|

|

市場調査レポート

商品コード

1032439

屋内農業の市場規模、シェア、動向分析レポート:施設タイプ別(温室、垂直農法)、コンポーネント別(ハードウェア、ソフトウェア)、作物カテゴリー別、地域別、セグメント別予測、2022年~2030年Indoor Farming Market Size, Share & Trends Analysis Report By Facility Type (Greenhouses, Vertical Farms), By Component (Hardware, Software), By Crop Category, By Region, And Segment Forecasts, 2022 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 屋内農業の市場規模、シェア、動向分析レポート:施設タイプ別(温室、垂直農法)、コンポーネント別(ハードウェア、ソフトウェア)、作物カテゴリー別、地域別、セグメント別予測、2022年~2030年 |

|

出版日: 2022年04月04日

発行: Grand View Research

ページ情報: 英文 120 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

屋内農業の市場成長と動向

Grand View Research, Inc.が実施した新しいレポートによると、世界の屋内農業市場規模は、2022年から2030年にかけて13.5%のCAGRを示し、2030年には1,223億米ドルに達すると推定されています。人口増加に伴う食料需要の増加が、成長の原動力になると予想されます。水供給の減少、都市化、気候変動などの要因によって、耕作地が失われています。このため、食料を生産するための屋内型ファームの需要が高まっています。さらに、地球の気温上昇や異常気象などの課題が、従来の農業技術に対する障壁として作用しています。欧州環境機関(EEA)は、これらの課題を克服し、環境に優しい方法で食料を生産するために、垂直農場を建設するためのいくつかのイニシアチブを実施しています。

屋内農業は作物の収穫量を増やし、サプライチェーンでの移動距離を減らすことで、農業が環境に与える影響を軽減することができます。また、栽培棚を垂直に設置することで、従来の農法に比べて植物の栽培に必要な土地面積を削減することができます。健康的で新鮮な食品の消費に関する消費者意識の高まりは、予測期間中、屋内農業市場にプラスの影響を与えると予想されます。さらに、LED屋内農業などの技術を使用して自然に近い状態を作り出すことで、農家は近い将来予想される食糧供給の需要に応えることができるようになります。

欧州は2021年に市場を独占し、LED照明や制御環境農業などの先進技術の継続的な採用により、予測期間中も支配的であると予想されます。アジア太平洋は、中国や日本などの国々で屋内農場が増加していることから、2022年から2030年にかけて最も速いCAGRを示すと予測されます。温室や垂直農法の採用が増加していることが、この地域の成長を支えていると予想されます。また、無農薬の新鮮な野菜や果物に対する需要の高まりが、地域の市場成長を促進すると予想されます。

屋内農業市場のレポートハイライト

- これらの施設ではより高い収量が得られるため、2021年の収益では温室部門が市場を独占しています。温室は、花、野菜、果物の栽培に安定した高度に制御された環境を提供する

- 果物、野菜、ハーブのセグメントは、特に欧州やアジア太平洋などの地域で、健康的な食事の重要性に関する消費者の意識の高まりとともに、食品消費の増加により、予測期間中に最も速いCAGRを記録すると予測される

- 気候制御システム分野は、ミネラル濃度の調整とモニタリングにより作物の成長を制御できるため、予測期間中に最も高いCAGRで拡大すると予測されています。

目次

第1章 調査手法と範囲

- 市場セグメンテーション

- 市場の定義

- 調査手法

- 調査範囲と前提

- 調査手法

- データソースへのリスト

第2章 エグゼクティブサマリー

- 屋内農業市場- 収益

- セグメント別見通し

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- 施設の種類

第3章 業界の見通し

- 屋内農業の市場規模と成長見通し

- 屋内農業-バリューチェーン分析

- 屋内農業市場力学

- 市場促進要因分析

- 一人当たり耕地の減少

- オーガニック食品の需要が高まる

- 屋内農業技術と技術の進歩に伴う高収量

- 現代的な農業方法の採用に対する政府の支援の拡大

- 市場制約分析

- 初期投資の増加

- 維持費が高い

- 市場機会分析

- バイオ医薬品の製造

- 新興経済国における垂直農業の採用の増加

- 屋内農業の環境へのプラスの影響

- 革新的技術の開発

- 市場促進要因分析

- 屋内農業市場分析-Porter's

- 屋内農業市場分析-PEST

- 主要取引と戦略的提携分析

- パートナーシップとコラボレーション

- 製品開発

- 屋内農業市場:COVID-19の影響

- 垂直農業における技術動向

- 垂直農業における人工知能

- 垂直農業におけるロボティクス、自動化、およびデータ処理

- 照明とセンサー技術の進歩

- 再生可能エネルギーの利用

- 建設される垂直農場と温室の推定数(2022-2030)

- 米国で建設される垂直農場の推定数(2022~2030年)

- 米国で建設される温室の推定数(2022-2030)

- カナダで建設される垂直農場の推定数(2022~2030年)

- カナダで建設される温室の推定数(2022~2030年)

- 2020年の垂直農場と温室の資本支出と運営支出の平均内訳

- 資本支出と運用支出(CAPEXとOPEX)を評価するための、カナダのある州の温室の使用事例分析

- さまざまなタイプの垂直農場のCAPEXおよびOPEX分析

- 垂直農業市場の動向:

- 成長ポッド

- コンテナファーム

- コンテナファームの世界推定数(2021年)

- 垂直農業市場-CO2分析

- CO2を利用した現在の課題

- 平均的なCO2コンテナのニーズと支出

- 屋内農場で使用されるCO2の平均量

- 屋内営農施設数

- 屋内農業施設の数、2021年および2030年

- 温室と垂直農場の数、2021年

- 国別屋内農業施設、2021

- 世界の屋内農業市場:メガトレンド

- 屋内農業に対する農業技術(AgTech)の影響

- 屋内農業の地域動向

- 北米

- 欧州

- アジア太平洋地域

- 南米

- 中東とアフリカ

第4章 屋内農業センサー:定性分析

- 地域別のセンサー屋内農業市場、2017年から2030年(数量)

- 2017年から2030年までの地域別の有線センサー屋内農業市場(数量)

- 2017年から2030年までの地域別ワイヤレスセンサー屋内農業市場(数量)

- 屋内農業センサーにおけるIoTソリューションの割合、2021年

- 追加のデータポイント

- 世界の屋内農業市場:ワイヤレスモジュール(%)、2021年

- 世界の屋内農業市場:センシングデバイスの種類(%)、2021年

第5章 出荷/量別屋内農業センサー市場

- 農業における技術の重要性

- 屋内農業センサー

- 農業IoTで利用されるネットワーク技術

- 屋内農業における物理センサーの種類とその使用法

- さまざまな農業シナリオでのネットワークプロトコルの使用(%)

- ワイヤレスセンサーネットワーク(WSN)のシステム要件

- 各種無線センサー技術の通信距離と消費電力

- 農業用途向けのワイヤレスルーティングプロトコルスキーム

第6章 施設タイプの推定・動向分析

- 屋内農業市場:施設タイプの変動分析

- 温室

- 垂直農場

- 出荷用コンテナ

- 建物ベース

- その他

第7章 コンポーネントの推定・動向分析

- 屋内農業市場:コンポーネントの変動分析

- ハードウェア

- 気候制御システム

- 照明システム

- センサー

- 灌漑システム

- ソフトウェア

- ウェブベース

- クラウドベース

- ハードウェア

第8章 作物カテゴリの推定・動向分析

- 屋内農業市場:作物カテゴリの変動分析

- 果物野菜、ハーブ

- トマト

- レタス

- ベル&チリペッパーズ

- いちご

- キュウリ

- 葉物野菜(レタス除く)

- ハーブ

- その他

- 花と観葉植物

- 多年草

- 年次

- 観葉植物

- その他

- 果物野菜、ハーブ

第9章 地域推定・動向分析

- 地域別屋内農業市場シェア、2021年および2030年

- 北米

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- その他

- 米国

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- カナダ

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- その他

- メキシコ

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- その他

- 施設の種類

- 欧州

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- その他

- 英国

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- ドイツ

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- フランス

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- スペイン

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- 施設の種類

- アジア太平洋地域

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- 中国

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- 日本

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- インド

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- 施設の種類

- 南米

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- ブラジル

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- 施設の種類

- MEA

- 施設の種類

- 温室

- 垂直農場

- その他

- 成分

- ハードウェア

- ソフトウェア

- 作物のカテゴリー

- 果物、野菜、ハーブ

- 花と観葉植物

- 施設の種類

第10章 競合分析

- 主要な市場参加者別最近の動向と影響分析

- 企業/競合の分類(主要なイノベーター、マーケットリーダー、新興企業)

- ベンダー情勢

- 主要企業の市場シェア分析、2021年

- 企業分析ツール

- 市況分析

- 競合ダッシュボード分析

第11章 競合情勢

- Argus Control System Limited

- 会社概要

- 製品のベンチマーク

- 最近の開発

- Certhon

- 会社概要

- 製品のベンチマーク

- 実施したプロジェクト

- 最近の開発

- General Hydroponics(Hawthorne Gardening Company)

- 会社概要

- 製品のベンチマーク

- Hydrodynamics International

- 会社概要

- 製品のベンチマーク

- Illumitex

- 会社概要

- 製品のベンチマーク

- 最近の開発

- LumiGrow Inc.

- 会社概要

- 製品のベンチマーク

- 最近の開発

- Netafim

- 会社概要

- 製品のベンチマーク

- PRIVA

- 会社概要

- 製品のベンチマーク

- Richel Group

- 会社概要

- 製品のベンチマーク

- Vertical Farm Systems

- 会社概要

- 製品のベンチマーク

List of Tables

- Table 1 List of abbreviations

- Table 2 Indoor farming market, 2017 - 2030 (USD Million)

- Table 3 Indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 4 Indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 5 Indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 6 Indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 7 Greenhouses indoor farming market, 2017 - 2030 (USD Million)

- Table 8 Greenhouses indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 9 Vertical farms indoor farming market, 2017 - 2030 (USD Million)

- Table 10 Vertical farms indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 11 Shipping container vertical farms indoor farming market, 2017 - 2030 (USD Million)

- Table 12 Shipping container vertical farms indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 13 Building based vertical farms indoor farming market, 2017 - 2030 (USD Million)

- Table 14 Building based vertical farms indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 15 Others indoor farming market, 2017 - 2030 (USD Million)

- Table 16 Others indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 17 Hardware indoor farming market, 2017 - 2030 (USD Million)

- Table 18 Hardware indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 19 Climate control systems indoor farming market, 2017 - 2030 (USD Million)

- Table 20 Climate control systems indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 21 Lighting systems indoor farming market, 2017 - 2030 (USD Million)

- Table 22 Lighting systems indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 23 Sensors indoor farming market, 2017 - 2030 (USD Million)

- Table 24 Sensors indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 25 Irrigation systems indoor farming market, 2017 - 2030 (USD Million)

- Table 26 Irrigation systems indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 27 Software indoor farming market, 2017 - 2030 (USD Million)

- Table 28 Software indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 29 Web-based indoor farming market, 2017 - 2030 (USD Million)

- Table 30 Web-based indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 31 Cloud-based indoor farming market, 2017 - 2030 (USD Million)

- Table 32 Cloud-based indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 33 Fruits vegetables, & herbs indoor farming market, 2017 - 2030 (USD Million)

- Table 34 Fruits vegetables, & herbs indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 35 Tomato indoor farming market, 2017 - 2030 (USD Million)

- Table 36 Tomato management indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 37 Lettuce indoor farming market, 2017 - 2030 (USD Million)

- Table 38 Lettuce indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 39 Bell & chili peppers indoor farming market, 2017 - 2030 (USD Million)

- Table 40 Bell & chili peppers indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 41 Strawberry indoor farming market, 2017 - 2030 (USD Million)

- Table 42 Strawberry indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 43 Cucumber indoor farming market, 2017 - 2030 (USD Million)

- Table 44 Cucumber indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 45 Leafy greens (excluding lettuce) indoor farming market, 2017 - 2030 (USD Million)

- Table 46 Leafy greens (excluding lettuce) indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 47 Herbs indoor farming market, 2017 - 2030 (USD Million)

- Table 48 Herbs indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 49 Others indoor farming market, 2017 - 2030 (USD Million)

- Table 50 Others indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 51 Flowers & ornamentals indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 52 Flowers & ornamentals indoor farming market, 2017 - 2030 (USD Million)

- Table 53 Perennials indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 54 Perennials indoor farming market, 2017 - 2030 (USD Million)

- Table 55 Annuals indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 56 Annuals indoor farming market, 2017 - 2030 (USD Million)

- Table 57 Ornamentals indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 58 Ornamentals indoor farming market, 2017 - 2030 (USD Million)

- Table 59 Others indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 60 Others indoor farming market, 2017 - 2030 (USD Million)

- Table 61 Pulp & paper indoor farming market, by region, 2017 - 2030 (USD Million)

- Table 62 Pulp & paper indoor farming market, 2017 - 2030 (USD Million)

- Table 63 North America indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 64 North America indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 65 North America indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 66 U.S. indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 67 U.S. indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 68 U.S. indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 69 Canada indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 70 Canada indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 71 Canada indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 72 Mexico indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 73 Mexico indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 74 Mexico indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 75 Europe indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 76 Europe indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 77 Europe indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 78 U.K. indoor farming market, by facility type, 2017-2030 (USD Million)

- Table 79 U.K. indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 80 U.K. indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 81 Germany indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 82 Germany indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 83 Germany indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 84 France indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 85 France indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 86 France indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 87 Asia Pacific indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 88 Asia Pacific indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 89 Asia Pacific indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 90 China indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 91 China indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 92 China indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 93 India indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 94 India indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 95 India indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 96 Japan indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 97 Japan indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 98 Japan indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 99 South America indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 100 South America indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 101 South America indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 102 Brazil indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 103 Brazil indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 104 Brazil indoor farming market, by crop category, 2017 - 2030 (USD Million)

- Table 105 MEA indoor farming market, by facility type, 2017 - 2030 (USD Million)

- Table 106 MEA indoor farming market, by component, 2017 - 2030 (USD Million)

- Table 107 MEA indoor farming market, by crop category, 2017 - 2030 (USD Million)

List of Figures

- Fig. 1 Vertical Farming market segmentation

- Fig. 2 Vertical Farming market, 2017 - 2030 (USD Million)

- Fig. 3 Value chain analysis

- Fig. 4 Vertical Farming market driver impact

- Fig. 5 Vertical Farming market restraint impact

- Fig. 6 Vertical Farming market opportunity impact

- Fig. 7 Vertical Farming penetration & growth prospects mapping

- Fig. 8 Vertical Farming market - Porter's five force analysis

- Fig. 9 Vertical Farming market - PESTLE analysis

- Fig. 10 Vertical Farming Market, By Component, 2021 & 2030 (USD Million)

- Fig. 11 Vertical Farming Market, By Frequency, 2021 & 2030 (USD Million)

- Fig. 12 Vertical Farming Market, By Spectrum, 2021 & 2030 (USD Million)

- Fig. 13 Vertical Farming Market, By Vertical, 2021 & 2030 (USD Million)

- Fig. 14 Vertical Farming Market, By Region, 2021 & 2030

- Fig. 15 Company Dashboard Analysis, 2021

- Fig. 16 Company Position Analysis, 2021

Indoor Farming Market Growth & Trends:

The global indoor farming market size is estimated to reach USD 122.3 billion by 2030, exhibiting a CAGR of 13.5% from 2022 to 2030, according to the new report conducted by Grand View Research, Inc. The increasing demand for food owing to the rising population is expected to drive the growth. Factors such as declining water supply, urbanization, and climate change have contributed to the loss of arable land. This, in turn, is driving demand for indoor farms to produce food. In addition, challenges, such as rising global temperature and extreme weather conditions, act as a barrier to the traditional farming technique. The European Environment Agency (EEA) has carried out several initiatives to build vertical farms to overcome these challenges and produce food in an eco-friendly way.

Indoor farming increases the crop yield and reduces the farming impact on the environment by reducing the distance traveled in the supply chain. It reduces the need for the land space required to grow plants compared to traditional farming methods by using growing shelves mounted vertically. Rising consumer awareness regarding the consumption of healthy and fresh food is anticipated to positively influence the market for indoor farming during the forecast period. Furthermore, the use of technology, such as LED indoor farming, to create nature-like conditions will help farmers meet the expected demand for food supply in the near future.

Europe dominated the market in 2021 and is anticipated to remain dominant over the forecast period, owing to the continuous adoption of advanced technologies such as LED lighting, and controlled environment agriculture. Asia Pacific is expected to exhibit the fastest CAGR from 2022 to 2030, owing to the increasing indoor farms in countries such as China and Japan. Increasing adoption of greenhouses and vertical farms is expected to support regional growth. In addition, the rising demand for pesticide-free, fresh vegetables and fruits is expected to fuel the regional market growth.

Indoor Farming Market Report Highlights:

- The greenhouses segment dominated the market in terms of revenue in 2021, as these facilities produce higher yields. Greenhouses offer a stable and highly controlled environment for the cultivation of flowers, vegetables, and fruits

- The fruits, vegetables, and herbs segment is estimated to register the fastest CAGR over the forecast period, owing to the increasing food consumption along with growing consumer awareness regarding the importance of healthy eating, especially in regions such as Europe and Asia Pacific

- The climate control systems segment is projected to expand at the highest CAGR during the forecast period, as crop development can be controlled by adjusting and monitoring the concentration of minerals

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market Segmentation

- 1.2 Market Definition

- 1.3 Research Methodology

- 1.4 Research Scope and Assumptions

- 1.5 Research Methodology

- 1.6 List to Data Sources

Chapter 2 Executive Summary

- 2.1 Indoor Farming - Industry Snapshot & Key Buying Criteria, 2017 - 2030

- 2.1.1 Indoor Farming Market - Revenue

- 2.2 Segmental Outlook

- 2.2.1 Facility Type

- 2.2.1.1 Greenhouse

- 2.2.1.2 Vertical farms

- 2.2.1.3 Others

- 2.2.2 Component

- 2.2.2.1 Hardware

- 2.2.2.2 Software

- 2.2.3 Crop Category

- 2.2.3.1 Fruits, Vegetables, & Herbs

- 2.2.3.2 Flowers & Ornamentals

- 2.2.1 Facility Type

Chapter 3 Industry Outlook

- 3.1 Indoor Farming Market Size and Growth Prospects

- 3.2 Indoor Farming-Value Chain Analysis

- 3.3 Indoor Farming Market Dynamics

- 3.3.1 Market Driver Analysis

- 3.3.1.1 Reduction in Per Capita Arable Land

- 3.3.1.2 Increasing demand for organic food

- 3.3.1.3 High yield associated with indoor farming techniques and advancements in the technologies

- 3.3.1.4 Growing government support for the adoption of modern agricultural methods

- 3.3.2 Market Restraint Analysis

- 3.3.2.1 Higher initial investments

- 3.3.2.2 High cost of maintenance

- 3.3.3 Market Opportunity Analysis

- 3.3.3.1 Production of biopharmaceutical products

- 3.3.3.2 Growing adoption of vertical farming in emerging economies

- 3.3.3.3 Positive environmental impact of indoor farming

- 3.3.3.4 Development of innovative technologies

- 3.3.1 Market Driver Analysis

- 3.4 Indoor Farming Market Analysis - Porter's

- 3.5 Indoor Farming Market Analysis - PEST

- 3.6 Major Deals & Strategic Alliances Analysis

- 3.6.1 Partnership & Collaborations

- 3.6.2 Product Development

- 3.7 Indoor Farming Market: COVID-19 Impact

- 3.8 Technology trends in vertical farming

- 3.8.1 Artificial intelligence in vertical farming

- 3.8.2 Robotics, automation, and data processing in vertical farming

- 3.8.3 Lighting and sensor technology advancements

- 3.8.4 Use of renewable energy

- 3.9 Estimated Number of Vertical Farms and Greenhouses to be Built (2022 - 2030)

- 3.9.1 U.S. Estimated number of vertical farms to be built (2022 - 2030) in acres

- 3.9.2 U.S. Estimated number of greenhouses to be built (2022 - 2030) in acres

- 3.9.3 Canada estimated number of vertical farms to be built (2022 - 2030) in acres

- 3.9.4 Canada estimated number of greenhouses to be built (2022 - 2030) in acres

- 3.10 Average Breakdown of Capital Expenditure and Operating Expenditure for Vertical Farms and Greenhouses in 2020

- 3.10.1 Use case analysis of greenhouse in a Canadian province to evaluate the capital and operational expenditure (CAPEX and OPEX)

- 3.10.2 CAPEX and OPEX analysis of different types of vertical farms

- 3.11 Vertical Farming Market Trends for:

- 3.11.1. Growth Pods

- 3.11.2. Container Farms

- 3.11.2.1. Global Estimated Number of Container Farms (2021)

- 3.12 Vertical Farming Market- CO2 Analysis

- 3.12.1. Current issues using CO2

- 3.12.2. Average CO2 container needs and spending

- 3.12.3. Average amount of CO2 used in an indoor farm

- 3.13 Number of Indoor Farming Facilities

- 3.13.1 Number of Indoor Farming Facilities, 2021 & 2030

- 3.13.2 Number of greenhouse vs vertical farms, 2021

- 3.13.3 Indoor Farming Facilities By Country, 2021

- 3.14 Global Indoor Farming Market: Megatrends

- 3.15 Impact of Agricultural Technology (AgTech) on Indoor Farming

- 3.16 Regional Trends in Indoor farming

- 3.16.1 North America

- 3.16.2 Europe

- 3.16.3 Asia Pacific

- 3.16.4 South America

- 3.16.5 Middle East & Africa

Chapter 4 Indoor Farming Sensors: Qualitative Analysis

- 4.1 Sensors Indoor Farming Market by Region, 2017 - 2030 (Volume in Million Units)

- 4.2 Wired Sensors Indoor Farming Market by Region, 2017 - 2030 (Volume in Million Units)

- 4.3 Wireless Sensors Indoor Farming Market by Region, 2017 - 2030 (Volume in Million Units)

- 4.4 Percentage of IoT Solution in Indoor Farming Sensors, 2021

- 4.5 Additional Datapoints

- 4.5.1 Global indoor farming market: wireless module (%), 2021

- 4.5.2 Global indoor farming market: type of sensing devices (%), 2021

Chapter 5 Indoor Farming Sensors Market by Shipment/Volume

- 5.1 Importance of Technology in Agriculture

- 5.2 Indoor Farming Sensors

- 5.2.1 Network technologies used in agricultural IoT

- 5.2.2 Types of physical sensors and their usage in indoor farming

- 5.2.3 Use of network protocols in different agriculture scenarios (%)

- 5.2.4 System requirement of the wireless sensor network (WSN)

- 5.2.5 Communication distance and power consumption of different wireless sensor technologies

- 5.2.6 Wireless routing protocol schemes for agricultural applications

Chapter 6 Facility Type Estimates & Trend Analysis

- 6.1 Indoor Farming Market: Facility Type Movement Analysis

- 6.1.1 Greenhouses

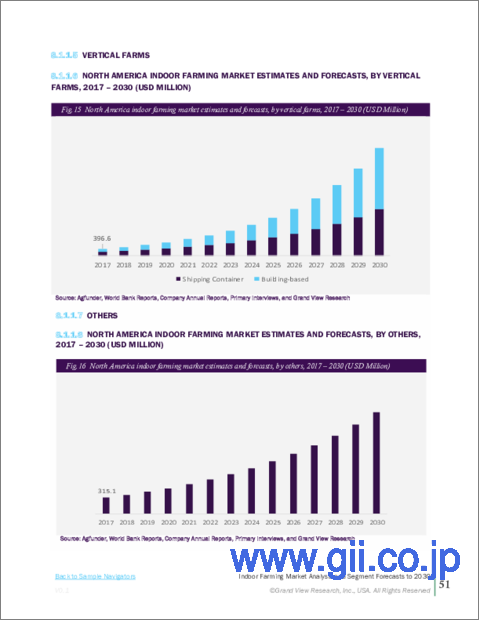

- 6.1.2 Vertical Farms

- 6.1.2.1 Shipping Container

- 6.1.2.2 Building-based

- 6.1.3 Others

Chapter 7 Component Estimates & Trend Analysis

- 7.1 Indoor Farming Market: Component Movement Analysis

- 7.1.1 Hardware

- 7.1.1.1 Climate Control Systems

- 7.1.1.2 Lighting Systems

- 7.1.1.3 Sensors

- 7.1.1.4 Irrigation Systems

- 7.1.2 Software

- 7.1.2.1 Web-Based

- 7.1.2.2 Cloud-Based

- 7.1.1 Hardware

Chapter 8 Crop Category Estimates & Trend Analysis

- 8.1 Indoor Farming Market: Crop Category Movement Analysis

- 8.1.1 Fruits Vegetables, & Herbs

- 8.1.1.1 Tomato

- 8.1.1.2 Lettuce

- 8.1.1.3 Bell & Chili Peppers

- 8.1.1.4 Strawberry

- 8.1.1.5 Cucumber

- 8.1.1.6 Leafy Greens (excluding lettuce)

- 8.1.1.7 Herbs

- 8.1.1.8 Others

- 8.1.2 Flowers & Ornamentals

- 8.1.2.1 Perennials

- 8.1.2.2 Annuals

- 8.1.2.3 Ornamentals

- 8.1.3 Others

- 8.1.1 Fruits Vegetables, & Herbs

Chapter 9 Regional Estimates & Trend Analysis

- 9.1 Indoor Farming Market Share By Region, 2021 & 2030

- 9.2 North America

- 9.2.1 Facility Type

- 9.2.1.1 Greenhouse

- 9.2.1.2 Vertical farms

- 9.2.1.3 Other

- 9.2.2 Component

- 9.2.2.1 Hardware

- 9.2.2.2 Software

- 9.2.3 Crop Category

- 9.2.3.1 Fruits, Vegetables, & Herbs

- 9.2.3.2 Flowers & Ornamentals

- 9.2.3.3 Others

- 9.2.4 U.S.

- 9.2.5 Facility Type

- 9.2.5.1 Greenhouse

- 9.2.5.2 Vertical farms

- 9.2.5.3 Other

- 9.2.6 Component

- 9.2.6.1 Hardware

- 9.2.6.2 software

- 9.2.7 Crop Category

- 9.2.9.1 Fruits, Vegetables, & Herbs

- 9.2.9.2 Flowers & Ornamentals

- 9.2.8 Canada

- 9.2.9 Facility Type

- 9.2.9.1 Greenhouse

- 9.2.9.2 Vertical farms

- 9.2.9.3 Other

- 9.2.10 Component

- 9.2.10.1 Hardware

- 9.2.10.2 software

- 9.2.11 Crop Category

- 9.2.11.1 Fruits, Vegetables, & Herbs

- 9.2.11.2 Flowers & Ornamentals

- 9.2.11.3 Other

- 9.2.12 Mexico

- 9.2.13 Facility Type

- 9.2.13.1 Greenhouse

- 9.2.13.2 Vertical farms

- 9.2.13.3 Other

- 9.2.14 Component

- 9.2.14.1 Hardware

- 9.2.14.2 software

- 9.2.15 Crop Category

- 9.2.15.1 Fruits, Vegetables, & Herbs

- 9.2.15.2 Flowers & Ornamentals

- 9.2.15.3 Other

- 9.2.1 Facility Type

- 9.3 Europe

- 9.3.1 Facility Type

- 9.3.1.1 Greenhouse

- 9.3.1.2 Vertical farms

- 9.3.1.3 Other

- 9.3.2 Component

- 9.3.2.1 Hardware

- 9.3.2.2 Software

- 9.3.3 Crop Category

- 9.3.3.1 Fruits, Vegetables, & Herbs

- 9.3.3.2 Flowers & Ornamentals

- 9.3.3.3 Others

- 9.3.4 U.K.

- 9.3.5 Facility Type

- 9.3.5.1 Greenhouse

- 9.3.5.2 Vertical farms

- 9.3.5.3 Other

- 9.3.6 Component

- 9.3.6.1 Hardware

- 9.3.6.2 software

- 9.3.7 Crop Category

- 9.3.7.1 Fruits, Vegetables, & Herbs

- 9.3.7.2 Flowers & Ornamentals

- 9.3.8 Germany

- 9.3.9 Facility Type

- 9.3.9.1 Greenhouse

- 9.3.9.2 Vertical farms

- 9.3.9.3 Other

- 9.3.10 Component

- 9.3.10.1 Hardware

- 9.3.10.2 software

- 9.3.11 Crop Category

- 9.3.11.1 Fruits, Vegetables, & Herbs

- 9.3.11.2 Flowers & Ornamentals

- 9.3.12 France

- 9.3.13 Facility Type

- 9.3.13.1 Greenhouse

- 9.3.13.2 Vertical farms

- 9.3.13.3 Other

- 9.3.14 Component

- 9.3.14.1 Hardware

- 9.3.14.2 software

- 9.3.15 Crop Category

- 9.3.15.1 Fruits, Vegetables, & Herbs

- 9.3.15.2 Flowers & Ornamentals

- 9.3.16 Spain

- 9.3.17 Facility Type

- 9.3.17.1 Greenhouse

- 9.3.17.2 Vertical farms

- 9.3.17.3 Other

- 9.3.18 Component

- 9.3.18.1 Hardware

- 9.3.18.2 software

- 9.3.19 Crop Category

- 9.3.19.1 Fruits, Vegetables, & Herbs

- 9.3.19.2 Flowers & Ornamentals

- 9.3.1 Facility Type

- 9.4 Asia Pacific

- 9.4.1 Facility Type

- 9.4.1.1 Greenhouse

- 9.4.1.2 Vertical farms

- 9.4.1.3 Other

- 9.4.2 Component

- 9.4.2.1 Hardware

- 9.4.2.2 Software

- 9.4.3 Crop Category

- 9.4.3.1 Fruits, Vegetables, & Herbs

- 9.4.3.2 Flowers & Ornamentals

- 9.4.4 China

- 9.4.5 Facility Type

- 9.4.5.1 Greenhouse

- 9.4.5.2 Vertical farms

- 9.4.5.3 Other

- 9.4.6 Component

- 9.4.6.1 Hardware

- 9.4.6.2 software

- 9.4.7 Crop Category

- 9.4.7.1 Fruits, Vegetables, & Herbs

- 9.4.7.2 Flowers & Ornamentals

- 9.4.8 Japan

- 9.4.9 Facility Type

- 9.4.9.1 Greenhouse

- 9.4.9.2 Vertical farms

- 9.4.9.3 Other

- 9.4.10 Component

- 9.4.10.1 Hardware

- 9.4.10.2 software

- 9.4.11 Crop Category

- 9.4.11.1 Fruits, Vegetables, & Herbs

- 9.4.11.2 Flowers & Ornamentals

- 9.4.12 India

- 9.4.13 Facility Type

- 9.4.13.1 Greenhouse

- 9.4.13.2 Vertical farms

- 9.4.13.3 Other

- 9.4.14 Component

- 9.4.14.1 Hardware

- 9.4.14.2 software

- 9.4.15 Crop Category

- 9.4.15.1 Fruits, Vegetables, & Herbs

- 9.4.15.2 Flowers & Ornamentals

- 9.4.1 Facility Type

- 9.5 South America

- 9.5.1 Facility Type

- 9.5.1.1 Greenhouse

- 9.5.1.2 Vertical farms

- 9.5.1.3 Other

- 9.5.2 Component

- 9.5.2.1 Hardware

- 9.5.2.2 Software

- 9.5.3 Crop Category

- 9.5.3.1 Fruits, Vegetables, & Herbs

- 9.5.3.2 Flowers & Ornamentals

- 9.5.4 Brazil

- 9.5.5 Facility Type

- 9.5.5.1 Greenhouse

- 9.5.5.2 Vertical farms

- 9.5.5.3 Other

- 9.5.6 Component

- 9.5.6.1 Hardware

- 9.5.6.2 software

- 9.5.7 Crop Category

- 9.5.7.1 Fruits, Vegetables, & Herbs

- 9.5.7.2 Flowers & Ornamentals

- 9.5.1 Facility Type

- 9.6 MEA

- 9.6.1 Facility Type

- 9.6.1.1 Greenhouse

- 9.6.1.2 Vertical farms

- 9.6.1.3 Other

- 9.6.2 Component

- 9.6.2.1 Hardware

- 9.6.2.2 Software

- 9.6.3 Crop Category

- 9.6.3.1 Fruits, Vegetables, & Herbs

- 9.6.3.2 Flowers & Ornamentals

- 9.6.1 Facility Type

Chapter 10 Competitive Analysis

- 10.1 Recent Developments & Impact Analysis, By Key Market Participants

- 10.2 Company/Competition Categorization (Key Innovators, Market Leaders, Emerging Players)

- 10.3 Vendor Landscape

- 10.3.1 Key company market share analysis, 2021

- 10.4 Company Analysis Tools

- 10.4.1 market position analysis

- 10.4.2 Competitive Dashboard Analysis

Chapter 11 Competitive Landscape

- 11.1 Argus Control System Limited

- 11.1.1 Company overview

- 11.1.2 Product benchmarking

- 11.1.3 Recent developments

- 11.2 Certhon

- 11.2.1 Company overview

- 11.2.2 Product benchmarking

- 11.2.3 Projects Undertaken

- 11.2.4 Recent developments

- 11.3 General Hydroponics (Hawthorne Gardening Company)

- 11.3.1 Company overview

- 11.3.2 Product benchmarking

- 11.4 Hydrodynamics International

- 11.4.1 Company overview

- 11.4.2 Product benchmarking

- 11.5 Illumitex

- 11.5.1 Company overview

- 11.5.2 Product benchmarking

- 11.5.3 Recent developments

- 11.6 LumiGrow Inc.

- 11.6.1 Company overview

- 11.6.2 Product benchmarking

- 11.6.3 Recent developments

- 11.7 Netafim

- 11.7.1 Company overview

- 11.7.2 Product benchmarking

- 11.8 PRIVA

- 11.8.1 Company overview

- 11.8.2 Product benchmarking

- 11.9 Richel Group

- 11.9.1 Company overview

- 11.9.2 Product benchmarking

- 11.10 Vertical Farm Systems

- 11.10.1 Company overview

- 11.10.2 Product benchmarking