|

|

市場調査レポート

商品コード

1138437

合成ゴムの世界市場:種類別 (SBR、BR、SBC、EPDM、IIR、NBR)・用途別 (タイヤ、自動車 (タイヤ以外) 、履物、工業用品、消費財、繊維)・地域別 (北米、欧州、アジア太平洋、南米、中東・アフリカ) の将来予測 (2027年まで)Synthetic Rubber Market by Type (SBR, BR, SBC, EPDM, IIR, NBR) Application (Tire, Automotive (Non-tire), Footwear, Industrial Goods, Consumer Goods, Textiles), and Region (North America, Europe, APAC, South America, MEA) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 合成ゴムの世界市場:種類別 (SBR、BR、SBC、EPDM、IIR、NBR)・用途別 (タイヤ、自動車 (タイヤ以外) 、履物、工業用品、消費財、繊維)・地域別 (北米、欧州、アジア太平洋、南米、中東・アフリカ) の将来予測 (2027年まで) |

|

出版日: 2022年10月11日

発行: MarketsandMarkets

ページ情報: 英文 223 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の合成ゴムの市場規模は、2022年に230億米ドル、2027年には289億米ドルに達すると推定され、2022年から2027年のCAGRは4.6%と予測されています。

予測期間中、合成ゴムの最大の用途はタイヤ分野であり、次いで自動車分野と推定されます。合成ゴムは天然ゴムに比べて、耐油性や耐熱性に優れているなど多くの利点があります。

種類別では、SBCが予測期間中に最も高いCAGRで成長する見通しです。地域別では、中東・アフリカが予測期間中に最も高いCAGRを達成すると考えられています。

当レポートでは、世界の合成ゴムの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- エコシステム/市場マッピング

- 技術分析

- チーグラー・ナッタ触媒

- メタロセン触媒

- ACE技術

- AMC技術

- バイオベースEPDM

- 規制状況

- 価格分析

- ケーススタディ

- 貿易分析

- 顧客のビジネスに影響を与える動向/混乱

- マクロ経済指標

- 自動車産業

- サプライチェーン分析

- バリューチェーン分析

- 主な会議とイベント (2022年~2023年)

- 特許分析

第6章 合成ゴム市場:種類別

- イントロダクション

- スチレンブタジエンゴム (SBR)

- ポリブタジエンゴム (BR)

- スチレンブロック共重合体 (SBC)

- エチレンプロピレンジエンモノマー (EPDM)

- ブチルゴム (IIR)

- アクリロニトリルブタジエンゴム (NBR)

- その他

第7章 合成ゴム市場:用途別

- イントロダクション

- タイヤ

- 自動車 (タイヤ以外)

- 履物

- 工業製品

- 消費財

- テキスタイル

- その他

第8章 合成ゴム市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- ASEAN諸国

- オーストラリア・ニュージーランド (ANZ)

- 他のアジア太平洋諸国

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- イタリア

- スペイン

- 他の欧州諸国

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- 他の中東・アフリカ諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

第9章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 市場シェア分析

- 主要企業のランキング (2021年)

- 主要企業の市場シェア (2021年)

- 企業評価クアドラント

- スタートアップ/中小企業 (SME) の評価クアドラント

- 競合ベンチマーキング

- 競合シナリオと動向

- 資本取引

- その他

第10章 企業プロファイル

- EXXON MOBIL CORPORATION

- THE DOW CHEMICAL COMPANY

- DUPONT

- CHINA PETROLEUM AND CHEMICAL CORPORATION

- ASAHI KASEI CORPORATION

- DENKA COMPANY LIMITED

- SABIC

- RELIANCE INDUSTRIES LTD.

- TOSOH CORPORATION

- その他の企業

- MITSUI CHEMICALS INC.

- SIBUR

- GOODYEAR TIRE AND RUBBER COMPANY

- NIZHNEKAMSKNEFTEKHIM

- ZEON CORPORATION

- KUMHO PETROCHEMICAL COMPANY LTD.

- PETROCHINA COMPANY LTD.

- TAIWAN SYNTHETIC RUBBER CORP.

- LION ELASTOMERS

- SYNTHOS

- CHANG RUBBER

- NANTEX INDUSTRY CO., LTD

- SK GEO CENTRIC CO., LTD.

- WARCO (WEST AMERICAN RUBBER COMPANY, LLC)

- LYONDELLBASELL INDUSTRIES N.V

- DYNASOL ELASTOMEROS SAU

第11章 付録

The global synthetic rubber market size is estimated to be USD 23.0 Billion in 2022 and is projected to reach USD 28.9 Billion by 2027, at a CAGR of 4.6% between 2022 and 2027. The tire segment is estimated to be the largest application of synthetic rubber during the forecast period, followed by the automotive. Synthetic rubber is produced from crude oil and natural gas. It is mainly produced by the polymerization of monomers. Synthetic rubber has many benefits over natural rubber, such as better resistance to oil and temperature. It is used in a wide range of applications, but its major application is in tires.

"By Type, SBC expects to reach the highest CAGR during forecast period"

SBC, made from styrene and butadiene linked homopolymer blocks, belongs to the class of thermoplastic elastomer (TPE). It has an elastic behavior, the property to change and recover the shape when a force is first applied and then removed; and thermoplastic behavior, the property to make it soften, viscous, and free-flowing like a liquid when heated and return to solid when cooled at room temperatures. There are three main types of SBCs, poly (styrene-butadiene-styrene) (SBS), poly (styrene-isoprene-styrene) (SIS), and poly (styrene-ethylene/butylene-styrene) (SEBS). SBC has properties such as high flexibility, good quality constancy, and reproducibility. SBS block copolymers are used for their compounding and adhesive qualities. They have recently gained popularity for use as an element within modified asphalts; they are used in the paving of new roads and highway construction, repair of roads and highways, and roofing of construction projects. SIS block copolymers are popular mainly due to their combination of unique attributes. SEBS is replacing flexible PVC in numerous applications in the medical industry. Footwear is also one of the largest applications of SBC.

"MEA (Middle East & Asia) is estimated to register the highest CAGR during forecast period."

A MEA is the fastest-growing segment and estimated to register the highest cagr during the forecast period . The growing automotive and industrial manufacturing industries in the Saudi Arabia act as a key growth driver for the synthetic rubber market in MEA. The growth in automobile production in the country is also likely to impact the synthetic rubber market, as synthetic rubber is used to manufacture tires and other automotive rubber parts. Saudi Arabia is the largest importer of vehicles and automotive components globally, accounting for approximately 770,000 sales per year. The region accounted for a market share of 3.3%, in terms of volume, in 2021. It is one of the fastest growing synthetic rubber markets, registering a CAGR of 6.2%, in terms of value, between 2022 and 2027.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub segments and information gathered through secondary research.

The break-up of primary interviews is given below:

- By Company Type - Tier 1 - 40%, Tier 2 - 20%, and Tier 3 - 40%

- By Designation - C level - 20%, Director level - 20%, and Others* - 60%

- By Region - North America- 40%, Europe - 40%, APAC - 15%, and Rest of World- 5%

Notes: Others include sales, marketing, and product managers.

Companies have been selected based on recent financials (Tier 1: revenue >USD 5 billion, Tier 2: revenue between USD 1 billion to 5 billion, and Tier 3: revenue below USD 1 billion).

The companies profiled in this market research report include The Dow Chemical Company (U.S), ExxonMobil (U.S), Kumho Petrochemical Company Ltd (South Korea), Zeon Corporation (Japan), Nizhnekamskneftekhim (Russia), The Goodyear Tire and Rubber Company (U.S), Mitsui Chemical Inc. (Japan), JSR Corporation (Japan), Denka Company Ltd. (Japan), and Asahi Kasei Corporation (Japan).

Research Coverage:

This research report categorizes the synthetic rubber market on the basis of type, application and region. The report includes detailed information regarding the major factors influencing the growth of the synthetic rubber market, such as drivers, restraints, challenges, and opportunities. A detailed analysis of the key industry players has been done to provide insights into business overviews, products & services, key strategies, expansions, new product developments, agreements, and recent developments associated with the market.

Reasons to Buy the Report

The report will help market leaders/new entrants in this market in the following ways:

1. This report segments the synthetic rubber market comprehensively and provides the closest approximations of market sizes for the overall market and subsegments across verticals and regions.

2. The report will help stakeholders understand the pulse of the market and provide them information on the key market drivers, restraints, challenges, and opportunities.

3. This report will help stakeholders understand the major competitors and gain insights to enhance their position in the business. The competitive landscape section includes expansions, new product developments, and joint ventures.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- FIGURE 1 SYNTHETIC RUBBER MARKET SEGMENTATION

- 1.2.2 REGIONS COVERED

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 SYNTHETIC RUBBER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Critical secondary inputs

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Critical primary inputs

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION APPROACH

- 2.2.1 MARKET SIZE ESTIMATION (BOTTOM-UP APPROACH): ASSESSMENT OF OVERALL SYNTHETIC RUBBER MARKET SIZE BASED ON INDIVIDUAL PRODUCT MARKET SIZE

- FIGURE 3 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 4 MARKET SIZE ESTIMATION: BY TYPE

- 2.2.2 ESTIMATING SYNTHETIC RUBBER MARKET SIZE FROM MARKET SHARE OF KEY APPLICATIONS

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- FIGURE 6 SYNTHETIC RUBBER MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 SBR ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 8 TIRE SEGMENT DOMINATED SYNTHETIC RUBBER MARKET IN 2021

- FIGURE 9 ASIA PACIFIC DOMINATED GLOBAL SYNTHETIC RUBBER MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF SYNTHETIC RUBBER MARKET

- FIGURE 10 GROWING DEMAND IN TIRE APPLICATION TO DRIVE MARKET

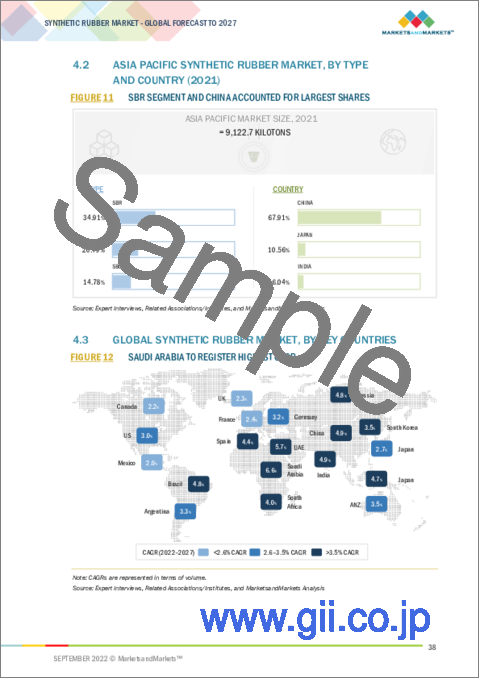

- 4.2 ASIA PACIFIC SYNTHETIC RUBBER MARKET, BY TYPE AND COUNTRY (2021)

- FIGURE 11 SBR SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

- 4.3 GLOBAL SYNTHETIC RUBBER MARKET, BY KEY COUNTRIES

- FIGURE 12 SAUDI ARABIA TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SYNTHETIC RUBBER MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing penetration of electric vehicles

- TABLE 1 TYPE OF RUBBER USED IN ELECTRIC VEHICLES AND INTERNAL COMBUSTION ENGINES

- 5.2.1.2 Stringent emission regulations and standards in developed economies

- 5.2.1.3 Increasing demand in Asia Pacific

- 5.2.2 RESTRAINTS

- 5.2.2.1 Health hazards associated with production of synthetic rubber

- 5.2.2.2 Economic slowdown and impact of COVID-19 on manufacturing sector

- FIGURE 14 EUROPE: MANUFACTURING INDUSTRY OUTPUT INDEX

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for high-performance and eco-friendly tires

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatile raw material prices

- FIGURE 15 FLUCTUATIONS IN CRUDE OIL PRICES DURING 2010-2021

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 SYNTHETIC RUBBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 SYNTHETIC RUBBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 ECOSYSTEM/MARKET MAPPING

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 ZIEGLER-NATTA CATALYST

- 5.5.2 METALLOCENE CATALYST

- 5.5.3 ACE TECHNOLOGY

- 5.5.4 AMC TECHNOLOGY

- 5.5.5 BIO-BASED EPDM

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7 PRICING ANALYSIS

- FIGURE 17 CRUDE OIL PRICES, 2010-2021 (USD/BARREL)

- 5.8 CASE STUDY

- 5.8.1 ETHYLENE PROPYLENE DIENE MONOMER RUBBER ROOFING MEMBRANE - IDEAL CHOICE FOR POOLING APPLICATION

- 5.8.2 ETHYLENE PROPYLENE DIENE MONOMER RUBBER ROOFING MEMBRANE - IDEAL CHOICE FOR GREEN ROOF APPLICATION

- 5.9 TRADE ANALYSIS

- TABLE 6 SYNTHETIC RUBBER EXPORTS, BY COUNTRY, 2021 (USD MILLION)

- TABLE 7 SYNTHETIC RUBBER IMPORTS, BY COUNTRY, 2021 (USD MILLION)

- TABLE 8 SYNTHETIC RUBBER EXPORTS, BY COUNTRY, 2021 (TON)

- TABLE 9 SYNTHETIC RUBBER IMPORTS, BY COUNTRY, 2021 (TON)

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 18 NEXT-GEN MOBILITY, LIGHTWEIGHTING, DIGITALIZATION, AND IMPROVED MEDICAL CARE TO CHANGE REVENUE MIX OF SUPPLIERS

- TABLE 10 SYNTHETIC RUBBER MARKET: YC & YCC SHIFT

- 5.11 MACROECONOMIC INDICATORS

- 5.11.1 AUTOMOTIVE INDUSTRY

- TABLE 11 PRODUCTION OF PASSENGER CARS, COMMERCIAL VEHICLES, TRUCKS, AND BUSES, 2019-2021

- TABLE 12 WORLD GDP GROWTH PROJECTION (2021-2023)

- 5.12 SUPPLY CHAIN ANALYSIS

- TABLE 13 SYNTHETIC RUBBER MARKET: SUPPLY CHAIN

- FIGURE 19 SYNTHETIC RUBBER MARKET: SUPPLY CHAIN ANALYSIS

- 5.13 VALUE CHAIN ANALYSIS

- 5.13.1 INTRODUCTION

- FIGURE 20 SYNTHETIC RUBBER MARKET: VALUE CHAIN ANALYSIS

- 5.14 KEY CONFERENCES & EVENTS IN 2022-2023

- 5.15 PATENT ANALYSIS

- 5.15.1 INTRODUCTION

- 5.15.2 METHODOLOGY

- 5.15.3 DOCUMENT TYPE

- FIGURE 21 TOTAL NUMBER OF PATENTS

- 5.15.4 PUBLICATION TRENDS

- FIGURE 22 NUMBER OF PATENTS YEAR-WISE IN LAST 10 YEARS

- 5.15.5 TOP PATENT APPLICANTS

- FIGURE 23 TOP 10 PATENT APPLICANTS

- 5.15.6 JURISDICTION ANALYSIS

- FIGURE 24 SHARE OF PATENTS, BY JURISDICTION

6 SYNTHETIC RUBBER MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 25 SBR TO HOLD LARGEST MARKET SHARE BY 2027

- TABLE 14 SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 15 SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- 6.2 STYRENE BUTADIENE RUBBER (SBR)

- 6.2.1 GROWTH OF TIRE INDUSTRY TO DRIVE DEMAND

- TABLE 16 STYRENE BUTADIENE RUBBER MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 17 STYRENE BUTADIENE RUBBER MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- 6.3 POLYBUTADIENE RUBBER (BR)

- 6.3.1 INCREASING CONSUMPTION IN ASIA PACIFIC TO SUPPORT MARKET GROWTH

- TABLE 18 POLYBUTADIENE RUBBER MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 19 POLYBUTADIENE RUBBER MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- 6.4 STYRENIC BLOCK COPOLYMER (SBC)

- 6.4.1 GROWTH OF AUTOMOTIVE INDUSTRY TO BOOST MARKET

- TABLE 20 STYRENIC BLOCK COPOLYMER MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 21 STYRENIC BLOCK COPOLYMER MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- 6.5 ETHYLENE PROPYLENE DIENE MONOMER (EPDM)

- 6.5.1 ASIA PACIFIC AUTOMOTIVE INDUSTRY TO DRIVE MARKET

- TABLE 22 ETHYLENE PROPYLENE DINE MONOMER MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

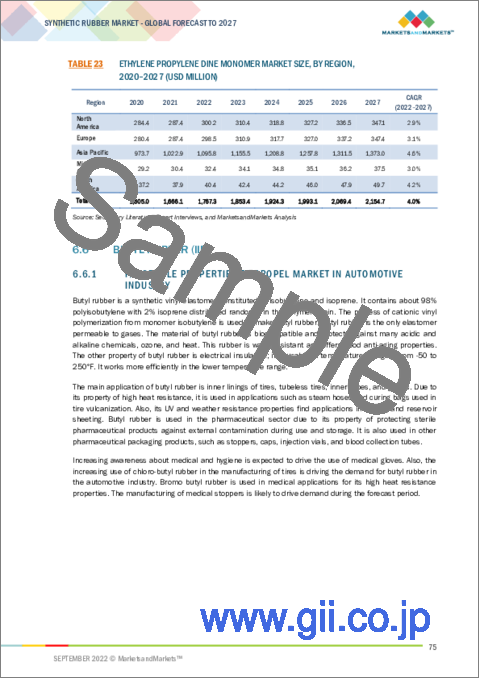

- TABLE 23 ETHYLENE PROPYLENE DINE MONOMER MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- 6.6 BUTYL RUBBER (IIR)

- 6.6.1 FAVORABLE PROPERTIES TO PROPEL MARKET IN AUTOMOTIVE INDUSTRY

- FIGURE 26 DEMAND FOR IIR (2020)

- TABLE 24 BUTYL RUBBER MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 25 BUTYL RUBBER MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- 6.7 ACRYLONITRILE BUTADIENE RUBBER (NBR)

- 6.7.1 MARKET IN ASIA PACIFIC TO REGISTER STEADY GROWTH

- TABLE 26 ACRYLONITRILE BUTADIENE RUBBER MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 27 ACRYLONITRILE BUTADIENE RUBBER MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- 6.8 OTHERS

- TABLE 28 OTHERS: SYNTHETIC RUBBER MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 29 OTHERS: SYNTHETIC RUBBER MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

7 SYNTHETIC RUBBER MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 27 TIRE SEGMENT TO BE LARGEST APPLICATION OF SYNTHETIC RUBBER

- TABLE 30 SYNTHETIC RUBBER MARKET, BY APPLICATION

- TABLE 31 SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 32 SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 7.2 TIRE

- 7.2.1 RECOVERY OF AUTOMOTIVE INDUSTRY FROM IMPACT OF COVID-19 TO PROPEL MARKET

- FIGURE 28 GLOBAL TIRE MARKET SHARE, BY KEY COMPANIES, 2020

- 7.2.2 IMPACT OF DISRUPTIVE TECHNOLOGIES ON TIRES AND TUBES

- FIGURE 29 EV TIRES: INCREASE IN DEMAND FOR PERFORMANCE

- TABLE 33 SYNTHETIC RUBBER MARKET SIZE IN TIRE SEGMENT, BY REGION, 2020-2027 (KILOTON)

- TABLE 34 SYNTHETIC RUBBER MARKET SIZE IN TIRE SEGMENT, BY REGION, 2020-2027 (USD MILLION)

- 7.3 AUTOMOTIVE (NON-TIRE)

- 7.3.1 GROWING EV PRODUCTION TO DRIVE MARKET

- TABLE 35 SYNTHETIC RUBBER MARKET SIZE IN AUTOMOTIVE (NON-TIRE) SEGMENT, BY REGION, 2020-2027 (KILOTON)

- TABLE 36 SYNTHETIC RUBBER MARKET SIZE IN AUTOMOTIVE (NON-TIRE) SEGMENT, BY REGION, 2020-2027 (USD MILLION)

- 7.4 FOOTWEAR

- 7.4.1 ADVANCED PROPERTIES IMPARTED BY SYNTHETIC RUBBER TO DRIVE MARKET

- FIGURE 30 GLOBAL FOOTWEAR PRODUCTION SHARE, BY COUNTRY, 2020

- TABLE 37 SYNTHETIC RUBBER MARKET SIZE IN FOOTWEAR SEGMENT, BY REGION, 2020-2027 (KILOTON)

- TABLE 38 SYNTHETIC RUBBER MARKET SIZE IN FOOTWEAR SEGMENT, BY REGION, 2020-2027 (USD MILLION)

- 7.5 INDUSTRIAL GOODS

- 7.5.1 STEADY RECOVERY IN MANUFACTURING SECTOR TO PROPEL MARKET

- FIGURE 31 TOTAL INDUSTRY PRODUCTION OUTPUT INDEX OF OECD COUNTRIES, Q2-2019-Q1-2021

- TABLE 39 SYNTHETIC RUBBER MARKET SIZE IN INDUSTRIAL GOODS SEGMENT, BY REGION, 2020-2027 (KILOTON)

- TABLE 40 SYNTHETIC RUBBER MARKET SIZE IN INDUSTRIAL GOODS SEGMENT, BY REGION, 2020-2027 (USD MILLION)

- 7.6 CONSUMER GOODS

- 7.6.1 CHANGING DEMAND FROM CONSUMERS IN APPAREL AND SPORTSWEAR SEGMENTS TO FAVOR MARKET GROWTH

- TABLE 41 SYNTHETIC RUBBER MARKET SIZE IN CONSUMER GOODS SEGMENT, BY REGION, 2020-2027 (KILOTON)

- TABLE 42 SYNTHETIC RUBBER MARKET SIZE IN CONSUMER GOODS SEGMENT, BY REGION, 2020-2027 (USD MILLION)

- 7.7 TEXTILES

- 7.7.1 INCREASING USE OF SYNTHETIC RUBBER TO CONTRIBUTE TO MARKET GROWTH

- TABLE 43 SYNTHETIC RUBBER MARKET SIZE IN TEXTILES SEGMENT, BY REGION, 2020-2027 (KILOTON)

- TABLE 44 SYNTHETIC RUBBER MARKET SIZE IN TEXTILES SEGMENT, BY REGION, 2020-2027 (USD MILLION)

- 7.8 OTHERS

- TABLE 45 SYNTHETIC RUBBER MARKET SIZE IN OTHERS SEGMENT, BY REGION, 2020-2027 (KILOTON)

- TABLE 46 SYNTHETIC RUBBER MARKET SIZE IN OTHERS SEGMENT, BY REGION, 2020-2027 (USD MILLION)

8 SYNTHETIC RUBBER MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 32 RAPIDLY GROWING MARKETS TO EMERGE AS NEW HOTSPOTS

- TABLE 47 SYNTHETIC RUBBER MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 48 SYNTHETIC RUBBER MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- 8.2 ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SNAPSHOT

- TABLE 49 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 50 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 51 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 52 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 53 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 54 ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2.1 CHINA

- 8.2.1.1 Growing industrialization to drive demand for synthetic rubber

- TABLE 55 CHINA: TIRE PRODUCTION IN 2015-2020 (MILLION UNIT)

- TABLE 56 CHINA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 57 CHINA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 58 CHINA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 59 CHINA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2.2 JAPAN

- 8.2.2.1 Emission standards to fuel market

- FIGURE 34 JAPAN: AUTOMOBILE PRODUCTION, 2010-2021

- TABLE 60 JAPAN: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 61 JAPAN: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 62 JAPAN: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 63 JAPAN: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2.3 SOUTH KOREA

- 8.2.3.1 Increasing automobile manufacturing to push demand for synthetic rubber

- TABLE 64 SOUTH KOREA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 65 SOUTH KOREA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 66 SOUTH KOREA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 67 SOUTH KOREA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2.4 INDIA

- 8.2.4.1 One of fastest-growing markets for synthetic rubber by volume

- TABLE 68 INDIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 69 INDIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 70 INDIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 71 INDIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2.5 ASEAN COUNTRIES

- 8.2.5.1 Lucrative opportunities for tire manufacturers

- TABLE 72 ASEAN COUNTRIES: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 73 ASEAN COUNTRIES: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 74 ASEAN COUNTRIES: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 75 ASEAN: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2.6 AUSTRALIA & NEW ZEALAND (ANZ)

- 8.2.6.1 Growth in automotive sector to drive market

- TABLE 76 AUSTRALIA & NEW ZEALAND: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 77 AUSTRALIA & NEW ZEALAND: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 78 AUSTRALIA & NEW ZEALAND: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 79 AUSTRALIA & NEW ZEALAND: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2.7 REST OF ASIA PACIFIC

- TABLE 80 REST OF ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 81 REST OF ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 83 REST OF ASIA PACIFIC: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.3 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: AUTOMOBILE PRODUCTION, 2019-2021

- TABLE 84 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 85 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 87 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 89 NORTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.3.1 US

- 8.3.1.1 Increasing automotive exports to drive market

- TABLE 90 US: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 91 US: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 92 US: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 93 US: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.3.2 CANADA

- 8.3.2.1 Policies related to EV to drive demand for synthetic rubber

- TABLE 94 CANADA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 95 CANADA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 96 CANADA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 97 CANADA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.3.3 MEXICO

- 8.3.3.1 Growth in automotive sector to drive market

- TABLE 98 MEXICO: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 99 MEXICO: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 100 MEXICO: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 101 MEXICO: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4 EUROPE

- FIGURE 36 EUROPE: SYNTHETIC RUBBER MARKET SNAPSHOT

- FIGURE 37 EUROPE: AUTOMOBILE PRODUCTION AND Y-O-Y GROWTH (%), 2017-2021

- TABLE 102 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 103 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 104 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 105 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 106 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 107 EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4.1 GERMANY

- 8.4.1.1 Government support to boost EV market

- FIGURE 38 GERMANY: AUTOMOBILE PRODUCTION AND EXPORTS, 2018-2021

- TABLE 108 GERMANY: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 109 GERMANY: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 110 GERMANY: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 111 GERMANY: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4.2 UK

- 8.4.2.1 Expected recovery of automotive industry to drive market

- TABLE 112 UK: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 113 UK: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 114 UK: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 115 UK: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4.3 FRANCE

- 8.4.3.1 Growing consumption of synthetic rubber in EV to drive market

- TABLE 116 FRANCE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 117 FRANCE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 118 FRANCE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 119 FRANCE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4.4 RUSSIA

- 8.4.4.1 Market hampered by sharp decline in automobile production

- TABLE 120 RUSSIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 121 RUSSIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 122 RUSSIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 123 RUSSIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4.5 ITALY

- 8.4.5.1 Increasing EV sales to drive market

- TABLE 124 ITALY: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 125 ITALY: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 126 ITALY: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 127 ITALY: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4.6 SPAIN

- 8.4.6.1 Significant recovery of economy and automotive industry to propel market

- FIGURE 39 SPAIN: TOTAL AUTOMOBILE PRODUCTION, 2020

- TABLE 128 SPAIN: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 129 SPAIN: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 130 SPAIN: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 131 SPAIN: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.4.7 REST OF EUROPE

- TABLE 132 REST OF EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 133 REST OF EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 134 REST OF EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 135 REST OF EUROPE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.5 MIDDLE EAST & AFRICA

- TABLE 136 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 137 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 139 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 141 MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.5.1 SAUDI ARABIA

- 8.5.1.1 Vision 2030 and other government plans to boost automotive industry

- TABLE 142 SAUDI ARABIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 143 SAUDI ARABIA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 144 SAUDI ARABIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 145 SAUDI ARABIA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.5.2 UAE

- 8.5.2.1 Steady recovery of end-use industries from impact of COVID-19 to support market growth

- TABLE 146 UAE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 147 UAE: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 148 UAE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 149 UAE: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.5.3 SOUTH AFRICA

- 8.5.3.1 New vehicle market to witness slow demand

- TABLE 150 SOUTH AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 151 SOUTH AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 152 SOUTH AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 153 SOUTH AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 154 REST OF MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 155 REST OF MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 157 REST OF MIDDLE EAST & AFRICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.6 SOUTH AMERICA

- TABLE 158 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- TABLE 159 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 160 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 161 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 162 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 163 SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.6.1 BRAZIL

- 8.6.1.1 Economic growth and growing automobile production to impact synthetic rubber demand

- FIGURE 40 BRAZIL: TOTAL VEHICLE PRODUCTION, 2018-2021

- TABLE 164 BRAZIL: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 165 BRAZIL: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 166 BRAZIL: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 167 BRAZIL: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.6.2 ARGENTINA

- 8.6.2.1 Increasing passenger car sales to drive market

- TABLE 168 ARGENTINA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 169 ARGENTINA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 170 ARGENTINA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 171 ARGENTINA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.6.3 REST OF SOUTH AMERICA

- TABLE 172 REST OF SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (KILOTON)

- TABLE 173 REST OF SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 174 REST OF SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 175 REST OF SOUTH AMERICA: SYNTHETIC RUBBER MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 176 OVERVIEW OF STRATEGIES ADOPTED BY SYNTHETIC RUBBER MANUFACTURERS

- 9.3 MARKET SHARE ANALYSIS

- 9.3.1 RANKING OF KEY MARKET PLAYERS, 2021

- FIGURE 41 RANKING OF TOP 5 PLAYERS IN SYNTHETIC RUBBER MARKET, 2021

- 9.3.2 MARKET SHARE OF KEY PLAYERS, 2021

- TABLE 177 SYNTHETIC RUBBER MARKET: MARKET SHARE OF KEY PLAYERS

- FIGURE 42 SYNTHETIC RUBBER MARKET SHARE ANALYSIS

- 9.3.2.1 China Petroleum and Chemical Corporation

- 9.3.2.2 Kumho Petrochemical Co, Ltd.

- 9.3.2.3 PetroChina Company Limited

- 9.3.2.4 Exxon Mobil Corporation

- 9.3.2.5 Taiwan Synthetic Rubber Corporation

- 9.4 COMPANY EVALUATION QUADRANT

- 9.4.1 STARS

- 9.4.2 PERVASIVE PLAYERS

- 9.4.3 EMERGING LEADERS

- 9.4.4 PARTICIPANTS

- FIGURE 43 SYNTHETIC RUBBER MARKET: COMPANY EVALUATION QUADRANT, 2021

- 9.5 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANT

- 9.5.1 PROGRESSIVE COMPANIES

- 9.5.2 RESPONSIVE COMPANIES

- 9.5.3 DYNAMIC COMPANIES

- 9.5.4 STARTING BLOCKS

- FIGURE 44 START-UP AND SMALL AND MEDIUM-SIZED ENTERPRISE (SMES) EVALUATION MATRIX, 2021

- 9.6 COMPETITIVE BENCHMARKING

- TABLE 178 SYNTHETIC RUBBER MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 179 SYNTHETIC RUBBER MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 9.7 COMPETITIVE SCENARIO AND TRENDS

- 9.7.1 DEALS

- TABLE 180 SYNTHETIC RUBBER MARKET: DEALS

- 9.7.2 OTHERS

- TABLE 181 SYNTHETIC RUBBER MARKET: OTHERS

10 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 10.1 EXXON MOBIL CORPORATION

- TABLE 182 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- FIGURE 45 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- 10.2 THE DOW CHEMICAL COMPANY

- TABLE 183 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 46 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- 10.3 DUPONT

- TABLE 184 DUPONT: COMPANY OVERVIEW

- FIGURE 47 DUPONT: COMPANY SNAPSHOT

- 10.4 CHINA PETROLEUM AND CHEMICAL CORPORATION

- TABLE 185 CHINA PETROLEUM AND CHEMICAL CORPORATION: COMPANY OVERVIEW

- FIGURE 48 CHINA PETROLEUM AND CHEMICAL CORPORATION: COMPANY SNAPSHOT

- 10.5 ASAHI KASEI CORPORATION

- TABLE 186 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- FIGURE 49 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- 10.6 DENKA COMPANY LIMITED

- TABLE 187 DENKA COMPANY LIMITED: COMPANY OVERVIEW

- FIGURE 50 DENKA COMPANY LIMITED: COMPANY SNAPSHOT

- 10.7 SABIC

- TABLE 188 SABIC: COMPANY OVERVIEW

- FIGURE 51 SABIC: COMPANY SNAPSHOT

- 10.8 RELIANCE INDUSTRIES LTD.

- TABLE 189 RELIANCE INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 52 RELIANCE INDUSTRIES LTD.: COMPANY SNAPSHOT

- 10.9 TOSOH CORPORATION

- TABLE 190 TOSOH CORPORATION: COMPANY OVERVIEW

- FIGURE 53 TOSOH CORPORATION: COMPANY SNAPSHOT

- 10.10 OTHER PLAYERS

- 10.10.1 MITSUI CHEMICALS INC.

- TABLE 191 MITSUI CHEMICALS INC.: COMPANY OVERVIEW

- 10.10.2 SIBUR

- TABLE 192 SIBUR: COMPANY OVERVIEW

- 10.10.3 GOODYEAR TIRE AND RUBBER COMPANY

- TABLE 193 GOODYEAR TIRE AND RUBBER COMPANY: COMPANY OVERVIEW

- 10.10.4 NIZHNEKAMSKNEFTEKHIM

- TABLE 194 NIZHNEKAMSKNEFTEKHIM: COMPANY OVERVIEW

- 10.10.5 ZEON CORPORATION

- TABLE 195 ZEON CORPORATION: COMPANY OVERVIEW

- 10.10.6 KUMHO PETROCHEMICAL COMPANY LTD.

- TABLE 196 KUMHO PETROCHEMICAL COMPANY LTD.: COMPANY OVERVIEW

- 10.10.7 PETROCHINA COMPANY LTD.

- TABLE 197 PETROCHINA COMPANY LTD.: COMPANY OVERVIEW

- 10.10.8 TAIWAN SYNTHETIC RUBBER CORP.

- TABLE 198 TAIWAN SYNTHETIC RUBBER CORP.: COMPANY OVERVIEW

- 10.10.9 LION ELASTOMERS

- TABLE 199 LION ELASTOMERS: COMPANY OVERVIEW

- 10.10.10 SYNTHOS

- TABLE 200 SYNTHOS: COMPANY OVERVIEW

- 10.10.11 CHANG RUBBER

- TABLE 201 CHANG RUBBER: COMPANY OVERVIEW

- 10.10.12 NANTEX INDUSTRY CO., LTD

- TABLE 202 NANTEX INDUSTRY CO., LTD: COMPANY OVERVIEW

- 10.10.13 SK GEO CENTRIC CO., LTD.

- TABLE 203 SK GEO CENTRIC CO., LTD.: COMPANY OVERVIEW

- 10.10.14 WARCO (WEST AMERICAN RUBBER COMPANY, LLC)

- TABLE 204 WARCO: COMPANY OVERVIEW

- 10.10.15 LYONDELLBASELL INDUSTRIES N.V

- TABLE 205 LYONDELLBASELL INDUSTRIES N.V: COMPANY OVERVIEW

- 10.10.16 DYNASOL ELASTOMEROS SAU

- TABLE 206 DYNASOL ELASTOMEROS SAU: COMPANY OVERVIEW

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS