|

|

市場調査レポート

商品コード

1292340

バルク食品原料の世界市場:一次加工の種類別・二次加工の種類別・用途別 (食品、飲料)・流通チャネル別 (メーカー直販、流通業者)・地域別の将来予測 (2028年まで)Bulk Food Ingredients Market by Primary Processed Type, Secondary Processed Type, Application (Food, Beverage), Distribution Channel (Direct from Manufacturers, Distributors), and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| バルク食品原料の世界市場:一次加工の種類別・二次加工の種類別・用途別 (食品、飲料)・流通チャネル別 (メーカー直販、流通業者)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月12日

発行: MarketsandMarkets

ページ情報: 英文 374 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のバルク食品原料の市場規模は、2023年までに3,667億米ドルに、2028年までに4,546億米ドルに達する見通しで、予測期間中に4.4%のCAGR (金額ベース) で成長すると予測されています。 バルク食品原料の需要は、いくつかの要因によって世界規模で高まっています。

第一に、世界人口の増加が食品消費の増加につながり、効率的でコスト効率の高い生産が必要とされています。第二に、消費者の嗜好の変化とインスタント食品の台頭によって拡大する食品加工業界では、大量の原材料を確実に供給する必要があります。一括購入はスケールメリットをもたらし、メーカーのコスト削減につながります。さらに、製品のカスタマイズや処方への注目が高まっており、特定の要件を満たす多種多様なバルク原料の必要性が高まっています。さらに、食品サプライチェーンの世界化と国際貿易の普及により、企業はさまざまな地域から原料を調達する機会が生まれています。これらの要因は、効率的な調達、費用対効果、生産における柔軟性のニーズとともに、バルク食品原料に対する世界の需要の高まりに寄与しています。

"一次加工の種類別では、ハーブ・スパイスセグメントが予測期間中に高い需要が見込まれる"

バルク食品市場における一次加工タイプのハーブ・スパイスセグメントは、いくつかの理由で需要が高いです。ハーブとスパイスは、食品の風味、アロマ、全体的な官能体験を高める上で重要な役割を果たしています。様々な料理に深み、複雑さ、独特の風味を与え、消費者に好まれます。ハーブとスパイスに関連する健康効果に対する認識と評価は高まっています。多くのハーブやスパイスは、抗酸化作用、抗炎症作用、潜在的な健康促進作用で知られています。消費者は食品の選択に天然素材や機能性素材を求めるようになっており、一次加工バルク食品原料としてのハーブとスパイスの需要を牽引しています。

"二次加工の種類別では、加工穀物・豆類の分野が予測期間中に高い需要が見込まれます。"

穀物・豆類の加工品には、フレーク状、砕いたもの、磨いたもの、割ったものなどがあります。これらは、スナック菓子、レディミール、インスタント食品、乳児用調製粉乳などの食品や、アルコールを含む飲食品の製造に最も広く使用されています。朝食用シリアルの消費量が世界的に増加したため、シリアル・フレークの消費量も増加しています。加工穀物・豆類の需要は、可処分所得の絶え間ない上昇と食習慣の変化により、アジア太平洋地域で最も高い成長率を示すと予測されます。これらの原料は食物繊維とタンパク質を多く含むため、健康的で様々な食品に最適な成分となっています。

"流通チャネル別では、メーカー直販セグメントが予測期間中に高い需要が見込まれる"

地域レベルでの製造市場の成長を促進する競合要因として、原材料価格の変動、競合/代替製品の価格、販売戦略、規模の経済、特化した優位性、事業法規制などが挙げられます。バルク食品市場における新製品とソリューションの開発のための研究開発活動への投資が市場成長を牽引すると予測されます。加工食品とインスタント食品に関する研究プロジェクトは世界的に増加しています。バルク食品の生産は、加工食品・インスタント食品の研究開発活動の増加の影響を受けると予測されます。研究開発活動は、油脂の様々な用途に向けた新製品やソリューションの革新に役立っています。先進地域と発展途上地域の両方において、これらの原料に対する需要が増加しているため、投資が増加しています。北米と欧州は新興経済諸国であり、ハイテク設備と技術の存在により製造市場をリードしています。

"用途別では、飲料分野が予測期間中に高い需要が見込まれる"

世界人口の増加により、食品消費量が増加しています。その結果、食品業界は加工食品や包装食品の需要増に対応するため、大量の原料を安定的に供給する必要があります。消費者の嗜好は、すぐに食べられる食事やスナック菓子、加工食品など、インスタント食品へとシフトしています。これらの製品は、風味、食感、栄養価を高めるために、幅広いバルク食品原料を必要とすることが多いです。さらに食品業界は、消費者の動向や食生活の嗜好の変化に対応するため、絶えず技術革新と新製品の投入を行っています。これには、機能性食品、天然有機製品、栄養強化食品の開発が含まれます。これらの製品は多くの場合、特定の健康効果をもたらすために、タンパク質、繊維、ビタミン、ミネラルなどのバルク原料に依存しています。

"アジア太平洋は予測期間中に市場成長に大きく貢献します"

アジア太平洋地域のバルク食品原料市場は、いくつかの要因によって増加すると予測されます。第一に、同地域の人口増加と可処分所得の増加が食品消費の増加を促し、バルク食品原料の高い需要を生み出しています。第二に、中国、インド、日本のような国々で拡大する食品加工産業は、大量の原材料の確実な供給を必要とします。さらに、食生活パターンの変化やインスタント食品への嗜好の高まりも市場の成長に寄与しています。さらに、機能性食品や栄養強化食品を含む製品イノベーションへの注力は、特定のバルク食品の需要を押し上げています。全体として、こうした要因がアジア太平洋地域のバルク食品市場の成長を促進すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- サプライチェーン分析

- エコシステム

- バリューチェーン分析

- 技術分析

- 平均販売価格の傾向

- 顧客のビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- 特許分析

- 特許分析

- 主な会議とイベント (2023年~2024年)

- 貿易分析

- ケーススタディ

- 主要な利害関係者と購入基準

第7章 規制枠組み

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- アジア太平洋

- 中国

- インド

- 日本

- 南米

- ブラジル

第8章 一次加工バルク食品原料市場:種類別

- イントロダクション

- 穀物・豆類

- 紅茶・コーヒー・ココア

- ナッツ

- ハーブ・スパイス

- 油糧種子

- 砂糖

- 食塩

- その他の種類

第9章 二次加工バルク食品原料市場:種類別

- イントロダクション

- 加工穀物・豆類

- 植物油

- 紅茶・コーヒー・ココア

- ドライフルーツ・ナッツ加工品

- 小麦粉

- 砂糖・甘味料

- 加工ハーブ・スパイス

- 海塩

- その他の種類

第10章 二次加工バルク食品原料市場:用途別

- イントロダクション

- 食品用途:種類別

- 食品用途:地域別

- ベーカリー製品

- スナック・スプレッド

- レディミール

- 菓子類製品

- その他の食品用途

- タイプ別の飲料用途

- アルコール飲料

- ノンアルコール飲料

- ノンアルコール飲料の種類別

第11章 バルク食品原料市場:流通チャネル別

- イントロダクション

- メーカー直販

- 流通業者

第12章 バルク食品原料市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- 韓国

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- その他の地域 (ROW)

- アフリカ

- 中東

第13章 競合情勢

- 概要

- 市場シェア分析 (2022年)

- 主要企業の収益分析:セグメント別

- 主要企業の年間収益 vs. 成長率

- 主要企業のEBITDA

- 主要企業が採用した戦略

- 主要企業の世界スナップショット

- 企業評価クアドラント:主要企業

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- ADM

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- OLAM GROUP

- CARGILL, INCORPORATED

- INGREDION

- ASSOCIATED BRITISH FOODS PLC

- TATE & LYLE

- SUDZUCKER AG

- RAIZEN

- GRAINCORP

- WILMAR INTERNATIONAL LIMITED

- MCCORMICK & COMPANY, INC.

- BORGES INTERNATIONAL GROUP, S.L.U

- EBRO FOODS, S.A.

- JB COCOA

- その他の企業

- THE GREEN LABS LLC

- DOHLER GMBH

- GRAIN MILLERS, INC.

- DIEFENBAKER SPICE & PULSE

- SILVA INTERNATIONAL

- VAN DRUNEN FARMS

- BERGIN FRUIT AND NUT COMPANY

- ROQUETTE FRERES

- FRENCH FOOD ADDITIVES COMPANY

- TECHNO FOOD INGREDIENTS CO., LTD

第15章 隣接・関連市場

- イントロダクション

- 調査の限界

- スパイス・調味料市場

第16章 付録

According to MarketsandMarkets, the bulk food ingredients market is projected to reach USD 454.6 billion by 2028 from USD 366.7 billion by 2023, at a CAGR of 4.4% during the forecast period in terms of value. The demand for bulk food ingredients is rising globally due to several factors. Firstly, the growing global population is leading to increased food consumption and the need for efficient and cost-effective production. Secondly, the expanding food processing industry, driven by changing consumer preferences and the rise of convenience foods, requires a reliable supply of ingredients in large quantities. Bulk purchasing offers economies of scale, reducing costs for manufacturers. Moreover, there is a growing focus on product customization and formulation, driving the need for a wide variety of bulk ingredients to meet specific requirements. Additionally, the globalization of the food supply chain and the increasing prevalence of international trade have created opportunities for companies to source ingredients from different regions. These factors, along with the need for efficient sourcing, cost-effectiveness, and flexibility in production, contribute to the rising demand for bulk food ingredients globally.

"By primary processed type, herbs & spices segment is projected at a high demand during the forecast period."

The herbs and spices segment of the primary processed type in the bulk food ingredients market is high in demand for several reasons. Herbs and spices play a vital role in enhancing the flavors, aromas, and overall sensory experience of food products. They add depth, complexity, and unique taste profiles to various dishes, making them desirable to consumers. There is a growing awareness and appreciation for the health benefits associated with herbs and spices. Many herbs and spices are known for their antioxidant properties, anti-inflammatory effects, and potential health-promoting properties. Consumers are increasingly seeking natural and functional ingredients in their food choices, driving the demand for herbs and spices as primary processed bulk ingredients.

"By secondary processed type, the processed grains, pulses, and cereals segment is projected in high demand during the forecast period."

Processed grains, pulses, and cereals include flaked, broken, polished, or cracked whole ingredients. These are most widely used in the manufacturing of food products, such as snacks, ready or convenience food products, and infant formulas, as well as beverages, including alcohol. The global rise in consumption of breakfast cereals has led to an increase in the consumption of cereal flakes. The demand for processed grains, pulses, and cereals is projected to grow at the highest rate in the Asia Pacific region due to the constant rise in disposable income and changing eating habits. The high fiber and protein content of these ingredients makes them a healthy and ideal component for various food products.

"By distribution channel, direct from manufacturers segment is projected in high demand during the forecast period."

Common factors that drive the growth of the manufacturing market at the local level are raw material prices (fluctuation), prices of competitive/substitute products, sales strategies, economies of scale, specialization advantages, and business laws & regulations. Investments in R&D activities for the development of new products and solutions in the bulk food ingredients market are projected to drive the market growth. The number of research projects on processed & convenience foods is increasing globally. The production of bulk food ingredients is projected to be influenced by the increase in R&D activities for processed & convenience foods. R&D activities help in innovating new products and solutions for various applications of fats & oils. The increase in demand for these ingredients in both developed and developing regions has increased investments. North America and Europe are the developed economies and are leading the manufacturing market due to the presence of high-tech equipment and technology.

"By application, beverages segment is projected in high demand during the forecast period."

The global population is increasing, leading to higher food consumption. As a result, the food industry requires a steady supply of ingredients in large quantities to meet the growing demand for processed and packaged food products. There is a shift in consumer preferences towards convenience foods, including ready-to-eat meals, snacks, and processed food items. These products often require a wide range of bulk food ingredients to enhance flavor, texture, and nutritional value. Furthermore, the food industry is continually innovating and introducing new products to cater to changing consumer trends and dietary preferences. This includes the development of functional foods, natural and organic products, and fortified food items. These products often rely on bulk ingredients such as proteins, fibers, vitamins, and minerals to deliver specific health benefits.

"Asia Pacific will significantly contribute towards market growth during the forecast period."

The bulk food ingredients market in the Asia Pacific region is projected to increase due to several factors. Firstly, the region's growing population and rising disposable incomes are driving increased food consumption, creating a higher demand for bulk ingredients. Secondly, the expanding food processing industry in countries like China, India, and Japan requires a reliable supply of ingredients in large quantities. Additionally, changing dietary patterns and the increasing preference for convenience foods contribute to the growth of the market. Furthermore, the focus on product innovation, including functional and fortified foods, is boosting the demand for specific bulk ingredients. Overall, these factors are expected to drive the growth of the bulk food ingredients market in the Asia Pacific region.

Break-up of Primaries:

By Company Type: Tier1-30%, Tier 2-30%, Tier 3- 40%

By Designation: CXOs-31%, Managers - 24%, and Executives- 45%

By Region: Europe - 30%, Asia Pacific - 20%, North America - 35%, RoW - 5%, South America-10%

Leading players profiled in this report:

- Archer Daniels Midland Company (US)

- International Flavours & Fragrances Inc. (US)

- Olam Group (Singapore)

- Cargill, Incorporated (US)

- Ingredion (US)

- Associated British Foods plc (UK)

- Tate & Lyle PLC (UK)

- EHL Ingredients (UK)

- Batory Foods (US)

- Graincorp (Australia)

- Community Foods (UK)

- McCormick & Company, Inc. (US)

- The Source Bulk Foods (Australia)

- Essex Food Ingredients (US)

- Subnutra (India)

The study includes an in-depth competitive analysis of these key players in the Bulk food ingredients market with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the bulk food ingredients market on the basis of by primary processed type, by secondary processed type, by distribution channel, by application and by Region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global bulk food ingredients market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall bulk food ingredients market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Stringent safety and quality regulations for food ingredients commodities), restraints (Lack of coordination between market stakeholders and supporting infrastructure in developing economies, and improper enforcement of regulatory laws), opportunity (Technological advancements in the food and beverage industry), and challenges (The high cost of bulk food ingredients) influencing the growth of the bulk food ingredients market.

- Product Development/Innovation: Detailed insights on research & development activities, and new product & service launches in the bulk food ingredient market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the bulk food ingredients market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the bulk food ingredients market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players include Archer Daniels Midland Company (US), International Flavours & Fragrances Inc. (US), Olam Group (Singapore), Cargill, Incorporated (US), Ingredion (US), (US)are among others in the bulk food ingredients market strategies. The report also helps stakeholders understand the bulk food ingredients service market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.6.1 CURRENCY

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2022

- 1.6.2 VOLUME

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 BULK FOOD INGREDIENTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key primary insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE: BOTTOM-UP (BASED ON TYPE, BY REGION)

- 2.2.2 APPROACH TWO: TOP-DOWN (BASED ON GLOBAL MARKET)

- 2.3 DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- 2.4 STUDY ASSUMPTIONS

- 2.5 STUDY LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 2 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 4 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 5 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 6 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2028 (USD BILLION)

- FIGURE 7 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2028 (USD BILLION)

- FIGURE 8 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD BILLION)

- FIGURE 9 BULK FOOD INGREDIENTS MARKET (VALUE), BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES IN BULK FOOD INGREDIENTS MARKET

- FIGURE 10 RISING CONSUMPTION OF READY-TO-EAT FOOD & BEVERAGE PRODUCTS TO DRIVE DEMAND FOR BULK FOOD INGREDIENTS

- 4.2 ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE AND COUNTRY (2022)

- FIGURE 11 GRAINS, PULSES, AND CEREALS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC

- 4.3 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE

- FIGURE 12 PROCESSED GRAINS, PULSES, AND CEREALS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE

- FIGURE 13 GRAINS, PULSES, AND CEREALS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL

- FIGURE 14 DIRECT FROM MANUFACTURERS TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.6 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION

- FIGURE 15 FOOD SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GROWING DEMAND FOR FORTIFIED FOOD OWING TO RISING HEALTH AWARENESS

- FIGURE 16 AUSTRALIA: RETAIL SALES OF FUNCTIONAL AND FORTIFIED FOOD PRODUCTS, 2018-2022 (USD MILLION)

- FIGURE 17 NUMBER OF COUNTRIES MANDATING FOOD FORTIFICATION, 2011-2019

- 5.2.2 CONSUMER AWARENESS OF MICRONUTRIENT DEFICIENCIES

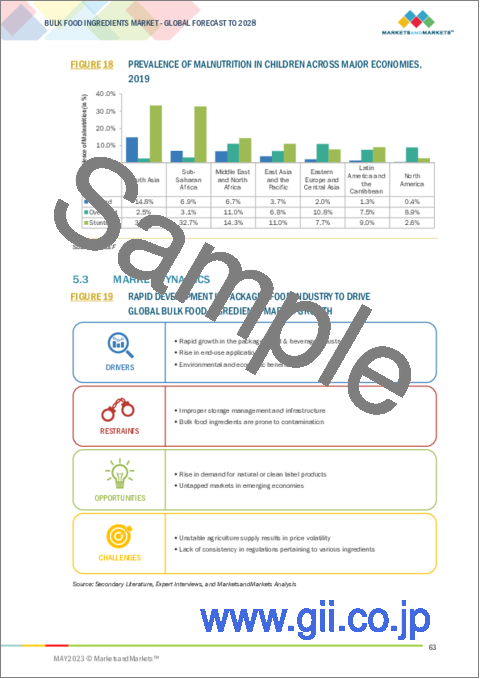

- FIGURE 18 PREVALENCE OF MALNUTRITION IN CHILDREN ACROSS MAJOR ECONOMIES, 2019

- 5.3 MARKET DYNAMICS

- FIGURE 19 RAPID DEVELOPMENT IN PACKAGED FOOD INDUSTRY TO DRIVE GLOBAL BULK FOOD INGREDIENTS MARKET GROWTH

- 5.3.1 DRIVERS

- 5.3.1.1 Rapid growth in packaged food & beverage industry

- FIGURE 20 CONSUMPTION TREND OF ALCOHOLIC BEVERAGES, 2018-2020 (LITER PER CAPITA)

- 5.3.1.2 Rise in end-use applications

- FIGURE 21 NORTH AMERICA: PROCESSED FOOD CONSUMPTION SHARE IN DIETS, 2019

- FIGURE 22 FOOD PROCESSING INDUSTRY SALES, 2009-2019

- 5.3.1.3 Environmental and economic benefits

- 5.3.2 RESTRAINTS

- 5.3.2.1 Improper storage management and infrastructure

- FIGURE 23 FOOD LOSS AND WASTAGE IN DIFFERENT STAGES OF SUPPLY CHAIN, 2019

- 5.3.2.2 Bulk food ingredients are prone to contamination

- FIGURE 24 DIFFERENT CAUSES OF FOOD SAFETY ISSUES IN DEVELOPED AND DEVELOPING COUNTRIES, 2020

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Rise in demand for natural or clean label products

- FIGURE 25 US: CONSUMER PREFERENCE FOR CLEAN-LABEL PRODUCTS AND INGREDIENTS, 2020

- 5.3.3.2 Untapped markets in emerging economies

- 5.3.4 CHALLENGES

- 5.3.4.1 Unstable agricultural supply resulting in price volatility

- FIGURE 26 FAO FOOD PRICE INDEX, 2020-2022

- 5.3.4.2 Lack of consistency in regulations pertaining to various ingredients

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 27 BULK FOOD INGREDIENTS MARKET: SUPPLY CHAIN ANALYSIS

- 6.2.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.2.2 DISTRIBUTION

- 6.2.3 END USERS

- 6.3 ECOSYSTEM

- FIGURE 28 BULK FOOD INGREDIENTS: MARKET MAP

- TABLE 4 BULK FOOD INGREDIENTS MARKET: ECOSYSTEM

- 6.4 VALUE CHAIN ANALYSIS

- FIGURE 29 VALUE CHAIN ANALYSIS: BULK FOOD INGREDIENTS

- 6.4.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.4.2 SOURCING

- 6.4.3 PRODUCTION & PROCESSING

- 6.4.4 DISTRIBUTION, SALES & MARKETING

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 BULK FOOD INGREDIENTS AND SENSORS

