|

|

市場調査レポート

商品コード

1092579

男性不妊症の市場規模・市場シェア・動向分析 (2022-2030年):検査 (DNA断片化技術・酸化ストレス分析・顕微鏡検査)・治療・地域別Male Infertility Market Size, Share & Trends Analysis Report By Test (DNA Fragmentation Technique, Oxidative Stress Analysis, Microscopic Examination), By Treatment, By Region, And Segment Forecasts, 2022 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 男性不妊症の市場規模・市場シェア・動向分析 (2022-2030年):検査 (DNA断片化技術・酸化ストレス分析・顕微鏡検査)・治療・地域別 |

|

出版日: 2022年05月12日

発行: Grand View Research

ページ情報: 英文 100 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の男性不妊症の市場規模は予測期間中4.9%のCAGRで推移し、2030年には59億米ドルの規模に成長すると予測されています。

診断検査の進歩や男性不妊症の増加などが同市場を牽引する主な要因となっています。また、不妊の原因となる生活習慣病、肥満の増加、高齢化の進展なども予測期間中の市場成長を押し上げると考えられています。

当レポートでは、世界の男性不妊症の市場を調査し、市場概要、市場成長への各種影響因子の分析、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合環境、市場シェア、主要企業のプロファイルなどをまとめています。

目次

第1章 調査手法・調査範囲

第2章 エグゼクティブサマリー

第3章 市場可変因子・動向・展望

- 市場系統の見通し

- 市場の分類

- 普及・成長の見通しマッピング

- 事業環境分析ツール

- 臨床試験分析

第4章 男性不妊症市場:検査別の分析

- 市場シェア分析

- セグメントダッシュボード

- 市場規模の予測・動向分析

第5章 男性不妊症市場:治療別の分析

- 市場シェア分析

- セグメントダッシュボード

- 市場規模の予測・動向分析

第6章 男性不妊症市場:地域別の分析

- 市場シェア分析

- セグメントダッシュボード

- 地域市場のスナップショット

- SWOT分析

- 市場規模の予測・動向分析

第7章 競合分析

- 戦略的枠組み/競合上の分類

- ベンダー情勢

- 企業の位置付け

- 企業プロファイル

- EMD Serono, Inc.

- Endo International plc

- Sanofi

- Bayer Group

- SCSA Diagnostics

- Andrology Solutions

- Halotech DNA SL

- Intas Pharmaceuticals Ltd.

- Aytu BioScience, Inc.

- Cadila Pharmaceuticals

- Vitrolife

第8章 推奨事項

List of Tables

- TABLE 1 List of secondary sources

- TABLE 2 North America Male Infertility market, by country, 2017 - 2030 (USD Million)

- TABLE 3 North America Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 4 North America Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 5 U.S. Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 6 U.S. Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 7 Canada Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 8 Canada Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 9 Europe Male Infertility market, by country, 2017 - 2030 (USD Million)

- TABLE 10 Europe Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 11 Europe Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 12 U.K. Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 13 U.K. Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 14 Germany Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 15 Germany Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 16 France Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 17 France Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 18 Italy Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 19 Italy Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 20 Spain Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 21 Spain Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 22 Asia Pacific Male Infertility market, by country, 2017 - 2030 (USD Million)

- TABLE 23 Asia Pacific Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 24 Asia Pacific Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 25 Japan Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 26 Japan Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 27 China Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 28 China Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 29 India Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 30 India Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 31 Latin America Male Infertility market, by country, 2017 - 2030 (USD Million)

- TABLE 32 Latin America Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 33 Latin America Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 34 Brazil Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 35 Brazil Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 36 Mexico Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 37 Mexico Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 38 MEA Male Infertility market, by country, 2017 - 2030 (USD Million)

- TABLE 39 MEA Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 40 MEA Male Infertility market, by treatment, 2017 - 2030 (USD Million)

- TABLE 41 South Africa Male Infertility market, by test, 2017 - 2030 (USD Million)

- TABLE 42 South Africa Male Infertility market, by treatment, 2017 - 2030 (USD Million)

List of Figures

- FIG. 1 Market research process

- FIG. 2 Information procurement

- FIG. 3 Primary research pattern

- FIG. 4 Market research approaches

- FIG. 5 Value chain based sizing & forecasting

- FIG. 6 QFD modeling for market share assessment

- FIG. 7 Market formulation & validation

- FIG. 8 Male infertility market outlook, 2021 (USD Million)

- FIG. 9 Market trends & outlook

- FIG. 10 Male infertility market segmentation

- FIG. 11 Penetration & growth prospect mapping

- FIG. 12 Market driver relevance analysis (Current & future impact)

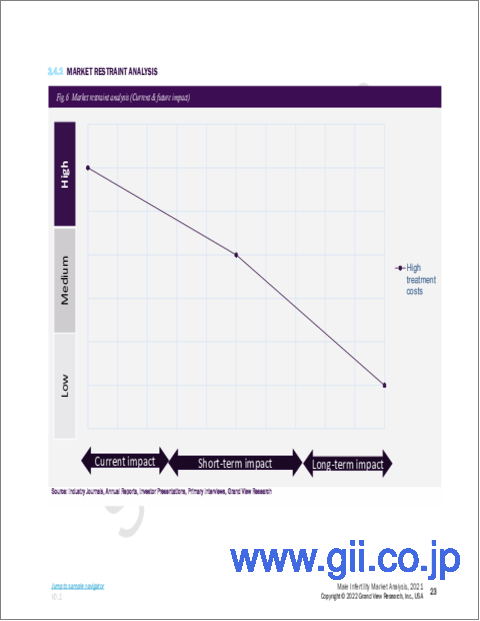

- FIG. 13 Market restraint relevance analysis (Current & future impact)

- FIG. 14 Porter's five forces analysis

- FIG. 15 PESTEL analysis

- FIG. 16 Male infertility test market share analysis, 2021 & 2030

- FIG. 17 Male infertility test market: Segment dashboard

- FIG. 18 DNA fragmentation technique market, 2017 - 2030 (USD Million)

- FIG. 19 Oxidative stress analysis market, 2017 - 2030 (USD Million)

- FIG. 20 Microscopic examination market, 2017 - 2030 (USD Million)

- FIG. 21 Sperm agglutination market, 2017 - 2030 (USD Million)

- FIG. 22 Computer assisted semen analysis market, 2017 - 2030 (USD Million)

- FIG. 23 Sperm penetration assay market, 2017 - 2030 (USD Million)

- FIG. 24 Others market, 2017 - 2030 (USD Million)

- FIG. 25 Male infertility treatment market share analysis, 2021 & 2030

- FIG. 26 Male infertility treatment market: Segment dashboard

- FIG. 27 ART & varicocele surgery market, 2017 - 2030 (USD Million)

- FIG. 28 Medication market, 2017 - 2030 (USD Million)

- FIG. 29 Male infertility regional market share analysis, 2021 & 2030

- FIG. 30 Male infertility regional market: Segment dashboard

- FIG. 31 Regional market place: Key takeaways

- FIG. 32 SWOT analysis: North America

- FIG. 33 SWOT analysis: Europe

- FIG. 34 SWOT analysis: Asia Pacific

- FIG. 35 SWOT analysis: Latin America

- FIG. 36 SWOT analysis: MEA

- FIG. 37 North America male infertility market, 2017 - 2030 (USD Million)

- FIG. 38 U.S. male infertility market, 2017 - 2030 (USD Million)

- FIG. 39 Canada male infertility market, 2017 - 2030 (USD Million)

- FIG. 40 Europe male infertility market, 2017 - 2030 (USD Million)

- FIG. 41 U.K. male infertility market, 2017 - 2030 (USD Million)

- FIG. 42 Germany male infertility market, 2017 - 2030 (USD Million)

- FIG. 43 France male infertility market, 2017 - 2030 (USD Million)

- FIG. 44 Italy male infertility market, 2017 - 2030 (USD Million)

- FIG. 45 Spain male infertility market, 2017 - 2030 (USD Million)

- FIG. 46 Asia Pacific male infertility market, 2017 - 2030 (USD Million)

- FIG. 47 Japan male infertility market, 2017 - 2030 (USD Million)

- FIG. 48 China male infertility market, 2017 - 2030 (USD Million)

- FIG. 49 India male infertility market, 2017 - 2030 (USD Million)

- FIG. 50 Latin America male infertility market, 2017 - 2030 (USD Million)

- FIG. 51 Brazil male infertility market, 2017 - 2030 (USD Million)

- FIG. 52 Mexico male infertility market, 2017 - 2030 (USD Million)

- FIG. 53 MEA male infertility market, 2017 - 2030 (USD Million)

- FIG. 54 South Africa male infertility market, 2017 - 2030 (USD Million)

- FIG. 55 Strategy framework

- FIG. 56 Male infertility competitive landscape: Market position analysis (based on products, regional presence, and recent updates (2021)

Male Infertility Market Growth & Trends:

The global male infertility market size is expected to reach USD 5.9 billion by 2030, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 4.9% from 2022 to 2030. Advancements in diagnostic tests and increasing infertility in males are some of the major factors driving the market for male infertility. In addition, lifestyle-associated diseases causing infertility, rising obesity, and the growing aging population are likely to boost the market growth during the forecast period. In the U.S., one-third of infertility cases are due to female factors, one-third due to male factors, and the remaining one-third of the cases are unknown.

The COVID-19 pandemic had a severe impact on healthcare services. The diagnostic kits and critical medical supplies witnessed growing demand. On the other hand, most elective medical procedures dropped by around 50%. As only emergency medical procedures were allowed during the initial phase of the pandemic, the market observed a decline.

DNA fragmentation technique emerged as the largest test segment in 2021 and is expected to maintain its lead during the forecast period. Increasing adoption in developed countries and high cost due to higher sensitivity and reliable analysis of sperm DNA integrity are the key factors driving the segment. The Assisted Reproductive Technology (ART) and varicocele surgery segment dominated the market for male infertility in 2021 due to its high success rate. Intracytoplasmic sperm injection (ICSI) and in vitro fertilization (IVF) are the most commonly used ARTs.

Partnerships and agreements among key manufacturers are expected to boost the market growth in the coming years. For instance, in July 2019, Vitrolife entered into a collaboration with Prime Tech for the development and exclusive marketing of the Piezo technique for improved Intracytoplasmic Sperm Injection (ICSI) procedure in human IVF globally except Malaysia, Thailand, and Japan. Additionally, Vitrolife will initiate the regulatory approval procedures in various markets for the future commercialization of the technology.

Male Infertility Market Report Highlights:

- Based on test, DNA fragmentation technique dominated the market in 2021 and is estimated to witness significant growth over the forecast period due to the higher accuracy of the test

- The oxidative stress analysis test segment is gaining popularity due to the accurate determination of reactive oxygen species. In March 2018, Aytu BioScience, Inc. received registration from COFEPRIS in Mexico for MiOXSYS System, which is used for diagnosing male infertility

- Europe dominated the market in 2021 and is expected to maintain its lead during the forecast period due to high adoption of costlier treatment, strong diagnosis rate, and increased awareness

- Asia Pacific is projected to witness substantial growth over the forecast period owing to increasing investment by several clinics and pharmaceutical companies and growing healthcare expenditure

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market Segmentation & Scope

- 1.1.1 Test

- 1.1.2 Treatment

- 1.1.3 Regional Scope

- 1.1.4 Estimates and Forecast Timeline

- 1.2 Research Methodology

- 1.3 Information Procurement

- 1.3.1 Purchased Database

- 1.3.2 GVR's Internal Database

- 1.3.3 Secondary Sources

- 1.3.4 Primary research

- 1.4 Information or Data Analysis

- 1.4.1 Data Analysis Models

- 1.5 Market Formulation & Validation

- 1.6 Model Details

- 1.6.1 Commodity flow analysis (Model 1)

- 1.6.2 Volume price analysis (model 2)

- 1.7 List of Secondary Sources

- 1.8 Objectives

- 1.8.1 Objective - 1

- 1.8.2 Objective - 2

Chapter 2 Executive Summary

- 2.1 Market Outlook

- 2.2 Segment Outlook

- 2.2.1 Test

- 2.2.2 Treatment

- 2.2.3 Region

- 2.3 Competitive Insights

- 2.4 Male Infertility Market Outlook, 2021

Chapter 3 Market Variables, Trends & Scope

- 3.1 Market Lineage Outlook

- 3.1.1 Parent Market Outlook

- 3.2 Market Segmentation

- 3.3 Penetration & Growth Prospect Mapping

- 3.3.1 Penetration Analysis

- 3.3.2 Market driver analysis

- 3.3.2.1 High Adoption of Assisted Reproductive Technology (ART)

- 3.3.2.2 Increasing incidence of infertility

- 3.3.2.3 Acquisitions, mergers, and partnerships in the market

- 3.3.2.4 Technological advancements

- 3.3.3 Market restraint analysis

- 3.3.3.1 High cost of treatment

- 3.4 Male Infertility Market: Business Environment Analysis Tools

- 3.4.1 Porter's Five Forces Analysis

- 3.4.2 PESTEL Analysis

- 3.5 Clinical Trial Analysis

Chapter 4 Male Infertility Market: Test Analysis

- 4.1 Male Infertility Test Market Share Analysis, 2021 & 2030

- 4.2 Male Infertility Test Market: Segment Dashboard:

- 4.3 Market Size & Forecasts and Trend Analyses, 2017 - 2030 for the Test Segment

- 4.3.1 DNA Fragmentation Technique

- 4.3.1.1 DNA fragmentation technique market, 2017 - 2030 (USD Million)

- 4.3.2 Oxidative Stress Analysis

- 4.3.2.1 Oxidative stress analysis market, 2017 - 2030 (USD Million)

- 4.3.3 Microscopic Examination

- 4.3.3.1 Microscopic Examination market, 2017 - 2030 (USD Million)

- 4.3.4 Sperm Agglutination

- 4.3.4.1 Sperm agglutination market, 2017 - 2030 (USD Million)

- 4.3.5 Computer Assisted Semen Analysis

- 4.3.5.1 Computer-assisted semen analysis market, 2017 - 2030 (USD Million)

- 4.3.6 Sperm Penetration Assay

- 4.3.6.1 Sperm penetration assay market, 2017 - 2030 (USD Million)

- 4.3.7 Others

- 4.3.7.1 Others market, 2017 - 2030 (USD Million)

- 4.3.1 DNA Fragmentation Technique

Chapter 5 Male Infertility Market: Treatment Analysis

- 5.1 Male Infertility Treatment Market Share Analysis, 2021 & 2030

- 5.2 Male Infertility Treatment Market: Segment Dashboard:

- 5.3 Market Size & Forecasts and Trend Analyses, 2017 - 2030 for the Treatment Segment

- 5.3.1 ART & Varicocele Surgery

- 5.3.1.1 ART & varicocele surgery market, 2017 - 2030 (USD Million)

- 5.3.2 Medication

- 5.3.2.1 Medication market, 2017 - 2030 (USD Million)

- 5.3.1 ART & Varicocele Surgery

Chapter 6 Male Infertility Market: Regional Analysis

- 6.1 Male Infertility Regional Market Share Analysis, 2021 & 2030

- 6.2 Male Infertility Regional Market: Segment Dashboard

- 6.3 Regional Market Snapshot (Market Size, CAGR, Top Verticals, Key Players, Top Trends)

- 6.4 SWOT Analysis, by Region

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 MEA

- 6.5 Market Size, & Forecasts, and Trend Analysis, 2017 - 2030

- 6.5.1 North America

- 6.5.1.1 North America male infertility market, 2017 - 2030 (USD Million)

- 6.5.1.1.1 U.S.

- 6.5.1.1.1.1 Regulatory & reimbursement scenario

- 6.5.1.1.1.2 U.S. male infertility market, 2017 - 2030 (USD Million)

- 6.5.1.1.2 Canada

- 6.5.1.1.2.1 Regulatory & reimbursement scenario

- 6.5.1.1.2.2 Canada male infertility market, 2017 - 2030 (USD Million)

- 6.5.2 Europe

- 6.5.2.1 Europe male infertility market, 2017 - 2030 (USD Million)

- 6.5.2.1.1 U.K.

- 6.5.2.1.1.1 Regulatory & reimbursement scenario

- 6.5.2.1.1.2 U.K. male infertility market, 2017 - 2030 (USD Million)

- 6.5.2.1.2 Germany

- 6.5.2.1.2.1 Regulatory & reimbursement scenario

- 6.5.2.1.2.2 Germany male infertility market, 2017 - 2030 (USD Million)

- 6.5.2.1.3 France

- 6.5.2.1.3.1 Regulatory & reimbursement scenario

- 6.5.2.1.3.2 France male infertility market, 2017 - 2030 (USD Million)

- 6.5.2.1.4 Italy

- 6.5.2.1.4.1 Regulatory & reimbursement scenario

- 6.5.2.1.4.2 Italy male infertility market, 2017 - 2030 (USD Million)

- 6.5.2.1.5 Spain

- 6.5.2.1.5.1 Regulatory & reimbursement scenario

- 6.5.2.1.5.2 Spain male infertility market, 2017 - 2030 (USD Million)

- 6.5.3 Asia Pacific

- 6.5.3.1 Asia Pacific male infertility market, 2017 - 2030 (USD Million)

- 6.5.3.1.1 Japan

- 6.5.3.1.1.1 Regulatory & reimbursement scenario

- 6.5.3.1.1.2 Japan male infertility market, 2017 - 2030 (USD Million)

- 6.5.3.1.2 China

- 6.5.3.1.2.1 Regulatory & reimbursement scenario

- 6.5.3.1.2.2 China male infertility market, 2017 - 2030 (USD Million)

- 6.5.3.1.3 India

- 6.5.3.1.3.1 Regulatory & reimbursement scenario

- 6.5.3.1.3.2 India male infertility market, 2017 - 2030 (USD Million)

- 6.5.4 Latin America

- 6.5.4.1 Latin America male infertility market, 2017 - 2030 (USD Million)

- 6.5.4.1.1 Brazil

- 6.5.4.1.1.1 Regulatory & reimbursement scenario

- 6.5.4.1.1.2 Brazil male infertility market, 2017 - 2030 (USD Million)

- 6.5.4.1.2 Mexico

- 6.5.4.1.2.1 Regulatory & reimbursement scenario

- 6.5.4.1.2.2 Mexico male infertility market, 2017 - 2030 (USD Million)

- 6.5.5 Middle East and Africa (MEA)

- 6.5.5.1 MEA male infertility market, 2017 - 2030 (USD Million)

- 6.5.5.1.1 South Africa

- 6.5.5.1.1.1 Regulatory & reimbursement scenario

- 6.5.5.1.1.2 South Africa male infertility market, 2017 - 2030 (USD Million)

- 6.5.1 North America

Chapter 7 Competitive Analysis

- 7.1 Strategic Framework/ Competition Categorization (Key innovators, Market leaders, emerging players

- 7.2 Vendor Landscape

- 7.2.1 Strategy Mapping

- 7.2.2 Launch of New Products

- 7.2.3 Merger and Acquisition

- 7.2.4 Product Approvals

- 7.3 Company Market Position Analysis (Geographic Presence, Product Portfolio, Strategic Initiatives)

- 7.4 Company Profiles

- 7.4.1 EMD Serono, Inc.

- 7.4.1.1 Company overview

- 7.4.1.2 Financial performance

- 7.4.1.3 Product benchmarking

- 7.4.1.4 Strategic initiatives

- 7.4.2 Endo International plc

- 7.4.2.1 Company overview

- 7.4.2.2 Financial performance

- 7.4.2.3 Product benchmarking

- 7.4.2.4 Strategic initiatives

- 7.4.2.5 SWOT analysis

- 7.4.3 Sanofi

- 7.4.3.1 Company overview

- 7.4.3.2 Financial performance

- 7.4.3.3 Product benchmarking

- 7.4.3.4 Strategic initiatives

- 7.4.3.5 SWOT Analysis

- 7.4.4 Bayer Group

- 7.4.4.1 Company overview

- 7.4.4.2 Financial performance

- 7.4.4.3 Product benchmarking

- 7.4.4.4 Strategic initiatives

- 7.4.4.5 SWOT analysis

- 7.4.5 SCSA Diagnostics

- 7.4.5.1 Company overview

- 7.4.5.2 Product benchmarking

- 7.4.6 Andrology Solutions

- 7.4.6.1 Company overview

- 7.4.6.2 Product benchmarking

- 7.4.7 Halotech DNA SL

- 7.4.7.1 Company overview

- 7.4.7.2 Product benchmarking

- 7.4.7.3 Strategic initiatives

- 7.4.8 Intas Pharmaceuticals Ltd.

- 7.4.8.1 Company overview

- 7.4.8.2 Financial performance

- 7.4.8.3 Product benchmarking

- 7.4.8.4 Strategic initiatives

- 7.4.8.5 SWOT analysis

- 7.4.9 Aytu BioScience, Inc.

- 7.4.9.1 Company overview

- 7.4.9.2 Financial performance

- 7.4.9.3 Product Benchmarking

- 7.4.9.4 Strategic initiatives

- 7.4.9.5 SWOT Analysis

- 7.4.10 Cadila Pharmaceuticals

- 7.4.10.1 Company overview

- 7.4.10.2 Product benchmarking

- 7.4.10.3 Strategic initiatives

- 7.4.11 Vitrolife

- 7.4.11.1 Company overview

- 7.4.11.2 Financial performance

- 7.4.11.3 Product benchmarking

- 7.4.11.4 Strategic initiatives

- 7.4.11.5 SWOT Analysis

- 7.4.1 EMD Serono, Inc.