|

|

市場調査レポート

商品コード

1095865

高級家具の世界市場The World High-end Furniture Market |

||||||

| 高級家具の世界市場 |

|

出版日: 2022年06月30日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 194 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

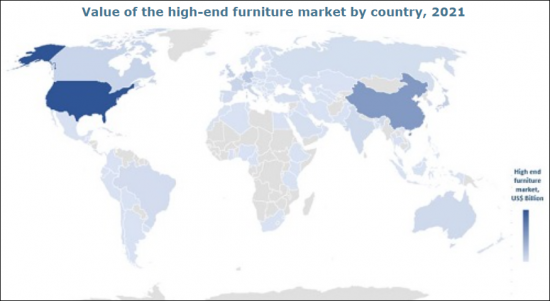

世界の高級家具の市場規模は約500億米ドルと推計されています。北米と中国を含むアジア太平洋地域が主要な市場です。

2021年の市場は、2020年における市場の落ち込みからの反動と、ロックダウン後の例外的な需要の影響を受け、大幅な成長を示しました。

当レポートでは、世界の高級家具の市場を調査し、市場概要、市場規模の推移・予測、各種区分・地域/主要国別の内訳、需要決定要因、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 世界の高級家具市場:概要

第3章 世界の高級家具市場の発展

- COVID-19前の需要決定要因の変化

- 2020年と2021年の高級家具市場:例外的な2年

第4章 欧州の高級家具市場

- 高級家具市場:地域別

- 高級家具市場の内訳:主要製品区分・仕向地・主要流通チャネル別

- 高級家具市場の推移:EU・英国・ノルウェー・チェコ

- 高級家具市場の予測・成長率:EU・英国・ノルウェー・チェコ

- 各国の高級家具市場:イタリア・ドイツ・英国・フランス・ロシア

- 市場規模

- 市場成長

- 高級家具の重量

- シェア

- 市場予測

- 概要・欧州市場との比較

- マクロ経済指標

- 需要決定要因:実績

- 需要決定要因:予測

第5章 北米の高級家具市場

- 高級家具市場:国別

- 高級家具市場の予測:国別

- 高級家具市場の内訳:主要製品区分・仕向地別

- 各国の高級家具市場:米国・カナダ

- 市場規模

- 市場成長

- 高級家具の重量

- シェア

- 市場予測

- 概要・北米市場との比較

- マクロ経済指標

- 需要決定要因:実績

- 需要決定要因:予測

第6章 中国・その他のアジア地域の高級家具市場

- アジア太平洋の高級家具市場:国別

- アジア太平洋の高級家具市場の予測:国別

- 中国の高級家具市場

- 市場規模

- 市場成長

- 高級家具の重量

- シェア

- 市場予測

- 概要・アジア市場との比較

- マクロ経済指標

- 需要決定要因:実績

- 需要決定要因:予測

- 中国の高級家具市場の特徴

- 各国の高級家具市場:インド・日本・韓国

- 市場規模

- 市場成長

- 高級家具の重量

- シェア

- 市場予測

- 概要・アジア市場との比較

- マクロ経済指標

- 需要決定要因:実績

- 需要決定要因:予測

第7章 ブラジル・その他の南米地域の高級家具市場

- 高級家具市場:国別

- 高級家具市場の予測・成長率:国別

- ブラジルの高級家具市場

- 概要・南米市場との比較

- マクロ経済指標・需要決定要因 (実績)

- 需要決定要因 (予測)

- 市場予測

- 市場の特徴

第8章 競合システム・高級家具企業の戦略

- 欧州の主な高級家具製造業者

- 北米の主な高級家具製造業者/ブランド

- アジアの主な高級家具製造業者/ブランド

- 競合システム:高級家具小売業者

第9章 主な高級家具製造業者のプロファイル

第10章 付録:主な小売業者

- ドイツ

- 英国

- フランス

- イタリア

- EU27カ国のその他の国

- ロシア

- 米国

- カナダ

- 中国

- インド

- 日本

- ブラジル

CSIL Market Research Report “The World High-end furniture market” provides an overview of the world market for high-end furniture, at the world level and by main geographical areas/countries. In detail, the research includes:

- The assessment of the high-end furniture market size, at the world level and by main geographical areas and countries.

- The formulation of medium-term (2022-2025) high-end furniture market forecasts by main geographical areas and countries.

- Demand drivers at global level and by main regions and countries.

- Analysis of the demand determinants evolution related to Wealth and Households' income and the non-residential segments (tourism, hospitality).

- The high-end furniture competitive system. CSIL operated a wide mapping, retrieving data for over 400 high-end manufacturing companies/brands operating in the high-end segment. A focused analysis was then carried out to identify the top 120 players. The other 300 relevant manufacturers are showed in the Annex. Extended manufacturers' profiles are presented for 30 companies.

- The identification of the prevalent distribution channels and the main high-end furniture retailers. Information was gathered and processed for the high-end furniture retailers (about 400 companies monitored) with a focus on 30 major high-end retailers.

- The description of the high-end furniture market features and of the purchasing trends in specific regions/countries. The breakdown of the high-end furniture market is also provided by product (kitchen and bathroom furniture, office furniture, other furniture) and by destination (residential/non residential) per each region.

- The identification of potential entry barriers in specific markets, if any.

In the Annex: short profiles of the 400 high-end manufacturing companies/brands operating in the high-end segment and lists of high-end furniture retailers for each country.

FURNITURE PRODUCTS COVERED The furniture aggregate considered in the report includes the following products: kitchen and bathroom furniture, other home furniture (including upholstered furniture, seating, outdoor furniture), office furniture, other non-residential furniture.

GEOGRAPHICAL AREAS The report focuses on Europe, North America, South America and Asia and Pacific. Within each area the following largest markets are analysed:

- Europe: Germany, United Kingdom, France, Italy, Russia.

- North America: United States, Canada.

- Asia and Pacific: China, Japan, India, South Korea.

- South America: Brazil.

Highlights:

The world market for high-end furniture is worth approximately USD 50 billion. North America and Asia and the Pacific, including China, are the main markets.

The world high-end furniture market saw exceptional growth in 2021, determined mainly by the rebound from the market decline observed in 2020, and the exceptional demand experienced in most countries in the wake of the lockdown periods.

The high-end furniture industry is much fragmented. On top of large companies focused on luxury, the high-end market is satisfied by a huge number of middle and small companies, artisans as well as companies that include a premium range in their portfolio, both in design and classic style. While North American and Asian high-end brands tend to be focused on their domestic market, the European high-end manufacturers play a pivotal role in the Worldwide market, especially in the contemporary/design segment, reaching worldwide notoriety.

Selected companies mentioned:

Lifestyle Design Group, Molteni Group, Vitra International, Poliform, Minotti, B&B Italia (Design Holding Group), Restoration Hardware, Brown Jordan International, Karimoku Furniture, Camerich.

TABLE OF CONTENTS

1. INTRODUCTION

2. The World high-end furniture market: overview

- The size of the world high-end furniture market

- The world high-end furniture market by geographical areas

- The world high-end furniture market by destination: residential/non residential

3. The development of the global high-end furniture market

- Demand determinant evolution in the pre-covid period

- The high-end furniture market in 2020 and 2021: two exceptional years

4. THE EUROPEAN HIGH-END FURNITURE MARKET

- Europe. High-end furniture market by geographical area, 2019-2021

- European Union + UK, NO, CH

- Central Eastern Europe outside the EU

- Europe. High-end furniture market breakdown by main product segments, by destination and by main distribution channel, 2021

- European Union+UK, NO, CH. High-end furniture market by countries, 2019-2021

- European Union+UK, NO, CH. High-end furniture market forecasts by countries, 2022-2025. Annual average growth rates in real terms.

- The High-end furniture market, for each country: Italy, Germany, the UK, France, Russia

- high-end furniture market size

- high-end furniture market growth

- high-end furniture weight

- country high-end furniture share

- furniture market forecasts

- outline and comparison with Europe

- macroeconomic indicators, 2016-2021

- demand determinants, 2016-2021

- demand determinants. Forecasts up to 2025

5. THE NORTH AMERICAN HIGH-END FURNITURE MARKET

- North America. High-end furniture market by countries, 2019-2021

- North America. High-end furniture market forecasts by countries, 2022-2025.

- North America. High-end furniture market breakdown by main product segments and by destination, 2021

- The High-end furniture market, for each country: United States and Canada

- high-end furniture market size

- high-end furniture market growth

- high-end furniture weight

- country high-end furniture share

- furniture market forecasts

- outline and comparison with North America

- macroeconomic indicators, 2016-2021

- demand determinants, 2016-2021

- demand determinants. Forecasts up to 2025

6. THE ASIAN HIGH-END FURNITURE MARKET, with a focus on China

- Asia and Pacific. High-end furniture market by countries, 2019-2021

- Asia and Pacific. High-end furniture market forecasts by countries, 2022-2025. Annual average growth rates in real terms.

- The High-end furniture market in China

- high-end furniture market size

- high-end furniture market growth

- high-end furniture weight

- country high-end furniture share

- furniture market forecasts

- outline and comparison with Asia Pacific

- macroeconomic indicators, 2016-2021

- demand determinants, 2016-2021

- demand determinants. Forecasts up to 2025

- The features of the high-end furniture market in China

- China. High-end furniture market breakdown by main product segments, 2021

- The High-end furniture market, for each country: India, Japan and South Korea

- high-end furniture market size

- high-end furniture market growth

- high-end furniture weight

- country high-end furniture share

- furniture market forecasts

- outline and comparison with Asia Pacific

- macroeconomic indicators, 2016-2021

- demand determinants, 2016-2021

- outline and comparison with Asia Pacific

- macroeconomic indicators, 2016-2021

- demand determinants, 2016-2021

- demand determinants. Forecasts up to 2025

7. THE SOUTH AMERICAN HIGH-END FURNITURE MARKET, with a focus on BRAZIL

- South America. High-end furniture market by countries, 2019-2021

- South America. High-end furniture market forecasts by countries, 2022-2025. Annual average growth rates in real terms.

- The High-end furniture market in Brazil

- Brazil. High-end furniture market outline and comparison with South America

- Brazil. Macroeconomic indicators and the demand determinants, 2016-2021.

- Brazil. Demand determinants. Forecasts up to 2025

- Brazil. The High-end furniture market, 2019-2021. US$ Million

- The features of the high-end furniture market in Brazil

8. The competitive system and the high-end companies' strategies

- The main high-end furniture European manufacturers

- The North American high-end furniture manufacturers/brands

- The Asian high-end furniture manufacturers/brands

- The competitive system: high-end furniture retailers

9. Profiles of selected major high-end furniture manufacturers

10. ANNEX. A selection of retailers operating in the High-end furniture market

- Germany

- United Kingdom

- France

- Italy

- Other EU27

- Russia

- United States

- Canada

- China

- India

- Japan

- Brazil