|

|

市場調査レポート

商品コード

1199187

スマートセンサーの世界市場Smart Sensors |

||||||

| スマートセンサーの世界市場 |

|

出版日: 2023年01月01日

発行: Global Industry Analysts, Inc.

ページ情報: 英文 359 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界のスマートセンサーの市場規模は、2022年の424億米ドルから、2030年までに1,711億米ドルに達し、予測期間の2022年~2030年の間にCAGR19.1%で成長すると予測されます。

同市場のスマートフローセンサーセグメントは、CAGR19%を記録し、予測期間終了時には779億米ドルに達すると予測されます。また、パンデミック後の回復を考慮し、今後8年間のスマート圧力センサーセグメントの成長率はCAGR19.5%に再調整される見込みです。

当レポートでは、世界のスマートセンサー市場について調査分析し、市場動向と促進要因、地域分析、競合情勢などの情報を提供しています。

調査対象企業の例(全213社):

- ABB

- Analog Devices Inc.

- Delphi Automotive Plc

- Eaton Corporation Plc

- Honeywell International, Inc.

- Infineon Technologies AG

- NXP Semiconductors

- Omron Corp.

- Raytek Corp.

- Robert Bosch GmBH

- Schneider Electric SE

- Sensata Technologies Inc.

- SICK AG

- Siemens AG

- Smart Sensors Inc.

- Vishay Intertechnology Inc.

- Yokogawa Electric Corp.

目次

第1章 調査手法

第2章 エグゼクティブサマリー

- 市場概要

- 主要企業

- 市場動向と促進要因

- 世界市場の見通し

第3章 市場分析

- 米国

- カナダ

- 日本

- 中国

- 欧州

- フランス

- ドイツ

- イタリア

- 英国

- その他欧州

- アジア太平洋

- 世界のその他の地域

第4章 競合

What`s New for 2023?

»Special coverage on Russia-Ukraine war; global inflation; easing of "zero-Covid" policy in China and its `bumpy` reopening; supply chain disruptions, global trade tensions; and risk of recession.

»Global competitiveness and key competitor percentage market shares

» Market presence across multiple geographies - Strong/Active/Niche/Trivial

»Online interactive peer-to-peer collaborative bespoke updates

»Access to our digital archives and MarketGlass Research Platform

»Complimentary updates for one year

Looking Ahead to 2023

The global economy is at a critical crossroads with a number of interlocking challenges and crises running in parallel. The uncertainty around how Russia`s war on Ukraine will play out this year and the war`s role in creating global instability means that the trouble on the inflation front is not over yet. Food and fuel inflation will remain a persistent economic problem. Higher retail inflation will impact consumer confidence and spending. As governments combat inflation by raising interest rates, new job creation will slowdown and impact economic activity and growth. Lower capital expenditure is in the offing as companies go slow on investments, held back by inflation worries and weaker demand. With slower growth and high inflation, developed markets seem primed to enter into a recession. Fears of new COVID outbreaks and China's already uncertain post-pandemic path poses a real risk of the world experiencing more acute supply chain pain and manufacturing disruptions this year. Volatile financial markets, growing trade tensions, stricter regulatory environment and pressure to mainstream climate change into economic decisions will compound the complexity of challenges faced. Year 2023 is expected to be tough year for most markets, investors and consumers. Nevertheless, there is always opportunity for businesses and their leaders who can chart a path forward with resilience and adaptability.

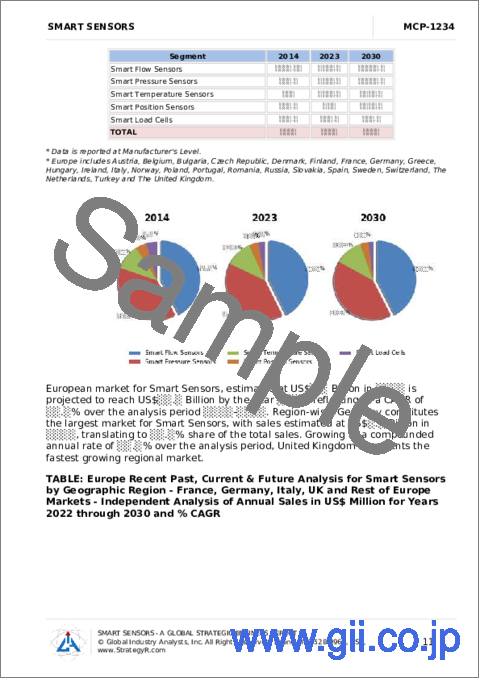

Global Smart Sensors Market to Reach $171.1 Billion by 2030

In the changed post COVID-19 business landscape, the global market for Smart Sensors estimated at US$42.4 Billion in the year 2022, is projected to reach a revised size of US$171.1 Billion by 2030, growing at a CAGR of 19.1% over the analysis period 2022-2030. Smart Flow Sensors, one of the segments analyzed in the report, is projected to record a 19% CAGR and reach US$77.9 Billion by the end of the analysis period. Taking into account the ongoing post pandemic recovery, growth in the Smart Pressure Sensors segment is readjusted to a revised 19.5% CAGR for the next 8-year period.

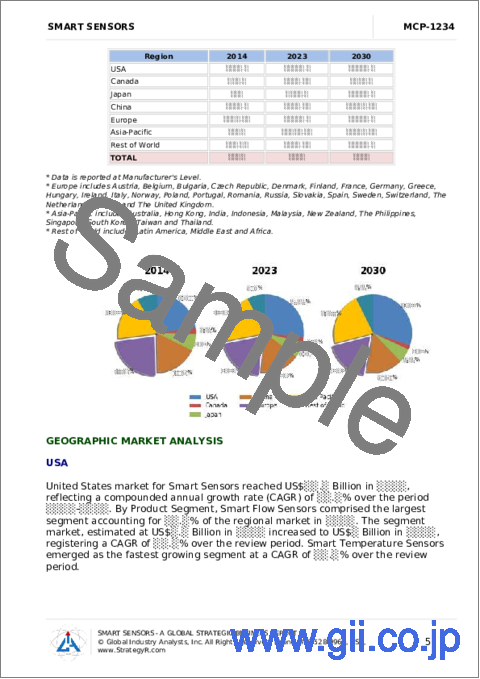

The U.S. Market is Estimated at $12.4 Billion, While China is Forecast to Grow at 17.9% CAGR

The Smart Sensors market in the U.S. is estimated at US$12.4 Billion in the year 2022. China, the world`s second largest economy, is forecast to reach a projected market size of US$28.5 Billion by the year 2030 trailing a CAGR of 17.9% over the analysis period 2022 to 2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 17.4% and 16.4% respectively over the 2022-2030 period. Within Europe, Germany is forecast to grow at approximately 13.7% CAGR.

Select Competitors (Total 213 Featured):

- ABB

- Analog Devices Inc.

- Delphi Automotive Plc

- Eaton Corporation Plc

- Honeywell International, Inc.

- Infineon Technologies AG

- NXP Semiconductors

- Omron Corp.

- Raytek Corp.

- Robert Bosch GmBH

- Schneider Electric SE

- Sensata Technologies Inc.

- SICK AG

- Siemens AG

- Smart Sensors Inc.

- Vishay Intertechnology Inc.

- Yokogawa Electric Corp.

TABLE OF CONTENTS

I. METHODOLOGY

II. EXECUTIVE SUMMARY

- 1. MARKET OVERVIEW

- Influencer Market Insights

- World Market Trajectories

- Recent Market Activity

- Sensors - A Prelude

- Introduction to Smart Sensors

- Smart Sensors Market over the Years

- The IoT Phenomenon Necessitates Usage of Smart Sensors

- Smart Sensors Witness Demand from Various Application Markets

- Energy Efficient Miniaturized Sensors in Demand

- MEMS - Enjoys Highest Popularity among All Sectors

- Smart Sensing Improves Manufacturing Efficiencies

- Initiating Maintenance Protocols and Predicting Equipment Failures

- Sensors to Control, Monitor and Improve Processes

- Maintenance of Historical Records, Logs and Regulatory Compliance

- Sending Irregularities and Quality Standards Notifications Automatically

- Predictive Monitoring, Analytics and Informatics with Smart Sensors

- More Information Quickly and Easily

- Rapidly Developing Sensor Technology Landscape

- IoT for Analyzing and Unearthing Big Data

- Smart Sensors - Global Key Competitors Percentage Market Share in 2022 (E)

- Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2022 (E)

- Enhance Responsiveness and Fasten Flow of Information

- Impact of Covid-19 and a Looming Global Recession

- 2. FOCUS ON SELECT PLAYERS

- ABB (Switzerland)

- Analog Devices Inc. (USA)

- Delphi Automotive Plc (UK)

- Eaton Corporation Plc (Ireland)

- Honeywell International, Inc. (USA)

- Infineon Technologies AG (Germany)

- NXP Semiconductors (The Netherlands)

- Omron Corp. (Japan)

- Raytek Corporation (USA)

- Robert Bosch GmBH (Germany)

- Schneider Electric SE (France)

- Sensata Technologies, Inc. (USA)

- SICK AG (Germany)

- Siemens AG (Germany)

- Smart Sensors Inc. (USA)

- Vishay Intertechnology, Inc (USA)

- Yokogawa Electric Corporation (Japan)

- 3. MARKET TRENDS & DRIVERS

- Smart Flow Sensors Market - The Largest Revenue Contributor

- A Look into Key End-Use Opportunities for Flow Sensors

- Healthy Outlook for Flow Meters to Benefit Demand for Smart Flow Sensors

- Opportunity Indicator

- Smart Pressure Sensors - The Fastest Growing Product Segment

- Review of Key End-Use Opportunities for Smart Pressure Sensors

- Smart Temperature Sensors

- Miniature Temperature Sensors Grow in Popularity

- Key Application Areas for Temperature Sensors

- Digital/Smart Load Cells - A Budding Market

- MEMS Technology Expands Opportunities for Smart Sensors

- Wireless Smart Sensors Gaining Traction

- Smart Grid Sensors - North America Dominates

- Automotive Market - Opportunities Galore

- Weight Reduction of Automobiles to Drive Demand for Light-Weight and Smaller Smart Sensors

- Integration of Safety & Control Technologies in Automobiles on the Rise - Bodes Well for Automotive Sensors Market

- Critical Role of Smart Sensors in Collision Avoidance Systems

- Airbags - A Key Application Area for Smart Sensors in Automotive Market

- Opportunity Indicators

- Growing Integration of TPMS Drives Demand for Smart Pressure Sensors

- Intelligent Sensors for Smart Cars

- Deployment of Smart Sensors Capable of "feeling" the Surroundings

- Leveraging Advanced Analytics to Make Systems that 'Think' Intelligently

- Balancing Innovation and Security to Steer the Road Ahead

- Opportunity Indicator for Smart Pressure Sensors in Automotive Market

- Growing Penetration of MEMS Pressure Sensors in Automotive Segment

- MEMS/MST Application Opportunities in Vehicle Diagnostic/Monitoring Systems

- Projected Rise in Automotive Demand & Subsequent Rise in Production Bodes Well for Smart Sensors Market

- Opportunity Indicators

- Resurgence in Manufacturing/Industrial Sector Boosts Demand for Smart Sensors in Production/Processing Activity and Machinery Applications

- Process Industries - A Major Market for Pressure Sensors

- Automation of Industrial Processes to Benefit Industrial Position Sensors

- Optimizing Energy Consumption in Manufacturing Plants: A Key Growth Driver for Smart Flow Sensors

- Position Sensors in Machine Tools to Witness Growth

- Opportunity Indicators

- Smart Sensors Predict Machinery Malfunctions

- Smart Sensors Ensure Reduced Industrial Emissions

- Oil & Gas Industry Presents Strong Growth Opportunities for Smart Sensors

- Oil & Gas - A Major Market for Smart Pressure Sensors

- Booming Shale Gas Extraction - A Boon for Smart Temperature Sensors Market

- Untapped Opportunities for Position Sensors in the Oil & Gas Industry

- Rising Focus on Wind Energy to Benefit Position Sensors Used in Wind Turbines

- Opportunity Indicator

- Growing Proliferation of Consumer Electronic Devices to Drive Demand for Electronic Components

- Inline Electronics Inspection with 3D Smart Sensors

- Blue Laser for Cleaner Profiles

- Sensor Firmware Customization

- Gocator Emulator - A 'Virtual Sensor' Testing Environment

- Increasing Demand for High-End Smartphones & Tablet PCs Boosts Demand for Multi-Functional Sensors

- Increasing Usage in Defense, Academic and Aerospace Sectors

- Medicine - Another High Growth Potential Market for Smart Sensors

- Smart Packaging Sensors in Safeguarding Foods and Drugs

- Future Applications

- Novel Technologies Redefine Market Dynamics - A Look into Key Technology Developments over the Years

- Sensors Become Smaller and Smarter

- Nano-Sensor Technology Demonstrate Bright Future Prospects

- Conventional Technologies Lose Share to Modern Technologies in Flow Sensors Market

- Technology Developments in Pressure Sensors Market Over the Years

- Micromachined Solutions Overshadows Mechanical Sensors Market

- Micromachined Solutions Overshadows Mechanical Sensors Market

- Smart Dust Technology Opens up New Avenues for Smart Sensors

- Wireless and Implantable Sensors - A Breakthrough in Medicine

- Smart Sensors & Their Use in 'Thought Controlled Computing' Applications - A Reality or Myth

- Integrated RFID Sensors - A Promising Market

- Multi-Functional Spintronic Smart Sensors - A Glimpse of the Future

- Plug and Play Smart TEDS Sensors - An Overview

- Bluetooth Technology Spurs Growth in Smart Sensors Market

- Intelligent Products - Ongoing Trend in Process Pressure Transmitter Industry

- Smart Adaptable Interfaces Offer Cost Effective Alternative

- BiSS - A Low Cost Interface

- Manufacturers Seek Cost-Focused Approach

- Growing Applications & Technology Advancements Attract New Players

- Customer Service and Specialization: An Emerging Strategy

- Smart Sensors - Corporate Security and Counter-Terrorism

- Interface Standards - No Longer a Contentious Issue?

- Sensors Market - Competitive Scenario

- Companies in Expansion Mode through M&A Activities

- Smart Sensors Drive Manufacturers towards Smart Strategies

- Identifying the Appropriate Strategic Move

- 4. GLOBAL MARKET PERSPECTIVE

- TABLE 1: World Recent Past, Current & Future Analysis for Smart Sensors by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2022 through 2030 and % CAGR

- TABLE 2: World Historic Review for Smart Sensors by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 3: World 16-Year Perspective for Smart Sensors by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets for Years 2014, 2023 & 2030

- TABLE 4: World Recent Past, Current & Future Analysis for Smart Flow Sensors by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2022 through 2030 and % CAGR

- TABLE 5: World Historic Review for Smart Flow Sensors by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 6: World 16-Year Perspective for Smart Flow Sensors by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2023 & 2030

- TABLE 7: World Recent Past, Current & Future Analysis for Smart Pressure Sensors by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2022 through 2030 and % CAGR

- TABLE 8: World Historic Review for Smart Pressure Sensors by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 9: World 16-Year Perspective for Smart Pressure Sensors by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2023 & 2030

- TABLE 10: World Recent Past, Current & Future Analysis for Smart Temperature Sensors by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2022 through 2030 and % CAGR

- TABLE 11: World Historic Review for Smart Temperature Sensors by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 12: World 16-Year Perspective for Smart Temperature Sensors by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2023 & 2030

- TABLE 13: World Recent Past, Current & Future Analysis for Smart Position Sensors by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2022 through 2030 and % CAGR

- TABLE 14: World Historic Review for Smart Position Sensors by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 15: World 16-Year Perspective for Smart Position Sensors by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2023 & 2030

- TABLE 16: World Recent Past, Current & Future Analysis for Smart Load Cells by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2022 through 2030 and % CAGR

- TABLE 17: World Historic Review for Smart Load Cells by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 18: World 16-Year Perspective for Smart Load Cells by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2023 & 2030

- TABLE 19: World Smart Sensors Market Analysis of Annual Sales in US$ Million for Years 2014 through 2030

III. MARKET ANALYSIS

- UNITED STATES

- Smart Sensors Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United States for 2023 (E)

- TABLE 20: USA Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 21: USA Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 22: USA 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030

- CANADA

- TABLE 23: Canada Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 24: Canada Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 25: Canada 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030

- JAPAN

- Smart Sensors Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Japan for 2023 (E)

- TABLE 26: Japan Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 27: Japan Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 28: Japan 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030

- CHINA

- Smart Sensors Market Presence - Strong/Active/Niche/Trivial - Key Competitors in China for 2023 (E)

- TABLE 29: China Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 30: China Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 31: China 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030

- EUROPE

- Smart Sensors Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Europe for 2023 (E)

- TABLE 32: Europe Recent Past, Current & Future Analysis for Smart Sensors by Geographic Region - France, Germany, Italy, UK and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Million for Years 2022 through 2030 and % CAGR

- TABLE 33: Europe Historic Review for Smart Sensors by Geographic Region - France, Germany, Italy, UK and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 34: Europe 16-Year Perspective for Smart Sensors by Geographic Region - Percentage Breakdown of Value Sales for France, Germany, Italy, UK and Rest of Europe Markets for Years 2014, 2023 & 2030

- TABLE 35: Europe Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 36: Europe Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 37: Europe 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030

- FRANCE

- Smart Sensors Market Presence - Strong/Active/Niche/Trivial - Key Competitors in France for 2023 (E)

- TABLE 38: France Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 39: France Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 40: France 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030

- GERMANY

- Smart Sensors Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Germany for 2023 (E)

- TABLE 41: Germany Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 42: Germany Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 43: Germany 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030

- ITALY

- TABLE 44: Italy Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 45: Italy Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 46: Italy 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030

- UNITED KINGDOM

- Smart Sensors Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United Kingdom for 2023 (E)

- TABLE 47: UK Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 48: UK Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 49: UK 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030

- REST OF EUROPE

- TABLE 50: Rest of Europe Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 51: Rest of Europe Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 52: Rest of Europe 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030

- ASIA-PACIFIC

- Smart Sensors Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Asia-Pacific for 2023 (E)

- TABLE 53: Asia-Pacific Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 54: Asia-Pacific Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 55: Asia-Pacific 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030

- REST OF WORLD

- TABLE 56: Rest of World Recent Past, Current & Future Analysis for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells - Independent Analysis of Annual Sales in US$ Million for the Years 2022 through 2030 and % CAGR

- TABLE 57: Rest of World Historic Review for Smart Sensors by Product Segment - Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2021 and % CAGR

- TABLE 58: Rest of World 16-Year Perspective for Smart Sensors by Product Segment - Percentage Breakdown of Value Sales for Smart Flow Sensors, Smart Pressure Sensors, Smart Temperature Sensors, Smart Position Sensors and Smart Load Cells for the Years 2014, 2023 & 2030