|

|

市場調査レポート

商品コード

1169011

フリーズドライの世界市場-2022-2029Global Freeze Dried Food Market - 2022-2029 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| フリーズドライの世界市場-2022-2029 |

|

出版日: 2022年12月08日

発行: DataM Intelligence

ページ情報: 英文 170 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

市場概要

フリーズドライ食品は、水分や湿気を含まないため、小型・軽量化が可能です。凍結乾燥は最も優れた方法であり、主に食品・医薬品業界で使用されています。フリーズドライ加工では、食品はその物理的特性を損なうことなく低温で乾燥されます。フリーズドライ加工法は、製品の保存期間を長くするのに役立ちます。フリーズドライ食品は、化学物質による保存や冷蔵の必要がなく、水を加えることで迅速かつ容易に再構成されるため、健康的な食品として選択することができます。予測期間には、スナック、果物、野菜、ペットフードなどのフリーズドライ食品の消費量が増加し、市場成長の原動力となっています。また、すぐに食べられる食品に対する消費者の需要は、予測期間中に市場で成長することが予想されます。

世界のフリーズドライ食品市場は、2021年に332億3,057万米ドルと評価され、予測期間(2022年~2029年)にはCAGR7.9%で成長すると予測されています。

市場力学:利便性の高い食品への需要増が市場成長を牽引

フリーズドライ食品は、生鮮食品に比べて製造にかかる時間が短く、調理にかかる手間も少ないです。コンビニエンス・フードに対する顧客の需要の高まりは、間接的にその恩恵を受けています。顧客の多忙なライフスタイルにより、フリーズドライ食品の需要に利便性を求めるニーズが高まっています。栄養価を維持しながら食品の保存期間を延長するニーズの高まりは、フリーズドライ食品市場を推進すると予測されています。フリーズドライ食品は、消費者に簡単で迅速な食事の選択肢を提供し、緊急時に役立ちます。その結果、フリーズドライ食品の採用が進み、市場を前進させることになります。健康的な食品を使った間食が人気を集めています。消費者は健康に気を配り、ビーガン、グルテンフリー、自然食品を求めるようになっているため、世界中のメーカーがフリーズドライのスナックを店頭に並べるようになっています。

さらに、女性の就業率が継続的に上昇していることも、市場の成長を後押ししています。働く女性にとって、忙しいスケジュールの中で常に新鮮な食事を作ることは容易ではありません。そのため、女性は食事や調理に時間がかからない他の選択肢や、冷凍スナックのようなすぐに食べられる食品を探しているのです。2021年、米国では働く女性の割合が46.3%となり、前年を上回りました。また、インドでは、2021年に女性の労働参加率が25.1%に上昇しました。インドの農村部については、女性の労働力率は27.7%と3%上昇し、都市部の女性の参加率は18.6%と2019年に比べ0.1上昇しました。世界中の女性の多忙なライフスタイルにより、すぐに食べられる食品の消費が増加しているため、メーカーは冷凍スナックに独自のフレーバーや素材を生産することを余儀なくされています。この要因は、フリーズドライ食品市場を牽引すると予想されます。

市場セグメンテーション。世界のフリーズドライ食品市場では、肉類・魚介類セグメントが最も高いシェアを占めています

予測期間中、肉・シーフードセグメントが圧倒的な市場シェアを占めています。このフリーズドライの肉・魚介類は、通常の製品よりも保存期間が長く、使い勝手が良いのが特徴です。米国、カナダ、英国、中国、フランス、イタリアなどの先進国および発展途上国の消費者は、多忙なスケジュールのため、フリーズドライ食品を好んでいます。ほとんどの消費者は、栄養価が高く、製品ラベルがきれいな肉や魚介類を好みます。フリーズドライ食品メーカーは、新製品をポートフォリオに加えようとしているため、消費者はより多くの肉類および魚介類製品を購入するように誘引されています。肉類や魚介類は、ハンバーガーのパテやピザの冷凍トッピングなど、さまざまなファーストフード製品に広く使われています。これらの製品は賞味期限が長く、簡単に保存することができます。これらの要因により、フリーズドライの肉・魚介類製品の売上が伸びています。

各地域における普及:予測期間中、アジア太平洋地域が圧倒的なシェアを占める

アジア太平洋地域は、多忙なライフスタイルや働く女性の増加による消費者のフリーズドライ食品需要の増加により、予測期間中に最大の市場シェアを占めました。インドと中国は、人口の増加により最大の市場シェアを持つ新興国です。可処分所得の増加や、調理や消費に便利な食品への嗜好が、特に都市部の人々の多忙なライフスタイルに起因して、非常に重要視されるようになりました。同地域の主要な主要企業は、消費者のフリーズドライ食品購入を促す新製品を発売しました。例えば、2020年4月、Nestleは、健康的でカスタマイズ可能なスーパーフードドリンクを作るために、100%天然成分を使用したnesQinoを発売しました。この新製品は、まず中国で発売されます。最新製品からは、健康に良いとされるさまざまな種類の食材を使い、クリエイティブな栄養士が考案した21種類のスーパーフードドリンクレシピを作ることができます。スーパーフードには、果物、野菜、ナッツ、種子、根菜、微細藻類が使われています。また、プロバイオティクスも含まれており、健康全般をサポートします。

目次

第1章 範囲と調査手法

- 調査手法

- 市場の範囲

第2章 主な動向と発展

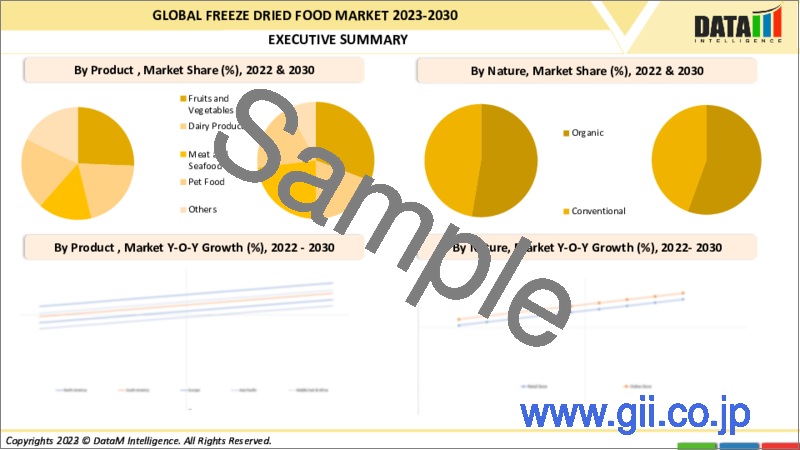

第3章 エグゼクティブサマリー

- 製品タイプ別の市場内訳

- 性質別市場内訳

- フォーム別の市場内訳

- 流通チャネル別の市場内訳

- 地域別の市場内訳

第4章 市場力学

- 市場に影響を与える要因

- 促進要因

- 抑制要因

- 機会

- 影響分析

第5章 業界分析

- ポーターのファイブフォース分析

- バリューチェーン分析

- 特許分析

- 規制分析

第6章 COVID-19分析

- 市場におけるCOVID-19の分析

- COVID-19以前の市場シナリオ

- 現在のCOVID-19市場シナリオ

- COVID-19後または将来のシナリオ

- COVID-19の中での価格のダイナミクス

- 需給スペクトル

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的イニシアチブ

第7章 製品タイプ別

- 果物

- 野菜

- 乳製品

- 肉と魚介類

- ペットフード

- その他

第8章 由来別

- オーガニック

- 従来型

第9章 形状別

- 粉末

- フレーク

- チャンク

第10章 流通経路別

- スーパーマーケット/ハイパーマーケット

- コンビニエンスストア

- オンライン販売

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他欧州

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東とアフリカ

第12章 競合情勢

- 競合シナリオ

- 競合の戦略分析

- 市場ポジショニング/シェア分析

- 合併と買収の分析

第13章 企業プロファイル

- Nestle

- 会社概要

- 製品ポートフォリオと説明

- 主なハイライト

- 財務概況

- Ajinomoto Co. Inc.

- Asahi Group Holdings Ltd

- Nuts.com

- Harmony House Foods Inc.

- Mercer Foods LLC

- OFD Foods LLC

- Crispy Green Inc.

- Mondelez International Inc.

- Unilever

- Kerry Group Plc.

第14章 DataMについて

Market Overview

Freeze dried foods have no moisture or water content, making them smaller and lighter. Freeze drying is the best method and is mainly used in the food and pharmaceutical industry. In the freeze-dried process, foods are dried at low temperatures without damaging their physical properties. The freeze-dried processing method helps to increase the shelf life of the products. Freeze-dried foods don't need to be preserved or refrigerated with chemicals, and it reconstituted quickly and easily by adding water and hence a healthy food choice. Consumption of freeze-dried food products such as snacks, fruits, vegetables, and pet food increased in the forecast period, driving market growth. Also, consumers' demand for ready-to-eat food products is expected to grow in the market in the forecast period.

The global freeze-dried food market were valued at USD 33,230.57 million in 2021. It is forecasted to reach USD YY million by 2029, growing at a CAGR of 7.9% during the forecast period (2022-2029).

Market Dynamics: Increased demand for the convenience food drives market growth

Freeze-dried food requires less time to produce and less effort to prepare than fresh food. The increasing customer demand for convenience foods has indirectly benefited the rising demand for them. Due to the customers' busy lifestyles; there is a rising need for convenience in demand for freeze-dried food. The growing need to increase the shelf life of food while maintaining its nutritional value is projected to propel the freeze dried foods market. Freeze-dried foods provide consumers with a simple and quick meal option and are helpful in emergencies. As a result, the adoption of freeze-dried food will rise, propelling the market forward. Snacking on healthy foods is becoming more popular. Consumers are increasingly concerned about their health and seeking vegan, gluten-free, and all-natural foods, prompting worldwide producers to place freeze-dried snacks on store shelves.

Moreover, continuously increasing women's employment rate helps the market to grow. For working women, it is not easy to cook fresh meals all the time owing to their busy schedules. That is the reason women are looking for other options for eating and cooking, which takes less time or ready-to-eat food like frozen snacks. In 2021 the United States had 46.3% working women, which is more than the previous year. Also, in India, female labor participation rose to 25.1 percent in 2021. For the rural part of India, the female labor force has increased by 3 percent to 27.7 percent, while urban women's participation rate has seen a 0.1 rise to 18.6 percent compared to 2019. Rising consumption of ready-to-eat food due to the busy lifestyle of women across the globe is compelling manufacturers to produce unique flavors and ingredients in frozen snacks. This factor is expected to drive the freeze dried foods market.

Market Segmentation: Meat and seafood segment accounted for the highest share in global freeze-dried food market

The meat and seafood segment accounted for a dominant market share over the forecast period. This freeze-dried meat and seafood have higher shelf life than regular products and are more convenient to use. Consumers in developed and developing countries like the United States, Canada, the U.K., China, France, and Italy prefer freeze-dried food due to their hectic schedules. Most consumers prefer meat and seafood due to their high nutrient value and clean product label. Freeze-dried food manufacturers are trying to add new products to their portfolio, which attracts consumers to buy more meat and seafood products. Meat and seafood are widely used in various fast-food items, such as patties in burgers and frozen toppings in pizzas. These products have a longer shelf life and can be stored easily. These factors increase the sales of freeze-dried meat and seafood products.

Geographical Penetration: Asia Pacific is the dominating region during the forecast period

Asia Pacific region held the largest market share in the forecast period due to the increased consumer demand freeze dried food due to the busy lifestyle and increased working women population. India and China are the developing countries that hold the largest market share due to their increased population. An increase in disposable income and preference for food that provides convenience in cooking and consumption has gained profound importance, especially among the urban populace owing to their busy lifestyle. Major Key players in the region launched new products that attract consumers to buy freeze-dried food products. For instance, in April 2020, Nestle launched nesQino with 100 % natural ingredients to create healthy, customizable super food drinks. The new product is first launched in China. From the latest product, customers can make 21 different super food drink recipes designed by creative nutritionists using different types of ingredients known to be healthy. The super food sachets are made from fruits, vegetables, nuts and seeds, roots and microalgae. They also have probiotics to help boost overall well-being.

Competitive Landscape:

There are several established participants in the industry and local manufacturers; hence, the market is fragmented. Some major market players are Nestle, Ajinomoto Co. Inc., Asahi Group Holdings Ltd, Nuts.com, Harmony House Foods Inc., Mercer Foods LLC, OFD Foods LLC, Crispy Green Inc., Mondelez International Inc., and Unilever, Kerry Group Plc. among others. Some major companies launched new products in the market to increase their sales. For instance, in June 2021, Sow Good Inc. launched its new product line of freeze-dried fruit and vegetable snacks and smoothies. All the products are made using freeze-drying technology to eliminate water from fruits and vegetables, which increases the crispiness of the product and maintains flavors and preserves more than 97% of the nutrients. The company's new product line includes nine snacks and six ready-to-make smoothies. The smoothie products feature a mix of new flavors, including acai relief, mint to be and berry appeeling. It also includes single-ingredient fruits and vegetables such as cherries, edamame and apples. The products are available direct-to-consumer online for $7.50 per smoothie and $5.25 per 1.5-oz snack bag. Also, European freeze-dry released its latest range of gourmet ingredients to be used in high-quality snacks and ready meals with a two years shelf life. The new gourmet range includes a range of high-quality freeze-dried ingredients which can be added to savory and sweet NPD, including ready meals, noodle pots and cereal bars. The latest product range includes Mulled apple, Char Sui pork, Carne Asada beef and Chilli marinated shrimp. Some key players follow merger and acquisition strategies to expand their business. For instance, in September 2022, Freeze-dried food manufacturer Thrive Foods announced its new facility of 341,000-square-foot in North America. The further facility support Thrive's freeze-drying capabilities for pet treats and probiotics.

COVID-19 Impact: Positive impact on the global freeze dried food market.

During the COVID-19 pandemic, most people worked from home, and due to government restrictions, hotels and restaurants were closed, which moved consumers to buy freeze-dried food products. Some of the other reasons which led to an increase in sales of frozen snacks during the pandemic are the high shelf life of freeze-dried food, consumer desire to stock up in case of food shortages, enabling consumers to limit the number of trips to the grocery store, the ease of preparation, saving time on trial and cleanup and consumers' belief that frozen foods are safer than fresh items. Also, the demand for home-prepared meals increased. Consumers turned to online shopping for freeze-dried food. Moreover, during the pandemic, there was an increasing demand for ready-to-cook freeze-dried foods. According to American Frozen Food Institute and FMI-the Food Industry Association report, American online frozen food sales increased by 21% in 2020, with frozen snacks, dinners, meat, poultry and seafood as the biggest online sellers. Some major key players in freeze-dried food announced that their sales increased during the pandemic. For instance, a European freeze-dry company boosts its sale during the pandemic, driven by consumers seeking a variety of meals at home.

The global freeze dried food market report would provide an access to approximately 61 market data tables, 54 figures and 170 pages.

Table of Contents

1. Scope and Methodology

- 1.1. Research Methodology

- 1.2. Scope of the Market

2. Key Trends and Developments

3. Executive Summary

- 3.1. Market Snippet by Product Type

- 3.2. Market Snippet by Nature

- 3.3. Market Snippet by Form

- 3.4. Market Snippet by Distribution Channel

- 3.5. Market Snippet by Region

4. Market Dynamics

- 4.1. Market impacting factors

- 4.1.1. Drivers

- 4.1.2. Restraints

- 4.1.3. Opportunities

- 4.2. Impact analysis

5. Industry Analysis

- 5.1. Porter's five forces analysis

- 5.2. Value chain analysis

- 5.3. Patent Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of Covid-19 on the Market

- 6.1.1. Before COVID-19 Market Scenario

- 6.1.2. Present COVID-19 Market Scenario

- 6.1.3. After COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid Covid-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

7. By Product Type

- 7.1. Introduction

- 7.1.1. Market size analysis, and y-o-y growth analysis (%), By Product Type Segment

- 7.1.2. Market attractiveness index, By Product Type Segment

- 7.2. Fruits *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis, US$ Million, 2020-2029 And Y-O-Y Growth Analysis (%), 2021-2029

- 7.3. Vegetables

- 7.4. Dairy Products

- 7.5. Meat and Seafood

- 7.6. Pet Food

- 7.7. Others

8. By Nature

- 8.1. Introduction

- 8.1.1. Market size analysis, and y-o-y growth analysis (%), By Nature Segment

- 8.1.2. Market attractiveness index, By Nature Segment

- 8.2. Organic *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis, US$ Million, 2020-2029 And Y-O-Y Growth Analysis (%), 2021-2029

- 8.3. Conventional

9. By Form

- 9.1. Introduction

- 9.1.1. Market size analysis, and y-o-y growth analysis (%), By Form Segment

- 9.1.2. Market attractiveness index, By Form Segment

- 9.2. Powders*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis, US$ Million, 2020-2029 And Y-O-Y Growth Analysis (%), 2021-2029

- 9.3. Flakes

- 9.4. Chunks

10. By Distribution Channel

- 10.1. Introduction

- 10.1.1. Market size analysis, and y-o-y growth analysis (%), By Distribution Channel Segment

- 10.1.2. Market attractiveness index, By Distribution Channel Segment

- 10.2. Supermarkets/Hypermarkets *

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis, US$ Million, 2020-2029 And Y-O-Y Growth Analysis (%), 2021-2029

- 10.3. Convenience Stores

- 10.4. Online Sales

- 10.5. Other

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key region-specific dynamics

- 11.2.3. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Product Type

- 11.2.4. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Nature

- 11.2.5. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Form

- 11.2.6. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Distribution Channel

- 11.2.7. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. South America

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Product Type

- 11.3.4. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Nature

- 11.3.5. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Form

- 11.3.6. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Distribution Channel

- 11.3.7. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Country

- 11.3.7.1. Brazil

- 11.3.7.2. Argentina

- 11.3.7.3. Rest of South America

- 11.4. Europe

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Product Type

- 11.4.4. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Nature

- 11.4.5. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Form

- 11.4.6. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Distribution Channel

- 11.4.7. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Country

- 11.4.7.1. Germany

- 11.4.7.2. U.K.

- 11.4.7.3. France

- 11.4.7.4. Spain

- 11.4.7.5. Italy

- 11.4.7.6. Rest of Europe

- 11.5. Asia Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Product Type

- 11.5.4. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Nature

- 11.5.5. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Form

- 11.5.6. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Distribution Channel

- 11.5.7. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Product Type

- 11.6.4. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Nature

- 11.6.5. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Form

- 11.6.6. Market Size Analysis, And Y-O-Y Growth Analysis (%), By Distribution Channel

12. Competitive Landscape

- 12.1. Competitive scenario

- 12.2. Competitor strategy analysis

- 12.3. Market positioning/share analysis

- 12.4. Mergers and acquisitions analysis

13. Company Profiles

- 13.1. Nestle *

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Key Highlights

- 13.1.4. Financial Overview

- 13.2. Ajinomoto Co. Inc.

- 13.3. Asahi Group Holdings Ltd

- 13.4. Nuts.com

- 13.5. Harmony House Foods Inc.

- 13.6. Mercer Foods LLC

- 13.7. OFD Foods LLC

- 13.8. Crispy Green Inc.

- 13.9. Mondelez International Inc.

- 13.10. Unilever

- 13.11. Kerry Group Plc.

- List not Exhaustive*

14. DataM

- 14.1. Appendix

- 14.2. About us and services

- 14.3. Contact us