|

|

市場調査レポート

商品コード

1149097

射出成形機の世界市場:機械の種類別 (油圧式、全電動式、ハイブリッド)・型締力別 (0~200、201~500、500以上)・製品種類別 (プラスチック、ゴム、金属)・エンドユース産業別 (自動車、包装)・地域別の将来予測 (2027年まで)Injection Molding Machine Market by Machine Type (Hydraulic, All-electric, and Hybrid), Clamping Force (0-200, 201-500 and Above 500), Product Type (Plastic, Rubber, Metals), End-Use Industry (Automotive, Packaging) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 射出成形機の世界市場:機械の種類別 (油圧式、全電動式、ハイブリッド)・型締力別 (0~200、201~500、500以上)・製品種類別 (プラスチック、ゴム、金属)・エンドユース産業別 (自動車、包装)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年10月31日

発行: MarketsandMarkets

ページ情報: 英文 279 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の射出成形機市場は、2022年の104億米ドルから3.6%のCAGRで成長し、2027年には124億米ドルに達すると予測されます。

昨今ではCOVID-19の世界的流行により、注射器やエアシステムなどの医療用具のニーズが非常に高まったため、医療産業が注目されています。中国やインドがその製造拠点となり、世界中のあらゆる医療機器の需要を支えています。

"型締力別では、201~500トンフォースが予測期間中に最も高いCAGRで成長する"

201~500トンフォースのセグメントは、2021年に金額ベースで最大の市場シェアを占め、予測期間中に最高のCAGRを記録すると予測されています。その要因として、自動車、包装、消費財、電気・電子などの著名なエンドユース産業から、中型成形部品の需要が高まっていることが挙げられます。

"製品種類別ではプラスチックが、予測期間中に最も高いCAGRで成長する"

2021年にはプラスチック製品向け射出成形機市場が金額ベースで最大を占めました。射出成形機で製造されるプラスチック製品は、通常、高品質の原料を使用しているため、優れた品質を確保することができます。金型は高価ですが、射出成形はプラスチック製品の大量生産に最も適した製造方法です。射出成形機は日常生活の中でさまざまなプラスチック製品を製造するために使用されています。

"油圧式射出成形機:機械の種類別では最大のセグメント"

油圧式射出成形機は、寿命が長く、駆動距離も長く、メンテナンスの必要性も少ないです。この種の機械の使用により、生産サイクルタイムは大幅に短縮されます。この機械は、消費財、電気・電子製品、自動車部品、キャップ・クローザー、医療用品などの高精度なプラスチック部品の製造に主に使用されています。

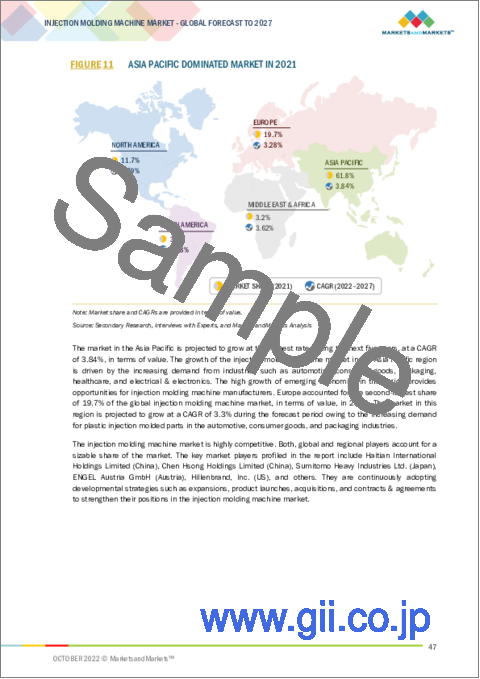

"2021年の射出成形機市場は、欧州が金額・数量ともに第2位となる"

欧州の厳しい排ガス規制は、自動車業界において射出成形機の需要を促進しています。軽量素材メーカーやサプライヤーは、要求される規制を満たすだけでなく、高度な軽量素材を生み出すために研究開発に多大な投資を行っています。その結果、軽量化によってエンジンの性能と効率を最適化することができるようになりました。

当レポートでは、世界の射出成形機の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、製品種類別・機械の種類別・エンドユース産業別・型締力別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- マクロ経済指標

- 主要国のGDPの動向と予測

第6章 産業動向

- サプライチェーン分析

- 原材料

- 射出成形機の製造

- エンドユーザー向け流通

- 顧客のビジネスに影響を与える動向/混乱

- 接続市場:エコシステム

- 技術分析

- ケーススタディ分析

- 主な利害関係者と購入基準

- 射出成形機市場:現実的、悲観的、楽観的、COVID-19以降のシナリオ

- 価格分析

- 貿易データ統計

- 世界の規制枠組みと射出成形機市場への影響

- 主な会議とイベント (2022年~2023年)

- 特許分析

第7章 射出成形機市場:製品種類別

- イントロダクション

- プラスチック

- 熱可塑性樹脂

- 熱硬化性樹脂

- ゴム

- 金属

- 粉末

- 液体

- セラミック

- その他

第8章 射出成形機市場:機械の種類別

- イントロダクション

- 油圧式射出成形機

- 全電動式射出成形機

- ハイブリッド射出成形機

第9章 射出成形機市場:エンドユース産業別

- イントロダクション

- 自動車

- 消費財

- 包装

- 医療

- 電気・電子機器

- その他

第10章 射出成形機市場:型締力別

- イントロダクション

- 0~200トンフォース

- 201~500トンフォース

- 500トンフォース以上

第11章 射出成形機市場:地域別

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- 南米

第12章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 市場シェア分析

- 主要企業のランキング (2021年)

- 主要企業の市場シェア

- 上位5社の収益分析

- 企業の製品フットプリント分析

- 企業評価クアドラント(ティア 1)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオと動向

- 新製品の発売

- 資本取引

- その他の開発

第13章 企業プロファイル

- 主要企業

- HAITIAN INTERNATIONAL HOLDINGS LIMITED

- SUMITOMO HEAVY INDUSTRIES LIMITED

- THE JAPAN STEEL WORKS LTD.

- CHEN HSONG HOLDINGS LIMITED

- HILLENBRAND, INC.

- NISSEI PLASTIC INDUSTRIAL CO., LTD.

- ENGEL AUSTRIA GMBH

- ARBURG GMBH & CO. KG

- HUSKY INJECTION MOLDING SYSTEM LTD.

- KRAUSSMAFFEI GROUP GMBH

- FANUC CORPORATION

- DONGSHIN HYDRAULICS CO., LTD.

- その他の企業

- NIIGATA MACHINE TECHNO COMPANY, LTD.

- HUARONG PLASTIC MACHINERY CO., LTD.

- FU CHUN SHIN MACHINERY MANUFACTURE CO., LTD.

- SHIBAURA MACHINE(TOSHIBA MACHINE CO., LTD.)

- OIMA SRL

- R.P. INJECTION SRL

- TOYO MACHINERY & METAL CO., LTD.

- BOCO PARDUBICE MACHINES S.R.O.

- MITSUBISHI HEAVY INDUSTRIES PLASTIC TECHNOLOGY CO., LTD.

- WOOJIN PLAIMM CO., LTD.

- BORCHE NORTH AMERICA INC.

- MULTIPLAS ENGINERY CO., LTD.

- MOLD HOTRUNNER SOLUTIONS LTD.

- DR. BOY GMBH & CO. KG

第14章 隣接・関連市場

- イントロダクション

- 制限事項

- 成形プラスチック市場

第15章 付録

The injection molding machine market is projected to reach USD 12.4 billion by 2027, at a CAGR of 3.6% from USD 10.4 billion in 2022. Plastic molds are used extensively in the healthcare industry. For production, injection molding equipment is preferred because it produces parts with a high degree of precision, accuracy, and complexity at a low cost. Surgical and medical devices: Syringes, vials, medical instruments, inhalers, lab consumables, plastic implants, cannulated, medicinal connectors, air systems, and prescription bottles can all be produced using these machines. The global coronavirus outbreak has brought attention to the healthcare industry. The need for medical equipment like syringes, air systems, and other medical tools increased enormously due to the explosive surge in the number of Covid-19 cases. China and India became the manufacturing centers for the demand for all such equipments worldwide.

"201-500 Tons Force is projected to grow at highest CAGR, by clamping force, during the forecast period"

The 201-500 ton-force segment accounted for the largest market share in terms of value, in 2021 and is projected to register the highest CAGR during the forecast period. This high growth is because of the rising demand for medium-sized molded parts from prominent end-use industries such as automotive, packaging, consumer goods, and electrical & electronics. Medium-sized injection molding machines are mainly machines with a clamping force of 201-500 tons force. Machine types such as hydraulic, all-electric, and hybrid are all available in 201-500 ton-force. These machines are mainly used for medium-sized molded parts which are used in applications for automotive, packaging, and consumer goods industries.

"Plastic product type is projected to grow at highest CAGR, during the forecast period"

The injection molding machine market for plastic products accounted for the largest in terms of value, in 2021. Injection molding is the manufacturing process for the production of plastic parts from thermoplastics and thermosetting materials with accuracy and low waste in a short time duration. Most commonly used plastic in the injection molding process are polypropylene, polystyrene, polyethylene, polycarbonate, ABS, nylon, and unsaturated aliphatic polyesters. Plastic products, which are manufactured using injection molding machines are of usually high-quality raw materials that ensures their superior quality. The injection molding process for plastic products involves feeding and heating the polymer then compressing using pressure to force it into the mold. This process is very fast and complicated. In spite of expensive tooling costs, injection molding is the most favored manufacturing process for the mass production of plastic materials. Injection molding machines are used to produce various plastic products in day-to-day life such as bottles, chairs, telephone handsets, electrical switches, car bumpers, dashboards, syringes, disposable razors, and toys.

"Hydraulic injection molding machine is the largest machine type for injection molding machine market in 2021"

Hydraulic injection molding machine is the most popular machine type, mainly because of its long service life and wide range of applications in automotive, packaging, and consumer goods. The variable-volume pump and a fixed-speed, three-phase motor make up the hydraulic injection molding machine. Hydraulic injection molding machines have a long lifespan, a great drive distance, and fewer maintenance requirements. The production cycle time is significantly shortened with the aid of this kind of machine. For large molding parts mainly the high-tonnage hydraulic machine is used. This machine is mostly used for manufacturing high-precision plastic components such as consumer goods, electrical & electronics goods, automotive parts, caps & closers, and medical supplies.

"Europe was the second-largest injection molding machine market, in terms of value and volume, in 2021"

The stringent emission regulations in Europe are driving the demand for injection molding machines in the automotive end-use industry. Euro 6 norms are being followed by the members of the European Union, which will have a knock-on effect on the reduction of pollutants such as nitrogen oxide and carbon monoxide as well as CO2 emission levels while improving fuel economy. The lightweight material manufacturers and suppliers are investing heavily in R&D to create advanced lightweight materials as well as meet the required regulations. This has also resulted in optimizing engine performance and efficiency through weight reduction.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 69%, Tier 2 - 23%, and Tier 3 - 8%

- By Designation: C-Level - 23%, Director Level - 37%, and Others - 40%

- By Region: North America - 32%, Europe - 21%, APAC - 28%, South America and Middle East & Africa - 19%,

The key market players profiled in the report include Haitian International Holdings Limited (China), Chen Hsong Holdings Limited (China), Sumitomo Heavy Industries Ltd. (Japan), Engel Austria GmbH (Austria), Hillenbrand, Inc. (US), and others. They are continuously undertaking developmental strategies such as expansions, new product launches, acquisitions, and contracts & agreements to strengthen their position in the injection molding machine market.

Research Coverage

This report segments the market for injection molding machine market on the basis of machine type, clamping force, product type, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisitions associated with the market for injection molding machine market.

Reasons to buy this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the injection molding machine market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on injection molding machine market offered by top players in the global injection molding machine market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the injection molding machine market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for injection molding machine market across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global injection molding machine market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the injection molding machine market

- Impact of COVID-19 on injection molding machine market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INJECTION MOLDING MACHINE MARKET: INCLUSIONS & EXCLUSIONS

- 1.2.2 INJECTION MOLDING MACHINE: MARKET DEFINITION AND INCLUSIONS, BY PRODUCT TYPE

- 1.2.3 INJECTION MOLDING MACHINE: MARKET DEFINITION AND INCLUSIONS, BY MACHINE TYPE

- 1.2.4 INJECTION MOLDING MACHINE: MARKET DEFINITION AND INCLUSIONS, BY CLAMPING FORCE

- 1.2.5 INJECTION MOLDING MACHINE: MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- 1.3 MARKET SCOPE

- FIGURE 1 INJECTION MOLDING MACHINE MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 INJECTION MOLDING MACHINE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE REVENUE OF COMPANIES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (DEMAND SIDE): PRODUCTS SOLD

- 2.3 DATA TRIANGULATION

- FIGURE 6 INJECTION MOLDING MACHINE MARKET: DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

- 2.4.1 SUPPLY SIDE

- FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE DRIVERS AND OPPORTUNITIES

- 2.5 FACTOR ANALYSIS

- 2.6 LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 1 INJECTION MOLDING MACHINE MARKET: RISK ASSESSMENT

- 2.8 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 PLASTIC PRODUCT TYPE SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 AUTOMOTIVE TO BE LEADING END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC DOMINATED MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES IN INJECTION MOLDING MACHINE MARKET

- FIGURE 12 MARKET EXPECTED TO WITNESS HIGH GROWTH BETWEEN 2021 AND 2027

- 4.2 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SHARE BY MACHINE TYPE AND COUNTRY

- FIGURE 13 CHINA AND HYDRAULIC SEGMENT ACCOUNTED FOR LARGEST SHARE, 2021

- 4.3 INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

- FIGURE 14 HYDRAULIC SEGMENT TO DOMINATE MARKET BETWEEN 2022 AND 2027

- 4.4 INJECTION MOLDING MACHINE MARKET GROWTH, BY REGION

- FIGURE 15 MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

- 4.5 INJECTION MOLDING MACHINE MARKET SIZE, BY REGION AND END-USE INDUSTRY, 2021

- FIGURE 16 AUTOMOTIVE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- 4.6 INJECTION MOLDING MACHINE MARKET ATTRACTIVENESS

- FIGURE 17 INDIA PROJECTED TO BE FASTEST-GROWING MARKET BETWEEN 2022 AND 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INJECTION MOLDING MACHINE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 High demand from packaging industry

- 5.2.1.2 Rising awareness about energy saving

- 5.2.1.3 Growth of automotive sector to drive demand for large plastic molds

- FIGURE 19 TOTAL CAR PRODUCTION, BY COUNTRY, 2021 (MILLION UNITS)

- 5.2.1.4 Increased demand for consumer electronics

- 5.2.1.5 Developments in injection molding technology

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial and maintenance cost of machines

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand from healthcare industry

- 5.2.3.2 Rising demand for large-tonnage injection molding machines

- 5.2.3.3 Rising trend in electric vehicles to increase demand for injection molds

- TABLE 2 KEY AUTOMAKER ANNOUNCEMENTS FOR ELECTRIC VEHICLES

- 5.2.4 CHALLENGES

- 5.2.4.1 High heating and hydraulic pressure

- 5.2.4.2 Less economical for small production capacities

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 INJECTION MOLDING MACHINE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 INJECTION MOLDING MACHINE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- TABLE 4 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020 - 2027 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 21 INJECTION MOLDING MACHINE MARKET: SUPPLY CHAIN

- 6.1.1 RAW MATERIALS

- 6.1.2 MANUFACTURE OF INJECTION MOLDING MACHINES

- 6.1.3 DISTRIBUTION TO END USERS

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.2.1 REVENUE SHIFT & POCKETS FOR INJECTION MOLDING MACHINES

- FIGURE 22 INJECTION MOLDING MACHINE MARKET: CHANGING REVENUE MIX

- 6.3 CONNECTED MARKETS: ECOSYSTEM

- FIGURE 23 INJECTION MOLDING MACHINE MARKET: ECOSYSTEM

- TABLE 5 INJECTION MOLDING MACHINE MARKET: SUPPLY CHAIN

- 6.4 TECHNOLOGY ANALYSIS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 CASE STUDY ON MULTI-COMPONENT INJECTION MOLDING MACHINE

- 6.5.2 CASE STUDY ON INJECTION MOLDING AUTOMATION

- 6.5.3 CASE STUDY ON SMARTTURN SELF-OPTIMIZATION FUNCTION

- 6.5.4 CASE STUDY ON DAKOTA MOLDING

- 6.5.5 CASE STUDY ON KARL KRUMPHOLZ GMBH & CO. KG.

- 6.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- 6.6.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- 6.7 INJECTION MOLDING MACHINE MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- FIGURE 26 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- TABLE 8 INJECTION MOLDING MACHINE MARKET FORECAST SCENARIO, 2019-2027 (USD MILLION)

- 6.7.1 NON-COVID-19 SCENARIO

- 6.7.2 OPTIMISTIC SCENARIO

- 6.7.3 PESSIMISTIC SCENARIO

- 6.7.4 REALISTIC SCENARIO

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY END-USE INDUSTRY

- FIGURE 27 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE END-USE INDUSTRIES

- TABLE 9 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE END-USE INDUSTRIES (USD THOUSAND/UNIT)

- 6.8.2 AVERAGE SELLING PRICE, BY REGION

- FIGURE 28 AVERAGE SELLING PRICE OF INJECTION MOLDING MACHINE, BY REGION, 2020-2027

- TABLE 10 AVERAGE SELLING PRICE OF INJECTION MOLDING MACHINE, BY REGION, 2020-2027 (USD THOUSAND/UNIT)

- 6.9 TRADE DATA STATISTICS

- 6.9.1 IMPORT SCENARIO OF INJECTION MOLDING MACHINES

- FIGURE 29 INJECTION MOLDING MACHINE IMPORTS, BY KEY COUNTRIES (2013-2021)

- TABLE 11 IMPORTS OF INJECTION MOLDING MACHINES, BY REGION, 2013-2021 (USD MILLION)

- 6.9.2 EXPORT SCENARIO OF INJECTION MOLDING MACHINES

- FIGURE 30 INJECTION MOLDING MACHINE EXPORT, BY KEY COUNTRIES (2013-2021)

- TABLE 12 EXPORTS OF INJECTION MOLDING MACHINES, BY REGION, 2013-2021 (USD MILLION)

- 6.10 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON INJECTION MOLDING MACHINE MARKET

- 6.10.1 REGULATIONS AND REGULATORY BODIES RELATED TO INJECTION MOLDING MACHINE

- 6.11 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 13 INJECTION MOLDING MACHINE MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 6.12 PATENT ANALYSIS

- 6.12.1 APPROACH

- 6.12.2 DOCUMENT TYPE

- TABLE 14 GRANTED PATENTS ARE 33.8% OF TOTAL COUNT

- FIGURE 31 PATENTS REGISTERED FOR INJECTION MOLDING MACHINES, 2011-2021

- FIGURE 32 PATENT PUBLICATION TRENDS FOR INJECTION MOLDING MACHINES, 2011-2021

- FIGURE 33 LEGAL STATUS OF PATENTS

- 6.12.3 JURISDICTION ANALYSIS

- FIGURE 34 MAXIMUM PATENTS FILED BY COMPANIES IN US

- 6.12.4 TOP APPLICANTS

- FIGURE 35 LG ELECTRONICS REGISTERED MAXIMUM PATENTS BETWEEN 2011 AND 2021

- TABLE 15 LIST OF A FEW RECENT PATENTS BY LG ELECTRONICS

- TABLE 16 LIST OF A FEW RECENT PATENTS BY SAMSUNG ELECTRONICS CO., LTD.

- TABLE 17 LIST OF A FEW RECENT PATENTS BY SUMITOMO HEAVY INDUSTRIES LTD.

- TABLE 18 LIST OF A FEW RECENT PATENTS BY FANUC LTD.

- TABLE 19 TOP 10 PATENT OWNERS IN US, 2011-2021

7 INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- FIGURE 36 PLASTIC SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 20 INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017-2020 (USD MILLION)

- TABLE 21 INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021-2027 (USD MILLION)

- TABLE 22 INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017-2020 (UNIT)

- TABLE 23 INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021-2027 (UNIT)

- 7.2 PLASTIC

- 7.2.1 HIGHEST UTILIZED MATERIAL IN VARIOUS APPLICATIONS

- TABLE 24 INJECTION MOLDING MACHINE MARKET SIZE IN PLASTIC PRODUCT TYPE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 25 INJECTION MOLDING MACHINE MARKET SIZE IN PLASTIC PRODUCT TYPE, BY REGION, 2021-2027 (USD MILLION)

- 7.2.2 THERMOPLASTICS

- 7.2.2.1 Lightweight, low melting point, chemical resistance, and other properties to drive market

- 7.2.3 THERMOSETS

- 7.2.3.1 Superior esthetic appearance, cost-effectiveness, and high level of dimensional stability to propel market

- 7.3 RUBBER

- 7.3.1 MAINLY UTILIZED FOR PRODUCTS WITH THIN WALLS AND LARGE SURFACE AREAS

- TABLE 26 INJECTION MOLDING MACHINE MARKET SIZE IN RUBBER PRODUCT TYPE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 27 INJECTION MOLDING MACHINE MARKET SIZE IN RUBBER PRODUCT TYPE, BY REGION, 2021-2027 (USD MILLION)

- 7.4 METAL

- 7.4.1 METAL MOLDS HAVE GOOD TENSILE AND MECHANICAL PROPERTIES

- TABLE 28 INJECTION MOLDING MACHINE MARKET SIZE IN METAL PRODUCT TYPE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 29 INJECTION MOLDING MACHINE MARKET SIZE IN METAL PRODUCT TYPE, BY REGION, 2021-2027 (USD MILLION)

- 7.4.2 POWDER

- 7.4.2.1 Cost-effective method for large-volume products

- 7.4.3 LIQUID

- 7.4.3.1 Amorphous, liquid-like atomic structure in solid state to drive demand

- 7.5 CERAMIC

- 7.5.1 CERAMIC MOLDS WIDELY USED IN ELECTRICAL INSULATION

- TABLE 30 INJECTION MOLDING MACHINE MARKET SIZE IN CERAMIC PRODUCT TYPE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 31 INJECTION MOLDING MACHINE MARKET SIZE IN CERAMIC PRODUCT TYPE, BY REGION, 2021-2027 (USD MILLION)

- 7.6 OTHERS

- TABLE 32 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER PRODUCT TYPE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 33 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER PRODUCT TYPES, BY REGION, 2021-2027 (USD MILLION)

8 INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

- 8.1 INTRODUCTION

- FIGURE 37 HYDRAULIC INJECTION MOLDING MACHINE SEGMENT TO BE LARGEST MACHINE TYPE DURING FORECAST PERIOD

- TABLE 34 INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (USD MILLION)

- TABLE 35 INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027 (USD MILLION)

- TABLE 36 INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (UNIT)

- TABLE 37 INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027 (UNIT)

- 8.2 HYDRAULIC INJECTION MOLDING MACHINE

- 8.2.1 HYDRAULIC INJECTION MOLDING MACHINE CONSUMES SIGNIFICANT ELECTRICITY

- TABLE 38 INJECTION MOLDING MACHINE MARKET SIZE IN HYDRAULIC MACHINE TYPE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 39 INJECTION MOLDING MACHINE MARKET SIZE IN HYDRAULIC MACHINE TYPE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 40 INJECTION MOLDING MACHINE MARKET SIZE IN HYDRAULIC MACHINE TYPE, BY REGION, 2017-2020 (UNIT)

- TABLE 41 INJECTION MOLDING MACHINE MARKET SIZE IN HYDRAULIC MACHINE TYPE, BY REGION, 2021-2027 (UNIT)

- 8.3 ALL-ELECTRIC INJECTION MOLDING MACHINE

- 8.3.1 SAVES ENERGY SIGNIFICANTLY BUT HIGH UPFRONT COST

- TABLE 42 INJECTION MOLDING MACHINE MARKET SIZE IN ALL-ELECTRIC MACHINE TYPE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 43 INJECTION MOLDING MACHINE MARKET SIZE IN ALL-ELECTRIC MACHINE TYPE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 44 INJECTION MOLDING MACHINE MARKET SIZE IN ALL-ELECTRIC MACHINE TYPE, BY REGION, 2017-2020 (UNIT)

- TABLE 45 INJECTION MOLDING MACHINE MARKET SIZE IN ALL-ELECTRIC MACHINE TYPE, BY REGION, 2021-2027 (UNIT)

- 8.4 HYBRID INJECTION MOLDING MACHINE

- 8.4.1 COMBINES ENERGY SAVING AND ACCURACY

- TABLE 46 INJECTION MOLDING MACHINE MARKET SIZE IN HYBRID MACHINE TYPE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 47 INJECTION MOLDING MACHINE MARKET SIZE IN HYBRID MACHINE TYPE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 48 INJECTION MOLDING MACHINE MARKET SIZE IN HYBRID MACHINE TYPE, BY REGION, 2017-2020 (UNIT)

- TABLE 49 INJECTION MOLDING MACHINE MARKET SIZE IN HYBRID MACHINE TYPE, BY REGION, 2021-2027 (UNIT)

9 INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 38 AUTOMOTIVE TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- TABLE 50 INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 51 INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 52 INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 53 INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 9.2 AUTOMOTIVE

- 9.2.1 WIDELY USED FOR MANUFACTURING STRUCTURAL COMPONENTS FOR VEHICLES

- TABLE 54 INJECTION MOLDING MACHINE MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 55 INJECTION MOLDING MACHINE MARKET SIZE IN AUTOMOTIVE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 56 INJECTION MOLDING MACHINE MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017-2020 (UNIT)

- TABLE 57 INJECTION MOLDING MACHINE MARKET SIZE IN AUTOMOTIVE, BY REGION, 2021-2027 (UNIT)

- 9.3 CONSUMER GOODS

- 9.3.1 MANUFACTURING MOLDS FOR DAILY ITEMS

- TABLE 58 INJECTION MOLDING MACHINE MARKET SIZE IN CONSUMER GOODS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 59 INJECTION MOLDING MACHINE MARKET SIZE IN CONSUMER GOODS, BY REGION, 2021-2027 (USD MILLION)

- TABLE 60 INJECTION MOLDING MACHINE MARKET SIZE IN CONSUMER GOODS, BY REGION, 2017-2020 (UNIT)

- TABLE 61 INJECTION MOLDING MACHINE MARKET SIZE IN CONSUMER GOODS, BY REGION, 2021-2027 (UNIT)

- 9.4 PACKAGING

- 9.4.1 HELPS CREATE INNOVATIVE AND UNIQUE PACKAGING FOR VARIOUS ITEMS

- TABLE 62 INJECTION MOLDING MACHINE MARKET SIZE IN PACKAGING, BY REGION, 2017-2020 (USD MILLION)

- TABLE 63 INJECTION MOLDING MACHINE MARKET SIZE IN PACKAGING, BY REGION, 2021-2027 (USD MILLION)

- TABLE 64 INJECTION MOLDING MACHINE MARKET SIZE IN PACKAGING, BY REGION, 2017-2020 (UNIT)

- TABLE 65 INJECTION MOLDING MACHINE MARKET SIZE IN PACKAGING, BY REGION, 2021-2027 (UNIT)

- 9.5 HEALTHCARE

- 9.5.1 QUALITY AND PRECISION MEDICAL EQUIPMENT AND PRODUCTS

- TABLE 66 INJECTION MOLDING MACHINE MARKET SIZE IN HEALTHCARE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 67 INJECTION MOLDING MACHINE MARKET SIZE IN HEALTHCARE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 68 INJECTION MOLDING MACHINE MARKET SIZE IN HEALTHCARE, BY REGION, 2017-2020 (UNIT)

- TABLE 69 INJECTION MOLDING MACHINE MARKET SIZE IN HEALTHCARE, BY REGION, 2021-2027 (UNIT)

- 9.6 ELECTRICAL & ELECTRONICS

- 9.6.1 DEMAND FOR SUPERIOR QUALITY AND PRECISION ELECTRONIC COMPONENTS

- TABLE 70 INJECTION MOLDING MACHINE MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 71 INJECTION MOLDING MACHINE MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2021-2027 (USD MILLION)

- TABLE 72 INJECTION MOLDING MACHINE MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2017-2020 (UNIT)

- TABLE 73 INJECTION MOLDING MACHINE MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2021-2027 (UNIT)

- 9.7 OTHERS

- 9.7.1 PREMIUM QUALITY MOLDS FOR PIPING AND INSULATION

- TABLE 74 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017-2020 (USD MILLION)

- TABLE 75 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2021-2027 (USD MILLION)

- TABLE 76 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017-2020 (UNIT)

- TABLE 77 INJECTION MOLDING MACHINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2021-2027 (UNIT)

10 INJECTION MOLDING MACHINE MARKET, BY CLAMPING FORCE

- 10.1 INTRODUCTION

- FIGURE 39 201-500 TON-FORCE PROJECTED TO BE LARGEST CLAMPING FORCE SEGMENT DURING FORECAST PERIOD

- TABLE 78 INJECTION MOLDING MACHINE MARKET SIZE, BY CLAMPING FORCE, 2017-2020 (USD MILLION)

- TABLE 79 INJECTION MOLDING MACHINE MARKET SIZE, BY CLAMPING FORCE, 2021-2027 (USD MILLION)

- TABLE 80 INJECTION MOLDING MACHINE MARKET SIZE, BY CLAMPING FORCE, 2017-2020 (UNIT)

- TABLE 81 INJECTION MOLDING MACHINE MARKET SIZE, BY CLAMPING FORCE, 2021-2027 (UNIT)

- 10.2 0-200 TON-FORCE

- 10.3 201-500 TON-FORCE

- 10.4 ABOVE 500 TON-FORCE

11 INJECTION MOLDING MACHINE MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 40 ASIA PACIFIC PROJECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 82 INJECTION MOLDING MACHINE MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 83 INJECTION MOLDING MACHINE MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 84 INJECTION MOLDING MACHINE MARKET SIZE, BY REGION, 2017-2020 (UNIT)

- TABLE 85 INJECTION MOLDING MACHINE MARKET SIZE, BY REGION, 2021-2027 (UNIT)

- 11.2 ASIA PACIFIC

- FIGURE 41 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SNAPSHOT

- 11.2.1 ASIA PACIFIC INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE

- TABLE 86 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017-2020 (USD MILLION)

- TABLE 87 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021-2027 (USD MILLION)

- 11.2.2 ASIA PACIFIC INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

- TABLE 88 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (USD MILLION)

- TABLE 89 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027 (USD MILLION)

- TABLE 90 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (UNIT)

- TABLE 91 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027 (UNIT)

- 11.2.3 ASIA PACIFIC INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY

- TABLE 92 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 93 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 94 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 95 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.2.4 ASIA PACIFIC INJECTION MOLDING MACHINE MARKET, BY COUNTRY

- TABLE 96 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 97 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 98 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017-2020 (UNIT)

- TABLE 99 ASIA PACIFIC: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021-2027 (UNIT)

- 11.2.4.1 China

- 11.2.4.1.1 Automotive, electronics, and packaging industries to drive market

- 11.2.4.1 China

- TABLE 100 CHINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 101 CHINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 102 CHINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 103 CHINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.2.4.2 Japan

- 11.2.4.2.1 Technologically developed to meet futuristic demand

- 11.2.4.2 Japan

- TABLE 104 JAPAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 105 JAPAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 106 JAPAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 107 JAPAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.2.4.3 India

- 11.2.4.3.1 Dynamic medical industry boosting market

- 11.2.4.3 India

- TABLE 108 INDIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 109 INDIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 110 INDIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 111 INDIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.2.4.4 South Korea

- 11.2.4.4.1 High potential in electrical & electronics industry

- 11.2.4.4 South Korea

- TABLE 112 SOUTH KOREA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 113 SOUTH KOREA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 114 SOUTH KOREA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 115 SOUTH KOREA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.2.4.5 Thailand

- 11.2.4.5.1 Lucrative foreign investment policies to drive market

- 11.2.4.5 Thailand

- TABLE 116 THAILAND: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 117 THAILAND: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 118 THAILAND: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 119 THAILAND: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.3 EUROPE

- FIGURE 42 EUROPE: INJECTION MOLDING MACHINE MARKET SNAPSHOT

- 11.3.1 EUROPE INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE

- TABLE 120 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017-2020 (USD MILLION)

- TABLE 121 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021-2027 (USD MILLION)

- 11.3.2 EUROPE INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

- TABLE 122 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (USD MILLION)

- TABLE 123 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027 (USD MILLION)

- TABLE 124 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (UNIT)

- TABLE 125 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027 (UNIT)

- 11.3.3 EUROPE INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY

- TABLE 126 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 127 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 128 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 129 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.3.4 EUROPE INJECTION MOLDING MACHINE MARKET, BY COUNTRY

- TABLE 130 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 131 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 132 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017-2020 (UNIT)

- TABLE 133 EUROPE: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021-2027 (UNIT)

- 11.3.4.1 Germany

- 11.3.4.1.1 Aerospace and automotive industries boosting market

- 11.3.4.1 Germany

- TABLE 134 GERMANY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 135 GERMANY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 136 GERMANY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 137 GERMANY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.3.4.2 Italy

- 11.3.4.2.1 Technological advancements in healthcare industry to drive market

- 11.3.4.2 Italy

- TABLE 138 ITALY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 139 ITALY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 140 ITALY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 141 ITALY: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.3.4.3 France

- 11.3.4.3.1 Developing industrial sector to fuel market growth

- 11.3.4.3 France

- TABLE 142 FRANCE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 143 FRANCE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 144 FRANCE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 145 FRANCE: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.3.4.4 Spain

- 11.3.4.4.1 Growing car manufacturing to fuel market growth

- 11.3.4.4 Spain

- TABLE 146 SPAIN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 147 SPAIN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 148 SPAIN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 149 SPAIN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.3.4.5 UK

- 11.3.4.5.1 Hub for automobiles to increase demand for injection molding machines

- 11.3.4.5 UK

- TABLE 150 UK: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 151 UK: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 152 UK: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 153 UK: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.4 NORTH AMERICA

- FIGURE 43 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SNAPSHOT

- 11.4.1 NORTH AMERICA INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE

- TABLE 154 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017-2020 (USD MILLION)

- TABLE 155 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021-2027 (USD MILLION)

- 11.4.2 NORTH AMERICA INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

- TABLE 156 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (USD MILLION)

- TABLE 157 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027(USD MILLION)

- TABLE 158 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (UNIT)

- TABLE 159 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027 (UNIT)

- 11.4.3 NORTH AMERICA INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY

- TABLE 160 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 161 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 162 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 163 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.4.4 NORTH AMERICA INJECTION MOLDING MACHINE MARKET, BY COUNTRY

- TABLE 164 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 165 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 166 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017-2020 (UNIT)

- TABLE 167 NORTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021-2027 (UNIT)

- 11.4.4.1 US

- 11.4.4.1.1 Rising demand for medical components to boost market

- 11.4.4.1 US

- TABLE 168 US: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 169 US: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 170 US: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 171 US: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.4.4.2 Canada

- 11.4.4.2.1 Rising demand from automotive, consumer goods, and healthcare industries

- 11.4.4.2 Canada

- TABLE 172 CANADA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 173 CANADA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 174 CANADA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 175 CANADA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.4.4.3 Mexico

- 11.4.4.3.1 Growing economy to fuel market growth

- 11.4.4.3 Mexico

- TABLE 176 MEXICO: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 177 MEXICO: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 178 MEXICO: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 179 MEXICO: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE

- TABLE 180 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017-2020 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021-2027 (USD MILLION)

- 11.5.2 MIDDLE EAST & AFRICA INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

- TABLE 182 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (UNIT)

- TABLE 185 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027 (UNIT)

- 11.5.3 MIDDLE EAST & AFRICA INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY

- TABLE 186 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 189 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.5.4 MIDDLE EAST & AFRICA INJECTION MOLDING MACHINE MARKET, BY COUNTRY

- TABLE 190 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017-2020 (UNIT)

- TABLE 193 MIDDLE EAST & AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021-2027 (UNIT)

- 11.5.4.1 Saudi Arabia

- 11.5.4.1.1 Development of non-oil industries to boost market

- 11.5.4.1 Saudi Arabia

- TABLE 194 SAUDI ARABIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 195 SAUDI ARABIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 196 SAUDI ARABIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 197 SAUDI ARABIA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.5.4.2 Iran

- 11.5.4.2.1 Rising government investments to fuel market growth

- 11.5.4.2 Iran

- TABLE 198 IRAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 199 IRAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 200 IRAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 201 IRAN: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.5.4.3 South Africa

- 11.5.4.3.1 Developing automotive industry boosting market

- TABLE 202 SOUTH AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 203 SOUTH AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 204 SOUTH AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 205 SOUTH AFRICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.6 SOUTH AMERICA

- 11.6.1 SOUTH AMERICA INJECTION MOLDING MACHINE MARKET, BY PRODUCT TYPE

- TABLE 206 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2017-2020 (USD MILLION)

- TABLE 207 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY PRODUCT TYPE, 2021-2027 (USD MILLION)

- 11.6.2 SOUTH AMERICA INJECTION MOLDING MACHINE MARKET, BY MACHINE TYPE

- TABLE 208 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (USD MILLION)

- TABLE 209 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027 (USD MILLION)

- TABLE 210 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2017-2020 (UNIT)

- TABLE 211 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY MACHINE TYPE, 2021-2027 (UNIT)

- 11.6.3 SOUTH AMERICA INJECTION MOLDING MACHINE MARKET, BY END-USE INDUSTRY

- TABLE 212 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 213 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 214 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 215 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.6.4 SOUTH AMERICA INJECTION MOLDING MACHINE MARKET, BY COUNTRY

- TABLE 216 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 217 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 218 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2017-2020 (UNIT)

- TABLE 219 SOUTH AMERICA: INJECTION MOLDING MACHINE MARKET SIZE, BY COUNTRY, 2021-2027 (UNIT)

- 11.6.4.1 Brazil

- 11.6.4.1.1 Emerging infrastructural developments to offer lucrative opportunities

- 11.6.4.1 Brazil

- TABLE 220 BRAZIL: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 221 BRAZIL: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 222 BRAZIL: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 223 BRAZIL: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

- 11.6.4.2 Argentina

- 11.6.4.2.1 Healthcare, packaging, and consumer goods industries to drive market

- 11.6.4.2 Argentina

- TABLE 224 ARGENTINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 225 ARGENTINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 226 ARGENTINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (UNIT)

- TABLE 227 ARGENTINA: INJECTION MOLDING MACHINE MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (UNIT)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY INJECTION MOLDING MACHINE MANUFACTURERS

- 12.3 MARKET SHARE ANALYSIS

- 12.3.1 RANKING OF KEY MARKET PLAYERS, 2021

- FIGURE 44 RANKING OF TOP FIVE PLAYERS IN INJECTION MOLDING MACHINE MARKET, 2021

- 12.3.2 MARKET SHARE OF KEY PLAYERS

- TABLE 228 INJECTION MOLDING MACHINE MARKET: DEGREE OF COMPETITION

- FIGURE 45 HAITIAN INTERNATIONAL HOLDINGS LIMITED LED INJECTION MOLDING MACHINE MARKET IN 2021

- 12.3.2.1 Haitian International Holdings Limited

- 12.3.2.2 Chen Hsong Holdings Limited

- 12.3.2.3 ENGEL Austria GmbH

- 12.3.2.4 Sumitomo Heavy Industries Limited

- 12.3.2.5 Hillenbrand, Inc.

- 12.3.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

- FIGURE 46 REVENUE ANALYSIS OF KEY COMPANIES DURING PAST FIVE YEARS

- 12.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 47 INJECTION MOLDING MACHINE MARKET: COMPANY FOOTPRINT

- TABLE 229 INJECTION MOLDING MACHINE MARKET: MACHINE TYPE FOOTPRINT

- TABLE 230 INJECTION MOLDING MACHINE MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 231 INJECTION MOLDING MACHINE MARKET: COMPANY REGION FOOTPRINT

- 12.5 COMPANY EVALUATION QUADRANT (TIER 1)

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 48 COMPANY EVALUATION QUADRANT FOR INJECTION MOLDING MACHINE MARKET (TIER 1)

- 12.6 COMPETITIVE BENCHMARKING

- TABLE 232 INJECTION MOLDING MACHINE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 233 INJECTION MOLDING MACHINE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.7 STARTUP/SME EVALUATION QUADRANT

- 12.7.1 RESPONSIVE COMPANIES

- 12.7.2 STARTING BLOCKS

- FIGURE 49 STARTUP/SME EVALUATION QUADRANT FOR INJECTION MOLDING MACHINE MARKET

- 12.8 COMPETITIVE SCENARIOS AND TRENDS

- 12.8.1 NEW PRODUCT LAUNCHES

- TABLE 234 INJECTION MOLDING MACHINE MARKET: NEW PRODUCT LAUNCHES (2019-2022)

- 12.8.2 DEALS

- TABLE 235 INJECTION MOLDING MACHINE MARKET: DEALS (2019-2022)

- 12.8.3 OTHER DEVELOPMENTS

- TABLE 236 INJECTION MOLDING MACHINE MARKET: OTHER DEVELOPMENTS (2019-2022)

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 13.1 MAJOR PLAYERS

- 13.1.1 HAITIAN INTERNATIONAL HOLDINGS LIMITED

- FIGURE 50 HAITIAN INTERNATIONAL HOLDINGS LIMITED: COMPANY SNAPSHOT

- TABLE 237 HAITIAN INTERNATIONAL HOLDINGS LIMITED: COMPANY OVERVIEW

- 13.1.2 SUMITOMO HEAVY INDUSTRIES LIMITED

- FIGURE 51 SUMITOMO HEAVY INDUSTRIES LIMITED: COMPANY SNAPSHOT

- TABLE 238 SUMITOMO HEAVY INDUSTRIES LIMITED: COMPANY OVERVIEW

- 13.1.3 THE JAPAN STEEL WORKS LTD.

- FIGURE 52 THE JAPAN STEEL WORKS LTD: COMPANY SNAPSHOT

- TABLE 239 THE JAPAN STEEL WORKS LTD.: COMPANY OVERVIEW

- 13.1.4 CHEN HSONG HOLDINGS LIMITED

- FIGURE 53 CHEN HSONG HOLDINGS LIMITED: COMPANY SNAPSHOT

- TABLE 240 CHEN HSONG HOLDINGS LIMITED: COMPANY OVERVIEW

- 13.1.5 HILLENBRAND, INC.

- FIGURE 54 HILLENBRAND, INC.: COMPANY SNAPSHOT

- TABLE 241 HILLENBRAND, INC.: COMPANY OVERVIEW

- 13.1.6 NISSEI PLASTIC INDUSTRIAL CO., LTD.

- FIGURE 55 NISSEI PLASTIC INDUSTRIAL CO., LTD: COMPANY SNAPSHOT

- TABLE 242 NISSEI PLASTIC INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- 13.1.7 ENGEL AUSTRIA GMBH

- TABLE 243 ENGEL AUSTRIA GMBH: COMPANY OVERVIEW

- 13.1.8 ARBURG GMBH & CO. KG

- TABLE 244 ARBURG GMBH & CO. KG: COMPANY OVERVIEW

- 13.1.9 HUSKY INJECTION MOLDING SYSTEM LTD.

- TABLE 245 HUSKY INJECTION MOLDING SYSTEM LTD.: COMPANY OVERVIEW

- 13.1.10 KRAUSSMAFFEI GROUP GMBH

- TABLE 246 KRAUSSMAFFEI GROUP GMBH: COMPANY OVERVIEW

- 13.1.11 FANUC CORPORATION

- FIGURE 56 FANUC CORPORATION: COMPANY SNAPSHOT

- 13.1.12 DONGSHIN HYDRAULICS CO., LTD.

- TABLE 247 DONGSHIN HYDRAULICS CO., LTD: COMPANY OVERVIEW

- 13.2 OTHER KEY MARKET PLAYERS

- 13.2.1 NIIGATA MACHINE TECHNO COMPANY, LTD.

- TABLE 248 NIIGATA MACHINE TECHNO COMPANY, LTD.: COMPANY OVERVIEW

- 13.2.2 HUARONG PLASTIC MACHINERY CO., LTD.

- TABLE 249 HUARONG PLASTIC MACHINERY CO., LTD.: COMPANY OVERVIEW

- 13.2.3 FU CHUN SHIN MACHINERY MANUFACTURE CO., LTD.

- TABLE 250 FU CHUN SHIN MACHINERY MANUFACTURE CO., LTD.: COMPANY OVERVIEW

- 13.2.4 SHIBAURA MACHINE (TOSHIBA MACHINE CO., LTD.)

- TABLE 251 SHIBAURA MACHINE (TOSHIBA MACHINE CO., LTD.): COMPANY OVERVIEW

- 13.2.5 OIMA SRL

- TABLE 252 OIMA SRL: COMPANY OVERVIEW

- 13.2.6 R.P. INJECTION SRL

- TABLE 253 R.P. INJECTION SRL: COMPANY OVERVIEW

- 13.2.7 TOYO MACHINERY & METAL CO., LTD.

- TABLE 254 TOYO MACHINERY & METAL CO., LTD.: COMPANY OVERVIEW

- 13.2.8 BOCO PARDUBICE MACHINES S.R.O.

- TABLE 255 BOCO PARDUBICE MACHINES S.R.O.: COMPANY OVERVIEW

- 13.2.9 MITSUBISHI HEAVY INDUSTRIES PLASTIC TECHNOLOGY CO., LTD.

- TABLE 256 MITSUBISHI HEAVY INDUSTRIES PLASTIC TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- 13.2.10 WOOJIN PLAIMM CO., LTD.

- TABLE 257 WOOJIN PLAIMM CO., LTD.: COMPANY OVERVIEW

- 13.2.11 BORCHE NORTH AMERICA INC.

- TABLE 258 BORCHE NORTH AMERICA INC.: COMPANY OVERVIEW

- 13.2.12 MULTIPLAS ENGINERY CO., LTD.

- TABLE 259 MULTIPLAS ENGINERY CO., LTD.: COMPANY OVERVIEW

- 13.2.13 MOLD HOTRUNNER SOLUTIONS LTD.

- TABLE 260 MOLD HOTRUNNER SOLUTIONS LTD.: COMPANY OVERVIEW

- 13.2.14 DR. BOY GMBH & CO. KG

- TABLE 261 DR. BOY GMBH & CO. KG: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 MOLDED PLASTICS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 MOLDED PLASTICS MARKET, BY TYPE

- TABLE 262 MOLDED PLASTICS MARKET SIZE, BY TYPE, 2016-2023 (KILOTON)

- TABLE 263 MOLDED PLASTICS MARKET SIZE, BY TYPE, 2016-2023 (USD MILLION)

- 14.3.3.1 Polyethylene

- TABLE 264 POLYETHYLENE MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

- TABLE 265 POLYETHYLENE MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

- 14.3.3.2 Polypropylene

- TABLE 266 POLYPROPYLENE MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

- TABLE 267 POLYPROPYLENE MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

- 14.3.3.3 Polyethylene Terephthalate

- TABLE 268 POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

- TABLE 269 POLYETHYLENE TEREPHTHALATE MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

- 14.3.3.4 Polystyrene

- TABLE 270 POLYSTYRENE MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

- TABLE 271 POLYSTYRENE MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

- 14.3.3.5 Polyurethane

- TABLE 272 POLYURETHANE MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

- TABLE 273 POLYURETHANE MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

- 14.3.3.6 Others

- TABLE 274 OTHER MOLDED PLASTICS MARKET SIZE, BY REGION, 2016-2023 (KILOTON)

- TABLE 275 OTHER MOLDED PLASTICS MARKET SIZE, BY REGION, 2016-2023 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS