|

|

市場調査レポート

商品コード

1274810

歯科用インプラントの世界市場 (2019-2029年):材料・設計・タイプ・エンドユーザー・地域別の市場規模・シェア・動向分析・機会・予測Dental Implants Market - Global Size, Share, Trend Analysis, Opportunity and Forecast Report, 2019-2029, Segmented By Material ; By Design ; By Type ; By End Use ; By Region |

||||||

| 歯科用インプラントの世界市場 (2019-2029年):材料・設計・タイプ・エンドユーザー・地域別の市場規模・シェア・動向分析・機会・予測 |

|

出版日: 2023年05月02日

発行: Blueweave Consulting

ページ情報: 英文 400 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界の歯科用インプラントの市場規模は、2022年の41億7000万米ドルから、予測期間中は6.5%のCAGRで推移し、2029年には64億8,000万米ドルの規模に成長すると予測されています。

市場の主な成長促進要因としては、さまざまな治療分野でのインプラント使用の増加や補綴物への需要の拡大が挙げられます。補綴物は、口腔内のリハビリテーションを支援し、患者の口腔機能と顔の形を回復させるため、歯科用インプラントの需要に大きな影響を及ぼします。取り外し可能な補綴物には、不快感、不自然な外観、メンテナンスの必要性などの欠点があるため、歯科用インプラントの人気は患者と歯科外科医の間で高まっています。また、歯科用インプラントの需要は、スポーツや交通事故による歯の傷害の発生率の増加によっても促進されています。

当レポートでは、世界の歯科用インプラントの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術動向、法規制環境、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 調査の枠組み

第2章 エグゼクティブサマリー

第3章 世界の歯科用インプラント市場に関する洞察

- 業界のバリューチェーン分析

- DROC分析

- 促進要因

- 抑制要因

- 機会

- 課題

- 設計の進歩/最近の開発

- 規制の枠組み

- ポーターのファイブフォース分析

第4章 世界の歯科用インプラント市場:概要

- 市場規模・予測

- 市場シェア・予測

- 材料別

- チタン

- ジルコニウム

- その他

- 設計別

- テーパードインプラント

- 平行壁インプラント

- タイプ別

- 骨内インプラント

- 骨膜下インプラント

- 骨貫通インプラント

- その他

- エンドユーザー別

- 病院

- 専門クリニック

- 研究・学術機関

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- 材料別

第5章 北米の歯科用インプラント市場

- 市場規模・予測

- 市場シェア・予測

- 材料別

- 設計別

- タイプ別

- エンドユーザー別

- 国別

第6章 欧州の歯科用インプラント市場

- 市場規模・予測

- 市場シェア・予測

- 材料別

- 設計別

- タイプ別

- エンドユーザー別

- 国別

第7章 アジア太平洋の歯科用インプラント市場

- 市場規模・予測

- 市場シェア・予測

- 材料別

- 設計別

- タイプ別

- エンドユーザー別

- 国別

第8章 ラテンアメリカの歯科用インプラント市場

- 市場規模・予測

- 市場シェア・予測

- 材料別

- 設計別

- タイプ別

- エンドユーザー別

- 国別

第9章 中東・アフリカの歯科用インプラント市場

- 市場規模・予測

- 市場シェア・予測

- 材料別

- 設計別

- タイプ別

- エンドユーザー別

- 国別

第10章 競合情勢

- 主要企業・製品リスト

- 市場シェア分析

- 競合ベンチマーキング:経営パラメーター別

- 主要な戦略的展開 (M&A・提携など)

第11章 世界の歯科用インプラント市場に対するCOVID-19の影響

第12章 企業プロファイル (企業概要・財務マトリックス・競合情勢・主要人材・主な競合相手・連絡先・戦略的展望・SWOT分析)

- Straumann Group

- Dentsply Sirona

- Zimmer Biomet Holdings, Inc.

- Danaher Corporation(Nobel Biocare Services AG)

- Osstem Implant Co., Ltd.

- BioHorizons IPH, Inc.

- Implant Direct LLC

- Anthogyr SAS

- CAMLOG Biotechnologies AG

- Sweden & Martina S.p.A.

- その他の主要企業

第13章 主な戦略的提言

第14章 調査手法

Global Dental Implants Market Size Set to Touch USD 6.48 billion by 2029.

Global dental implants market is flourishing because of a concentrated efforts on the management of growing prevalence of dental diseases and tooth loss; and the rapid adoption of technology advancements and digital technologies, such as computer-aided design and 3D printing, in dental implant materials and design.

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated global dental implants market size at USD 4.17 billion in 2022. During the forecast period between 2023 and 2029, BlueWeave expects global dental implants market size to grow at a significant CAGR of 6.5% reaching a value of USD 6.48 billion by 2029. Major growth drivers for the global dental implants market include an increasing use of implants in various therapeutic areas and the growing demand for prosthetics. Prosthetics have a significant impact on the demand for dental implants, as they aid in the oral rehabilitation process and restore a patient's oral function and facial form. The popularity of dental implants is increasing among both patients and dental surgeons due to the drawbacks of removable prosthetics, which include discomfort, unnatural appearance, and maintenance requirements. The demand for dental implants is being fueled by a growing incidence of dental injuries resulting from sports and road accidents. According to the World Health Organization (WHO), about 10 million people worldwide are injured or disabled each year as a result of road accidents. Also, the American Academy for Implant Dentistry estimates that more than 15 million Americans receive bridge and crown replacements for missing teeth annually, which drives the demand for dental implants. However, limited availability of skilled dental professionals to perform and interpret procedures and concerns over the safety and efficacy of dental implant procedures are anticipated to restrain the growth of the global dental implants market during the forecast period.

Global Dental Implants Market - Overview:

Dental implants are metal devices that are surgically implanted into the jawbone below the gums to provide support for artificial teeth. The process by which these implants fuse with the bone is called osseointegration, and they resemble screw-shaped prosthetic tooth roots. Once the dental implants are inserted into the jawbone, they fuse with the natural bone to create a sturdy foundation for one or more artificial teeth, called crowns. An abutment is attached to the dental implant to hold and support the crowns. Crowns can be customized to fit the shape and contour of natural teeth for a comfortable fit within the mouth. Dental implants are an effective solution to fill any gaps or spaces within the mouth caused by missing or damaged teeth.

Impact of COVID-19 on Global Dental Implants Market

COVID-19 had a detrimental impact on the growth of global dental implants market. The market had initially been projected to grow steadily in the coming years, but the pandemic disrupted the growth trajectory. One of the major factors affecting the dental implants market was the widespread closure of dental clinics and hospitals in many countries. The closure of these facilities led to a reduction in the number of dental implant procedures being performed, which, in turn, affected the demand for dental implant products. Also, the fear of contracting COVID-19 deterred many patients from seeking dental care, including dental implant procedures. Likewise, supply chain disruptions caused by the pandemic led to shortages of certain dental implant components and materials, resulting in increased prices and delayed delivery times.

The global dental implants market, on the other hand, is expected to recover from the impact of the pandemic in the coming years. The increasing demand for dental implants due to the rapidly aging population and rising dental treatment tourism are some of the factors expected to drive growth in the dental implants market in the post-pandemic period. Moreover, the development of advanced dental implant technologies and materials, such as 3D printing and titanium implants, is expected to further fuel the growth of the global dental implants market.

Global Dental Implants Market - By Material:

Based on material, the global dental implants market is bifurcated into Titanium and Zirconium segments. The titanium segment has dominated the market owing to its prevalent usage in dental implants. The primary benefit of utilizing pure titanium is its biocompatibility. Crude titanium is composed of a blend of other metals, including iron, vanadium, zirconium, silicon, ilmenite, and magnesium, which undergo a process of extraction and purification to produce a pure titanium ingot. Titanium dioxide is highly detrimental to human health and must be eliminated from the titanium implant. Also, the zirconium segment is forecast to be the faster growing product segment during the period in analysis. Zirconium material performs nearly identically to titanium. While titanium implants can be created as one-piece or two-piece systems, zirconium implants are strictly one-piece systems. Two-piece implants offer additional features, such as supporting overdentures. Implants come in various sizes (length and width), which permits selecting the right size implants based on the patients' bone size.

Competitive Landscape:

Major players operating in global dental implants market include: Straumann Group, Dentsply Sirona, Zimmer Biomet Holdings, Inc., Danaher Corporation (Nobel Biocare Services AG), Osstem Implant Co., Ltd., BioHorizons IPH, Inc., Implant Direct LLC, Anthogyr SAS, CAMLOG Biotechnologies AG, and Sweden & Martina S.p.A. To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product launches.

The in-depth analysis of the report provides information about growth potential, upcoming trends, and statistics of Global Dental Implants Market. It also highlights the factors driving forecasts of total market size. The report promises to provide recent technology trends in Global Dental Implants Market and industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyzes the growth drivers, challenges, and competitive dynamics of the market.

Table of Contents

1. Research Framework

- 1.1. Research Objective

- 1.2. Product Overview

- 1.3. Market Segmentation

2. Executive Summary

3. Global Dental Implants Market Insights

- 3.1. Industry Value Chain Analysis

- 3.2. DROC Analysis

- 3.2.1. Growth Drivers

- 3.2.1.1. Growing prevalence of dental diseases and tooth loss

- 3.2.1.2. Technological advancements in dental implant materials and design

- 3.2.1.3. Increasing adoption of digital technologies, such as computer-aided design and 3D printing

- 3.2.2. Restraints

- 3.2.2.1. Limited availability of skilled dental professionals to perform and interpret procedures

- 3.2.2.2. Concerns over the safety and efficacy of dental implant procedures

- 3.2.3. Opportunities

- 3.2.3.1. Growing trend towards digital dentistry, which can improve the accuracy and efficiency

- 3.2.3.2. Increasing focus on patient-centered care and personalized treatment plans

- 3.2.4. Challenges

- 3.2.4.1. Increasing competition from alternative dental restoration technologies

- 3.2.1. Growth Drivers

- 3.3. Design Advancements/Recent Developments

- 3.4. Regulatory Framework

- 3.5. Porter's Five Forces Analysis

- 3.5.1. Bargaining Power of Suppliers

- 3.5.2. Bargaining Power of Buyers

- 3.5.3. Threat of New Entrants

- 3.5.4. Threat of Substitutes

- 3.5.5. Intensity of Rivalry

4. Global Dental Implants Market Overview

- 4.1. Market Size & Forecast, 2019-2029

- 4.1.1. By Value (USD Billion)

- 4.2. Market Share and Forecast

- 4.2.1. By Material

- 4.2.1.1. Titanium

- 4.2.1.2. Zirconium

- 4.2.1.3. Others

- 4.2.2. By Design

- 4.2.2.1. Tampered Implants

- 4.2.2.2. Parallel Walled Implants

- 4.2.3. By Type

- 4.2.3.1. Endosteal Implants

- 4.2.3.2. Subperiosteal Implants

- 4.2.3.3. Transosteal Implants

- 4.2.3.4. Others

- 4.2.4. By End Use

- 4.2.4.1. Hospitals

- 4.2.4.2. Specialty Clinics

- 4.2.4.3. Research & Academic Institutes

- 4.2.4.4. Others

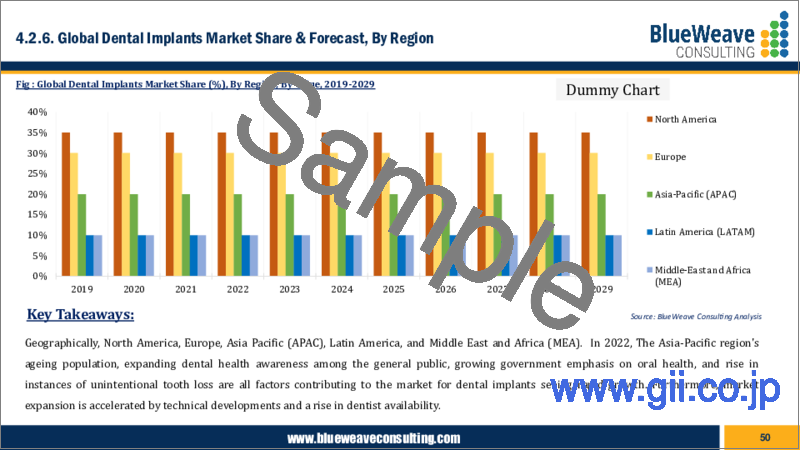

- 4.2.5. By Region

- 4.2.5.1. North America

- 4.2.5.2. Europe

- 4.2.5.3. Asia Pacific (APAC)

- 4.2.5.4. Latin America (LATAM)

- 4.2.5.5. Middle East and Africa (MEA)

- 4.2.1. By Material

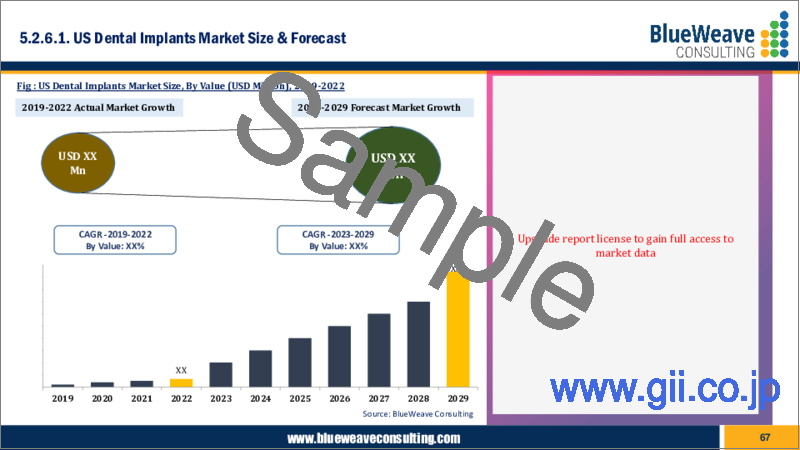

5. North America Dental Implants Market

- 5.1. Market Size & Forecast, 2019-2029

- 5.1.1. By Value (USD Billion)

- 5.2. Market Share & Forecast

- 5.2.1. By Material

- 5.2.2. By Design

- 5.2.3. By Type

- 5.2.4. By End Use

- 5.2.5. By Country

- 5.2.5.1. United States

- 5.2.5.1.1. By Material

- 5.2.5.1.2. By Design

- 5.2.5.1.3. By Type

- 5.2.5.1.4. By End Use

- 5.2.5.2. Canada

- 5.2.5.2.1. By Material

- 5.2.5.2.2. By Design

- 5.2.5.2.3. By Type

- 5.2.5.2.4. By End Use

6. Europe Dental Implants Market

- 6.1. Market Size & Forecast, 2019-2029

- 6.1.1. By Value (USD Billion)

- 6.2. Market Share & Forecast

- 6.2.1. By Material

- 6.2.2. By Design

- 6.2.3. By Type

- 6.2.4. By End Use

- 6.2.5. By Country

- 6.2.5.1. Germany

- 6.2.5.1.1. By Material

- 6.2.5.1.2. By Design

- 6.2.5.1.3. By Type

- 6.2.5.1.4. By End Use

- 6.2.5.2. United Kingdom

- 6.2.5.2.1. By Material

- 6.2.5.2.2. By Design

- 6.2.5.2.3. By Type

- 6.2.5.2.4. By End Use

- 6.2.5.3. Italy

- 6.2.5.3.1. By Material

- 6.2.5.3.2. By Design

- 6.2.5.3.3. By Type

- 6.2.5.3.4. By End Use

- 6.2.5.4. France

- 6.2.5.4.1. By Material

- 6.2.5.4.2. By Design

- 6.2.5.4.3. By Type

- 6.2.5.4.4. By End Use

- 6.2.5.5. Spain

- 6.2.5.5.1. By Material

- 6.2.5.5.2. By Design

- 6.2.5.5.3. By Type

- 6.2.5.5.4. By End Use

- 6.2.5.6. Belgium

- 6.2.5.6.1. By Material

- 6.2.5.6.2. By Design

- 6.2.5.6.3. By Type

- 6.2.5.6.4. By End Use

- 6.2.5.7. Russia

- 6.2.5.7.1. By Material

- 6.2.5.7.2. By Design

- 6.2.5.7.3. By Type

- 6.2.5.7.4. By End Use

- 6.2.5.8. The Netherlands

- 6.2.5.8.1. By Material

- 6.2.5.8.2. By Design

- 6.2.5.8.3. By Type

- 6.2.5.8.4. By End Use

- 6.2.5.9. Rest of Europe

- 6.2.5.9.1. By Material

- 6.2.5.9.2. By Design

- 6.2.5.9.3. By Type

- 6.2.5.9.4. By End Use

7. Asia-Pacific Dental Implants Market

- 7.1. Market Size & Forecast, 2019-2029

- 7.1.1. By Value (USD Billion)

- 7.2. Market Share & Forecast

- 7.2.1. By Material

- 7.2.2. By Design

- 7.2.3. By Type

- 7.2.4. By End Use

- 7.2.5. By Country

- 7.2.5.1. China

- 7.2.5.1.1. By Material

- 7.2.5.1.2. By Design

- 7.2.5.1.3. By Type

- 7.2.5.1.4. By End Use

- 7.2.5.2. India

- 7.2.5.2.1. By Material

- 7.2.5.2.2. By Design

- 7.2.5.2.3. By Type

- 7.2.5.2.4. By End Use

- 7.2.5.3. Japan

- 7.2.5.3.1. By Material

- 7.2.5.3.2. By Design

- 7.2.5.3.3. By Type

- 7.2.5.3.4. By End Use

- 7.2.5.4. South Korea

- 7.2.5.4.1. By Material

- 7.2.5.4.2. By Design

- 7.2.5.4.3. By Type

- 7.2.5.4.4. By End Use

- 7.2.5.5. Australia & New Zealand

- 7.2.5.5.1. By Material

- 7.2.5.5.2. By Design

- 7.2.5.5.3. By Type

- 7.2.5.5.4. By End Use

- 7.2.5.6. Indonesia

- 7.2.5.6.1. By Material

- 7.2.5.6.2. By Design

- 7.2.5.6.3. By Type

- 7.2.5.6.4. By End Use

- 7.2.5.7. Malaysia

- 7.2.5.7.1. By Material

- 7.2.5.7.2. By Design

- 7.2.5.7.3. By Type

- 7.2.5.7.4. By End Use

- 7.2.5.8. Singapore

- 7.2.5.8.1. By Material

- 7.2.5.8.2. By Design

- 7.2.5.8.3. By Type

- 7.2.5.8.4. By End Use

- 7.2.5.9. Vietnam

- 7.2.5.9.1. By Material

- 7.2.5.9.2. By Design

- 7.2.5.9.3. By Type

- 7.2.5.9.4. By End Use

- 7.2.5.10. Rest of APAC

- 7.2.5.10.1. By Material

- 7.2.5.10.2. By Design

- 7.2.5.10.3. By Type

- 7.2.5.10.4. By End Use

8. Latin America Dental Implants Market

- 8.1. Market Size & Forecast, 2019-2029

- 8.1.1. By Value (USD Billion)

- 8.2. Market Share & Forecast

- 8.2.1. By Material

- 8.2.2. By Design

- 8.2.3. By Type

- 8.2.4. By End Use

- 8.2.5. By Country

- 8.2.5.1. Brazil

- 8.2.5.1.1. By Material

- 8.2.5.1.2. By Design

- 8.2.5.1.3. By Type

- 8.2.5.1.4. By End Use

- 8.2.5.2. Mexico

- 8.2.5.2.1. By Material

- 8.2.5.2.2. By Design

- 8.2.5.2.3. By Type

- 8.2.5.2.4. By End Use

- 8.2.5.3. Argentina

- 8.2.5.3.1. By Material

- 8.2.5.3.2. By Design

- 8.2.5.3.3. By Type

- 8.2.5.3.4. By End Use

- 8.2.5.4. Peru

- 8.2.5.4.1. By Material

- 8.2.5.4.2. By Design

- 8.2.5.4.3. By Type

- 8.2.5.4.4. By End Use

- 8.2.5.5. Rest of LATAM

- 8.2.5.5.1. By Material

- 8.2.5.5.2. By Design

- 8.2.5.5.3. By Type

- 8.2.5.5.4. By End Use

9. Middle East & Africa Dental Implants Market

- 9.1. Market Size & Forecast, 2019-2029

- 9.1.1. By Value (USD Billion)

- 9.2. Market Share & Forecast

- 9.2.1. By Material

- 9.2.2. By Design

- 9.2.3. By Type

- 9.2.4. By End Use

- 9.2.5. By Country

- 9.2.5.1. Saudi Arabia

- 9.2.5.1.1. By Material

- 9.2.5.1.2. By Design

- 9.2.5.1.3. By Type

- 9.2.5.1.4. By End Use

- 9.2.5.2. UAE

- 9.2.5.2.1. By Material

- 9.2.5.2.2. By Design

- 9.2.5.2.3. By Type

- 9.2.5.2.4. By End Use

- 9.2.5.3. Qatar

- 9.2.5.3.1. By Material

- 9.2.5.3.2. By Design

- 9.2.5.3.3. By Type

- 9.2.5.3.4. By End Use

- 9.2.5.4. Kuwait

- 9.2.5.4.1. By Material

- 9.2.5.4.2. By Design

- 9.2.5.4.3. By Type

- 9.2.5.4.4. By End Use

- 9.2.5.5. South Africa

- 9.2.5.5.1. By Material

- 9.2.5.5.2. By Design

- 9.2.5.5.3. By Type

- 9.2.5.5.4. By End Use

- 9.2.5.6. Nigeria

- 9.2.5.6.1. By Material

- 9.2.5.6.2. By Design

- 9.2.5.6.3. By Type

- 9.2.5.6.4. By End Use

- 9.2.5.7. Algeria

- 9.2.5.7.1. By Material

- 9.2.5.7.2. By Design

- 9.2.5.7.3. By Type

- 9.2.5.7.4. By End Use

- 9.2.5.8. Rest of MEA

- 9.2.5.8.1. By Material

- 9.2.5.8.2. By Design

- 9.2.5.8.3. By Type

- 9.2.5.8.4. By End Use

10. Competitive Landscape

- 10.1. List of Key Players and Their Offerings

- 10.2. Global Dental Implants Market Share Analysis, 2022

- 10.3. Competitive Benchmarking, By Operating Parameters

- 10.4. Key Strategic Developments (Mergers, Acquisitions, Partnerships, etc.)

11. Impact of Covid-19 on Global Dental Implants Market

12. Company Profile (Company Overview, Financial Matrix, Competitive Landscape, Key Personnel, Key Competitors, Contact Address, Strategic Outlook, SWOT Analysis)

- 12.1. Straumann Group

- 12.2. Dentsply Sirona

- 12.3. Zimmer Biomet Holdings, Inc.

- 12.4. Danaher Corporation (Nobel Biocare Services AG)

- 12.5. Osstem Implant Co., Ltd.

- 12.6. BioHorizons IPH, Inc.

- 12.7. Implant Direct LLC

- 12.8. Anthogyr SAS

- 12.9. CAMLOG Biotechnologies AG

- 12.10. Sweden & Martina S.p.A.

- 12.11. Other Prominent Players

13. Key Strategic Recommendations

14. Research Methodology

- 14.1. Qualitative Research

- 14.1.1. Primary & Secondary Research

- 14.2. Quantitative Research

- 14.3. Market Breakdown & Data Triangulation

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.4. Breakdown of Primary Research Respondents, By Region

- 14.5. Assumptions & Limitations