- 6.5.2 BULK FOOD INGREDIENTS AND ARTIFICIAL INTELLIGENCE (AI)

- 6.6 AVERAGE SELLING PRICE TREND

- FIGURE 30 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET: PRICING ANALYSIS, BY TYPE, 2014-2020 (USD/KT)

- FIGURE 31 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET: PRICING ANALYSIS, BY TYPE, 2014-2020 (USD/KT)

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 32 YC-YCC: REVENUE SHIFT FOR BULK FOOD INGREDIENTS MARKET

- 6.8 PORTER'S FIVE FORCES ANALYSIS

- 6.8.1 BULK FOOD INGREDIENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.8.2 INTENSITY OF COMPETITIVE RIVALRY

- 6.8.3 BARGAINING POWER OF SUPPLIERS

- 6.8.4 BARGAINING POWER OF BUYERS

- 6.8.5 THREAT OF NEW ENTRANTS

- 6.8.6 THREAT OF SUBSTITUTES

- 6.9 PATENT ANALYSIS

- 6.9.1 INTRODUCTION

- 6.10 PATENT ANALYSIS

- FIGURE 33 LIST OF TOP PATENTS IN MARKET FOR TEN YEARS

- TABLE 5 KEY PATENTS PERTAINING TO BULK FOOD INGREDIENTS, 2020-2021

- 6.11 KEY CONFERENCES & EVENTS IN 2023-2024

- 6.12 TRADE ANALYSIS

- FIGURE 34 KEY IMPORTERS & EXPORTERS OF WHEAT, 2020

- FIGURE 35 KEY IMPORTERS & EXPORTERS OF CORN, 2020

- FIGURE 36 KEY IMPORTERS & EXPORTERS OF RICE, 2020

- FIGURE 37 KEY IMPORTERS & EXPORTERS OF SORGHUM, 2020

- FIGURE 38 KEY IMPORTERS & EXPORTERS OF NUTS, 2020

- FIGURE 39 KEY IMPORTERS & EXPORTERS OF SUGAR, 2020

- 6.13 CASE STUDIES

- TABLE 6 ALLERGEN SENSORS FOR CONSUMERS

- TABLE 7 SENSORY EXPERIENCE TO REMAIN KEY PRIORITY FOR CONSUMERS

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BULK FOOD INGREDIENT APPLICATIONS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BULK FOOD INGREDIENT APPLICATIONS

- FIGURE 41 KEY BUYING CRITERIA FOR TOP APPLICATIONS

7 REGULATORY FRAMEWORK

- 7.1 INTRODUCTION

- 7.2 NORTH AMERICA

- 7.2.1 US

- 7.2.2 CANADA

- 7.3 EUROPE

- 7.4 ASIA PACIFIC

- 7.4.1 CHINA

- 7.4.2 INDIA

- 7.4.3 JAPAN

- 7.5 SOUTH AMERICA

- 7.5.1 BRAZIL

8 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 42 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- TABLE 9 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 10 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2023-2028 (USD BILLION)

- 8.2 GRAINS, PULSES, AND CEREALS

- 8.2.1 POPULATION GROWTH AND CHANGE IN DIETS TO LEAD TO INCREASE IN DEMAND FOR GRAINS, PULSES, AND CEREALS

- TABLE 11 GRAINS, PULSES, AND CEREALS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 12 GRAINS, PULSES, AND CEREALS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 8.3 TEA, COFFEE, AND COCOA

- 8.3.1 PREFERENCE FOR HERBAL & GREEN TEA AND COFFEE TO DRIVE SEGMENT

- TABLE 13 TEA, COFFEE, AND COCOA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 14 TEA, COFFEE, AND COCOA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 8.4 NUTS

- 8.4.1 DIABETIC-FRIENDLY ATTRIBUTES OF ALMONDS TO LEAD TO SEGMENT'S GROWTH

- TABLE 15 NUTS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 16 NUTS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 8.5 HERBS & SPICES

- 8.5.1 GLOBALIZATION AND EXPOSURE TO CULINARY TRADITIONS TO LEAD TO INCREASED DEMAND FOR HERBS & SPICES

- TABLE 17 HERBS & SPICES: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 18 HERBS & SPICES: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 8.6 OILSEEDS

- 8.6.1 GROWING POPULARITY OF PLANT-BASED DIETS AND INCREASING DEMAND FOR ALTERNATIVE PROTEIN SOURCES TO DRIVE GROWTH

- TABLE 19 OILSEEDS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 20 OILSEEDS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 8.7 SUGAR

- 8.7.1 USAGE OF SUGAR AS PRESERVATIVE TO DRIVE DEMAND IN BULK FOOD INGREDIENTS MARKET

- TABLE 21 SUGAR: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 22 SUGAR: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 8.8 SALT

- 8.8.1 ANTI-INFLAMMATORY PROPERTIES OF SEA SALT AND APPLICATION IN COSMETIC PRODUCTS TO DRIVE DEMAND

- TABLE 23 SALT: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 24 SALT: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 8.9 OTHER TYPES

- 8.9.1 ALIGNMENT OF DRIED VEGETABLES AND CITRIC ACID WITH PREFERENCES FROM HEALTH-CONSCIOUS CONSUMERS TO DRIVE DEMAND FOR OTHER TYPES

- TABLE 25 OTHER TYPES: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 26 OTHER TYPES: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

9 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE

- 9.1 INTRODUCTION

- FIGURE 43 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- TABLE 27 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 28 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 29 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2019-2022 (KT)

- TABLE 30 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2023-2028 (KT)

- 9.2 PROCESSED GRAINS, PULSES, AND CEREALS

- 9.2.1 HIGH FIBER AND PROTEIN CONTENT TO ENCOURAGE DEMAND FOR PROCESSED GRAINS, PULSES, AND CEREALS

- TABLE 31 PROCESSED GRAINS, PULSES, AND CEREALS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 32 PROCESSED GRAINS, PULSES, AND CEREALS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 33 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN PROCESSED GRAINS, PULSES, AND CEREALS, BY REGION, 2019-2022 (KT)

- TABLE 34 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN PROCESSED GRAINS, PULSES, AND CEREALS, BY REGION, 2023-2028 (KT)

- 9.3 VEGETABLE OIL

- 9.3.1 GROWTH OF QUICK-SERVICE AND PROCESSED FOOD INDUSTRIES TO DRIVE MARKET GROWTH

- TABLE 35 VEGETABLE OIL: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 36 VEGETABLE OIL: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 37 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN VEGETABLE OIL, BY REGION, 2019-2022 (KT)

- TABLE 38 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN VEGETABLE OIL, BY REGION, 2023-2028 (KT)

- 9.4 TEA, COFFEE, AND COCOA

- 9.4.1 RAPID GROWTH OF HOTELS, RESTAURANTS, AND CAFES TO DRIVE MARKET GROWTH

- TABLE 39 TEA, COFFEE, AND COCOA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 40 TEA, COFFEE, AND COCOA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 41 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN TEA, COFFEE, AND COCOA, BY REGION, 2019-2022 (KT)

- TABLE 42 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN TEA, COFFEE, AND COCOA, BY REGION, 2023-2028 (KT)

- 9.5 DRY FRUITS & PROCESSED NUTS

- 9.5.1 RISE IN CONSUMER TREND OF HEALTHY SNACKING TO DRIVE MARKET GROWTH

- TABLE 43 DRY FRUITS & PROCESSED NUTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 44 DRY FRUITS & PROCESSED NUTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 45 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN DRY FRUITS & PROCESSED NUTS, BY REGION, 2019-2022 (KT)

- TABLE 46 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN DRY FRUITS & PROCESSED NUTS, BY REGION, 2023-2028 (KT)

- 9.6 FLOURS

- 9.6.1 MULTIPLE HEALTH BENEFITS ASSOCIATED WITH CONSUMPTION OF VARIOUS TYPES OF FLOURS TO DRIVE DEMAND

- TABLE 47 FLOURS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 48 FLOURS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 49 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN FLOURS, BY REGION, 2019-2022 (KT)

- TABLE 50 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN FLOURS, BY REGION, 2023-2028 (KT)

- 9.7 SUGAR & SWEETENERS

- 9.7.1 RISING NUMBER OF HEALTH-CONSCIOUS CONSUMERS TO LEAD TO INCREASE IN DEMAND FOR NATURAL SWEETENERS

- TABLE 51 SUGAR & SWEETENERS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 52 SUGAR & SWEETENERS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 53 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN SUGAR & SWEETENERS, BY REGION, 2019-2022 (KT)

- TABLE 54 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN SUGAR & SWEETENERS, BY REGION, 2023-2028 (KT)

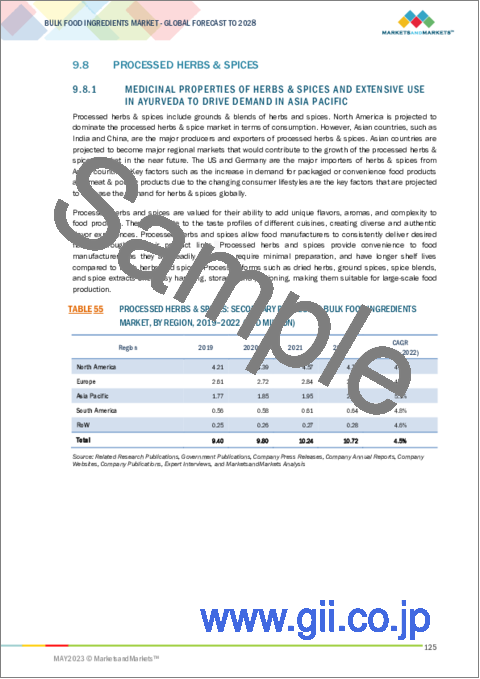

- 9.8 PROCESSED HERBS & SPICES

- 9.8.1 MEDICINAL PROPERTIES OF HERBS & SPICES AND EXTENSIVE USE IN AYURVEDA TO DRIVE DEMAND IN ASIA PACIFIC

- TABLE 55 PROCESSED HERBS & SPICES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 PROCESSED HERBS & SPICES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 57 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN PROCESSED HERBS & SPICES, BY REGION, 2019-2022 (KT)

- TABLE 58 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN PROCESSED HERBS & SPICES, BY REGION, 2023-2028 (KT)

- 9.9 SEA SALT

- 9.9.1 INCREASE IN DEMAND AS SEASONING AGENT TO DRIVE MARKET GROWTH

- TABLE 59 SEA SALT: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 SEA SALT: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 61 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN SEA SALT, BY REGION, 2019-2022 (KT)

- TABLE 62 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN SEA SALT, BY REGION, 2023-2028 (KT)

- 9.10 OTHER TYPES

- TABLE 63 OTHER TYPES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 OTHER TYPES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 65 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN OTHER TYPES, BY REGION, 2019-2022 (KT)

- TABLE 66 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE IN OTHER TYPES, BY REGION, 2023-2028 (KT)

10 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 44 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD BILLION)

- TABLE 67 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD BILLION)

- TABLE 68 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY APPLICATION, 2023-2028 (USD BILLION)

- 10.2 FOOD APPLICATIONS, BY TYPE

- TABLE 69 FOOD: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY SUBAPPLICATION, 2019-2022 (USD BILLION)

- TABLE 70 FOOD: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY SUBAPPLICATION, 2023-2028 (USD BILLION)

- 10.3 FOOD APPLICATIONS, BY REGION

- TABLE 71 FOOD: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 72 FOOD: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.3.1 BAKERY PRODUCTS

- 10.3.1.1 Increase in preference for low-calorie, ready-to-eat food items among consumers to lead to higher demand

- TABLE 73 BAKERY PRODUCTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 74 BAKERY PRODUCTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.3.2 SNACKS & SPREADS

- 10.3.2.1 Rapid urbanization to influence food preferences among consumers

- TABLE 75 SNACKS & SPREADS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 76 SNACKS & SPREADS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.3.3 READY MEALS

- 10.3.3.1 Consumers to prefer food items that can easily be consumed without much effort

- TABLE 77 READY MEALS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 78 READY MEALS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.3.4 CONFECTIONERY PRODUCTS

- 10.3.4.1 Confectionery products to witness high demand as they are used for gifting purposes

- TABLE 79 CONFECTIONERY PRODUCTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 80 CONFECTIONERY PRODUCTS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.3.5 OTHER FOOD APPLICATIONS

- 10.3.5.1 Rise in infant population and decrease in infant mortality rate to drive demand for infant formulas

- TABLE 81 OTHER FOOD APPLICATIONS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 82 OTHER FOOD APPLICATIONS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.4 BEVERAGE APPLICATIONS, BY TYPE

- TABLE 83 BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY SUBAPPLICATION, 2019-2022 (USD BILLION)

- TABLE 84 BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY SUBAPPLICATION, 2023-2028 (USD BILLION)

- TABLE 85 BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 86 BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.4.1 ALCOHOLIC BEVERAGES

- 10.4.1.1 Growth of alcoholic beverages market in US to drive demand for acidulants

- TABLE 87 ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 88 ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.4.2 NON-ALCOHOLIC BEVERAGES

- 10.4.2.1 Non-alcoholic beverages to provide nutrition in form of antioxidants and probiotics

- TABLE 89 NON-ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 90 NON-ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.4.3 NON-ALCOHOLIC BEVERAGES, BY TYPE

- TABLE 91 NON-ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD BILLION)

- TABLE 92 NON-ALCOHOLIC BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- 10.4.3.1 Hot beverages

- TABLE 93 HOT BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 94 HOT BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.4.3.2 Cold beverages

- TABLE 95 COLD BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 96 COLD BEVERAGES: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

11 BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL

- 11.1 INTRODUCTION

- FIGURE 45 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2028

- TABLE 97 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2019-2022 (USD BILLION)

- TABLE 98 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD BILLION)

- TABLE 99 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2019-2022 (USD BILLION)

- TABLE 100 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD BILLION)

- 11.2 DIRECT FROM MANUFACTURERS

- 11.2.1 INCREASE IN R&D ACTIVITIES FOR PROCESSED AND CONVENIENCE FOODS TO DRIVE DEMAND AMONG DIRECT MANUFACTURERS

- TABLE 101 DIRECT FROM MANUFACTURERS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 102 DIRECT FROM MANUFACTURERS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 103 DIRECT FROM MANUFACTURERS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 104 DIRECT FROM MANUFACTURERS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 11.3 DISTRIBUTORS

- 11.3.1 INCREASE IN GDP IN EMERGING MARKETS OF ASIA PACIFIC TO DRIVE MARKET GROWTH

- TABLE 105 DISTRIBUTORS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 106 DISTRIBUTORS: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 107 DISTRIBUTORS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 108 DISTRIBUTORS: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

12 BULK FOOD INGREDIENTS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 46 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 109 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 110 PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 111 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 112 SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 12.2 NORTH AMERICA

- FIGURE 47 NORTH AMERICA: BULK FOOD INGREDIENTS MARKET

- 12.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 48 INFLATION: COUNTRY-LEVEL DATA, 2018-2021

- FIGURE 49 NORTH AMERICAN PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 113 NORTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 114 NORTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 115 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 116 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 117 NORTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 121 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2019-2022 (KT)

- TABLE 122 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2023-2028 (KT)

- TABLE 123 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD BILLION)

- TABLE 124 NORTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 125 NORTH AMERICA: FOOD APPLICATION MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 126 NORTH AMERICA: FOOD APPLICATION MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 127 NORTH AMERICA: BEVERAGES MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 128 NORTH AMERICA: BEVERAGES MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 129 NORTH AMERICA: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 130 NORTH AMERICA: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 131 NORTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2019-2022 (USD BILLION)

- TABLE 132 NORTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2023-2028 (USD BILLION)

- TABLE 133 NORTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2019-2022 (USD BILLION)

- TABLE 134 NORTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2023-2028 (USD BILLION)

- 12.2.2 US

- 12.2.2.1 Expanding market for bulk food ingredients to be driven by prominent industry players and extensive distribution reach

- TABLE 135 US: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 136 US: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 137 US: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 138 US: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Preference for convenience to drive market growth in Canada

- TABLE 139 CANADA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 140 CANADA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 141 CANADA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 142 CANADA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.2.4 MEXICO

- 12.2.4.1 Growing demand for bulk food ingredients to be driven by imports of processed food products

- TABLE 143 MEXICO: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 144 MEXICO: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 145 MEXICO: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 146 MEXICO: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 50 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2018-2021

- FIGURE 51 EUROPE: RECESSION IMPACT ANALYSIS

- TABLE 147 EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 148 EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 149 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 150 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 151 EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 152 EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 153 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 154 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 155 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 156 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 157 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD BILLION)

- TABLE 158 EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 159 EUROPE: FOOD APPLICATION MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 160 EUROPE: FOOD APPLICATION MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 161 EUROPE: BEVERAGES MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 162 EUROPE: BEVERAGES MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 163 EUROPE: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 164 EUROPE: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 165 EUROPE: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2019-2022 (USD BILLION)

- TABLE 166 EUROPE: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2023-2028 (USD BILLION)

- TABLE 167 EUROPE: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2019-2022 (USD BILLION)

- TABLE 168 EUROPE: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2023-2028 (USD BILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Germany's prominence as Europe's largest industry sector and third-largest food & beverage exporter to drive market

- TABLE 169 GERMANY: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 170 GERMANY: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 171 GERMANY: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 172 GERMANY: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 High demand for premium-quality food products to fuel growth of market

- TABLE 173 UK: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 174 UK: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 175 UK: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 176 UK: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.3.4 FRANCE

- 12.3.4.1 Attractive opportunities for players to boost market growth in France

- TABLE 177 FRANCE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 178 FRANCE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 179 FRANCE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 180 FRANCE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.3.5 SPAIN

- 12.3.5.1 Food products, vegetables, and meat products to account for more than half of exports, leading to increased demand for bulk food ingredients

- TABLE 181 SPAIN: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 182 SPAIN: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 183 SPAIN: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 184 SPAIN: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.3.6 ITALY

- 12.3.6.1 Potential of organic, functional, and low-fat food products in Italian market to drive demand for bulk food ingredients

- TABLE 185 ITALY: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 186 ITALY: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 187 ITALY: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 188 ITALY: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.3.7 REST OF EUROPE

- TABLE 189 REST OF EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 190 REST OF EUROPE: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 191 REST OF EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 192 REST OF EUROPE: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 52 ASIA PACIFIC: BULK FOOD INGREDIENTS MARKET SNAPSHOT

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 53 INFLATION: COUNTRY-LEVEL DATA, 2018-2021

- FIGURE 54 ASIA PACIFIC BULK FOOD INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 193 ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 194 ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 195 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 196 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 197 ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 198 ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 199 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 200 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 201 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 202 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 203 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD BILLION)

- TABLE 204 ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 205 ASIA PACIFIC: FOOD APPLICATION MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 206 ASIA PACIFIC: FOOD APPLICATION MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 207 ASIA PACIFIC: BEVERAGES MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 208 ASIA PACIFIC: BEVERAGES MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 209 ASIA PACIFIC: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 210 ASIA PACIFIC: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 211 ASIA PACIFIC: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2019-2022 (USD BILLION)

- TABLE 212 ASIA PACIFIC: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2023-2028 (USD BILLION)

- TABLE 213 ASIA PACIFIC: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2019-2022 (USD BILLION)

- TABLE 214 ASIA PACIFIC: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2023-2028 (USD BILLION)

- 12.4.2 CHINA

- 12.4.2.1 Increasing import of bulk food ingredients to be driven by China's consumer behavior

- TABLE 215 CHINA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 216 CHINA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 217 CHINA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 218 CHINA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Rising GDP and changing lifestyles to drive India's food & beverage industry, in turn driving demand for bulk food ingredients

- TABLE 219 INDIA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 220 INDIA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 221 INDIA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 222 INDIA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Shortage of land suited for farming to result in over 60% of import of food products

- TABLE 223 JAPAN: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 224 JAPAN: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 225 JAPAN: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 226 JAPAN: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 New Zealand to hold top position as leading provider of processed beverages to Australia.

- TABLE 227 AUSTRALIA & NEW ZEALAND: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 228 AUSTRALIA & NEW ZEALAND: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 229 AUSTRALIA & NEW ZEALAND: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 230 AUSTRALIA & NEW ZEALAND: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Strong demand for healthy diets, diverse choices, and new flavors to drive market for bulk food ingredients

- TABLE 231 SOUTH KOREA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 232 SOUTH KOREA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 233 SOUTH KOREA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 234 SOUTH KOREA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.4.7 REST OF ASIA PACIFIC

- TABLE 235 REST OF ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 236 REST OF ASIA PACIFIC: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.5 SOUTH AMERICA

- 12.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 55 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2018-2021

- FIGURE 56 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2022-2023

- TABLE 239 SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 240 SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 241 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 242 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 243 SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 244 SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 245 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 246 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 247 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2019-2022 (KT)

- TABLE 248 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET SIZE, BY TYPE, 2023-2028(KT)

- TABLE 249 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD BILLION)

- TABLE 250 SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 251 SOUTH AMERICA: FOOD APPLICATION MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 252 SOUTH AMERICA: FOOD APPLICATION MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 253 SOUTH AMERICA: BEVERAGES MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 254 SOUTH AMERICA: BEVERAGES MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 255 SOUTH AMERICA: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 256 SOUTH AMERICA: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 257 SOUTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2019-2022 (USD BILLION)

- TABLE 258 SOUTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2023-2028 (USD BILLION)

- TABLE 259 SOUTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2019-2022 (USD BILLION)

- TABLE 260 SOUTH AMERICA: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2023-2028 (USD BILLION)

- 12.5.2 BRAZIL

- 12.5.2.1 Growth of Brazilian food & beverage sector to contribute to elevated consumption of sugar and sugar substitutes

- TABLE 261 BRAZIL: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 262 BRAZIL: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 263 BRAZIL: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 264 BRAZIL: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.5.3 ARGENTINA

- 12.5.3.1 Impact of cane sugar production on sugar industry in Argentina to boost demand for bulk food ingredients

- TABLE 265 ARGENTINA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 266 ARGENTINA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 267 ARGENTINA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 268 ARGENTINA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.5.4 REST OF SOUTH AMERICA

- TABLE 269 REST OF SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 270 REST OF SOUTH AMERICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 271 REST OF SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 272 REST OF SOUTH AMERICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 57 ROW: INFLATION RATES, BY KEY REGION, 2018-2021

- FIGURE 58 ROW: RECESSION IMPACT ANALYSIS, 2022-2023

- TABLE 273 ROW: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 274 ROW: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 275 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 276 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 277 ROW: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 278 ROW: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 279 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 280 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 281 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 282 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 283 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2019-2022 (USD BILLION)

- TABLE 284 ROW: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY APPLICATION, 2023-2028 (USD BILLION)

- TABLE 285 ROW: FOOD APPLICATION MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 286 ROW: FOOD APPLICATION MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 287 ROW: BEVERAGES MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 288 ROW: BEVERAGES MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 289 ROW: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2019-2022 (USD BILLION)

- TABLE 290 ROW: NON-ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2023-2028 (USD BILLION)

- TABLE 291 ROW: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2019-2022 (USD BILLION)

- TABLE 292 ROW: BULK FOOD INGREDIENTS MARKET, BY PRIMARY DISTRIBUTION CHANNEL APPLICATION, 2023-2028 (USD BILLION)

- TABLE 293 ROW: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2019-2022 (USD BILLION)

- TABLE 294 ROW: BULK FOOD INGREDIENTS MARKET, BY SECONDARY DISTRIBUTION CHANNEL APPLICATION, 2023-2028 (USD BILLION)

- 12.6.2 AFRICA

- 12.6.2.1 Increasing consumer preference for convenience food products to fuel demand for bulk food ingredients

- TABLE 295 AFRICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 296 AFRICA: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 297 AFRICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 298 AFRICA: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 12.6.3 MIDDLE EAST

- 12.6.3.1 Market in Middle East set to grow as more food processing companies enter industry

- TABLE 299 MIDDLE EAST: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 300 MIDDLE EAST: PRIMARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 301 MIDDLE EAST: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 302 MIDDLE EAST: SECONDARY PROCESSED BULK FOOD INGREDIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS, 2022

- TABLE 303 BULK FOOD INGREDIENTS MARKET: DEGREE OF COMPETITION, 2022

- 13.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 59 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018-2022 (USD BILLION)

- 13.4 ANNUAL REVENUE VS. GROWTH OF KEY PLAYERS

- FIGURE 60 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022 (%)

- 13.5 EBITDA OF KEY PLAYERS

- FIGURE 61 EBITDA, 2022 (USD BILLION)

- 13.6 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 62 BULK FOOD INGREDIENTS: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- 13.8 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- FIGURE 63 BULK FOOD INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 13.8.5 FOOTPRINT, BY TYPE

- TABLE 304 COMPANY FOOTPRINT, BY TYPE

- TABLE 305 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 306 COMPANY FOOTPRINT, BY REGION

- TABLE 307 OVERALL COMPANY FOOTPRINT

- 13.9 EVALUATION QUADRANT OF STARTUPS/SMES

- 13.9.1 PROGRESSIVE COMPANIES

- 13.9.2 STARTING BLOCKS

- 13.9.3 RESPONSIVE COMPANIES

- 13.9.4 DYNAMIC COMPANIES

- FIGURE 64 BULK FOOD INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- 13.9.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 308 BULK FOOD INGREDIENTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 309 BULK FOOD INGREDIENTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.10 COMPETITIVE SCENARIO

- 13.10.1 PRODUCT LAUNCHES

- TABLE 310 PRODUCT LAUNCHES, 2019-2023

- 13.10.2 DEALS

- TABLE 311 DEALS, 2019-2023

- 13.10.3 OTHERS

- TABLE 312 OTHERS, 2019-2023

14 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 14.1 KEY PLAYERS

- 14.1.1 ADM

- TABLE 313 ADM: COMPANY OVERVIEW

- FIGURE 65 ADM: COMPANY SNAPSHOT

- TABLE 314 ADM: PRODUCT LAUNCHES

- TABLE 315 ADM: DEALS

- TABLE 316 ADM: OTHERS

- 14.1.2 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- TABLE 317 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- FIGURE 66 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- TABLE 318 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- TABLE 319 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

- 14.1.3 OLAM GROUP

- TABLE 320 OLAM GROUP: BUSINESS OVERVIEW

- FIGURE 67 OLAM GROUP: COMPANY SNAPSHOT

- TABLE 321 OLAM GROUP: PRODUCT LAUNCHES

- TABLE 322 OLAM GROUP: DEALS

- TABLE 323 OLAM GROUP: OTHERS

- 14.1.4 CARGILL, INCORPORATED

- TABLE 324 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 68 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 325 CARGILL, INCORPORATED: PRODUCT LAUNCHES

- TABLE 326 CARGILL, INCORPORATED: DEALS

- TABLE 327 CARGILL, INCORPORATED: OTHERS

- 14.1.5 INGREDION

- TABLE 328 INGREDION: BUSINESS OVERVIEW

- FIGURE 69 INGREDION: COMPANY SNAPSHOT

- TABLE 329 INGREDION: DEALS

- TABLE 330 INGREDION: OTHERS

- 14.1.6 ASSOCIATED BRITISH FOODS PLC

- TABLE 331 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

- FIGURE 70 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- TABLE 332 ASSOCIATED BRITISH FOODS PLC: OTHERS

- 14.1.7 TATE & LYLE

- TABLE 333 TATE & LYLE: COMPANY OVERVIEW

- FIGURE 71 TATE & LYLE: COMPANY SNAPSHOT

- TABLE 334 TATE & LYLE: PRODUCT LAUNCHES

- TABLE 335 TATE & LYLE: DEALS

- TABLE 336 TATE & LYLE: OTHERS

- 14.1.8 SUDZUCKER AG

- TABLE 337 SUDZUCKER AG: BUSINESS OVERVIEW

- FIGURE 72 SUDZUCKER AG: COMPANY SNAPSHOT

- 14.1.9 RAIZEN

- TABLE 338 RAIZEN: BUSINESS OVERVIEW

- FIGURE 73 RAIZEN: COMPANY SNAPSHOT

- TABLE 339 RAIZEN: DEALS

- 14.1.10 GRAINCORP

- TABLE 340 GRAINCORP: COMPANY OVERVIEW

- FIGURE 74 GRAINCORP: COMPANY SNAPSHOT

- 14.1.11 WILMAR INTERNATIONAL LIMITED

- TABLE 341 WILMAR INTERNATIONAL LIMITED: BUSINESS OVERVIEW

- FIGURE 75 WILMAR INTERNATIONAL LIMITED: COMPANY SNAPSHOT

- 14.1.12 MCCORMICK & COMPANY, INC.

- TABLE 342 MCCORMICK & COMPANY, INC.: BUSINESS OVERVIEW

- FIGURE 76 MCCORMICK & COMPANY, INC.: COMPANY SNAPSHOT

- TABLE 343 MCCORMICK & COMPANY, INC.: DEALS

- 14.1.13 BORGES INTERNATIONAL GROUP, S.L.U

- TABLE 344 BORGES INTERNATIONAL GROUP, S.L.U: BUSINESS OVERVIEW

- FIGURE 77 BORGES INTERNATIONAL GROUP, S.L.U: COMPANY SNAPSHOT

- TABLE 345 BORGES INTERNATIONAL GROUP, S.L.U: DEALS

- TABLE 346 BORGES INTERNATIONAL GROUP, S.L.U: OTHERS

- 14.1.14 EBRO FOODS, S.A.

- TABLE 347 EBRO FOODS, S.A.: BUSINESS OVERVIEW

- FIGURE 78 EBRO FOODS, S.A.: COMPANY SNAPSHOT

- 14.1.15 JB COCOA

- TABLE 348 JB COCOA: BUSINESS OVERVIEW

- FIGURE 79 JB COCOA: COMPANY SNAPSHOT

- TABLE 349 JB COCOA: OTHERS

- 14.2 OTHER PLAYERS

- 14.2.1 THE GREEN LABS LLC

- TABLE 350 THE GREEN LABS LLC: BUSINESS OVERVIEW

- 14.2.2 DOHLER GMBH

- TABLE 351 DOHLER GMBH: BUSINESS OVERVIEW

- 14.2.3 GRAIN MILLERS, INC.

- TABLE 352 GRAIN MILLERS, INC.: BUSINESS OVERVIEW

- 14.2.4 DIEFENBAKER SPICE & PULSE

- TABLE 353 DIEFENBAKER SPICE & PULSE: BUSINESS OVERVIEW

- 14.2.5 SILVA INTERNATIONAL

- TABLE 354 SILVA INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 355 SILVA INTERNATIONAL: OTHERS

- 14.2.6 VAN DRUNEN FARMS

- TABLE 356 VAN DRUNEN FARMS: BUSINESS OVERVIEW

- 14.2.7 BERGIN FRUIT AND NUT COMPANY

- TABLE 357 BERGIN FRUIT AND NUT COMPANY: BUSINESS OVERVIEW

- 14.2.8 ROQUETTE FRERES

- TABLE 358 ROQUETTE FRERES: BUSINESS OVERVIEW

- 14.2.9 FRENCH FOOD ADDITIVES COMPANY

- TABLE 359 FRENCH FOOD ADDITIVES COMPANY: BUSINESS OVERVIEW

- 14.2.10 TECHNO FOOD INGREDIENTS CO., LTD

- TABLE 360 TECHNO FOOD INGREDIENTS CO., LTD: BUSINESS OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 361 ADJACENT MARKETS

- 15.2 RESEARCH LIMITATIONS

- 15.2.1 SPECIALTY FOOD INGREDIENTS MARKET

- 15.2.2 MARKET DEFINITION

- 15.2.3 MARKET OVERVIEW

- TABLE 362 ACIDULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 363 ACIDULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 15.3 SPICES & SEASONINGS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 364 SPICES & SEASONINGS MARKET, BY APPLICATION, 2016-2020 (USD MILLION)

- TABLE 365 SPICES & SEASONINGS MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS