|

|

市場調査レポート

商品コード

1092310

デジタルバイオマニュファクチャリング市場 - 世界全体・地域別:分析と予測 (2022年~2031年)Digital Biomanufacturing Market - A Global and Regional Analysis: Analysis and Forecast, 2022-2031 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| デジタルバイオマニュファクチャリング市場 - 世界全体・地域別:分析と予測 (2022年~2031年) |

|

出版日: 2022年06月20日

発行: BIS Research

ページ情報: 英文 203 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のデジタルバイオマニュファクチャリングの市場規模は、2021年に157億6,890万米ドル、2031年末までに555億6,490万米ドルに達する見通しです。

また、予測期間中 (2022年~2031年) に13.12%のCAGRで成長すると予測されています。

当レポートでは、世界のデジタルバイオマニュファクチャリング市場について分析し、市場の基本構造や規制体制、新型コロナウイルス感染症 (COVID-19) の影響、主な市場促進・抑制要因や成長機会、用途別・エンドユーザー別・技術別および地域別の市場規模の動向見通し、主要企業/新興企業のプロファイルと主要戦略、といった情報を取りまとめてお届けいたします。

当レポートの分析対象企業:

Atos SE、Agilent Technologies Inc、Danaher Corporation、Donaldson Company, Inc、Emerson Electric Co.、General Electric Company、Honeywell International Inc、SAP SE、Siemens Healthineers AG、Bota Biosciences、Culture Biosciences、e-matica srl、 Exponential Genomics, Inc、FabricNano、OVO Biomanufacturing、Symphony Innovation, LLC、Synthony Innovation、LLC

目次

第1章 市場

- 市場の見通し

- 業界の見通し

- デジタルバイオマニュファクチャリングの新たな傾向

- デジタルバイオマニュファクチャリングの普及における重大な課題

- 特許分析

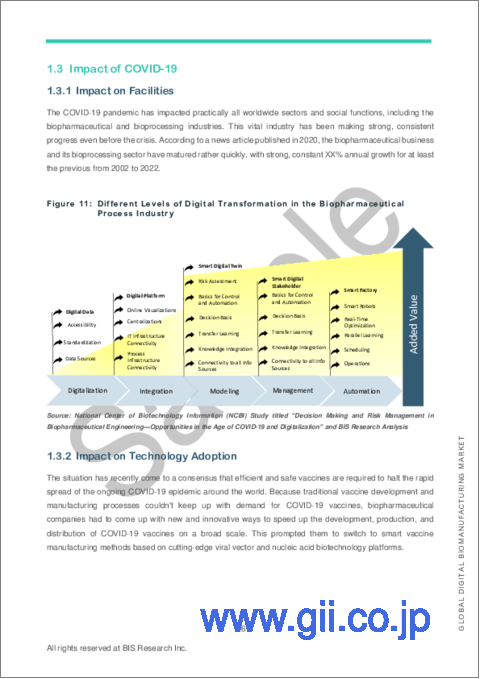

- 新型コロナウイルス感染症 (COVID-19) の影響

- 施設への影響

- 技術導入への影響

- 市場規模への影響

- 事業動向

- 影響分析

- 事業促進要因

- 事業抑制要因

- 事業機会

第2章 世界のデジタルバイオマニュファクチャリング市場:用途別

- 市場機会の評価

- 成長率・市場シェアのマトリックス

- バイオマニュファクチャリングプロセスの自動化と制御

- バイオプロセスの最適化とプロセス分析

- フレキシブル生産

第3章 世界のデジタルバイオマニュファクチャリング市場:エンドユーザー別

- 市場機会の評価

- 成長率・市場シェアのマトリックス

- バイオ医薬品企業

- 教育・研究機関

第4章 世界のデジタルバイオマニュファクチャリング市場:技術別

- 市場機会の評価

- 成長率・市場シェアのマトリックス

- 人工知能 (AI)・IoMT (医療用IoT) ソリューション

- プロセス分析技術

- データ分析ソフトウェア

- 予測分析とデジタルツイン技術

- その他

第5章 地域

- 北米のデジタルバイオマニュファクチャリング市場

- 規制の枠組み

- 市場機会の評価

- 市場力学

- 市場規模とその予測

- 国別分析

- 欧州のデジタルバイオマニュファクチャリング市場

- アジア太平洋のデジタルバイオマニュファクチャリング市場

- 他の国々 (RoW) のデジタルバイオマニュファクチャリング市場

第6章 市場・競合ベンチマーキングと企業プロファイル

- 競合情勢

- 主な戦略と動向

- 企業プロファイル

- 既存企業

- 新興企業

List of Figures

- Figure 1: Global Digital Biomanufacturing Market, Impact Analysis

- Figure 2: Global Digital Biomanufacturing Market Potential, $Million, 2020, 2024, 2027, and 2031

- Figure 3: Global Digital Biomanufacturing Market (by Technology)

- Figure 4: Global Digital Biomanufacturing Market (by End User)

- Figure 5: Global Digital Biomanufacturing Market, Key Developments, January 2017-March 2022

- Figure 6: Global Digital Biomanufacturing Market Growth-Share Matrix, 2021-2031

- Figure 7: Global Digital Biomanufacturing Market Segmentation

- Figure 8: Global Digital Biomanufacturing Market, Research Methodology

- Figure 9: Primary Research

- Figure 10: Secondary Research

- Figure 11: Data Triangulation

- Figure 12: Assumptions and Limitations

- Figure 13: Global Digital Biomanufacturing Market, Realistic Growth Scenario, $Million, 2020-2031

- Figure 14: Global Digital biomanufacturing Market, Optimistic Growth Scenario, $Million, 2020-2031

- Figure 15: Global Digital biomanufacturing Market, Pessimistic Growth Scenario, $Million, 2020-2031

- Figure 16: Global Digital Biomanufacturing Market, Patent Publication Growth Trend, January 2018-December 2021

- Figure 17: Global Digital Biomanufacturing Market, Patent Filing Trend (by Country/Cluster), January 2018-December 2021

- Figure 18: Different Levels of Digital Transformation in the Biopharmaceutical Process Industry

- Figure 19: Building an Integrative Approach to Biomanufacturing Across Vaccines and CGTs

- Figure 20: Global Digital Biomanufacturing Market, Pre-COVID-19 Scenario, $Million, 2019-2031

- Figure 21: Global Digital Biomanufacturing Market, Impact Analysis

- Figure 22: In Silico Design for Experimental Planning for Smart Biomanufacturing

- Figure 23: Global Digital Biomanufacturing Market (by Application)

- Figure 24: Global Digital Biomanufacturing Market Incremental Opportunity (by Application), $Million, 2022-2031

- Figure 25: Global Digital Biomanufacturing Market, Growth-Share Matrix (by Application), 2021-2031

- Figure 26: Global Digital Biomanufacturing Market (by Biomanufacturing Process Automation and Control), $Million, 2020-2031

- Figure 27: Global Digital Biomanufacturing Market (by Bioprocess Optimization and Process Analytics), $Million, 2020-2031

- Figure 28: Global Digital Biomanufacturing Market (by Flexible Manufacturing), $Million, 2020-2031

- Figure 29: Global Digital Biomanufacturing Market (by End User)

- Figure 30: Global Digital Biomanufacturing Market Incremental Opportunity (by End User), $Million, 2021-2031

- Figure 31: Global Digital Biomanufacturing Market, Growth-Share Matrix (by End User), 2020-2031

- Figure 32: Global Digital Biomanufacturing Market (by Biopharmaceutical Companies), $Million, 2020-2031

- Figure 33: Global Digital Biomanufacturing Market (by Academic and Research Institutes), $Million, 2020-2031

- Figure 34: Global Digital Biomanufacturing Market (by Technology)

- Figure 35: Global Digital Biomanufacturing Market Incremental Opportunity (by Technology Type), $Million, 2022-2031

- Figure 36: Global Digital Biomanufacturing Market, Growth-Share Matrix (by Technology Type), 2021-2031

- Figure 37: Quality by Design: Data-Driven Approach

- Figure 38: Global Digital Biomanufacturing Market (by AI and IoMT Solutions), $Million, 2020-2031

- Figure 39: Knowledge Pyramid for Model-Based Decision Making

- Figure 40: Global Digital Biomanufacturing Market (by Process Analytical Technology), $Million, 2020-2031

- Figure 41: Workflow: Implementing Digital Biomanufacturing in Process Development

- Figure 42: Global Digital Biomanufacturing Market (by Data Analytics Software), $Million, 2020-2031

- Figure 43: Predictive Analytics: The Industrial Perspective

- Figure 44: Global Digital Biomanufacturing Market (by Predictive Analytics and Digital Twin Technologies), $Million, 2020-2031

- Figure 45: Global Digital Biomanufacturing Market (by Others), $Million, 2020-2031

- Figure 46: North America Digital Biomanufacturing Market Incremental Growth Opportunity, $Million, 2021-2031

- Figure 47: North America Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 48: North America Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 49: North America Digital Biomanufacturing Market (by End User), $Million, 2021-2031

- Figure 50: North America Digital Biomanufacturing Market (by Technology), $Million, 2001-2031

- Figure 51: North America Digital Biomanufacturing Market Share (by Country), $Million, 2021 and 2031

- Figure 52: U.S. Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 53: U.S. Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 54: U.S. Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 55: Canada Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 56: Canada Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 57: Canada Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 58: Europe Digital Biomanufacturing Market Incremental Growth Opportunity (by Country), $Million, 2022-2031

- Figure 59: Europe Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 60: Europe Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 61: Europe Digital Biomanufacturing Market (by End User), $Million, 2021-2031

- Figure 62: Europe Digital Biomanufacturing Market (by Technology), $Million, 2021-2031

- Figure 63: Germany Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 64: Germany Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 65: Germany Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 66: France Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 67: France Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 68: France Digital Biomanufacturing Market (by End User), $Million, 2021-2031

- Figure 69: Italy Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 70: Italy Digital Biomanufacturing Market (by Application), $Million, 2021-2031

- Figure 71: Italy Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 72: Spain Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 73: Spain Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 74: Spain Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 75: U.K. Digital Biomanufacturing Market, $Million, 2021-2031

- Figure 76: U.K. Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 77: U.K. Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 78: Rest-of-Europe Digital Biomanufacturing Market, $Million, 2021-2031

- Figure 79: Rest-of-Europe Digital Biomanufacturing Market (by Application), $Million, 2021-2031

- Figure 80: Rest-of-Europe Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 81: Asia Pacific Digital Biomanufacturing Market Incremental Growth Opportunity (by Country), $Million, 2021-2031

- Figure 82: Asia-Pacific Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 83: Asia-Pacific Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 84: Asia-Pacific Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 85: Asia-Pacific Digital Biomanufacturing Market (by Technology), $Million, 2020-2031

- Figure 86: Japan Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 87: Japan Digital Biomanufacturing Market (by Application), $Million, 2021-2031

- Figure 88: Japan Digital Biomanufacturing Market (by End User), $Million, 2021-2031

- Figure 89: China Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 90: China Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 91: China Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 92: India Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 93: India Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 94: India Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 95: South Korea Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 96: South Korea Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 97: South Korea Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 98: Australia and New Zealand Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 99: Australia and New Zealand Digital Biomanufacturing Market (by Application), $Million, 2021-2031

- Figure 100: Australia and New Zealand Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 101: Rest-of-Asia-Pacific Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 102: Rest-of-Asia-Pacific Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 103: Rest-of-Asia-Pacific Digital Biomanufacturing Market (by End User), $Million, 2021-2031

- Figure 104: Rest-of-the-World Digital Biomanufacturing Market Incremental Growth Opportunity (by Country), $Million, 2022-2031

- Figure 105: Rest-of-the-World Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 106: Rest-of-the-World Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 107: Rest-of-the-World Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 108: Rest-of-the-World Digital Biomanufacturing Market (by Technology), $Million, 2020-2031

- Figure 109: Latin America Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 110: Latin America Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 111: Latin America Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 112: Middle East Africa Digital Biomanufacturing Market, $Million, 2020-2031

- Figure 113: Middle East Africa Digital Biomanufacturing Market (by Application), $Million, 2020-2031

- Figure 114: Middle East Africa Digital Biomanufacturing Market (by End User), $Million, 2020-2031

- Figure 115: Global Digital Biomanufacturing Market, Key Developments, January 2017-March 2022

- Figure 116: Partnerships, Alliances, and Business Expansions Share (by Company), January 2017-March 2022

- Figure 117: Funding Activities (by Company), January 2017-March 2022

- Figure 118: New Product Offerings and Upgradations Share (by Company), January 2017-March 2022

- Figure 119: Mergers and Acquisitions (by Company), January 2017-March 2022

- Figure 120: Atos SE: Product Offerings

- Figure 121: Atos SE: Overall Financials, $Million, 2019-2021

- Figure 122: Atos SE: Net Revenue (by Segment), $Million, 2019-2021

- Figure 123: Atos SE: Net Revenue (by Region), $Million, 2019-2021

- Figure 124: Agilent Technologies Inc.: Product Offerings

- Figure 125: Agilent Technologies Inc.: Overall Financials, $Million, 2019-2021

- Figure 126: Agilent Technologies Inc.: Net Revenue (by Segment), $Million, 2019-2021

- Figure 127: Agilent Technologies Inc.: Net Revenue (by Region), $Million, 2019-2021

- Figure 128: Agilent Technologies Inc.: R&D Expenditure, $Million, 2019-2021

- Figure 129: Danaher Corporation: Product Offerings

- Figure 130: Danaher Corporation: Overall Financials, $Million, 2019-2021

- Figure 131: Danaher Corporation: Net Revenue (by Segment), $Million, 2019-2021

- Figure 132: Danaher Corporation: Net Revenue (by Region), $Million, 2019-2021

- Figure 133: Danaher Corporation: R&D Expenditure, $Million, 2019-2021

- Figure 134: Donaldson Company, Inc.: Product Offerings

- Figure 135: Donaldson Company, Inc.: Overall Financials, $Million, 2019-2021

- Figure 136: Donaldson Company, Inc.: Net Revenue (by Segment), $Million, 2019-2021

- Figure 137: Donaldson Company, Inc.: Net Revenue (by Region), $Million, 2019-2021

- Figure 138: Donaldson Company, Inc.: R&D Expenditure, $Million, 2019-2021

- Figure 139: Emerson Electric Co.: Product Offerings

- Figure 140: EMERSON ELECTRIC CO.: Overall Financials, $Million, 2019-2021

- Figure 141: EMERSON ELECTRIC CO.: Net Revenue (by Segment), $Million, 2019-2021

- Figure 142: EMERSON ELECTRIC CO.: Net Revenue (by Region), $Million, 2019-2021

- Figure 143: EMERSON ELECTRIC CO.: R&D Expenditure, $Million, 2019-2021

- Figure 144: General Electric Company: Product Portfolio

- Figure 145: General Electric Company.: Overall Financials, $Million, 2019-2021

- Figure 146: General Electric Company: Net Revenue (by Segment), $Million, 2019-2021

- Figure 147: General Electric Company: Net Revenue (by Region), $Million, 2019-2021

- Figure 148: General Electric Company: R&D Expenditure, $Million, 2019-2021

- Figure 149: Honeywell International Inc.: Product Portfolio

- Figure 150: Honeywell International Inc.: Overall Financials, 2019-2021

- Figure 151: Honeywell International Inc.: Net Revenue (by Segment), $Million, 2019-2021

- Figure 152: Honeywell International Inc.: R&D Expenditure, $Million, 2019-2021

- Figure 153: SAP SE: Product Offerings

- Figure 154: SAP SE: Overall Financials, $Million, 2019-2021

- Figure 155: SAP SE: Net Revenue (by Segment), $Million, 2019-2021

- Figure 156: SAP SE: Net Revenue (by Region), $Million, 2019-2021

- Figure 157: SAP SE: R&D Expenditure, $Million, 2019-2021

- Figure 158: Siemens Healthineers AG: Product Offerings

- Figure 159: Siemens Healthineers AG: Overall Financials, $Million, 2019-2021

- Figure 160: Siemens Healthineers AG: Net Revenue (by Segment), $Million, 2019-2021

- Figure 161: Siemens Healthineers AG: Net Revenue (by Region), $Million, 2019-2021

- Figure 162: Siemens Healthineers AG: R&D Expenditure, $Million, 2019-2021

- Figure 163: Bota Biosciences: Product Portfolio

- Figure 164: Culture Biosciences: Product Portfolio

- Figure 165: e-matica srl: Product Portfolio

- Figure 166: Exponential Genomics, Inc. (Xenomics): Product Portfolio

- Figure 167: FabricNano: Product Portfolio

- Figure 168: OVO Biomanufacturing: Product Portfolio

- Figure 169: Symphony Innovation, LLC: Product Portfolio

List of Tables

- Table 1: Global Digital Biomanufacturing Market, Challenges

- Table 2: North America Digital Biomanufacturing Market, Regulatory Framework

- Table 3: North America Digital Biomanufacturing Market, Impact Analysis

- Table 4: Europe Digital Biomanufacturing Market Regulatory Framework

- Table 5: Europe Digital Biomanufacturing Market, Impact Analysis

- Table 6: Asia-Pacific Digital Biomanufacturing Market, Regulatory Framework

- Table 7: Asia-Pacific Digital Biomanufacturing Market, Impact Analysis

- Table 8: Rest-of-the-World Digital Biomanufacturing Market, Regulatory Framework

- Table 9: Rest-of-the-World Digital Biomanufacturing Market, Impact Analysis

“Global Digital Biomanufacturing Market to Reach $55,564.9 Million by 2031.”

Market Report Coverage - Digital Biomanufacturing

Market Segmentation

- By Technology Type - Process Analytical Technologies, Data Analytics Software, AI and IoMT Solutions, Predictive Analytics and Digital Twin Technologies and Others

- By End-User - Biopharmaceutical Companies and Academic and Research Institutes

- By Application - Bioprocess Optimization and Process Analytics, Biomanufacturing Process Automation and Control and Flexible Manufacturing

- By Region - North America, Europe, Asia-Pacific and Rest-of-the-World

Regional Segmentation

- North America - U.S. and Canada

- Europe - Germany, U.K., Spain, Italy, France, and Rest-of-Europe

- Asia-Pacific - Japan, China, South Korea, India, Australia and New Zealand, and Rest-of-Asia-Pacific

- Rest-of-the-World- Latin America and Middle East and Africa

Market Growth Drivers

- Rising Automation Process in Various Industries

- Rising Focus on Process Efficiency and Flexibility in Manufacturing

- Shift Toward Digitalization and Biomanufacturing in the Healthcare Industry

Market Challenges

- Lack of Technology Adoption and Awareness Leading to Low Return-of-Investments

- Lack of Data Security in Biomanufacturing Settings

Market Opportunities

- Increased Demand for Biologics

Key Companies Profiled

Atos SE, Agilent Technologies Inc., Danaher Corporation, Donaldson Company, Inc., Emerson Electric Co., General Electric Company, Honeywell International Inc., SAP SE, Siemens Healthineers AG, Bota Biosciences, Culture Biosciences, e-matica srl, Exponential Genomics, Inc., FabricNano, OVO Biomanufacturing, Symphony Innovation, LLC.

How This Report Can Add Value

Assuming that the reader is a developer of digital biomanufacturing technologies, they will be able to do the following:

- Understand their position as compared to some of the key players in the market

- Stay updated with novel technology integration, features, and the latest developments in the market

- Understand the impact of COVID-19 on the adoption of digital biomanufacturing technologies and the entry barriers as a result of it

- Gain insights into which regions to target globally

- Gain insights into the end-user perception concerning the adoption of digital biomanufacturing technologies

- Identify some of the key players in the market and understand their valuable contribution

Key Questions Answered in the Global Digital Biomanufacturing Market Report

- How has COVID-19 impacted the growth of the global digital biomanufacturing market?

- What are the key regulations governing the digital biomanufacturing market in key regions?

- What technological developments are projected to have the maximum influence on the global digital biomanufacturing market?

- Who are the leading players holding significant dominance in the global digital biomanufacturing market?

- What are some of the growth opportunities which market players can capitalize on?

- What are the drivers and restraints for the global digital biomanufacturing market?

- Which region has the highest growth rate in the digital biomanufacturing market?

- Which are the fastest growing countries in terms of the global digital biomanufacturing market?

- What are the key strategies being adopted by market players in the global digital biomanufacturing market?

- Which are the emerging technologies in the global digital biomanufacturing market?

Digital Biomanufacturing Market Industry Overview

The global digital biomanufacturing market is a huge market comprised of various software and platforms that include process analytical technologies, data analytics software, ai and IoMT solutions, predictive analytics and digital twin technologies, and others. If application is involved, we have bioprocess optimization and process analytics, biomanufacturing process automation and control, and flexible manufacturing.

The global digital biomanufacturing market report highlights that the market was valued at $15,768.9 million in 2021 and is expected to reach $55,564.9 million by the end of 2031. The market is expected to grow at a CAGR of 13.12% during the forecast period from 2022 to 2031.

Global Digital Biomanufacturing Market Drivers

Smart factories have the potential to improve sustainability by allowing for real-time production monitoring, with automated control systems reducing the number of failed batches and lowering maintenance costs. Thus, biomanufacturing businesses' ability to autonomously and appropriately control bioprocesses in their optimal condition is critical, as this aids in lowering or maintaining production costs and increasing yields while maintaining product quality uniformity. This will help driving the market.

In today's bio-manufacturing firms, digitalization in the form of Big Data and Digital Twin-inspired applications are hot themes. As a result, many companies are allocating staff and equipment to these applications. In order to evaluate the existing situation and projected future difficulties in integrating digitalization principles in biotech production processes, a targeted survey was performed among individuals from the Danish biotech industry.

Global Digital Biomanufacturing Market Challenges

The factors restraining the market growth of digital biomanufacturing market include the lack of technology adoption and awareness leading to low return on investment. ROI calculations allow a business to establish and use measures for project appraisal that can be used consistently across a portfolio and go beyond simple profitability analyses.

Multiple stakeholders, including industry, governments, and healthcare providers, must pay attention to cybersecurity in order to provide safe and effective biopharmaceuticals. Breach of cyberbio security could have a direct impact on patients, ranging from compromising data privacy to production disruptions jeopardizing worldwide pandemic response. In today's economy, when advanced manufacturing technology and digital strategies are becoming the standard, maintaining cybersecurity is a key concern.

Global Digital Biomanufacturing Market Opportunities

The opportunity for growth of the global Digital Biomanufacturing market lies in the opportunity to the increased demand for biologics. It is desirable to develop an alternative manufacturing technique that relies less on human labour and transitioning steps between unit activities require a smaller facility footprint and is more open to scalability, automation, and adaption across diverse drug modalities.

Impact of COVID-19 on the Global Digital Biomanufacturing Market.

The COVID-19 pandemic had thrusted the global Digital Biomanufacturing market. The impact of the pandemic global Digital Biomanufacturing market has brought in a positive impact to the market. One of the major impacts of COVID-19 on the global digital biomanufacturing was understanding the importance of automation and innovation of new technologies.

Market Segmentation

Global Digital Biomanufacturing Market (by Technology)

The global Digital Biomanufacturing market has been segmented based on the technology type into eight different segments, namely, process analytical technologies, data analytics software, AI and IoMT solutions, predictive analytics and digital twin technologies, and others.

Global Digital Biomanufacturing Market (by End-User)

The global Digital Biomanufacturing market has been segmented based on the end-users into two major segments, namely, biopharmaceutical companies and academic and research institutes.

biopharmaceutical companies account for the major share in the global digital biomanufacturing market.

Global Digital Biomanufacturing Market (by Application)

The global digital biomanufacturing market has been segmented based on product type into two major segments, namely, bioprocess optimization and process analytics, biomanufacturing process automation and control, and flexible manufacturing.

Global Digital Biomanufacturing Market (by Region)

The different regions covered under the global digital biomanufacturing market include North America, Europe, Asia-Pacific and Rest-of-the-World.

North America and Europe are two of the largest markets for digital biomanufacturing market while developing countries are expected to register strong growth in their adoption shortly.

Key Market Players and Competition Synopsis

Some of the key players operating in the market include: Atos SE, Agilent Technologies Inc., Danaher Corporation, Donaldson Company, Inc., Emerson Electric Co., General Electric Company, Honeywell International Inc., SAP SE, Siemens Healthineers AG, Bota Biosciences, Culture Biosciences, e-matica srl, Exponential Genomics, Inc., FabricNano, OVO Biomanufacturing, and Symphony Innovation, LLC

In the past few years, the global digital biomanufacturing market has witnessed several strategic and technological developments undertaken by the different market players to attain their respective market shares in this emerging domain. Some of the strategies covered in this segment are funding activities, mergers and acquisitions (M&A), partnerships, alliances, business expansions, regulatory and legal activities, and new offerings. The preferred strategy for companies has been new offerings of products followed by partnerships, alliances, and business expansions.

Table of Contents

1 Market

- 1.1 Market Outlook

- 1.1.1 Product Definition

- 1.1.1.1 Biomanufacturing 4.0

- 1.1.1.2 Digital Biomanufacturing Software

- 1.1.2 Inclusion and Exclusion Criteria

- 1.1.3 Global Market Scenario

- 1.1.3.1 Realistic Growth Scenario

- 1.1.3.2 Optimistic Growth Scenario

- 1.1.3.3 Pessimistic/Conservative Growth Scenario

- 1.1.1 Product Definition

- 1.2 Industry Outlook

- 1.2.1 Emerging Trends in Digital Biomanufacturing

- 1.2.2 Critical Issues in Adopting Digital Biomanufacturing

- 1.2.2.1 Not So Strong Change Management Strategy

- 1.2.2.2 Complexity in Software and Technology

- 1.2.2.3 Adoption of Modernized Tools and Processes

- 1.2.2.4 Evolution According to Customer Needs

- 1.2.2.5 Dearth of Strategy in Digital Transformation

- 1.2.2.6 Lack of Skilled Professionals

- 1.2.2.7 Culture Mindset

- 1.2.3 Patent Analysis

- 1.2.3.1 Patent Publication Growth Trend

- 1.2.3.2 Patent Analysis by Country/Cluster

- 1.3 Impact of COVID-19

- 1.3.1 Impact on Facilities

- 1.3.2 Impact on Technology Adoption

- 1.3.3 Impact on Market Size

- 1.3.3.1 Pre-COVID-19 Phase

- 1.3.3.2 During COVID-19 Phase

- 1.3.3.3 Post-COVID-19 Phase

- 1.4 Business Dynamics

- 1.4.1 Impact Analysis

- 1.4.2 Business Drivers

- 1.4.2.1 Rising Automation Process in Various Industries

- 1.4.2.2 Rising Focus on Process Efficiency and Flexibility in Manufacturing

- 1.4.2.3 Shift Toward Digitalization and Biomanufacturing in the Healthcare Industry

- 1.4.3 Business Restraints

- 1.4.3.1 Lack of Technology Adoption and Awareness Leading to Low Return-of-Investments

- 1.4.3.2 Lack of Data Security in Biomanufacturing Settings

- 1.4.4 Business Opportunities

- 1.4.4.1 Increased Demand for Biologics

2 Global Digital Biomanufacturing Market by Application

- 2.1 Opportunity Assessment

- 2.2 Growth-Share Matrix

- 2.3 Biomanufacturing Process Automation and Control

- 2.4 Bioprocess Optimization and Process Analytics

- 2.5 Flexible Manufacturing

3 Global Digital Biomanufacturing Market by End User

- 3.1 Opportunity Assessment

- 3.2 Growth-Share Matrix

- 3.3 Biopharmaceutical Companies

- 3.4 Academic and Research Institutes

4 Global Digital Biomanufacturing Market by Technology

- 4.1 Opportunity Assessment

- 4.2 Growth-Share Matrix

- 4.3 AI and IoMT Solutions

- 4.4 Process Analytical Technologies

- 4.5 Data Analytics Software

- 4.6 Predictive Analytics and Digital Twin Technologies

- 4.7 Others

5 Region

- 5.1 North America Digital Biomanufacturing Market

- 5.1.1 Regulatory Framework

- 5.1.2 Opportunity Assessment

- 5.1.3 Market Dynamics

- 5.1.3.1 Impact Analysis

- 5.1.3.2 Business Drivers

- 5.1.3.3 Business Restraints

- 5.1.4 Market Sizing and Forecast

- 5.1.4.1 North America Digital Biomanufacturing Market (by Application)

- 5.1.4.2 North America Digital Biomanufacturing Market (by End User)

- 5.1.4.3 North America Digital Biomanufacturing Market (by Technology)

- 5.1.5 North America Digital Biomanufacturing Market (by Country)

- 5.1.5.1 U.S.

- 5.1.5.1.1 Market Dynamics

- 5.1.5.1.2 Sizing and Forecast

- 5.1.5.1.2.1 U.S. Digital Biomanufacturing Market (by Application)

- 5.1.5.1.2.2 U.S. Digital Biomanufacturing Market (by End User)

- 5.1.5.2 Canada

- 5.1.5.2.1 Market Dynamics

- 5.1.5.2.2 Sizing and Forecast

- 5.1.5.2.2.1 Canada Digital Biomanufacturing Market (by Application)

- 5.1.5.2.2.2 Canada Digital Biomanufacturing Market (by End User)

- 5.1.5.1 U.S.

- 5.2 Europe Digital Biomanufacturing Market

- 5.2.1 Regulatory Framework

- 5.2.2 Opportunity Assessment

- 5.2.3 Market Dynamics

- 5.2.3.1 Impact Analysis

- 5.2.3.2 Business Drivers

- 5.2.3.3 Business Restraint

- 5.2.4 Market Sizing and Forecast

- 5.2.4.1 Europe Digital Biomanufacturing Market (by Application)

- 5.2.4.2 Europe Digital Biomanufacturing Market (by End User)

- 5.2.4.3 Europe Digital Biomanufacturing Market (by Technology)

- 5.2.5 Europe Digital Biomanufacturing Market (by Country)

- 5.2.5.1 Germany

- 5.2.5.1.1 Market Dynamics

- 5.2.5.1.2 Market Sizing and Forecast

- 5.2.5.1.2.1 Germany Digital Biomanufacturing Market (by Application)

- 5.2.5.1.2.2 Germany Digital Biomanufacturing Market (by End User)

- 5.2.5.2 France

- 5.2.5.2.1 Market Dynamics

- 5.2.5.2.2 Market Sizing and Forecast

- 5.2.5.2.2.1 France Digital Biomanufacturing Market (by Application)

- 5.2.5.2.2.2 France Digital Biomanufacturing Market (by End User)

- 5.2.5.3 Italy

- 5.2.5.3.1 Market Dynamics

- 5.2.5.3.2 Market Sizing and Forecast

- 5.2.5.3.2.1 Italy Digital Biomanufacturing Market (by Application)

- 5.2.5.3.2.2 Italy Digital Biomanufacturing Market (by End User)

- 5.2.5.4 Spain

- 5.2.5.4.1 Market Dynamics

- 5.2.5.4.2 Market Sizing and Forecast

- 5.2.5.4.2.1 Spain Digital Biomanufacturing Market (by Application)

- 5.2.5.4.2.2 Spain Digital Biomanufacturing Market (by End User)

- 5.2.5.5 U.K.

- 5.2.5.5.1 Market Dynamics

- 5.2.5.5.2 Market Sizing and Forecast

- 5.2.5.5.2.1 U.K. Digital Biomanufacturing Market (by Application)

- 5.2.5.5.2.2 U.K. Digital Biomanufacturing Market (by End User)

- 5.2.5.6 Rest-of-Europe

- 5.2.5.6.1 Market Dynamics

- 5.2.5.6.2 Market Sizing and Forecast

- 5.2.5.6.2.1 Rest-of-Europe Digital Biomanufacturing Market (by Application)

- 5.2.5.6.2.2 Rest-of-Europe Digital Biomanufacturing Market (by End User)

- 5.2.5.1 Germany

- 5.3 Asia-Pacific Digital Biomanufacturing Market

- 5.3.1 Regulatory Framework

- 5.3.2 Opportunity Assessment

- 5.3.3 Market Dynamics

- 5.3.3.1 Impact Analysis

- 5.3.3.2 Business Driver

- 5.3.3.3 Business Restraint

- 5.3.4 Market Sizing and Forecast

- 5.3.4.1 Asia-Pacific Digital Biomanufacturing Market (by Application)

- 5.3.4.2 Asia-Pacific Digital Biomanufacturing Market (by End User)

- 5.3.4.3 Asia-Pacific Digital Biomanufacturing Market (by Technology)

- 5.3.5 Asia-Pacific Digital Biomanufacturing Market (by Country)

- 5.3.5.1 Japan

- 5.3.5.1.1 Market Dynamics

- 5.3.5.1.2 Market Sizing and Forecast

- 5.3.5.1.2.1 Japan Digital Biomanufacturing Market (by Application)

- 5.3.5.1.2.2 Japan Digital Biomanufacturing Market (by End User)

- 5.3.5.2 China

- 5.3.5.2.1 Market Dynamics

- 5.3.5.2.2 Market Sizing and Forecast

- 5.3.5.2.2.1 China Digital Biomanufacturing Market (by Application)

- 5.3.5.2.2.2 China Digital Biomanufacturing Market (by End User)

- 5.3.5.3 India

- 5.3.5.3.1 Market Dynamics

- 5.3.5.3.2 Market Sizing and Forecast

- 5.3.5.3.2.1 India Digital Biomanufacturing Market (by Application)

- 5.3.5.3.2.2 India Digital Biomanufacturing Market (by End User)

- 5.3.5.4 South Korea

- 5.3.5.4.1 Market Dynamics

- 5.3.5.4.2 Market Sizing and Forecast

- 5.3.5.4.2.1 South Korea Digital Biomanufacturing Market (by Application)

- 5.3.5.4.2.2 South Korea Digital Biomanufacturing Market (by End User)

- 5.3.5.5 Australia and New Zealand

- 5.3.5.5.1 Market Dynamics

- 5.3.5.5.2 Market Sizing and Forecast

- 5.3.5.5.2.1 Australia and New Zealand Digital Biomanufacturing Market (by Application)

- 5.3.5.5.2.2 Australia and New Zealand Digital Biomanufacturing Market (by End User)

- 5.3.5.6 Rest-of-Asia-Pacific

- 5.3.5.6.1 Market Dynamics

- 5.3.5.6.2 Market Sizing and Forecast

- 5.3.5.6.2.1 Rest-of-Asia Pacific Digital Biomanufacturing Market (by Application)

- 5.3.5.6.2.2 Rest-of-Asia-Pacific Digital Biomanufacturing Market (by End User)

- 5.3.5.1 Japan

- 5.4 Rest-of-the-World Digital Biomanufacturing Market

- 5.4.1 Regulatory Framework

- 5.4.2 Opportunity Assessment

- 5.4.3 Market Dynamics

- 5.4.3.1 Impact Analysis

- 5.4.3.2 Business Driver

- 5.4.3.3 Business Restraint

- 5.4.4 Market Sizing and Forecast

- 5.4.4.1 Rest-of-the-World Digital Biomanufacturing Market (by Application)

- 5.4.4.2 Rest-of-the-World Digital Biomanufacturing Market (by End User)

- 5.4.4.3 Rest-of-the-World Digital Biomanufacturing Market (by Technology)

- 5.4.5 Rest-of-the-World Digital Biomanufacturing Market (by Country)

- 5.4.5.1 Latin America

- 5.4.5.1.1 Market Dynamics

- 5.4.5.1.2 Market Sizing and Forecast

- 5.4.5.1.2.1 Latin America Digital Biomanufacturing Market (by Application)

- 5.4.5.1.2.2 Latin America Digital Biomanufacturing Market (by End User)

- 5.4.5.2 Middle East Africa

- 5.4.5.2.1 Market Dynamics

- 5.4.5.2.2 Market Sizing and Forecast

- 5.4.5.2.2.1 Middle East Africa Digital Biomanufacturing Market (by Application)

- 5.4.5.2.2.2 Middle East Africa Digital Biomanufacturing Market (by End User)

- 5.4.5.1 Latin America

6 Market - Competitive Benchmarking & Company Profiles

- 6.1 Competitive Landscape

- 6.1.1 Key Strategies and Developments

- 6.1.1.1 Partnerships, Alliances, and Business Expansions

- 6.1.1.2 Funding Activities

- 6.1.1.3 New Offerings and Upgradations

- 6.1.1.4 Mergers and Acquisitions

- 6.1.1.5 Regulatory and Legal Activities

- 6.1.1 Key Strategies and Developments

- 6.2 Company Profiles

- 6.2.1 Established Companies

- 6.2.1.1 Atos SE

- 6.2.1.1.1 Company Overview

- 6.2.1.1.2 Role of Atos SE in the Global Digital Biomanufacturing Market

- 6.2.1.1.3 Financials

- 6.2.1.1.4 Recent Developments

- 6.2.1.1.5 Target Customers

- 6.2.1.1.6 Analyst Perspectives

- 6.2.1.2 Agilent Technologies Inc.

- 6.2.1.2.1 Company Overview

- 6.2.1.2.2 Role of Agilent Technologies Inc. in the Global Digital Biomanufacturing Market

- 6.2.1.2.3 Financials

- 6.2.1.2.4 Recent Developments

- 6.2.1.2.5 Target Customers

- 6.2.1.2.6 Analyst Perspectives

- 6.2.1.3 Danaher Corporation

- 6.2.1.3.1 Company Overview

- 6.2.1.3.2 Role of Danaher Corporation in the Global Digital Biomanufacturing Market

- 6.2.1.3.3 Financials

- 6.2.1.3.4 Recent Developments

- 6.2.1.3.5 Target Customers

- 6.2.1.3.6 Analyst Perspectives

- 6.2.1.4 Donaldson Company, Inc.

- 6.2.1.4.1 Company Overview

- 6.2.1.4.2 Role of Donaldson Company, Inc. in the Global Digital Biomanufacturing Market

- 6.2.1.4.3 Financials

- 6.2.1.4.4 Recent Developments

- 6.2.1.4.5 Target Customers

- 6.2.1.4.6 Analyst Perspectives

- 6.2.1.5 Emerson Electric Co.

- 6.2.1.5.1 Company Overview

- 6.2.1.5.2 Role of Emerson Electric Co. in the Global Digital Biomanufacturing Market

- 6.2.1.5.3 Financials

- 6.2.1.5.4 Target Customers

- 6.2.1.5.5 Analyst Perspectives

- 6.2.1.6 General Electric Company

- 6.2.1.6.1 Company Overview

- 6.2.1.6.2 Role of General Electric Company in Global Digital Biomanufacturing Market

- 6.2.1.6.3 Financials

- 6.2.1.6.4 Recent Developments

- 6.2.1.6.5 Target Customers

- 6.2.1.6.6 Analyst Perspectives

- 6.2.1.7 Honeywell International Inc.

- 6.2.1.7.1 Company Overview

- 6.2.1.7.2 Role of Honeywell International Inc. in the Global Digital Biomanufacturing Market

- 6.2.1.7.3 Financials

- 6.2.1.7.4 Recent Developments

- 6.2.1.7.5 Target Customers

- 6.2.1.7.6 Analyst Perspectives

- 6.2.1.8 SAP SE

- 6.2.1.8.1 Company Overview

- 6.2.1.8.2 Role of SAP SE in the Global Digital Biomanufacturing Market

- 6.2.1.8.3 Financials

- 6.2.1.8.4 Target Customers

- 6.2.1.8.5 Analyst Perspectives

- 6.2.1.9 Siemens Healthineers AG

- 6.2.1.9.1 Company Overview

- 6.2.1.9.2 Role of Siemens Healthineers AG in the Global Digital Biomanufacturing Market

- 6.2.1.9.3 Financials

- 6.2.1.9.4 Recent Developments

- 6.2.1.9.5 Target Customers

- 6.2.1.9.6 Analyst Perspectives

- 6.2.1.1 Atos SE

- 6.2.2 Emerging Companies

- 6.2.2.1 Bota Biosciences

- 6.2.2.1.1 Company Overview

- 6.2.2.1.2 Role of Bota Biosciences in the Global Digital Biomanufacturing Market

- 6.2.2.1.3 Recent Developments

- 6.2.2.1.4 Target Customers

- 6.2.2.1.5 Analyst Perspectives

- 6.2.2.2 Culture Biosciences

- 6.2.2.2.1 Company Overview

- 6.2.2.2.2 Role of Culture Biosciences in the Global Digital Biomanufacturing Market

- 6.2.2.2.3 Recent Developments

- 6.2.2.2.4 Target Customers

- 6.2.2.2.5 Analyst Perspectives

- 6.2.2.3 e-matica srl

- 6.2.2.3.1 Company Overview

- 6.2.2.3.2 Role of e-matica srl in the Global Digital Biomanufacturing Market

- 6.2.2.3.3 Recent Developments

- 6.2.2.3.4 Target Customers

- 6.2.2.3.5 Analyst Perspectives

- 6.2.2.4 Exponential Genomics, Inc. (Xenomics)

- 6.2.2.4.1 Company Overview

- 6.2.2.4.2 Role of Exponential Genomics, Inc. (Xenomics) in the Global Digital Biomanufacturing Market

- 6.2.2.4.3 Target Customers

- 6.2.2.4.4 Analyst Perspectives

- 6.2.2.5 FabricNano

- 6.2.2.5.1 Company Overview

- 6.2.2.5.2 Role of FabricNano in the Global Digital Biomanufacturing Market

- 6.2.2.5.3 Recent Developments

- 6.2.2.5.4 Target Customers

- 6.2.2.5.5 Analyst Perspectives

- 6.2.2.6 OVO Biomanufacturing

- 6.2.2.6.1 Company Overview

- 6.2.2.6.2 Role of OVO Biomanufacturing in the Global Digital Biomanufacturing Market

- 6.2.2.6.3 Recent Developments

- 6.2.2.6.4 Target Customers

- 6.2.2.6.5 Analyst Perspectives

- 6.2.2.7 Symphony Innovation, LLC

- 6.2.2.7.1 Company Overview

- 6.2.2.7.2 Role of Symphony Innovation, LLC in the Global Digital Biomanufacturing Market

- 6.2.2.7.3 Recent Developments

- 6.2.2.7.4 Target Customers

- 6.2.2.7.5 Analyst Perspectives

- 6.2.2.1 Bota Biosciences

- 6.2.1 Established Companies