|

|

市場調査レポート

商品コード

1121760

高度文書処理(IDP)の世界市場:コンポーネント(ソリューション、サービス)、デプロイメントモード(クラウド、オンプレミス)、組織規模、技術、業界、地域別 - 2027年までの予測Intelligent Document Processing Market by Component (Solutions, Services), Deployment Mode (Cloud, On-Premises), Organization Size, Technology, Vertical (BFSI, Government, Healthcare and Life Sciences) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 高度文書処理(IDP)の世界市場:コンポーネント(ソリューション、サービス)、デプロイメントモード(クラウド、オンプレミス)、組織規模、技術、業界、地域別 - 2027年までの予測 |

|

出版日: 2022年08月26日

発行: MarketsandMarkets

ページ情報: 英文 271 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の高度文書処理(IDP)の市場規模は、2022年の11億米ドルから、2027年までに52億米ドルに成長する見通しで、予測期間中にCAGR37.5%で推移すると予測されています。

クラウドベースの文書処理ソリューションの採用拡大や、デジタル変革へのシフトなどが、高度文書処理(IDP)市場の成長を後押ししている主な要因です。

サービス別では、プロフェッショナルサービス分野が予測期間中に最大の市場規模を占めると予想される

プロフェッショナルサービスは、ソリューションプロバイダーが提供する無形のサービスで、顧客のソリューションの導入や管理を支援するものです。このサービスは、展開と統合、サポートとトレーニング、コンサルティングに分類されます。プロフェッショナルサービスは、文書処理ソリューションの購入後に顧客に提供されます。文書処理ソリューションの効果的な導入に注力する企業が増えていることから、プロフェッショナルサービスの普及が進むと予想されます。

市場セグメンテーションに基づくと、オンプレミス型が予測期間中に最大の市場規模を占めると予測される

オンプレミス型とは、遠隔地の施設にアプリケーションをインストールするのではなく、組織の敷地内にインストールすることを指します。オンプレミス・ソリューションは、1回限りのライセンス料とサービス契約で提供されます。この展開モードでは、強力なインフラと個人用データセンターが必要なため、これらのソリューションの展開にコストをかけられるのは大企業だけです。規制の厳しい政府機関、BFSI、ヘルスケア、ライフサイエンスの各業界では、データ保護に力を入れているため、オンプレミス型の高度文書処理(IDP)ソリューションの採用が進むと予想されます。

組織規模別では、中小企業が予測期間中に高いCAGRで成長する見込み

従業員数が1人から999人の組織は、中小企業に分類されます。インテリジェント・ドキュメント・プロセッシングの必要性は、規模に関係なく、市場で競争するためにすべての組織で同様に求められています。文書処理ソリューション・サービスは、費用対効果の高いクラウドソリューションが利用可能であることから、予測期間中、中小企業において力強い成長を遂げると予想されます。

業界別では、政府機関が予測期間中に高いCAGRで成長する

政府機関では、顧客サービスレベルの向上への関心が高まっており、市民の体験を向上させるための取り組みも積極的に行われています。政府機関では、個人、部門、プロセス、機関のセキュリティで保護されたプライベートデータを取り扱います。政府機関で生成されるデータ量は膨大で、非構造化形式であるため、政府機関のプロセスを合理化するためには、意味を正確に把握、分類、抽出する必要があります。柔軟性の向上、データセキュリティの強化、高度なインテリジェンスに対する需要の高まりが、政府機関向け高度文書処理(IDP)市場の原動力になると予想されます。

APACは予測期間中、より高いCAGRで成長すると予想される

APACは、予測期間中に高度文書処理(IDP)市場で最も高いCAGRを記録すると予測されます。同地域では、BFSI、小売・eコマース、ヘルスケア・ライフサイエンスなどの業種において、高度文書処理(IDP)ソリューションの採用が進んでいます。高度文書処理(IDP)ソリューションは、コスト削減、顧客体験の向上、業務効率の改善などのメリットを提供するため、急速に採用が進んでいます。APACでは、中国、日本、インドが市場全体を牽引すると予想されます。中でも日本とインドは、インテリジェント・ドキュメント・プロセッシングの取り組みにおいて、最も有利な市場であると推定されます。この地域では、CAPEXとOPEXの節約により、インテリジェント・ドキュメント・プロセッシングのソリューションとサービスが急速に採用されています。このような急成長の背景には、技術的な進歩に加え、規制や業界標準があります。Datamatics社やInfrrd社などの企業が、APACで文書処理ソリューションやサービスを提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- 高度文書処理(IDP):アーキテクチャ

- バリューチェーン分析

- サプライチェーン分析

- エコシステム

- ポーターのファイブフォース分析

- 市場動向/クライアントに影響を与える動向/ディスラプション

- 特許分析

- 価格モデル分析

- 規制状況

- 関税と規制状況

- 主な利害関係者と購入基準

第6章 高度文書処理(IDP)市場:コンポーネント別

- イントロダクション

- ソリューション

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 高度文書処理(IDP)市場:デプロイメントモード別

- イントロダクション

- オンプレミス

- クラウド

第8章 高度文書処理(IDP)市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第9章 高度文書処理(IDP)市場:技術別

- 人工知能

- 自然言語処理

- 光学文字認識

- 機械学習

- ディープラーニング

- ロボティックプロセスオートメーション

- ビジョンアプリケーションプログラミングインターフェイス

第10章 高度文書処理(IDP)市場:業界別

- イントロダクション

- BFSI

- 政府

- 小売・eコマース

- ヘルスケア・ライフサイエンス

- 製造

- 輸送・物流

- その他

第11章 高度文書処理(IDP)市場:地域別

- イントロダクション

- 北米

- 北米:高度文書処理(IDP)市場促進要因

- 北米:規制の影響

- 米国

- カナダ

- 欧州

- 欧州:高度文書処理(IDP)市場促進要因

- 欧州:規制の影響

- ドイツ

- 英国

- フランス

- その他

- アジア太平洋地域

- アジア太平洋:高度文書処理(IDP)市場促進要因

- アジア太平洋:規制の影響

- 中国

- インド

- 日本

- その他

- 中東とアフリカ

- 中東とアフリカ:高度文書処理(IDP)市場促進要因

- 中東とアフリカ:規制の影響

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカ:高度文書処理(IDP)市場促進要因

- ラテンアメリカ:規制の影響

- ブラジル

- メキシコ

- その他

第12章 競合情勢

- 概要

- 主要企業の採用戦略

- 収益分析

- 市場シェア分析

- 企業評価クアドラント(2022年)

- スタートアップ/中小企業評価クアドラント、2022年

- 競合ベンチマーキング

- 競合シナリオ

第13章 企業プロファイル

- イントロダクション

- 主要企業

- ABBYY

- IBM

- KOFAX

- WORKFUSION

- AUTOMATION ANYWHERE

- APPIAN

- UIPATH

- DATAMATICS

- DELOITTE

- ANTWORKS

- PARASCRIPT

- HYPERSCIENCE

- OPENTEXT

- HYLAND

- EXTRACT SYSTEMS

- CELATON

- HCL TECHNOLOGIES

- EPHESOFT

- IRIS

- BIS

- KODAK ALARIS

- HIVE

- OCROLUS

- INDATA LABS

- スタートアップ

- ACODIS

- EVOLUTION AI

- INFRRD

- ROSSUM

- AMYGB

- HYPATOS

- IN-D

第14章 隣接/関連市場

- 自動コンテンツ認識市場

- 書画カメラ市場

第15章 付録

The global Intelligent Document Processing market size is expected to grow to USD 5.2 billion in 2027 from USD 1.1 billion in 2022, at a Compound Annual Growth Rate (CAGR) of 37.5% during the forecast period. The major factors such as rising adoption of cloud-based document processing solutions, and shift towards digital transformation are driving growth of the intelligent document processing market. .

Based on services, the professional service segment is projected to account for the largest market size during the forecast period

Professional services are intangible offerings provided by solution providers that help customers in deploying and managing their solutions. They are categorized into deployment and integration, support and training, and consulting services. Professional services are delivered to customers after the purchase of the intelligent document processing solution. The growing focus of organizations to effectively deploy intelligent document processing solutions is expected to fuel the adoption of professional services.

Based on deployment, On-premises segment is projected to account for the largest market size during the forecast period.

On-premises deployment refers to the installation of applications on the premises of an organization rather than its installation at a remote facility. On-premises solutions are delivered for a one-time license fee, along with a service agreement. As this deployment mode requires a strong infrastructure and a personal data center, only large organizations can afford the cost to deploy these solutions. The focus of the regulated government, BFSI, healthcare, and life science verticals on data protection are expected to drive the adoption of on-premises intelligent document processing solutions.

SMEs, by organization size segment, to grow at a higher CAGR during the forecast period

Organizations with employees ranging between 1 and 999 are categorized as SMEs. The need for intelligent document processing is equally required in all organizations for competing in the market, irrespective of size. Intelligent document processing solutions and services are expected to witness robust growth among SMEs during the forecast period due to the availability of cost-effective cloud solutions.

Government, by vertical segment, to grow at a higher CAGR during the forecast period

The Government agencies are increasingly looking to improve customer service levels and are also making active efforts to enhance citizens' experiences. Government agencies handle secured and private data of individuals, departments, processes, and agencies. The volume of data generated in government agencies is huge and in unstructured formats, which needs to accurately capture, classify, and extract meaning to streamline the government process. Growing demand for greater flexibility, enhanced data security, and advanced intelligence are expected to drive the intelligent document processing market in the government vertical.

APAC is expected to grow at a higher CAGR during the forecast period

The APAC is expected to register the highest CAGR in the intelligent document processing market during the forecast period. The adoption of intelligent document processing solutions among verticals, such as BFSI, retail and eCommerce, and healthcare and life sciences, in the region, is on the rise. Intelligent document processing solutions are being adopted rapidly since these solutions and services offer benefits, such as reduced cost, enhanced customer experience, and improved operational efficiency. In APAC, China, Japan, and India are expected to drive the overall market. Among these, Japan and India are estimated to be the most lucrative markets for intelligent document processing initiatives. CAPEX and OPEX savings have led to the rapid adoption of intelligent document processing solutions and services in this region. The surge in growth can be attributed to technological advancements, along with mandatory regulations and industry standards. Companies, such as Datamatics and Infrrd, are major players that offer intelligent document processing solutions and services in the APAC.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the intelligent document processing market.

- By Company Type: Tier 1 - 34%, Tier 2 - 43%, and Tier 3 - 23%

- By Designation: C-level - 50%, Directors - 30%, and Others - 20%

- By Region: North America - 25%, Europe - 30%, APAC - 30%, MEA - 10%, Latin America- 5%.

Some prominent players profiled in the study include ABBY (US), IBM (US), Kofax (US), WorkFusion (US), Automation Anywhere (US), Appian (US), UiPath (US), Datamatics (India), Deloitte (England), AntWorks (Singapore), Parascript (US), HyperScience (US), OpenText (Canada), Hyland (US), Extract Systems (US), Infrrd (US), Celaton (UK), HCL Technologies (India), Kodak Alaris (UK), Rossum (UK), InData Labs (Belarus), Ephesoft (US), IRIS (Europe), Evolution AI (England), BIS (US), and AmyGB (India), Acodis (Switzerland), Ocrolus (US), Hive (California), Hypatos (Germany), and IN-D (Singapore).

Research coverage

The market study covers the intelligent document processing market across different segments. It aims at estimating the market size and the growth potential of this market across different segments, such as component (solutions and services), deployment mode (cloud, on-premises), organization size, technology, vertical (bfsi, government, healthcare and life sciences), and regions. The services segment is further professional services and managed services. The regional analysis of the intelligent document processing market includes North America, Europe, APAC, the MEA, and Latin America. The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key benefits of buying the report

The report is expected to help the market leaders/new entrants in this market by providing them information on the closest approximations of the revenue numbers for the intelligent document processing market and its segments. This report is also expected to help stakeholders understand the competitive landscape and gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 4 INTELLIGENT DOCUMENT PROCESSING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 5 RESEARCH METHODOLOGY: APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY-SIDE): REVENUE OF SOLUTIONS/SERVICES IN INTELLIGENT DOCUMENT PROCESSING MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY -APPROACH 2 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF SOLUTIONS/SERVICES IN INTELLIGENT DOCUMENT PROCESSING MARKET

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3-BOTTOM-UP (DEMAND-SIDE): SHARE OF INTELLIGENT DOCUMENT PROCESSING MARKET THROUGH OVERALL INTELLIGENT DOCUMENT PROCESSING SPENDING

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 COMPANY EVALUATION MATRIX METHODOLOGY

- FIGURE 9 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

- FIGURE 10 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 2.7 ASSUMPTIONS

- 2.8 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 3 GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET SIZE AND GROWTH RATE, 2017-2021 (USD MILLION, Y-O-Y%)

- TABLE 4 GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET SIZE AND GROWTH RATE, 2022-2027 (USD MILLION, Y-O-Y%)

- FIGURE 11 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

- FIGURE 12 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

- FIGURE 13 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

- FIGURE 14 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

- FIGURE 15 HEALTHCARE AND LIFE SCIENCES VERTICAL CONTRIBUTES TO LARGEST MARKET SHARE IN 2022

- FIGURE 16 NORTH AMERICA TO BE EMERGING DOMINANT REGION IN TERMS OF MARKET SIZE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN INTELLIGENT DOCUMENT PROCESSING MARKET

- FIGURE 17 ENTERPRISES' NEED TO PROCESS LARGE VOLUMES OF SEMI-STRUCTURED AND UNSTRUCTURED DOCUMENTS FOR GREATER ACCURACY DRIVES MARKET GROWTH DURING FORECAST PERIOD

- 4.2 INTELLIGENT DOCUMENT PROCESSING MARKET: TOP THREE VERTICALS

- FIGURE 18 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION

- FIGURE 19 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- 4.4 NORTH AMERICA INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT AND COUNTRY

- FIGURE 20 SOLUTIONS SEGMENT (COMPONENT) AND US (COUNTRY) TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 INTELLIGENT DOCUMENT PROCESSING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Enterprises' need to extract data from unstructured documents with greater accuracy and speed

- 5.2.1.2 Shift toward digital transformation

- 5.2.1.3 Adopting cloud-based document processing solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Changing governance and compliance requirements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advanced technologies in document processing

- 5.2.3.2 Rising need for improving customer satisfaction

- 5.2.4 CHALLENGES

- 5.2.4.1 Misjudging technological possibilities

- 5.2.4.2 High implementation costs

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 TRANSPORTATION AND LOGISTICS

- 5.3.1.1 Use case 1: Polaris Transportation automated its customs paperwork processing with WorkFusion

- 5.3.2 BANKING

- 5.3.2.1 Use case 1: Payment's bank used computer vision for fraud detection

- 5.3.3 AUTOMOBILES

- 5.3.3.1 Use case 1: Renault Argentina transformed its finance department with ABBYY Digital Intelligence

- 5.3.4 HEALTHCARE

- 5.3.4.1 Use case 1: Rapid access to vital healthcare information with Kofax TotalAgility

- 5.3.5 INSURANCE

- 5.3.5.1 Use case 1: Wefox Insurance boosted its application processing

- 5.3.1 TRANSPORTATION AND LOGISTICS

- 5.4 INTELLIGENT DOCUMENT PROCESSING: ARCHITECTURE

- FIGURE 22 ARCHITECTURE OF INTELLIGENT DOCUMENT PROCESSING

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS: INTELLIGENT DOCUMENT PROCESSING

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 24 SUPPLY CHAIN ANALYSIS: INTELLIGENT DOCUMENT PROCESSING

- 5.7 ECOSYSTEM

- TABLE 5 ECOSYSTEM: INTELLIGENT DOCUMENT PROCESSING

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 IMPACT OF EACH FORCE ON INTELLIGENT DOCUMENT PROCESSING MARKET

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS: INTELLIGENT DOCUMENT PROCESSING MARKET

- 5.8.1 THREAT FROM NEW ENTRANTS

- 5.8.2 THREAT FROM SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 TRENDS/DISRUPTIONS IMPACTING BUYERS/ CLIENTS OF INTELLIGENT DOCUMENT PROCESSING MARKET

- FIGURE 26 INTELLIGENT DOCUMENT PROCESSING MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.10.2 DOCUMENT TYPE

- TABLE 7 PATENTS FILED, 2019-2022

- 5.10.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 27 ANNUAL NUMBER OF PATENTS GRANTED, 2019-2022

- 5.10.4 TOP APPLICANTS

- FIGURE 28 TOP 10 PATENT APPLICANTS, 2019-2022

- 5.11 PRICING MODEL ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 GENERAL DATA PROTECTION REGULATION

- 5.12.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996

- 5.12.3 GOVERNANCE, RISK, AND COMPLIANCE

- 5.12.4 EUROPEAN UNION DATA PROTECTION REGULATION

- 5.12.5 CAN-SPAM ACT

- 5.12.6 SARBANES-OXLEY ACT OF 2002

- 5.12.7 FINANCIAL INDUSTRY REGULATORY AUTHORITY

- 5.12.8 SERVICE ORGANIZATIONAL CONTROL 2

- 5.12.9 MARKETS IN FINANCIAL INSTRUMENTS DIRECTIVE II

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- 5.14.2 BUYING CRITERIA

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

6 INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 29 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 15 INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 16 INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 SOLUTIONS: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- TABLE 17 SOLUTIONS: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 18 SOLUTIONS: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 SERVICES: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- TABLE 19 SERVICES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 20 SERVICES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 21 SERVICES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 22 SERVICES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.2 PROFESSIONAL SERVICES

- 6.3.3 PROFESSIONAL SERVICES: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- TABLE 23 PROFESSIONAL SERVICES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 24 PROFESSIONAL SERVICES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.4 MANAGED SERVICES

- 6.3.5 MANAGED SERVICES: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- TABLE 25 MANAGED SERVICES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 26 MANAGED SERVICES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

7 INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- FIGURE 30 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 27 INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 28 INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- 7.2 ON-PREMISES

- 7.2.1 ON-PREMISES: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- TABLE 29 ON-PREMISES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 30 ON-PREMISES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

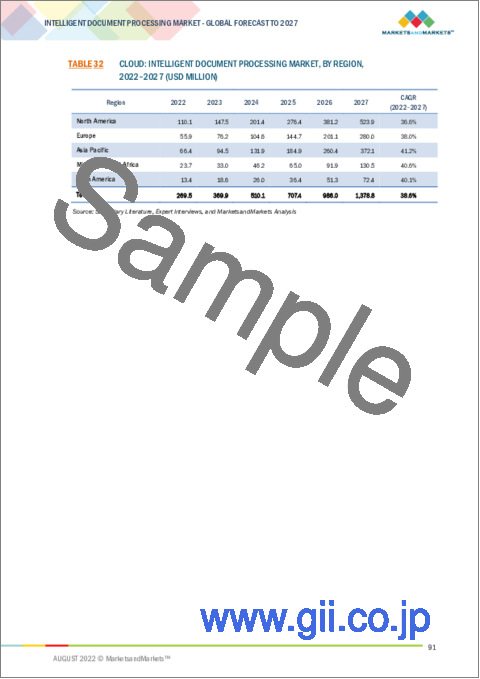

- 7.3 CLOUD

- 7.3.1 CLOUD: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- TABLE 31 CLOUD: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 32 CLOUD: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

8 INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- FIGURE 31 SMALL AND MEDIUM-SIZED ENTERPRISES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 33 INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 34 INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 8.2 LARGE ENTERPRISES

- 8.2.1 LARGE ENTERPRISES: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- TABLE 35 LARGE ENTERPRISES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 36 LARGE ENTERPRISES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 8.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- TABLE 37 SMES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 38 SMES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

9 INTELLIGENT DOCUMENT PROCESSING MARKET, BY TECHNOLOGY

- 9.1 ARTIFICIAL INTELLIGENCE

- 9.2 NATURAL LANGUAGE PROCESSING

- 9.3 OPTICAL CHARACTER RECOGNITION

- 9.4 MACHINE LEARNING

- 9.5 DEEP LEARNING

- 9.6 ROBOTIC PROCESS AUTOMATION

- 9.7 VISION APPLICATION PROGRAMMING INTERFACE

10 INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 32 GOVERNMENT VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 39 INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 40 INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.2 BFSI

- 10.2.1 BFSI: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- 10.2.2 BFSI: APPLICATION AREAS

- TABLE 41 BFSI: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 42 BFSI: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 GOVERNMENT

- 10.3.1 GOVERNMENT: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- 10.3.2 GOVERNMENT: APPLICATION AREAS

- TABLE 43 GOVERNMENT: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 44 GOVERNMENT: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 RETAIL AND ECOMMERCE

- 10.4.1 RETAIL AND ECOMMERCE: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- 10.4.2 RETAIL AND ECOMMERCE: APPLICATION AREAS

- TABLE 45 RETAIL AND ECOMMERCE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 46 RETAIL AND ECOMMERCE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 HEALTHCARE AND LIFE SCIENCES

- 10.5.1 HEALTHCARE AND LIFE SCIENCES: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- 10.5.2 HEALTHCARE AND LIFE SCIENCES: APPLICATION AREAS

- TABLE 47 HEALTHCARE AND LIFE SCIENCES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 48 HEALTHCARE AND LIFE SCIENCES: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.6 MANUFACTURING

- 10.6.1 MANUFACTURING: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- 10.6.2 MANUFACTURING: APPLICATION AREAS

- TABLE 49 MANUFACTURING: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 50 MANUFACTURING: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.7 TRANSPORTATION AND LOGISTICS

- 10.7.1 TRANSPORTATION AND LOGISTICS: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- 10.7.2 TRANSPORTATION AND LOGISTICS: APPLICATION AREAS

- TABLE 51 TRANSPORTATION AND LOGISTICS: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 52 TRANSPORTATION AND LOGISTICS: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.8 OTHER VERTICALS

- 10.8.1 OTHER VERTICALS: APPLICATION AREAS

- TABLE 53 OTHER VERTICALS: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 54 OTHER VERTICALS: INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION, 2022-2027 (USD MILLION)

11 INTELLIGENT DOCUMENT PROCESSING MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 33 NORTH AMERICA TO HOLD LARGEST MARKET SIZE AND ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- 11.2.2 NORTH AMERICA: REGULATORY IMPLICATIONS

- 11.2.2.1 Health Insurance Portability and Accountability Act of 1996

- 11.2.2.2 California Consumer Privacy Act

- 11.2.2.3 Gramm-Leach-Bliley Act

- 11.2.2.4 Health Information Technology for Economic and Clinical Health Act

- 11.2.2.5 Sarbanes-Oxley Act

- 11.2.2.6 United States Securities and Exchange Commission

- 11.2.2.7 International Organization for Standardization 27001

- 11.2.2.8 Federal Information Security Management Act

- 11.2.2.9 Payment Card Industry Data Security Standard

- 11.2.2.10 Federal Information Processing Standards

- FIGURE 34 NORTH AMERICA MARKET SNAPSHOT

- TABLE 55 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 59 NORTH AMERICA INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 64 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 66 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.2.3 US

- TABLE 67 US: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 68 US: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 69 US: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 70 US: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 71 US: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 72 US: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 73 US: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 74 US: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 75 US: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 76 US: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.2.4 CANADA

- TABLE 77 CANADA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 78 CANADA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 79 CANADA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 80 CANADA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 81 CANADA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 82 CANADA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 83 CANADA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 84 CANADA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 85 CANADA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 86 CANADA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- 11.3.2 EUROPE: REGULATORY IMPLICATIONS

- 11.3.2.1 General Data Protection Regulation

- 11.3.2.2 European Committee for Standardization

- 11.3.2.3 European Technical Standards Institute

- TABLE 87 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 88 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 89 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 90 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 91 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 92 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 93 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 94 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 95 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 96 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 97 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 98 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.3.3 GERMANY

- TABLE 99 GERMANY: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 100 GERMANY: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 101 GERMANY: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 102 GERMANY: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 103 GERMANY INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 104 GERMANY: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 105 GERMANY: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 106 GERMANY: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 107 GERMANY: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 108 GERMANY: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.3.4 UK

- TABLE 109 UK: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 110 UK: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 111 UK: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 112 UK: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 113 UK: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 114 UK: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 115 UK: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 116 UK: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 117 UK: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 118 UK: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.3.5 FRANCE

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: REGULATORY IMPLICATIONS

- 11.4.2.1 Privacy Commissioner for Personal Data

- 11.4.2.2 Act on the Protection of Personal Information

- 11.4.2.3 Critical Information Infrastructure

- 11.4.2.4 International Organization for Standardization 27001

- 11.4.2.5 Personal Data Protection Act

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 119 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 120 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 121 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 122 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 123 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 124 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 125 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 126 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 127 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 128 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 129 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 130 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.4.3 CHINA

- TABLE 131 CHINA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 132 CHINA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 133 CHINA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 134 CHINA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 135 CHINA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 136 CHINA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 137 CHINA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 138 CHINA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 139 CHINA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 140 CHINA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.4.4 INDIA

- 11.4.5 JAPAN

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST AND AFRICA

- 11.5.1 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- 11.5.2 MIDDLE EAST AND AFRICA: REGULATORY IMPLICATIONS

- 11.5.2.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

- 11.5.2.2 Cloud Computing Framework

- 11.5.2.3 GDPR Applicability in Kingdom of Saudi Arabia

- 11.5.2.4 Protection of Personal Information Act

- TABLE 141 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 142 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 143 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 144 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 145 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 146 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 147 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 148 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 149 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 150 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 151 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 152 MIDDLE EAST AND AFRICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.5.3 MIDDLE EAST

- TABLE 153 MIDDLE EAST: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 154 MIDDLE EAST: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 155 MIDDLE EAST: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 156 MIDDLE EAST: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 157 MIDDLE EAST: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 158 MIDDLE EAST: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 159 MIDDLE EAST: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 160 MIDDLE EAST: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 161 MIDDLE EAST: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 162 MIDDLE EAST: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.5.4 AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET DRIVERS

- 11.6.2 LATIN AMERICA: REGULATORY IMPLICATIONS

- 11.6.2.1 Brazil Data Protection Law

- 11.6.2.2 Argentina Personal Data Protection Law No. 25.326

- 11.6.2.3 Federal Law on Protection of Personal Data Held by Individuals

- TABLE 163 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 164 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 165 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 166 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 167 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 168 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 169 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 170 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 171 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 172 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 173 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 174 LATIN AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.4 MEXICO

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 175 OVERVIEW OF STRATEGIES ADOPTED BY KEY INTELLIGENT DOCUMENT PROCESSING VENDORS

- 12.3 REVENUE ANALYSIS

- FIGURE 36 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST FOUR YEARS

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 37 MARKET SHARE ANALYSIS OF COMPANIES IN INTELLIGENT DOCUMENT PROCESSING MARKET

- TABLE 176 INTELLIGENT DOCUMENT PROCESSING MARKET: DEGREE OF COMPETITION

- 12.5 COMPANY EVALUATION QUADRANT, 2022

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 38 GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET, COMPANY EVALUATION MATRIX 2022

- 12.6 STARTUP/SME EVALUATION QUADRANT, 2022

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 39 GLOBAL INTELLIGENT DOCUMENT PROCESSING MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 12.7 COMPETITIVE BENCHMARKING

- TABLE 177 INTELLIGENT DOCUMENT PROCESSING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 178 INTELLIGENT DOCUMENT PROCESSING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- TABLE 179 PRODUCT LAUNCHES, SEPTEMBER 2018-JULY 2022

- 12.8.2 DEALS

- TABLE 180 DEALS, JULY 2018- JULY 2022

- 12.8.3 OTHERS

- TABLE 181 OTHERS, DECEMBER 2019-MARCH 2019

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 MAJOR PLAYERS

(Business Overview, Products, Recent Developments, MnM View)**

- 13.2.1 ABBYY

- TABLE 182 ABBYY: BUSINESS OVERVIEW

- TABLE 183 ABBYY: PRODUCTS OFFERED

- TABLE 184 ABBYY: INTELLIGENT DOCUMENT PROCESSING MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

- TABLE 185 ABBYY: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- TABLE 186 ABBYY: INTELLIGENT DOCUMENT PROCESSING MARKET: OTHERS

- 13.2.2 IBM

- TABLE 187 IBM: BUSINESS OVERVIEW

- FIGURE 40 IBM: COMPANY SNAPSHOT

- TABLE 188 IBM: PRODUCT OFFERED

- TABLE 189 IBM: INTELLIGENT DOCUMENT PROCESSING MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 190 IBM: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- 13.2.3 KOFAX

- TABLE 191 KOFAX: BUSINESS OVERVIEW

- TABLE 192 KOFAX: PRODUCTS OFFERED

- TABLE 193 KOFAX: INTELLIGENT DOCUMENT PROCESSING MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 194 KOFAX: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- 13.2.4 WORKFUSION

- TABLE 195 WORKFUSION: BUSINESS OVERVIEW

- TABLE 196 WORKFUSION: PRODUCTS OFFERED

- TABLE 197 WORKFUSION: INTELLIGENT DOCUMENT PROCESSING MARKET: PRODUCT LAUNCHES

- TABLE 198 WORKFUSION: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- 13.2.5 AUTOMATION ANYWHERE

- TABLE 199 AUTOMATION ANYWHERE: BUSINESS OVERVIEW

- TABLE 200 AUTOMATION ANYWHERE: PRODUCTS OFFERED

- TABLE 201 AUTOMATION ANYWHERE: INTELLIGENT DOCUMENT PROCESSING MARKET: PRODUCTS LAUNCHES AND ENHANCEMENTS

- TABLE 202 AUTOMATION ANYWHERE: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- TABLE 203 AUTOMATION ANYWHERE: INTELLIGENT DOCUMENT PROCESSING MARKET: OTHERS

- 13.2.6 APPIAN

- TABLE 204 APPIAN: BUSINESS OVERVIEW

- FIGURE 41 APPIAN: COMPANY SNAPSHOT

- TABLE 205 APPIAN: PRODUCTS OFFERED

- TABLE 206 APPIAN: INTELLIGENT DOCUMENT PROCESSING MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 207 APPIAN: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- 13.2.7 UIPATH

- TABLE 208 UIPATH: BUSINESS OVERVIEW

- TABLE 209 UIPATH: PRODUCTS OFFERED

- TABLE 210 UIPATH: INTELLIGENT DOCUMENT PROCESSING MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

- TABLE 211 UIPATH: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- TABLE 212 UIPATH: INTELLIGENT DOCUMENT PROCESSING MARKET: OTHERS

- 13.2.8 DATAMATICS

- TABLE 213 DATAMATICS: BUSINESS OVERVIEW

- FIGURE 42 DATAMATICS: COMPANY SNAPSHOT

- TABLE 214 DATAMATICS: PRODUCTS OFFERED

- TABLE 215 DATAMATICS: INTELLIGENT DOCUMENT PROCESSING MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

- TABLE 216 DATAMATICS: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- 13.2.9 DELOITTE

- TABLE 217 DELOITTE: BUSINESS OVERVIEW

- TABLE 218 DELOITTE: PRODUCTS OFFERED

- TABLE 219 DELOITTE: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- 13.2.10 ANTWORKS

- TABLE 220 ANTWORKS: BUSINESS OVERVIEW

- TABLE 221 ANTWORKS: PRODUCTS OFFERED

- TABLE 222 ANTWORKS: INTELLIGENT DOCUMENT PROCESSING MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 223 ANTWORKS: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- 13.2.11 PARASCRIPT

- TABLE 224 PARASCRIPT: BUSINESS OVERVIEW

- TABLE 225 PARASCRIPT: PRODUCTS OFFERED

- TABLE 226 PARASCRIPT: INTELLIGENT DOCUMENT PROCESSING MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

- TABLE 227 PARASCRIPT: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- 13.2.12 HYPERSCIENCE

- TABLE 228 HYPERSCIENCE: BUSINESS OVERVIEW

- TABLE 229 HYPERSCIENCE: PRODUCTS OFFERED

- TABLE 230 HYPERSCIENCE: INTELLIGENT DOCUMENT PROCESSING MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

- TABLE 231 HYPERSCIENCE: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- 13.2.13 OPENTEXT

- TABLE 232 OPENTEXT: BUSINESS OVERVIEW

- FIGURE 43 OPENTEXT: COMPANY SNAPSHOT

- TABLE 233 OPENTEXT: PRODUCTS OFFERED

- TABLE 234 OPENTEXT: INTELLIGENT DOCUMENT PROCESSING MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

- TABLE 235 OPENTEXT: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- TABLE 236 OPENTEXT: INTELLIGENT DOCUMENT PROCESSING MARKET: OTHERS

- 13.2.14 HYLAND

- 13.2.15 EXTRACT SYSTEMS

- 13.2.16 CELATON

- 13.2.17 HCL TECHNOLOGIES

- 13.2.18 EPHESOFT

- 13.2.19 IRIS

- 13.2.20 BIS

- 13.2.21 KODAK ALARIS

- 13.2.22 HIVE

- 13.2.23 OCROLUS

- 13.2.24 INDATA LABS

- *Details on Business Overview, Products, MnM View might not be captured in case of unlisted companies.

- 13.3 STARTUPS

- 13.3.1 ACODIS

- TABLE 237 ACODIS: BUSINESS OVERVIEW

- TABLE 238 ACODIS: PRODUCTS OFFERED

- TABLE 239 ACODIS: INTELLIGENT DOCUMENT PROCESSING MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

- TABLE 240 ACODIS: INTELLIGENT DOCUMENT PROCESSING MARKET: DEALS

- 13.3.2 EVOLUTION AI

- 13.3.3 INFRRD

- 13.3.4 ROSSUM

- 13.3.5 AMYGB

- 13.3.6 HYPATOS

- 13.3.7 IN-D

14 ADJACENT/RELATED MARKETS

- 14.1 AUTOMATIC CONTENT RECOGNITION MARKET

- 14.1.1 MARKET OVERVIEW

- 14.1.2 AUTOMATIC CONTENT RECOGNITION MARKET, BY COMPONENT

- TABLE 241 AUTOMATIC CONTENT RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 242 AUTOMATIC CONTENT RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 14.1.2.1 Solutions

- TABLE 243 SOLUTIONS: AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 244 SOLUTIONS: AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.1.2.2 Services

- TABLE 245 SERVICES: AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 246 SERVICES: AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.1.3 AUTOMATIC CONTENT RECOGNITION MARKET, BY TECHNOLOGY

- TABLE 247 AUTOMATIC CONTENT RECOGNITION MARKET, BY TECHNOLOGY, 2016-2021 (USD MILLION)

- TABLE 248 AUTOMATIC CONTENT RECOGNITION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 14.1.4 AUTOMATIC CONTENT RECOGNITION MARKET, BY APPLICATION

- TABLE 249 AUTOMATIC CONTENT RECOGNITION MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 250 AUTOMATIC CONTENT RECOGNITION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 14.1.5 AUTOMATIC CONTENT RECOGNITION MARKET, BY CONTENT

- TABLE 251 AUTOMATIC CONTENT RECOGNITION MARKET, BY CONTENT, 2016-2021 (USD MILLION)

- TABLE 252 AUTOMATIC CONTENT RECOGNITION MARKET, BY CONTENT, 2022-2027 (USD MILLION)

- 14.1.6 AUTOMATIC CONTENT RECOGNITION MARKET, BY INDUSTRY VERTICAL

- TABLE 253 AUTOMATIC CONTENT RECOGNITION MARKET, BY INDUSTRY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 254 AUTOMATIC CONTENT RECOGNITION MARKET, BY INDUSTRY VERTICAL, 2022-2027 (USD MILLION)

- 14.1.7 AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION

- TABLE 255 AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 256 AUTOMATIC CONTENT RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.2 DOCUMENT CAMERA MARKET

- 14.2.1 MARKET DEFINITION

- 14.2.2 LIMITATIONS

- 14.2.3 MARKET OVERVIEW

- 14.2.4 DOCUMENT CAMERA MARKET, BY PRODUCT TYPE

- TABLE 257 DOCUMENT CAMERA MARKET, BY VALUE AND VOLUME, 2017-2025

- TABLE 258 DOCUMENT CAMERA MARKET, BY PRODUCT TYPE, 2017-2025 (USD MILLION)

- 14.2.4.1 Portable document

- TABLE 259 PORTABLE DOCUMENT CAMERA MARKET, BY END USER, 2017-2025 (USD MILLION)

- TABLE 260 PORTABLE DOCUMENT CAMERA MARKET, BY REGION, 2017-2025 (USD MILLION)

- TABLE 261 APAC: PORTABLE DOCUMENT CAMERA MARKET, BY COUNTRY, 2017-2025 (USD MILLION)

- 14.2.4.2 Non-portable 252 TABLE 262 NON-PORTABLE DOCUMENT CAMERA MARKET, BY END USER, 2017-2025 (USD MILLION)

- TABLE 263 NON-PORTABLE DOCUMENT CAMERA MARKET, BY REGION, 2017-2025 (USD THOUSAND)

- TABLE 264 EUROPE: NON-PORTABLE DOCUMENT CAMERA MARKET, BY COUNTRY, 2017-2025 (USD THOUSAND)

- TABLE 265 APAC: NON-PORTABLE DOCUMENT CAMERA MARKET, BY COUNTRY, 2017-2025 (USD THOUSAND)

- TABLE 266 ROW: NON-PORTABLE DOCUMENT CAMERA MARKET, BY REGION, 2017-2025 (USD THOUSAND)

- 14.2.5 DOCUMENT CAMERA MARKET, BY CONNECTION TYPE

- TABLE 267 DOCUMENT CAMERA MARKET, BY CONNECTION TYPE, 2017-2025 (USD MILLION)

- TABLE 268 WIRED DOCUMENT CAMERA MARKET, BY END USER, 2017-2025 (USD MILLION)

- TABLE 269 WIRED DOCUMENT CAMERA MARKET, BY REGION, 2017-2025 (USD MILLION)

- TABLE 270 NORTH AMERICA: WIRED DOCUMENT CAMERA MARKET, BY COUNTRY, 2017-2025 (USD MILLION)

- TABLE 271 WIRELESS DOCUMENT CAMERA MARKET, BY END USER, 2017-2025 (USD MILLION)

- TABLE 272 WIRELESS DOCUMENT CAMERA MARKET, BY REGION, 2017-2025 (USD MILLION)

- 14.2.6 DOCUMENT CAMERA MARKET, BY END USER

- TABLE 273 DOCUMENT CAMERA MARKET, BY END USER, 2017-2025 (USD MILLION)

- 14.2.6.1 Education

- TABLE 274 DOCUMENT CAMERA MARKET FOR EDUCATION SECTOR, BY PRODUCT TYPE, 2017-2025 (USD MILLION)

- TABLE 275 DOCUMENT CAMERA MARKET FOR EDUCATION SECTOR, BY CONNECTION TYPE, 2017-2025 (USD MILLION)

- TABLE 276 DOCUMENT CAMERA MARKET FOR EDUCATION SECTOR, BY REGION, 2017-2025 (USD MILLION)

- 14.2.6.2 Corporate

- TABLE 277 DOCUMENT CAMERA MARKET FOR CORPORATE SECTOR, BY PRODUCT TYPE, 2017-2025 (USD THOUSAND)

- TABLE 278 DOCUMENT CAMERA MARKET FOR CORPORATE SECTOR, BY CONNECTION TYPE, 2017-2025 (USD MILLION)

- 14.2.6.3 Other end users

- TABLE 279 DOCUMENT CAMERA MARKET FOR OTHER END USERS, BY PRODUCT TYPE, 2017-2025 (USD MILLION)

- TABLE 280 DOCUMENT CAMERA MARKET FOR OTHER END USERS, BY CONNECTION TYPE, 2017-2025 (USD MILLION)

- 14.2.7 DOCUMENT CAMERA MARKET, BY REGION

- TABLE 281 DOCUMENT CAMERA MARKET, BY REGION, 2017-2025 (USD MILLION)

- TABLE 282 NORTH AMERICA: DOCUMENT CAMERA MARKET, BY COUNTRY, 2017-2025 (USD MILLION)

- TABLE 283 NORTH AMERICA: DOCUMENT CAMERA MARKET, BY PRODUCT TYPE, 2017-2025 (USD MILLION)

- TABLE 284 NORTH AMERICA: DOCUMENT CAMERA MARKET, BY CONNECTION TYPE, 2017-2025 (USD MILLION)

- TABLE 285 EUROPE: DOCUMENT CAMERA MARKET, BY COUNTRY, 2017-2025 (USD MILLION)

- TABLE 286 EUROPE: DOCUMENT CAMERA MARKET, BY PRODUCT TYPE, 2017-2025 (USD MILLION)

- TABLE 287 EUROPE: DOCUMENT CAMERA MARKET, BY CONNECTION TYPE, 2017-2025 (USD MILLION)

- TABLE 288 APAC: DOCUMENT CAMERA MARKET, BY PRODUCT TYPE, 2017-2025 (USD MILLION)

- TABLE 289 APAC: DOCUMENT CAMERA MARKET, BY CONNECTION TYPE, 2017-2025 (USD MILLION)

- TABLE 290 APAC: DOCUMENT CAMERA MARKET, BY END USER, 2017-2025 (USD MILLION)

- TABLE 291 ROW: DOCUMENT CAMERA MARKET, BY PRODUCT TYPE, 2017-2025 (USD MILLION)

- TABLE 292 ROW: DOCUMENT CAMERA MARKET, BY CONNECTION TYPE, 2017-2025 (USD MILLION)

- TABLE 293 ROW: DOCUMENT CAMERA MARKET, BY END USER, 2017-2025 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATIONS OFFERED

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS