|

|

市場調査レポート

商品コード

1147391

GaN&SiCパワー半導体の世界市場 (2023年~2032年):市場規模 (製品・用途別)・用途の潜在性・競合市場シェア・予測GaN & SiC Power Semiconductor Market Size By Product, By Application, Application Potential, Competitive Market Share & Forecast, 2023 - 2032 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| GaN&SiCパワー半導体の世界市場 (2023年~2032年):市場規模 (製品・用途別)・用途の潜在性・競合市場シェア・予測 |

|

出版日: 2022年10月21日

発行: Global Market Insights Inc.

ページ情報: 英文 170 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のGaN&SiCパワー半導体の市場は、鉄道車両のメンテナンスが世界的に重要視されていることから、2022年から2032年にかけて大幅な成長を示すと予測されています。

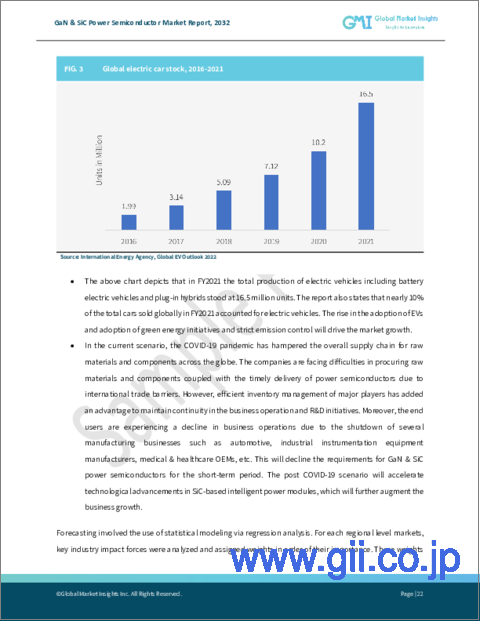

また、電気自動車の人気も年々高まっており、IEAの統計によると、2021年の電気自動車販売台数は660万台に達し、2年前と比較して3倍の市場シェアとなることが示されています。このような世界的な動向は、EV用SiC&GaN半導体の採用に拍車をかけると考えられています。

当レポートでは、世界のGaN&SiCパワー半導体の市場を調査し、市場概要、市場成長への各種影響因子の分析、法規制環境、技術・イノベーションの情勢、特許動向、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 調査手法・調査範囲

第2章 エグゼクティブサマリー

第3章 GaN&SiCパワー半導体産業の考察

- COVID-19の影響

- ロシア・ウクライナ戦争の影響

- GaN&SiCパワー半導体産業のエコシステム分析

- 利益率分析

- 技術・イノベーションの情勢

- 特許情勢

- 主なイニシアチブ・ニュース

- 規制状況

- 産業への影響要因

- 促進要因

- 潜在的リスク&課題

- 投資ポートフォリオ

- 成長性分析

- ポーターの分析

- PESTEL分析

第4章 競合情勢

- 企業の市場シェア

- 主要企業の分析

- 革新的企業の分析

- ベンダー採用マトリックス

- 戦略的展望マトリックス

第5章 GaN&SiCパワー半導体市場:製品別

- 主要動向

- SiCパワーモジュール

- GaNパワーモジュール

- ディスクリートSiC

- ディスクリートGaN

第6章 GaN&SiCパワー半導体市場:用途別

- 主要動向

- 電源装置

- 産業用モータードライブ

- ハイブリッド/電気自動車(H/EV)

- 太陽光発電インバーター

- トラクション

- その他

第7章 GaN&SiCパワー半導体市場:地域別

- 主要動向

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第8章 企業プロファイル

- Alpha & Omega Semiconductor

- CISSOID

- Diodes Incorporated

- Fuji Electric Co., Ltd.

- Infineon Technologies AG

- Littlefuse, Inc.

- Microsemi Corporation

- Mitsubishi Electric Corporation

- Nexperia

- ON Semiconductor Corporation

- Renesas Electronic Corporation

- ROHM Co.,Ltd.

- SEMIKRON

- Sensitron Semiconductor

- STMicroelectronics N.V.

- TOSHIBA ELECTRONICS DEVICES & STORAGE CORPORATION

- Vishay Intertechnology

- Wolfspeed

Data Tables

- TABLE 1 GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 2 GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 3 Total Addressable Market (TAM), 2023 - 2032 (USD Millions)

- TABLE 4 GaN & SiC power semiconductor market, by region, 2018 - 2022 (USD Million)

- TABLE 5 GaN & SiC power semiconductor market, by region, 2023-2032 (USD Million)

- TABLE 6 GaN & SiC power semiconductor market, by product, 2018 - 2022 (USD Million)

- TABLE 7 GaN & SiC power semiconductor market, by product, 2023 - 2032 (USD Million)

- TABLE 8 GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 9 GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 10 Impact of COVID-19 in North America

- TABLE 11 Impact of COVID-19 in Europe

- TABLE 12 Impact of COVID-19 in Asia Pacific

- TABLE 13 Impact of COVID-19 in Latin America

- TABLE 14 Impact of COVID-19 in MEA

- TABLE 15 Vendor matrix

- TABLE 16 Profit margin analysis

- TABLE 17 Patent landscape

- TABLE 18 Industry impact forces

- TABLE 19 Company market share, 2022

- TABLE 20 SiC power module market size, 2018 - 2022 (USD Million)

- TABLE 21 SiC power module market size, 2023 - 2032 (USD Million)

- TABLE 22 GaN power module market size, 2018- 2022 (USD Million)

- TABLE 23 GaN power module market size, 2023 - 2032 (USD Million)

- TABLE 24 Discrete SiC power semiconductor market size, 2018- 2022 (USD Million)

- TABLE 25 Discrete SiC power semiconductor market size, 2023 - 2032 (USD Million)

- TABLE 26 Discrete GaN power semiconductor market size, 2018- 2022 (USD Million)

- TABLE 27 Discrete GaN power semiconductor market size, 2023 - 2032 (USD Million)

- TABLE 28 GaN & SiC power semiconductor demand in power supplies, 2018- 2022 (USD Million)

- TABLE 29 GaN & SiC power semiconductor demand in power supplies, 2023 - 2032 (USD Million)

- TABLE 30 GaN & SiC power semiconductor demand in industrial motor drive, 2018- 2022 (USD Million)

- TABLE 31 GaN & SiC power semiconductor demand in industrial motor drive, 2023 - 2032 (USD Million)

- TABLE 32 GaN & SiC power semiconductor demand in H/EVs, 2018- 2022 (USD Million)

- TABLE 33 GaN & SiC power semiconductor demand in H/EVs, 2023 - 2032 (USD Million)

- TABLE 34 GaN & SiC power semiconductor demand in PV inverters, 2018- 2022 (USD Million)

- TABLE 35 GaN & SiC power semiconductor demand in PV inverters, 2023 - 2032 (USD Million)

- TABLE 36 GaN & SiC power semiconductor demand in traction application, 2018- 2022 (USD Million)

- TABLE 37 GaN & SiC power semiconductor demand in traction application, 2023 - 2032 (USD Million)

- TABLE 38 GaN & SiC power semiconductor demand in others application, 2018- 2022 (USD Million)

- TABLE 39 GaN & SiC power semiconductor demand in others application, 2023 - 2032 (USD Million)

- TABLE 40 North America GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 41 North America GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 42 North America GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 43 North America GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 44 North America GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 45 North America GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 46 U.S. GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 47 U.S. GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 48 U.S. GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 49 U.S. GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 50 U.S. GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 51 U.S. GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 52 Canada GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 53 Canada GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 54 Canada GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 55 Canada GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 56 Canada GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 57 Canada GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 58 Canada GaN & SiC power semiconductor market, by marine application, 2023 - 2032 (USD Million)

- TABLE 59 Europe GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 60 Europe GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 61 Europe GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 62 Europe GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 63 Europe GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 64 Europe GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 65 UK GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 66 UK GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 67 UK GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 68 UK GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 69 UK GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 70 UK GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 71 Germany GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 72 Germany GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 73 Germany GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 74 Germany GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 75 Germany GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 76 Germany GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 77 France GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 78 France GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 79 France GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 80 France GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 81 France GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 82 France GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 83 Italy GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 84 Italy GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 85 Italy GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 86 Italy GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 87 Italy GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 88 Italy GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 89 Spain GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 90 Spain GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 91 Spain GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 92 Spain GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 93 Spain GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 94 Spain GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 95 Russia GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 96 Russia GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 97 Russia GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 98 Russia GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 99 Russia GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 100 Russia GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 101 Asia Pacific GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 102 Asia Pacific GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 103 Asia Pacific GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 104 Asia Pacific GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 105 Asia Pacific GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 106 Asia Pacific GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 107 China GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 108 China GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 109 China GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 110 China GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 111 China GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 112 China GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 113 India GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 114 India GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 115 India GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 116 India GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 117 India GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 118 India GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 119 Japan GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 120 Japan GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 121 Japan GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 122 Japan GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 123 Japan GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 124 Japan GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 125 South Korea GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 126 South Korea GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 127 South Korea GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 128 South Korea GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 129 South Korea GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 130 South Korea GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 131 Taiwan GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 132 Taiwan GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 133 Taiwan GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 134 Taiwan GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 135 Taiwan GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 136 Taiwan GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 137 Latin America GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 138 Latin America GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 139 Latin America GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 140 Latin America GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 141 Latin America GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 142 Latin America GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 143 Brazil GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 144 Brazil GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 145 Brazil GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 146 Brazil GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 147 Brazil GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 148 Brazil GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 149 Mexico GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 150 Mexico GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 151 Mexico GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 152 Mexico GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 153 Mexico GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 154 Mexico GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

- TABLE 155 MEA GaN & SiC power semiconductor market, 2018 - 2022 (USD Million)

- TABLE 156 MEA GaN & SiC power semiconductor market, 2023 - 2032 (USD Million)

- TABLE 157 MEA GaN & SiC power semiconductor market, by product, 2018-2021 (USD Million)

- TABLE 158 MEA GaN & SiC power semiconductor market, by product, 2023-2032 (USD Million)

- TABLE 159 MEA GaN & SiC power semiconductor market, by application, 2018 - 2022 (USD Million)

- TABLE 160 MEA GaN & SiC power semiconductor market, by application, 2023 - 2032 (USD Million)

Charts & Figures

- FIG 1 GaN & SiC power semiconductor industry 360 degre synopsis, 2018-2032

- FIG 2 Industry ecosystem analysis

- FIG 3 Growth potential analysis

- FIG 4 Porter's analysis

- FIG 5 PESTEL analysis

- FIG 6 Company market share, 2022

- FIG 7 Competitive analysis of major market players, 2022

- FIG 8 Competitive analysis of prominent market players, 2022

- FIG 9 Vendor adoption matrix

- FIG 10 Strategic outlook matrix

- FIG 11 GaN & SiC power semiconductor market, by product, 2022 & 2030

- FIG 12 GaN & SiC power semiconductor market, by application, 2022 & 2030

- FIG 13 GaN & SiC power semiconductor market, by region, 2021 & 2030

- FIG 14 SWOT Analysis, Alpha & Omega Semiconductor

- FIG 15 SWOT Analysis, CISSOID

- FIG 16 SWOT Analysis, Diodes Incorporated

- FIG 17 SWOT Analysis, Fuji Electric Co., Ltd.

- FIG 18 SWOT Analysis, Infineon Technologies AG

- FIG 19 SWOT Analysis, Littelfuse, Inc.

- FIG 20 SWOT Analysis, Microsemi Corporation

- FIG 21 SWOT Analysis, Mitsubishi Electric Corporation

- FIG 22 SWOT Analysis, Nexperia

- FIG 23 SWOT Analysis, ON Semiconductor Corporation

- FIG 24 SWOT Analysis, Renesas Electronics Corporation

- FIG 25 SWOT Analysis, ROHM CO., LTD.

- FIG 26 SWOT Analysis, SEMIKRON

- FIG 27 SWOT Analysis, Sensitron Semiconductor

- FIG 28 SWOT Analysis, STMicroelectronics N.V.

- FIG 29 SWOT Analysis, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- FIG 30 SWOT Analysis, Vishay Intertechnology

- FIG 31 SWOT Analysis, Wolfspeed

The global GaN & SiC power semiconductor market size is projected to increase considerably over 2022-2032, due to the growing emphasis on the maintenance of rolling stocks worldwide.

For example, in April 2022, Alstom obtained an eight-year contract from Alpha Trains Group for the maintenance of 70 locomotives on the European corridor. Since rolling stocks are integrated with air conditioning equipment, auxiliary power supply units, propulsion systems, and other power electronics, the strong focus on vehicle maintenance is expected to augment GaN and SiC power semiconductor demand.

