|

|

市場調査レポート

商品コード

1147280

商用ドローンの世界市場 - 規模・シェア・動向分析・機会・予測(2018年~2028年):ペイロード別、技術別、コンポーネント別(ハードウェア、ソフトウェア)、用途別、地域別Commercial Drones Market - Global Size, Share, Trend Analysis, Opportunity and Forecast Report, 2018-2028, Segmented By Payload ; By Technology ; By Component (Hardware, Software); By Application ; By Region |

||||||

| 商用ドローンの世界市場 - 規模・シェア・動向分析・機会・予測(2018年~2028年):ペイロード別、技術別、コンポーネント別(ハードウェア、ソフトウェア)、用途別、地域別 |

|

出版日: 2022年10月10日

発行: Blueweave Consulting

ページ情報: 英文 340 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界の商用ドローンの市場規模は、2021年の94億3,000万米ドルから、2028年までに541億7,000万米ドルに達し、2022年から2028年の予測期間中にCAGRで29.8%の成長が予測されています。マッピング、eコマース、クラウドベースのデータサービスやアプリケーション、および農業に対する需要の増加により、世界の商用ドローン市場は活況を呈しています。農業や環境などの分野での需要が高いため、農業管理やグリーンマッピングをすぐに促進する可能性も期待されています。

当レポートでは、世界の商用ドローン市場について調査分析し、市場規模と予測、セグメント分析、地域分析、企業プロファイルなどの情報を提供しています。

目次

第1章 調査の枠組み

第2章 エグゼクティブサマリー

第3章 世界の商用ドローン市場の考察

- 業界バリューチェーン分析

- DROC分析

- 成長促進要因

- 技術的に高度な製品に対する需要の高まり

- 農業分野での需要増加

- その他

- 抑制要因

- プライバシーとセキュリティに関する懸念

- その他

- 機会

- GIS、LiDAR、マッピングサービス分野での用途増加

- その他

- 課題

- チップ不足

- その他

- 成長促進要因

- 技術の進歩/最新動向

- 規制の枠組み

- ポーターのファイブフォース分析

第4章 世界の商用ドローン市場概要

- 市場規模と予測(2018年~2028年)

- 金額別(10億米ドル)

- 数量別(1,000台)

- 市場シェアと予測

- ペイロード別

- 5kg未満

- 5~25kg

- 26~50kg

- 51~100kg

- 100kg以上

- 技術別

- 完全自律型

- 半自律型

- コンポーネント別

- ハードウェア

- ソフトウェア

- 用途別

- 配送・物流

- 映画撮影・写真撮影

- 園芸・農業

- 点検・整備

- マッピング・測量

- 監視・モニタリング

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- ペイロード別

第5章 北米の商用ドローン市場

- 市場規模と予測(2018年~2028年)

- 金額別(10億米ドル)

- 数量別(1,000台)

- 市場シェアと予測

- ペイロード別

- 技術別

- コンポーネント別

- 用途別

- 国別

- 米国

- カナダ

第6章 欧州の商用ドローン市場

- 市場規模と予測(2018年~2028年)

- 金額別(10億米ドル)

- 数量別(1,000台)

- 市場シェアと予測

- ペイロード別

- 技術別

- コンポーネント別

- 用途別

- 国別

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- オランダ

- ベルギー

- 北欧諸国

- その他

第7章 アジア太平洋の商用ドローン市場

- 市場規模と予測(2018年~2028年)

- 金額別(10億米ドル)

- 数量別(1,000台)

- 市場シェアと予測

- ペイロード別

- 技術別

- コンポーネント別

- 用途別

- 国別

- 中国

- インド

- 日本

- 韓国

- オーストラリア・ニュージーランド

- インドネシア

- マレーシア

- シンガポール

- フィリピン

- ベトナム

- その他

第8章 ラテンアメリカの商用ドローン市場

- 市場規模と予測(2018年~2028年)

- 金額別(10億米ドル)

- 数量別(1,000台)

- 市場シェアと予測

- ペイロード別

- 技術別

- コンポーネント別

- 用途別

- 国別

- ブラジル

- メキシコ

- アルゼンチン

- ペルー

- コロンビア

- その他

第9章 中東・アフリカの商用ドローン市場

- 市場規模と予測(2018年~2028年)

- 金額別(10億米ドル)

- 数量別(1,000台)

- 市場シェアと予測

- ペイロード別

- 技術別

- コンポーネント別

- 用途別

- 国別

- サウジアラビア

- アラブ首長国連邦

- カタール

- クウェート

- イラン

- 南アフリカ

- ナイジェリア

- ケニア

- エジプト

- モロッコ

- アルジェリア

- その他

第10章 競合情勢

- 主要企業とその製品のリスト

- 企業の市場シェア分析(2021年)

- 競合ベンチマーキング:経営パラメータ別

- 主要な戦略的展開(合併、買収、パートナーシップなど)

第11章 世界の商用ドローン市場に対するCOVID-19の影響

第12章 企業プロファイル(企業概要、財務マトリックス、競合情勢、主な人員、主な競合企業、連絡先住所、戦略的展望)

- Aeronavics Ltd.

- AeroVironment Inc.

- Autel Robotics

- Ehang Holdings Limited

- 3D Robotics, Inc.

- SZ DJI Technology Co., Ltd.

- FLIR Drones

- Holy Stone

- AgEagle Aerial Components Inc.

- Skydio, Inc.

- Yuneec Holding Ltd.

- Parrot Drone SAS

- Kespry

- Delair

- Hubsan

- SenseFly

- Uvify Inc.

- DRONESENSE, INC.

- その他

第13章 主要な戦略的推奨事項

第14章 調査手法

Global Commercial Drone Market Size to Boom 5x to Touch USD 54.2 Billion by 2028

Global commercial drones market is thriving because of increasing demand for mapping, e-commerce, cloud-based data services and application, and agriculture. The high- reaching demand in sectors, such as agriculture and environment, could promote farming management and green mapping soon.

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated that the global commercial drone market at USD 9.43 billion in 2021. During the forecast period between 2022 and 2028, the size of the global commercial drone market is expected grow at an impressive CAGR of 29.8%, reaching a value of USD 54.17 billion by 2028. Drones are ideal for assistance in some of the world's most arduous professions, as they can be controlled remotely and flown at varying distances and heights. They can help in the hunt for survivors after a hurricane, assist in law enforcement, and be an eye in the sky for the military during terrorist incidents. They also contribute to scientific study in some of the world's most harsh climates. Drones have even made their way into homes, where they serve as a source of entertainment and a vital tool for photographers. These factors could propel the growth of drones market in the coming years.

Global Commercial Drone Market - Overview

Drones can replace traditional ways of operation in many corporate tasks. This comes after the Federal Aviation Administration increased authorization for commercial, non-hobbyist drone use. Drones can save time and money as they require less human intervention and have no safety infrastructure. They can also improve data analytics, allowing businesses to better understand and anticipate performance. Drones even enable new business models and prospects in some industries. Drones are projected to become commonplace in businesses ranging from insurance to agriculture to journalism. The industrial drone fleet in Europe and the United States will be worth $50 billion and have over 1 million units by 2050, with the majority of the value tied to drone services and data collecting.

Global Commercial Drone Market - Regional Insights

Asia-Pacific commercial drone market is expected to become the world's largest during the forecast period. North America could come in second. In 2026, the global commercial drone industry may grow to be worth roughly 58.4 billion dollars. Between 2021 and 2026, the market will likely increase at a compound annual growth rate of nearly 16%.

Impact of COVID-19 on Global Commercial Drone Market

COVID-19 has influenced some of the market application sectors in 2020, since drone procurement is a direct proponent of demand from end-user industries. However, as the restrictions on commercial activities have been relaxed, the commercial drones market has begun to recover since 2021.

