|

|

市場調査レポート

商品コード

1092393

自動車金融の世界市場:市場規模、シェア、動向分析-プロバイダータイプ別、金融タイプ別、目的タイプ別、車両タイプ別、地域別-セグメント予測(2022~2030年)Automotive Finance Market Size, Share & Trends Analysis Report By Provider Type, By Finance Type, By Purpose Type, By Vehicle Type, By Region, And Segment Forecasts, 2022 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自動車金融の世界市場:市場規模、シェア、動向分析-プロバイダータイプ別、金融タイプ別、目的タイプ別、車両タイプ別、地域別-セグメント予測(2022~2030年) |

|

出版日: 2022年05月02日

発行: Grand View Research

ページ情報: 英文 160 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の自動車金融の市場規模は、2022~2030年にかけて7.2%のCAGRで成長し、2030年までに4,517億1,000万米ドルに達すると予測されています。

世界の自律走行車に対する需要の高まりが、市場成長の原動力になると予想されます。交通安全の向上に関する政府の規制が強化され、高度な技術を持つ自律走行車のニーズが世界的に高まっています。

当レポートでは、世界の自動車金融市場について調査分析し、市場力学、プロバイダータイプ・金融タイプ・目的タイプ・車両タイプ・地域別の市場の見通し、競合情勢に関する情報を提供しています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 自動車金融業界の見通し

- 市場セグメンテーションと範囲

- 市場規模と成長の見通し

- 自動車金融市場-バリューチェーン分析

- 自動車金融市場力学

- 市場の促進要因分析

- 市場の課題分析

- 浸透と成長の見通しのマッピング

- 自動車金融市場-ポーターのファイブフォース分析

- 自動車金融市場-PESTEL分析

第4章 自動車金融のプロバイダータイプの見通し

- 自動車金融の市場シェア:プロバイダータイプ別(2021年)

- 銀行

- OEM

- その他の金融機関

第5章 自動車金融タイプの見通し

- 自動車金融の市場シェア:金融タイプ別(2021年)

- ダイレクト

- インダイレクト

第6章 自動車金融の目的タイプの見通し

- 自動車金融の市場シェア:目的タイプ別(2021年)

- ローン

- リース

- その他

第7章 自動車金融の車両タイプの見通し

- 自動車金融の市場シェア:車両タイプ別(2021年)

- 商用車

- 乗用車

第8章 自動車金融の地域展望

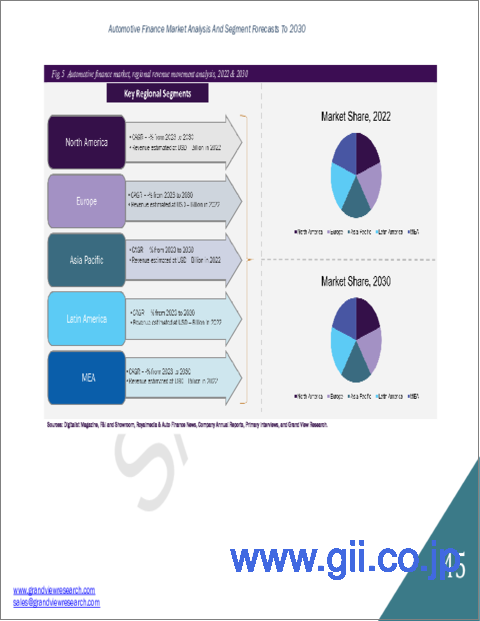

- 自動車金融の市場シェア:地域別(2021年)

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- アジア太平洋

- 中国

- インド

- 日本

- ラテンアメリカ

- ブラジル

- 中東・アフリカ

第9章 競合分析

- 最近の動向と影響分析:主要な市場参入者別

- 企業の分類

- ベンダー情勢

- 企業分析ツール

- 企業の市況分析

- 競合ダッシュボード分析

第10章 競合情勢

- Ally Financial

- Bank of America

- Capital One

- Chase Auto Finance

- Daimler Financial Services

- Ford Motor Credit Company

- GM Financial Inc.