The popularity of electric vehicles has also been rising over the years. Based on statistics from the IEA, sales of electric cars reached 6.6 million in 2021, indicating a 3 times increase in market share from two years earlier. Global trends such as these are likely to fuel the adoption of SiC and GaN semiconductors for EV applications.

The GaN & SiC power semiconductor industry is categorized based on product, application, and region.

In terms of product, the market value from the GaN power module segment reached over USD 30 million in 2022. The need for radio frequency in the semiconductor industry and the escalating consumption of electronics is likely to stimulate product demand.

As compared to Laterally Diffused MOSFET technology, GaN power modules can deliver and support high electron mobility, efficiency, and frequencies. With the rapid adoption of 5G technology, the use of these power modules will rise to offer high-quality signal output.

The GaN & SiC power semiconductor market size from the photovoltaic (PV) inverters applications segment was worth over USD 350 million in 2022, as a result of the reliance on clean energy for power generation.

To mitigate the impacts of climate change and lower greenhouse gas emissions, government bodies, especially in emerging economies like Taiwan, India, and South Korea, have also been implementing strict regulations. These initiatives are anticipated to drive the consumption of renewables such as solar energy for electricity generation applications and in consequence, bolster the usage of GaN and SiC semiconductors in PV inverters.

The others application segment, which includes power factor corrections, rolling stocks, and vehicle charging infrastructure, held over 25% share of the GaN & SiC power semiconductor market in 2022. As compared to conventional power electronic devices, wide bandgap semiconductor devices can ensure faster-switching speed and low energy losses, among other key features, contributing to product demand.

Regionally speaking, the North America GaN & SiC power semiconductor industry recorded a revenue of over USD 350 million in 2022. The introduction of favorable policies to promote the clean energy sector may propel the use of power semiconductors in the region.

For example, the U.S. government proposed federal tax incentive schemes including the Modified Accelerated Cost-Recovery System, Renewable Electricity Production Tax Credit, and Residential Energy Credit, among others. These schemes were intended to support and subsidize the installation of clean energy equipment in the country. These initiatives are projected to fuel the consumption of GaN and SiC power semiconductors in PV inverters and other renewable energy applications, in turn strengthening the regional market outlook.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Scope and definition

- 1.2 Methodology & forecast parameters

- 1.3 COVID-19 impact

- 1.3.1 North America

- 1.3.2 Europe

- 1.3.3 Asia Pacific

- 1.3.4 Latin America

- 1.3.5 MEA

- 1.4 Data Sources

- 1.4.1 Secondary

- 1.4.1.1 Paid sources

- 1.4.1.2 Public sources

- 1.4.2 Primary

- 1.4.1 Secondary

- 1.5 Industry Glossary

Chapter 2 Executive Summary

- 2.1 GaN & SiC power semiconductor industry 360 degree snapshots, 2018-2032

- 2.2 Business trends

- 2.2.1 TAM, 2023 - 2032

- 2.3 Regional trends

- 2.4 Product trends

- 2.5 Application trends

Chapter 3 GaN & SiC Power Semiconductor Industry Insights

- 3.1 Introduction

- 3.2 COVID-19 impact

- 3.2.1 Global impact

- 3.2.2 Impact by region

- 3.2.2.1 North America

- 3.2.2.2 Europe

- 3.2.2.3 Asia Pacific

- 3.2.2.4 Latin America

- 3.2.2.5 MEA

- 3.2.3 Impact by value chain

- 3.2.3.1 Research & development

- 3.2.3.2 Manufacturing

- 3.2.3.3 Marketing

- 3.2.3.4 Supply

- 3.2.4 Impact by competitive landscape

- 3.2.4.1 Strategy

- 3.2.4.2 Distribution network

- 3.2.4.3 Business growth

- 3.3 Russia-Ukraine war impact

- 3.4 GaN & SiC power semiconductor industry ecosystem analysis

- 3.4.1 Raw material suppliers

- 3.4.2 Manufacturers

- 3.4.3 Distribution channel analysis

- 3.4.4 Applications

- 3.4.5 Vendor matrix

- 3.4.5.1 Raw material suppliers

- 3.4.5.2 Manufacturers

- 3.4.5.3 Distribution channel analysis

- 3.4.5.4 Applications

- 3.5 Profit margin analysis

- 3.6 Technology & innovation landscape

- 3.7 Patent landscape

- 3.8 Key initiative & news

- 3.9 Regulatory landscape

- 3.9.1 International

- 3.9.2 North America

- 3.9.3 Europe

- 3.9.4 Asia Pacific

- 3.9.5 Latin America

- 3.9.6 MEA

- 3.10 Industry impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Stronger capabilities of SiC and GaN over Silicon

- 3.10.1.2 Rising penitration of hybrid and electric vehicles across globally

- 3.10.1.3 High adoption of power device in renewable energy applications

- 3.10.1.4 Rising investment in research and development for Wide Band Gap Semiconductors

- 3.10.1.5 Surge in the investment for infrastructure development and proliferation of 5G technology

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High use of conventional silicon materials for manufacturing

- 3.10.2.2 High cost of manufacturing

- 3.10.1 Growth drivers

- 3.11 Investment portfolio

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.13.1 Threat of new entrant

- 3.13.2 Bargaining power of supplier

- 3.13.3 Bargaining power of buyer

- 3.13.4 Threat of substitution

- 3.13.5 Competitive rivalry

- 3.14 PESTEL analysis

- 3.14.1 Political

- 3.14.2 Economical

- 3.14.3 Social

- 3.14.4 Technological

- 3.14.5 Legal

- 3.14.6 Environmental

Chapter 4 Competitive Landscape, 2022

- 4.1 Introduction

- 4.2 Company market share, 2022

- 4.3 Completive analysis of key market players, 2022

- 4.3.1 Infineon Technologies AG

- 4.3.2 ON Semiconductor Corporation

- 4.3.3 STMicroelectronics N.V.

- 4.3.4 ROHM CO., LTD.

- 4.3.5 Mitsubishi Electric Corporation

- 4.3.6 Wolfspeed

- 4.3.7 Renesas Electronics Corporation

- 4.4 Completive analysis of innovative players, 2022

- 4.4.1 Fuji Electric Co., Ltd.

- 4.4.2 Microsemi Corporation

- 4.4.3 Nexperia

- 4.4.4 Toshiba Electronic Devices & Storage Corporation

- 4.4.5 Alpha & Omega Semiconductor

- 4.5 Vendor adoption matrix

- 4.6 Strategic outlook matrix

Chapter 5 GaN & SiC Power Semiconductor Market, By Product

- 5.1 Key trends, by product

- 5.2 SiC power module

- 5.2.1 Market estimates and forecast, 2018-2032

- 5.3 GaN power module

- 5.3.1 Market estimates and forecast, 2018-2032

- 5.4 Discrete SiC

- 5.4.1 Market estimates and forecast, 2018-2032

- 5.5 Discrete GaN

- 5.5.1 Market estimates and forecast, 2018-2032

Chapter 6 GaN & SiC Power Semiconductor Market, By Application

- 6.1 Key trends, by application

- 6.2 Power supplies

- 6.2.1 Market estimates and forecast, 2018-2032

- 6.3 Industrial motor drives

- 6.3.1 Market estimates and forecast, 2018-2032

- 6.4 Hybrid/Electric Vehicles (H/EVs)

- 6.4.1 Market estimates and forecast, 2018-2032

- 6.5 Photovoltaic inverters

- 6.5.1 Market estimates and forecast, 2018-2032

- 6.6 Traction

- 6.6.1 Market estimates and forecast, 2018-2032

- 6.7 Others

- 6.7.1 Market estimates and forecast, 2018-2032

Chapter 7 GaN & SiC Power Semiconductor Market, By Region

- 7.1 Key trends, by region

- 7.2 North America

- 7.2.1 Market estimates and forecast, 2018-2032

- 7.2.2 Market estimates and forecast, by product, 2018-2032

- 7.2.3 Market estimates and forecast, by application, 2018-2032

- 7.2.4 U.S.

- 7.2.4.1 Market estimates and forecast, 2018-2032

- 7.2.4.2 Market estimates and forecast, by product, 2018-2032

- 7.2.4.3 Market estimates and forecast, by application, 2018-2032

- 7.2.5 Canada

- 7.2.5.1 Market estimates and forecast, 2018-2032

- 7.2.5.2 Market estimates and forecast, by product, 2018-2032

- 7.2.5.3 Market estimates and forecast, by application, 2018-2032

- 7.3 Europe

- 7.3.1 Market estimates and forecast, 2018-2032

- 7.3.2 Market estimates and forecast, by product, 2018-2032

- 7.3.3 Market estimates and forecast, by application, 2018-2032

- 7.3.4 UK

- 7.3.4.1 Market estimates and forecast, 2018-2032

- 7.3.4.2 Market estimates and forecast, by product, 2018-2032

- 7.3.4.3 Market estimates and forecast, by application, 2018-2032

- 7.3.5 Germany

- 7.3.5.1 Market estimates and forecast, 2018-2032

- 7.3.5.2 Market estimates and forecast, by product, 2018-2032

- 7.3.5.3 Market estimates and forecast, by application, 2018-2032

- 7.3.6 France

- 7.3.6.1 Market estimates and forecast, 2018-2032

- 7.3.6.2 Market estimates and forecast, by product, 2018-2032

- 7.3.6.3 Market estimates and forecast, by application, 2018-2032

- 7.3.7 Italy

- 7.3.7.1 Market estimates and forecast, 2018-2032

- 7.3.7.2 Market estimates and forecast, by product, 2018-2032

- 7.3.7.3 Market estimates and forecast, by application, 2018-2032

- 7.3.8 Spain

- 7.3.8.1 Market estimates and forecast, 2018-2032

- 7.3.8.2 Market estimates and forecast, by product, 2018-2032

- 7.3.8.3 Market estimates and forecast, by application, 2018-2032

- 7.3.9 Russia

- 7.3.9.1 Market estimates and forecast, 2018-2032

- 7.3.9.2 Market estimates and forecast, by product, 2018-2032

- 7.3.9.3 Market estimates and forecast, by application, 2018-2032

- 7.4 Asia Pacific

- 7.4.1 Market estimates and forecast, 2018-2032

- 7.4.2 Market estimates and forecast, by product, 2018-2032

- 7.4.3 Market estimates and forecast, by application, 2018-2032

- 7.4.4 China

- 7.4.4.1 Market estimates and forecast, 2018-2032

- 7.4.4.2 Market estimates and forecast, by product, 2018-2032

- 7.4.4.3 Market estimates and forecast, by application, 2018-2032

- 7.4.5 India

- 7.4.5.1 Market estimates and forecast, 2018-2032

- 7.4.5.2 Market estimates and forecast, by product, 2018-2032

- 7.4.5.3 Market estimates and forecast, by application, 2018-2032

- 7.4.6 Japan

- 7.4.6.1 Market estimates and forecast, 2018-2032

- 7.4.6.2 Market estimates and forecast, by product, 2018-2032

- 7.4.6.3 Market estimates and forecast, by application, 2018-2032

- 7.4.7 South Korea

- 7.4.7.1 Market estimates and forecast, 2018-2032

- 7.4.7.2 Market estimates and forecast, by product, 2018-2032

- 7.4.7.3 Market estimates and forecast, by application, 2018-2032

- 7.4.8 Taiwan

- 7.4.8.1 Market estimates and forecast, 2018-2032

- 7.4.8.2 Market estimates and forecast, by product, 2018-2032

- 7.4.8.3 Market estimates and forecast, by application, 2018-2032

- 7.5 Latin America

- 7.5.1 Market estimates and forecast, 2018-2032

- 7.5.2 Market estimates and forecast, by product, 2018-2032

- 7.5.3 Market estimates and forecast, by application, 2018-2032

- 7.5.4 Brazil

- 7.5.4.1 Market estimates and forecast, 2018-2032

- 7.5.4.2 Market estimates and forecast, by product, 2018-2032

- 7.5.4.3 Market estimates and forecast, by application, 2018-2032

- 7.5.5 Mexico

- 7.5.5.1 Market estimates and forecast, 2018-2032

- 7.5.5.2 Market estimates and forecast, by product, 2018-2032

- 7.5.5.3 Market estimates and forecast, by application, 2018-2032

- 7.6 MEA

- 7.6.1 Market estimates and forecast, 2018-2032

- 7.6.2 Market estimates and forecast, by product, 2018-2032

- 7.6.3 Market estimates and forecast, by application, 2018-2032

Chapter 8 Company Profiles

- 8.1 Alpha & Omega Semiconductor

- 8.1.1 Business Overview

- 8.1.2 Financial Data

- 8.1.3 Product Landscape

- 8.1.4 Strategic Outlook

- 8.1.5 SWOT Analysis

- 8.2 CISSOID

- 8.2.1 Business Overview

- 8.2.2 Financial Data

- 8.2.3 Product Landscape

- 8.2.4 Strategic Outlook

- 8.2.5 SWOT Analysis

- 8.3 Diodes Incorporated

- 8.3.1 Business Overview

- 8.3.2 Financial Data

- 8.3.3 Product Landscape

- 8.3.4 Strategic Outlook

- 8.3.5 SWOT Analysis

- 8.4 Fuji Electric Co., Ltd.

- 8.4.1 Business Overview

- 8.4.2 Financial Data

- 8.4.3 Product Landscape

- 8.4.4 Strategic Outlook

- 8.4.5 SWOT Analysis

- 8.5 Infineon Technologies AG

- 8.5.1 Business Overview

- 8.5.2 Financial Data

- 8.5.3 Product Landscape

- 8.5.4 Strategic Outlook

- 8.5.5 SWOT Analysis

- 8.6 Littlefuse, Inc.

- 8.6.1 Business Overview

- 8.6.2 Financial Data

- 8.6.3 Product Landscape

- 8.6.4 Strategic Outlook

- 8.6.5 SWOT Analysis

- 8.7 Microsemi Corporation

- 8.7.1 Business Overview

- 8.7.2 Financial Data

- 8.7.3 Product Landscape

- 8.7.4 Strategic Outlook

- 8.7.5 SWOT Analysis

- 8.8 Mitsubishi Electric Corporation

- 8.8.1 Business Overview

- 8.8.2 Financial Data

- 8.8.3 Product Landscape

- 8.8.4 Strategic Outlook

- 8.8.5 SWOT Analysis

- 8.9 Nexperia

- 8.9.1 Business Overview

- 8.9.2 Financial Data

- 8.9.3 Product Landscape

- 8.9.4 Strategic Outlook

- 8.9.5 SWOT Analysis

- 8.10 ON Semiconductor Corporation

- 8.10.1 Business Overview

- 8.10.2 Financial Data

- 8.10.3 Product Landscape

- 8.10.4 Strategic Outlook

- 8.10.5 SWOT Analysis

- 8.11 Renesas Electronic Corporation

- 8.11.1 Business Overview

- 8.11.2 Financial Data

- 8.11.3 Product Landscape

- 8.11.4 Strategic Outlook

- 8.11.5 SWOT Analysis

- 8.12 ROHM Co.,Ltd.

- 8.12.1 Business Overview

- 8.12.2 Financial Data

- 8.12.3 Product Landscape

- 8.12.4 Strategic Outlook

- 8.12.5 SWOT Analysis

- 8.13 SEMIKRON

- 8.13.1 Business Overview

- 8.13.2 Financial Data

- 8.13.3 Product Landscape

- 8.13.4 Strategic Outlook

- 8.13.5 SWOT Analysis

- 8.14 Sensitron Semiconductor

- 8.14.1 Business Overview

- 8.14.2 Financial Data

- 8.14.3 Product Landscape

- 8.14.4 Strategic Outlook

- 8.14.5 SWOT Analysis

- 8.15 STMicroelectronics N.V.

- 8.15.1 Business Overview

- 8.15.2 Financial Data

- 8.15.3 Product Landscape

- 8.15.4 Strategic Outlook

- 8.15.5 SWOT Analysis

- 8.16 TOSHIBA ELECTRONICS DEVICES & STORAGE CORPORATION

- 8.16.1 Business Overview

- 8.16.2 Financial Data

- 8.16.3 Product Landscape

- 8.16.4 Strategic Outlook

- 8.16.5 SWOT Analysis

- 8.17 Vishay Intertechnology

- 8.17.1 Business Overview

- 8.17.2 Financial Data

- 8.17.3 Product Landscape

- 8.17.4 Strategic Outlook

- 8.17.5 SWOT Analysis

- 8.18 Wolfspeed

- 8.18.1 Business Overview

- 8.18.2 Financial Data

- 8.18.3 Product Landscape

- 8.18.4 Strategic Outlook

- 8.18.5 SWOT Analysis