Competitive Landscape

SZ DJI Technology Co. Ltd, Terra Drone Corporation, The Boeing Company (Insitu), Parrot Drones SAS, Intel Corporation, Birds Eye View Aerobotics, Yuneec, and Delair SAS are some of the leading companies in global commercial drones market. A few well-established enterprises with a strong foothold dominate the market. Furthermore, numerous small businesses and startups have entered the market recently due to their high profitability. To capture high market share, companies are developing advanced technology-integrated drone hardware and software solutions that reduce human effort in applications, including mining, construction, and aerial mapping. In addition, the advent of corporations, such as Boeing, Alphabet, and Intel, into commercial drones, the market is projected to split the market in the coming years. The emergence of alternative fuel-powered drones could generate significant changes in the competitive environment, as payload, endurance, and flying range are the primary concerns of OEMs and operators alike. Moreover, R&D work in composite-based materials to produce crucial components and parts of drones would improve the platforms' capabilities and fuel their widespread adoption across many industries.

The in-depth analysis of the report provides information about growth potential, upcoming trends, and statistics of Global Commercial Drones Market. It also highlights the factors driving forecasts of total market size. The report promises to provide recent technology trends in Global Commercial Drones Market and industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyzes the growth drivers, challenges, and competitive dynamics of the market.

Table of Contents

1. Research Framework

- 1.1. Research Objective

- 1.2. Type Overview

- 1.3. Market Segmentation

2. Executive Summary

3. Global Commercial Drones Market Insights

- 3.1. Industry Value Chain Analysis

- 3.2. DROC Analysis

- 3.2.1. Growth Drivers

- 3.2.1.1. Growing Demand for Technologically Advanced Products

- 3.2.1.2. Growing Demand from Agriculture Sector

- 3.2.1.3. Others

- 3.2.2. Restraints

- 3.2.2.1. Privacy and Security Concerns

- 3.2.2.2. Others

- 3.2.3. Opportunity

- 3.2.3.1. Increased Application in areas for GIS, LiDAR, and Mapping Services

- 3.2.3.2. Others

- 3.2.4. Challenges

- 3.2.4.1. Chip Shortages

- 3.2.4.2. Others

- 3.2.1. Growth Drivers

- 3.3. Technological Advancement/Recent Development

- 3.4. Regulatory Framework

- 3.5. Porter's Five Forces Analysis

- 3.5.1. Bargaining Power of Suppliers

- 3.5.2. Bargaining Power of Buyers

- 3.5.3. Threat of New Entrants

- 3.5.4. Threat of Substitutes

- 3.5.5. Intensity of Rivalry

4. Global Commercial Drones Market Overview

- 4.1. Market Size & Forecast, 2018-2028

- 4.1.1. By Value (USD Billion)

- 4.1.2. By Volume (Thousand Units)

- 4.2. Market Share & Forecast

- 4.2.1. By Payload

- 4.2.1.1. <5kg

- 4.2.1.2. 5-25Kg

- 4.2.1.3. 26-50Kg

- 4.2.1.4. 51-100Kg

- 4.2.1.5. Above 100Kg

- 4.2.2. By Technology

- 4.2.2.1. Fully Autonomous

- 4.2.2.2. Semi-autonomous

- 4.2.3. By Component

- 4.2.3.1. Hardware

- 4.2.3.1.1. Airframe

- 4.2.3.1.2. Payload

- 4.2.3.1.3. Propulsion Component

- 4.2.3.1.4. Others

- 4.2.3.2. Software

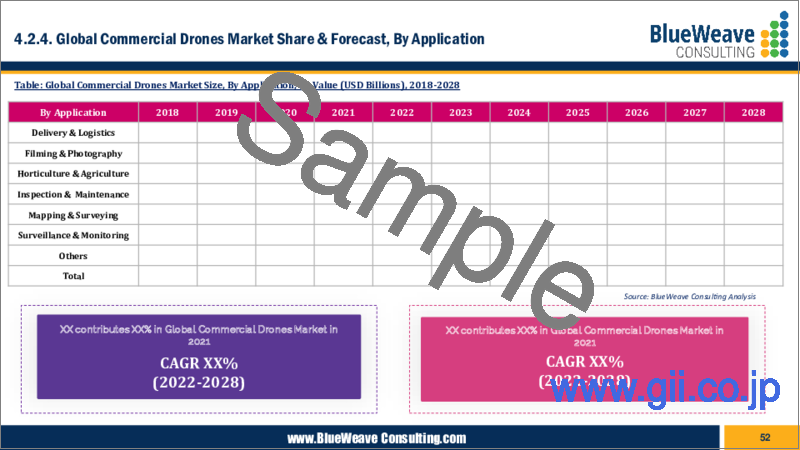

- 4.2.4. By Application

- 4.2.4.1. Delivery & Logistics

- 4.2.4.2. Filming & Photography

- 4.2.4.3. Horticulture & Agriculture

- 4.2.4.4. Inspection & Maintenance

- 4.2.4.5. Mapping & Surveying

- 4.2.4.6. Surveillance & Monitoring

- 4.2.4.7. Others

- 4.2.5. By Region

- 4.2.5.1. North America

- 4.2.5.2. Europe

- 4.2.5.3. Asia Pacific

- 4.2.5.4. Latin America

- 4.2.5.5. Middle East and Africa

- 4.2.1. By Payload

5. North America Commercial Drones Market

- 5.1.1. Market Size & Forecast, 2018-2028

- 5.1.2. By Value (USD Billion)

- 5.1.3. By Volume (Thousand Units)

- 5.2. Market Share & Forecast

- 5.2.1. By Payload

- 5.2.2. By Technology

- 5.2.3. By Component

- 5.2.4. By Application

- 5.2.5. By Country

- 5.2.5.1. United States

- 5.2.5.1.1. By Payload

- 5.2.5.1.2. By Technology

- 5.2.5.1.3. By Component

- 5.2.5.1.4. By Application

- 5.2.5.2. Canada

- 5.2.5.2.1. By Payload

- 5.2.5.2.2. By Technology

- 5.2.5.2.3. By Component

- 5.2.5.2.4. By Application

6. Europe Commercial Drones Market

- 6.1. Market Size & Forecast, 2018-2028

- 6.1.1. By Value (USD Billion)

- 6.1.2. By Volume (Thousand Units)

- 6.2. Market Share & Forecast

- 6.2.1. By Payload

- 6.2.2. By Technology

- 6.2.3. By Component

- 6.2.4. By Application

- 6.2.5. By Country

- 6.2.5.1. Germany

- 6.2.5.1.1. By Payload

- 6.2.5.1.2. By Technology

- 6.2.5.1.3. By Component

- 6.2.5.1.4. By Application

- 6.2.5.2. United Kingdom

- 6.2.5.2.1. By Payload

- 6.2.5.2.2. By Technology

- 6.2.5.2.3. By Component

- 6.2.5.2.4. By Application

- 6.2.5.3. Italy

- 6.2.5.3.1. By Payload

- 6.2.5.3.2. By Technology

- 6.2.5.3.3. By Component

- 6.2.5.3.4. By Application

- 6.2.5.4. France

- 6.2.5.4.1. By Payload

- 6.2.5.4.2. By Technology

- 6.2.5.4.3. By Component

- 6.2.5.4.4. By Application

- 6.2.5.5. Spain

- 6.2.5.5.1. By Payload

- 6.2.5.5.2. By Technology

- 6.2.5.5.3. By Component

- 6.2.5.5.4. By Application

- 6.2.5.6. The Netherlands

- 6.2.5.6.1. By Payload

- 6.2.5.6.2. By Technology

- 6.2.5.6.3. By Component

- 6.2.5.6.4. By Application

- 6.2.5.7. Belgium

- 6.2.5.7.1. By Payload

- 6.2.5.7.2. By Technology

- 6.2.5.7.3. By Component

- 6.2.5.7.4. By Application

- 6.2.5.8. NORDIC Countries

- 6.2.5.8.1. By Payload

- 6.2.5.8.2. By Technology

- 6.2.5.8.3. By Component

- 6.2.5.8.4. By Application

- 6.2.5.9. Rest of Europe

- 6.2.5.9.1. By Payload

- 6.2.5.9.2. By Technology

- 6.2.5.9.3. By Component

- 6.2.5.9.4. By Application

7. Asia Pacific Commercial Drones Market

- 7.1. Market Size & Forecast, 2018-2028

- 7.1.1. By Value (USD Billion)

- 7.1.2. By Volume (Thousand Units)

- 7.2. Market Share & Forecast

- 7.2.1. By Payload

- 7.2.2. By Technology

- 7.2.3. By Component

- 7.2.4. By Application

- 7.2.5. By Country

- 7.2.5.1. China

- 7.2.5.1.1. By Payload

- 7.2.5.1.2. By Technology

- 7.2.5.1.3. By Component

- 7.2.5.1.4. By Application

- 7.2.5.2. India

- 7.2.5.2.1. By Payload

- 7.2.5.2.2. By Technology

- 7.2.5.2.3. By Component

- 7.2.5.2.4. By Application

- 7.2.5.3. Japan

- 7.2.5.3.1. By Payload

- 7.2.5.3.2. By Technology

- 7.2.5.3.3. By Component

- 7.2.5.3.4. By Application

- 7.2.5.4. South Korea

- 7.2.5.4.1. By Payload

- 7.2.5.4.2. By Technology

- 7.2.5.4.3. By Component

- 7.2.5.4.4. By Application

- 7.2.5.5. Australia & New Zealand

- 7.2.5.5.1. By Payload

- 7.2.5.5.2. By Technology

- 7.2.5.5.3. By Component

- 7.2.5.5.4. By Application

- 7.2.5.6. Indonesia

- 7.2.5.6.1. By Payload

- 7.2.5.6.2. By Technology

- 7.2.5.6.3. By Component

- 7.2.5.6.4. By Application

- 7.2.5.7. Malaysia

- 7.2.5.7.1. By Payload

- 7.2.5.7.2. By Technology

- 7.2.5.7.3. By Component

- 7.2.5.7.4. By Application

- 7.2.5.8. Singapore

- 7.2.5.8.1. By Payload

- 7.2.5.8.2. By Technology

- 7.2.5.8.3. By Component

- 7.2.5.8.4. By Application

- 7.2.5.9. Philippines

- 7.2.5.9.1. By Payload

- 7.2.5.9.2. By Technology

- 7.2.5.9.3. By Component

- 7.2.5.9.4. By Application

- 7.2.5.10. Vietnam

- 7.2.5.10.1. By Payload

- 7.2.5.10.2. By Technology

- 7.2.5.10.3. By Component

- 7.2.5.10.4. By Application

- 7.2.5.11. Rest of Asia Pacific

- 7.2.5.11.1. By Payload

- 7.2.5.11.2. By Technology

- 7.2.5.11.3. By Component

- 7.2.5.11.4. By Application

8. Latin America Commercial Drones Market

- 8.1. Market Size & Forecast, 2018-2028

- 8.1.1. By Value (USD Billion)

- 8.1.2. By Volume (Thousand Units)

- 8.2. Market Share & Forecast

- 8.2.1. By Payload

- 8.2.2. By Technology

- 8.2.3. By Component

- 8.2.4. By Application

- 8.2.5. By Country

- 8.2.5.1. Brazil

- 8.2.5.1.1. By Payload

- 8.2.5.1.2. By Technology

- 8.2.5.1.3. By Component

- 8.2.5.1.4. By Application

- 8.2.5.2. Mexico

- 8.2.5.2.1. By Payload

- 8.2.5.2.2. By Technology

- 8.2.5.2.3. By Component

- 8.2.5.2.4. By Application

- 8.2.5.3. Argentina

- 8.2.5.3.1. By Payload

- 8.2.5.3.2. By Technology

- 8.2.5.3.3. By Component

- 8.2.5.3.4. By Application

- 8.2.5.4. Peru

- 8.2.5.4.1. By Payload

- 8.2.5.4.2. By Technology

- 8.2.5.4.3. By Component

- 8.2.5.4.4. By Application

- 8.2.5.5. Colombia

- 8.2.5.5.1. By Payload

- 8.2.5.5.2. By Technology

- 8.2.5.5.3. By Component

- 8.2.5.5.4. By Application

- 8.2.5.6. Rest of Latin America

- 8.2.5.6.1. By Payload

- 8.2.5.6.2. By Technology

- 8.2.5.6.3. By Component

- 8.2.5.6.4. By Application

9. Middle East & Africa Commercial Drones Market

- 9.1. Market Size & Forecast, 2018-2028

- 9.1.1. By Value (USD Billion)

- 9.1.2. By Volume (Thousand Units)

- 9.2. Market Share & Forecast

- 9.2.1. By Payload

- 9.2.2. By Technology

- 9.2.3. By Component

- 9.2.4. By Application

- 9.2.5. By Country

- 9.2.5.1. Saudi Arabia

- 9.2.5.1.1. By Payload

- 9.2.5.1.2. By Technology

- 9.2.5.1.3. By Component

- 9.2.5.1.4. By Application

- 9.2.5.2. UAE

- 9.2.5.2.1. By Payload

- 9.2.5.2.2. By Technology

- 9.2.5.2.3. By Component

- 9.2.5.2.4. By Application

- 9.2.5.3. Qatar

- 9.2.5.3.1. By Payload

- 9.2.5.3.2. By Technology

- 9.2.5.3.3. By Component

- 9.2.5.3.4. By Application

- 9.2.5.4. Kuwait

- 9.2.5.4.1. By Payload

- 9.2.5.4.2. By Technology

- 9.2.5.4.3. By Component

- 9.2.5.4.4. By Application

- 9.2.5.5. Iran

- 9.2.5.5.1. By Payload

- 9.2.5.5.2. By Technology

- 9.2.5.5.3. By Component

- 9.2.5.5.4. By Application

- 9.2.5.6. South Africa

- 9.2.5.6.1. By Payload

- 9.2.5.6.2. By Technology

- 9.2.5.6.3. By Component

- 9.2.5.6.4. By Application

- 9.2.5.7. Nigeria

- 9.2.5.7.1. By Payload

- 9.2.5.7.2. By Technology

- 9.2.5.7.3. By Component

- 9.2.5.7.4. By Application

- 9.2.5.8. Kenya

- 9.2.5.8.1. By Payload

- 9.2.5.8.2. By Technology

- 9.2.5.8.3. By Component

- 9.2.5.8.4. By Application

- 9.2.5.9. Egypt

- 9.2.5.9.1. By Payload

- 9.2.5.9.2. By Technology

- 9.2.5.9.3. By Component

- 9.2.5.9.4. By Application

- 9.2.5.10. Morocco

- 9.2.5.10.1. By Payload

- 9.2.5.10.2. By Technology

- 9.2.5.10.3. By Component

- 9.2.5.10.4. By Application

- 9.2.5.11. Algeria

- 9.2.5.11.1. By Payload

- 9.2.5.11.2. By Technology

- 9.2.5.11.3. By Component

- 9.2.5.11.4. By Application

- 9.2.5.12. Rest of Middle East & Africa

- 9.2.5.12.1. By Payload

- 9.2.5.12.2. By Technology

- 9.2.5.12.3. By Component

- 9.2.5.12.4. By Application

10. Competitive Landscape

- 10.1. List of Key Players and Their Offerings

- 10.2. Company Market Share Analysis, 2021

- 10.3. Competitive Benchmarking, By Operating Parameters

- 10.4. Key Strategic Developments (Mergers, Acquisitions, Partnerships, and others)

11. Impact of Covid-19 on Global Commercial Drones Market

12. Company Profile (Company Overview, Financial Matrix, Competitive landscape, Key Personnel, Key Competitors, Contact Address, and Strategic Outlook)

- 12.1. Aeronavics Ltd.

- 12.2. AeroVironment Inc.

- 12.3. Autel Robotics

- 12.4. Ehang Holdings Limited

- 12.5. 3D Robotics, Inc.

- 12.6. SZ DJI Technology Co., Ltd.

- 12.7. FLIR Drones

- 12.8. Holy Stone

- 12.9. AgEagle Aerial Components Inc.

- 12.10. Skydio, Inc.

- 12.11. Yuneec Holding Ltd.

- 12.12. Parrot Drone SAS

- 12.13. Kespry

- 12.14. Skydio

- 12.15. Delair

- 12.16. Hubsan

- 12.17. SenseFly

- 12.18. Uvify Inc.

- 12.19. DRONESENSE, INC.

- 12.20. Other Prominent Players

13. Key Strategic Recommendations

14. Research Methodology

- 14.1. Qualitative Research

- 14.1.1. Primary & Secondary Research

- 14.2. Quantitative Research

- 14.3. Market Breakdown & Data Triangulation

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.4. Breakdown of Primary Research Respondents, By Region

- 14.5. Assumptions & Limitations