|

|

市場調査レポート

商品コード

1106662

インタラクティブ患者治療 (IPC)・インタラクティブ患者エンゲージメントソリューションの世界市場:製品別 (ハードウェア (テレビ、IBT/支援装置、タブレット)、ソフトウェア)・種類別 (入院患者、外来)・エンドユーザー別 (病院、診療所)・地域別の将来予測 (2027年まで)Interactive Patient Care(IPC) Market & Interactive Patient Engagement Solutions Market by Product(Hardware(Television, IBT/ Assisted Devices, Tablets), Software), Type(Inpatient, Outpatient), End User(Hospitals, Clinics) & Region -Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| インタラクティブ患者治療 (IPC)・インタラクティブ患者エンゲージメントソリューションの世界市場:製品別 (ハードウェア (テレビ、IBT/支援装置、タブレット)、ソフトウェア)・種類別 (入院患者、外来)・エンドユーザー別 (病院、診療所)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年07月20日

発行: MarketsandMarkets

ページ情報: 英文 179 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

インタラクティブ患者エンゲージメントソリューション市場は、2022年の1億4,600万米ドルから2027年には3億米ドルに達すると予測され、予測期間中に15.5%のCAGRで推移しています。

この市場の成長は、政府のイニシアチブの増加、技術的に高度な製品の迅速な導入、デジタルヘルスケアソリューションに関する認知度の向上が要因となっています。

しかし、医療インフラ巨額の投資の必要性が、予測期間中にこの市場の成長をある程度抑制することが予想されます。

"推定・予測期間中、ハードウェア分野が最も高い成長率を示す"

ハードウェア分野は、2021年のインタラクティブ患者エンゲージメントソリューション市場で最大のシェアを占め、予測期間中に最も速いCAGRで成長すると予測されています。テレビベース・ソリューションの開発の進展や、室内テレビの病因での採用増加が、この分野の成長の主要因となっています。

"2021年のインタラクティブ患者エンゲージメントソリューション市場では、入院患者向けソリューションセグメントが最大のシェアを占めた"

入院患者ソリューションセグメントは、2021年の世界市場で最大のシェアを占めています。患者ケアの改善の必要性と、これらのソリューションの採用に対する政府の有利なイニシアチブは、このセグメントの市場成長を支える要因の一部です。

"エンドユーザー別でみると病院セグメントが、2022年に世界のインタラクティブ患者エンゲージメントソリューション市場で最大のシェアを占める"

エンドユーザー別に見ると、2021年のインタラクティブ患者エンゲージメントソリューション市場では、病院部門が最大の市場シェアを占めています。病院スタッフの需要に取り組むためのITツールに対する需要の高まりと、効果的なコミュニケーションツールに対する需要の高まりが、このセグメントの主な成長要因です。

"北米がインタラクティブ患者エンゲージメントソリューション市場を独占する (2021年)"

北米は、2021年にインタラクティブ患者エンゲージメントソリューション市場で最大かつ最も成長率の高い地域市場シェアを占め、予測期間中に最も高いCAGRで成長すると予測されています。政府の好意的な取り組み、慢性疾患の有病率の上昇、デジタルヘルスケア製品に関する認知度の向上が、このセグメントの市場成長を支える主要因となっています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- 市場力学

- ケーススタディ

- エコシステムの範囲

- 技術分析

- 規則

- 価格分析

- 市場調査分析:エンドユーザーの視点

- ポーターのファイブフォース分析

- 産業動向

- 医療用ITソリューションの相互運用性とインテグレーションに対するニーズの高まり

- 「価値に基づく医療」に対する需要の増大

第6章 インタラクティブ患者エンゲージメントソリューション市場:種類別

- イントロダクション

- 入院患者向けソリューション

- 外来向けソリューション

第7章 インタラクティブ患者エンゲージメントソリューション市場:製品別

- イントロダクション

- ハードウェア

- 室内テレビ

- 統合型ベッドサイド端末 (IBT)/支援装置

- タブレット

- ソフトウェア

第8章 インタラクティブ患者エンゲージメントソリューション市場:エンドユーザー別

- イントロダクション

- 病院

- クリニック

- その他のエンドユーザー

第9章 インタラクティブ患者エンゲージメントソリューション市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 日本

- 中国

- インド

- 他のアジア太平洋諸国

- その他の地域

第10章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 市場ランキング

- 競合リーダーシップマッピング

- 新興企業/中小企業向けの競合リーダーシップマッピング

- 企業のフットプリント

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- GETWELLNETWORK, INC.

- EPIC SYSTEMS CORPORATION

- SONIFI HEALTH

- ADVANTECH CO., LTD.

- BARCO

- SENTRICS

- HOSPEDIA LIMITED

- EVIDEON

- ACESO INTERACTIVE INC.

- PDI COMMUNICATION SYSTEMS, INC.

- LINCOR, INC.

- CLINICALL

- HOPITEL INC.

- I3SOLUTIONS INC.

- HEALTHHUB PATIENT ENGAGEMENT SOLUTIONS

- ARBOR TECHNOLOGY CORP.

- HEALTHCARE INFORMATION, LLC

- BEWATEC CONNECTEDCARE GMBH

- ONYX HEALTHCARE INC.

- REMEDI COMPLETE MEDICAL SOLUTIONS

- その他の企業

- ONEVIEW HEALTHCARE

- SIEMENS

- VECOTON

- PCARE

- MEDIX-CARE GMBH

第12章 付録

The interactive patient engagement solutions market is projected to reach USD 300 million by 2027 from USD 146 million in 2022, at a CAGR of 15.5% during the forecast period. The growth of this market is driven by the increasing government initiatives, fast adoption of technologically advanced products, and increasing awareness about digital healthcare solutions.

However, large investment requirements for healthcare infrastructure are expected to restrain the growth of this market to a certain extent during the forecast period.

"Hardware segment is estimated to grow at the highest rate over the the forecast period"

On the basis of product, the interactive patient engagement solutions market is bifurcated into hardware and software. The hardware segment accounted for the largest share of the interactive patient engagement solutions market in 2021 and expected to grow fastest CAGR during the forecast period.Rising development of TV-based solutions and the increased adoption of in-room televisions by hospitals are the key factors for the growth of this segment.

"The inpatient solutions segment accounted for the largest share of the Interactive patient engagement solutions market in 2021"

On the basis of type, the interactive patient engagement solutions market is bifurcated into inpatient and outpatient solutions. The inpatient solutions segment accounted for the largest share of the global marketin 2021. The need for improved patient care and favorable government initiatives for the adoption of these solutions are some of the factors supporting the market growth of this segment.

"Hospitals segment in the end users is expected expectd to hold the largest share of the global Interactive patient engagement solutions market in 2022"

On the basis of end users, the interactive patient engagement solutions market is bifurcated into hospitals, clinics, and other end users. The hospitals segment accounted for the largest market share of the interactive patient engagement solutions market in 2021. Rising demand for IT tools to tackle the demand of hospital staff and the increasing demand for effective communication tools are the key growth factor of this segment.

"North America to dominate the Interactive patient engagement solutions marketin 2021"

North America accounted for the largest and the fastest-growing regional market share of the interactive patient engagement solutions market in 2021 and expected to grow at the highest CAGR during the forecasted period. Favorable government initiatives, the rising prevalence of chronic diseases, and rising awareness about digital healthcare products are the key factors supporting the market growth of this segment.

Breakdown of supply-side primary interviews, by company type, designation, and region:

- By Company Type: Tier 1 (25%), Tier 2 (35%), and Tier 3 (40%)

- By Designation: C-level (31%), Director-level (36%), and Others (31%)

- By Region: North America (55%), Europe (15%), Asia Pacific (25%), and Rest of the World (5%)

Prominent players in this market are GetWellNetwork (US), Epic Systems Corporation (US), SONIFI Health (US), Barco (Belgium), Sentrics (US), Advantech Co., Ltd. (Taiwan), Aceso Interactive Inc. (US), HealthHub Patient Engagement Solutions (Canada), Lincor, Inc. (US), eVideon (US), Remedi Complete Medical Solutions (Taiwan), i3solutions (Canada), PDi Communication Systems, Inc. (US), BEWATEC ConnectedCare GmbH (Germany), Hopitel Inc. (Canada), Hospedia (UK), Onyx Healthcare Inc. (US), ClinicAll (US), ARBOR Technology Corp. (Taiwan), Healthcare Information, LLC (US), Oneview Healthcare (Ireland), Siemens (Germany), Vecoton (China), pCare (US), and Medix-Care GmbH (Germany). These players are increasingly focusing on product launches, expansions, acquisitions, and partnerships to expand their product offerings in the interactive patient engagement solutions market.

Research Coverage

- The report studies the interactive patient engagement solutions market based on type, product, end user, and region

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders

- The report studies micro-markets with respect to their growth trends, prospects, and contributions to the total interactive patient engagement solutions market

- The report forecasts the revenue of market segments with respect to four major regions

Key Benefits of Buying the Report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the interactive patient engagement solutions market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 MARKETS COVERED

- FIGURE 1 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH METHODOLOGY STEPS

- FIGURE 2 RESEARCH METHODOLOGY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET

- FIGURE 3 RESEARCH DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY RESEARCH

- FIGURE 4 PRIMARY SOURCES

- 2.2.3 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3.1 GROWTH FORECAST

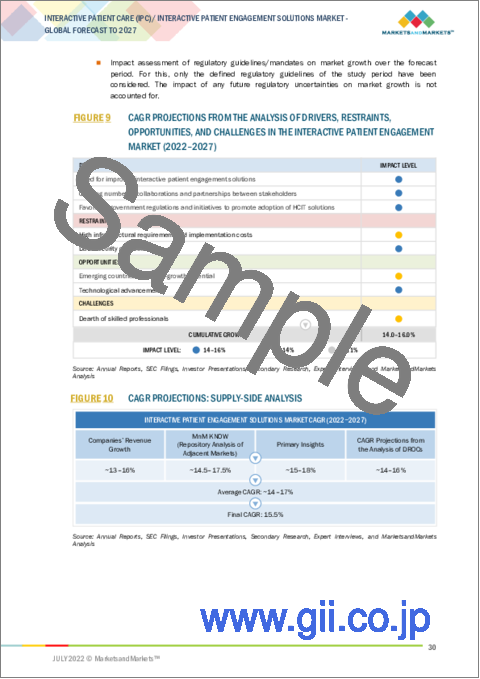

- FIGURE 9 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE INTERACTIVE PATIENT ENGAGEMENT MARKET (2022-2027)

- FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.4 MARKET DATA ESTIMATION AND TRIANGULATION

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- 2.5 STUDY ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 12 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 GEOGRAPHICAL SNAPSHOT OF INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET

4 PREMIUM INSIGHTS

- 4.1 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET OVERVIEW

- FIGURE 16 FAVORABLE GOVERNMENT INITIATIVES TO DRIVE MARKET

- 4.2 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE AND COUNTRY (2021)

- FIGURE 17 INPATIENT SOLUTIONS SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2021

- 4.3 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET SHARE, BY TYPE, 2022 VS. 2027

- FIGURE 18 INPATIENT SOLUTIONS SEGMENT WILL CONTINUE TO DOMINATE INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET IN 2027

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- FIGURE 19 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.1.1 DRIVERS

- 5.1.1.1 Need for improved interactive patient engagement solutions

- 5.1.1.2 Growing number of collaborations and partnerships between stakeholders

- 5.1.1.3 Favorable government regulations and initiatives to promote adoption of HCIT solutions

- 5.1.2 RESTRAINTS

- 5.1.2.1 High infrastructural requirement and implementation costs

- 5.1.2.2 Data security concerns

- FIGURE 20 TYPES OF HEALTHCARE BREACHES REPORTED TO THE US DEPARTMENT OF HEALTH AND HUMAN SERVICES, 2018-2020

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Emerging countries offer high-growth potential

- 5.1.3.2 Technological advancements

- 5.1.4 CHALLENGES

- 5.1.4.1 Dearth of skilled professionals

- 5.2 CASE STUDIES

- 5.2.1 FOCUS ON REDUCING READMISSION RATES AND IMPROVING CARE

- TABLE 1 USE CASE 1: TO REDUCE PATIENT STAY

- 5.2.2 IMPROVE OUTPATIENT COMMUNICATION

- TABLE 2 USE CASE 2: TO CURB COMMUNICATION ISSUES WITH DISCHARGED PATIENTS

- 5.2.3 INTERACTIVE PLATFORMS IMPROVE HOSPITAL OUTCOMES

- TABLE 3 USE CASE 3: TO IMPROVE PATIENT EDUCATION COMPLETION RATES VIA IN-ROOM TELEVISIONS

- 5.3 ECOSYSTEM COVERAGE

- FIGURE 21 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET: ECOSYSTEM ANALYSIS

- 5.4 TECHNOLOGY ANALYSIS

- TABLE 4 TECHNOLOGICAL DEVELOPMENTS BY LEADING VENDORS

- 5.5 REGULATIONS

- 5.5.1 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA)

- 5.5.2 HEALTH INFORMATION TECHNOLOGY FOR ECONOMIC AND CLINICAL HEALTH ACT OF 2009 (HITECH)

- 5.5.3 CONSUMER PRIVACY PROTECTION ACT OF 2017

- 5.5.4 NATIONAL CYBERSECURITY PROTECTION ADVANCEMENT ACT OF 2015

- 5.5.5 CYBERSECURITY LAW OF THE PEOPLE'S REPUBLIC OF CHINA

- 5.5.6 AFFORDABLE CARE ACT, 2010

- 5.5.7 GENERAL DATA PROTECTION REGULATION (GDPR)

- 5.5.8 CALIFORNIA CONSUMER PRIVACY ACT (CCPA)

- 5.6 PRICING ANALYSIS

- 5.7 MARKET SURVEY ANALYSIS: END-USER VIEWPOINT

- FIGURE 22 FACTORS INFLUENCING THE ADOPTION OF INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9 INDUSTRY TRENDS

- 5.9.1 RISING NEED FOR INTEROPERABILITY AND INTEGRATION OF HCIT SOLUTIONS

- 5.9.2 GROWING DEMAND FOR VALUE-BASED HEALTHCARE

6 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 6 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 6.2 INPATIENT SOLUTIONS

- 6.2.1 NEED FOR PATIENT INVOLVEMENT IN CARE PROCESS TO SUPPORT MARKET GROWTH

- TABLE 7 INPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 8 NORTH AMERICA: INPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 9 EUROPE: INPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 10 ASIA PACIFIC: INPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3 OUTPATIENT SOLUTIONS

- 6.3.1 LARGE NUMBER OF OUTPATIENT PROCEDURES TO DRIVE MARKET

- TABLE 11 OUTPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 12 NORTH AMERICA: OUTPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 13 EUROPE: OUTPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 14 ASIA PACIFIC: OUTPATIENT INTERACTIVE ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

7 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- TABLE 15 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 7.2 HARDWARE

- TABLE 16 INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 17 INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 18 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 19 EUROPE: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 20 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.1 IN-ROOM TELEVISIONS

- 7.2.1.1 Increase in adoption of in-room televisions by hospitals

- TABLE 21 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR IN-ROOM TELEVISIONS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 22 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR IN-ROOM TELEVISIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 23 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR IN-ROOM TELEVISIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 24 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR IN-ROOM TELEVISIONS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.2 INTEGRATED BEDSIDE TERMINALS/ASSISTIVE DEVICES

- 7.2.2.1 Integrated bedside terminals enhance patient experience

- TABLE 25 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR INTEGRATED BEDSIDE TERMINALS/ASSISTIVE DEVICES, BY REGION, 2020-2027 (USD MILLION)

- TABLE 26 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR INTEGRATED BEDSIDE TERMINALS/ASSISTIVE DEVICES, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 27 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR INTEGRATED BEDSIDE TERMINALS/ASSISTIVE DEVICES, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 28 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR INTEGRATED BEDSIDE TERMINALS/ASSISTIVE DEVICES, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2.3 TABLETS

- 7.2.3.1 Portability and cost-effectiveness of tablets supporting adoption

- TABLE 29 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR TABLETS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 30 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR TABLETS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 31 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR TABLETS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 32 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR TABLETS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 SOFTWARE

- 7.3.1 SOFTWARE HELPS PERFORM PRIMARY TASKS

- TABLE 33 INTERACTIVE PATIENT ENGAGEMENT SOFTWARE SOLUTIONS MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 34 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOFTWARE SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 35 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOFTWARE SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 36 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOFTWARE SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

8 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 37 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.2 HOSPITALS

- 8.2.1 HOSPITALS LARGEST AND FASTEST-GROWING END USERS OF INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS

- TABLE 38 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR HOSPITALS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR HOSPITALS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 40 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR HOSPITALS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 41 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR HOSPITALS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3 CLINICS

- 8.3.1 REDUCED MORTALITY RATES WITH USE OF INTERACTIVE BEDSIDE SOLUTIONS

- TABLE 42 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR CLINICS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR CLINICS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 44 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR CLINICS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 45 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR CLINICS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.4 OTHER END USERS

- TABLE 46 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR OTHER END USERS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 47 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 48 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 49 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY, 2020-2027 (USD MILLION)

9 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 50 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 23 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET SNAPSHOT

- TABLE 51 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 US dominates North American interactive patient engagement solutions market

- TABLE 56 US: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 57 US: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 58 US: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 59 US: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Government initiatives and awareness about digital healthcare solutions to support market growth

- TABLE 60 CANADA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 61 CANADA: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 62 CANADA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 63 CANADA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.3 MEXICO

- 9.2.3.1 Growing COVID-19 cases and need to curtail healthcare costs supporting market growth

- TABLE 64 MEXICO: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 65 MEXICO: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 66 MEXICO: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 67 MEXICO: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3 EUROPE

- TABLE 68 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 69 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 70 EUROPE: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 71 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 72 EUROPE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Germany largest market for interactive patient engagement solutions in Europe

- TABLE 73 GERMANY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 74 GERMANY: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 75 GERMANY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 76 GERMANY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Initiatives to improve healthcare to boost market

- TABLE 77 UK: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 78 UK: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 79 UK: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 80 UK: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Rising geriatric population in France to support market growth

- TABLE 81 FRANCE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 82 FRANCE: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 83 FRANCE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 84 FRANCE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Growing burden of chronic diseases driving market

- TABLE 85 ITALY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 86 ITALY: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 87 ITALY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 88 ITALY: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Technological innovations to support market growth

- TABLE 89 SPAIN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 90 SPAIN: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 91 SPAIN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 92 SPAIN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 93 ROE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 94 ROE: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 95 ROE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 96 ROE: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 24 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET SNAPSHOT

- TABLE 97 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 98 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 99 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 100 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 101 ASIA PACIFIC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.1 JAPAN

- 9.4.1.1 Fast adoption of advanced technologies and rising geriatric population key growth drivers

- TABLE 102 JAPAN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 103 JAPAN: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 104 JAPAN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 105 JAPAN: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Government initiatives to drive market in China

- TABLE 106 CHINA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 107 CHINA: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 108 CHINA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 109 CHINA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Rising healthcare awareness and changing demographics to drive market

- TABLE 110 INDIA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 111 INDIA: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 112 INDIA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 113 INDIA: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.4 REST OF ASIA PACIFIC

- TABLE 114 ROAPAC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 115 ROAPAC: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 116 ROAPAC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 117 ROAPAC: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.5 REST OF THE WORLD

- TABLE 118 ROW: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 119 ROW: INTERACTIVE PATIENT ENGAGEMENT HARDWARE SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 120 ROW: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 121 ROW: INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER, 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 122 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN THE INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET

- 10.3 MARKET RANKING

- FIGURE 25 RANKING OF COMPANIES IN INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET (2021)

- 10.4 COMPETITIVE LEADERSHIP MAPPING

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- FIGURE 26 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

- 10.5 COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 STARTING BLOCKS

- 10.5.3 RESPONSIVE COMPANIES

- 10.5.4 DYNAMIC COMPANIES

- FIGURE 27 INTERACTIVE PATIENT ENGAGEMENT SOLUTIONS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES (2021)

- 10.6 COMPANY FOOTPRINT

- TABLE 123 FOOTPRINT OF COMPANIES

- TABLE 124 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 125 REGIONAL FOOTPRINT OF COMPANIES

- 10.7 COMPETITIVE SCENARIO

- TABLE 126 PRODUCT LAUNCHES, JANUARY 2018-JUNE 2022

- TABLE 127 DEALS, JANUARY 2018-JUNE 2022

- TABLE 128 OTHER DEVELOPMENTS, JANUARY 2018-JUNE 2022

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products & Services Offered, Recent Developments, and MnM View)**

- 11.1.1 GETWELLNETWORK, INC.

- TABLE 129 GETWELLNETWORK, INC.: BUSINESS OVERVIEW

- 11.1.2 EPIC SYSTEMS CORPORATION

- TABLE 130 EPIC SYSTEMS CORPORATION: BUSINESS OVERVIEW

- 11.1.3 SONIFI HEALTH

- TABLE 131 SONIFI HEALTH: BUSINESS OVERVIEW

- 11.1.4 ADVANTECH CO., LTD.

- TABLE 132 ADVANTECH CO., LTD.: BUSINESS OVERVIEW

- FIGURE 28 ADVANTECH CO., LTD.: COMPANY SNAPSHOT (2021)

- 11.1.5 BARCO

- TABLE 133 BARCO: BUSINESS OVERVIEW

- FIGURE 29 BARCO: COMPANY SNAPSHOT (2021)

- 11.1.6 SENTRICS

- TABLE 134 SENTRICS: BUSINESS OVERVIEW

- 11.1.7 HOSPEDIA LIMITED

- TABLE 135 HOSPEDIA LIMITED: BUSINESS OVERVIEW

- 11.1.8 EVIDEON

- TABLE 136 EVIDEON: BUSINESS OVERVIEW

- 11.1.9 ACESO INTERACTIVE INC.

- TABLE 137 ACESO INTERACTIVE INC.: BUSINESS OVERVIEW

- 11.1.10 PDI COMMUNICATION SYSTEMS, INC.

- TABLE 138 PDI COMMUNICATION SYSTEMS, INC.: BUSINESS OVERVIEW

- 11.1.11 LINCOR, INC.

- TABLE 139 LINCOR, INC.: BUSINESS OVERVIEW

- 11.1.12 CLINICALL

- TABLE 140 CLINICALL: BUSINESS OVERVIEW

- 11.1.13 HOPITEL INC.

- TABLE 141 HOPITEL INC.: BUSINESS OVERVIEW

- 11.1.14 I3SOLUTIONS INC.

- TABLE 142 I3SOLUTIONS: BUSINESS OVERVIEW

- 11.1.15 HEALTHHUB PATIENT ENGAGEMENT SOLUTIONS

- TABLE 143 HEALTHHUB PATIENT ENGAGEMENT SOLUTIONS: BUSINESS OVERVIEW

- 11.1.16 ARBOR TECHNOLOGY CORP.

- TABLE 144 ARBOR TECHNOLOGY CORP.: BUSINESS OVERVIEW

- 11.1.17 HEALTHCARE INFORMATION, LLC

- TABLE 145 HEALTHCARE INFORMATION, LLC: BUSINESS OVERVIEW

- 11.1.18 BEWATEC CONNECTEDCARE GMBH

- TABLE 146 BEWATEC CONNECTEDCARE GMBH: BUSINESS OVERVIEW

- 11.1.19 ONYX HEALTHCARE INC.

- TABLE 147 ONYX HEALTHCARE INC.: BUSINESS OVERVIEW

- 11.1.20 REMEDI COMPLETE MEDICAL SOLUTIONS

- TABLE 148 REMEDI COMPLETE MEDICAL SOLUTIONS: BUSINESS OVERVIEW

- *Business Overview, Products & Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 11.2 OTHER KEY PLAYERS

- 11.2.1 ONEVIEW HEALTHCARE

- 11.2.2 SIEMENS

- 11.2.3 VECOTON

- 11.2.4 PCARE

- 11.2.5 MEDIX-CARE GMBH

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS