDDLE EAST & AFRICA: NETWORK PROBE MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 70 MIDDLE EAST & AFRICA: NETWORK PROBE MARKET, BY SERVICE, 2020-2027 (USD MILLION)

- TABLE 71 MIDDLE EAST & AFRICA: NETWORK PROBE MARKET, BY DEPLOYMENT MODE, 2020-2027 (USD MILLION)

- TABLE 72 MIDDLE EAST & AFRICA: NETWORK PROBE MARKET, BY ORGANIZATION SIZE, 2020-2027 (USD MILLION)

- TABLE 73 MIDDLE EAST & AFRICA: NETWORK PROBE MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 74 MIDDLE EAST & AFRICA: NETWORK PROBE ENTERPRISES MARKET, BY VERTICAL, 2020-2027 (USD MILLION)

- TABLE 75 MIDDLE EAST & AFRICA: NETWORK PROBE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Increase in government initiatives for digitization of society to drive market

- TABLE 76 MIDDLE EAST: NETWORK PROBE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.5.3.2 United Arab Emirates

- 10.5.3.3 Kingdom of Saudi Arabia

- 10.5.4 AFRICA

- 10.5.4.1 Need for digitalization to drive network probe market

- TABLE 77 AFRICA: NETWORK PROBE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.5.4.2 South Africa

- 10.5.4.3 Egypt

- 10.5.4.4 Nigeria

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: RECESSION IMPACT

- 10.6.2 LATIN AMERICA: PESTLE ANALYSIS

- TABLE 78 LATIN AMERICA: NETWORK PROBE MARKET, BY COMPONENT, 2020-2027 (USD MILLION)

- TABLE 79 LATIN AMERICA: NETWORK PROBE MARKET, BY SERVICE, 2020-2027 (USD MILLION)

- TABLE 80 LATIN AMERICA: NETWORK PROBE MARKET, BY DEPLOYMENT MODE, 2020-2027 (USD MILLION)

- TABLE 81 LATIN AMERICA: NETWORK PROBE MARKET, BY ORGANIZATION SIZE, 2020-2027 (USD MILLION)

- TABLE 82 LATIN AMERICA: NETWORK PROBE MARKET, BY END USER, 2020-2027 (USD MILLION)

- TABLE 83 LATIN AMERICA: NETWORK PROBE ENTERPRISES MARKET, BY VERTICAL, 2020-2027 (USD MILLION)

- TABLE 84 LATIN AMERICA: NETWORK PROBE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 High foreign direct investments and presence of large enterprises

- 10.6.4 MEXICO

- 10.6.4.1 Advancements in mobile communication and high internet penetration

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET EVALUATION FRAMEWORK

- FIGURE 35 MARKET EVALUATION FRAMEWORK, 2019-2021

- 11.3 COMPETITIVE SCENARIO AND TRENDS

- 11.3.1 PRODUCT LAUNCHES

- TABLE 85 NETWORK PROBE MARKET: PRODUCT LAUNCHES, 2019-2021

- 11.3.2 DEALS

- TABLE 86 DEALS, 2019-2022

- 11.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 87 NETWORK PROBE MARKET: DEGREE OF COMPETITION

- FIGURE 36 MARKET SHARE ANALYSIS OF COMPANIES, 2022

- 11.5 HISTORICAL REVENUE ANALYSIS

- FIGURE 37 HISTORICAL REVENUE ANALYSIS, 2017-2021 (USD MILLION)

- 11.6 COMPANY EVALUATION MATRIX OVERVIEW

- 11.7 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

- TABLE 88 PRODUCT FOOTPRINT WEIGHTAGE

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 38 NETWORK PROBE MARKET (GLOBAL), COMPANY EVALUATION QUADRANT, 2022

- 11.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 89 COMPANY PRODUCT FOOTPRINT

- TABLE 90 COMPANY COMPONENT FOOTPRINT

- TABLE 91 COMPANY END-USER FOOTPRINT

- TABLE 92 COMPANY REGION FOOTPRINT

- 11.9 COMPANY MARKET RANKING ANALYSIS

- FIGURE 39 RANKING OF KEY PLAYERS IN NETWORK PROBE MARKET, 2022

- 11.10 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

- TABLE 93 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 11.10.1 PROGRESSIVE COMPANIES

- 11.10.2 RESPONSIVE COMPANIES

- 11.10.3 DYNAMIC COMPANIES

- 11.10.4 STARTING BLOCKS

- FIGURE 40 NETWORK PROBE MARKET (STARTUPS/SMES), COMPANY EVALUATION QUADRANT, 2022

- 11.11 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 94 NETWORK PROBE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 95 NETWORK PROBE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 96 NETWORK PROBE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY REGION

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- (Business Overview, Solutions, Products & Services, Recent Developments, MnM View)**

- 12.1.1 SOLARWINDS

- TABLE 97 SOLARWINDS: BUSINESS OVERVIEW

- FIGURE 41 SOLARWINDS: COMPANY SNAPSHOT

- TABLE 98 SOLARWINDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 99 SOLARWINDS: NETWORK PROBE MARKET: NEW PRODUCT LAUNCHES

- TABLE 100 SOLARWINDS: NETWORK PROBE MARKET: DEALS

- 12.1.2 NETSCOUT

- TABLE 101 NETSCOUT: BUSINESS OVERVIEW

- FIGURE 42 NETSCOUT: COMPANY SNAPSHOT

- TABLE 102 NETSCOUT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 103 NETSCOUT: NETWORK PROBE MARKET: NEW PRODUCT LAUNCHES

- TABLE 104 NETSCOUT: NETWORK PROBE MARKET: DEALS

- 12.1.3 BROADCOM

- TABLE 105 BROADCOM: BUSINESS OVERVIEW

- FIGURE 43 BROADCOM: COMPANY SNAPSHOT

- TABLE 106 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 107 BROADCOM: NETWORK PROBE MARKET: NEW PRODUCT LAUNCHES

- TABLE 108 BROADCOM: NETWORK PROBE MARKET: DEALS

- 12.1.4 IBM

- TABLE 109 IBM: BUSINESS OVERVIEW

- FIGURE 44 IBM: COMPANY SNAPSHOT

- TABLE 110 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 111 IBM: NETWORK PROBE MARKET: DEALS

- 12.1.5 CISCO

- TABLE 112 CISCO: BUSINESS OVERVIEW

- FIGURE 45 CISCO: COMPANY SNAPSHOT

- TABLE 113 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 114 CISCO: NETWORK PROBE MARKET: DEALS

- 12.1.6 NOKIA

- TABLE 115 NOKIA: BUSINESS OVERVIEW

- FIGURE 46 NOKIA: COMPANY SNAPSHOT

- TABLE 116 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 117 NOKIA: NETWORK PROBE MARKET: DEALS

- 12.1.7 NEC

- TABLE 118 NEC: BUSINESS OVERVIEW

- FIGURE 47 NEC: COMPANY SNAPSHOT

- TABLE 119 NEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 NEC: NETWORK PROBE MARKET: NEW PRODUCT LAUNCHES

- TABLE 121 NEC: NETWORK PROBE MARKET: DEALS

- 12.1.8 APPNETA

- TABLE 122 APPNETA: BUSINESS OVERVIEW

- TABLE 123 APPNETA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 APPNETA: NETWORK PROBE MARKET: NEW PRODUCT LAUNCHES

- 12.1.9 CATCHPOINT

- TABLE 125 CATCHPOINT: BUSINESS OVERVIEW

- TABLE 126 CATCHPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 CATCHPOINT: NETWORK PROBE MARKET: NEW SOLUTION LAUNCHES

- TABLE 128 CATCHPOINT: NETWORK PROBE MARKET: DEALS

- 12.1.10 ACCEDIAN

- TABLE 129 ACCEDIAN: BUSINESS OVERVIEW

- TABLE 130 ACCEDIAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 131 ACCEDIAN: NETWORK PROBE MARKET: DEALS

- 12.1.11 PAESSLER

- TABLE 132 PAESSLER: BUSINESS OVERVIEW

- TABLE 133 PAESSLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 PAESSLER: NETWORK PROBE MARKET: NEW SOLUTION LAUNCHES

- TABLE 135 PAESSLER: NETWORK PROBE MARKET: DEALS

- 12.1.12 MANAGEENGINE

- TABLE 136 MANAGEENGINE: BUSINESS OVERVIEW

- TABLE 137 MANAGEENGINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 MANAGEENGINE: NETWORK PROBE MARKET: NEW SOLUTION LAUNCHES

- 12.1.13 PROGRESS

- 12.1.14 DYNATRACE

- 12.1.15 HELPSYSTEMS

- 12.1.16 RIVERBED

- 12.1.17 MICRO FOCUS

- 12.1.18 PLIXER

- 12.1.19 OBJECTPLANET

- 12.1.20 FIRSTWAVE

- 12.1.21 RADCOM

- *Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 12.2 STARTUPS/SMES

- 12.2.1 KENTIK

- 12.2.2 FLOWMON

- 12.2.3 QOSMOS

- 12.2.4 NAGIOS

- 12.2.5 EXTRAHOP

- 12.2.6 CUBRO

- 12.2.7 3COLUMNS

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.1.1 LIMITATIONS

- 13.2 NETWORK ANALYTICS MARKET - GLOBAL FORECAST TO 2025

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 Network analytics market, by component

- TABLE 139 NETWORK ANALYTICS MARKET BY COMPONENT, 2017-2024 (USD MILLION)

- TABLE 140 NETWORK INTELLIGENCE SOLUTIONS: NETWORK ANALYTICS MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 141 SERVICES: NETWORK ANALYTICS MARKET, BY TYPE, 2017-2024 (USD MILLION)

- TABLE 142 SERVICES: NETWORK ANALYTICS MARKET, BY REGION, 2017-2024 (USD MILLION)

- 13.2.2.2 Network analytics market, by application

- TABLE 143 NETWORK ANALYTICS MARKET, BY APPLICATION, 2017-2024 (USD MILLION)

- TABLE 144 CUSTOMER ANALYSIS: NETWORK ANALYTICS MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 145 RISK MANAGEMENT AND FAULT DETECTION: NETWORK ANALYTICS MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 146 NETWORK PERFORMANCE MANAGEMENT: NETWORK ANALYTICS MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 147 COMPLIANCE MANAGEMENT: NETWORK ANALYTICS MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 148 QUALITY MANAGEMENT: NETWORK ANALYTICS MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 149 OTHER APPLICATIONS: NETWORK ANALYTICS MARKET, BY REGION, 2017-2024 (USD MILLION)

- 13.2.2.3 Network analytics market, by deployment type

- TABLE 150 NETWORK ANALYTICS MARKET, BY DEPLOYMENT TYPE, 2017-2024 (USD MILLION)

- TABLE 151 ON-PREMISES: NETWORK ANALYTICS MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 152 CLOUD: NETWORK ANALYTICS MARKET, BY REGION, 2017-2024 (USD MILLION)

- 13.3 NETWORK AUTOMATION MARKET - GLOBAL FORECAST TO 2027

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 Network automation market, by component

- TABLE 153 NETWORK AUTOMATION MARKET, BY COMPONENT, 2014-2019 (USD MILLION)

- TABLE 154 NETWORK AUTOMATION MARKET, BY COMPONENT, 2020-2025 (USD MILLION)

- TABLE 155 SOLUTIONS: NETWORK AUTOMATION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 156 SOLUTIONS: NETWORK AUTOMATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 157 SERVICES: NETWORK AUTOMATION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 158 SERVICES: NETWORK AUTOMATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- 13.3.2.2 Network automation market, by solution

- TABLE 159 NETWORK AUTOMATION MARKET, BY SOLUTION, 2014-2019 (USD MILLION)

- TABLE 160 NETWORK AUTOMATION MARKET, BY SOLUTION, 2020-2025 (USD MILLION)

- TABLE 161 NETWORK AUTOMATION TOOLS: NETWORK AUTOMATION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 162 NETWORK AUTOMATION TOOLS: NETWORK AUTOMATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 163 INTENT-BASED NETWORKING: NETWORK AUTOMATION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 164 INTENT-BASED NETWORKING: NETWORK AUTOMATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- 13.3.2.3 Network automation market, by network type

- TABLE 165 NETWORK AUTOMATION MARKET, BY NETWORK TYPE, 2014-2019 (USD MILLION)

- TABLE 166 NETWORK AUTOMATION MARKET, BY NETWORK TYPE, 2020-2025 (USD MILLION)

- TABLE 167 PHYSICAL NETWORK: NETWORK AUTOMATION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 168 PHYSICAL NETWORK: NETWORK AUTOMATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 169 VIRTUAL NETWORK: NETWORK AUTOMATION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 170 VIRTUAL NETWORK: NETWORK AUTOMATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 171 HYBRID NETWORK: NETWORK AUTOMATION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 172 HYBRID NETWORK: NETWORK AUTOMATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- 13.3.2.4 Network automation market, by end user

- TABLE 173 NETWORK AUTOMATION MARKET, BY END USER, 2014-2019 (USD MILLION)

- TABLE 174 NETWORK AUTOMATION MARKET, BY END USER, 2020-2025 (USD MILLION)

- TABLE 175 ENTERPRISE VERTICAL: NETWORK AUTOMATION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 176 ENTERPRISE VERTICAL: NETWORK AUTOMATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 177 SERVICE PROVIDERS: NETWORK AUTOMATION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 178 SERVICE PROVIDERS: NETWORK AUTOMATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- 13.3.2.5 Network automation market, by region

- TABLE 179 NETWORK AUTOMATION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 180 NETWORK AUTOMATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 181 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY COMPONENT, 2014-2019 (USD MILLION)

- TABLE 182 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY COMPONENT, 2020-2025 (USD MILLION)

- TABLE 183 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY SOLUTION, 2014-2019 (USD MILLION)

- TABLE 184 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY SOLUTION, 2020-2025 (USD MILLION)

- TABLE 185 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY PROFESSIONAL SERVICE, 2014-2019 (USD MILLION)

- TABLE 186 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY PROFESSIONAL SERVICE, 2020-2025 (USD MILLION)

- TABLE 187 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY NETWORK TYPE, 2014-2019 (USD MILLION)

- TABLE 188 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY NETWORK TYPE, 2020-2025 (USD MILLION)

- TABLE 189 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY DEPLOYMENT MODE, 2014-2019 (USD MILLION)

- TABLE 190 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2025 (USD MILLION)

- TABLE 191 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY ORGANIZATION SIZE, 2014-2019 (USD MILLION)

- TABLE 192 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2025 (USD MILLION)

- TABLE 193 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY END USER, 2014-2019 (USD MILLION)

- TABLE 194 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY END USER, 2020-2025 (USD MILLION)

- TABLE 195 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY ENTERPRISE VERTICAL, 2014-2019 (USD MILLION)

- TABLE 196 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY ENTERPRISE VERTICAL, 2020-2025 (USD MILLION)

- TABLE 197 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY COUNTRY, 2014-2019 (USD MILLION)

- TABLE 198 NORTH AMERICA: NETWORK AUTOMATION MARKET, BY COUNTRY, 2020-2025 (USD MILLION)

- 13.4 NETWORK MONITORING MARKET - GLOBAL FORECAST TO 2027

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.4.2.1 Network monitoring market, by offering

- TABLE 199 NETWORK MONITORING MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 200 NETWORK MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 13.4.2.2 Network monitoring market, by bandwidth

- TABLE 201 NETWORK MONITORING MARKET, BY BANDWIDTH, 2018-2021 (USD MILLION)

- TABLE 202 NETWORK MONITORING MARKET, BY BANDWIDTH, 2022-2027 (USD MILLION)

- 13.4.2.3 Network monitoring market, by technology

- TABLE 203 NETWORK MONITORING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 204 NETWORK MONITORING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4.2.4 Network monitoring market, by end user

- TABLE 205 NETWORK MONITORING MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 206 NETWORK MONITORING MARKET, BY END USER, 2022-2027 (USD MILLION)

- 13.4.2.5 Network monitoring market, by region

- TABLE 207 NETWORK MONITORING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 208 NETWORK MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS