|

|

市場調査レポート

商品コード

1119573

メディカルツーリズム市場:用途別規模、産業分析レポート、地域別展望、成長性、競合市場シェアと予測、2022年~2030年Medical Tourism Market Size By Application, Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2022 - 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| メディカルツーリズム市場:用途別規模、産業分析レポート、地域別展望、成長性、競合市場シェアと予測、2022年~2030年 |

|

出版日: 2022年08月17日

発行: Global Market Insights Inc.

ページ情報: 英文 135 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

メディカルツーリズムの市場規模は、世界の高齢者人口の増加により、2030年までに大きく拡大すると予測されています。

また、低侵襲技術における最新の進歩が、予測期間を通じて市場の成長をさらに後押しするものと思われます。

当レポートでは、世界のメディカルツーリズム市場について調査し、市場の概要とともに、用途別、地域別動向、および市場に参入する企業の競合動向などを提供しています。

目次

第1章 調査手法

第2章 エグゼクティブサマリー

第3章 メディカルツーリズム業界考察

- 業界セグメンテーション

- 業界情勢、2017年~2030年

- 業界への影響要因

- 成長性分析

- COVID-19の響分析

- ポーターの分析

- 競合情勢、2021年

- PESTEL分析

第4章 メディカルツーリズム市場、用途別

- 主要セグメントの動向

- 心臓血管外科

- 美容整形

- 歯科外科

- 整形外科

- 肥満手術

- 不妊治療

- 腫瘍治療

- その他

第5章 メディカルツーリズム市場、地域別

- 主な地域動向

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第6章 企業プロファイル

- 競合ダッシュボード

- Apollo Hospitals Enterprise Limited

- Asklepios Kliniken GmbH & Co. KGaA

- Bumrungrad International Hospital

- Fortis Healthcare Limited

- KPJ Healthcare Berhad

- Manipal Hospital

- Max Healthcare

- Mount Elizbeth Hospitals

- Narayana Health

- Raffles Medical Group

Data Tables

- TABLE 1. Global medical tourism market, 2017 - 2021 (USD Million)

- TABLE 2. Global medical tourism market, 2022 - 2030 (USD Million)

- TABLE 3. Global medical tourism market, by application, 2017 - 2021 (USD Million)

- TABLE 4. Global medical tourism market, by application, 2022 - 2030 (USD Million)

- TABLE 5. Global medical tourism market, by region, 2017 - 2021 (USD Million)

- TABLE 6. Global medical tourism market, by region, 2022 - 2030 (USD Million)

- TABLE 7. Industry impact forces

- TABLE 8. Cardiovascular surgery market, by region, 2017 - 2021, (USD Million)

- TABLE 9. Cardiovascular surgery market, by region, 2022 - 2030, (USD Million)

- TABLE 10. Cosmetic surgery market, by region, 2017 - 2021, (USD Million)

- TABLE 11. Cosmetic surgery market, by region, 2022 - 2030, (USD Million)

- TABLE 12. Hair transplant market, by region, 2017 - 2021, (USD Million)

- TABLE 13. Hair transplant market, by region, 2022 - 2030, (USD Million)

- TABLE 14. Breast augmentation market, by region, 2017 - 2021, (USD Million)

- TABLE 15. Breast augmentation market, by region, 2022 - 2030, (USD Million)

- TABLE 16. Others market, by region, 2017 - 2021, (USD Million)

- TABLE 17. Others market, by region, 2022 - 2030, (USD Million)

- TABLE 18. Dental surgery market, by region, 2017 - 2021, (USD Million)

- TABLE 19. Dental surgery market, by region, 2022 - 2030, (USD Million)

- TABLE 20. Orthopaedic surgery market, by region, 2017 - 2021, (USD Million)

- TABLE 21. Orthopaedic surgery market, by region, 2022 - 2030, (USD Million)

- TABLE 22. Bariatric surgery market, by region, 2017 - 2021, (USD Million)

- TABLE 23. Bariatric surgery market, by region, 2022 - 2030, (USD Million)

- TABLE 24. Fertility treatment market, by region, 2017 - 2021, (USD Million)

- TABLE 25. Fertility treatment market, by region, 2022 - 2030, (USD Million)

- TABLE 26. Oncology treatment market, by region, 2017 - 2021, (USD Million)

- TABLE 27. Oncology treatment market, by region, 2022 - 2030, (USD Million)

- TABLE 28. Other market, by region, 2017 - 2021, (USD Million)

- TABLE 29. Other market, by region, 2022 - 2030, (USD Million)

- TABLE 30. North America medical tourism market, by country, 2017-2021, (USD Million)

- TABLE 31. North America medical tourism market, by country, 2022-2030, (USD Million)

- TABLE 32. North America medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 33. North America medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 34. North America medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 35. North America medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 36. U.S. medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 37. U.S. medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 38. U.S. medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 39. U.S. medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 40. Canada medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 41. Canada medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 42. Canada medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 43. Canada medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 44. Europe medical tourism market, by country, 2017-2021, (USD Million)

- TABLE 45. Europe medical tourism market, by country, 2022-2030, (USD Million)

- TABLE 46. Europe medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 47. Europe medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 48. Europe medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 49. Europe medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 50. Germany medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 51. Germany medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 52. Germany medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 53. Germany medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 54. UK medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 55. UK medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 56. UK medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 57. UK medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 58. France medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 59. France medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 60. France medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 61. France medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 62. Spain medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 63. Spain medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 64. Spain medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 65. Spain medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 66. Italy medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 67. Italy medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 68. Italy medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 69. Italy medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 70. Poland medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 71. Poland medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 72. Poland medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 73. Poland medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 74. Turkey medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 75. Turkey medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 76. Turkey medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 77. Turkey medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 78. The Netherlands medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 79. The Netherlands medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 80. The Netherlands medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 81. The Netherlands medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 82. Asia Pacific medical tourism market, by country, 2017-2021, (USD Million)

- TABLE 83. Asia Pacific medical tourism market, by country, 2022-2030, (USD Million)

- TABLE 84. Asia Pacific medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 85. Asia Pacific medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 86. Asia Pacific medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 87. Asia Pacific medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 88. India medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 89. India medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 90. India medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 91. India medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 92. Thailand medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 93. Thailand medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 94. Thailand medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 95. Thailand medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 96. Singapore medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 97. Singapore medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 98. Singapore medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 99. Singapore medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 100. Malaysia medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 101. Malaysia medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 102. Malaysia medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 103. Malaysia medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 104. Latin America medical tourism market, by country, 2017-2021, (USD Million)

- TABLE 105. Latin America medical tourism market, by country, 2022-2030, (USD Million)

- TABLE 106. Latin America medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 107. Latin America medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 108. Latin America medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 109. Latin America medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 110. Mexico medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 111. Mexico medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 112. Mexico medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 113. Mexico medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 114. Columbia medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 115. Columbia medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 116. Columbia medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 117. Columbia medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 118. Costa Rica medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 119. Costa Rica medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 120. Costa Rica medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 121. Costa Rica medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 122. MEA medical tourism market, by country, 2017-2021, (USD Million)

- TABLE 123. MEA medical tourism market, by country, 2022-2030, (USD Million)

- TABLE 124. MEA medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 125. MEA medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 126. MEA medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 127. MEA medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 128. South Africa medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 129. South Africa medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 130. South Africa medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 131. South Africa medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 132. UAE medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 133. UAE medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 134. UAE medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 135. UAE medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

- TABLE 136. Iraq medical tourism market, by application, 2017-2021, (USD Million)

- TABLE 137. Iraq medical tourism market, by application, 2022-2030, (USD Million)

- TABLE 138. Iraq medical tourism market, by cosmetic surgery, 2017-2021, (USD Million)

- TABLE 139. Iraq medical tourism market, by cosmetic surgery, 2022-2030, (USD Million)

