|

|

市場調査レポート

商品コード

1176536

フェムテックの世界市場 (2023年~2032年):市場規模 (タイプ・用途・エンドユーザー別)・地域的展望・成長の潜在性・競争市場シェア・予測Femtech Market Size By Type, By Application, By End-use, Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2023 - 2032 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| フェムテックの世界市場 (2023年~2032年):市場規模 (タイプ・用途・エンドユーザー別)・地域的展望・成長の潜在性・競争市場シェア・予測 |

|

出版日: 2022年12月08日

発行: Global Market Insights Inc.

ページ情報: 英文 145 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

フェムテックの市場は、2023年から2032年にかけて大規模な成長を示すと予測されています。

この成長は、遠隔地における女性のケアへのアクセスが改善されたことに起因しています。注目すべきは、女性の健康問題が憂慮すべき速度で増加していることです。いくつかの国の政府は、農村部における女性の健康と衛生に関する意識を広めるために多くのイニシアチブを取っています。さらに、病気の診断・治療のための革新的技術の利用を促進することが、今後数年の市場成長をさらに後押しする見通しです。

当レポートでは、世界のフェムテックの市場を調査し、市場概要、市場成長への各種影響因子の分析、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 調査手法・調査範囲

第2章 エグゼクティブサマリー

第3章 フェムテック産業の考察

- 産業の分類

- 産業情勢

- 産業への影響要因

- 促進要因

- 潜在的リスク&課題

- 成長性分析

- COVID-19影響分析

- ポーターの分析

- PESTLE分析

第4章 競合情勢

- 企業マトリックス分析

- 戦略ダッシュボード

第5章 フェムテック市場:タイプ別

- 主要動向

- 製品

- ソフトウェア

- サービス

第6章 フェムテック市場:用途別

- 主要動向

- リプロダクティブヘルス

- 妊娠・介護

- 骨盤・子宮の健康

- 一般的なヘルスケア・ウェルネス

- その他

第7章 フェムテック市場:エンドユーザー別

- 主要動向

- 消費者向け

- 病院

- 不妊治療クリニック

- 外科センター

- 診断センター

- その他

第8章 フェムテック市場:地域別

- 主要動向

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第9章 企業プロファイル

- 競合ダッシュボード

- BioWink GmbH

- Athena Feminine Technologies

- Conceivable Inc

- Elvie

- HeraMED

- iSono Health

- Minerva Surgical

- Prelude

- Sera Prognostics

- Sustain Natural

- Totohealth

- Univfy

- Nuvo Cares

Femtech Market is expected to witness massive growth during 2023-2032. The growth can be attributed to improved access to women care in remote areas. Notably, health issues amongst women are increasing at an alarming rate. The governments of several nations are taking numerous initiatives to spread awareness regarding women wellness and hygiene in rural areas. Moreover, promoting the availability of innovative technology for disease diagnosis and treatment will further support market expansion in the coming years.

The transforming healthcare industry and importance of precision medicine is anticipated to further boost the demand for femtech worldwide. Besides, several leading companies are emphasizing on promoting various technologically advanced products to track and monitor health periodically for preventive care and to ensure early disease diagnosis and effective and timely treatment.

The key players and start-ups in femtech industry are incorporating strategic initiatives such as acquisitions and mergers, partnerships, hefty investments, and new product launches. For instance, in April 2019, NextGen Jane secured $9 million in Series A funding for a smart tampon that can be used in the lab to test the early signs of endometriosis. In addition, the strong foothold of several leading market giants which aim to improve women's quality of life, is expected to positively impact business growth during 2023-2032.

Overall, the femtech market is segregated in terms of type, application, end-use, and region.

Based on type, the software segment held over USD 5.2 billion market share in 2022 and is expected to grow exponentially through 2032. The innovations and updates in smartphone-based software solutions to trace women's health issues will support the segment expansion.

Considering the application, the general healthcare and wellness segment will demonstrate massive growth owing to the initiatives taken by the government to spread awareness regarding women's health and well-being. In addition, the availability of innovative technological solutions for precise treatment will positively influence segment growth.

By end-use, the direct-to-consumer segment is expected to grow significantly in the overall market. In 2022, the segment captured over 25% market share. The segment comprises of individuals who buy products directly without any middlemen, third-party retailers, wholesalers, or others. Besides, the rising prevalence regarding the availability of technologically advanced feminine products, including menstrual cups over conventional sanitary napkins and tampons, will further drive segment growth.

Regionally, the North America femtech market is expected to hold a considerable share due to the highly developed healthcare systems in the U.S. and Canada and the availability of advanced products. The rising prevalence of women's health-related diseases will also be a major factor contributing to regional revenue.

Table of Contents

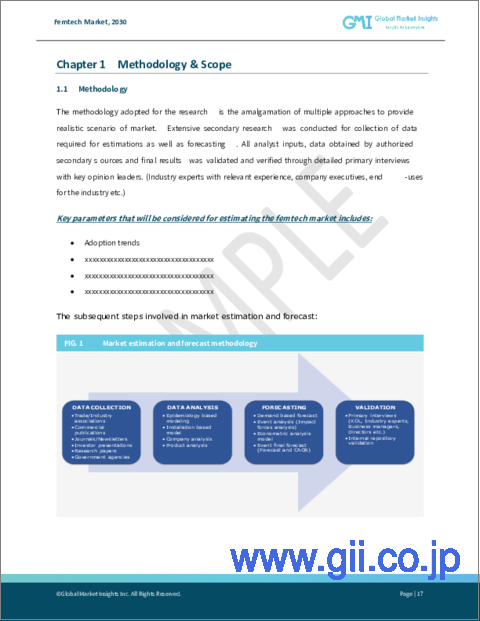

Chapter 1 Methodology & Scope

- 1.1 Methodology

- 1.2 Market scope & definitions

- 1.3 Base estimates and calculations

- 1.3.1 North America

- 1.3.2 Europe

- 1.3.3 Asia Pacific

- 1.3.4 Latin America

- 1.3.5 MEA

- 1.4 Forecast calculations

- 1.5 Data validation

- 1.6 Data sources

- 1.6.1 Primary

- 1.6.2 Secondary

- 1.6.2.1 Paid sources

- 1.6.2.2 Unpaid sources

Chapter 2 Executive Summary

- 2.1 Femtech industry 360 degree synopsis, 2018 - 2032

- 2.1.1 Business trends

- 2.1.2 Type trends

- 2.1.3 Application trends

- 2.1.4 End-use trends

- 2.1.5 Regional trends

Chapter 3 Femtech Industry Insights

- 3.1 Industry landscape, 2018 - 2032

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Usage of digital technology to manage women health in developed countries

- 3.2.1.2 Improving access to women care in remote areas

- 3.2.1.3 Growing awareness regarding women health and wellness in developing countries

- 3.2.1.4 Increasing burden of chronic and infectious diseases among the female population

- 3.2.1.5 Growing investments in femtech industry

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Lack of awareness about femtech products and applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.3.1 By type

- 3.3.2 By application

- 3.3.3 By end-use

- 3.4 COVID- 19 impact analysis

- 3.5 Porter's analysis

- 3.6 PESTLE analysis

Chapter 4 Competitive Landscape, 2021

- 4.1 Introduction

- 4.1.1 BioWink GmbH

- 4.1.2 Athena Feminine Technologies

- 4.1.3 Conceivable Inc

- 4.2 Competitive dashboard, 2021

- 4.3 Company matrix analysis, 2021

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Femtech Market, By Type

- 5.1 Key segment trends

- 5.2 Products

- 5.2.1 Market estimates and forecast, 2018 - 2032 (USD Million)

- 5.3 Software

- 5.3.1 Market estimates and forecast, 2018 - 2032 (USD Million)

- 5.4 Services

- 5.4.1 Market estimates and forecast, 2018 - 2032 (USD Million)

Chapter 6 Femtech Market, By Application

- 6.1 Key segment trends

- 6.2 Reproductive health

- 6.2.1 Market estimates and forecast, 2018 - 2032 (USD Million)

- 6.3 Pregnancy and nursing care

- 6.3.1 Market estimates and forecast, 2018 - 2032 (USD Million)

- 6.4 Pelvic & uterine healthcare

- 6.4.1 Market estimates and forecast, 2018 - 2032 (USD Million)

- 6.5 General healthcare & wellness

- 6.5.1 Market estimates and forecast, 2018 - 2032 (USD Million)

- 6.6 Others

- 6.6.1 Market estimates and forecast, 2018 - 2032 (USD Million)

Chapter 7 Femtech Market, By End-use

- 7.1 Key segment trends

- 7.2 Direct-to-consumer

- 7.2.1 Market estimates and forecast, 2018 - 2032 (USD Million)

- 7.3 Hospitals

- 7.3.1 Market estimates and forecast, 2018 - 2032 (USD Million)

- 7.4 Fertility clinics

- 7.4.1 Market estimates and forecast, 2018 - 2032 (USD Million)

- 7.5 Surgical centers

- 7.5.1 Market estimates and forecast, 2018 - 2032 (USD Million)

- 7.6 Diagnostic centers

- 7.6.1 Market estimates and forecast, 2018 - 2032 (USD Million)

- 7.7 Others

- 7.7.1 Market estimates and forecast, 2018 - 2032 (USD Million)

Chapter 8 Femtech Market, By Region

- 8.1 Key regional trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 BioWink GmbH

- 9.2 Athena Feminine Technologies

- 9.3 Conceivable Inc

- 9.4 Elvie

- 9.5 HeraMED

- 9.6 iSono Health

- 9.7 Minerva Surgical

- 9.8 Prelude

- 9.9 Sera Prognostics

- 9.10 Sustain Natural

- 9.11 Totohealth

- 9.12 Univfy

- 9.13 Nuvo Cares

Data Tables

- TABLE 1 Global femtech market, 2018 - 2024 (USD Million)

- TABLE 2 Global femtech market, 2025 - 2032 (USD Million)

- TABLE 3 Global femtech market, by product, 2018 - 2024 (USD Million)

- TABLE 4 Global femtech market, by product, 2025 - 2032 (USD Million)

- TABLE 5 Global femtech market, by application, 2018 - 2024 (USD Million)

- TABLE 6 Global femtech market, by application, 2025 - 2032 (USD Million)

- TABLE 7 Global femtech market, by end-use, 2018 - 2024 (USD Million)

- TABLE 8 Global femtech market, by end-use, 2025 - 2032 (USD Million)

- TABLE 9 Global femtech market, by region, 2018 - 2024 (USD Million)

- TABLE 10 Global femtech market, by region, 2025 - 2032 (USD Million)

- TABLE 11 Industry impact forces

- TABLE 12 Products market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 13 Products market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 14 Software market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 15 Software market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 16 Services market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 17 Services market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 18 Reproductive health market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 19 Reproductive health market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 20 Pregnancy and nursing care market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 21 Pregnancy and nursing care market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 22 Pelvic & uterine healthcare market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 23 Pelvic & uterine healthcare market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 24 General healthcare & wellness market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 25 General healthcare & wellness market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 26 Others market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 27 Others market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 28 Direct-to-consumer market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 29 Direct-to-consumer market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 30 Hospitals market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 31 Hospitals market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 32 Fertility clinics market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 33 Fertility clinics market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 34 Surgical centers market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 35 Surgical centers market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 36 Diagnostic centers market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 37 Diagnostic centers market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 38 Others market estimates and forecast, 2018 - 2024 (USD Million)

- TABLE 39 Others market estimates and forecast, 2025 - 2032 (USD Million)

- TABLE 40 North America femtech Market size, by country, 2018 - 2024 (USD Million)

- TABLE 41 North America femtech Market size, by country, 2025 - 2032 (USD Million)

- TABLE 42 North America femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 43 North America femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 44 North America Femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 45 North America Femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 46 North America femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 47 North America femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 48 U.S. femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 49 U.S. femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 50 U.S. femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 51 U.S. femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 52 U.S. femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 53 U.S. femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 54 Canada femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 55 Canada femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 56 Canada femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 57 Canada femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 58 Canada femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 59 Canada femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 60 Europe femtech Market size, by country, 2018 - 2024 (USD Million)

- TABLE 61 Europe femtech Market size, by country, 2025 - 2032 (USD Million)

- TABLE 62 Europe femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 63 Europe femtech Market size, by type, 2025 - 2032 (USD Million)

- TABLE 64 Europe femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 65 Europe femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 66 Europe femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 67 Europe femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 68 Germany femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 69 Germany femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 70 Germany femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 71 Germany femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 72 Germany femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 73 Germany femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 74 UK femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 75 UK femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 76 UK femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 77 UK femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 78 UK femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 79 UK femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 80 France femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 81 France femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 82 France femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 83 France femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 84 France femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 85 France femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 86 Italy femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 87 Italy femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 88 Italy femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 89 Italy femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 90 Italy femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 91 Italy femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 92 Spain femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 93 Spain femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 94 Spain femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 95 Spain femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 96 Spain femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 97 Spain femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 98 Russia femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 99 Russia femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 100 Russia femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 101 Russia femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 102 Russia femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 103 Russia femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 104 Asia Pacific femtech Market size, by country, 2018 - 2024 (USD Million)

- TABLE 105 Asia Pacific femtech Market size, by country, 2025 - 2032 (USD Million)

- TABLE 106 Asia Pacific femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 107 Asia Pacific femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 108 Asia Pacific femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 109 Asia Pacific femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 110 Asia Pacific femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 111 Asia Pacific femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 112 India femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 113 India femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 114 India femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 115 India femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 116 India femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 117 India femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 118 China femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 119 China femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 120 China femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 121 China femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 122 China femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 123 China femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 124 Japan femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 125 Japan femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 126 Japan femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 127 Japan femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 128 Japan femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 129 Japan femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 130 Australia femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 131 Australia femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 132 Australia femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 133 Australia femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 134 Australia femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 135 Australia femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 136 Latin America femtech Market size, by country, 2018 - 2024 (USD Million)

- TABLE 137 Latin America femtech Market size, by country, 2025 - 2032 (USD Million)

- TABLE 138 Latin America femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 139 Latin America femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 140 Latin America femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 141 Latin America femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 142 Latin America femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 143 Latin America femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 144 Brazil femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 145 Brazil femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 146 Brazil femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 147 Brazil femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 148 Brazil femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 149 Brazil femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 150 Mexico femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 151 Mexico femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 152 Mexico femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 153 Mexico femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 154 Mexico femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 155 Mexico femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 156 MEA femtech market size, by country, 2018 - 2024 (USD Million)

- TABLE 157 MEA femtech market size, by country, 2025 - 2032 (USD Million)

- TABLE 158 MEA femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 159 MEA femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 160 MEA femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 161 MEA femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 162 MEA femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 163 MEA femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 164 South Africa femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 165 South Africa femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 166 South Africa femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 167 South Africa femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 168 South Africa femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 169 South Africa femtech market size, by end-use, 2025 - 2032 (USD Million)

- TABLE 170 Saudi Arabia femtech market size, by type, 2018 - 2024 (USD Million)

- TABLE 171 Saudi Arabia femtech market size, by type, 2025 - 2032 (USD Million)

- TABLE 172 Saudi Arabia femtech market size, by application, 2018 - 2024 (USD Million)

- TABLE 173 Saudi Arabia femtech market size, by application, 2025 - 2032 (USD Million)

- TABLE 174 Saudi Arabia femtech market size, by end-use, 2018 - 2024 (USD Million)

- TABLE 175 Saudi Arabia femtech market size, by end-use, 2025 - 2032 (USD Million)

Charts & Figures

- FIG. 1 GMI report coverage: Critical research elements

- FIG. 2 Industry segmentation

- FIG. 3 Top-down approach

- FIG. 4 Market estimation and forecast methodology

- FIG. 5 Market forecasting methodology

- FIG. 6 Breakdown of primary participants

- FIG. 7 Femtech industry 360 degree synopsis, 2018 - 2032

- FIG. 8 Global femtech market, 2018 - 2032 (USD Million)

- FIG. 9 Growth potential analysis, by type

- FIG. 10 Growth potential analysis, by application

- FIG. 11 Growth potential analysis, by end-use

- FIG. 12 Porter's analysis

- FIG. 13 PESTEL analysis

- FIG. 14 Competitive dashboard, 2021

- FIG. 15 Company matrix analysis, 2021

- FIG. 16 Competitive analysis of major market players, 2021

- FIG. 17 Competitive positioning matrix

- FIG. 18 Strategic outlook matrix