|

|

市場調査レポート

商品コード

1268631

防水膜の市場規模、シェア、動向分析レポート:製品別(液状塗布、シート(PVC、EPDM))、用途別(屋根、建物)、地域別、セグメント予測、2023~2030年Waterproofing Membranes Market Size, Share & Trends Analysis Report By Product (Liquid Applied, Sheet (PVC, EPDM)), By Application (Roofing, Building), By Region, And Segment Forecasts, 2023 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 防水膜の市場規模、シェア、動向分析レポート:製品別(液状塗布、シート(PVC、EPDM))、用途別(屋根、建物)、地域別、セグメント予測、2023~2030年 |

|

出版日: 2023年04月06日

発行: Grand View Research

ページ情報: 英文 100 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

防水膜の市場成長と動向:

Grand View Research, Inc.の新しいレポートによると、世界の防水膜の市場規模は2030年までに401億5,000万米ドルに達するようです。

2023年から2030年までのCAGRは7.1%で拡大すると予想されています。インフラや建設活動の進展と、廃水や水管理の需要増が相まって、市場を牽引すると予想されます。バイオメンブレンは、グリーンビルディング建設における製品需要の増加により、今後高い採用傾向が見込まれます。また、古い建物を新しい建物に建て替えるための政府の支援は、建設業界に新たな成長の道を開き、ひいては市場に成長をもたらしています。

市場は、原材料のサプライチェーンのダイナミズムに大きく依存しています。防水膜の製造には、セメント系、瀝青系、ポリウレタン系などあらゆるタイプの製品が使用されていますが、セメント系液体塗布膜と瀝青系シート膜が、市場で最も一般的に使用されている防水膜です。この業界では、いくつかの成熟した企業が大きな市場シェアを占めています。しかし、アジア太平洋地域の多数の小規模・ローカルメーカーとの競争が激化し、市場競争は激化すると予想されます。市場関係者は、顧客に環境に優しいイメージを与えるため、持続可能な原材料を使用することに重きを置いています。

防水メンブレン市場レポートハイライト

- 液体塗布メンブレン製品セグメントは、あらゆる外面用途に対応する熱反射特性により、市場をリードし、2022年の世界売上高の63.9%以上のシェアを占める。

- ポリウレタン液体塗布防水膜セグメントは、シームレスな仕上げと簡単で迅速な設置手順により、予測期間中に収益面で最も速いCAGR(9.1%)を記録すると予想されます。

- 屋根材用途は、気候条件の変化や住宅、商業施設、工業施設での雨漏りにさらされる機会が多いため、2022年には31.8%の最大収益シェアを占めています。

- アジア太平洋は、急速な工業化と人口増加別住宅および商業建築への投資の増加により、2022年に32.1%の最大の収益シェアを占めました。

- メーカーの大半は、市場での存在感を高めるために、防水膜を製造するための持続可能で腐食性のない原材料を重視するようになりました。また、中国、インド、ブラジルなどの新興国市場では、インフラ整備が進み、建設部門が急成長しており、市場の成長見通しが高まっています。

目次

第1章 調査手法と範囲

- 市場セグメンテーションと範囲

- 市場の定義

- 情報調達

- 購入したデータベース

- GVRの内部データベース

- 二次情報と第三者の視点

- 1次調査

- 情報分析

- データ分析モデル

- 市場の形成とデータの視覚化

- データの検証と公開

第2章 エグゼクティブサマリー

- 市場の見通し

- セグメント別の見通し

- 競合考察

第3章 市場変数、動向、および範囲

- 普及と成長の見通しマッピング

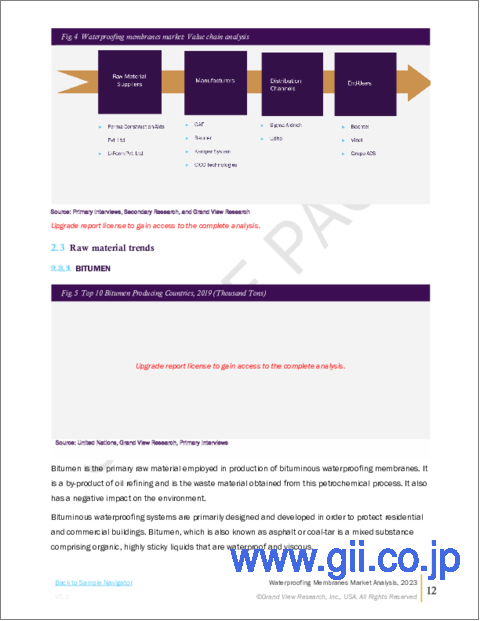

- 業界のバリューチェーン分析

- 主要原材料動向分析

- 原材料の動向

- アスファルト

- ポリプロピレン

- 技術動向

- 防水膜の製造工程

- PVC系防水膜の製造

- ポリウレタン液膜- 技術概要

- αテクノロジー

- 湿気別引き起こされるポリウレタン技術を使用した液体塗布膜

- 速硬化樹脂技術

- 無溶剤・無臭コンクリート表面技術

- 液体冷間塗布膜

- 規制の枠組み

- 市場力学

- 市場促進要因の分析

- 市場抑制要因分析

- 業界の課題

- ビジネス環境ツール分析:防水膜市場

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

- PESTLE分析

- 政治的情勢

- 経済情勢

- 社会的情勢

- テクノロジーの情勢

- 環境情勢

- 法的情勢

- ポーターのファイブフォース分析

- ケーススタディ

第4章 防水膜市場:製品推定・動向分析

- 防水膜市場:物質変動分析、2022年および2030年

- 液体塗布膜

- 市場推計・予測、2018~2030年

- セメント質

- 市場推計・予測、2018~2030年

- 瀝青質

- 市場推計・予測、2018~2030年

- ポリエチレン

- 市場推計・予測、2018~2030年

- アクリル

- 市場推計・予測、2018~2030年

- その他

- 市場推計・予測、2018~2030年

- シート膜

- 市場推計・予測、2018~2030年

- 瀝青質

- 市場推計・予測、2018~2030年

- ポリ塩化ビニル(PVC)

- 市場推計・予測、2018~2030年

- エチレンプロピレンジエンモノマー(EPDM)

- 市場推計・予測、2018~2030年

- その他

- 市場推計・予測、2018~2030年

第5章 防水膜市場:用途推定・動向分析

- 防水膜市場:用途変動分析、2022年および2030年

- 屋根材

- 市場推計・予測、2018~2030年

- 壁

- 市場推計・予測、2018~2030年

- 建築構造物

- 市場推計・予測、2018~2030年

- 埋め立て地と構造物

- 市場推計・予測、2018~2030年

- その他

- 市場推計・予測、2018~2030年

第6章 防水膜市場:地域推定・動向分析

- 地域変動分析と市場シェア、2022年と2030年

- 防水膜市場:地域変動分析、2022年および2030年

- 北米

- 市場推計・予測、2018~2030年

- 製品別、2018~2030年

- 用途別、2018年~2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 市場推計・予測、2018~2030年

- 製品別、2018~2030年

- 用途別、2018年~2030年

- ドイツ

- 英国

- アジア太平洋地域

- 市場推計・予測、2018~2030年

- 製品別、2018~2030年

- 用途別、2018年~2030年

- 中国

- 日本

- 中南米

- 市場推計・予測、2018~2030年

- 製品別、2018~2030年

- 用途別、2018年~2030年

- ブラジル

- 中東とアフリカ

- 市場推計・予測、2018~2030年

- 製品別、2018~2030年

- 用途別、2018年~2030年

第7章 競合情勢

- 主要な世界的プレーヤー、その取り組み、市場への影響

- 競合環境

- ベンダー情勢

- 公開会社

- 企業の市況分析

- SWOT

- 非公開会社

第8章 企業プロファイル

- Sika AG

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- Pidilite Industries Ltd.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- BASF SE

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- Paul Bauder GmbH &Co. KG

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- Kemper System America, Inc.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- Dow Chemical Company

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- DuPont

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- GAF Materials Corporation

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- Fosroc Ltd.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- CICO Technologies Ltd.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- Alchimica Building Chemicals

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- Maris Polymers

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- Saint-Gobain Weber GmbH

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- Isomat SA

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

- Covestro AG.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的取り組み

List of Tables

- 1. Liquid applied waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 2. Cementitious liquid applied waterproofing membranes market volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 3. Bituminous liquid applied waterproofing membranes market volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 4. Polyurethane liquid applied waterproofing membranes market volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 5. Acrylic liquid applied waterproofing membranes market volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 6. Other liquid-applied waterproofing membranes market volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 7. Sheet waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 8. Bituminous sheet waterproofing membranes market volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 9. Polyvinylchloride sheet waterproofing membranes market volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 10. Ethylene propylene diene monomer sheet waterproofing membranes market volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 11. Other sheet waterproofing membranes market volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 12. Waterproofing membranes market revenue and volume, in roofing, 2018 - 2030 (USD Million) (Million Square Meters)

- 13. Waterproofing membranes market revenue and volume, in walls, 2018 - 2030 (USD Million) (Million Square Meters)

- 14. Waterproofing membranes market revenue and volume, in building structures, 2018 - 2030 (USD Million) (Million Square Meters)

- 15. Waterproofing membranes market revenue and volume, in landfills & tunnels, 2018 - 2030 (USD Million) (Million Square Meters)

- 16. Waterproofing membranes market revenue and volume, in other applications, 2018 - 2030 (USD Million) (Million Square Meters)

- 17. North America waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 18. North America waterproofing membranes market revenue by application, 2018 - 2030 (USD Million)

- 19. North America waterproofing membranes market volume by application, 2018 - 2030 (Million Square Meters)

- 20. North America liquid applied waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 21. North America liquid applied waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 22. North America sheet waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 23. Table 23 North America sheet waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 24. North America waterproofing membranes market revenue by end-use, 2018 - 2030 (USD Million)

- 25. North America waterproofing membranes market volume by end-use, 2018 - 2030 (Million Square Meters)

- 26. U.S. waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 27. U.S. waterproofing membranes market revenue by application, 2018 - 2030 (USD Million)

- 28. U.S. waterproofing membranes market volume by application, 2018 - 2030 (Million Square Meters)

- 29. U.S. liquid applied waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 30. U.S. liquid applied waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 31. U.S. sheet waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 32. U.S. sheet waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 33. U.S. waterproofing membranes market revenue by end-use, 2018 - 2030 (USD Million)

- 34. U.S. waterproofing membranes market volume by end-use, 2018 - 2030 (Million Square Meters)

- 35. Europe waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 36. Europe waterproofing membranes market revenue by application, 2018 - 2030 (USD Million)

- 37. Europe waterproofing membranes market volume by application, 2018 - 2030 (Million Square Meters)

- 38. Europe liquid applied waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 39. Europe liquid applied waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 40. Europe sheet waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 41. Europe sheet waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 42. Europe waterproofing membranes market revenue by end-use, 2018 - 2030 (USD Million)

- 43. Europe waterproofing membranes market volume by end-use, 2018 - 2030 (Million Square Meters)

- 44. Germany waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 45. Germany waterproofing membranes market revenue by application, 2018 - 2030 (USD Million)

- 46. Germany waterproofing membranes market volume by application, 2018 - 2030 (Million Square Meters)

- 47. Germany liquid applied waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 48. Germany liquid applied waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 49. Germany sheet waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 50. Germany sheet waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 51. Germany waterproofing membranes market revenue by end-use, 2018 - 2030 (USD Million)

- 52. Germany waterproofing membranes market volume by end-use, 2018 - 2030 (Million Square Meters)

- 53. U.K. waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 54. U.K. waterproofing membranes market revenue by application, 2018 - 2030 (USD Million)

- 55. U.K. waterproofing membranes market volume by application, 2018 - 2030 (Million Square Meters)

- 56. U.K. liquid applied waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 57. U.K. liquid applied waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 58. U.K. sheet waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 59. U.K. sheet waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 60. U.K. waterproofing membranes market revenue by end-use, 2018 - 2030 (USD Million)

- 61. U.K. waterproofing membranes market volume by end-use, 2018 - 2030 (Million Square Meters)

- 62. Asia Pacific waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 63. Asia Pacific waterproofing membranes market revenue by application, 2018 - 2030 (USD Million)

- 64. Asia Pacific waterproofing membranes market volume by application, 2018 - 2030 (Million Square Meters)

- 65. Asia Pacific liquid applied waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 66. Asia Pacific liquid applied waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 67. Asia Pacific sheet waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 68. Asia Pacific sheet waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 69. Asia Pacific waterproofing membranes market revenue by end-use, 2018 - 2030 (USD Million)

- 70. Asia Pacific waterproofing membranes market volume by end-use, 2018 - 2030 (Million Square Meters)

- 71. China waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 72. China waterproofing membranes market revenue by application, 2018 - 2030 (USD Million)

- 73. China waterproofing membranes market volume by application, 2018 - 2030 (Million Square Meters)

- 74. China liquid applied waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 75. China liquid applied waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 76. China sheet waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 77. China sheet waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 78. China waterproofing membranes market revenue by end-use, 2018 - 2030 (USD Million)

- 79. China waterproofing membranes market volume by end-use, 2018 - 2030 (Million Square Meters)

- 80. Japan waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 81. Japan waterproofing membranes market revenue by application, 2018 - 2030 (USD Million)

- 82. Japan waterproofing membranes market volume by application, 2018 - 2030 (Million Square Meters)

- 83. Japan liquid applied waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 84. Japan liquid applied waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 85. Japan sheet waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 86. Japan sheet waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 87. Japan waterproofing membranes market revenue by end-use, 2018 - 2030 (USD Million)

- 88. Japan waterproofing membranes market volume by end-use, 2018 - 2030 (Million Square Meters)

- 89. Central & South America waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 90. Central & South America waterproofing membranes market revenue by application, 2018 - 2030 (USD Million)

- 91. Central & South America waterproofing membranes market volume by application, 2018 - 2030 (Million Square Meters)

- 92. Central & South America liquid applied waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 93. Central & South America liquid applied waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 94. Central & South America sheet waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 95. Central & South America sheet waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 96. Central & South America waterproofing membranes market revenue by end-use, 2018 - 2030 (USD Million)

- 97. Central & South America waterproofing membranes market volume by end-use, 2018 - 2030 (Million Square Meters)

- 98. Brazil waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 99. Brazil waterproofing membranes market revenue by application, 2018 - 2030 (USD Million)

- 100. Brazil waterproofing membranes market volume by application, 2018 - 2030 (Million Square Meters)

- 101. Brazil liquid applied waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 102. Brazil liquid applied waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 103. Brazil sheet waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 104. Brazil sheet waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 105. Brazil waterproofing membranes market revenue by end-use, 2018 - 2030 (USD Million)

- 106. Brazil waterproofing membranes market volume by end-use, 2018 - 2030 (Million Square Meters)

- 107. Middle East & Africa waterproofing membranes market revenue and volume, 2018 - 2030 (USD Million) (Million Square Meters)

- 108. Middle East & Africa waterproofing membranes market revenue by application, 2018 - 2030 (USD Million)

- 109. Middle East & Africa waterproofing membranes market volume by application, 2018 - 2030 (Million Square Meters)

- 110. Middle East & Africa liquid applied waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 111. Middle East & Africa liquid applied waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters

- 112. Middle East & Africa sheet waterproofing membranes market revenue by product, 2018 - 2030 (USD Million)

- 113. Middle East & Africa sheet waterproofing membranes market volume by product, 2018 - 2030 (Million Square Meters)

- 114. Middle East & Africa waterproofing membranes market revenue by end-use,

- 115. Middle East & Africa waterproofing membranes market volume by end-use, 2018 - 2030 (Million Square Meters)

- 116. Vendor Landscape - Waterproofing membranes market)

List of Figures

- 1. Waterproofing Membranes Market

- 2. Information procurement

- 3. Primary research pattern

- 4. Primary research process

- 5. Primary research approaches

- 6. Penetration & Growth Prospect Mapping

- 7. Waterproofing Membranes - Value Chain Analysis

- 8. Top 10 Bitumen Producing Countries, 2022 (Million Tons)

- 9. Global Average Bitumen Price, 2018 - 2030 (USD/Ton)

- 10. Polypropylene Average Price Trend, 2018 - 2030 (USD/Ton)

- 11. Waterproofing Membranes - Market Dynamics

- 12. Market Driver Analysis

- 13. Infrastructure Investment in Asia Pacific, 2018 - 2030 (USD Billion)

- 14. Liquid Waste Management Market by Region, 2020 (USD Million)

- 15. Market Restraint Analysis

- 16. Average Bitumen Price, 2018 - 2030 (USD/Ton)

- 17. Waterproofing membranes market: Product movement analysis, 2022 & 2030

- 18. Waterproofing membranes market: Application movement analysis, 2022 & 2030

- 19. Waterproofing membranes market: Regional movement analysis, 2022 & 2030

- 20. SWOT analysis - Sika AG

- 21. SWOT analysis - DowDupont

- 22. SWOT analysis - BASF SE

Waterproofing Membranes Market Growth & Trends:

The global waterproofing membranes market size is likely to reach USD 40.15 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 7.1% from 2023 to 2030. Growing advancement in infrastructure and construction activities coupled with a rise in demand for wastewater and water management is expected to drive the market. Biomembranes are expected to witness a high adoption trend in the coming future owing to the increasing product demand in green-building construction. In addition, government support to replace old buildings with new ones is opening new growth avenues for the construction industry, which, in turn, is adding growth to the market.

The market is highly dependent upon the dynamic of the raw material supply chain. Although all types of products including cementitious, bituminous, polyurethane, and others are used for manufacturing waterproofing membranes, cementitious liquid applied membrane and bituminous sheet membranes are the most commonly used waterproofing membrane in the market. The industry exhibits several mature players controlling the significant market share. However, increasing competition from a large number of small and local manufacturers from Asia Pacific is expected to increase the market competition. The market players put high stress on using sustainable raw materials to ensure an environmentally friendly image to their clients.

Waterproofing Membranes Market Report Highlights:

- The liquid applied membrane product segment led the market and accounted for more than 63.9% share of the global revenue in 2022, on account of its thermal-reflective properties for any exterior surface application

- The polyurethane liquid applied waterproofing membrane segment is expected to witness the fastest CAGR of 9.1% in terms of revenue during the forecast period, owing to seamless finish and easy and fast installation procedure

- The roofing application segment held the largest revenue share of 31.8% in 2022., owing to its high exposure to changing climatic conditions and leakages across residential, commercial, and industrial buildings

- Asia Pacific accounted for the largest revenue share of 32.1% in 2022., owing to increasing investment in residential and commercial construction due to rapid industrialization and growing population

- The majority of the manufacturers have started emphasizing sustainable and corrosive protective raw materials for producing waterproofing membranes to increase their market presence. In addition, growing infrastructure in the developing markets of China, India, Brazil, and others are adding rapid growth to the construction sector, thereby adding growth prospects for the market

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources & Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segmental Outlook

- 2.3. Competitive Insights

Chapter 3. Market Variables, Trends, and Scope

- 3.1. Penetration & Growth Prospect Mapping

- 3.2. Industry Value Chain Analysis

- 3.2.1. Major Raw Material Trends Analysis

- 3.3. Raw-material trends

- 3.3.1. Bitumen

- 3.3.2. Polypropylene

- 3.4. Technology Trend

- 3.4.1. Process for manufacturing a waterproofing membrane.

- 3.4.2. Manufacturing of PVC-type waterproofing membrane

- 3.4.2.1. Co-Extrusion

- 3.4.2.2. Caste Spreading

- 3.5. Polyurethane Liquid Membranes - Technology overview

- 3.5.1. The α Technology

- 3.5.2. Liquid-applied membrane with moisture-triggered polyurethane technology.

- 3.5.3. Rapid-curing resin technology

- 3.5.4. Solvent-free and "Odor-free" technology for concrete surface

- 3.5.5. Liquid cold-applied membranes

- 3.6. Regulatory Framework

- 3.7. Market Dynamics

- 3.7.1. Market Driver Analysis

- 3.7.2. Market Restraint Analysis

- 3.7.3. Industry Challenges

- 3.8. Business Environmental Tools Analysis: Waterproofing Membranes Market

- 3.8.1. Porter's Five Forces Analysis

- 3.8.1.1. Bargaining Power of Suppliers

- 3.8.1.2. Bargaining Power of Buyers

- 3.8.1.3. Threat of Substitution

- 3.8.1.4. Threat of New Entrants

- 3.8.1.5. Competitive Rivalry

- 3.8.2. PESTLE Analysis

- 3.8.2.1. Political Landscape

- 3.8.2.2. Economic Landscape

- 3.8.2.3. Social Landscape

- 3.8.2.4. Technology Landscape

- 3.8.2.5. Environmental Landscape

- 3.8.2.6. Legal Landscape

- 3.8.1. Porter's Five Forces Analysis

- 3.9. Case studies

Chapter 4. Waterproofing Membranes Market: Product Estimates & Trend Analysis

- 4.1. Waterproofing Membranes Market: Material Movement Analysis, 2022 & 2030

- 4.2. Liquid Applied Membranes

- 4.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 4.2.2. Cementitious

- 4.2.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square Meters)

- 4.2.3. Bituminous

- 4.2.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square Meters)

- 4.2.4. Polyethylene

- 4.2.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square Meters)

- 4.2.5. Acrylic

- 4.2.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 4.2.6. Others

- 4.2.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 4.3. Sheet Membranes

- 4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 4.3.2. Bituminous

- 4.3.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square Meters)

- 4.3.3. Polyvinyl Chloride (PVC)

- 4.3.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square Meters)

- 4.3.4. Ethylene Propylene Diene Monomer (EPDM)

- 4.3.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square Meters)

- 4.3.5. Others

- 4.3.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

Chapter 5. Waterproofing Membranes Market: Application Estimates & Trend Analysis

- 5.1. Waterproofing Membranes Market: Application Movement Analysis, 2022 & 2030

- 5.2. Roofing

- 5.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 5.3. Walls

- 5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 5.4. Building Structures

- 5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 5.5. Landfills & Structures

- 5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 5.6. Others

- 5.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

Chapter 6. Waterproofing Membranes Market: Regional Estimates & Trend Analysis

- 6.1. Regional Movement Analysis & Market Share, 2022 & 2030

- 6.2. Waterproofing membranes market: Regional movement analysis, 2022 & 2030

- 6.3. North America

- 6.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.4. U.S.

- 6.3.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.4.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.4.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.4.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.4.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.5. Canada

- 6.3.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.5.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.5.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.5.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.5.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.6. Mexico

- 6.3.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.6.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.6.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.6.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.3.6.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4. Europe

- 6.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.4. Germany

- 6.4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.4.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.4.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.4.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.4.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.5. U.K.

- 6.4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.5.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.5.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.5.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.4.5.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5. Asia Pacific

- 6.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.4. China

- 6.5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.4.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.4.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.4.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.4.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.5. Japan

- 6.5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.5.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.5.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.5.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.5.5.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.6. Central & South America

- 6.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.6.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.6.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.6.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.6.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.6.4. Brazil

- 6.6.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.6.4.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.6.4.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.6.4.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.6.4.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

- 6.7. Middle East & Africa

- 6.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Million Square meters)

- 6.7.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.7.2.1. Market estimates and forecasts, by liquid membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.7.2.2. Market estimates and forecasts, by sheet waterproofing membrane product, 2018 - 2030 (USD Million) (Million Square meters)

- 6.7.3. Market estimates and forecasts, by application, 2018 - 2030 (USD Million) (Million Square meters)

Chapter 7. Competitive Landscape

- 7.1. Key Global Players, Their Initiatives, & Their Impact on the Market

- 7.2. Competitive Environment

- 7.3. Vendor Landscape

- 7.4. Public companies

- 7.4.1. Company Market Position Analysis

- 7.4.2. SWOT

- 7.5. Private companies

Chapter 8. Company Profiles

- 8.1. Sika AG

- 8.1.1. Company overview

- 8.1.2. Financial performance

- 8.1.3. Product benchmarking

- 8.1.4. Strategic initiatives

- 8.2. Pidilite Industries Ltd.

- 8.2.1. Company overview

- 8.2.2. Financial performance

- 8.2.3. Product benchmarking

- 8.2.4. Strategic initiatives

- 8.3. BASF SE

- 8.3.1. Company overview

- 8.3.2. Financial performance

- 8.3.3. Product benchmarking

- 8.3.4. Strategic initiatives

- 8.4. Paul Bauder GmbH & Co. KG

- 8.4.1. Company overview

- 8.4.2. Financial performance

- 8.4.3. Product benchmarking

- 8.4.4. Strategic initiatives

- 8.5. Kemper System America, Inc.

- 8.5.1. Company overview

- 8.5.2. Financial performance

- 8.5.3. Product benchmarking

- 8.5.4. Strategic initiatives

- 8.6. Dow Chemical Company

- 8.6.1. Company overview

- 8.6.2. Financial performance

- 8.6.3. Product benchmarking

- 8.6.4. Strategic initiatives

- 8.7. DuPont

- 8.7.1. Company overview

- 8.7.2. Financial performance

- 8.7.3. Product benchmarking

- 8.7.4. Strategic initiatives

- 8.8. GAF Materials Corporation

- 8.8.1. Company overview

- 8.8.2. Financial performance

- 8.8.3. Product benchmarking

- 8.8.4. Strategic initiatives

- 8.9. Fosroc Ltd.

- 8.9.1. Company overview

- 8.9.2. Financial performance

- 8.9.3. Product benchmarking

- 8.9.4. Strategic initiatives

- 8.10. CICO Technologies Ltd.

- 8.10.1. Company overview

- 8.10.2. Financial performance

- 8.10.3. Product benchmarking

- 8.10.4. Strategic initiatives

- 8.11. Alchimica Building Chemicals

- 8.11.1. Company overview

- 8.11.2. Financial performance

- 8.11.3. Product benchmarking

- 8.11.4. Strategic initiatives

- 8.12. Maris Polymers

- 8.12.1. Company overview

- 8.12.2. Financial performance

- 8.12.3. Product benchmarking

- 8.12.4. Strategic initiatives

- 8.13. Saint-Gobain Weber GmbH

- 8.13.1. Company overview

- 8.13.2. Financial performance

- 8.13.3. Product benchmarking

- 8.13.4. Strategic initiatives

- 8.14. Isomat S.A.

- 8.14.1. Company overview

- 8.14.2. Financial performance

- 8.14.3. Product benchmarking

- 8.14.4. Strategic initiatives

- 8.15. Covestro AG.

- 8.15.1. Company overview

- 8.15.2. Financial performance

- 8.15.3. Product benchmarking

- 8.15.4. Strategic initiatives