|

|

市場調査レポート

商品コード

1068255

グランピングの市場規模・市場シェア・動向分析 (2022-2030年):宿泊施設 (キャビン&ポッド・テント・ツリーハウス)・年齢層 (18~32歳・33~50歳)・地域別Glamping Market Size, Share & Trends Analysis Report By Accommodation (Cabins & Pods, Tents, Treehouses), By Age Group (18-32 Years, 33-50 Years), By Region (APAC, North America), And Segment Forecasts, 2022 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| グランピングの市場規模・市場シェア・動向分析 (2022-2030年):宿泊施設 (キャビン&ポッド・テント・ツリーハウス)・年齢層 (18~32歳・33~50歳)・地域別 |

|

出版日: 2022年03月21日

発行: Grand View Research

ページ情報: 英文 87 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のグランピングの市場規模は予測期間中10.9%のCAGRで推移し、2030年には59億4,000万米ドルの規模に成長すると予測されています。

ストレス解消やリラクゼーションが市場成長の主な要因であると考えられています。また、エコツーリズムや健康的なライフスタイルへのニーズから、アクティブなアウトドアに対する高いニーズが生み出されています。このことも予測期間中の市場にプラスの影響を与える見通しです。

当レポートでは、世界のグランピングの市場を調査し、市場概要、市場成長への各種影響因子の分析、消費者行動の分析、市場規模の推移・予測、宿泊施設・年齢層・地域/主要国など各種区分別の内訳、競合環境、市場シェア、主要企業のプロファイルなどをまとめています。

目次

第1章 調査手法・調査範囲

第2章 エグゼクティブサマリー

第3章 グランピング市場の可変因子・動向・展望

- 普及・成長の見通しマッピング

- 産業のバリューチェーン分析

- 市場力学

- 事業環境の分析

- 市場のロードマップ

- 市場参入戦略

- COVID-19の影響

第4章 消費者行動の分析

- 人口統計分析

- 消費者の動向と好み

- 購入決定に影響を与える要因

- 消費者による製品の採用

- 観察・推奨事項

第5章 グランピング市場:宿泊施設別の推計・動向分析

- 動向分析・市場シェア

- キャビン&ポッド

- テント

- パオ

- ツリーハウス

- その他

第6章 グランピング市場:年齢層別の推計・動向分析

- 動向分析・市場シェア

- 18~32歳

- 33~50歳

- 51~65歳

- 65歳以上

第7章 グランピング市場:地域別の推計・動向分析

- 動向分析・市場シェア

- 北米

- 欧州

- アジア太平洋

- 中南米

- 中東・アフリカ

第8章 競合分析

- 主要企業・近年の展開・影響分析

- 主要企業/競合上の分類

- ベンダー情勢

第9章 企業プロファイル

- The Last Best Beef LLC

- Under Canvas

- Collective Retreats

- Tentrr

- Eco Retreats

- Baillie Lodges

- Nightfall Camp Pty Ltd

- Tanja Lagoon Camp

- Wildman Wilderness Lodge

- Paperbark Camp

List of Tables

- 1. The average cost of setting up a glamping site for one ready-to-assemble dome structure

- 2. Glamping market - Driving factor market analysis.

- 3. America's largest music festivals

- 4. Glamping market - Restraint factor market analysis

- 5. Cabins & pods glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 6. Tents market estimates and forecast, 2017 - 2030 (USD Million)

- 7. Yurts market estimates and forecast, 2017 - 2030 (USD Million)

- 8. Treehouse market estimates and forecast, 2017 - 2030 (USD Million)

- 9. Others market estimates and forecast, 2017 - 2030 (USD Million)

- 10. Glamping market estimates and forecast in 18-32 years age group, 2017 - 2030 (USD Million)

- 11. Glamping market estimates and forecast in 33-50 years age group, 2017 - 2030 (USD Million)

- 12. Glamping market estimates and forecast in 51-65 years age group, 2017 - 2030 (USD Million)

- 13. Glamping market estimates and forecast in above 65 years age group, 2017 - 2030 (USD Million)

- 14. North America glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 15. North America glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 16. North America glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 17. U.S. glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 18. U.S. glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 19. U.S. glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 20. Europe glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 21. Europe glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 22. Europe glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 23. Italy glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 24. Italy glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 25. Italy glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 26. U.K. glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 27. U.K. glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 28. U.K. glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 29. Asia Pacific glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 30. Asia Pacific glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 31. Asia Pacific glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 32. Australia glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 33. Australia glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 34. Australia glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 35. India glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 36. India glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 37. India glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 38. Middle East & Africa glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 39. Middle East & Africa glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 40. Middle East & Africa glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 41. South Africa glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 42. South Africa glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 43. South Africa glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 44. Central & South America glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 45. Central & South America glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 46. Central & South America glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 47. Brazil glamping market estimates and forecast, 2017 - 2030 (USD Million)

- 48. Brazil glamping market estimates and forecast, by accommodation type, 2017 - 2030 (USD Million)

- 49. Brazil glamping market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 50. Company categorization

List of Figures

- 1. Glamping market segmentation

- 2. Information procurement

- 3. Primary research pattern

- 4. Primary research approaches

- 5. Primary research process

- 6. Glamping market - Accommodation type growth

- 7. Glamping market - Value chain analysis

- 8. Glamping market - Sales channels

- 9. Average spend on staycation in the UK, 2011 - 2019 (GBP)

- 10. Glamping market: Porter's Five Forces Analysis

- 11. Roadmap of glamping market

- 12. Leisure traveler participation in glamping by generation in North America, 2019 (%)

- 13. Glamping market: Accommodation share (%) analysis, 2021 & 2030

- 14. Glamping market: Age group share (%) analysis, 2021 & 2030

- 15. Glamping market: Regional share (%) analysis, 2021 & 2030

- 16. Glamping market: Company market share, 2020 (%)

Glamping Market Growth & Trends:

The global glamping market size is anticipated to reach USD 5.94 billion by 2030, registering a CAGR of 10.9% over the forecast period, according to a new report by Grand View Research, Inc. With continuous modification in service offerings and expansions, the market is expected to witness a prominent acceptance among tourists who prefer to stay closer to home over foreign vacations. Also, staycations are becoming increasingly popular and are expected to continue growing further through Airbnb and various other advertising campaigns supported by the governments across all regions. While de-stressing and relaxation are considered to be the main factors propelling the market growth, the need for a healthy lifestyle along with eco-tourism has created high demand for an active outdoors regime.

This, in turn, will have a positive impact on the market over the forecast period. Most consumers prefer spending a huge sum of money on immersive experiences as opposed to material possessions. Ethical awareness as well as rising demand for greater ethical conscientiousness from brands is expected to fuel industry growth from 2022 to 2030. Millennials nowadays seek adventurous, personal as well as local experiences wherever they go and are also willing to pay to get that emotionally evocative understanding, thus high target population is expected to have a positive impact on the market over the forecast period. In addition, another trend observed in the market is that in the past, staycations were only employed for celebratory purposes.

However, over the past few years, families, groups of individuals, etc. need to pamper themselves on their days off from work. Another reason for the increase in staycations is that people today prefer nearby getaways for long weekends, which is why consumers prefer holidaying within city limits. Moreover, the growing inclination of young consumers towards prioritizing their travel experiences over materialistic possessions, particularly among millennials, has made glamping a trending camping option. Millennials and Gen X constitute a driving force for the market. According to the KOA report, leisure traveler participation in glamping by generations comprised 48% of millennials and 28% of Gen X in North America in 2019.

Although the impact of COVID-19 on disposable income over the forecast period is not known, it is seen to have not much of a change on the industry. Glamping is a fairly low-cost leisure offering within the tourism industry and thus remains attractive to a large percentage. Moreover, traditional hospitality offerings including hotels, restaurants, and resorts have had a destructive impact due to COVID-19, whereas the glamping and camping industries witnessed a higher demand as they offer socially distant, hygienic, and scheduled breaks away from the city. With no common areas or front desk, no bars or restaurants, operators like Hipcamp, Getaway, and Tentrr offer tents or secluded cabins that are well-positioned to capture this demand.

In addition, glamping service providers are also focusing on partnering with hotels and resorts to popularize and generate greater profits. For instance, Glampique's services are a perfect solution for business-to-business glamping deals. However, getting planning permission to start a glamping site is one of the challenges faced by numerous owners. Land use permission to build glamping sites may take up to a year and is a very lengthy procedure. This is one of the major challenges that discourage people from starting their own glamping business; particularly in the U.S.A., a few planning authorities simply don't relate glamping as a business or the benefits of luxury camping as an environmentally conscious way to use a piece of land or building and diversify or boost a local economy.

Glamping Market Report Highlights:

- Rising preference for contemporary tents, pods, and cabins amidst nature is expected to be one of the key reasons driving the market over the forecast period

- The cabins and pods segment accounted for the largest revenue share in 2021 and is expected to grow at a steady CAGR over the forecast period

- Cabin and pods accommodation has been the most preferred glamping type due to amenities, such as safe door and window locks. With outdoor activities becoming more popular, travel enthusiasts get highly attracted by luxury services offered by the glamping service providers

- The 18-32 years age group segment will register the fastest CAGR over the forecast period. The rising trend of travel & tourism in the millennial generation category is fueling the segment growth

- Europe held the largest revenue share of over 35.00% in 2021. The market started as a niche segment in Europe; however, it has been gaining traction over the past few years due to rising consumer awareness about the benefits of glamping

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources & Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Accommodation Outlook

- 2.3. Age Group Outlook

- 2.4. Competitive Insights

Chapter 3. Glamping Market Variables, Trends & Scope

- 3.1. Market Introduction

- 3.2. Penetration & Growth Prospect Mapping

- 3.3. Industry Value Chain Analysis

- 3.3.1. Retail Chain Analysis

- 3.3.2. Profit Margin Analysis

- 3.4. Market Dynamics

- 3.4.1. Market Driver Analysis

- 3.4.2. Market Restraint Analysis

- 3.4.3. Industry Challenges

- 3.4.4. Industry Opportunities

- 3.5. Business Environment Analysis

- 3.5.1. Industry Analysis - Porter's

- 3.5.1.1. Supplier Power

- 3.5.1.2. Buyer Power

- 3.5.1.3. Substitution Threat

- 3.5.1.4. Threat from New Entrant

- 3.5.1.5. Competitive Rivalry

- 3.5.1. Industry Analysis - Porter's

- 3.6. Roadmap of Glamping Market

- 3.7. Market Entry Strategies

- 3.8. Impact of COVID-19 on the Glamping Market

Chapter 4. Consumer Behavior Analysis

- 4.1. Demographic Analysis

- 4.2. Consumer Trends and Preferences

- 4.3. Factors Affecting Buying Decision

- 4.4. Consumer Product Adoption

- 4.5. Observations & Recommendations

Chapter 5. Glamping Market: Accommodation Estimates & Trend Analysis

- 5.1. Accommodation Movement Analysis & Market Share, 2018 & 2025

- 5.2. Cabins and Pods

- 5.2.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 5.3. Tents

- 5.3.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 5.4. Yurts

- 5.4.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 5.5. Treehouse

- 5.5.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 5.6. Others

- 5.6.1. Market estimates and forecast, 2017 - 2030 (USD Million)

Chapter 6. Glamping Market: Age Group Estimates & Trend Analysis

- 6.1. Age Group Movement Analysis & Market Share, 2018 & 2025

- 6.2. 18-32 years

- 6.2.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 6.3. 33-50 years

- 6.3.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 6.4. 51-65 years

- 6.4.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 6.5. Above 65 years

- 6.5.1. Market estimates and forecast, 2017 - 2030 (USD Million)

Chapter 7. Glamping Market: Regional Estimates & Trend Analysis

- 7.1. Regional Movement Analysis & Market Share, 2018 & 2025

- 7.2. North America

- 7.2.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.2.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

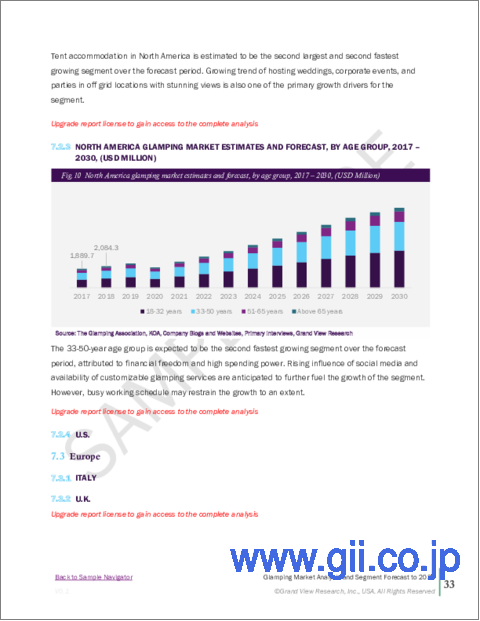

- 7.2.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 7.2.4. U.S.

- 7.2.4.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.2.4.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

- 7.2.4.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 7.3. Europe

- 7.3.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.3.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

- 7.3.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 7.3.4. Italy

- 7.3.4.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.3.4.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

- 7.3.4.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 7.3.5. U.K.

- 7.3.5.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.3.5.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

- 7.3.5.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 7.4. Asia Pacific

- 7.4.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.4.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

- 7.4.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 7.4.4. India

- 7.4.4.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.4.4.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

- 7.4.4.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 7.4.5. Australia

- 7.4.5.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.4.5.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

- 7.4.5.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 7.5. Central & South America

- 7.5.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.5.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

- 7.5.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 7.5.4. Brazil

- 7.5.4.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.5.4.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

- 7.5.4.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 7.6. Middle East & Africa (MEA)

- 7.6.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.6.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

- 7.6.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

- 7.6.4. South Africa

- 7.6.4.1. Market estimates and forecast, 2017 - 2030 (USD Million)

- 7.6.4.2. Market estimates and forecast, by accommodation, 2017 - 2030 (USD Million)

- 7.6.4.3. Market estimates and forecast, by age group, 2017 - 2030 (USD Million)

Chapter 8. Competitive Analysis

- 8.1. Key global players, recent developments & their impact on the industry

- 8.2. Key Company/Competition Categorization (Key innovators, Market leaders, Emerging players)

- 8.3. Vendor Landscape

- 8.3.1. Key company market share analysis, 2021

Chapter 9. Company Profiles

- 9.1. The Last Best Beef LLC

- 9.1.1. Company Overview

- 9.1.2. Financial Performance

- 9.1.3. Product Benchmarking

- 9.1.4. Strategic Initiatives

- 9.2. Under Canvas

- 9.2.1. Company Overview

- 9.2.2. Financial Performance

- 9.2.3. Product Benchmarking

- 9.2.4. Strategic Initiatives

- 9.3. Collective Retreats

- 9.3.1. Company Overview

- 9.3.2. Financial Performance

- 9.3.3. Product Benchmarking

- 9.3.4. Strategic Initiatives

- 9.4. Tentrr

- 9.4.1. Company Overview

- 9.4.2. Financial Performance

- 9.4.3. Product Benchmarking

- 9.4.4. Strategic Initiatives

- 9.5. Eco Retreats

- 9.5.1. Company Overview

- 9.5.2. Financial Performance

- 9.5.3. Product Benchmarking

- 9.5.4. Strategic Initiatives

- 9.6. Baillie Lodges

- 9.6.1. Company Overview

- 9.6.2. Financial Performance

- 9.6.3. Product Benchmarking

- 9.6.4. Strategic Initiatives

- 9.7. Nightfall Camp Pty Ltd

- 9.7.1. Company Overview

- 9.7.2. Financial Performance

- 9.7.3. Product Benchmarking

- 9.7.4. Strategic Initiatives

- 9.8. Tanja Lagoon Camp

- 9.8.1. Company Overview

- 9.8.2. Financial Performance

- 9.8.3. Product Benchmarking

- 9.8.4. Strategic Initiatives

- 9.9. Wildman Wilderness Lodge

- 9.9.1. Company Overview

- 9.9.2. Financial Performance

- 9.9.3. Product Benchmarking

- 9.9.4. Strategic Initiatives

- 9.10. Paperbark Camp

- 9.10.1. Company Overview

- 9.10.2. Financial Performance

- 9.10.3. Product Benchmarking

- 9.10.4. Strategic Initiatives