|

|

市場調査レポート

商品コード

1301108

遠隔画像診断市場規模、シェア、動向分析レポート:製品別(超音波、MRI、CT、X線)、レポート別、最終用途別(病院、外来画像診断センター、放射線クリニック)、地域別、セグメント別予測、2023年~2030年Teleradiology Market Size, Share & Trends Analysis Report By Product (Ultrasound, MRI, CT, X-ray), By Report (Preliminary, Final), By End-use (Hospital, Ambulatory Imaging Center, Radiology Clinics), By Region, And Segment Forecasts, 2023 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 遠隔画像診断市場規模、シェア、動向分析レポート:製品別(超音波、MRI、CT、X線)、レポート別、最終用途別(病院、外来画像診断センター、放射線クリニック)、地域別、セグメント別予測、2023年~2030年 |

|

出版日: 2023年06月21日

発行: Grand View Research

ページ情報: 英文 120 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

遠隔画像診断市場の成長と動向

Grand View Research, Inc.の最新レポートによると、世界の遠隔画像診断市場規模は、2023年から2030年にかけて12.9%のCAGRを記録し、2030年までに62億8,000万米ドルに達すると予測されています。

慢性疾患の有病率の増加、技術的に高度な診断のイントロダクション、緊急時やセカンドオピニオンのための遠隔画像診断のニーズの増加が、遠隔画像診断サービスの需要を刺激しています。

また、放射線科医の不足と画像診断に対する継続的な需要の高まりも、市場成長の原動力になると予想されます。英国、米国、シンガポールなどの国々では、放射線機器の設置台数は年々増加しているが、画像診断の需要増には対応できていないです。例えば、NHSの報告書によると、2021年のイングランドにおけるMRI検査の平均待ち時間は22日と報告されています。

さらに、画像診断サービスに関する世界各国の政府による法改正は、予測期間中の同市場の成長を促進すると思われます。例えば、オーストラリアの1973年健康保険法における画像診断に関する改正は、2008年3月以降、メディケアによる画像診断サービスへの助成を可能にしました。これにより、様々な疾患に対する画像診断へのアクセスが向上しました。北米は2021年の主要地域市場であり、世界シェアの39.09%を占めました。これは、研究開発費の多寡、患者の意識レベル、がん罹患率などの要因によるものです。

加齢は、骨粗鬆症のような関節の退行性障害を発症する最大の危険因子と考えられています。したがって、世界の高齢者人口の増加は、市場に大きな影響を与える促進要因になると予想されます。変形性関節症や骨粗鬆症は、70歳以上の高齢者に最もよく見られる疾患です。これらの疾患の有病率の増加は、多くの国々における経済的負担の増加につながり、それによって遠隔画像診断に対する需要が増加しています。

遠隔画像診断市場レポートハイライト

- X線は、歯の損傷や骨の骨折の検出など幅広い用途があるため、2022年に最大の市場シェアを占めました。

- レポートの種類別では、速報セグメントが2022年に最大の市場シェアを占めました。

- 最終用途別では、病院が2022年に最大の市場シェアを占めました。これは、患者数の多さ、財政能力の構築、先端技術への受容性別。

- 北米は、先端技術の幅広い利用、主要企業の存在、同地域で確立されたヘルスケアインフラにより、2022年に最大の遠隔画像診断市場シェアを占めました。

- アジア太平洋地域は、遠隔画像診断の拡大に対する政府の支援的な規制と新技術の迅速な導入により、予測期間中に最も急成長する地域となる見込みです。

- 製造企業の多くは、製品ポートフォリオの拡大とアジア太平洋などの未開拓市場への参入に注力しています。

目次

第1章 調査手法と範囲

- 市場セグメンテーションと範囲

- 製品

- 報告

- 最終用途

- 地域範囲

- 推定・予測のタイムライン

- 調査手法

- 情報調達

- 購入したデータベース

- GVRの内部データベース

- 二次情報

- 1次調査

- 1次調査の詳細

- 情報またはデータ分析

- データ分析モデル

- 市場の形成と検証

- モデル詳細

- 商品フロー解析(モデル1)

- 数量価格分析(モデル2)

- 二次情報のリスト

- 一次情報のリスト

- 目的

第2章 エグゼクティブサマリー

- 市場の見通し

- セグメントの見通し

- 製品展望

- レポートの見通し

- 最終用途の見通し

- 地域別の見通し

- 競合考察

第3章 遠隔画像診断市場の変数、動向、範囲

- 市場系統の見通し

- 親市場の見通し

- 関連/補助的な市場見通し

- 普及と成長の見通しマッピング

- 業界のバリューチェーン分析

- 償還の枠組み

- 市場力学

- 市場促進要因の分析

- 市場抑制要因分析

- 遠隔画像診断市場分析ツール

- 業界分析- ポーターズ

- PESTEL分析

- 主要取引と戦略的提携の分析

- 市場参入戦略

第4章 世界の遠隔画像診断市場:製品の推定・動向分析

- 定義と範囲

- X線

- 超音波

- 磁気共鳴画像法(MRI)

- コンピュータ断層撮影(CT)

- 核イメージング

- 遠隔画像診断市場シェア、2021年および2030年

- セグメントダッシュボード

- 製品別の世界の遠隔画像診断市場の見通し

- 以下の市場規模、予測および傾向分析、2018年から2030年まで

- X線

- 超音波

- 磁気共鳴画像法(MRI)

- コンピュータ断層撮影(CT)

- 核イメージング

第5章 世界の遠隔画像診断市場:レポートの推定・動向分析

- 定義と範囲

- 予選報告書

- 最終報告書

- 遠隔画像診断市場シェア、2021年および2030年

- セグメントダッシュボード

- レポート別世界の遠隔画像診断市場の展望

- 以下の市場規模、予測および傾向分析、2018年から2030年まで

- 暫定報告書

- 最終報告書

第6章 世界の遠隔画像診断市場:最終用途の推定・動向分析

- 定義と範囲

- 病院

- 外来画像診断センター

- 放射線科クリニック

- 遠隔画像診断市場シェア、2021年および2030年

- セグメントダッシュボード

- 最終用途別の世界の遠隔画像診断市場の見通し

- 以下の市場規模、予測および傾向分析、2018年から2030年まで

- 病院

- 外来画像診断センター

- 放射線科クリニック

第7章 世界の遠隔画像診断市場:地域推定・動向分析

- 地域市場シェア分析、2021年および2030年

- 地域市場ダッシュボード

- 世界の地域市場のスナップショット

- 地域市場シェアと主要企業、2021年

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東とアフリカ

- SWOT分析、要因別(政治・法律、経済・技術)

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東とアフリカ

- 市場規模、予測、量および傾向分析、2021年から2030年:

- 北米

- 市場推計・予測、2018~2030年(100万米ドル)

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- スイス

- オランダ

- スウェーデン

- ベルギー

- アジア太平洋地域

- 日本

- 中国

- インド

- タイ

- シンガポール

- オーストラリア

- 台湾

- インドネシア

- マレーシア

- 韓国

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- コロンビア

- チリ

- MEA

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- クウェート

- イスラエル

第8章 競合情勢

- 主要市場参入企業別最近の動向と影響分析

- 会社/競合の分類

- イノベーター

- ベンダー情勢

- List of key distributors and channel partners

- Key customers

- Key company market share analysis, 2021

- Virtual Radiologic(vRad)

- Agfa-Gevaert Group

- ONRAD, Inc.

- Everlight Radiology

- 4ways Healthcare Ltd.

- RamSoft, Inc.

- USARAD Holdings, Inc.

- Koninklijke Philips NV

- Matrix(Teleradiology Division of Radiology Partners)

- Medica Group PLC.

- 5C Network

List of Tables

- Table 1 List of Abbreviation

- Table 2 North America teleradiology market, by region, 2018 - 2030 (USD Million)

- Table 3 North America teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 4 North America teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 5 North America teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 6 U.S. teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 7 U.S. teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 8 U.S. teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 9 Canada teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 10 Canada teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 11 Canada teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 12 Europe teleradiology market, by region, 2018 - 2030 (USD Million)

- Table 13 Europe teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 14 Europe teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 15 Europe teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 16 Germany teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 17 Germany teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 18 Germany teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 19 UK teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 20 UK teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 21 UK teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 22 France teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 23 France teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 24 France teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 25 Italy teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 26 Italy teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 27 Italy teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 28 Spain teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 29 Spain teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 30 Spain teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 31 Russia teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 32 Russia teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 33 Russia teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 34 The Netherlands teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 35 The Netherlands teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 36 The Netherlands teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 37 Sweden teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 38 Sweden teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 39 Sweden teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 40 Belgium teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 41 Belgium teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 42 Belgium teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 43 Switzerland teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 44 Switzerland teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 45 Switzerland teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 46 APAC teleradiology market, by region, 2018 - 2030 (USD Million)

- Table 47 APAC teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 48 APAC teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 49 APAC teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 50 China teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 51 China teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 52 China teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 53 Japan teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 54 Japan teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 55 Japan teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 56 India teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 57 India teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 58 India teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 59 Thailand teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 60 Thailand teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 61 Thailand teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 62 South Korea teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 63 South Korea teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 64 South Korea teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 65 Indonesia teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 66 Indonesia teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 67 Indonesia teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 68 Taiwan teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 69 Taiwan teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 70 Taiwan teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 71 Singapore teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 72 Singapore teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 73 Singapore teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 74 Australia teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 75 Australia teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 76 Australia teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 77 Malaysia teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 78 Malaysia teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 79 Malaysia teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 80 Latin America teleradiology market, by region, 2018 - 2030 (USD Million)

- Table 81 Latin America teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 82 Latin America teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 83 Latin America teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 84 Brazil teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 85 Brazil teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 86 Brazil teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 87 Mexico teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 88 Mexico teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 89 Mexico teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 90 Argentina teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 91 Argentina teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 92 Argentina teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 93 Colombia teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 94 Colombia teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 95 Colombia teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 96 Chile teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 97 Chile teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 98 Chile teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 99 Middle East and Africa teleradiology market, by region, 2018 - 2030 (USD Million)

- Table 100 Middle East and Africa teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 101 Middle East and Africa teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 102 Middle East and Africa teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 103 South Africa teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 104 South Africa teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 105 South Africa teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 106 Saudi Arabia teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 107 Saudi Arabia teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 108 Saudi Arabia teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 109 UAE teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 110 UAE teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 111 UAE teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 112 Kuwait teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 113 Kuwait teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 114 Kuwait teleradiology market, by end use, 2018 - 2030 (USD Million)

- Table 115 Israel teleradiology market, by product, 2018 - 2030 (USD Million)

- Table 116 Israel teleradiology market, by report, 2018 - 2030 (USD Million)

- Table 117 Israel teleradiology market, by end use, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Market research process

- Fig. 2 Data triangulation techniques

- Fig. 3 Primary research pattern

- Fig. 4 Primary interviews in North America

- Fig. 5 Primary interviews in Europe

- Fig. 6 Primary interviews in APAC

- Fig. 7 Primary interviews in Latin America

- Fig. 8 Primary interviews in MEA

- Fig. 9 Market research approaches

- Fig. 10 Value-chain-based sizing & forecasting

- Fig. 11 QFD modeling for market share assessment

- Fig. 12 Market formulation & validation

- Fig. 13 Teleradiology market :market outlook

- Fig. 14 Teleradiology market competitive insights

- Fig. 15 Parent market outlook

- Fig. 16 Related/ancillary market outlook

- Fig. 17 Penetration and growth prospect mapping

- Fig. 18 Industry value chain analysis

- Fig. 19 Teleradiology market driver impact

- Fig. 20 Teleradiology market restraint impact

- Fig. 21 Teleradiology market strategic initiatives analysis

- Fig. 22 Teleradiology market: product movement analysis

- Fig. 23 Teleradiology market: product outlook and key takeaways

- Fig. 24 X-ray market estimates and forecast, 2018 - 2030

- Fig. 25 Ultrasound market estimates and forecast, 2018 - 2030

- Fig. 26 Computed tomography (CT) market estimates and forecast, 2018 - 2030

- Fig. 27 Magnetic resonance imaging (MRI) market estimates and forecast, 2018 - 2030

- Fig. 28 Nuclear imaging market estimates and forecast, 2018 - 2030

- Fig. 29 Teleradiology market: report movement analysis

- Fig. 30 Teleradiology market: report outlook and key takeaways

- Fig. 31 Preliminary reports market estimates and forecast, 2018 - 2030

- Fig. 32 Final reports market estimates and forecast, 2018 - 2030

- Fig. 33 Teleradiology market: end use movement analysis

- Fig. 34 Teleradiology market: end use outlook and key takeaways

- Fig. 35 Hospitals market estimates and forecast, 2018 - 2030

- Fig. 36 Ambulatory imaging center estimates and forecast, 2018 - 2030

- Fig. 37 Radiology clinic estimates and forecast, 2018 - 2030

- Fig. 38 Global Teleradiology market: regional movement analysis

- Fig. 39 Global Teleradiology market: regional outlook and key takeaways

- Fig. 40 Global teleradiology market share and leading players

- Fig. 41 North America market share and leading players

- Fig. 42 Europe market share and leading players

- Fig. 43 Asia Pacific market share and leading players

- Fig. 44 Latin America market share and leading players

- Fig. 45 Middle East & Africa market share and leading players

- Fig. 46 North America: SWOT

- Fig. 47 Europe SWOT

- Fig. 48 Asia Pacific SWOT

- Fig. 49 Latin America SWOT

- Fig. 50 MEA SWOT

- Fig. 51 North America, by country

- Fig. 52 North America

- Fig. 53 North America market estimates and forecast, 2018 - 2030

- Fig. 54 U.S.

- Fig. 55 U.S. market estimates and forecast, 2018 - 2030

- Fig. 56 Canada

- Fig. 57 Canada market estimates and forecast, 2018 - 2030

- Fig. 58 Europe

- Fig. 59 Europe. market estimates and forecast, 2018 - 2030

- Fig. 60 UK

- Fig. 61 UK market estimates and forecast, 2018 - 2030

- Fig. 62 Germany

- Fig. 63 Germany market estimates and forecast, 2018 - 2030

- Fig. 64 France

- Fig. 65 France market estimates and forecast, 2018 - 2030

- Fig. 66 Italy

- Fig. 67 Italy market estimates and forecast, 2018 - 2030

- Fig. 68 Spain

- Fig. 69 Spain market estimates and forecast, 2018 - 2030

- Fig. 70 Russia

- Fig. 71 Russia market estimates and forecast, 2018 - 2030

- Fig. 72 The Netherlands

- Fig. 73 The Netherlands market estimates and forecast, 2018 - 2030

- Fig. 74 Switzerland

- Fig. 75 Switzerland market estimates and forecast, 2018 - 2030

- Fig. 76 Sweden

- Fig. 77 Sweden market estimates and forecast, 2018 - 2030

- Fig. 78 Belgium

- Fig. 79 Belgium market estimates and forecast, 2018 - 2030

- Fig. 80 Asia Pacific

- Fig. 81 Asia Pacific market estimates and forecast, 2018 - 2030

- Fig. 82 China

- Fig. 83 China market estimates and forecast, 2018 - 2030

- Fig. 84 Japan

- Fig. 85 Japan market estimates and forecast, 2018 - 2030

- Fig. 86 India

- Fig. 87 India market estimates and forecast, 2018 - 2030

- Fig. 88 Thailand

- Fig. 89 Thailand. market estimates and forecast, 2018 - 2030

- Fig. 90 South Korea

- Fig. 91 South Korea market estimates and forecast, 2018 - 2030

- Fig. 92 Indonesia

- Fig. 93 Indonesia market estimates and forecast, 2018 - 2030

- Fig. 94 Taiwan

- Fig. 95 Taiwan market estimates and forecast, 2018 - 2030

- Fig. 96 Singapore

- Fig. 97 Singapore market estimates and forecast, 2018 - 2030

- Fig. 98 Australia

- Fig. 99 Australia market estimates and forecast, 2018 - 2030

- Fig. 100 Malaysia

- Fig. 101 Malaysia market estimates and forecast, 2018 - 2030

- Fig. 102 Latin America

- Fig. 103 Latin America market estimates and forecast, 2018 - 2030

- Fig. 104 Brazil

- Fig. 105 Brazil market estimates and forecast, 2018 - 2030

- Fig. 106 Mexico

- Fig. 107 Mexico market estimates and forecast, 2018 - 2030

- Fig. 108 Argentina

- Fig. 109 Argentina market estimates and forecast, 2018 - 2030

- Fig. 110 Colombia

- Fig. 111 Colombia market estimates and forecast, 2018 - 2030

- Fig. 112 Chile

- Fig. 113 Chile market estimates and forecast, 2018 - 2030

- Fig. 114 Middle East and Africa

- Fig. 115 Middle East and Africa. market estimates and forecast, 2018 - 2030

- Fig. 116 South Africa

- Fig. 117 South Africa market estimates and forecast, 2018 - 2030

- Fig. 118 Saudi Arabia

- Fig. 119 Saudi Arabia market estimates and forecast, 2018 - 2030

- Fig. 120 UAE

- Fig. 121 UAE market estimates and forecast, 2018 - 2030

- Fig. 122 Kuwait

- Fig. 123 Kuwait market estimates and forecast, 2018 - 2030

- Fig. 124 Israel

- Fig. 125 Israel market estimates and forecast, 2018 - 2030

- Fig. 126 Participant categorization- teleradiology market

- Fig. 127 Market share of key market players- teleradiology market

Teleradiology Market Growth & Trends

The global teleradiology market size is expected to reach USD 6.28 billion by 2030 registering a CAGR of 12.9% from 2023 to 2030, according to a new report by Grand View Research, Inc. The growing prevalence of chronic disorders, the introduction of technologically advanced diagnoses, and an increasing need for teleradiology for emergencies and second opinions are stimulating demand for teleradiology services.

The shortage of radiologists coupled with a continuously rising demand for imaging procedures is also expected to drive market growth. Although, the number of radiology equipment installed in the countries such as the U.K., U.S., and Singapore has increased over years; however, it is unable to meet the rising demand for diagnostics imaging. For instance, as per the NHS report, the average waiting time for an MRI test is reported to be 22 days in England in the year 2021.

In addition, legislative amendments made by the various governments worldwide for diagnostic imaging services will enhance the growth of this market during the forecast period. For instance, amendments in Australia's Health Insurance Act 1973 for diagnostic imaging have enabled Medicare funding for these diagnostic imaging services since March 2008. This has allowed better access to diagnostic imaging for various conditions. North America was the major regional market in 2021 and accounted for 39.09% of the global share due to the factors, such as the higher amount of funding for R&D, patient awareness levels, and cancer prevalence.

Aging is considered as the greatest risk factor for developing degenerative disorders of the joints, such as osteoporosis. Thus, the growing geriatric population, globally, is expected to be a high-impact rendering driver of the market. Osteoarthritis and osteoporosis are some of the most common disorders in the population aged over 70 years. The growing prevalence of these disorders is leading to an increase in the economic burden on many countries, thereby growing demand for teleradiology.

Teleradiology Market Report Highlights

- X-ray held the largest market share in 2022 owing to its wide applications, such as in the detection of dental injuries and fractures in bones

- Based on report type, the preliminary reports segment held the largest market share in 2022

- Based on end-use, hospitals held the largest market share in 2022, owing to large patient base, building financial capacity, and receptivity to advanced technology

- North America held the largest teleradiology market share in 2022 due to wide usage of the advanced technologies and the presence of key companies along with established healthcare infrastructure in the region

- Asia Pacific is expected to be the fastest-growing region during the forecast period due to the supportive government regulations for the expansion of teleradiology and the quick adoption of the new technologies

- Most of the manufacturing companies focus on expanding their product portfolios and entering untapped markets, such as Asia Pacific

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.1.1. Product

- 1.1.2. Report

- 1.1.3. End-use

- 1.1.4. Regional scope

- 1.1.5. Estimates and forecast timeline

- 1.2. Research Methodology

- 1.3. Information Procurement

- 1.3.1. Purchased database

- 1.3.2. GVR's internal database

- 1.3.3. Secondary sources

- 1.3.4. Primary research

- 1.3.5. Details of primary research

- 1.3.5.1. Data for primary interviews in North America

- 1.3.5.2. Data for primary interviews in Europe

- 1.3.5.3. Data for primary interviews in Asia Pacific

- 1.3.5.4. Data for primary interviews in Latin America

- 1.3.5.5. Data for Primary interviews in MEA

- 1.4. Information or Data Analysis

- 1.4.1. Data analysis models

- 1.5. Market Formulation & Validation

- 1.6. Model Details

- 1.6.1. Commodity flow analysis (Model 1)

- 1.6.1.1. Approach 1: Commodity flow approach

- 1.6.2. Volume price analysis (Model 2)

- 1.6.2.1. Approach 2: Volume price analysis

- 1.6.1. Commodity flow analysis (Model 1)

- 1.7. List of Secondary Sources

- 1.8. List of Primary Sources

- 1.9. Objectives

- 1.9.1. Objective 1

- 1.9.2. Objective 2

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.2.1. Product outlook

- 2.2.2. Report outlook

- 2.2.3. End-use outlook

- 2.2.4. Regional outlook

- 2.3. Competitive Insights

Chapter 3. Teleradiology Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent market outlook

- 3.1.2. Related/ancillary market outlook

- 3.2. Penetration & Growth Prospect Mapping

- 3.3. Industry Value Chain Analysis

- 3.3.1. Reimbursement framework

- 3.4. Market Dynamics

- 3.4.1. Market driver analysis

- 3.4.1.1. Increasing prevalence of target diseases

- 3.4.1.2. Introduction of technologically advanced diagnostics

- 3.4.1.3. Low costs compared to conventional office visits

- 3.4.2. Market restraint analysis

- 3.4.2.1. Lack of skilled professionals

- 3.4.2.2. Lack of security for data imaging

- 3.4.1. Market driver analysis

- 3.5. Teleradiology Market Analysis Tools

- 3.5.1. Industry Analysis - Porter's

- 3.5.1.1. Supplier power

- 3.5.1.2. Buyer power

- 3.5.1.3. Substitution threat

- 3.5.1.4. Threat of new entrant

- 3.5.1.5. Competitive rivalry

- 3.5.2. PESTEL Analysis

- 3.5.2.1. Political landscape

- 3.5.2.2. Technological landscape

- 3.5.2.3. Economic landscape

- 3.5.3. Major Deals & Strategic Alliances Analysis

- 3.5.4. Market Entry Strategies

- 3.5.1. Industry Analysis - Porter's

Chapter 4. Global Teleradiology Market: Product Estimates & Trend Analysis

- 4.1. Definitions and Scope

- 4.1.1. X-ray

- 4.1.2. Ultrasound

- 4.1.3. Magnetic Resonance Imaging (MRI)

- 4.1.4. Computed Tomography (CT)

- 4.1.5. Nuclear Imaging

- 4.2. Teleradiology Market Share, 2021 & 2030

- 4.3. Segment Dashboard

- 4.4. Global Teleradiology Market by Product Outlook

- 4.5. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

- 4.5.1. X-ray

- 4.5.1.1. X-ray teleradiology market, 2018 - 2030 (USD Million)

- 4.5.2. Ultrasound

- 4.5.2.1. Ultrasound teleradiology market, 2018 - 2030 (USD Million)

- 4.5.3. Magnetic Resonance Imaging (MRI)

- 4.5.3.1. Magnetic Resonance Imaging (MRI) teleradiology market, 2018 - 2030 (USD Million)

- 4.5.4. Computed Tomography (CT)

- 4.5.4.1. Computed Tomography (CT) teleradiology market, 2018 - 2030 (USD Million)

- 4.5.5. Nuclear Imaging

- 4.5.5.1. Nuclear imaging teleradiology market, 2018 - 2030 (USD Million)

- 4.5.1. X-ray

Chapter 5. Global Teleradiology Market: Report Estimates & Trend Analysis

- 5.1. Definitions and Scope

- 5.1.1. Preliminary reports

- 5.1.2. Final reports

- 5.2. Teleradiology Market Share, 2021 & 2030

- 5.3. Segment Dashboard

- 5.4. Global Teleradiology Market by Report Outlook

- 5.5. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

- 5.5.1. Preliminary reports

- 5.5.1.1. Preliminary reports market, 2018 - 2030 (USD Million)

- 5.5.2. Final reports

- 5.5.2.1. Final reports market, 2018 - 2030 (USD Million)

- 5.5.1. Preliminary reports

Chapter 6. Global Teleradiology Market: End Use Estimates & Trend Analysis

- 6.1. Definitions and Scope

- 6.1.1. Hospitals

- 6.1.2. Ambulatory Imaging Centers

- 6.1.3. Radiology Clinics

- 6.2. Teleradiology Market Share, 2021 & 2030

- 6.3. Segment Dashboard

- 6.4. Global Teleradiology Market by End Use Outlook

- 6.5. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

- 6.5.1. Hospitals

- 6.5.1.1. Hospitals teleradiology market, 2018 - 2030 (USD Million)

- 6.5.2. Ambulatory Imaging Center

- 6.5.2.1. Ambulatory Imaging Center teleradiology market, 2018 - 2030 (USD Million)

- 6.5.3. Radiology Clinic

- 6.5.3.1. Radiology clinic teleradiology market, 2018 - 2030 (USD Million)

- 6.5.1. Hospitals

Chapter 7. Global Teleradiology Market: Regional Estimates & Trend Analysis

- 7.1. Regional market share analysis, 2021 & 2030

- 7.2. Regional Market Dashboard

- 7.3. Global Regional Market Snapshot

- 7.4. Regional Market Share and Leading Players, 2021

- 7.4.1. North America

- 7.4.2. Europe

- 7.4.3. Asia Pacific

- 7.4.4. Latin America

- 7.4.5. Middle East and Africa

- 7.5. SWOT Analysis, by Factor (Political & Legal, Economic and Technological)

- 7.5.1. North America

- 7.5.2. Europe

- 7.5.3. Asia Pacific

- 7.5.4. Latin America

- 7.5.5. Middle East and Africa

- 7.6. Market Size, & Forecasts, Volume and Trend Analysis, 2021 to 2030:

- 7.7. North America

- 7.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.7.2. U.S.

- 7.7.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.7.3. Canada

- 7.7.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.8. Europe

- 7.8.1. UK

- 7.8.1.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.8.2. Germany

- 7.8.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.8.3. France

- 7.8.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.8.4. Italy

- 7.8.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.8.5. Spain

- 7.8.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.8.6. Russia

- 7.8.6.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.8.7. Switzerland

- 7.8.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.8.8. The Netherland

- 7.8.8.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.8.9. Sweden

- 7.8.9.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.8.10. Belgium

- 7.8.10.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.8.1. UK

- 7.9. Asia Pacific

- 7.9.1. Japan

- 7.9.1.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.9.2. China

- 7.9.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.9.3. India

- 7.9.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.9.4. Thailand

- 7.9.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.9.5. Singapore

- 7.9.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.9.6. Australia

- 7.9.6.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.9.7. Taiwan

- 7.9.7.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.9.8. Indonesia

- 7.9.8.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.9.9. Malaysia

- 7.9.9.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.9.10. South Korea

- 7.9.10.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.9.1. Japan

- 7.10. Latin America

- 7.10.1. Brazil

- 7.10.1.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.10.2. Mexico

- 7.10.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.10.3. Argentina

- 7.10.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.10.4. Colombia

- 7.10.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.10.5. Chile

- 7.10.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.10.1. Brazil

- 7.11. MEA

- 7.11.1. South Africa

- 7.11.1.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.11.2. Saudi Arabia

- 7.11.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.11.3. UAE

- 7.11.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.11.4. Kuwait

- 7.11.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.11.5. Israel

- 7.11.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.11.1. South Africa

Chapter 8. Competitive Landscape

- 8.1. Recent Developments & Impact Analysis, By Key Market Participants

- 8.2. Company/Competition Categorization

- 8.2.1. Innovators

- 8.3. Vendor Landscape

- 8.3.1. List of key distributors and channel partners

- 8.3.2. Key customers

- 8.3.3. Key company market share analysis, 2021

- 8.3.4. Virtual Radiologic (vRad)

- 8.3.4.1. Company overview

- 8.3.4.2. Financial performance

- 8.3.4.3. Product benchmarking

- 8.3.4.4. Strategic initiatives

- 8.3.5. Agfa-Gevaert Group

- 8.3.5.1. Company overview

- 8.3.5.2. Financial performance

- 8.3.5.3. Product benchmarking

- 8.3.5.4. Strategic initiatives

- 8.3.6. ONRAD, Inc.

- 8.3.6.1. Company overview

- 8.3.6.2. Financial performance

- 8.3.6.3. Product benchmarking

- 8.3.6.4. Strategic initiatives

- 8.3.7. Everlight Radiology

- 8.3.7.1. Company overview

- 8.3.7.2. Financial performance

- 8.3.7.3. Product benchmarking

- 8.3.7.4. Strategic initiatives

- 8.3.8. 4ways Healthcare Ltd.

- 8.3.8.1. Company overview

- 8.3.8.2. Financial performance

- 8.3.8.3. Product benchmarking

- 8.3.8.4. Strategic initiatives

- 8.3.9. RamSoft, Inc.

- 8.3.9.1. Company overview

- 8.3.9.2. Financial performance

- 8.3.9.3. Product benchmarking

- 8.3.9.4. Strategic initiatives

- 8.3.10. USARAD Holdings, Inc.

- 8.3.10.1. Company overview

- 8.3.10.2. Financial performance

- 8.3.10.3. Product benchmarking

- 8.3.10.4. Strategic initiatives

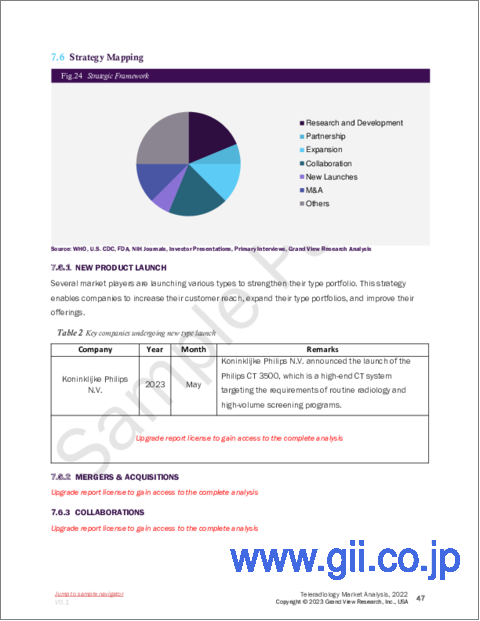

- 8.3.11. Koninklijke Philips N.V.

- 8.3.11.1. Company overview

- 8.3.11.2. Financial performance

- 8.3.11.3. Product benchmarking

- 8.3.11.4. Strategic initiatives

- 8.3.12. Matrix (Teleradiology Division of Radiology Partners)

- 8.3.12.1. Company overview

- 8.3.12.2. Financial performance

- 8.3.12.3. Product benchmarking

- 8.3.12.4. Strategic initiatives

- 8.3.13. Medica Group PLC.

- 8.3.13.1. Company overview

- 8.3.13.2. Financial performance

- 8.3.13.3. Product benchmarking

- 8.3.13.4. Strategic initiatives

- 8.3.14. 5C Network

- 8.3.14.1. Company overview

- 8.3.14.2. Financial performance

- 8.3.14.3. Product benchmarking

- 8.3.14.4. Strategic initiatives