|

|

市場調査レポート

商品コード

1403881

アキシャルフラックスモーターの世界市場の予測(2023年~2028年)Axial Flux Motor Market - Forecast(2023 - 2028) |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| アキシャルフラックスモーターの世界市場の予測(2023年~2028年) |

|

出版日: 2023年12月01日

発行: IndustryARC

ページ情報: 英文 115 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界のアキシャルフラックスモーターの市場規模は、2028年までに9億3,988万米ドルに達し、2023年~2028年にCAGRで9.85%の成長が予測されています。電気自動車市場に対する輸送企業の投資の拡大が、アキシャルフラックスモーター市場に大きな成長機会を与えると思われます。例えば、OLAは2020年12月に電気スクーターに3億2,000万米ドルを投資しました。Uber Technologiesは、アメリカの輸送企業Limeの支援を受けており、Limeも電動バイクやスクーターを大量に購入しています。製品需要は、より優れた製品をより高い効率で生産するための、設計と製造プロセスの改良への注力から恩恵を受けると予測され、これは永久磁石同期モーターの産業拡大をさらに促進します。世界の環境保護意識の高まりは、電気自動車や熱回収換気の採用を加速させ、2023年~2028年のアキシャルフラックスモーター需要を促進すると予測されます。

要点

電気乗用車セグメントは、政府の取り組みの増加と主要企業の優位性を維持するための戦略的アプローチにより、予測期間の2022年~2027年にCAGRで10.70%の成長が見込まれます。

自動車は、2021年に2億222万米ドルの収益を上げてアキシャルフラックスモーター市場を独占し、2027年までに3億5,974万米ドルに達し、予測期間の2022年~2027年にCAGRで10.82%のもっとも急成長するセグメントとなります。アキシャルフラックス電気モーターは、継続的に発展する自動車部門のおかげで、さまざまな自動車産業や多くの地域で高い需要があります。

欧州は、2021年に1億7,978万米ドルの収益を上げてアキシャルフラックスモーター市場を独占し、2027年までに2億7,423万米ドルに達し、2022年~2027年の予測期間にCAGRで8.00%の成長が推定されています。電気自動車の普及に向けた政府の積極的な施策が、この部門の欧州全域での大規模な成長を後押ししています。

高出力密度アキシャルフラックスモーターへの需要の高まりが産業の拡大を後押ししており、市場成長にプラスの影響を与える見込みです。

アキシャルフラックスモーター市場の促進要因

資金調達と投資の増加が、予測期間にアキシャルフラックスモーター市場の成長を促進する

アキシャルフラックスモーターとアキシャルフラックスモーターシードの開発は、多くの企業から資金提供や投資を受けています。例えば、英国政府は2020年6月、最先端のEV技術を開発するため、自動車産業への9,130万米ドルの投資を発表しました。TechProは2019年10月、電気自動車と関連インフラの研究開発のため、インドに1,000万米ドルを投資すると発表しました。ドイツのGovecs AGは2018年9月、シェアードモビリティ市場向けに6,000台のeスクーターを納入する覚書を英国企業と締結し、2019年にSchwalbeのeスクーター3,000台、2020年に残りの3,000台を供給します。アキシャルフラックス電気モーター市場は、上記のような特性の恩恵を受けています。例えば、Mercedes-Benzは2020年1月、中国のZhejiang Geely Holding Groupとスマート電気自動車を共同開発すると発表しました。この工場は年間15万台の生産能力を有しています。この2社の自動車メーカーは、寧波の世界本社と中国とドイツの販売拠点に54億人民元を投資する可能性があります。自動車メーカーは、電気自動車の需要増に対応するため、世界各地に多数の生産施設の建設を計画しています。予測期間の2022年~2027年に、こうした改善がアキシャルフラックスモーターの需要を押し上げると予測されます。

高出力密度のアキシャルフラックスモーターへの需要の高まりが、産業の拡大を促進し、市場成長にプラスの影響を与える

アキシャルフラックス永久磁石同期モータは、コンパクトな構造と高出力密度を持ち、産業用ロボット、送風機、ポンプ、コンプレッサーおよび類似の機械に加え、電気自動車、ドローンなどに最適です。コンパクトなフットプリントが特徴で、製造コストと材料の使用を最小限に抑えることができます。従来のモーターと同量の電流を使用するにもかかわらず、より高いトルクと出力密度を生み出します。この特性により、アキシャルフラックスモーターはバッテリーの寿命が長くなり、費用対効果が高くなります。

当レポートでは、世界のアキシャルフラックスモーター市場について調査し、市場シェア、促進要因、セグメント、地域、主要企業などの分析を提供しています。

目次

第1章 アキシャルフラックスモーター市場の概要

- 定義と範囲

第2章 アキシャルフラックスモーター市場 - エグゼクティブサマリー

- 市場収益、市場規模、主要動向:企業別

- 主要動向:製品タイプ別

- 主要動向:機能別

- 主要動向:サンプル別

- 主要動向:範囲別

- 主要動向:反応別

- 主要動向:産業別

- 主要動向:地域別

第3章 アキシャルフラックスモーター市場 - 市場情勢

- 比較分析

- 製品/企業ベンチマーク - 上位5社

- 5大財務分析

- 市場金額の分割:上位5社別

- 特許分析

- 価格分析(市場での一般的な価格の比較)

第4章 アキシャルフラックスモーター市場 - 業界の市場参入シナリオ(プレミアム)

- 規制シナリオ

- ビジネスのしやすさ指数

- ケーススタディ

- 顧客分析

第5章 アキシャルフラックスモーター市場 - スタートアップ企業のシナリオ(プレミアム)

- ベンチャーキャピタルと資金調達のシナリオ

- スタートアップ企業分析

第6章 アキシャルフラックスモーター市場 - 市場要因

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析モデル

第7章 アキシャルフラックスモーター市場 - 戦略的分析別

- バリューチェーン分析

- 機会の分析

- 製品ライフサイクル/市場ライフサイクル分析

- サプライヤーと販売業者

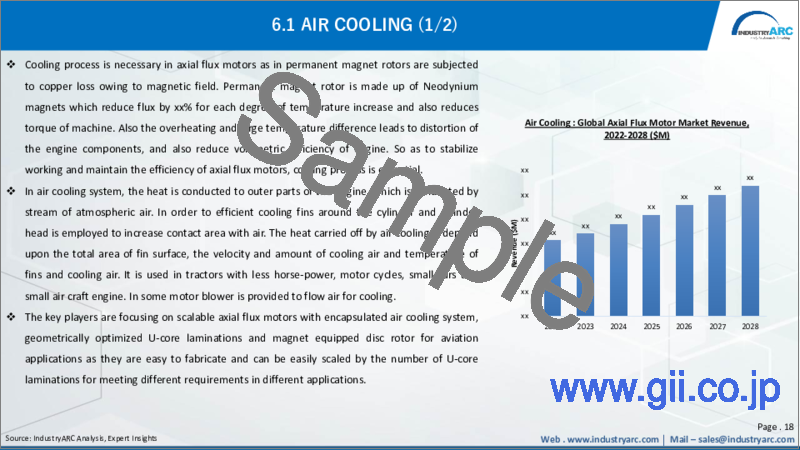

第8章 アキシャルフラックスモーター市場 - 冷却プロセス別

- 空冷

- 液冷

第9章 アキシャルフラックスモーター市場 - 電力別

- 1kw~15kw

- 15kw-80kw

- 80kw-160kw

- 160kw超

第10章 アキシャルフラックスモーター市場 - 用途別

- 電気乗用車

- 商用車

- 産業機械

- エレベーター

- ロボットアクチュエーター、推進システム

- 航空機・電動グライダー飛行機

- ヨット・電気ボート

- 電動ドローン、その他

第11章 アキシャルフラックスモーター市場 - 最終用途産業別

- 一般製造業

- 電力

- 建設

- 自動車

- 航空宇宙

- 海事

- 農業

- その他

第12章 アキシャルフラックスモーター市場 - 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- チリ

- コロンビア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- オランダ

- その他

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- その他

- その他の地域

- 中東

- アフリカ

第13章 アキシャルフラックスモーター市場 - 市場エントロピー

- 新製品の発売

- M&A、提携、JV、パートナーシップ

第14章 アキシャルフラックスモーター市場 - 業界の競合情勢(プレミアム)

