|

|

市場調査レポート

商品コード

1180152

車内決済の世界市場 (2022-2031年):用途・製品・国別分析・予測In-Vehicle Payments Market - A Global and Regional Analysis: Focus on Application, Product, and Country-Level Analysis - Analysis and Forecast, 2022-2031 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 車内決済の世界市場 (2022-2031年):用途・製品・国別分析・予測 |

|

出版日: 2023年01月02日

発行: BIS Research

ページ情報: 英文 178 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の車内決済の市場規模は、2021年の49億米ドルから、2031年には259億1,860万米ドルに達し、予測期間中のCAGRは18.15%を示すと予測されています。

現在、車内決済の需要で最も高いシェアを占めているのは乗用車です。乗用車の需要が高いこと、登録台数が多いこと、商用車と比較して操作の難易度が低いことなどが、技術的に受け入れられた主な要因です。また、用途別では、ガソリンスタンド/充電ステーションの部門が最大のシェアを占めています。さらに、決済タイプ別では、クレジットカード/デビットカードおよびアプリの部門がもっとも大きな市場を占めています。

当レポートでは、世界の車内決済の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術ロードマップ、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 市場

- 産業の見通し

- 動向:現在と未来

- サプライチェーンネットワーク・MAP

- 進行中のプログラム

- 技術ロードマップ

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業戦略

- 企業戦略

- 事業機会

第2章 用途

- 世界の車内決済市場:用途と仕様

- 世界の車内決済市場(車両タイプ別)

- 世界の車内決済市場(用途別)

- 世界の車内決済市場:需要分析(用途別)

- 世界の車内決済市場の需要分析(車両タイプ別)

- 世界の車内決済市場の需要分析(用途別)

第3章 製品

- 世界の車内決済市場:製品と仕様

- 世界の車内決済市場(決済タイプ別)

- 世界の車内決済市場の需要分析(製品別)

- 世界の車内決済市場の需要分析(決済タイプ別)

- 製品ベンチマーキング:成長率:市場シェアマトリックス

- 機会マトリックス(地域別)

- 機会マトリックス(用途別)

- 主要特許マッピング

第4章 地域

- 北米

- 欧州

- 英国

- 中国

- アジア太平洋・日本

- その他の地域

第5章 市場:競合ベンチマーキング・企業プロファイル

- 競合ベンチマーキング

- 企業プロファイル

- ティア1企業:自動車OEM

- ティア2企業:サービスプロバイダー

- その他の主要企業のリスト

- スタートアッププロファイル

- Ramp

- Brex

- Numadic Ltd.

- Lynk

- Paymentology

第6章 調査手法

List of Figures

- Figure 1: Global In-Vehicle Payments Market Overview, $Million, 2021-2031

- Figure 2: Global In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Figure 3: Global In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Figure 4: Global In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Figure 5: Global In-Vehicle Payments Market (by Region), $Million, 2021

- Figure 6: Global In-Vehicle Payments Market Segmentation

- Figure 7: Global In-Vehicle Payments Market Supply Chain

- Figure 8: Global In-Vehicle Payments Market Supply Chain Participants

- Figure 9: Technology Roadmap

- Figure 10: Business Dynamics for Global In-Vehicle Payments Market

- Figure 11: Impact of Business Drivers

- Figure 12: Impact of Business Challenges

- Figure 13: Share of Key Market Developments (2020-2022)

- Figure 14: Share of Key Product Developments (2020-2022)

- Figure 15: Share of Key Market Developments (2020-2022)

- Figure 16: Share of Key Corporate Strategies and Developments (2020-2022)

- Figure 17: Share of Key Mergers and Acquisitions (2020-2022)

- Figure 18: Share of Key Partnerships, Collaborations, Joint Ventures, and Alliances (2020-2022)

- Figure 19: Impact of Business Opportunities

- Figure 20: Global In-Vehicle Payments Market (Passenger Vehicle), $Million, 2021-2031

- Figure 21: Global In-Vehicle Payments Market (Commercial Vehicles), $Million, 2021-2031

- Figure 22: Global In-Vehicle Payments Market (Parking), $Million, 2021-2031

- Figure 23: Global In-Vehicle Payments Market (Gas/Charging Stations), $Million, 2021-2031

- Figure 24: Global In-Vehicle Payments Market (Food and Beverages), $Million, 2021-2031

- Figure 25: Global In-Vehicle Payments Market (Toll Collection), $Million, 2021-2031

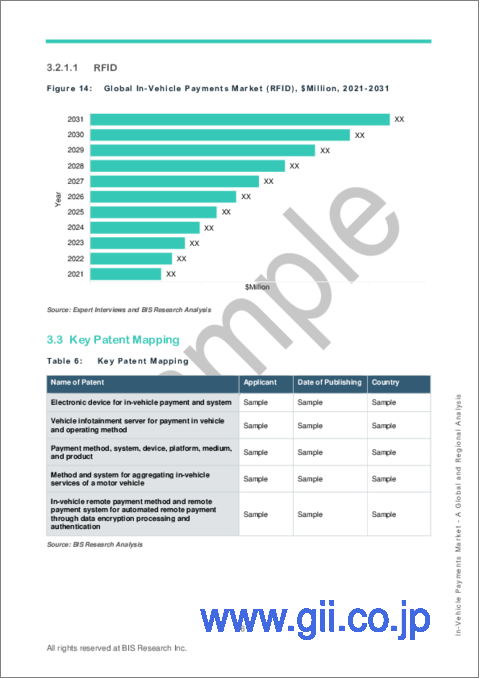

- Figure 26: Global In-Vehicle Payments Market (RFID), $Million, 2021-2031

- Figure 27: Global In-Vehicle Payments Market (QR Codes and e-Wallets), $Million, 2021-2031

- Figure 28: Global In-Vehicle Payments Market (by Credit/Debit Cards & Apps), $Million, 2021-2031

- Figure 29: Global In-Vehicle Payments Market, Opportunity Matrix (by Region), $Million

- Figure 30: Global In-Vehicle Payments Market, Opportunity Matrix (by Application Type), $Million

- Figure 31: Global Competitive Benchmarking, 2021

- Figure 32: BMW Group: R&D Expenditure, $Billion, 2019-2021

- Figure 33: Ford Motor Company: R&D Expenditure, $Billion, 2019-2021

- Figure 34: General Motors: R&D Expenditure, $Billion, 2019-2021

- Figure 35: Honda Motor Co., Ltd.: R&D Expenditure, $Billion, 2020-2022

- Figure 36: Hyundai Motor Group: R&D Expenditure, $Billion, 2019-2021

- Figure 37: Jaguar Land Rover Automotive plc: R&D Expenditure, $Million, 2019-2021

- Figure 38: Volkswagen AG: R&D Expenditure, $Billion, 2019-2021

- Figure 39: Apple Inc.: R&D Expenditure, $Billion, 2019-2021

- Figure 40: HARMAN International: R&D Expenditure, $Billion, 2019-2021

- Figure 41: IBM: R&D Expenditure, $Billion, 2019-2021

- Figure 42: Shell plc: R&D Expenditure, $Million, 2019-2021

- Figure 43: Sirius XM Holdings Inc.: R&D Expenditure, $Million, 2019-2021

- Figure 44: Data Triangulation

- Figure 45: Top-Down and Bottom-Up Approach

List of Tables

- Table 1: Global In-Vehicle Payments Market Overview

- Table 2: Key Companies Profiled

- Table 3: Programs by Research Institutions and Universities

- Table 4: Global In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 5: Global In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 6: Global In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 7: Key Patent Mapping

- Table 8: Global In-Vehicle Payments Market (by Region), $Million, 2021-2031

- Table 9: North America In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 10: North America In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 11: North America In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 12: U.S. In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 13: U.S. In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 14: U.S. In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 15: Canada In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 16: Canada In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 17: Canada In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 18: Mexico In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 19: Mexico In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 20: Mexico In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 21: Europe In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 22: Europe In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 23: Europe In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 24: Germany In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 25: Germany In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 26: Germany In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 27: France In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 28: France In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 29: France In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 30: Italy In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 31: Italy In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 32: Italy In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 33: Rest-of-Europe In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 34: Rest-of-Europe In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 35: Rest-of-Europe In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 36: U.K. In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 37: U.K. In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 38: U.K. In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 39: China In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 40: China In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 41: China In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 42: Asia-Pacific and Japan In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 43: Asia-Pacific and Japan In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 44: Asia-Pacific and Japan In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 45: Japan In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 46: Japan In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 47: Japan In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 48: South Korea In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 49: South Korea In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 50: South Korea In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 51: Rest-of-Asia-Pacific In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 52: Rest-of-Asia-Pacific In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 53: Rest-of-Asia-Pacific In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 54: Rest-of-the-World In-Vehicle Payments Market (by Vehicle Type), $Million, 2021-2031

- Table 55: Rest-of-the-World In-Vehicle Payments Market (by Application Type), $Million, 2021-2031

- Table 56: Rest-of-the-World In-Vehicle Payments Market (by Mode of Payment Type), $Million, 2021-2031

- Table 57: BMW Group: Product and Service Portfolio

- Table 58: BMW Group: Product Development

- Table 59: BMW Group: Mergers and Acquisitions

- Table 60: Ford Motor Company: Product and Service Portfolio

- Table 61: Ford Motor Company: Mergers and Acquisitions

- Table 62: Ford Motor Company: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 63: General Motors: Product and Service Portfolio

- Table 64: General Motors: Mergers and Acquisitions

- Table 65: General Motors: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 66: Honda Motor Co., Ltd.: Product and Service Portfolio

- Table 67: Honda Motor Co., Ltd.: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 68: Hyundai Motor Group: Product and Service Portfolio

- Table 69: Hyundai Motor Group: Product Development

- Table 70: Hyundai Motor Group: Market Development

- Table 71: Hyundai Motor Group: Mergers and Acquisitions

- Table 72: Hyundai Motor Group: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 73: Jaguar Land Rover Automotive plc: Product and Service Portfolio

- Table 74: Jaguar Land Rover Automotive plc: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 75: Volkswagen AG: Product and Service Portfolio

- Table 76: Volkswagen AG: Market Development

- Table 77: Volkswagen AG: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 78: Apple Inc.: Product and Service Portfolio

- Table 79: Apple Inc. : Product Development

- Table 80: Apple Inc. : Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 81: HARMAN International: Product and Service Portfolio

- Table 82: HARMAN International: Market Development

- Table 83: HARMAN International: Mergers and Acquisitions

- Table 84: HARMAN International: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 85: IBM: Product and Service Portfolio

- Table 86: IBM: Product Development

- Table 87: IBM: Mergers and Acquisitions

- Table 88: IBM: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 89: Mastercard: Product and Service Portfolio

- Table 90: Mastercard: Mergers and Acquisitions

- Table 91: Mastercard: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 92: P97 Networks: Product and Service Portfolio

- Table 93: P97 Networks: Product Development

- Table 94: P97 Networks: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 95: Sheeva.AI: Product and Service Portfolio

- Table 96: Sheeva.AI: Product Development

- Table 97: Sheeva.AI: Market Development

- Table 98: Sheeva.AI: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 99: Shell plc: Product and Service Portfolio

- Table 100: Shell plc: Market Development

- Table 101: Shell plc: Mergers and Acquisitions

- Table 102: Shell plc: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 103: Sirius XM Holding Inc.: Product and Service Portfolio

- Table 104: Sirius XM Holdings Inc.: Mergers and Acquisitions

- Table 105: Visa: Product and Service Portfolio

- Table 106: Visa: Mergers and Acquisitions

- Table 107: Visa: Partnerships, Joint Ventures, Collaborations, and Alliances

“Global In-Vehicle Payments Market to Reach $25,918.6 Million by 2031.”

Global In-Vehicle Payments Market: Industry Overview

The global in-vehicle payments market is projected to reach $25,918.6 million by 2031 from $4,900.0 million in 2021, growing at a CAGR of 18.15% during the forecast period 2022-2031. The recent surge in the adoption of in-vehicle payment services across developed economies and their growing global awareness is shifting automakers' focus to equip their upcoming models with the in-vehicle payment system. For example, well-known automakers, including Honda, General Motors, Mercedes, and others, have already begun to offer in-vehicle payment services in recent years. This shift in original equipment manufacturer (OEM) focus toward developing in-car payment services is expected to drive growth in the in-vehicle payments market in the coming years.

Market Lifecycle Stage

The in-vehicle payment system is a payment technology-equipped automotive system. This system enables the driver to make payments or transactions with various companies or applications, including gas/charging stations, parking, toll collection, and others. Furthermore, the system allows passengers to make purchases directly from their vehicle dashboard, saving time and making the process more convenient. As a result, the growing public demand for timely and efficient contactless transactions is driving the adoption of these services.

Impact of Global In-Vehicle Payments Market

In-vehicle payment services enable drivers to order and pay for food, coffee, gasoline, groceries, parking spaces, and tolls without leaving the vehicle. MasterCard, Visa, and PayPal, among others, are collaborating with automakers around the world to develop and integrate new payment processes and methods in vehicles. For instance, in January 2019, Visa announced a partnership with SiriusXM to launch vehicle-based payments. Other automakers, including Volkswagen AG, Honda Motor Co. Ltd., and Ford Motor Co., have also created in-vehicle payment solutions and platforms.

Market Segmentation:

Segmentation 1: by Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Passenger vehicles are currently credited with the highest share of the demand for in-vehicle payments. Some key factors that have enabled the technical acceptance of these vehicles are high demand, higher registration of passenger cars, and less operating difficulty as compared to commercial vehicles. The need for passenger vehicles is growing due to the demand for heavy and luxury vehicles and an increase in the number of cars driven by diesel engines. Additionally, increased population, urbanization, and disposable income have significantly increased passenger vehicle production.

Segmentation 2: by Application Type

- Parking

- Gas/Charging Stations

- Food and Beverages

- Toll Collection

The gas/charging stations segment accounts for the largest market. A growing number of locations support the ability to pay from an app while driving. One must enter their pump number to begin pumping or charging their vehicle. Contactless payment readers can read payment information from a compatible credit card or a digital device such as an Apple CarPlay. The general idea behind the CarPlay update is that users can pay for gas using their car's touchscreen instead of a credit card.

Segmentation 3: by Mode of Payment Type

- RFID

- QR Codes and e-Wallets

- Credit/Debit Cards & Apps

The credit/debit card and apps segment accounts for the largest market. Debit and credit cards are the most popular payment methods and are widely used to make in-vehicle payments. They provide a convenient way to pay without cash or checks and are accepted almost everywhere.

Segmentation 4: by Region

- North America

- Europe

- U.K.

- China

- Asia-Pacific and Japan

- Rest-of-the-World

North America currently holds the largest share of the global in-vehicle payments market. The North America region comprises the U.S., Canada, and Mexico. The presence of technology providers, minimal miscalculations, product customization, and reduced production timescale are the primary driving factors of the North America in-vehicle payments market. The U.S. government's policies for research and development activities regarding in-vehicle payments also hasten the region's adoption of in-vehicle payments.

Recent Developments in the Global In-Vehicle Payments Market

- In May 2021, Hyundai made in-car payments available for its all-electric Ioniq 5 crossovers. This launch enabled the company to provide advanced payment capabilities to drivers as well as assist them in paying at the electric vehicle (EV) charging stations and restaurants.

- In January 2022, Ford Motor Company and Stripe, an online payment processor, signed Ford Motor Company as a customer in a five-year deal designed to strengthen the automotive giant's e-commerce strategy. Ford Motor Credit Company, the automaker's financial services arm, would process digital payments in markets across North America and Europe using Stripe's technology.

- In May 2022, General Motors announced that it would pay $2.1 billion for SoftBank's equity stake in its majority-owned driverless vehicle company, which is expected to boost the in-vehicle payments market.

- In September 2021, Honda Motor Co., Ltd. and Google announced their partnership in which the two companies had agreed to integrate Google's in-vehicle connected service into an all-new model that would go for sale in North America by the end of 2022, boosting the global in-vehicle payments market.

Demand - Drivers and Limitations

Following are the drivers for the global in-vehicle payments market:

- Increased Demand for Contactless Payment Solutions

- Growing Demand for Connected Vehicles

- Increase in Production of Autonomous Vehicles across the Globe

Following are the challenges for the global in-vehicle payments market:

- Connectivity and Subscription Complexity

- Risk of Cyber Attacks

How can this report add value to end users?

- Product/Innovation Strategy: The product segment helps the readers understand the different types of in-vehicle payments. Also, the study provides the readers with a detailed understanding of the global in-vehicle payments market based on application and product.

- Growth/Marketing Strategy: To improve the capabilities of their product offerings, players in the global in-vehicle payments market are developing unique products. The readers will be able to comprehend the revenue-generating tactics used by players in the global in-vehicle payments market by looking at the growth/marketing strategies. Other market participants' tactics, such as go-to-market plans, will also assist readers in making strategic judgments.

- Competitive Strategy: Players in the global in-vehicle payments market analyzed and profiled in the study include vehicle manufacturers that capture the maximum share of the market. Moreover, a detailed competitive benchmarking of the players operating in the global in-vehicle payments market has been done to help the readers understand how players compete against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, collaborations, and mergers and acquisitions are expected to aid the readers in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Key Companies Profiled

Tier 1 Companies: Automotive OEMs

- BMW Group

- Ford Motor Company

- General Motors

- Honda Motor Co., Ltd.

- Hyundai Motor Group

- Jaguar Land Rover Automotive plc

- Volkswagen AG

Tier 2 Companies: Service Providers

- Apple Inc.

- HARMAN International

- International Business Machines (IBM)

- Mastercard

- P97 Networks

- Sheeva.AI

- Shell plc

- Sirius XM Holdings Inc.

- Visa

Table of Contents

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Trends: Current and Future

- 1.1.1.1 Increase in Adoption of Digital Payment Systems

- 1.1.1.2 Emergence of Various Technologies, such as 5G and AI

- 1.1.1.3 Rising Investments in Automobile Industry

- 1.1.2 Supply Chain Network/MAP

- 1.1.2.1 In-Vehicle Payments Ecosystem

- 1.1.3 Ongoing Programs

- 1.1.3.1 Consortiums, Associations, and Regulatory Bodies

- 1.1.3.2 Government Programs and Initiatives

- 1.1.3.3 Programs by Research Institutions and Universities

- 1.1.4 Technology Roadmap

- 1.1.1 Trends: Current and Future

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Increased Demand for Contactless Payment Solutions

- 1.2.1.2 Growing Demand for Connected Vehicles

- 1.2.1.3 Increase in Production of Autonomous Vehicles across the Globe

- 1.2.2 Business Challenges

- 1.2.2.1 Connectivity and Subscription Complexity

- 1.2.2.2 Risk of Cyber Attacks

- 1.2.3 Business Strategies

- 1.2.3.1 Product Development

- 1.2.3.2 Market Development

- 1.2.4 Corporate Strategies

- 1.2.4.1 Mergers and Acquisitions

- 1.2.4.2 Partnerships, Collaborations, Joint Ventures, and Alliances

- 1.2.5 Business Opportunities

- 1.2.5.1 Growing Demand for Connected and Autonomous Vehicles

- 1.2.5.2 Future Potential of 5G and Artificial Intelligence

- 1.2.1 Business Drivers

2 Application

- 2.1 Global In-Vehicle Payments Market - Applications and Specifications

- 2.1.1 Global In-Vehicle Payments Market (by Vehicle Type)

- 2.1.1.1 Passenger Vehicles

- 2.1.1.2 Commercial Vehicles

- 2.1.2 Global In-Vehicle Payments Market (by Application Type)

- 2.1.2.1 Parking

- 2.1.2.2 Gas/Charging Stations

- 2.1.2.3 Food and Beverages

- 2.1.2.4 Toll Collection

- 2.1.1 Global In-Vehicle Payments Market (by Vehicle Type)

- 2.2 Global In-Vehicle Payments Market: Demand Market Analysis (by Application)

- 2.2.1 Demand Analysis of the Global In-Vehicle Payments Market (by Vehicle Type)

- 2.2.1.1 Passenger Vehicles

- 2.2.1.2 Commercial Vehicles

- 2.2.2 Demand Analysis of the Global In-Vehicle Payments Market (by Application Type)

- 2.2.2.1 Parking

- 2.2.2.2 Gas/Charging Stations

- 2.2.2.3 Food and Beverages

- 2.2.2.4 Toll Collection

- 2.2.1 Demand Analysis of the Global In-Vehicle Payments Market (by Vehicle Type)

3 Products

- 3.1 Global In-Vehicle Payments Market - Products and Specifications

- 3.1.1 Global In-Vehicle Payments Market (by Mode of Payment Type)

- 3.1.1.1 RFID

- 3.1.1.2 QR Codes and e-Wallets

- 3.1.1.3 Credit/Debit Cards & Apps

- 3.1.1 Global In-Vehicle Payments Market (by Mode of Payment Type)

- 3.2 Demand Analysis of the Global In-Vehicle Payments Market (by Product)

- 3.2.1 Demand Analysis of Global In-Vehicle Payments Market, Value Data (by Mode of Payment Type)

- 3.2.1.1 RFID

- 3.2.1.2 QR Codes and e-Wallets

- 3.2.1.3 Credit/Debit Cards & Apps

- 3.2.1 Demand Analysis of Global In-Vehicle Payments Market, Value Data (by Mode of Payment Type)

- 3.3 Product Benchmarking: Growth Rate - Market Share Matrix

- 3.3.1 Opportunity Matrix (by Region)

- 3.3.2 Opportunity Matrix (by Application Type)

- 3.4 Key Patent Mapping

4 Regions

- 4.1 North America

- 4.1.1 Market

- 4.1.1.1 Buyer Attributes

- 4.1.1.2 Key Solution Providers in North America

- 4.1.1.3 Business Challenges

- 4.1.1.4 Business Drivers

- 4.1.2 Application

- 4.1.2.1 North America In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.1.2.2 North America In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.1.3 Product

- 4.1.3.1 North America In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.1.4 North America (by Country)

- 4.1.4.1 U.S.

- 4.1.4.1.1 Market

- 4.1.4.1.1.1 Buyer Attributes

- 4.1.4.1.1.2 Key Solution Providers in the U.S.

- 4.1.4.1.1.3 Business Challenges

- 4.1.4.1.1.4 Business Drivers

- 4.1.4.1.2 Application

- 4.1.4.1.2.1 U.S. In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.1.4.1.2.2 U.S. In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.1.4.1.3 Product

- 4.1.4.1.3.1 U.S. In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.1.4.1.1 Market

- 4.1.4.2 Canada

- 4.1.4.2.1 Market

- 4.1.4.2.1.1 Buyer Attributes

- 4.1.4.2.1.2 Key Solution Providers in Canada

- 4.1.4.2.1.3 Business Challenges

- 4.1.4.2.1.4 Business Drivers

- 4.1.4.2.2 Application

- 4.1.4.2.2.1 Canada In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.1.4.2.2.2 Canada In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.1.4.2.3 Product

- 4.1.4.2.3.1 Canada In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.1.4.2.1 Market

- 4.1.4.3 Mexico

- 4.1.4.3.1 Market

- 4.1.4.3.1.1 Buyer Attributes

- 4.1.4.3.1.2 Key Solution Providers in Mexico

- 4.1.4.3.1.3 Business Challenges

- 4.1.4.3.1.4 Business Drivers

- 4.1.4.3.2 Application

- 4.1.4.3.2.1 Mexico In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.1.4.3.2.2 Mexico In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.1.4.3.3 Product

- 4.1.4.3.3.1 Mexico In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.1.4.3.1 Market

- 4.1.4.1 U.S.

- 4.1.1 Market

- 4.2 Europe

- 4.2.1 Market

- 4.2.1.1 Buyer Attributes

- 4.2.1.2 Key Solution Providers in Europe

- 4.2.1.3 Business Challenges

- 4.2.1.4 Business Drivers

- 4.2.2 Application

- 4.2.2.1 Europe In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.2.2.2 Europe In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.2.3 Product

- 4.2.3.1 Europe In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.2.4 Europe (by Country)

- 4.2.4.1 Germany

- 4.2.4.1.1 Market

- 4.2.4.1.1.1 Buyer Attributes

- 4.2.4.1.1.2 Key Solution Providers in Germany

- 4.2.4.1.1.3 Business Challenges

- 4.2.4.1.1.4 Business Drivers

- 4.2.4.1.2 Application

- 4.2.4.1.2.1 Germany In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.2.4.1.2.2 Germany In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.2.4.1.3 Product

- 4.2.4.1.3.1 Germany In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.2.4.1.1 Market

- 4.2.4.2 France

- 4.2.4.2.1 Market

- 4.2.4.2.1.1 Buyer Attributes

- 4.2.4.2.1.2 Key Solution Providers in France

- 4.2.4.2.1.3 Business Challenges

- 4.2.4.2.1.4 Business Drivers

- 4.2.4.2.2 Application

- 4.2.4.2.2.1 France In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.2.4.2.2.2 France In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.2.4.2.3 Product

- 4.2.4.2.3.1 France In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.2.4.2.1 Market

- 4.2.4.3 Italy

- 4.2.4.3.1 Market

- 4.2.4.3.1.1 Buyer Attributes

- 4.2.4.3.1.2 Key Solution Providers in Italy

- 4.2.4.3.1.3 Business Challenges

- 4.2.4.3.1.4 Business Drivers

- 4.2.4.3.2 Application

- 4.2.4.3.2.1 Italy In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.2.4.3.2.2 Italy In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.2.4.3.3 Product

- 4.2.4.3.3.1 Italy In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.2.4.3.1 Market

- 4.2.4.4 Rest-of-Europe

- 4.2.4.4.1 Market

- 4.2.4.4.1.1 Buyer Attributes

- 4.2.4.4.1.2 Key Solution Providers in Rest-of-Europe

- 4.2.4.4.1.3 Business Challenges

- 4.2.4.4.1.4 Business Drivers

- 4.2.4.4.2 Application

- 4.2.4.4.2.1 Rest-of-Europe In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.2.4.4.2.2 Rest-of-Europe In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.2.4.4.3 Product

- 4.2.4.4.3.1 Rest-of-Europe In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.2.4.4.1 Market

- 4.2.4.1 Germany

- 4.2.1 Market

- 4.3 U.K.

- 4.3.1 Market

- 4.3.1.1 Buyer Attributes

- 4.3.1.2 Key Solution Providers in the U.K.

- 4.3.1.3 Business Challenges

- 4.3.1.4 Business Drivers

- 4.3.2 Application

- 4.3.2.1 U.K. In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.3.2.2 U.K. In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.3.3 Product

- 4.3.3.1 U.K. In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.3.1 Market

- 4.4 China

- 4.4.1 Market

- 4.4.1.1 Buyer Attributes

- 4.4.1.2 Key Solution Providers in China

- 4.4.1.3 Business Challenges

- 4.4.1.4 Business Drivers

- 4.4.2 Application

- 4.4.2.1 China In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.4.2.2 China In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.4.3 Product

- 4.4.3.1 China In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.4.1 Market

- 4.5 Asia-Pacific and Japan

- 4.5.1 Market

- 4.5.1.1 Buyer Attributes

- 4.5.1.2 Key Solution Providers in Asia-Pacific and Japan

- 4.5.1.3 Business Challenges

- 4.5.1.4 Business Drivers

- 4.5.2 Application

- 4.5.2.1 Asia-Pacific and Japan In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.5.2.2 Asia-Pacific and Japan In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.5.3 Product

- 4.5.3.1 Asia-Pacific and Japan In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.5.4 Asia-Pacific and Japan (by Country)

- 4.5.4.1 Japan

- 4.5.4.1.1 Market

- 4.5.4.1.1.1 Buyer Attributes

- 4.5.4.1.1.2 Key Solution Providers in Japan

- 4.5.4.1.1.3 Business Challenges

- 4.5.4.1.1.4 Business Drivers

- 4.5.4.1.2 Application

- 4.5.4.1.2.1 Japan In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.5.4.1.2.2 Japan In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.5.4.1.3 Product

- 4.5.4.1.3.1 Japan In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.5.4.1.1 Market

- 4.5.4.2 South Korea

- 4.5.4.2.1 Market

- 4.5.4.2.1.1 Buyer Attributes

- 4.5.4.2.1.2 Key Solution Providers in South Korea

- 4.5.4.2.1.3 Business Challenges

- 4.5.4.2.1.4 Business Drivers

- 4.5.4.2.2 Application

- 4.5.4.2.2.1 South Korea In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.5.4.2.2.2 South Korea In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.5.4.2.3 Product

- 4.5.4.2.3.1 South Korea In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.5.4.2.1 Market

- 4.5.4.3 Rest-of-Asia-Pacific

- 4.5.4.3.1 Market

- 4.5.4.3.1.1 Buyer Attributes

- 4.5.4.3.1.2 Key Solution Providers in Rest-of-Asia-Pacific

- 4.5.4.3.1.3 Business Challenges

- 4.5.4.3.1.4 Business Drivers

- 4.5.4.3.2 Application

- 4.5.4.3.2.1 Rest-of-Asia-Pacific In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.5.4.3.2.2 Rest-of-Asia-Pacific In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.5.4.3.3 Product

- 4.5.4.3.3.1 Rest-of-Asia-Pacific In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.5.4.3.1 Market

- 4.5.4.1 Japan

- 4.5.1 Market

- 4.6 Rest-of-the-World

- 4.6.1 Market

- 4.6.1.1 Buyer Attributes

- 4.6.1.2 Key Solution Providers in Rest-of-the-World

- 4.6.1.3 Business Challenges

- 4.6.1.4 Business Drivers

- 4.6.2 Applications

- 4.6.2.1 Rest-of-the-World In-Vehicle Payments Market Demand (by Vehicle type), Value Data

- 4.6.2.2 Rest-of-the-World In-Vehicle Payments Market Demand (by Application Type), Value Data

- 4.6.3 Product

- 4.6.3.1 Rest-of-the-World In-Vehicle Payments Market Demand (by Mode of Payment Type), Value Data

- 4.6.1 Market

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Competitive Benchmarking

- 5.2 Company Profiles

- 5.2.1 Tier 1 Companies: Automotive OEMs

- 5.2.1.1 BMW Group

- 5.2.1.1.1 Company Overview

- 5.2.1.1.1.1 Role of BMW Group in the In-Vehicle Payments Market

- 5.2.1.1.1.2 Product Portfolio

- 5.2.1.1.1.3 R&D Analysis

- 5.2.1.1.2 Business Strategies

- 5.2.1.1.2.1 Product Development

- 5.2.1.1.3 Corporate Strategies

- 5.2.1.1.3.1 Mergers and Acquisitions

- 5.2.1.1.4 Analyst View

- 5.2.1.1.1 Company Overview

- 5.2.1.2 Ford Motor Company

- 5.2.1.2.1 Company Overview

- 5.2.1.2.1.1 Role of Ford Motor Company in the In-Vehicle Payments Market

- 5.2.1.2.1.2 Product Portfolio

- 5.2.1.2.1.3 R&D Analysis

- 5.2.1.2.2 Corporate Strategies

- 5.2.1.2.2.1 Mergers and Acquisitions

- 5.2.1.2.2.2 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.1.2.3 Analyst View

- 5.2.1.2.1 Company Overview

- 5.2.1.3 General Motors

- 5.2.1.3.1 Company Overview

- 5.2.1.3.1.1 Role of General Motors in the In-Vehicle Payments Market

- 5.2.1.3.1.2 Product Portfolio

- 5.2.1.3.1.3 R&D Analysis

- 5.2.1.3.2 Corporate Strategies

- 5.2.1.3.2.1 Mergers and Acquisitions

- 5.2.1.3.2.2 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.1.3.3 Analyst View

- 5.2.1.3.1 Company Overview

- 5.2.1.4 Honda Motor Co., Ltd.

- 5.2.1.4.1 Company Overview

- 5.2.1.4.1.1 Role of Honda Motor Co., Ltd. in the In-Vehicle Payments Market

- 5.2.1.4.1.2 Product Portfolio

- 5.2.1.4.1.3 R&D Analysis

- 5.2.1.4.2 Corporate Strategies

- 5.2.1.4.2.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.1.4.3 Analyst View

- 5.2.1.4.1 Company Overview

- 5.2.1.5 Hyundai Motor Group

- 5.2.1.5.1 Company Overview

- 5.2.1.5.1.1 Role of Hyundai Motor Group in the In-Vehicle Payments Market

- 5.2.1.5.1.2 Product Portfolio

- 5.2.1.5.1.3 R&D Analysis

- 5.2.1.5.2 Business Strategies

- 5.2.1.5.2.1 Product Development

- 5.2.1.5.2.2 Market Development

- 5.2.1.5.3 Corporate Strategies

- 5.2.1.5.3.1 Mergers and Acquisitions

- 5.2.1.5.3.2 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.1.5.4 Analyst View

- 5.2.1.5.1 Company Overview

- 5.2.1.6 Jaguar Land Rover Automotive plc

- 5.2.1.6.1 Company Overview

- 5.2.1.6.1.1 Role of Jaguar Land Rover Automotive plc in the In-Vehicle Payments Market

- 5.2.1.6.1.2 Product Portfolio

- 5.2.1.6.1.3 R&D Analysis

- 5.2.1.6.2 Corporate Strategies

- 5.2.1.6.2.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.1.6.3 Analyst View

- 5.2.1.6.1 Company Overview

- 5.2.1.7 Volkswagen AG

- 5.2.1.7.1 Company Overview

- 5.2.1.7.1.1 Role of Volkswagen AG in the In-Vehicle Payments Market

- 5.2.1.7.1.2 Product Portfolio

- 5.2.1.7.1.3 R&D Analysis

- 5.2.1.7.2 Business Strategies

- 5.2.1.7.2.1 Market Development

- 5.2.1.7.3 Corporate Strategies

- 5.2.1.7.3.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.1.7.4 Analyst View

- 5.2.1.7.1 Company Overview

- 5.2.1.1 BMW Group

- 5.2.2 Tier 2 Companies: Service Providers

- 5.2.2.1 Apple Inc.

- 5.2.2.1.1 Company Overview

- 5.2.2.1.1.1 Role of Apple Inc. in the In-Vehicle Payments Market

- 5.2.2.1.1.2 Product Portfolio

- 5.2.2.1.1.3 R&D Analysis

- 5.2.2.1.2 Business Strategies

- 5.2.2.1.2.1 Product Development

- 5.2.2.1.3 Corporate Strategies

- 5.2.2.1.3.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.2.1.4 Analyst View

- 5.2.2.1.1 Company Overview

- 5.2.2.2 HARMAN International

- 5.2.2.2.1 Company Overview

- 5.2.2.2.1.1 Role of HARMAN International in the In-Vehicle Payments Market

- 5.2.2.2.1.2 Product Portfolio

- 5.2.2.2.1.3 R&D Analysis

- 5.2.2.2.2 Business Strategies

- 5.2.2.2.2.1 Market Development

- 5.2.2.2.3 Corporate Strategies

- 5.2.2.2.3.1 Mergers and Acquisitions

- 5.2.2.2.3.2 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.2.2.4 Analyst View

- 5.2.2.2.1 Company Overview

- 5.2.2.3 International Business Machines (IBM)

- 5.2.2.3.1 Company Overview

- 5.2.2.3.1.1 Role of IBM in the In-Vehicle Payments Market

- 5.2.2.3.1.2 Product Portfolio

- 5.2.2.3.1.3 R&D Analysis

- 5.2.2.3.2 Business Strategies

- 5.2.2.3.2.1 Product Development

- 5.2.2.3.3 Corporate Strategies

- 5.2.2.3.3.1 Mergers and Acquisitions

- 5.2.2.3.3.2 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.2.3.4 Analyst View

- 5.2.2.3.1 Company Overview

- 5.2.2.4 Mastercard

- 5.2.2.4.1 Company Overview

- 5.2.2.4.1.1 Role of Mastercard in the In-Vehicle Payments Market

- 5.2.2.4.1.2 Product Portfolio

- 5.2.2.4.2 Corporate Strategies

- 5.2.2.4.2.1 Mergers and Acquisitions

- 5.2.2.4.2.2 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.2.4.3 Analyst View

- 5.2.2.4.1 Company Overview

- 5.2.2.5 P97 Networks

- 5.2.2.5.1 Company Overview

- 5.2.2.5.1.1 Role of P97 Networks in the In-Vehicle Payments Market

- 5.2.2.5.1.2 Product Portfolio

- 5.2.2.5.2 Business Strategies

- 5.2.2.5.2.1 Product Development

- 5.2.2.5.3 Corporate Strategies

- 5.2.2.5.3.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.2.5.4 Analyst View

- 5.2.2.5.1 Company Overview

- 5.2.2.6 Sheeva.AI

- 5.2.2.6.1 Company Overview

- 5.2.2.6.1.1 Role of Sheeva.AI in the In-Vehicle Payments Market

- 5.2.2.6.1.2 Product Portfolio

- 5.2.2.6.2 Business Strategies

- 5.2.2.6.2.1 Product Development

- 5.2.2.6.2.2 Market Development

- 5.2.2.6.3 Corporate Strategies

- 5.2.2.6.3.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.2.6.4 Analyst View

- 5.2.2.6.1 Company Overview

- 5.2.2.7 Shell plc

- 5.2.2.7.1 Company Overview

- 5.2.2.7.1.1 Role of Shell plc in the In-Vehicle Payments Market

- 5.2.2.7.1.2 Product Portfolio

- 5.2.2.7.1.3 R&D Analysis

- 5.2.2.7.2 Business Strategies

- 5.2.2.7.2.1 Market Development

- 5.2.2.7.3 Corporate Strategies

- 5.2.2.7.3.1 Mergers and Acquisitions

- 5.2.2.7.3.2 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.2.7.4 Analyst View

- 5.2.2.7.1 Company Overview

- 5.2.2.8 Sirius XM Holdings Inc.

- 5.2.2.8.1 Company Overview

- 5.2.2.8.1.1 Role of Sirius XM Holding Inc. in the In-Vehicle Payments Market

- 5.2.2.8.1.2 Product Portfolio

- 5.2.2.8.1.3 R&D Analysis

- 5.2.2.8.2 Corporate Strategies

- 5.2.2.8.2.1 Mergers and Acquisitions

- 5.2.2.8.3 Analyst View

- 5.2.2.8.1 Company Overview

- 5.2.2.9 Visa

- 5.2.2.9.1 Company Overview

- 5.2.2.9.1.1 Role of Visa in the In-Vehicle Payments Market

- 5.2.2.9.1.2 Product Portfolio

- 5.2.2.9.2 Corporate Strategies

- 5.2.2.9.2.1 Mergers and Acquisitions

- 5.2.2.9.2.2 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.2.2.9.3 Analyst View

- 5.2.2.9.1 Company Overview

- 5.2.2.1 Apple Inc.

- 5.2.3 List of Other Key Players

- 5.2.1 Tier 1 Companies: Automotive OEMs

- 5.3 Start-Up Profiles

- 5.3.1 Ramp

- 5.3.1.1 Company Overview

- 5.3.1.1.1 Role of Ramp in the In-Vehicle Payments Market

- 5.3.1.1 Company Overview

- 5.3.2 Brex

- 5.3.2.1 Company Overview

- 5.3.2.1.1 Role of Brex in the In-Vehicle Payments Market

- 5.3.2.1 Company Overview

- 5.3.3 Numadic Ltd.

- 5.3.3.1 Company Overview

- 5.3.3.1.1 Role of Numadic Ltd. in the In-Vehicle Payments Market

- 5.3.3.1 Company Overview

- 5.3.4 Lynk

- 5.3.4.1 Company Overview

- 5.3.4.1.1 Role of Lynx in the In-Vehicle Payments Market

- 5.3.4.1 Company Overview

- 5.3.5 Paymentology

- 5.3.5.1 Company Overview

- 5.3.5.1.1 Role of Paymentology in the In-Vehicle Payments Market

- 5.3.5.1 Company Overview

- 5.3.1 Ramp

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast

- 6.2.1 Factors for Data Prediction and Modeling