|

|

市場調査レポート

商品コード

1108929

CD47阻害剤の世界市場:臨床試験の洞察(2028年)Global CD47 Inhibitor Drug Clinical Trials Insight 2028 |

||||||

| CD47阻害剤の世界市場:臨床試験の洞察(2028年) |

|

出版日: 2022年08月01日

発行: KuicK Research

ページ情報: 英文 132 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のCD47阻害剤の市場規模は、2028年までに20億米ドルを超えると予測されています。これは主に、承認取得が期待される多数の臨床開発品があること、さらに、製薬大手による巨額の投資も、同市場の成長を促進するとみられています。

当レポートでは、世界のCD47阻害剤市場について調査し、市場の概要とともに、CD47阻害剤のパイプライン概要、企業別、適応症別、相別動向、および市場に参入する企業の競合動向などを提供しています。目次

第1章 新たな癌免疫療法の標的としてのCD47

第2章 臨床試験で進行中のCD47阻害剤

- モノクローナル抗体を標的とするCD47

- 二重特異性抗体を標的とするCD47

第3章 現在の市場動向と将来の展望

第4章 世界のCD47阻害剤の臨床パイプライン概要

- 国別

- 企業別

- 適応症別

- 相別

第5章 世界のCD47阻害剤の臨床パイプライン、企業別、適応症別、相別

- 研究

- 前臨床

- 第I相

- 第I/II相

- 第Ⅱ相

- 第II/III相

- 第III相

第6章 世界のCD47阻害剤市場力学

- CD47阻害剤の臨床試験を促進する主な要因

- 臨床的および技術的課題

第7章 競合情勢

- Adagene

- Alector

- ALX Oncology

- Beta Pharma

- Biocad

- ImmuneOncia Therapeutics

- ImmuneOnco Biopharma

- Light Chain Bioscience

- Phanes Therapeutics

- Virtuoso Therapeutics

List of Figures

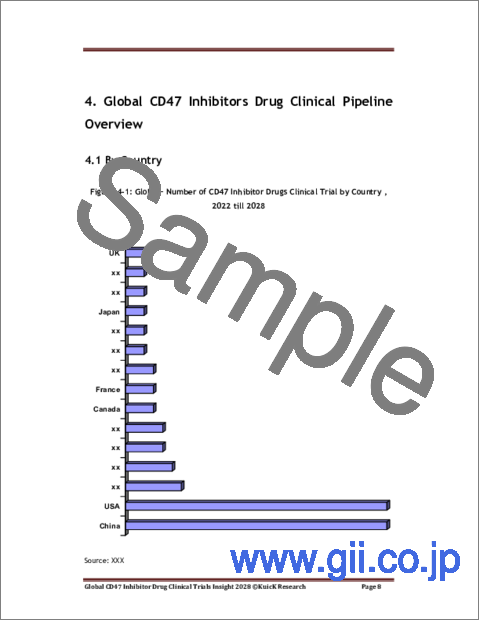

- Figure 4-1: Global - Number of CD47 Inhibitor Drugs Clinical Trial by Country, 2022 till 2028

- Figure 4-2: Global - Number of CD47 Inhibitor Drugs in Clinical Pipeline by Company, 2022 till 2028

- Figure 4-3: Global - Number of CD47 Inhibitor Drugs in Clinical Pipeline by Indication, 2022 till 2028

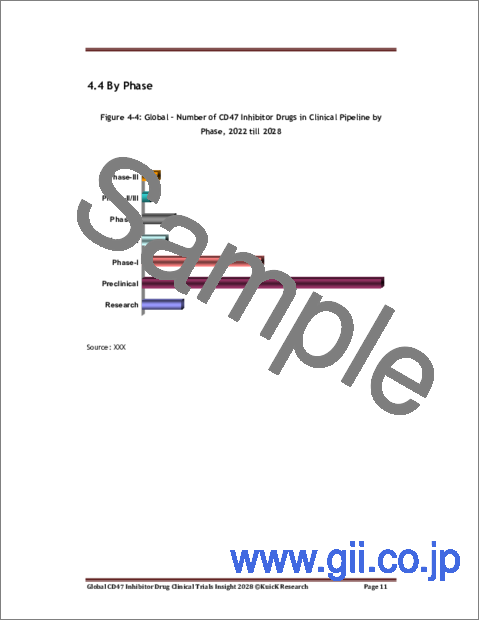

- Figure 4-4: Global - Number of CD47 Inhibitor Drugs in Clinical Pipeline by Phase, 2022 till 2028

“Global CD47 Inhibitor Drug Clinical Trials Insight 2028” Report Highlights:

- CD47 Inhibitor Drug Market Trends & Future Prospects

- Insight On More Than 50 CD47 Inhibitors Drugs In Clinical Trials

- Orphan, Fast Track, Breakthrough Therapy Designation Insight

- Insight On CD47 Inhibitors Drugs Biomarkers Sourced During Clinical Trials

- CD47 Inhibitors Drug Clinical Trials Insight By Company, Indication & Phase

- CD47 Inhibitors Drug Clinical Trials Insight As Mono & Combination Therapy

- Global CD47 Inhibitor Drug Market Dynamics

Immunotherapy particularly with immune checkpoint inhibitor has shown to transform the global cancer therapeutics market. However, despite these huge advancements in the field of cancer therapeutics, the majority of patients does not respond to or develop resistance to immunotherapy, highlighting the need for additional approaches to expand cancer immunotherapy. In last few years, technological advancements have enabled the identification of various other receptors which can be of therapeutic potential. Recently, CD47 has gained major focus of researchers as therapeutic potential target for drug development.

Till date, no CD47 targeting antibody has gained market authorization. However, the pipeline is highly crowded indicating encouraging role of CD47 targeting therapies in the management of cancer. Magrolimab developed by GlaxoSmithKline is one of the most promising CD47 targeting antibodies in clinical development. Currently, the company is evaluating the drug in phase-III clinical trial accessing the efficacy and safety of Magrolimab in combination with azacitidine for the management of acute myeloid leukemia and myelodysplastic syndrome. The drug has received fast track designation from US FDA and is expected to enter the market by 2024.

Apart from this, several other pharmaceutical giants have developed a robust clinical pipeline of the CD47 targeting therapies which are being evaluated in various phase-I/II clinical trials. The companies have also adopted strategic alliances such as collaboration, partnership, or acquisitions to maintain their competitive edge in the market. For instance, AbbVie entered into collaboration with I-Mab for the development and commercialization of lemzoparlimab (also known as TJC4), an innovative anti-CD47 monoclonal antibody internally discovered and developed by I-Mab for the treatment of multiple cancers. In addition, the two partners have the potential to expand the collaboration to additional transformative therapies.

To further enhance the therapeutic potential of CD47 targeting therapies, researchers have also initiated clinical trials evaluating their role in combination therapies. For instance, Arch Oncology and Merck are currently conducting phase-I/II clinical trial to evaluate AO-176, the Company's novel anti-CD47 antibody in combination with Keytruda for the treatment of patients with select solid tumors including relapsed, platinum-resistant ovarian cancer, endometrial cancer, and gastroesophageal cancer. Another, ALX Oncology in collaboration with Eli Lilly to evaluate the combination of ALX148, a next generation CD47 blocker and Cyramza for the treatment of patients with HER2-positive gastric cancer or gastroesophageal junction cancer. It is suggested that combination therapies will dominate the global market owing to their enhanced efficacy and specificity towards the cancer cells.

US & Chinese pharmaceutical firms are currently dominating the CD47 inhibitors drugs R&D landscape driven by encouraging clinical pipeline, increasing cancer research activities to find innovative therapies, and favorable government policy framework. For instance in 2022, US FDA has granted orphan drug designation to AO-176 for the management of relapsed or refractory multiple myeloma. AO-173 is investigational CD47 targeting monoclonal antibody developed by Arch Oncology. Another, ALX Oncology has also received orphan drug designation for evorpacept for the treatment of patients with acute myeloid leukemia. The orphan drug designation is associated with incentives which favor the rapid approval of the drug in the region.

As per our report findings, the global CD47 market opportunity is expected to surpass US$ 2 Billion by 2028. This is mainly due to large number of clinical pipeline products which are expected to gain approval and their encouraging response in the management of cancer. Further, the huge investments by pharmaceutical giants and special designations also suggest the promising growth of the market.

Table of Contents

1. CD 47 as Novel Cancer Immunotherapy Target

2. Ongoing Anti-CD47 Agents in Clinical Trials

- 2.1 CD47 Targeting Monoclonal Antibodies

- 2.2 CD47 Targeting Bispecific Antibodies

3. Current Market Trends & Future Prospects

4. Global CD47 Inhibitors Drug Clinical Pipeline Overview

- 4.1 By Country

- 4.2 By Company

- 4.3 By Indication

- 4.4 By Phase

5. Global CD47 Inhibitors Drug Clinical Pipeline By Company, Indication & Phase

- 5.1 Research

- 5.2 Preclinical

- 5.3 Phase-I

- 5.4 Phase-I/II

- 5.5 Phase-II

- 5.6 Phase-II/III

- 5.7 Phase-III

6. Global CD47 Inhibitor Drug Market Dynamics

- 6.1 Key Factors Driving CD47 Inhibitor Clinical Trials

- 6.2 Clinical & Technological Challenges

7. Competitive Landscape

- 7.1 Adagene

- 7.2 Alector

- 7.3 ALX Oncology

- 7.4 Beta Pharma

- 7.5 Biocad

- 7.6 ImmuneOncia Therapeutics

- 7.7 ImmuneOnco Biopharma

- 7.8 Light Chain Bioscience

- 7.9 Phanes Therapeutics

- 7.10 Virtuoso Therapeutics