|

|

市場調査レポート

商品コード

1404638

ゲノミクス市場規模、シェア、動向分析レポート:用途・技術別、成果物別、最終用途別、地域別、セグメント予測、2024年~2030年Genomics Market Size, Share & Trends Analysis Report By Application & Technology (Functional Genomics, Epigenomics), By Deliverable (Products, Services), By End-use (Clinical Research, Hospital & Clinics), By Region, & Segment Forecasts, 2024 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ゲノミクス市場規模、シェア、動向分析レポート:用途・技術別、成果物別、最終用途別、地域別、セグメント予測、2024年~2030年 |

|

出版日: 2023年11月10日

発行: Grand View Research

ページ情報: 英文 200 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

ゲノミクス市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界のゲノミクス市場規模は2030年までに948億6,000万米ドルに達する見込みです。

同市場は、ゲノミクスにおける新規治療・研究アプリケーションの需要増加により、予測期間中にCAGR 16.5%を記録すると予測されています。さらに、ゲノミクスは薬理ゲノミクスやメタゲノミクスなど、幅広い用途に使用されています。ゲノミクスの新たな応用は、産業界との提携や事業拡大によって強化されています。例えば、2020年6月、Merck &Co., Inc.と10x Genomics, Inc.は、CRISPRライブラリーを用いて単一細胞をスクリーニングするために10x Genomicsのバーコード技術を使用することにより、特定の遺伝子と疾患との関係をよりよく理解するための強力なゲノミクスに基づく実験を開発するために協力します。

染色体不安定性や遺伝子シグネチャーに関する調査など、ゲノミクス市場における技術の進歩は、膨大なデータベースからのユニークなサンプルを利用することで、臨床応用可能性に関する包括的な洞察を与えます。例えば、2022年6月、ケンブリッジ大学と国立がん研究センター(スペイン、マドリード)の研究者は、染色体の不安定性とコピー数の変化を追跡し、自然界で致命的ながんにおけるこのようなゲノムの変化を促進する内部要因の役割を理解することを推論しました。

遺伝によって引き起こされる疾患は、心血管疾患、糖尿病、がんなど幅広い疾患を引き起こす可能性があります。遺伝性疾患は、個人のゲノム配列の特定の特徴を理解することで、効果的に闘うことができます。例えば、2021年11月、Illumina, Inc.とGenetic Allianceは、iHope遺伝的健康プログラムの立ち上げを共同で宣言し、世界中の遺伝性疾患の生存者に全ゲノム配列決定へのアクセスを容易にするようにしました。

市場は、ゲノム配列に関する研究の進展に対する政府やその他の研究機関からの有利な支援によって積極的に牽引されています。希少疾患、感染症、遺伝性疾患、がんの治療に役立つ成果を導き出すために、ゲノム配列研究のデータ主導型イニシアチブのための資金への注目が高まっています。例えば、2022年8月、医療機器イノベーションコンソーシアムは、NGSに基づくがん診断の強化を支援するため、臨床的に関連するサンプルと公開ゲノムデータセットを開発する体細胞参照サンプルイニシアチブを開始しました。同様に、2022年9月、疾病管理センター(CDC)は、バイオインフォマティクス、病原体ゲノム、分子疫学におけるイノベーションと能力を育成するために、病原体ゲノムセンターオブエクセレンス(PGCoE)ネットワークを設立するための5年間の賞の授与を宣言しました。

ゲノミクス市場に影響を与えると予想される最も重要な要因のひとつは、医療界が個別化医療において利用可能なゲノム情報をどの程度、どの程度活用するかです。さらに、シーケンシングのコストが急落していることも、全ゲノムシーケンシングの採用増加を後押ししています。科学者たちは、シーケンシングから生成されたデータを診断学と組み合わせており、個別化治療の強化に有効であることが証明されています。OGLが発表した報告書によると、2021年7月の時点で、英国ではSARS-CoV-2のゲノムシーケンス検査が60万件を超えました。ゲノムシークエンシングは、SARS-CoV-2との闘いにおいて、懸念される変異を迅速に特定し、その拡散方法を解明し、阻止することで役立っています。

ゲノム市場レポートハイライト

- ゲノミクス市場全体の成長は、遺伝性疾患やがんの新規治療薬がゲノミクスに基づく理解に依存するようになってきたことに起因します。

- 機能ゲノミクスは、診断や遺伝子治療への応用需要の高まりにより、2023年には最大の市場シェアを占める。バイオマーカー探索は、疾患や治療研究へのバイオマーカーの応用が増加しているため、予測期間中に最も急成長する分野と予想されます。

- 北米は、主要プレイヤーの存在と、同地域でゲノム研究を推進するための政府や研究機関からの支援の高まりにより、2023年の市場を独占しました。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 市場変数、動向、および範囲

- 市場セグメンテーションと範囲

- 市場系統の見通し

- 親市場の見通し

- 関連/付随市場の見通し

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 業界分析ツール

- SWOT分析;要因別(政治・法律、経済・技術)