Charts & Figures

- FIG 1. Top-down approach

- FIG 2. Breakdown of primary participants

- FIG 3. Medical tourism industry 360 degree synopsis, 2017 - 2030

- FIG 4. Industry segmentation

- FIG 5. Industry landscape, 2017-2030 (USD Million)

- FIG 6. Growth potential analysis, by application

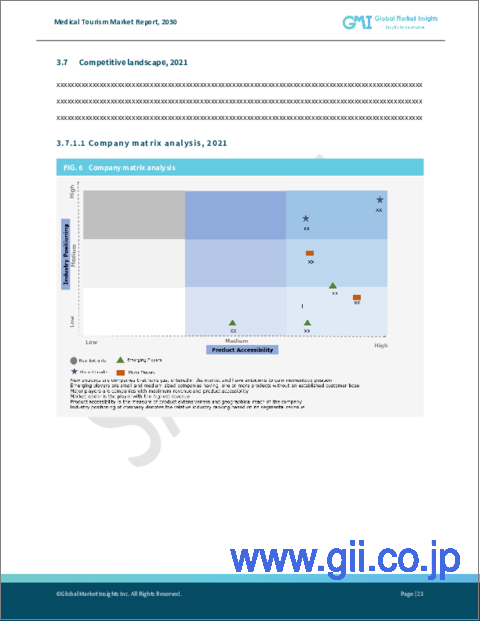

- FIG 7. Company matrix analysis, 2021

- FIG 8. Porter's analysis

- FIG 9. PESTEL analysis

- FIG 10. Key segment trends, by application

- FIG 11. Key regional trends

- FIG 12. Strategy dashboard, 2021

The medical tourism market is set to register significant growth by 2030 owing to growing geriatric population worldwide. In addition, latest advancements in minimally invasive technology are likely to further support market growth through the forecast period.

The industry was negatively affected by the COVID-19 pandemic because of the resulting travel restrictions and acute shortage of medical staff across the globe. However, easing of restrictions imposed on the tourism sector is helping the market recover from the initial lull.

Recently, major players in the industry have been investing in product innovation to improve their business standing, thereby bolstering medical tourism market expansion. For instance, in July 2022, Chevala Wellness Hua Hin, a Thailand-based skin care clinic, launched a new clinic in collaboration with InterContinental Resort at the coastal resort's Bluport Mall. This clinic aimed to target high-end tourists and has added long Covid and anti-aging treatment.

The medical tourism market has been bifurcated in terms of application and region.

On the basis of application, the market has been segmented into cosmetic surgery, orthopedic surgery, fertility treatment, cardiovascular surgery, dental surgery, bariatric surgery, and oncology treatment. Among these, the cardiovascular surgery segment was valued at more than $2674.8 million in 2021 and is poised to register notable expansion through the analysis timeframe. Cardiovascular surgeries primarily include heart valve replacement, angioplasty, and insertion of a pacemaker, among other procedures.

The oncology treatment segment is projected to exceed $13,486.8 million in revenue by 2030. The oncology treatment market is foreseen to progress at a sizable pace in the future owing to rising number of cancer cases in developing as well as developed nations. With the surging number of people who are being diagnosed with cancer, the demand for cancer diagnosis and treatment will see a spike in the future. The cost of cancer therapy in developed countries is very high, and more advanced and sophisticated techniques are being used in developing nations. These factors will augment the number of foreign patients traveling in the forthcoming years.

In the regional context, the Asia Pacific medical tourism market is anticipated to observe significant growth through 2030 due to the soaring number of patients traveling to developing countries in the APAC region. The medical tourism industry in the Middle East & Africa was valued at more than $876.0 million in 2021 driven by the expanding healthcare infrastructure in countries like South Africa and UAE. Numerous government initiatives that are promoting medical tourism is set to positively impact the MEA market.