- Hitachi Capital

- Toyota Financial Services

- Volkswagen Financial Services

List of Tables

- Table 1 Automotive finance market - Industry snapshot & key buying criteria, 2017 - 2030

- Table 2 Global automotive finance market, 2017 - 2030 (USD Billion)

- Table 3 Global automotive finance market, by region, 2017 - 2030 (USD Billion)

- Table 4 Global automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 5 Global automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 6 Global automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 7 Global automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 8 Vendor landscape

- Table 9 Automotive finance market - Key market driver impact

- Table 10 Automotive finance market - Key market challenge impact

- Table 11 Automotive finance market in banks, 2017 - 2030 (USD Billion)

- Table 12 Automotive finance market in banks, by region, 2017 - 2030 (USD Billion)

- Table 13 Automotive finance market in OEMs, 2017 - 2030 (USD Billion)

- Table 14 Automotive finance market in OEMs, by region, 2017 - 2030 (USD Billion)

- Table 15 Automotive finance market in other financial institutions, 2017 - 2030 (USD Billion)

- Table 16 Automotive finance market in other financial institutions, by region, 2017 - 2030 (USD Billion)

- Table 17 Direct automotive finance market, 2017 - 2030 (USD Billion)

- Table 18 Direct automotive finance market, by region, 2017 - 2030 (USD Billion)

- Table 19 Indirect automotive finance market, 2017 - 2030 (USD Billion)

- Table 20 Indirect automotive finance market, by region, 2017 - 2030 (USD Billion)

- Table 21 Automotive finance market by loan, 2017 - 2030 (USD Billion)

- Table 22 Automotive finance market by loan, by region, 2017 - 2030 (USD Billion)

- Table 23 Automotive finance market by leasing, 2017 - 2030 (USD Billion)

- Table 24 Automotive finance market by leasing, by region, 2017 - 2030 (USD Billion)

- Table 25 Automotive finance market by other purpose types, 2017 - 2030 (USD Billion)

- Table 26 Automotive finance market by other purpose types, by region, 2017 - 2030 (USD Billion)

- Table 27 Automotive finance market for commercial vehicles, 2017 - 2030 (USD Billion)

- Table 28 Automotive finance market for commercial vehicles, by region, 2017 - 2030 (USD Billion)

- Table 29 Automotive finance market for passenger vehicles, 2017 - 2030 (USD Billion)

- Table 30 Automotive finance market for passenger vehicles, by region, 2017 - 2030 (USD Billion)

- Table 31 North America automotive finance market, 2017 - 2030 (USD Billion)

- Table 32 North America automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 33 North America automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 34 North America automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 35 North America automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 36 U.S. automotive finance market, 2017 - 2030 (USD Billion)

- Table 37 U.S. automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 38 U.S. automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 39 U.S. automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 40 U.S. automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 41 Canada automotive finance market, 2017 - 2030 (USD Billion)

- Table 42 Canada automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 43 Canada automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 44 Canada automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 45 Canada automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 46 Europe automotive finance market, 2017 - 2030 (USD Billion)

- Table 47 Europe automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 48 Europe automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 49 Europe automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 50 Europe automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 51 Germany automotive finance market, 2017 - 2030 (USD Billion)

- Table 52 Germany automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 53 Germany automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 54 Germany automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 55 Germany automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 56 U.K. automotive finance market, 2017 - 2030 (USD Billion)

- Table 57 U.K. automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 58 U.K. automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 59 U.K. automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 60 U.K. automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 61 Asia Pacific automotive finance market, 2017 - 2030 (USD Billion)

- Table 62 Asia Pacific automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 63 Asia Pacific automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 64 Asia Pacific automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 65 Asia Pacific automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 66 China automotive finance market, 2017 - 2030 (USD Billion)

- Table 67 China automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 68 China automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 69 China automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 70 China automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 71 India automotive finance market, 2017 - 2030 (USD Billion)

- Table 72 India automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 73 India automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 74 India automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 75 India automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 76 Japan automotive finance market, 2017 - 2030 (USD Billion)

- Table 77 Japan automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 78 Japan automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 79 Japan automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 80 Japan automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 81 Latin America automotive finance market, 2017 - 2030 (USD Billion)

- Table 82 Latin America automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 83 Latin America automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 84 Latin America automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 85 Latin America automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 86 Brazil automotive finance market, 2017 - 2030 (USD Billion)

- Table 87 Brazil automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 88 Brazil automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 89 Brazil automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 90 Brazil automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

- Table 91 MEA automotive finance market, 2017 - 2030 (USD Billion)

- Table 92 MEA automotive finance market, by provider type, 2017 - 2030 (USD Billion)

- Table 93 MEA automotive finance market, by finance type, 2017 - 2030 (USD Billion)

- Table 94 MEA automotive finance market, by purpose type, 2017 - 2030 (USD Billion)

- Table 95 MEA automotive finance market, by vehicle type, 2017 - 2030 (USD Billion)

List of Figures

- Fig. 1 Market segmentation

- Fig. 2 Automotive finance market, 2017 - 2030 (USD Billion)

- Fig. 3 Automotive finance market - Value chain analysis

- Fig. 4 Automotive finance market - Market dynamics

- Fig. 5 Key opportunities prioritized

- Fig. 7 Automotive finance market - Porter's five forces analysis

- Fig. 8 Automotive finance market - PESTEL analysis

- Fig. 9 Automotive finance market, by provider type, 2021

- Fig. 10 Automotive finance market, by finance type, 2021

- Fig. 11 Automotive finance market, by purpose type, 2021

- Fig. 12 Automotive finance market, by vehicle type, 2021

- Fig. 13 Automotive finance market, by region, 2021

- Fig. 14 North America automotive finance market - Key takeaways

- Fig. 15 Europe automotive finance market - Key takeaways

- Fig. 16 Asia Pacific automotive finance market - Key takeaways

- Fig. 17 Latin America automotive finance market - Key takeaways

- Fig. 18 MEA automotive finance market - Key takeaways

- Fig. 19 Automotive finance market - Key company ranking/market share analysis, 2021

- Fig. 20 Automotive finance market - Company market position analysis, 2021

- Fig. 21 Automotive finance market - Competitive dashboard analysis

Automotive Finance Market Growth & Trends:

The global automotive finance market size is expected to reach USD 451.71 billion by 2030, registering a CAGR of 7.2% from 2022 to 2030, according to a new report by Grand View Research, Inc. Growing global demand for autonomous cars is expected to drive the market growth. Increasing government regulations on rising road safety are creating the need for autonomous cars with highly advanced technologies worldwide.

The investment made in the automotive finance industry is also creating new opportunities for market growth. For instance, in January 2021, MotoRefi, an automotive refinancing company, announced that it raised USD 10.0 million in a round that Moderna Ventures led. The company uses this funding to hire more employees and expand its offerings.

Various auto car manufacturers are entering into a partnership with automotive finance providers to enhance their customer experience. For instance, in March 2022, CIG Motors, a GAC brand distributor, announced its collaboration with Polaris Bank Limited. By means of this partnership, the former company aims to make vehicle ownership and acquisition easy for Nigerians through the Easy Buy scheme.

COVID-19 had a negative impact on the market growth in 2021. However, the global auto manufacturers, lenders, and dealers have got adjusted to the current COVID-19 situation. For instance, the automotive manufacturers incentivized their new car sales to grow their sales amid COVID-19. These efforts taken by the automakers are expected to improve the demand for automotive finance during the forecast period.

Automotive Finance Market Report Highlights:

- The banks segment is expected to dominate the market growth during the forecast period as banks offer secure financing to their customers. Banks also offer customers the facility to apply for pre-approval. This facility helps customers in comparing estimated loan offers

- The direct segment is expected to dominate the market growth during the forecast period. Numerous customers across the globe prefer direct auto loans as they can easily access and get loans from the credit unions, banks, and other loan lending companies

- The leasing segment is expected to register the highest CAGR during the forecast period. Customers are focusing on adopting the leasing model as it is a more flexible model in comparison to others for new, shared, and used vehicles that could comprise services such as insurance

- The passenger segment dominated the market in 2021 and is expected to show similar trends during the forecast period. The number of passenger vehicles including pickup trucks and others on the road, continues to rise across the globe, thereby creating growth opportunities for the passenger vehicles segment during the forecast period

- The presence of many prominent automotive finance providers in the European region and the adoption of innovative tools, such as biometrics, e-contracts, and machine learning, is expected to drive the regional market growth during the forecast period

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Research Methodology

- 1.2 Research Scope and Assumptions

- 1.3 List of Data Sources

Chapter 2 Executive Summary

- 2.1 Automotive Finance Market - Industry Snapshot & Key Buying Criteria, 2017 - 2030

- 2.2 Global Automotive Finance Market, 2017 - 2030

- 2.2.1 Global automotive finance market, by region, 2017 - 2030

- 2.2.2 Global automotive finance market, by provider type, 2017 - 2030

- 2.2.3 Global automotive finance market, by finance type, 2017 - 2030

- 2.2.4 Global automotive finance market, by purpose type, 2017 - 2030

- 2.2.5 Global automotive finance market, by vehicle type, 2017 - 2030

Chapter 3 Automotive Finance Industry Outlook

- 3.1 Market Segmentation and Scope

- 3.2 Market Size and Growth Prospects

- 3.3 Automotive Finance Market - Value Chain Analysis

- 3.4 Automotive Finance Market Dynamics

- 3.4.1 Market driver analysis

- 3.4.1.1 Increasing investments in autonomous vehicles

- 3.4.1.2 Growing demand for EVs

- 3.4.2 Market challenge analysis

- 3.4.2.1 High competition within the industry

- 3.4.1 Market driver analysis

- 3.5 Penetration and Growth Prospect Mapping

- 3.6 Automotive Finance Market - Porter's Five Forces Analysis

- 3.7 Automotive Finance Market - PESTEL Analysis

Chapter 4 Automotive Finance Provider Type Outlook

- 4.1 Automotive Finance Market Share by Provider Type, 2021

- 4.2 Banks

- 4.2.1 Automotive finance market in banks, 2017 - 2030

- 4.3 OEMs

- 4.3.1 Automotive finance market in OEMs, 2017 - 2030

- 4.4 Other Financial Institutions

- 4.4.1 Automotive finance market in other financial institutions, 2017 - 2030

Chapter 5 Automotive Finance Type Outlook

- 5.1 Automotive Finance Market Share by Finance Type, 2021

- 5.2 Direct

- 5.2.1 Direct automotive finance market, 2017 - 2030

- 5.3 Indirect

- 5.3.1 Indirect automotive finance market, 2017 - 2030

Chapter 6 Automotive Finance Purpose Type Outlook

- 6.1 Automotive Finance Market Share by Purpose Type, 2021

- 6.2 Loan

- 6.2.1 Automotive finance market by loan, 2017 - 2030

- 6.3 Leasing

- 6.3.1 Automotive finance market by leasing, 2017 - 2030

- 6.4 Others

- 6.4.1 Automotive finance market by other purpose types, 2017 - 2030

Chapter 7 Automotive Finance Vehicle Type Outlook

- 7.1 Automotive Finance Market Share by Vehicle Type, 2021

- 7.2 Commercial Vehicles

- 7.2.1 Automotive finance market for commercial vehicles, 2017 - 2030

- 7.3 Passenger Vehicles

- 7.3.1 Automotive finance market for passenger vehicles, 2017 - 2030

Chapter 8 Automotive Finance Regional Outlook

- 8.1 Automotive Finance Market Share by Region, 2021

- 8.2 North America

- 8.2.1 North America automotive finance market, 2017 - 2030

- 8.2.2 North America automotive finance market, by provider type, 2017 - 2030

- 8.2.3 North America automotive finance market, by finance type, 2017 - 2030

- 8.2.4 North America automotive finance market, by purpose type, 2017 - 2030

- 8.2.5 North America automotive finance market, by vehicle type, 2017 - 2030

- 8.2.6 U.S.

- 8.2.6.1 U.S. automotive finance market, 2017 - 2030

- 8.2.6.2 U.S. automotive finance market, by provider type, 2017 - 2030

- 8.2.6.3 U.S. automotive finance market, by finance type, 2017 - 2030

- 8.2.6.4 U.S. automotive finance market, by purpose type, 2017 - 2030

- 8.2.6.5 U.S. automotive finance market, by vehicle type, 2017 - 2030

- 8.2.7 Canada

- 8.2.7.1 Canada automotive finance market, 2017 - 2030

- 8.2.7.2 Canada automotive finance market, by provider type, 2017 - 2030

- 8.2.7.3 Canada automotive finance market, by finance type, 2017 - 2030

- 8.2.7.4 Canada automotive finance market, by purpose type, 2017 - 2030

- 8.2.7.5 Canada automotive finance market, by vehicle type, 2017 - 2030

- 8.3 Europe

- 8.3.1 Europe automotive finance market, 2017 - 2030

- 8.3.2 Europe automotive finance market, by provider type, 2017 -2030

- 8.3.3 Europeautomotive finance market, by finance type, 2017 -2030

- 8.3.4 Europeautomotive finance market, by purpose type, 2017 - 2030

- 8.3.5 Europeautomotive finance market, by vehicle type, 2017 - 2030

- 8.3.6 Germany

- 8.3.6.1 Germany automotive finance market, 2017 -2030

- 8.3.6.2 Germany automotive finance market, by provider type, 2017 - 2030

- 8.3.6.3 Germany automotive finance market, by finance type, 2017 - 2030

- 8.3.6.4 Germany automotive finance market, by purpose type, 2017 - 2030

- 8.3.6.5 Germany automotive finance market, by vehicle type, 2017 - 2030

- 8.3.7 U.K.

- 8.3.7.1 U.K. automotive finance market, 2017 - 2030

- 8.3.7.2 U.K. automotive finance market, by provider type, 2017 - 2030

- 8.3.7.3 U.K. automotive finance market, by finance type, 2017 - 2030

- 8.3.7.4 U.K. automotive finance market, by purpose type, 2017 - 2030

- 8.3.7.5 U.K. automotive finance market, by vehicle type, 2017 - 2030

- 8.4 Asia Pacific

- 8.4.1 Asia Pacific automotive finance market, 2017 - 2030

- 8.4.2 Asia Pacific automotive finance market, by provider type, 2017 - 2030

- 8.4.3 Asia Pacific automotive finance market, by finance type, 2017 - 2030

- 8.4.4 Asia Pacific automotive finance market, by purpose type, 2017 - 2030

- 8.4.5 Asia Pacific automotive finance market, by vehicle type, 2017 - 2030

- 8.4.6 China

- 8.4.6.1 China automotive finance market, 2017 - 2030

- 8.4.6.2 China automotive finance market, by provider type, 2017 - 2030

- 8.4.6.3 China automotive finance market, by finance type, 2017 - 2030

- 8.4.6.4 China automotive finance market, by purpose type, 2017 - 2030

- 8.4.6.5 China automotive finance market, by vehicle type, 2017 - 2030

- 8.4.7 India

- 8.4.7.1 India automotive finance market, 2017 - 2030

- 8.4.7.2 India automotive finance market, by provider type, 2017 - 2030

- 8.4.7.3 India automotive finance market, by finance type, 2017 - 2030

- 8.4.7.4 India automotive finance market, by purpose type, 2017 - 2030

- 8.4.7.5 India automotive finance market, by vehicle type, 2017 - 2030

- 8.4.8 Japan

- 8.4.8.1 Japan automotive finance market, 2017 - 2030

- 8.4.8.2 Japan automotive finance market, by provider type, 2017 - 2030

- 8.4.8.3 Japan automotive finance market, by finance type, 2017 - 2030

- 8.4.8.4 Japan automotive finance market, by purpose type, 2017 - 2030

- 8.4.8.5 Japan automotive finance market, by vehicle type, 2017 - 2030

- 8.5 Latin America

- 8.5.1 Latin America automotive finance market, 2017 - 2030

- 8.5.2 Latin America automotive finance market, by provider type, 2017 - 2030

- 8.5.3 Latin America automotive finance market, by finance type, 2017 - 2030

- 8.5.4 Latin America automotive finance market, by purpose type, 2017 - 2030

- 8.5.5 Latin America automotive finance market, by vehicle type, 2017 - 2030

- 8.5.6 Brazil

- 8.5.6.1 Brazil automotive finance market, 2017 - 2030

- 8.5.6.2 Brazil automotive finance market, by provider type, 2017 - 2030

- 8.5.6.3 Brazil automotive finance market, by finance type, 2017 - 2030

- 8.5.6.4 Brazil automotive finance market, by purpose type, 2017 - 2030

- 8.5.6.5 Brazil automotive finance market, by vehicle type, 2017 - 2030

- 8.6 MEA

- 8.6.1 MEA automotive finance market, 2017 - 2030

- 8.6.2 MEA automotive finance market, by provider type, 2017 - 2030

- 8.6.3 MEA automotive finance market, by finance type, 2017 - 2030

- 8.6.4 MEA automotive finance market, by purpose type, 2017 - 2030

- 8.6.5 MEA automotive finance market, by vehicle type, 2017 - 2030

Chapter 9 Competitive Analysis

- 9.1 Recent Developments & Impact Analysis, By Key Market Participants

- 9.2 Company Categorization

- 9.3 Vendor Landscape

- 9.3.1 Key company ranking/company market share analysis, 2021

- 9.4 Company Analysis Tools

- 9.4.1 Company market position analysis

- 9.4.2 Competitive dashboard analysis

Chapter 10 Competitive Landscape

- 10.1 Ally Financial

- 10.1.1 Company overview

- 10.1.2 Financial performance

- 10.1.3 Product benchmarking

- 10.1.4 Strategic initiatives

- 10.2 Bank of America

- 10.2.1 Company overview

- 10.2.2 Financial performance

- 10.2.3 Product benchmarking

- 10.2.4 Strategic initiatives

- 10.3 Capital One

- 10.3.1 Company overview

- 10.3.2 Financial performance

- 10.3.3 Product benchmarking

- 10.3.4 Strategic initiatives

- 10.4 Chase Auto Finance

- 10.4.1 Company overview

- 10.4.2 Financial performance

- 10.4.3 Product benchmarking

- 10.4.4 Strategic initiatives

- 10.5 Daimler Financial Services

- 10.5.1 Company overview

- 10.5.2 Financial performance

- 10.5.3 Product benchmarking

- 10.5.4 Strategic initiatives

- 10.6 Ford Motor Credit Company

- 10.6.1 Company overview

- 10.6.2 Financial performance

- 10.6.3 Product benchmarking

- 10.6.4 Strategic initiatives

- 10.7 GM Financial Inc.

- 10.7.1 Company overview

- 10.7.2 Financial performance

- 10.7.3 Product benchmarking

- 10.7.4 Strategic initiatives

- 10.8 Hitachi Capital

- 10.8.1 Company overview

- 10.8.2 Financial performance

- 10.8.3 Product benchmarking

- 10.8.4 Strategic initiatives

- 10.9 Toyota Financial Services

- 10.9.1 Company overview

- 10.9.2 Financial performance

- 10.9.3 Product benchmarking

- 10.9.4 Strategic initiatives

- 10.10 Volkswagen Financial Services

- 10.10.1 Company overview

- 10.10.2 Financial performance

- 10.10.3 Product benchmarking

- 10.10.4 Strategic initiatives