- ポーターのファイブフォース分析

- COVID-19感染症の影響分析

第4章 ゲノミクス市場:用途および技術ビジネス分析

- ゲノミクス市場:用途および技術の市場シェア分析

- 用途および技術別

- 機能的ゲノミクス

- エピゲノミクス

- 経路解析

- バイオマーカーの発見

- その他

第5章 ゲノミクス市場:成果物ビジネス分析

- ゲノミクス市場:成果物市場シェア分析

- 成果物別

- 製品

- サービス

第6章 ゲノミクス市場:最終用途ビジネス分析

- ゲノミクス市場:最終用途市場シェア分析

- 最終用途別

- 臨床調査

- 学術機関および政府機関

- 病院とクリニック

- 製薬およびバイオテクノロジー企業

- その他

第7章 ゲノミクス市場:地域ビジネス分析

- 地域別のゲノミクス市場シェア、2022年および2030年

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

第8章 競合情勢

- 財務実績

- 参入企業

- マーケットリーダー

- 参入企業の概要

- Agilent Technologies

- Bio-Rad Laboratories, Inc

- BGI Genomics

- Color Genomics, Inc

- Danaher Corporation

- Eppendorf AG

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd.

- GE Healthcare

- Illumina, Inc.

- Myriad Genetics, Inc

- Oxford Nanopore Technologies

- Pacific Biosciences of California, Inc

- QIAGEN NV

- Quest Diagnostics Incorporated

- Thermo Fisher Scientific, Inc

- 23andMe, Inc

- 戦略マッピング

- 拡大

- 取得

- コラボレーション

- 製品/サービスの開始

- パートナーシップ

- その他

List of Tables

- Table 1 List of secondary sources

- Table 2 List of abbreviations

- Table 3 Global genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 4 Global genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 5 Global genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 6 Global genomics market, by region, 2018 - 2030 (USD Million)

- Table 7 North America genomics market, by country, 2018 - 2030 (USD Million)

- Table 8 North America genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 9 North America genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 10 North America genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 11 U.S. genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 12 U.S. genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 13 U.S. genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 14 Canada genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 15 Canada genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 16 Canada genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 17 Europe genomics market, by country, 2018 - 2030 (USD Million)

- Table 18 Europe genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 19 Europe genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 20 Europe genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 21 UK genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 22 UK genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 23 UK genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 24 Germany genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 25 Germany genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 26 Germany genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 27 France genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 28 France genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 29 France genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 30 Italy genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 31 Italy genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 32 Italy genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 33 Spain genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 34 Spain genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 35 Spain genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 36 Denmark genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 37 Denmark genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 38 Denmark genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 39 Sweden genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 40 Sweden genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 41 Sweden genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 42 Norway genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 43 Norway genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 44 Norway genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 45 Asia Pacific genomics market, by country, 2018 - 2030 (USD Million)

- Table 46 Asia Pacific genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 47 Asia Pacific genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 48 Asia Pacific genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 49 Japan genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 50 Japan genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 51 Japan genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 52 China genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 53 China genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 54 China genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 55 India genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 56 India genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 57 India genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 58 Australia genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 59 Australia genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 60 Australia genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 61 Thailand genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 62 Thailand genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 63 Thailand genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 64 South Korea genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 65 South Korea genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 66 South Korea genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 67 Latin America genomics market, by country, 2018 - 2030 (USD Million)

- Table 68 Latin America genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 69 Latin America genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 70 Latin America genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 71 Brazil genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 72 Brazil genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 73 Brazil genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 74 Mexico genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 75 Mexico genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 76 Mexico genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 77 Argentina genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 78 Argentina genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 79 Argentina genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 80 Middle East & Africa genomics market, by country, 2018 - 2030 (USD Million)

- Table 81 Middle East & Africa genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 82 Middle East & Africa genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 83 Middle East & Africa genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 84 South Africa genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 85 South Africa genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 86 South Africa genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 87 Saudi Arabia genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 88 Saudi Arabia genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 89 Saudi Arabia genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 90 UAE genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 91 UAE genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 92 UAE genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 93 Kuwait genomics market, by technology & application, 2018 - 2030 (USD Million)

- Table 94 Kuwait genomics market, by deliverables, 2018 - 2030 (USD Million)

- Table 95 Kuwait genomics market, by End-use, 2018 - 2030 (USD Million)

- Table 96 Participant's overview

- Table 97 Financial performance

- Table 98 Key companies undergoing expansions

- Table 99 Key companies undergoing acquisitions

- Table 100 Key companies undergoing collaborations

- Table 101 Key companies launching new products/services

- Table 102 Key companies undertaking other strategies

List of Figures

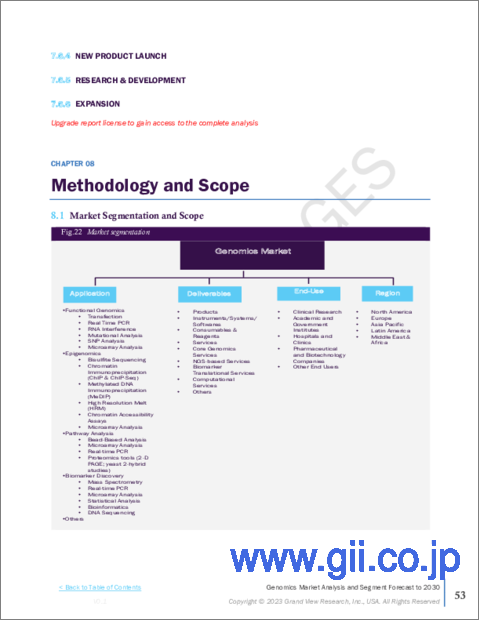

- Fig. 1 Genomics market segmentation

- Fig. 2 Market research process

- Fig. 3 Data triangulation techniques

- Fig. 4 Primary research pattern

- Fig. 5 Market research approaches

- Fig. 6 Value-chain-based sizing & forecasting

- Fig. 7 QFD modeling for market share assessment

- Fig. 8 Market formulation & validation

- Fig. 9 Market snapshot

- Fig. 10 Segment snapshot

- Fig. 11 Competitive landscape snapshot

- Fig. 12 Parent market outlook

- Fig. 13 Related/ancillary market outlook

- Fig. 14 Genomics - Industry value chain analysis

- Fig. 15 Genomics market driver analysis

- Fig. 16 Genomics market restraint analysis

- Fig. 17 Genomics market: Porter's analysis

- Fig. 18 Genomics market: application & technology outlook and key takeaways

- Fig. 19 Genomics market: Application & technology market share analysis, 2022 - 2030

- Fig. 20 Global sequencing by Functional Genomics market, 2018 - 2030 (USD Million)

- Fig. 21 Global sequencing by Real-time PCR market, 2018 - 2030 (USD Million)

- Fig. 22 Global sequencing by Transfection market, 2018 - 2030 (USD Million)

- Fig. 23 Global sequencing by SNP analysis market, 2018 - 2030 (USD Million)

- Fig. 24 Global sequencing by Mutational analysis market, 2018 - 2030 (USD Million)

- Fig. 25 Global sequencing by Microarray analysis market, 2018 - 2030 (USD Million)

- Fig. 26 Global sequencing by RNA interference market, 2018 - 2030 (USD Million)

- Fig. 27 Global sequencing by Epigenomics market, 2018 - 2030 (USD Million)

- Fig. 28 Global sequencing by Bisulfite sequencing market, 2018 - 2030 (USD Million)

- Fig. 29 Global sequencing by Microarray analysis market, 2018 - 2030 (USD Million)

- Fig. 30 Global sequencing by Chromatin immunoprecipitation (ChIP & ChIP-Seq) market, 2018 - 2030 (USD Million)

- Fig. 31 Global sequencing by Methylated DNA immunoprecipitation (MeDIP) market, 2018 - 2030 (USD Million)

- Fig. 32 Global sequencing by High resolution melt (HRM) market, 2018 - 2030 (USD Million)

- Fig. 33 Global sequencing by Chromatin accessibility assays market, 2018 - 2030 (USD Million)

- Fig. 34 Global sequencing by Pathway Analysis market, 2018 - 2030 (USD Million)

- Fig. 35 Global sequencing by Microarray analysis market, 2018 - 2030 (USD Million)

- Fig. 36 Global sequencing by Bead-based analysis market, 2018 - 2030 (USD Million)

- Fig. 37 Global sequencing by Proteomics tools (2-D PAGE; yeast 2-hybrid studies) market, 2018 - 2030 (USD Million)

- Fig. 38 Global sequencing by Real-time PCR market, 2018 - 2030 (USD Million)

- Fig. 39 Global sequencing by Biomarker Discovery market, 2018 - 2030 (USD Million)

- Fig. 40 Global sequencing by DNA sequencing market, 2018 - 2030 (USD Million)

- Fig. 41 Global sequencing by Microarray analysis market, 2018 - 2030 (USD Million)

- Fig. 42 Global sequencing by Real-time PCR market, 2018 - 2030 (USD Million)

- Fig. 43 Global sequencing by Mass spectrometry market, 2018 - 2030 (USD Million)

- Fig. 44 Global sequencing by Statistical analysis market, 2018 - 2030 (USD Million)

- Fig. 45 Global sequencing by Bioinformatics market, 2018 - 2030 (USD Million)

- Fig. 46 Global sequencing by Products market, 2018 - 2030 (USD Million)

- Fig. 47 Global sequencing by Services market, 2018 - 2030 (USD Million)

- Fig. 48 Global sequencing by Instruments/Systems/Softwares market, 2018 - 2030 (USD Million)

- Fig. 49 Global sequencing by Consumables & Reagents market, 2018 - 2030 (USD Million)

- Fig. 50 Global sequencing by NGS-based Services market, 2018 - 2030 (USD Million)

- Fig. 51 Global sequencing by Core Genomics Services market, 2018 - 2030 (USD Million)

- Fig. 52 Global sequencing by Biomarker Translation Services market, 2018 - 2030 (USD Million)

- Fig. 53 Global sequencing by Computational Services market, 2018 - 2030 (USD Million)

- Fig. 54 Global sequencing by Others market, 2018 - 2030 (USD Million)

- Fig. 55 Global sequencing by Pharmaceutical and Biotechnology Companies market, 2018 - 2030 (USD Million)

- Fig. 56 Global sequencing by Hospitals and Clinics market, 2018 - 2030 (USD Million)

- Fig. 57 Global sequencing by Academic and Government Institutes market, 2018 - 2030 (USD Million)

- Fig. 58 Global sequencing by Clinical Research market, 2018 - 2030 (USD Million)

- Fig. 59 Global sequencing by Other End-uses market, 2018 - 2030 (USD Million)

- Fig. 60 Regional marketplace: Key takeaways

- Fig. 61 Regional marketplace: Key takeaways

- Fig. 62 North America genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 63 U.S. key country dynamics

- Fig. 64 U.S. genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 65 Canada key country dynamics

- Fig. 66 Canada genomics market, 2018 - 2030 (USD Million)

- Fig. 67 Europe genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 68 UK key country dynamics

- Fig. 69 UK genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 70 Germany key country dynamics

- Fig. 71 Germany genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 72 France key country dynamics

- Fig. 73 France genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 74 Italy key country dynamics

- Fig. 75 Italy genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 76 Spain key country dynamics

- Fig. 77 Spain genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 78 Denmark key country dynamics

- Fig. 79 Denmark genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 80 Sweden key country dynamics

- Fig. 81 Sweden genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 82 Norway key country dynamics

- Fig. 83 Norway genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 84 Asia-Pacific genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 85 Japan key country dynamics

- Fig. 86 Japan genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 87 China key country dynamics

- Fig. 88 China genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 89 India key country dynamics

- Fig. 90 India genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 91 Australia key country dynamics

- Fig. 92 Australia genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 93 Thailand key country dynamics

- Fig. 94 Thailand genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 95 South Korea key country dynamics

- Fig. 96 South Korea genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 97 Latin America genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 98 Brazil key country dynamics

- Fig. 99 Brazil genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 100 Mexico key country dynamics

- Fig. 101 Mexico genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 102 Argentina key country dynamics

- Fig. 103 Argentina genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 104 MEA genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 105 South Africa key country dynamics

- Fig. 106 South Africa genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 107 Saudi Arabia key country dynamics

- Fig. 108 Saudi Arabia genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 109 UAE key country dynamics

- Fig. 110 UAE genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 111 Kuwait key country dynamics

- Fig. 112 Kuwait genomics market estimates and forecast, 2018 - 2030 (USD Million)

- Fig. 113 Key company categorization

- Fig. 114 Company market positioning

- Fig. 115 Market participant categorization

- Fig. 116 Strategy framework

Genomics Market Growth & Trends:

The global genomics market size is expected to reach USD 94.86 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to register a CAGR of 16.5% in the forecast period owing to the increasing demand for novel therapeutic and research applications in genomics. Moreover, it is extensively used for a wide variety of applications, such as pharmacogenomics, and metagenomics. The emerging applications of genomics are braced up by industrial collaborations and expansions. For instance, in June 2020, Merck & Co., Inc., and 10x Genomics, Inc., collaborates to develop powerful genomics-based experiments to better understand the relationship between specific genes and disease by using 10x Genomics' barcode technology to screen single cells using CRISPR libraries.

Technological advancements in the genomics market such as research on chromosomal instability and gene signatures utilizing unique samples from huge databases give out comprehensive insights into their clinical applicability. For instance, in June 2022, researchers from Cambridge University and the National Cancer Research Center (at Madrid, Spain) deduced to track chromosomal instability and copy number variations to understand the role of internal factors in driving such genomic alterations in cancers that are fatal in nature.

Diseases caused by genetic inheritance can cause a wide range of disease conditions such as cardiovascular, diabetes, and cancer conditions. Genetic disorders can be effectively combatted by understanding specific characteristics of an individual's genome sequence. For instance, in November 2021, Illumina, Inc. and the Genetic Alliance, collectively declared the launch of the iHope genetic health program so as to facilitate access to whole-genome sequencing to survivors of genetic disorders across the globeDee with one-third of the efforts to support subjects in Africa.

The market is positively driven by the lucrative support from the government and other research organizations for advancement in research on the genome sequence. There has been an increasing focus on funds for data-driven initiatives on genome sequence research to derive outcomes that are helpful for the treatment of rare diseases, infectious diseases, inherited disorders, and cancers. For instance, in August 2022, Medical Device Innovation Consortium launched its somatic reference samples initiative to develop clinically relevant samples and public genomic datasets to aid the enhancement of NGS-based cancer diagnostics. Similarly, in September 2022, the Centres for Disease Control (CDC) declared 5-year awards to establish the pathogen genomics centers of excellence (PGCoE) network to foster innovation and capabilities in bioinformatics, pathogen genomics, and molecular epidemiology.

One of the most important factors anticipated to impact the genomics market is how much and to what extent the medical community will make use of available genomic information in personalized medicine. Furthermore, plummeting costs of sequencing support an increase in the adoption of whole genome sequencing. Scientists are combining the data generated from sequencing with diagnostics, which has proven effective in enhancing the personalized treatment landscape. According to a report published by OGL, as of July 2021, the UK exceeded 600,000 SARS-CoV-2 genomically sequenced tests. Genomic sequencing has been helpful in the fight against SARS-CoV-2 by quickly identifying variations that are of concern, elucidating how they spread, and halting them.

Genomics Market Report Highlights:

- The overall growth of the genomics market is attributed to the rising dependence of novel therapeutics for genetic disorders and cancers on genomics-based understanding

- Functional genomics held the largest market share in the year 2023, owing to the demand for rising applications in diagnostics and gene therapy. Biomarker discovery is anticipated to be the fastest-growing segment in the forecast period due to rising applications of biomarkers in disease and therapeutics research

- North America dominated the market in 2023 due to the presence of key players and rising support from the government and research institutes to advance the research on Genomics in the region

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Market Definitions

- 1.2.1. Application & Technology

- 1.2.2. Deliverables

- 1.2.3. End use

- 1.3. Information analysis

- 1.4. Market formulation & data visualization

- 1.5. Data validation & publishing

- 1.6. Information Procurement

- 1.6.1. Primary Research

- 1.7. Information or Data Analysis

- 1.8. Market Formulation & Validation

- 1.9. Market Model

- 1.10. Objectives

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

- 3.1. Market Segmentation and Scope

- 3.2. Market Lineage Outlook

- 3.2.1. Parent Market Outlook

- 3.2.2. Related/Ancillary Market Outlook

- 3.3. Market Dynamics

- 3.3.1. Market Driver Analysis

- 3.3.1.1. Growing integration of genomics data into clinical workflows

- 3.3.1.1.1. More targeted and personalized healthcare

- 3.3.1.1.2. Growth of newborn genetic screening programs

- 3.3.1.1.3. Advancements in noninvasive cancer screening

- 3.3.1.1.4. Military genomics

- 3.3.1.2. Technological advances to facilitate genomic R&D

- 3.3.1.2.1. Emergence of advanced genome editing techniques

- 3.3.1.2.2. Integration of new data streams

- 3.3.1.2.3. RNA biology

- 3.3.1.2.4. Single-cell biology

- 3.3.1.3. Rising adoption of DIRECT-TO-CONSUMER genomics

- 3.3.1.4. Success of genetic tools in agrigenomics

- 3.3.1.5. Increasing participation of different companies

- 3.3.1.6. Increase in government role and funding in genomics

- 3.3.2. Market Restraint Analysis

- 3.3.2.1. Issues regarding intellectual property protection, data management, and public policies

- 3.3.2.2. Dearth of Public databases and personnel knowledge on machine learning algorithms

- 3.3.1. Market Driver Analysis

- 3.4. Industry Analysis Tools

- 3.4.1. SWOT Analysis; By Factor (Political & Legal, Economic And Technological)

- 3.4.2. Porter's Five Forces Analysis

- 3.5. COVID-19 Impact Analysis

Chapter 4. Genomics Market: Application & Technology Business Analysis

- 4.1. Genomics Market: Application & Technology Market Share Analysis

- 4.2. Genomics Market Estimates & Forecast, By Application & Technology (USD Million)

- 4.3. Functional Genomics

- 4.3.1. Global Functional Genomics Market, 2018 - 2030 (USD Million)

- 4.3.2. Transfection

- 4.3.2.1. Global Transfection Market, 2018 - 2030 (USD Million)

- 4.3.3. Real-Time PCR

- 4.3.3.1. Global Real-Time PCR Market, 2018 - 2030 (USD Million)

- 4.3.4. RNA Interference

- 4.3.4.1. Global RNA Interference Market, 2018 - 2030 (USD Million)

- 4.3.5. Mutational Analysis

- 4.3.5.1. Global Mutational Analysis Market, 2018 - 2030 (USD Million)

- 4.3.6. SNP Analysis

- 4.3.6.1. Global SNP Analysis Market, 2018 - 2030 (USD Million)

- 4.3.7. Microarray Analysis

- 4.3.7.1. Global Microarray Analysis Market, 2018 - 2030 (USD Million)

- 4.4. Epigenomics

- 4.4.1. Global Epigenomics Market, 2018 - 2030 (USD Million)

- 4.4.2. Bisulfite Sequencing

- 4.4.2.1. Global Bisulfite Sequencing Market, 2018 - 2030 (USD Million)

- 4.4.3. Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- 4.4.3.1. Global Chromatin Immunoprecipitation (ChIP & ChIP-Seq) Market, 2018 - 2030 (USD Million)

- 4.4.4. Methylated DNA Immunoprecipitation (MeDIP)

- 4.4.4.1. Global Methylated DNA Immunoprecipitation (MeDIP) Market, 2018 - 2030 (USD Million)

- 4.4.5. High-Resolution Melt (HRM)

- 4.4.5.1. Global High-Resolution Melt (HRM) Market, 2018 - 2030 (USD Million)

- 4.4.6. Chromatin Accessibility Assays

- 4.4.6.1. Global Chromatin Accessibility Assays Market, 2018 - 2030 (USD Million)

- 4.4.7. Microarray Analysis

- 4.4.7.1. Global Microarray Analysis Market, 2018 - 2030 (USD Million)

- 4.5. Pathway Analysis

- 4.5.1. Global Pathway Analysis Market, 2018 - 2030 (USD Million)

- 4.5.2. Bead-Based Analysis

- 4.5.2.1. Global Bead-Based Analysis Market, 2018 - 2030 (USD Million)

- 4.5.3. Microarray Analysis

- 4.5.3.1. Global Microarray Analysis Market, 2018 - 2030 (USD Million)

- 4.5.4. Real-time PCR

- 4.5.4.1. Global Real-time PCR Market, 2018 - 2030 (USD Million)

- 4.5.5. Proteomics Tools (2-D PAGE; yeast 2-hybrid studies)

- 4.5.5.1. Global Proteomics Tools (2-D PAGE; yeast 2-hybrid studies) Market, 2018 - 2030 (USD Million)

- 4.6. Biomarker Discovery

- 4.6.1. Global Biomarker Discovery Market, 2018 - 2030 (USD Million)

- 4.6.2. Mass Spectrometry

- 4.6.2.1. Global Mass Spectrometry Market, 2018 - 2030 (USD Million)

- 4.6.3. Real-time PCR

- 4.6.3.1. Global Real-time PCR Market, 2018 - 2030 (USD Million)

- 4.6.4. Microarray Analysis

- 4.6.4.1. Global Microarray Analysis Market, 2018 - 2030 (USD Million)

- 4.6.5. Statistical Analysis

- 4.6.5.1. Global Statistical Analysis Market, 2018 - 2030 (USD Million)

- 4.6.6. Bioinformatics

- 4.6.6.1. Global Bioinformatics Market, 2018 - 2030 (USD Million)

- 4.6.7. DNA Sequencing

- 4.6.7.1. Global DNA Sequencing Market, 2018 - 2030 (USD Million)

- 4.7. Others

- 4.7.1. Global Others Market, 2018 - 2030 (USD Million)

Chapter 5. Genomics Market: Deliverables Business Analysis

- 5.1. Genomics Market: Deliverables Market Share Analysis

- 5.2. Genomics Market Estimates & Forecast, By Deliverables (USD Million)

- 5.3. Products

- 5.3.1. Global Products Market, 2018 - 2030 (USD Million)

- 5.3.2. Instruments/Systems/Software

- 5.3.2.1. Global Instruments/Systems/Software Market, 2018 - 2030 (USD Million)

- 5.3.3. Consumables & Reagents

- 5.3.3.1. Global Consumables & Reagents Market, 2018 - 2030 (USD Million)

- 5.4. Services

- 5.4.1. Global Services Market, 2018 - 2030 (USD Million)

- 5.4.2. NGS-based Services

- 5.4.2.1. Global NGS-based Services Market, 2018 - 2030 (USD Million)

- 5.4.3. Core Genomics Services

- 5.4.3.1. Global Core Genomics Services Market, 2018 - 2030 (USD Million)

- 5.4.4. Biomarker Translation Services

- 5.4.4.1. Global Biomarker Translation Services Market, 2018 - 2030 (USD Million)

- 5.4.5. Computational Services

- 5.4.5.1. Global Computational Services Market, 2018 - 2030 (USD Million)

- 5.4.6. Others

- 5.4.6.1. Global Others Market, 2018 - 2030 (USD Million)

Chapter 6. Genomics Market: End-use business Analysis

- 6.1. Genomics Market: End-use Market Share Analysis

- 6.2. Genomics Market Estimates & Forecast, By End-use (USD Million)

- 6.3. Clinical Research

- 6.3.1. Global Clinical Research Market, 2018 - 2030 (USD Million)

- 6.4. Academic & Government Institutes

- 6.4.1. Global Academic & Government Institutes Market, 2018 - 2030 (USD Million)

- 6.5. Hospitals & Clinics

- 6.5.1. Global Hospitals & Clinics Market, 2018 - 2030 (USD Million)

- 6.6. Pharmaceutical & Biotechnology Companies

- 6.6.1. Global Pharmaceutical & Biotechnology Companies Market, 2018 - 2030 (USD Million)

- 6.7. Others

- 6.7.1. Global Others Market, 2018 - 2030 (USD Million)

Chapter 7. Genomics Market: Regional Business Analysis

- 7.1. Genomics Market Share By Region, 2022 & 2030

- 7.2. North America

- 7.2.1. North America Genomics Market, 2018 - 2030 (USD Million)

- 7.2.2. U.S.

- 7.2.2.1. Key Country Dynamics

- 7.2.2.2. Competitive Scenario

- 7.2.2.3. Regulatory Framework

- 7.2.2.4. U.S. Genomics Market, 2018 - 2030 (USD Million)

- 7.2.3. Canada

- 7.2.3.1. Key Country Dynamics

- 7.2.3.2. Competitive Scenario

- 7.2.3.3. Regulatory Framework

- 7.2.3.4. Canada Genomics Market, 2018 - 2030 (USD Million)

- 7.3. Europe

- 7.3.1. Europe Genomics Market, 2018 - 2030 (USD Million)

- 7.3.2. UK

- 7.3.2.1. Key Country Dynamics

- 7.3.2.2. Competitive Scenario

- 7.3.2.3. Regulatory Framework

- 7.3.2.4. UK Genomics Market, 2018 - 2030 (USD Million)

- 7.3.3. Germany

- 7.3.3.1. Key Country Dynamics

- 7.3.3.2. Competitive Scenario

- 7.3.3.3. Regulatory Framework

- 7.3.3.4. Germany Genomics Market, 2018 - 2030 (USD Million)

- 7.3.4. France

- 7.3.4.1. Key Country Dynamics

- 7.3.4.2. Competitive Scenario

- 7.3.4.3. Regulatory Framework

- 7.3.4.4. France Genomics Market, 2018 - 2030 (USD Million)

- 7.3.5. Italy

- 7.3.5.1. Key Country Dynamics

- 7.3.5.2. Competitive Scenario

- 7.3.5.3. Regulatory Framework

- 7.3.5.4. Italy Genomics Market, 2018 - 2030 (USD Million)

- 7.3.6. Spain

- 7.3.6.1. Key Country Dynamics

- 7.3.6.2. Competitive Scenario

- 7.3.6.3. Regulatory Framework

- 7.3.6.4. Spain Genomics Market, 2018 - 2030 (USD Million)

- 7.3.7. Denmark

- 7.3.7.1. Key Country Dynamics

- 7.3.7.2. Competitive Scenario

- 7.3.7.3. Regulatory Framework

- 7.3.7.4. Denmark Genomics Market, 2018 - 2030 (USD Million)

- 7.3.8. Sweden

- 7.3.8.1. Key Country Dynamics

- 7.3.8.2. Competitive Scenario

- 7.3.8.3. Regulatory Framework

- 7.3.8.4. Sweden Genomics Market, 2018 - 2030 (USD Million)

- 7.3.9. Norway

- 7.3.9.1. Key Country Dynamics

- 7.3.9.2. Competitive Scenario

- 7.3.9.3. Regulatory Framework

- 7.3.9.4. Norway Genomics Market, 2018 - 2030 (USD Million)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific Genomics Market, 2018 - 2030 (USD Million)

- 7.4.2. Japan

- 7.4.2.1. Key Country Dynamics

- 7.4.2.2. Competitive Scenario

- 7.4.2.3. Regulatory Framework

- 7.4.2.4. Japan Genomics Market, 2018 - 2030 (USD Million)

- 7.4.3. China

- 7.4.3.1. Key Country Dynamics

- 7.4.3.2. Competitive Scenario

- 7.4.3.3. Regulatory Framework

- 7.4.3.4. China Genomics Market, 2018 - 2030 (USD Million)

- 7.4.4. India

- 7.4.4.1. Key Country Dynamics

- 7.4.4.2. Competitive Scenario

- 7.4.4.3. Regulatory Framework

- 7.4.4.4. India Genomics Market, 2018 - 2030 (USD Million)

- 7.4.5. Australia

- 7.4.5.1. Key Country Dynamics

- 7.4.5.2. Competitive Scenario

- 7.4.5.3. Regulatory Framework

- 7.4.5.4. Australia Genomics Market, 2018 - 2030 (USD Million)

- 7.4.6. Thailand

- 7.4.6.1. Key Country Dynamics

- 7.4.6.2. Competitive Scenario

- 7.4.6.3. Regulatory Framework

- 7.4.6.4. Thailand Genomics Market, 2018 - 2030 (USD Million)

- 7.4.7. South Korea

- 7.4.7.1. Key Country Dynamics

- 7.4.7.2. Competitive Scenario

- 7.4.7.3. Regulatory Framework

- 7.4.7.4. South Korea Genomics Market, 2018 - 2030 (USD Million)

- 7.5. Latin America

- 7.5.1. Latin America Genomics Market, 2018 - 2030 (USD Million)

- 7.5.2. Brazil

- 7.5.2.1. Key Country Dynamics

- 7.5.2.2. Competitive Scenario

- 7.5.2.3. Regulatory Framework

- 7.5.2.4. Brazil Genomics Market, 2018 - 2030 (USD Million)

- 7.5.3. Mexico

- 7.5.3.1. Key Country Dynamics

- 7.5.3.2. Competitive Scenario

- 7.5.3.3. Regulatory Framework

- 7.5.3.4. Mexico Genomics Market, 2018 - 2030 (USD Million)

- 7.5.4. Argentina

- 7.5.4.1. Key Country Dynamics

- 7.5.4.2. Competitive Scenario

- 7.5.4.3. Regulatory Framework

- 7.5.4.4. Argentina Genomics Market, 2018 - 2030 (USD Million)

- 7.6. MEA

- 7.6.1. MEA Genomics Market, 2018 - 2030 (USD Million)

- 7.6.2. South Africa

- 7.6.2.1. Key Country Dynamics

- 7.6.2.2. Competitive Scenario

- 7.6.2.3. Regulatory Framework

- 7.6.2.4. South Africa Genomics Market, 2018 - 2030 (USD Million)

- 7.6.3. Saudi Arabia

- 7.6.3.1. Key Country Dynamics

- 7.6.3.2. Competitive Scenario

- 7.6.3.3. Regulatory Framework

- 7.6.3.4. Saudi Arabia Genomics Market, 2018 - 2030 (USD Million)

- 7.6.4. UAE

- 7.6.4.1. Key Country Dynamics

- 7.6.4.2. Competitive Scenario

- 7.6.4.3. Regulatory Framework

- 7.6.4.4. UAE Genomics Market, 2018 - 2030 (USD Million)

- 7.6.5. Kuwait

- 7.6.5.1. Key Country Dynamics

- 7.6.5.2. Competitive Scenario

- 7.6.5.3. Regulatory Framework

- 7.6.5.4. Kuwait Genomics Market, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

- 8.1. Financial Performance

- 8.2. Participant Categorization

- 8.2.1. Market Leaders

- 8.2.1.1. Market share analysis, 2023

- 8.2.1. Market Leaders

- 8.3. Participant's Overview

- 8.3.1. Agilent Technologies

- 8.3.1.1. Overview

- 8.3.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.1.3. Technology Benchmarking

- 8.3.1.4. Strategic Initiatives

- 8.3.2. Bio-Rad Laboratories, Inc

- 8.3.2.1. Overview

- 8.3.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.2.3. Technology Benchmarking

- 8.3.2.4. Strategic Initiatives

- 8.3.3. BGI Genomics

- 8.3.3.1. Overview

- 8.3.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.3.3. Technology Benchmarking

- 8.3.3.4. Strategic Initiatives

- 8.3.4. Color Genomics, Inc

- 8.3.4.1. Overview

- 8.3.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.4.3. Technology Benchmarking

- 8.3.4.4. Strategic Initiatives

- 8.3.5. Danaher Corporation

- 8.3.5.1. Overview

- 8.3.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.5.3. Technology Benchmarking

- 8.3.5.4. Strategic Initiatives

- 8.3.6. Eppendorf AG

- 8.3.6.1. Overview

- 8.3.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.6.3. Technology Benchmarking

- 8.3.6.4. Strategic Initiatives

- 8.3.7. Eurofins Scientific

- 8.3.7.1. Overview

- 8.3.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.7.3. Technology Benchmarking

- 8.3.7.4. Strategic Initiatives

- 8.3.8. F. Hoffmann-La Roche Ltd.

- 8.3.8.1. Overview

- 8.3.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.8.3. Technology Benchmarking

- 8.3.8.4. Strategic Initiatives

- 8.3.9. GE Healthcare

- 8.3.9.1. Overview

- 8.3.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.9.3. Technology Benchmarking

- 8.3.9.4. Strategic Initiatives

- 8.3.10. Illumina, Inc.

- 8.3.10.1. Overview

- 8.3.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.10.3. Technology Benchmarking

- 8.3.10.4. Strategic Initiatives

- 8.3.11. Myriad Genetics, Inc

- 8.3.11.1. Overview

- 8.3.11.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.11.3. Technology Benchmarking

- 8.3.11.4. Strategic Initiatives

- 8.3.12. Oxford Nanopore Technologies

- 8.3.12.1. Overview

- 8.3.12.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.12.3. Technology Benchmarking

- 8.3.12.4. Strategic Initiatives

- 8.3.13. Pacific Biosciences of California, Inc

- 8.3.13.1. Overview

- 8.3.13.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.13.3. Technology Benchmarking

- 8.3.13.4. Strategic Initiatives

- 8.3.14. QIAGEN N.V.

- 8.3.14.1. Overview

- 8.3.14.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.14.3. Technology Benchmarking

- 8.3.14.4. Strategic Initiatives

- 8.3.15. Quest Diagnostics Incorporated

- 8.3.15.1. Overview

- 8.3.15.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.15.3. Technology Benchmarking

- 8.3.15.4. Strategic Initiatives

- 8.3.16. Thermo Fisher Scientific, Inc

- 8.3.16.1. Overview

- 8.3.16.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.16.3. Technology Benchmarking

- 8.3.16.4. Strategic Initiatives

- 8.3.17. 23andMe, Inc

- 8.3.17.1. Overview

- 8.3.17.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

- 8.3.17.3. Technology Benchmarking

- 8.3.17.4. Strategic Initiatives

- 8.3.1. Agilent Technologies

- 8.4. Strategy Mapping

- 8.4.1. Expansion

- 8.4.2. Acquisition

- 8.4.3. Collaborations

- 8.4.4. Product/service launch

- 8.4.5. Partnerships

- 8.4.6. Others