- 世界の市場シェア

- 市場シェア:地域別

- 市場シェア:製品タイプ別

- 市場シェア:エンドユーザー別

- 市場シェア:国別

第15章 アキシャルフラックスモーター市場 - 主要企業リスト:国別(プレミアム)

第16章 アキシャルフラックスモーター市場の企業分析

- Honeywell

- Mettler Toledo

- Emerson

- DKK-TOA Corporation

- Hach Company

- ProMinent

- PCE Instruments

- BMT Messtechnik GMBH

- Shanndong

Axial Flux Motor Market Report Overview

Axial Flux Motor Market size is analyzed to grow at a CAGR of 9.85% during the forecast 2023-2028 to reach USD $939.88 million by 2028. Axial flux motors are suited for applications that require a high torque density in a small footprint. Axial flow drives are also known as flattened and pancake electrically commutated motors due to their extremely low axial length-to-diameter ratio. It delivers more torque and power density than radial flux motors while using the same electrical components. When an axial flux motor has this feature, the battery lasts longer, making these motors more economically viable. Furthermore, using axial motors minimizes vehicle weight by reducing the amount of space occupied by machinery. Transportation corporations' growing investment in the electric vehicle market would give substantial growth opportunities for the Axial Flux Motor Market. For example, OLA, invested $320 million in electric scooters in December 2020. Uber Technologies was backed by Lime, an American transportation firm, that also purchased a big number of electric bikes and scooters. Product demand is expected to benefit from a growing focus on refining design and manufacturing processes in order to produce better products with greater efficiency, which further enhances the industry expansion for permanent magnet synchronous motors. Rising awareness of environmental preservation around the world is predicted to boost the adoption of electric vehicles and heat recovery ventilation, which will drive axial flux motor demand in 2023-2028.

Report Coverage

The report: "Axial Flux Motor Market Industry Outlook - Forecast (2023-2028)", by IndustryARC covers an in-depth analysis of the following segments of the Axial Flux Motor Market Report.

By Cooling Process: Air Cooling, Liquid Cooling.

By Power: 1kw-15kw, 15kw-80kw, 80kw-160kw, Above 160kw.

By Application: Electric Passenger Vehicles, Commercial Vehicles, Industrial Machinery, Elevators, Robotics Actuators, and Propulsion Systems, Aircrafts & Electric Glider Planes, Yachts & Electric Boats, Electric Drones, Others.

By End-User Industry: General Manufacturing, Power, Construction, Automotive, Aerospace, Marine, Agriculture, Others.

By Geography: North America (US, Canada, Mexico), South America (Brazil, Argentina, Chile, Colombia, Others), Europe (Germany, France, UK, Italy, Spain, Russia, Netherlands, Others), APAC (China, Japan, South Korea, India, Australia, Indonesia, Malaysia, Others), and RoW (Middle East, Africa)

Key Takeaways

The Electric Passenger Vehicles segment is expected to grow at a CAGR of 10.70% during the forecast period 2022-2027 owing to the increase in government initiatives and key players strategic approaches to maintain the dominance.

Automotive dominated the Axial Flux Motor Market with a revenue of $202.22m in 2021 and is projected to reach $359.74m by 2027 and is also set to be the fastest-growing segment with a CAGR of 10.82% during the forecast period 2022-2027. Axial flux electric motors are in high demand across a variety of vehicle industries and across numerous geographical locations, thanks to the continuously developing automotive sector.

Europe region is dominating the Axial Flux Motor Market with revenue of $179.78 m in 2021 and is estimated to grow at a CAGR of 8.00% during the forecast period of 2022-2027 to generate a revenue of $274.23m in 2027. The government's aggressive measures for the adoption of electric vehicles have aided the sector's massive growth throughout Europe.

The growing demand for high power density axial flux motors is enhancing the industry expansion and is set to positively impact the market growth.

Axial Flux Motor Market Value Share, By Region, 2022 (%)

Axial Flux Motor Market

For More Details on This Report - Request for Sample.

Axial Flux Motor Market Segment Analysis - Application

By Application, Electric Passenger Vehicles dominated the Axial Flux Motor Market with a revenue of $115.23m in 2021 and is projected to reach $203.37 million by 2027 growing at a CAGR of 10.70% during the forecast period 2022-2027 owing to the increase in government initiatives and key players strategic approaches to maintain the dominance. The various government's drive to promote the use of environmentally friendly e-vehicles to enhance the environment by reducing vehicle pollution is gaining traction as investments in environmentally friendly e-vehicles rise, driving the segment growth. According to the International Energy Agency, global sales of electric vehicles topped 2.1 million units in 2019. The Delhi government launched an EV strategy in December 2019 to reduce pollution and promote the use of electric vehicles, with the objective of registering at least 25% of electric vehicles by 2024. Whylot, a French company founded in the Lot region that pioneered a unique axial flux automotive e-motor, has sold a minority stake to Renault Group for a 21 percent stake, thus all of these investments and launches boost segment expansion.

Axial Flux Motor Market Segment Analysis - By End User

By End-User Industry, Automotive dominated the Axial Flux Motor Market with a revenue of $202.22m in 2021 and is projected to reach $359.74m by 2027 and is also set to be the fastest-growing segment with a CAGR of 10.82% during the forecast period 2022-2027. Axial flux electric motors are in high demand across a variety of vehicle industries and across numerous geographical locations, thanks to the continuously developing automotive sector. Axial flux motors are being adopted in the automotive segment by major players all over the world through acquisitions and partnerships. For instance, Mercedes-Benz, has acquired major players such as YASA to utilize their axial flux motors in their AMG electric platform in 2021, while Renault has teamed with WHYLOT to use axial flux motors in its hybrids starting in 2025. With its rising uses in some hybrid applications and high-performance vehicles, the axial flux motors market in automotive Electric Vehicles (EVs) is in great demand. Owing to forthcoming legislation for active and passive safety systems, which mandate the installation of safety systems in passenger automobiles, automotive safety norms are evolving in emerging countries. This raises the need for electric motors by significantly increasing the installation of safety systems such as ABS and ESC per vehicle. Furthermore, increased environmental awareness around the world is predicted to encourage the usage of electric vehicles, which will drive demand in the automotive industry.

Axial Flux Motor Market Share Segment Analysis - Geography

Europe region is dominating the Axial Flux Motor Market with revenue of $179.78 m in 2021 and is estimated to grow at a CAGR of 8.00% during the forecast period of 2022-2027 to generate a revenue of $274.23m in 2027. The government's aggressive measures for the adoption of electric vehicles have aided the sector's massive growth throughout Europe. The UK government spent a lot of money on delivery drones and electric scooters in March 2020, according to sources, as part of a scheme called "making trips easier, smarter, and greener." As a result of such global investments, the axial flux motor sector will see significant expansion. In May 2019, YASA, a manufacturer of axial-flux electric motors based in the United Kingdom, announced that one of their products is powering Ferrari's first hybrid series production sports car, the SF90 Stradale, hence, driving the regional growth. Countries throughout the area are recognizing the energy-saving potential of energy-efficient electric motors and are enforcing stringent rules and policies to encourage the use of energy-efficient Axial Flux motors. This move also includes detailed information on current effective efficiency standards in each key market, as well as their impact on the region's Axial Flux motors market growth. The government's strong policies for the adoption of electric vehicles have contributed to the enormous expansion of this sector in Europe. Aside from that, high investment in European e-scooter start-up firms contributes significantly to the market's growth in this region. For instance, a Swedish e-scooter business, Voi , raised $160 million in funding in December 2020 to expand throughout European markets.

Axial Flux Motor Market Drivers

Increasing funding & investment is poised to boost the market growth of the Axial Flux Motor market over the forecast period:

Axial Flux Motor and Axial Flux Motor seed development is being funded and invested in by a number of firms. For instance, The UK government announced a $91.3 million investment in the automotive industry in June 2020 to develop cutting-edge EV technologies. TechPro announced a $10 million investment in India in October 2019 for the R&D of electric vehicles and related infrastructure. Govecs AG, a German firm, signed a memorandum of intent with a British company in September 2018 for the delivery of 6000 e-scooters for the shared mobility market, with 3000 Schwalbe e-scooters supplied in 2019 and the remaining 3000 in 2020. The axial flux electric motor market benefits from the attributes outlined above. Mercedes-Benz, for instance, said in January 2020 that it will collaborate with China's Zhejiang Geely Holding Group to develop smart electric vehicles. The plant had the capacity to produce 150,000 automobiles per year. The two carmakers may invest CNY 5.4 billion (USD 780.3 million) in Ningbo's worldwide headquarters and distribution sites in China and Germany. Automobile manufacturers have planned the construction of numerous production sites in various locations throughout the world in order to meet the growing demand for electric vehicles. During the projected period, such improvements are expected to boost demand for axial flux motors in the forecast period 2022-2027.

The growing demand for high power density axial flux motors is enhancing the industry expansion and is set to positively impact the market growth:

Axial Flux permanent magnet synchronous motors have a compact structure and a high power density, making them perfect for industrial equipment such as industrial robots, blowers, pumps, compressors, and other similar machinery; electrical vehicles, drones, and so on. They feature a compact footprint, which minimizes production costs and material utilization. Despite using the same amount of current as traditional motors, it produces higher torque and power density. Because of this attribute, an axial flux motor has a longer battery life, making these motors more cost-effective. For instance, a prototype motor has been built to satisfy the US Department of Energy's 2025 power density goals, which call for an 89 % reduction in motor volume compared to 2020 expectations. Axial flux motors are primarily used in electric vehicles, and demand for electric vehicles is rapidly increasing owing to rising gasoline prices around the world (according to OECD data, in the United States, import crude oil prices increased from $59.2 to $64.4 per barrel from 2018 to 2021), as well as the negative environmental impact of driving oil-based vehicles, which drives demand for axial flux motors in automotive and other industries.

Axial Flux Motor Market Challenges

The industry expansion is projected to stifle owing to technical challenges faced by manufacturing organizations:

The highly technological manufacturing process is one of the primary factors impeding the growth of the Axial Flux Motor Market. The large magnetic forces necessary between the rotor and the stator make maintaining a constant air gap between the two components problematic during the manufacturing process. Many axial flux motor producers are confronted with this technical problem, which is expected to limit the market's overall income. Aside from that, owing to the precise placement of results, the production process has certain thermal difficulties. When the motor runs, the windings are located deep into the stator between the two rotor discs, causing cooling concerns. Axial flux motor comes with composite design and manufacturing problems, which add its cost to radial motor technology. The winding of an axial flux motor can be adjusted by geometric arrangement according to the design specific diameter, allowing for a significant reduction in the machine's total volume which is very challenging to architecture fit the motor in a compact design.

Axial Flux Motor Market Landscape

Technology launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Axial Flux Motor Market. In 2021, the market of Axial Flux Motor Market share has been fragmented by several companies. Axial Flux Motor Market top 10 companies include:

- ABB

- Siemens

- Saietta Group/Agni Motors 9

- Yasa

- Avid Technology/Turntide Technologies

- Magnax BV

- Lucchi R

- Nidec

- Danfoss/UQM

- Regal Rexnord

Recent Developments

In November 2021, Saietta Group plc has launched Propel division of axial flux motors for delivering the next-generation marine propulsion solutions. These axial flux motors use Flux Technology for supporting decarbonization and sustainable mobility on waterways. These motors combine optimal performance with efficiency and helps to meet upcoming legislations in all the major cities.

In August 2021, Turntide Technologies has acquired AVID Technology to enhance electrification capabilities and to develop sustainable electrification to industrial and commercial vehicles. The acquisition is intended to combine technology with AVID's to generate products that can be applied in industrial vehicles. The acquisition was aimed to eliminate the need for rare earth magnets in Electric vehicles.

In February 2021, Dana acquired Ashwoods Electric Motors to make it capable of manufacturing all core components of a fully integrated e-Drive system. This acquisition is aimed to keep the best of Ashwoods embracing the high-volume excellence of Dana and driving a culture of development. The company is also planning to offer Original Equipment Manufacturers (OEMs) a trusted network of breakthrough technologies.

Table of Contents

1. Axial Flux Motor Market Overview

- 1.1 Definitions and Scope

2. Axial Flux Motor Market - Executive Summary

- 2.1 Market Revenue, Market Size and Key Trends by Company

- 2.2 Key trends By Product Type

- 2.3 Key trends By Function

- 2.4 Key trends By Sample

- 2.5 Key trends By Range

- 2.6 Key trends By Response

- 2.7 Key trends By Industry Vertical

- 2.8 Key trends segmented by Geography

3. Axial Flux Motor Market - Market Landscape

- 3.1 Comparative Analysis

- 3.1.1 Product/Company Benchmarking-Top 5 Companies

- 3.1.2 Top 5 Financial Analysis

- 3.1.3 Market Value Split by Top 5 Companies

- 3.1.4 Patent Analysis

- 3.1.5 Pricing Analysis (Comparison of General Price Offerings in the Market)

4. Axial Flux Motor Market - Industry Market Entry Scenario Premium (Premium)

- 4.1 Regulatory Scenario

- 4.2 Ease of Doing Business Index

- 4.3 Case Studies

- 4.4 Customer Analysis

5. Axial Flux Motor Market - Startup Company Scenario (Premium)

- 5.1 Venture Capital and Funding Scenario

- 5.2 Startup Company Analysis

6. Axial Flux Motor Market - Market Forces

- 6.1 Market Drivers

- 6.2 Market Constraints

- 6.3 Porters five force model

- 6.3.1 Bargaining power of suppliers

- 6.3.2 Text Box: 05Bargaining powers of customers

- 6.3.3 Threat of new entrants

- 6.3.4 Rivalry among existing players

- 6.3.5 Threat of substitutes

7. Axial Flux Motor Market - By Strategic Analysis (Market Size -$Million/Billion)

- 7.1 Value Chain Analysis

- 7.2 Opportunities Analysis

- 7.3 Product Life Cycle/Market Life Cycle Analysis

- 7.4 Text Box: 06Suppliers and Distributors

8. Axial Flux Motor Market - By Cooling Process (Market Size -$Million/Billion)

- 8.1 Air Cooling

- 8.2 Liquid Cooling

9. Axial Flux Motor Market - By Power (Market Size -$Million/Billion)

- 9.1 1kw-15kw

- 9.2 15kw-80kw

- 9.3 80kw-160kw

- 9.4 Above 160kw

10. Axial Flux Motor Market - By Application (Market Size -$Million/Billion)

- 10.1 Electric Passenger Vehicles

- 10.2 Commercial Vehicles

- 10.3 Industrial Machinery

- 10.4 Elevators

- 10.5 Robotics Actuators and Propulsion Systems

- 10.6 Aircrafts & Electric Glider Planes

- 10.7 Yachts & Electric Boats

- 10.8 Electric Drones, Others

11. Axial Flux Motor Market - By End-User Industry (Market Size -$Million/Billion)

- 11.1 General Manufacturing

- 11.2 Power

- 11.3 Construction

- 11.4 Automotive

- 11.5 Aerospace

- 11.6 Marine

- 11.7 Agriculture

- 11.8 Others

12. Axial Flux Motor Market - By Geography (Market Size -$Million/Billion)

- 12.1 North America

- 12.1.1 U.S

- 12.1.2 Canada

- 12.1.3 Mexico

- 12.2 South America

- 12.2.1 Brazil

- 12.2.2 Argentina

- 12.2.3 Chile

- 12.2.4 Colombia

- 12.2.5 Others

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 France

- 12.3.3 UK

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Netherlands

- 12.3.8 Others

- 12.4 Asia-Pacific (APAC)

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 South Korea

- 12.4.4 India

- 12.4.5 Australia

- 12.4.6 Indonesia

- 12.4.7 Malaysia

- 12.4.8 Others

- 12.5 RoW

- 12.5.1 Middle East

- 12.5.2 Africa

13. Axial Flux Motor Market - Market Entropy

- 13.1 New product launches

- 13.2 M&A's, collaborations, JVs and partnerships

14. Axial Flux Motor Market - Industry Competition Landscape (Premium)

- 14.1 Market Share Global

- 14.2 Market Share by Region

- 14.3 Market Share By Product Type

- 14.4 Market Share by End-Users

- 14.5 Market Share by Country

15. Axial Flux Motor Market - Key Company List by Country Premium (Premium)

16. Axial Flux Motor Market - Company Analysis

- 16.1 Honeywell

- 16.2 Mettler Toledo

- 16.3 Emerson

- 16.4 DKK-TOA Corporation

- 16.5 Hach Company

- 16.6 ProMinent

- 16.7 PCE Instruments

- 16.8 BMT Messtechnik GMBH

- 16.9 Shanndong