|

|

市場調査レポート

商品コード

1166389

産業オートメーション向けシステムインテグレーターの世界市場:サービス展望別・技術別 (HMI、SCADA、MES、IIoT、PAM、DCS、PLC、マシンビジョン、産業ロボット、産業用PC)・業種別・地域別 (北米、欧州、アジア太平洋、他の国々 (RoW)) の将来予測 (2027年まで)System Integrator Market for Industrial Automation by Service Outlook, Technology (HMI, SCADA, MES, IIoT, PAM, DCS, PLC, Machine Vision, Industrial Robotics, Industrial PC), Industry and Region (North America, Europe, APAC, RoW) -Global forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 産業オートメーション向けシステムインテグレーターの世界市場:サービス展望別・技術別 (HMI、SCADA、MES、IIoT、PAM、DCS、PLC、マシンビジョン、産業ロボット、産業用PC)・業種別・地域別 (北米、欧州、アジア太平洋、他の国々 (RoW)) の将来予測 (2027年まで) |

|

出版日: 2022年11月29日

発行: MarketsandMarkets

ページ情報: 英文 219 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の産業オートメーション向けシステムインテグレーターの市場規模は、2022年に270億米ドル、2027年には355億米ドルに達すると予測されており、2022年~2027年に5.6%のCAGRで成長します。

安全性やセキュリティに対する懸念の高まりなどの要因が、自動化システムの需要を刺激し、市場を拡大させています。

"中東・アフリカの新興国政府による戦略的な取り組みが、産業用オートメーションを促進"

中東・アフリカ諸国の政府は、自国の総合的な発展を確保するために、様々な産業支援の取り組みを行っています。また、プロセス産業の発展に重点を置いています。こうした政策を受けて、さまざまな産業用オートメーションプロセスの導入が促進されており、それが予測期間中、産業用オートメーション向けシステムインテグレーター市場を牽引するものと期待されています。

"熟練した専門家の不足"

産業用オートメーションにおける大きな問題は、プロジェクトに関わるさまざまな分野に対応するための十分なエンジニアリングスキルを習得するのに時間がかかることです。資格のあるエンジニアのほとんどはSEレベルで採用され、エンジニアリング・調達・建設 (EPC) レベルではごくわずかであり、フロントエンド・エンジニアリング・デザイン (FEED) レベルでは実質的に皆無に等しいです。他方、システムインテグレーション機器を効果的に操作できる熟練した専門家が継続的に必要とされています。

"機械学習とビッグデータアナリティクスの発展"

機械学習 (ML) の登場は、効率的なビッグデータ解析と並列処理フレームワークと相まって、仮想監視市場を大きく変貌させつつあります。ビッグデータアナリティクスは、大量のデータを処理できるため、状態監視システムで生成されたデータの解析プロセスを加速させました。機械学習は、機械性能の容易なベンチマーク、データの透明性の向上、状態監視システムのさまざまなプロセスの効率的な連携など、魅力的な機能を提供します。ビッグデータ対応の状態監視は、企業が資産の総所有コストを削減し、ビジネスをより効率的に運営するのに役立ちます。

当レポートでは、世界の産業オートメーション向けシステムインテグレーターの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、サービス展望別・技術別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステムマッピング

- YC-YCCのシフト:システムインテグレーター市場

- 価格分析

- 技術動向

- IIoTとMQTT (Message Queueing Telemetry Transport)

- データ管理

- 仮想化とクラウドコンピューティング

- ポーターのファイブフォース分析

- 主な利害関係者と購入プロセス・購入基準

- ケーススタディ

- 貿易分析

- 特許分析

- 主な会議とイベント (2022年~2023年)

- 関税と規制の状況

第6章 産業オートメーション向けシステムインテグレーター市場:サービス展望別

- イントロダクション

- コンサルティング

- ハードウェア統合サービス

第7章 産業オートメーション向けシステムインテグレーター市場:技術別

- イントロダクション

- ヒューマン・マシン・インターフェース (HMI)

- 監視制御・データ取得 (SCADA)

- 製造実行システム (MES)

- 機能安全システム

- マシンビジョン

- 産業用ロボット

- 産業用PC

- 産業用モノのインターネット (IIoT)

- 機械状態モニタリング

- プラント資産管理 (PAM)

- 分散制御システム (DCS)

- プログラマブルロジックコントローラ (PLC)

第8章 産業オートメーション向けシステムインテグレーター市場:業種別

- イントロダクション

- 石油・ガス

- 化学・石油化学

- 食品・飲料

- 自動車

- エネルギー・電力

- 医薬品

- パルプ・製紙

- 航空宇宙・防衛

- 電気・電子機器

- 鉱業・金属

- その他

第9章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- フランス

- ドイツ

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東・アフリカ

- 南米

第10章 競合情勢

- イントロダクション

- 上位3社の収益分析

- 市場シェア分析 (2021年)

- 企業評価マトリックス

- 中小企業 (SME) の評価クアドラント (2021年)

- 企業のフットプリント

- 競合ベンチマーキング

- 競争シナリオ

第11章 企業プロファイル

- 主要企業

- JOHN WOOD GROUP PLC

- ATS AUTOMATION

- AVANCEON LIMITED

- JR AUTOMATION

- TESCO CONTROLS, INC.

- BURROW GLOBAL, LLC

- PRIME CONTROLS, LP

- MAVERICK TECHNOLOGIES (A ROCKWELL AUTOMATION COMPANY)

- BARRY-WEHMILLER DESIGN GROUP

- INTECH PROCESS AUTOMATION INC.

- その他の企業

- AVID SOLUTIONS

- BROCK SOLUTIONS

- CONTROL ASSOCIATES, INC.

- DENNIS GROUP

- DYNAMYSK AUTOMATION LTD.

- E TECH GROUP INC.

- FORI AUTOMATION, INC.

- MANGAN INC.

- MATRIX TECHNOLOGIES, INC.

- OPTIMATION TECHNOLOGY, INC.

- PREMIER SYSTEM INTEGRATORS, INC.

- QUANTUM DESIGN INC.

- THE ROVISYS COMPANY

- SAGE AUTOMATION

- W-INDUSTRIES, INC.

第12章 付録

System integrator market for industrial automation size is valued at USD 27.0 billion in 2022 and is anticipated to be USD 35.5 billion by 2027; growing at a CAGR of 5.6% from 2022 to 2027. The growing demand of factors such as increasing safety and security concerns stimulating demand for automation systems to grow the market at an estimated rate.

Strategic initiatives by governments of emerging countries in Middle East & Africa to drive industrial automation

Governments of countries in the Middle East & Africa are taking various initiatives to support the development of industries for ensuring the holistic development of their respective countries. These governments are focusing on the development of process industries. For instance, initiatives such as Dubai Industrial Strategy 2030, National Industrial Development and Logistics Program, along with various other upcoming non-oil projects are expected to boost the industrial automation market in the Middle East. The Vision 2021 National Agenda of the UAE government also supports the development of the manufacturing sector by focusing on creating national policies that promote sustainable growth for the assembly technology. Thus, such measures undertaken by governments of different countries are promoting the adoption of various industrial automation processes and are expected to drive the market for system integration for industrial automation during the forecast period.

Lack of skilled professionals

A major problem in industrial automation is the amount of time it takes to acquire adequate engineering skills to address the variety of disciplines involved in a project. Most qualified engineers are employed at the systems integration level and only a few at the engineering, procurement, and construction (EPC) levels, and practically none at the front-end engineering design (FEED) level. There is a continuous need for skilled professionals who can effectively operate system integration equipment. The proper usage of equipment requires personnel with expertise, relevant experience, and knowledge. The selection of the right operational techniques specific to a given task is critical.

Development of machine learning and big data analytics

The advent of machine learning, coupled with efficient big data analytics and parallel processing framework, is transforming the virtual monitoring market. Big data analytics has accelerated the process of analysis of the data generated by condition monitoring systems due to the capability of processing large volumes of data. Machine learning offers attractive features such as easier benchmarking of machine performance, better transparency in data, and efficient collaboration of various processes of condition monitoring systems. Big data-enabled condition monitoring helps companies in lowering the overall cost of ownership for assets and running their businesses more efficiently.

The breakup of primaries conducted during the study is depicted below:

- By Company Type: Tier 1 - 38 %, Tier 2 - 28%, and Tier 3 -34%

- By Designation: C-Level Executives - 40%, Directors - 30%, and Others - 30%

- By Region: North America- 35%, Europe - 20%, Asia Pacific - 35%, RoW - 10%

The key players operating in the system integrator market include few globally established players such as John Wood Group PLC (UK), ATS Automation (Canada), Avanceon Limited (US), JR Automation (US), Tesco Controls, Inc. (US), Burrow Global LLC (US), Prime Controls LP (US), MAVERICK Technologies (US), Barry-Wehmiller Design Group (US), and INTECH Process Automation (US).

Research Coverage

The report segments the system integrator market and forecasts its size based on region (North America, Europe, Asia Pacific, and Rest of the World), By Service Outlook (Hardware Integration Service, Software Integration Service, Consulting Service); By Technology (Human-Machine Interface (HMI), Supervisory Control and Data Acquisition (SCADA), Manufacturing Execution System (MES), Functional Safety System, Machine Vision, Industrial Robotics, Industrial PC, Industrial Internet of Things (IIoT), Machine Condition Monitoring, Plant Asset Management, Distribute Control System (DCS), Programmable Logic Controller (PLC)); By Industry (Oil & Gas, Chemical & Petrochemical, Food & Beverage, Automotive, Pulp & Paper, Pharmaceutical, Aerospace & Defense, Electrical & Electronics, Mining & Metal and Others (textile, water & wastewater, printing, and packaging)).

The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the system integrator market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Key Benefits of Buying This Report

- This report includes market statistics pertaining to by service outlook, technology, industry and region.

- Major market drivers, restraints, challenges, and opportunities have been detailed in this report.

- Illustrative segmentation, analyses, and forecasts for the market based on product, material type, frequency band, application and region have been conducted to provide an overall view of the system integrator market.

- The report includes an in-depth analysis and ranking of key players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION: RESEARCH DESIGN

- 2.1.1 SECONDARY & PRIMARY RESEARCH

- 2.1.1.1 Key industry insights

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand size)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 APPROACH FOR CAPTURING MARKET SHARE BY TOP-DOWN ANALYSIS (SUPPLY SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 8 ASSUMPTIONS

- 2.4.1 LIMITATIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 HARDWARE INTEGRATION SERVICE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

- FIGURE 10 SYSTEM INTEGRATOR SERVICE MARKET FOR OIL & GAS INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 IIOT SEGMENT TO CAPTURE LARGEST MARKET SHARE BY 2027

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING REGION IN SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION DURING 2022-2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN GLOBAL SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION

- FIGURE 13 RISING ADOPTION OF AUTOMATION AND NEED TO INCREASE PRODUCTIVITY TO BOOST MARKET DURING 2022-2027

- 4.2 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY INDUSTRY

- FIGURE 14 OIL & GAS INDUSTRY TO LEAD SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION DURING FORECAST PERIOD

- 4.3 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY SERVICE OUTLOOK

- FIGURE 15 HARDWARE INTEGRATION SERVICE TO LEAD MARKET BY 2027

- 4.4 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY TECHNOLOGY

- FIGURE 16 IIOT TO ACCOUNT FOR LARGEST SHARE OF OVERALL SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION DURING FORECAST PERIOD

- 4.5 COUNTRY-WISE ANALYSIS OF SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION

- FIGURE 17 US ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing safety and security concerns stimulating demand for automation systems

- 5.2.1.2 Rising demand for low-cost, energy-efficient production processes

- 5.2.1.3 Expanding adoption of Internet of Things (IoT) and cloud computing in industrial automation

- 5.2.1.4 Growing instances of system integrators offering bundled products

- 5.2.1.5 Strategic initiatives by governments of emerging countries in Middle East & Africa

- 5.2.2 RESTRAINTS

- 5.2.2.1 High investment required for implementing and maintaining automation

- 5.2.2.2 Lack of skilled professionals

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Opportunities offered by Industry 4.0 and digitization

- 5.2.3.2 Development of machine learning and big data analytics

- 5.2.4 CHALLENGES

- 5.2.4.1 System interoperability

- 5.2.4.2 Security vulnerability in SCADA systems

- 5.2.4.3 Absence of standardization in industrial communication protocols and interfaces

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING ORIGINAL EQUIPMENT MANUFACTURING AND SYSTEM INTEGRATOR PHASES

- 5.4 ECOSYSTEM MAPPING

- FIGURE 20 SYSTEM INTEGRATOR MARKET: ECOSYSTEM

- FIGURE 21 SYSTEM INTEGRATORS FOR INDUSTRIAL AUTOMATION COVER A WIDE VARIETY OF FUNCTIONS

- TABLE 1 COMPANIES AND THEIR ROLES IN SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION ECOSYSTEM

- 5.5 YC-YCC SHIFT: SYSTEM INTEGRATOR MARKET

- FIGURE 22 YC-YCC SHIFT: SYSTEM INTEGRATOR MARKET

- 5.6 PRICING ANALYSIS

- 5.6.1 INDUSTRIAL ROBOTS

- TABLE 2 PRICE RANGE OF INDUSTRIAL ROBOTS

- 5.6.2 INDUSTRIAL MACHINE VISION SYSTEMS

- TABLE 3 PRICE RANGE OF MACHINE VISION SYSTEMS

- 5.7 TECHNOLOGY TRENDS

- 5.7.1 IIOT AND MESSAGE QUEUEING TELEMETRY TRANSPORT (MQTT)

- 5.7.2 DATA MANAGEMENT

- 5.7.3 VIRTUALIZATION AND CLOUD COMPUTING

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 IMPACT OF EACH FORCE ON SYSTEM INTEGRATOR MARKET

- 5.9 KEY STAKEHOLDERS AND BUYING PROCESS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.10 CASE STUDIES

- 5.10.1 ATS GLOBAL DEVELOPED CENTRAL MONITORING, CONTROL, AND MES SOLUTION FOR CONTACT LENS MANUFACTURER

- 5.10.2 EXIT LINE AUTOMATION AND CONTROLS UPGRADE

- 5.10.3 TANK MONITORING SYSTEM REPLACEMENT

- 5.10.4 PHARMACEUTICAL COMPANY ENABLED MANUFACTURE OF NEW GENERIC THERAPEUTIC DRUG WITH HELP OF ADVANCED PROCESS AUTOMATION SYSTEM

- 5.10.5 HIGH THROUGHPUT PISTON INSPECTION

- 5.11 TRADE ANALYSIS

- FIGURE 25 IMPORT DATA FOR INDUSTRIAL ROBOTS, 2017-2021 (USD THOUSANDS)

- TABLE 7 INDUSTRIAL ROBOT IMPORTS, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- FIGURE 26 EXPORT DATA FOR INDUSTRIAL ROBOTS, 2017-2021 (USD THOUSAND)

- TABLE 8 INDUSTRIAL ROBOT MACHINE EXPORTS, BY KEY COUNTRIES, 2017-2021 (USD THOUSAND)

- 5.12 PATENT ANALYSIS

- FIGURE 27 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

- TABLE 9 TOP 20 PATENT OWNERS IN US SYSTEM INTEGRATOR MARKET FROM 2012-2021

- FIGURE 28 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2012 TO 2021

- TABLE 10 LIST OF A FEW PATENTS IN SYSTEM INTEGRATOR MARKET

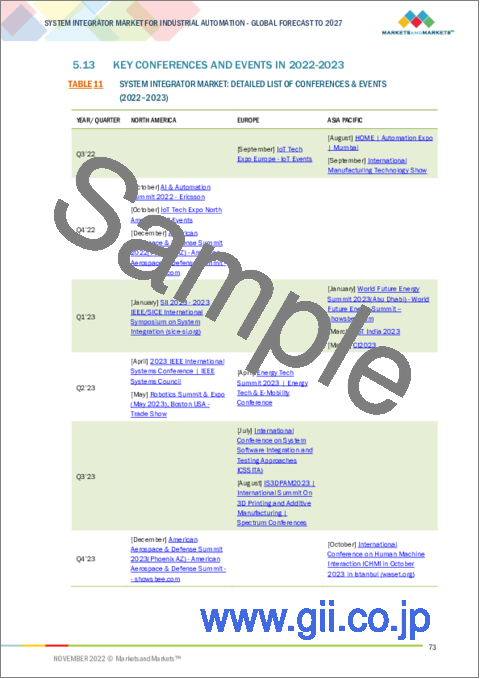

- 5.13 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 11 SYSTEM INTEGRATOR MARKET: DETAILED LIST OF CONFERENCES & EVENTS (2022-2023)

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS

- TABLE 12 TARIFF RATES FOR INDUSTRIAL ROBOTS EXPORTED BY JAPAN IN 2021

- TABLE 13 TARIFF RATES FOR INDUSTRIAL ROBOTS EXPORTED BY GERMANY IN 2021

- TABLE 14 TARIFF RATES FOR INDUSTRIAL ROBOTS EXPORTED BY ITALY IN 2021

- TABLE 15 TARIFF RATES FOR INDUSTRIAL ROBOTS EXPORTED BY US IN 2021

- TABLE 16 TARIFF RATES FOR INDUSTRIAL ROBOTS EXPORTED BY DENMARK IN 2021

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 STANDARDS AND REGULATIONS

- 5.14.3.1 ASTM International

- 5.14.3.2 International Organization for Standardization

- 5.14.3.3 MESA International

6 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY SERVICE OUTLOOK

- 6.1 INTRODUCTION

- FIGURE 29 HARDWARE INTEGRATION SERVICE TO ACCOUNT FOR LARGEST MARKET SIZE BETWEEN 2022 AND 2027

- TABLE 20 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 21 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- 6.2 CONSULTING

- 6.2.1 CONSULTING SERVICES ENABLE COMPANIES TO EXECUTE PROJECTS WITH GREATER CLARITY AT LOWER COST AND RISK

- TABLE 22 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION CONSULTING SERVICES, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 23 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION CONSULTING SERVICES, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 6.3 HARDWARE INTEGRATION SERVICE

- 6.3.1 AWARENESS ABOUT BENEFITS OF IT INFRASTRUCTURE TO CREATE DEMAND FOR INTEGRATION OF HARDWARE COMPONENTS

- TABLE 24 SYSTEM INTEGRATOR MARKET FOR HARDWARE INTEGRATION SERVICES, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 25 SYSTEM INTEGRATOR MARKET FOR HARDWARE INTEGRATION SERVICES, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 6.3.2 MODERN SOFTWARE PACKAGES HELP INCREASE PRODUCTIVITY AND ENABLE EFFECTIVE MANAGEMENT OF OPERATIONS

- TABLE 26 SYSTEM INTEGRATOR MARKET FOR SOFTWARE INTEGRATION SERVICE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 27 SYSTEM INTEGRATOR MARKET FOR SOFTWARE INTEGRATION SERVICE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

7 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 30 IIOT SEGMENT PROJECTED TO DOMINATE SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION DURING FORECAST PERIOD

- TABLE 28 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 29 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 7.2 HUMAN-MACHINE INTERFACE (HMI)

- 7.2.1 EMBEDDED HMI SOLUTIONS WITNESSING HIGH DEMAND FROM OIL & GAS INDUSTRY

- TABLE 30 SYSTEM INTEGRATOR MARKET FOR HMI, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 31 SYSTEM INTEGRATOR MARKET FOR HMI, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 32 SYSTEM INTEGRATOR MARKET FOR HMI, BY REGION, 2018-2021 (USD MILLION)

- TABLE 33 SYSTEM INTEGRATOR MARKET FOR HMI, BY REGION, 2022-2027 (USD MILLION)

- TABLE 34 SYSTEM INTEGRATOR MARKET FOR HMI, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 35 SYSTEM INTEGRATOR MARKET FOR HMI, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.3 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

- 7.3.1 INCREASED USAGE OF SMART FIELD DEVICES IN PROCESS INDUSTRIES TO FUEL MARKET GROWTH

- TABLE 36 SYSTEM INTEGRATOR MARKET FOR SCADA, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 37 SYSTEM INTEGRATOR MARKET FOR SCADA, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 38 SYSTEM INTEGRATOR MARKET FOR SCADA, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 SYSTEM INTEGRATOR MARKET FOR SCADA, BY REGION, 2022-2027 (USD MILLION)

- FIGURE 31 SCADA SEGMENT TO GROW AT HIGHEST CAGR IN ELECTRICAL & ELECTRONICS INDUSTRY DURING FORECAST PERIOD

- TABLE 40 SYSTEM INTEGRATOR MARKET FOR SCADA, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 41 SYSTEM INTEGRATOR MARKET FOR SCADA, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.4 MANUFACTURING EXECUTION SYSTEM (MES)

- 7.4.1 GROWING IMPORTANCE OF REGULATORY COMPLIANCE IN PHARMACEUTICAL INDUSTRY TO DRIVE MES ADOPTION

- TABLE 42 SYSTEM INTEGRATOR MARKET FOR MES, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 43 SYSTEM INTEGRATOR MARKET FOR MES, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 44 SYSTEM INTEGRATOR MARKET FOR MES, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 SYSTEM INTEGRATOR MARKET FOR MES, BY REGION, 2022-2027 (USD MILLION)

- FIGURE 32 MES SEGMENT TO GROW AT HIGHEST CAGR IN PHARMACEUTICAL INDUSTRY DURING FORECAST PERIOD

- TABLE 46 SYSTEM INTEGRATOR MARKET FOR MES, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 47 SYSTEM INTEGRATOR MARKET FOR MES, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.5 FUNCTIONAL SAFETY SYSTEMS

- 7.5.1 STRICT MANDATES FOR SAFETY REGULATIONS DRIVING MARKET

- TABLE 48 SYSTEM INTEGRATOR MARKET FOR FUNCTIONAL SAFETY, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 49 SYSTEM INTEGRATOR MARKET FOR FUNCTIONAL SAFETY, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 50 SYSTEM INTEGRATOR MARKET FOR FUNCTIONAL SAFETY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 SYSTEM INTEGRATOR MARKET FOR FUNCTIONAL SAFETY, BY REGION, 2022-2027 (USD MILLION)

- TABLE 52 SYSTEM INTEGRATOR MARKET FOR FUNCTIONAL SAFETY, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 53 SYSTEM INTEGRATOR MARKET FOR FUNCTIONAL SAFETY, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.6 MACHINE VISION

- 7.6.1 REQUIREMENT OF HIGH ACCURACY IN CRITICAL AUTOMOTIVE MANUFACTURING TO DRIVE DEMAND

- TABLE 54 SYSTEM INTEGRATOR MARKET FOR MACHINE VISION, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 55 SYSTEM INTEGRATOR MARKET FOR MACHINE VISION, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 56 SYSTEM INTEGRATOR MARKET FOR MACHINE VISION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 57 SYSTEM INTEGRATOR MARKET FOR MACHINE VISION, BY REGION, 2022-2027 (USD MILLION)

- TABLE 58 SYSTEM INTEGRATOR MARKET FOR MACHINE VISION, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 59 SYSTEM INTEGRATOR MARKET FOR MACHINE VISION, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.7 INDUSTRIAL ROBOTICS

- 7.7.1 LABOR-INTENSIVE FOOD & BEVERAGE INDUSTRY TO FUEL MARKET GROWTH

- TABLE 60 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL ROBOTICS, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 61 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL ROBOTICS, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 62 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL ROBOTICS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 63 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL ROBOTICS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 64 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL ROBOTICS, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 65 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL ROBOTICS, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.8 INDUSTRIAL PC

- 7.8.1 DESIGN FOR USE IN HARSH ENVIRONMENTAL CONDITIONS TO DRIVE GROWTH

- TABLE 66 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL PC, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 67 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL PC, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 68 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL PC, BY REGION, 2018-2021 (USD MILLION)

- TABLE 69 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL PC, BY REGION, 2022-2027 (USD MILLION)

- TABLE 70 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL PC, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 71 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL PC, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.9 INDUSTRIAL INTERNET OF THINGS (IIOT)

- 7.9.1 OPTIMIZES AND IMPROVES MANUFACTURING EQUIPMENT AND PRODUCTION

- TABLE 72 SYSTEM INTEGRATOR MARKET FOR IIOT, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 73 SYSTEM INTEGRATOR MARKET FOR IIOT, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 74 SYSTEM INTEGRATOR MARKET FOR IIOT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 75 SYSTEM INTEGRATOR MARKET FOR IIOT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 76 SYSTEM INTEGRATOR MARKET FOR IIOT, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 77 SYSTEM INTEGRATOR MARKET FOR IIOT, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.10 MACHINE CONDITION MONITORING

- 7.10.1 MULTIPLE BENEFITS TO DRIVE ADOPTION

- TABLE 78 SYSTEM INTEGRATOR MARKET FOR MACHINE CONDITION MONITORING, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 79 SYSTEM INTEGRATOR MARKET FOR MACHINE CONDITION MONITORING, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 80 SYSTEM INTEGRATOR MARKET FOR MACHINE CONDITION MONITORING, BY REGION, 2018-2021 (USD MILLION)

- TABLE 81 SYSTEM INTEGRATOR MARKET FOR MACHINE CONDITION MONITORING, BY REGION, 2022-2027 (USD MILLION)

- TABLE 82 SYSTEM INTEGRATOR MARKET FOR MACHINE CONDITION MONITORING, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 83 SYSTEM INTEGRATOR MARKET FOR MACHINE CONDITION MONITORING, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.11 PLANT ASSET MANAGEMENT

- 7.11.1 GROWING NEED FOR REAL-TIME DATA ANALYTICS TO DRIVE DEMAND

- TABLE 84 SYSTEM INTEGRATOR MARKET FOR PLANT ASSET MANAGEMENT, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 85 SYSTEM INTEGRATOR MARKET FOR PLANT ASSET MANAGEMENT, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 86 SYSTEM INTEGRATOR MARKET FOR PLANT ASSET MANAGEMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 87 SYSTEM INTEGRATOR MARKET FOR PLANT ASSET MANAGEMENT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 88 SYSTEM INTEGRATOR MARKET FOR PLANT ASSET MANAGEMENT, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 89 SYSTEM INTEGRATOR MARKET FOR PLANT ASSET MANAGEMENT, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.12 DISTRIBUTED CONTROL SYSTEM (DCS)

- 7.12.1 BOOMING ENERGY & POWER SECTOR TO OFFER SIGNIFICANT GROWTH OPPORTUNITIES

- TABLE 90 SYSTEM INTEGRATOR MARKET FOR DCS, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 91 SYSTEM INTEGRATOR MARKET FOR DCS, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 92 SYSTEM INTEGRATOR MARKET FOR DCS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 93 SYSTEM INTEGRATOR MARKET FOR DCS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 94 SYSTEM INTEGRATOR MARKET FOR DCS, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 95 SYSTEM INTEGRATOR MARKET FOR DCS, BY INDUSTRY, 2022-2027 (USD MILLION)

- 7.13 PROGRAMMABLE LOGIC CONTROLLER (PLC)

- 7.13.1 IIOT TO LEAD TO GROWTH ACROSS PROCESS INDUSTRIES

- TABLE 96 SYSTEM INTEGRATOR MARKET FOR PLC, BY SERVICE OUTLOOK, 2018-2021 (USD MILLION)

- TABLE 97 SYSTEM INTEGRATOR MARKET FOR PLC, BY SERVICE OUTLOOK, 2022-2027 (USD MILLION)

- TABLE 98 SYSTEM INTEGRATOR MARKET FOR PLC, BY REGION, 2018-2021 (USD MILLION)

- TABLE 99 SYSTEM INTEGRATOR MARKET FOR PLC, BY REGION, 2022-2027 (USD MILLION)

- TABLE 100 SYSTEM INTEGRATOR MARKET FOR PLC, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 101 SYSTEM INTEGRATOR MARKET FOR PLC, BY INDUSTRY, 2022-2027 (USD MILLION)

8 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY INDUSTRY

- 8.1 INTRODUCTION

- TABLE 102 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 103 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY INDUSTRY, 2022-2027 (USD MILLION)

- FIGURE 33 MINING & METAL INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 8.2 OIL & GAS

- 8.2.1 IMPLEMENTATION OF IIOT IN OIL & GAS INDUSTRY TO DRIVE MARKET GROWTH

- TABLE 104 SYSTEM INTEGRATOR MARKET FOR OIL & GAS INDUSTRY, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 105 SYSTEM INTEGRATOR MARKET FOR OIL & GAS INDUSTRY, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.3 CHEMICAL & PETROCHEMICAL

- 8.3.1 INDUSTRY 4.0 TECHNOLOGIES IMPROVE PRODUCTIVITY AND REDUCE RISK

- TABLE 106 SYSTEM INTEGRATOR MARKET FOR CHEMICAL & PETROCHEMICAL INDUSTRY, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 107 SYSTEM INTEGRATOR MARKET FOR CHEMICAL & PETROCHEMICAL INDUSTRY, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.4 FOOD & BEVERAGE

- 8.4.1 OVERCOMING CHALLENGES IN MAINTAINING PRODUCT QUALITY, EFFICIENCY, AND HYGIENE TO DRIVE MARKET

- TABLE 108 SYSTEM INTEGRATOR MARKET FOR FOOD & BEVERAGE INDUSTRY, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 109 SYSTEM INTEGRATOR MARKET FOR FOOD & BEVERAGE INDUSTRY, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.5 AUTOMOTIVE

- 8.5.1 INTRODUCTION OF HYBRID AND ELECTRIC VEHICLES TO DRIVE SYSTEM INTEGRATOR MARKET

- TABLE 110 SYSTEM INTEGRATOR MARKET FOR AUTOMOTIVE INDUSTRY, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 111 SYSTEM INTEGRATOR MARKET FOR AUTOMOTIVE INDUSTRY, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.6 ENERGY & POWER

- 8.6.1 INCREASING DEPLOYMENT OF RENEWABLE ENERGY TO DRIVE MARKET

- TABLE 112 SYSTEM INTEGRATOR MARKET FOR ENERGY & POWER INDUSTRY, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 113 SYSTEM INTEGRATOR MARKET FOR ENERGY & POWER INDUSTRY, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.7 PHARMACEUTICAL

- 8.7.1 EXTENSIVE USE OF AUTOMATION DRIVING NEED FOR SYSTEM INTEGRATORS

- TABLE 114 SYSTEM INTEGRATOR MARKET FOR PHARMACEUTICAL INDUSTRY, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 115 SYSTEM INTEGRATOR MARKET FOR PHARMACEUTICAL INDUSTRY, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.8 PULP & PAPER

- 8.8.1 AUTOMATION TO REDUCE ENVIRONMENTAL IMPACT AND OPTIMIZE USE OF RESOURCES

- TABLE 116 SYSTEM INTEGRATOR MARKET FOR PULP & PAPER INDUSTRY, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 117 SYSTEM INTEGRATOR MARKET FOR PULP & PAPER INDUSTRY, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.9 AEROSPACE & DEFENSE

- 8.9.1 AUTOMATION TO EASE COMPLEXITY OF WORK AND ENSURE QUALITY IN PROCESSES AND PRODUCTS

- TABLE 118 SYSTEM INTEGRATOR MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 119 SYSTEM INTEGRATOR MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.10 ELECTRICAL & ELECTRONICS

- 8.10.1 SCADA SYSTEMS TO HELP ELECTRONICS MANUFACTURERS ANALYZE COLLECTED DATA

- TABLE 120 SYSTEM INTEGRATOR MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 121 SYSTEM INTEGRATOR MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.11 MINING & METAL

- 8.11.1 HIGH FOCUS ON PROACTIVE SAFETY MEASURES TO DRIVE MARKET GROWTH

- TABLE 122 SYSTEM INTEGRATOR MARKET FOR MINING & METAL INDUSTRY, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 123 SYSTEM INTEGRATOR MARKET FOR MINING & METAL INDUSTRY, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.12 OTHERS

- TABLE 124 SYSTEM INTEGRATOR MARKET FOR OTHER INDUSTRIES, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 125 SYSTEM INTEGRATOR MARKET FOR OTHER INDUSTRIES, BY TECHNOLOGY, 2022-2027 (USD MILLION)

9 REGIONAL ANALYSIS

- 9.1 INTRODUCTION

- FIGURE 34 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION: GEOGRAPHIC SNAPSHOT

- TABLE 126 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 127 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, BY REGION, 2022-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: SNAPSHOT OF SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION

- TABLE 128 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 129 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 130 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN NORTH AMERICA, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 131 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN NORTH AMERICA, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Favorable economic conditions and growing concerns related to pollution, greenhouse gases, and environment to drive market

- 9.2.2 CANADA

- 9.2.2.1 Adoption of smart factory solutions to fuel market growth

- 9.2.3 MEXICO

- 9.2.3.1 Increasing industrial automation in automotive industry to drive market

- 9.3 EUROPE

- FIGURE 36 EUROPE: SNAPSHOT OF SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION

- TABLE 132 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 133 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 134 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN EUROPE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 135 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN EUROPE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 9.3.1 UK

- 9.3.1.1 Rising need for automation in food & beverage industry to drive demand for industrial automation systems and system integration services

- 9.3.2 FRANCE

- 9.3.2.1 Continuous adoption of new technologies to increase productivity and efficiency to lead to market growth

- 9.3.3 GERMANY

- 9.3.3.1 Increasing implementation of digital technologies in process industries to drive market

- 9.3.4 REST OF EUROPE

- 9.4 ASIA PACIFIC

- FIGURE 37 ASIA PACIFIC: SNAPSHOT OF SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION

- TABLE 136 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 137 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 138 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN ASIA PACIFIC, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 139 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN ASIA PACIFIC, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Rapidly soaring labor cost and decreasing labor force driving adoption of industrial robotics

- 9.4.2 JAPAN

- 9.4.2.1 Increase in automation, digitization, and AI to create demand for system integration services

- 9.4.3 INDIA

- 9.4.3.1 Strong growth in process automation industry to create demand for system integration services

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Government emphasis on increasing adoption of smart factory technologies to drive system integrator market for industrial automation

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD

- TABLE 140 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN REST OF THE WORLD, BY REGION, 2018-2021 (USD MILLION)

- TABLE 141 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN REST OF THE WORLD, BY REGION, 2022-2027 (USD MILLION)

- TABLE 142 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN REST OF THE WORLD, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 143 SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION IN REST OF THE WORLD, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 9.5.1 MIDDLE EAST & AFRICA

- 9.5.1.1 Increasing adoption of automation solutions in oil & gas industry to drive market

- 9.5.2 SOUTH AMERICA

- 9.5.2.1 Growing industrialization and upsurge in process tracking and compliance to drive demand

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 REVENUE ANALYSIS OF TOP THREE COMPANIES

- FIGURE 38 FIVE-YEAR REVENUE ANALYSIS OF TOP THREE PLAYERS

- 10.3 MARKET SHARE ANALYSIS, 2021

- FIGURE 39 MARKET SHARE: SYSTEM INTEGRATOR MARKET FOR INDUSTRIAL AUTOMATION, 2021

- 10.4 COMPANY EVALUATION MATRIX

- 10.4.1 STARS

- 10.4.2 PERVASIVE PLAYERS

- 10.4.3 EMERGING LEADERS

- 10.4.4 PARTICIPANTS

- FIGURE 40 COMPANY EVALUATION MATRIX, 2021

- 10.5 SMALL- AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2021

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- FIGURE 41 SME EVALUATION QUADRANT, 2021

- 10.6 COMPANY FOOTPRINT

- TABLE 144 FOOTPRINTS OF COMPANIES

- TABLE 145 INDUSTRY FOOTPRINTS OF COMPANIES

- TABLE 146 REGIONAL FOOTPRINTS OF COMPANIES

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 147 LIST OF KEY STARTUPS

- TABLE 148 COMPETITIVE BENCHMARKING OF KEY STARTUPS

- 10.8 COMPETITIVE SCENARIOS

- TABLE 149 PRODUCT LAUNCHES

- TABLE 150 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 11.1.1 JOHN WOOD GROUP PLC

- TABLE 151 JOHN WOOD GROUP PLC: COMPANY OVERVIEW

- FIGURE 42 JOHN WOOD GROUP PLC: COMPANY SNAPSHOT

- 11.1.2 ATS AUTOMATION

- TABLE 152 ATS AUTOMATION: COMPANY OVERVIEW

- FIGURE 43 ATS AUTOMATION: COMPANY SNAPSHOT

- 11.1.3 AVANCEON LIMITED

- TABLE 153 AVANCEON LIMITED: COMPANY OVERVIEW

- FIGURE 44 AVANCEON LIMITED: COMPANY SNAPSHOT

- 11.1.4 JR AUTOMATION

- TABLE 154 JR AUTOMATION: COMPANY OVERVIEW

- 11.1.5 TESCO CONTROLS, INC.

- TABLE 155 TESCO CONTROLS, INC.: COMPANY OVERVIEW

- 11.1.6 BURROW GLOBAL, LLC

- TABLE 156 BURROW GLOBAL, LLC: COMPANY OVERVIEW

- 11.1.7 PRIME CONTROLS, LP

- TABLE 157 PRIME CONTROLS, LP: COMPANY OVERVIEW

- 11.1.8 MAVERICK TECHNOLOGIES (A ROCKWELL AUTOMATION COMPANY)

- TABLE 158 MAVERICK TECHNOLOGIES: COMPANY OVERVIEW

- 11.1.9 BARRY-WEHMILLER DESIGN GROUP

- TABLE 159 BARRY-WEHMILLER DESIGN GROUP: COMPANY OVERVIEW

- 11.1.10 INTECH PROCESS AUTOMATION INC.

- TABLE 160 INTECH PROCESS AUTOMATION INC: COMPANY OVERVIEW

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 AVID SOLUTIONS

- 11.2.2 BROCK SOLUTIONS

- 11.2.3 CONTROL ASSOCIATES, INC.

- 11.2.4 DENNIS GROUP

- 11.2.5 DYNAMYSK AUTOMATION LTD.

- 11.2.6 E TECH GROUP INC.

- 11.2.7 FORI AUTOMATION, INC.

- 11.2.8 MANGAN INC.

- 11.2.9 MATRIX TECHNOLOGIES, INC.

- 11.2.10 OPTIMATION TECHNOLOGY, INC.

- 11.2.11 PREMIER SYSTEM INTEGRATORS, INC.

- 11.2.12 QUANTUM DESIGN INC.

- 11.2.13 THE ROVISYS COMPANY

- 11.2.14 SAGE AUTOMATION

- 11.2.15 W-INDUSTRIES, INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS