|

|

市場調査レポート

商品コード

1233098

電動スクーターの市場規模、シェア、動向分析レポートバッテリー別(リチウムイオン、鉛蓄電池)、駆動タイプ別(ベルトドライブ、ハブモーター)、最終用途別(パーソナル、コマーシャル)、地域別、セグメント予測、2023~2030年Electric Scooters Market Size, Share & Trends Analysis Report By Battery (Lithium-ion, Lead-acid), By Drive Type (Belt Drive, Hub Motor), By End-use (Personal, Commercial), By Region, And Segment Forecasts, 2023 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 電動スクーターの市場規模、シェア、動向分析レポートバッテリー別(リチウムイオン、鉛蓄電池)、駆動タイプ別(ベルトドライブ、ハブモーター)、最終用途別(パーソナル、コマーシャル)、地域別、セグメント予測、2023~2030年 |

|

出版日: 2023年02月02日

発行: Grand View Research

ページ情報: 英文 164 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 図表

- 目次

電動スクーター市場の成長と動向

Grand View Research, Inc.の調査によると、世界の電動スクーター市場規模は2030年までに786億5000万米ドルに達し、予測期間中に9.9%のCAGRで成長すると予測されています。

空気と闘う、燃料経済的な高性能車への需要の高まりが、業界の成長を促進すると予想されます。また、EVの採用を増やすための政府の取り組みが増加していること、自動車メーカーがバッテリー充電インフラの整備に投資していること、発展途上国の可処分所得が増加していることなどが、さらなる成長の原動力になると予想されています。さらに、e-スクーターの操縦のしやすさと広範囲に及ぶ運転の俊敏性が、その需要を押し上げると予想されます。

主要企業は、品質の向上、性能、快適性、安全性の強化、メンテナンスコストの低減に注力しています。さらに、主要企業は国際市場での顧客基盤の拡大を目指し、戦略的な取り組みを進めています。彼らは様々なEスクーターを発売することに注力しています。例えば、Gogoro, Inc.やKYMCOは、未開拓の市場の利益を獲得するため、他地域への進出を拡大しました。さらに、GenZe by Mahindra、YAMAHA Motor Pvt. Ltd.、Vassla Electric Scooters.、PURE EVなどの大手企業は、各国での充電システムの設置に投資し、e-スクーターのバリエーションに交換可能なバッテリーシステムを提供しています。

中国、インド、ASEAN諸国などの新興経済諸国では、既存の車両をEVに置き換えることを重視する政府の動きが活発化しているため、アジア太平洋地域は予測期間中に最も速いCAGRを記録すると予想されます。さらに、政府とEスクーターメーカーは公共充電インフラの整備に投資しており、消費者がEスクーターに移行することを後押ししています。欧州諸国では、バッテリー駆動の二輪車の販売を促進するため、政府が補助金を支給しています。こうした取り組みは、ガソリン価格の上昇に伴い、より強固なものになると予想されます。

電動スクーター市場レポートハイライト。

- 2023年から2030年にかけて、個人向けエンドユースセグメントが最も速い成長率を記録すると予想されます。この成長は、eスクーターへの大きな需要に起因すると考えられます。

- バッテリーに基づくと、低コストや堅牢性などの利点により、リチウムイオンセグメントが2022年に業界を支配しました。

- アジア太平洋地域は、予測期間中に最も大きく、最も急速に成長する地域市場になると予想されます。

- これは、車両充電インフラへの多額の投資と、バッテリー駆動スクーターに対する政府の補助金別ものです。

目次

第1章 調査手法と範囲

- 市場セグメンテーションと範囲

- 市場の定義

- 情報調達

- 購入したデータベース

- GVRの内部データベース

- 二次情報と第三者の視点

- 1次調査

- 情報分析

- 市場形成とデータ可視化

- データの検証と公開

第2章 エグゼクティブサマリー

第3章 電動スクーター市場の変数、動向、範囲

- 市場力学

- 市場促進要因分析

- 市場課題分析

- 業界バリューチェーン分析

- ビジネス環境分析ツール

- 業界分析- ポーターのファイブフォース分析

- PEST分析

- 電動スクーター市場:主要企業分析、2022年

- 電動スクーター市場:規制状況

- 北米

- 欧州

- アジア太平洋地域

- COVIDが電動スクーター市場に与える影響

第4章 電動スクーター市場のドライブタイプセグメント分析

- ベルト駆動

- チェーンドライブ

- ハブモーター

第5章 電動スクーター市場のバッテリーセグメント分析

- 鉛酸

- リチウムイオン

- 他の

第6章 電動スクーター市場の最終用途セグメント分析

- 個人使用

- 商用利用

第7章 電動スクーター市場の地域分析

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- アジア太平洋地域

- 中国

- 日本

- インド

- ラテンアメリカ

- ブラジル

- メキシコ

- MEA電動スクーター市場、ドライブ別、2018年から2030年(100万米ドル)

- MEA電動スクーター市場、バッテリー別、2018~2030年(USD Million)

- MEA電動スクーター市場、最終用途別、2018年~2030年(100万米ドル)

第8章 競合情勢

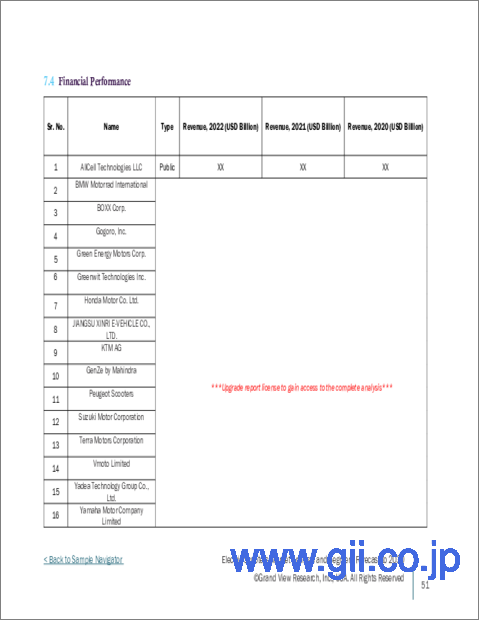

- AllCell Technologies LLC

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- BMW Motorrad International

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- BOXX Corp.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Gogoro, Inc.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Green Energy Motors Corp.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Greenwit Technologies Inc.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Honda Motor Co. Ltd.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Jiangsu Xinri E-Vehicle Co., Ltd.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- KTM AG

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Mahindra GenZe

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Peugeot Scooters

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Suzuki Motor Corporation

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Terra Motors Corporation

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Vmoto Limited

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Yadea Technology Group Co., Ltd.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Yamaha Motor Company Ltd.

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Xiaomi

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Ninebot Limited

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Lime

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

- Spin

- 会社概要

- 財務実績

- 製品のベンチマーク

- 戦略的イニシアチブ

List of Tables

- Table 1 List of Abbreviation

- Table 2 Belt drive electric scooters market, 2018 - 2030 (USD Million)

- Table 3 Chain Drive electric scooters market, 2018 - 2030 (USD Million)

- Table 4 Hub motor electric scooters market, 2018 - 2030 (USD Million)

- Table 5 Lead acid battery market, 2018 - 2030 (USD Million)

- Table 6 Lithium Ion battery market, 2018 - 2030 (USD Million)

- Table 7 Other battery market, 2018 - 2030 (USD Million)

- Table 8 Personal use electric scooters market, 2018 - 2030 (USD Million)

- Table 9 Commerical use electric scooters market, 2018 - 2030 (USD Million)

- Table 10 North America electric scooters market, by country, 2018 - 2030 (USD Million)

- Table 11 North American electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 12 North America electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 13 North America electric scooters, by end use, 2018 - 2030 (USD Million)

- Table 14 U.S. electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 15 U.S. electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 16 U.S. electric scooters market, by end use, 2018 - 2030 (USD Million)

- Table 17 Canada electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 18 Canada electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 19 Canada electric scooters market, by end use, 2018 - 2030 (USD Million)

- Table 20 Europe electric scooters market, by country, 2018 - 2030 (USD Million)

- Table 21 Europe electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 22 Europe electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 23 Europe electric scooters market, by end-use, 2018 - 2030 (USD Million)

- Table 24 Germany electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 25 Germany electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 26 Germany electric scooters market, by end-use, 2018 - 2030 (USD Million)

- Table 27 U.K. electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 28 U.K. electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 29 U.K. electric scooters market, by end-use, 2018 - 2030 (USD Million)

- Table 30 France electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 31 France electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 32 France electric scooters market, by end-use, 2018 - 2030 (USD Million)

- Table 33 Asia Pacific electric scooters market, by country, 2018 - 2030 (USD Million)

- Table 34 Asia Pacific electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 35 Asia Pacific electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 36 Asia Pacific electric scooters market, by end-use, 2018 - 2030 (USD Million)

- Table 37 China electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 38 China electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 39 China electric scooters market, by end-use, 2018 - 2030 (USD Million)

- Table 40 Japan electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 41 Japan electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 42 Japan electric scooters market, by end-use, 2018 - 2030 (USD Million)

- Table 43 India electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 44 India electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 45 India electric scooters market, by end-use, 2018 - 2030 (USD Million)

- Table 46 Latin America electric scooters market, by country, 2018 - 2030 (USD Million)

- Table 47 Latin America electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 48 Latin America electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 49 Latin America electric scooters market, by end-use, 2018 - 2030 (USD Million)

- Table 50 Brazil electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 51 Brazil electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 52 Brazil electric scooters market, by end-use, 2018 - 2030 (USD Million)

- Table 53 Mexico electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 54 Mexico electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 55 Mexico electric scooters market, by end-use, 2018 - 2030 (USD Million)

- Table 56 MEA electric scooters market, by drive, 2018 - 2030 (USD Million)

- Table 57 MEA electric scooters market, by battery, 2018 - 2030 (USD Million)

- Table 58 MEA electric scooters market, by end-use, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Market research process

- Fig. 2 Information procurement

- Fig. 3 Electric scooters segmentation

- Fig. 4 Electric Scooters market snapshot

- Fig. 5 Electric Scooters market, 2018 - 2030 (USD Million)

- Fig. 6 Electric scooters market, by drive, 2018 - 2030 (USD Million)

- Fig. 7 Electric scooters market, by battery, 2018 - 2030 (USD Million)

- Fig. 8 Electric scooters market, by end use, 2018 - 2030 (USD Million)

- Fig. 9 Electric scooters market, by region, 2018 - 2030 (USD Million)

- Fig. 10 Electric scooters market: value chain analysis

- Fig. 11 Electric scooters market: key company analysis, 2020

- Fig. 12 Electric scooters market: PEST analysis

- Fig. 13 Electric scooters market: Porter's five forces analysis

- Fig. 14 Electric scooters market: Drive analysis

- Fig. 15 Electric scooters market: Battery analysis

- Fig. 16 Electric scooters market: End use analysis

- Fig. 17 Electric scooters market: Regional analysis

- Fig. 18 North America electric scooters market- key takeaways

- Fig. 19 Europe electric scooters market - key takeaways

- Fig. 20 Asia Pacific electric scooters market - key takeaways

- Fig. 21 Latin America electric scooters market - key takeaways

- Fig. 22 MEA electric scooters market - key takeaways

Electric Scooters Market Growth & Trends:

The global electric scooters market size is expected to reach USD 78.65 billion by 2030, registering a CAGR of 9.9% during the forecast period, according to a study conducted by Grand View Research, Inc. Increasing demand for the air combating, fuel-economic high-performance vehicles is expected to fuel the growth of the industry. In addition, a growing number of government initiatives to increase the adoption of EVs, automobile manufacturers' investment in the development of battery charging infrastructure, and rising disposable income in developing nations are expected to drive the growth further. Moreover, the ease of maneuverability and extensive driving agility of e-scooters are expected to boost their demand.

Key players are focusing on improving quality, enhancing performance, comfort, and safety, and lowering the cost of maintenance. In addition, prominent players are undertaking strategic steps to expand their customer base in the international market. They are focusing on launching a range of e-scooters. For instance, Gogoro, Inc., and KYMCO expanded their reach in other regions to capture the benefit of the untapped market. Furthermore, prominent players, such as GenZe by Mahindra, YAMAHA Motor Pvt. Ltd., Vassla Electric Scooters., and PURE EV, have invested in installing charging systems across various countries and are offering swappable battery systems in their e-scooter variants.

The Asia Pacific region is expected to witness the fastest CAGR over the forecast period due to increasing government focus on replacing the existing fleet with EVs in developing economies, such as China, India, and ASEAN countries. Moreover, government and e-scooter manufacturers are investing in developing the public charging infrastructure, which will encourage consumers to shift to e-scooters over their counterparts. The governments in European countries have been providing subsidies to drive the sales of battery-powered two-wheelers. These initiatives are anticipated to become more robust with increasing gasoline prices.

Electric Scooters MarketReport Highlights:

- The personal end-use segment is expected to register the fastest growth rate from 2023 to 2030. This growth can be attributed to significant demand for e-scooters

- Based on battery, the lithium-ion segment dominated the industry in 2022 due to benefits, such as low cost and robustness

- Asia Pacific is expected to be the largest as well as the fastest-growing regional market during the forecast period

- This is owing to significant investments in vehicle charging infrastructure and government subsidies for battery-powered scooters

Table of Contents

Chapter 1 Methodology and Scope

- 1.1. Market segmentation & scope

- 1.2. Market Definition

- 1.3. Information procurement

- 1.3.1. Purchased database

- 1.3.2. GVR's internal database

- 1.3.3. Secondary sources & third-party perspectives

- 1.3.4. Primary research

- 1.4. Information analysis

- 1.5. Market formulation & data visualization

- 1.6. Data validation & publishing

Chapter 2. Executive Summary

Chapter 3. Electric Scooters Market Variables, Trends & Scope

- 3.1. Market Dynamics

- 3.1.1. Market Driver Analysis

- 3.1.2. Market Challenge Analysis

- 3.2. Industry Value Chain Analysis

- 3.3. Business Environment Analysis Tools

- 3.3.1. Industry Analysis - Porter's Five Forces Analysis

- 3.3.2. PEST Analysis

- 3.4. Electric Scooters Market: Key Company Analysis, 2022

- 3.5. Electric Scooters Market: Regulatory Landscape

- 3.5.1. North America

- 3.5.2. Europe

- 3.5.3. Asia Pacific

- 3.6. Impact of COVID on Electric Scooters Market

Chapter 4. Electric Scooters Market Drive Type Segment Analysis

- 4.1. Belt Drive

- 4.1.1. Belt Drive electric scooters market, 2018 - 2030 (USD Million)

- 4.2. Chain Drive

- 4.2.1. Chain Drive electric scooters market, 2018 - 2030 (USD Million)

- 4.3. Hub Motor

- 4.3.1. Hub motor electric scooters market, 2018 - 2030 (USD Million)

Chapter 5. Electric Scooters Market Battery Segment Analysis

- 5.1. Lead Acid

- 5.1.1. Sealed lead acid electric scooters market, 2018 - 2030 (USD Million)

- 5.2. Lithium-Ion

- 5.2.1. Lithium-Ion electric scooters market, 2018 - 2030 (USD Million)

- 5.3. Other

- 5.3.1. Other electric scooters market, 2018 - 2030 (USD Million)

Chapter 6. Electric Scooters Market End-use Segment Analysis

- 6.1. Personal Use

- 6.1.1. Personal use electric scooters market, 2018 - 2030 (USD Million)

- 6.2. Commercial Use

- 6.2.1. Commercial use electric scooters market, 2018 - 2030 (USD Million)

Chapter 7. Electric Scooters Market Regional Analysis

- 7.1. North America

- 7.1.1. North America electric scooters market, by country, 2018 - 2030 (USD Million)

- 7.1.2. North America electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.1.3. North America electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.1.4. North America electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.1.5. U.S.

- 7.1.5.1. Electric Scooters market by drive, 2018 - 2030 (USD Million)

- 7.1.5.2. Electric Scooters market by battery, 2018 - 2030 (USD Million)

- 7.1.5.3. Electric Scooters market by end-use, 2018 - 2030 (USD Million)

- 7.1.6. Canada

- 7.1.6.1. Canada electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.1.6.2. Canada electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.1.6.3. Canada electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.2. Europe

- 7.2.1. Europe electric scooters market, by country, 2018 - 2030 (USD Million)

- 7.2.2. Europe electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.2.3. Europe electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.2.4. Europe electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.2.5. Germany

- 7.2.5.1. Germany electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.2.5.2. Germany electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.2.5.3. Germany electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.2.6. U.K.

- 7.2.6.1. U.K. electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.2.6.2. U.K. electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.2.6.3. U.K. electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.2.7. France

- 7.2.7.1. France electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.2.7.2. France electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.2.7.3. France electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.3. Asia Pacific

- 7.3.1. Asia Pacific electric scooters market, by country, 2018 - 2030 (USD Million)

- 7.3.2. Asia Pacific electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.3.3. Asia Pacific electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.3.4. Asia Pacific electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.3.5. China

- 7.3.5.1. China electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.3.5.2. China electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.3.5.3. China electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.3.6. Japan

- 7.3.6.1. Japan electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.3.6.2. Japan electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.3.6.3. Japan electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.3.7. India

- 7.3.7.1. India electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.3.7.2. India electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.3.7.3. India electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.4. Latin America

- 7.4.1. Latin America electric scooters market, by country, 2018 - 2030 (USD Million)

- 7.4.2. Latin America electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.4.3. Latin America electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.4.4. Latin America electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.4.5. Brazil

- 7.4.5.1. Brazil electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.4.5.2. Brazil electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.4.5.3. Brazil electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.4.6. Mexico

- 7.4.6.1. Mexico electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.4.6.2. Mexico electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.4.6.3. Mexico electric scooters market, by end-use, 2018 - 2030 (USD Million)

- 7.5. MEA electric scooters market, by drive, 2018 - 2030 (USD Million)

- 7.6. MEA electric scooters market, by battery, 2018 - 2030 (USD Million)

- 7.7. MEA electric scooters market, by end-use, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

- 8.1. AllCell Technologies LLC

- 8.1.1. Company Overview

- 8.1.2. Financial Performance

- 8.1.3. Product Benchmarking

- 8.1.4. Strategic Initiatives

- 8.2. BMW Motorrad International

- 8.2.1. Company Overview

- 8.2.2. Financial Performance

- 8.2.3. Product Benchmarking

- 8.2.4. Strategic Initiatives

- 8.3. BOXX Corp.

- 8.3.1. Company Overview

- 8.3.2. Financial Performance

- 8.3.3. Product Benchmarking

- 8.3.4. Strategic Initiatives

- 8.4. Gogoro, Inc.

- 8.4.1. Company Overview

- 8.4.2. Financial Performance

- 8.4.3. Product Benchmarking

- 8.4.4. Strategic Initiatives

- 8.5. Green Energy Motors Corp.

- 8.5.1. Company Overview

- 8.5.2. Financial Performance

- 8.5.3. Product Benchmarking

- 8.5.4. Strategic Initiatives

- 8.6. Greenwit Technologies Inc.

- 8.6.1. Company Overview

- 8.6.2. Financial Performance

- 8.6.3. Product Benchmarking

- 8.6.4. Strategic Initiatives

- 8.7. Honda Motor Co. Ltd.

- 8.7.1. Company Overview

- 8.7.2. Financial Performance

- 8.7.3. Product Benchmarking

- 8.7.4. Strategic Initiatives

- 8.8. Jiangsu Xinri E-Vehicle Co., Ltd.

- 8.8.1. Company Overview

- 8.8.2. Financial Performance

- 8.8.3. Product Benchmarking

- 8.8.4. Strategic Initiatives

- 8.9. KTM AG

- 8.9.1. Company Overview

- 8.9.2. Financial Performance

- 8.9.3. Product Benchmarking

- 8.9.4. Strategic Initiatives

- 8.10. Mahindra GenZe

- 8.10.1. Company Overview

- 8.10.2. Financial Performance

- 8.10.3. Product Benchmarking

- 8.10.4. Strategic Initiatives

- 8.11. Peugeot Scooters

- 8.11.1. Company Overview

- 8.11.2. Financial Performance

- 8.11.3. Product Benchmarking

- 8.11.4. Strategic Initiatives

- 8.12. Suzuki Motor Corporation

- 8.12.1. Company Overview

- 8.12.2. Financial Performance

- 8.12.3. Product Benchmarking

- 8.12.4. Strategic Initiatives

- 8.13. Terra Motors Corporation

- 8.13.1. Company Overview

- 8.13.2. Financial Performance

- 8.13.3. Product Benchmarking

- 8.13.4. Strategic Initiatives

- 8.14. Vmoto Limited

- 8.14.1. Company Overview

- 8.14.2. Financial Performance

- 8.14.3. Product Benchmarking

- 8.14.4. Strategic Initiatives

- 8.15. Yadea Technology Group Co., Ltd.

- 8.15.1. Company Overview

- 8.15.2. Financial Performance

- 8.15.3. Product Benchmarking

- 8.15.4. Strategic Initiatives

- 8.16. Yamaha Motor Company Ltd.

- 8.16.1. Company Overview

- 8.16.2. Financial Performance

- 8.16.3. Product Benchmarking

- 8.16.4. Strategic Initiatives

- 8.17. Xiaomi

- 8.17.1. Company Overview

- 8.17.2. Financial Performance

- 8.17.3. Product Benchmarking

- 8.17.4. Strategic Initiatives

- 8.18. Ninebot Limited

- 8.18.1. Company Overview

- 8.18.2. Financial Performance

- 8.18.3. Product Benchmarking

- 8.18.4. Strategic Initiatives

- 8.19. Lime

- 8.19.1. Company Overview

- 8.19.2. Financial Performance

- 8.19.3. Product Benchmarking

- 8.19.4. Strategic Initiatives

- 8.20. Spin

- 8.20.1. Company Overview

- 8.20.2. Financial Performance

- 8.20.3. Product Benchmarking

- 8.20.4. Strategic Initiatives