Meanwhile, the medical tourism market in the Latin America region is estimated to exhibit solid progress over the review timespan as a result of the improving financial condition and the presence of cheaper healthcare facilities than the U.S. in the LATAM region.

Table of Contents

Chapter 1 Methodology

- 1.1 Methodology

- 1.2 Market definition

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Secondary

- 1.4.1.1 Paid sources

- 1.4.1.2 Unpaid sources

- 1.4.2 Primary

- 1.4.1 Secondary

Chapter 2 Executive Summary

- 2.1 Medical tourism industry 360 degree synopsis, 2017 - 2030

- 2.1.1 Business trends

- 2.1.2 Application trends

- 2.1.3 Regional trends

Chapter 3 Medical Tourism Industry Insights

- 3.1 Industry segmentation

- 3.2 Industry landscape, 2017 - 2030

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Low cost of medical treatment in developing countries

- 3.3.1.2 Rising awareness about medical tourism among patients

- 3.3.1.3 Availability of high-quality treatment in developing countries

- 3.3.1.4 Growing compliance towards international standard for surgical procedures

- 3.3.1.5 Ease and affordability of international travel

- 3.3.1.6 Various government policies to ease medical travel

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 Long wait time for certain medical procedures

- 3.3.2.2 Issue with patient follow-up and post-surgery complications

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.4.1 By application

- 3.5 COVID-19 impact analysis

- 3.6 Porter's analysis

- 3.7 Competitive landscape, 2021

- 3.7.1 Company matrix analysis

- 3.8 PESTEL analysis

Chapter 4 Medical Tourism Market, By Application

- 4.1 Key segment trends

- 4.2 Cardiovascular surgery

- 4.2.1 Market size, by region, 2017 - 2030 (USD Million)

- 4.3 Cosmetic Surgery

- 4.3.1 Market size, by region, 2017 - 2030 (USD Million)

- 4.3.2 Hair transplant

- 4.3.2.1 Market size, by region, 2017 - 2030 (USD Million)

- 4.3.3 Breast augmentation

- 4.3.3.1 Market size, by region, 2017 - 2030 (USD Million)

- 4.3.4 Others

- 4.3.4.1 Market size, by region, 2017 - 2030 (USD Million)

- 4.4 Dental surgery

- 4.4.1 Market size, by region, 2017 - 2030 (USD Million)

- 4.5 Orthopedic surgery

- 4.5.1 Market size, by region, 2017 - 2030 (USD Million)

- 4.6 Bariatric surgery

- 4.6.1 Market size, by region, 2017 - 2030 (USD Million)

- 4.7 Fertility treatment

- 4.7.1 Market size, by region, 2017 - 2030 (USD Million)

- 4.8 Oncology treatment

- 4.8.1 Market size, by region, 2017 - 2030 (USD Million)

- 4.9 Other

- 4.9.1 Market size, by region, 2017 - 2030 (USD Million)

Chapter 5 Medical Tourism Market, By Region

- 5.1 Key regional trends

- 5.2 North America

- 5.2.1 Market size, by country, 2017 - 2030 (USD Million)

- 5.2.2 Market size, by application, 2017 - 2030 (USD Million)

- 5.2.2.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.2.3 U.S.

- 5.2.3.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.2.3.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.2.3.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.2.4 Canada

- 5.2.4.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.2.4.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.2.4.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3 Europe

- 5.3.1 Market size, by country, 2017 - 2030 (USD Million)

- 5.3.2 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.2.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.3.3 Germany

- 5.3.3.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.3.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.3.3.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.4 UK

- 5.3.4.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.4.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.3.4.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.5 France

- 5.3.5.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.5.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.3.5.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.6 Spain

- 5.3.6.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.6.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.3.6.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.7 Italy

- 5.3.7.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.7.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.3.7.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.8 Poland

- 5.3.8.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.8.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.3.8.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.9 Turkey

- 5.3.9.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.9.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.3.9.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.10 The Netherlands

- 5.3.10.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.3.10.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.3.10.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.4 Asia Pacific

- 5.4.1 Market size, by country, 2017 - 2030 (USD Million)

- 5.4.2 Market size, by application, 2017 - 2030 (USD Million)

- 5.4.2.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.4.3 India

- 5.4.3.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.4.3.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.4.3.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.4.4 Thailand

- 5.4.4.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.4.4.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.4.4.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.4.5 Singapore

- 5.4.5.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.4.5.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.4.5.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.4.6 Malaysia

- 5.4.6.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.4.6.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.4.6.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.5 Latin America

- 5.5.1 Market size, by country, 2017 - 2030 (USD Million)

- 5.5.2 Market size, by application, 2017 - 2030 (USD Million)

- 5.5.2.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.5.3 Mexico

- 5.5.3.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.5.3.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.5.3.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.5.4 Columbia

- 5.5.4.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.5.4.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.5.4.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.5.5 Costa Rica

- 5.5.5.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.5.5.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.5.5.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.6 MEA

- 5.6.1 Market size, by country, 2017 - 2030 (USD Million)

- 5.6.2 Market size, by application, 2017 - 2030 (USD Million)

- 5.6.2.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.6.3 South Africa

- 5.6.3.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.6.3.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.6.3.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.6.4 UAE

- 5.6.4.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.6.4.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.6.4.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.6.5 Iraq

- 5.6.5.1 Market size, by application, 2017 - 2030 (USD Million)

- 5.6.5.1.1 Market size, by cosmetic surgery, 2017 - 2030 (USD Million)

- 5.6.5.1 Market size, by application, 2017 - 2030 (USD Million)

Chapter 6 Company Profiles

- 6.1 Competitive dashboard

- 6.2 Apollo Hospitals Enterprise Limited

- 6.2.1 Business overview

- 6.2.2 Financial data

- 6.2.3 Product landscape

- 6.2.4 Strategic outlook

- 6.2.5 SWOT analysis

- 6.3 Asklepios Kliniken GmbH & Co. KGaA

- 6.3.1 Business overview

- 6.3.2 Financial data

- 6.3.3 Product landscape

- 6.3.4 Strategic outlook

- 6.3.5 SWOT analysis

- 6.4 Bumrungrad International Hospital

- 6.4.1 Business overview

- 6.4.2 Financial data

- 6.4.3 Product landscape

- 6.4.4 Strategic outlook

- 6.4.5 SWOT analysis

- 6.5 Fortis Healthcare Limited

- 6.5.1 Business overview

- 6.5.2 Financial data

- 6.5.3 Product landscape

- 6.5.4 Strategic outlook

- 6.5.5 SWOT analysis

- 6.6 KPJ Healthcare Berhad

- 6.6.1 Business overview

- 6.6.2 Financial data

- 6.6.3 Product landscape

- 6.6.4 Strategic outlook

- 6.6.5 SWOT analysis

- 6.7 Manipal Hospital

- 6.7.1 Business overview

- 6.7.2 Financial data

- 6.7.3 Product landscape

- 6.7.4 Strategic outlook

- 6.7.5 SWOT analysis

- 6.8 Max Healthcare

- 6.8.1 Business overview

- 6.8.2 Financial data

- 6.8.3 Product landscape

- 6.8.4 Strategic outlook

- 6.8.5 SWOT analysis

- 6.9 Mount Elizbeth Hospitals

- 6.9.1 Business overview

- 6.9.2 Financial data

- 6.9.3 Product landscape

- 6.9.4 Strategic outlook

- 6.9.5 SWOT analysis

- 6.10 Narayana Health

- 6.10.1 Business overview

- 6.10.2 Financial data

- 6.10.3 Product landscape

- 6.10.4 Strategic outlook

- 6.10.5 SWOT analysis

- 6.11 Raffles Medical Group

- 6.11.1 Business overview

- 6.11.2 Financial data

- 6.11.3 Product landscape

- 6.11.4 Strategic outlook

- 6.11.5 SWOT analysis