|

|

市場調査レポート

商品コード

1078322

農業用フィルムの世界市場 (2022~2027年):製品・用途・国別の分析・予測・サプライチェーンの分析Agricultural Films Market - A Global and Regional Analysis: Focus on Product, Application, Supply Chain, and Country-Wise Analysis - Analysis and Forecast, 2022-2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 農業用フィルムの世界市場 (2022~2027年):製品・用途・国別の分析・予測・サプライチェーンの分析 |

|

出版日: 2022年05月23日

発行: BIS Research

ページ情報: 英文 213 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の農業用フィルムの市場規模は2021年の113億8,000万米ドルから、予測期間中は5.94%のCAGRで推移し、2027年には160億9,000万米ドルの規模に成長すると予測されています。

同市場の成長は、農業生産物に対する需要の増加と、管理農業の拡大によってもたらされると予測されています。生産性が高く、持続可能で経済的な農業用フィルムを開発するため、R&Dが活発に行われています。各国の政府が持続可能な農業生産を計画していることから、今後の需要は増加すると予想されています。また、生分解性フィルムに対する需要の増加が世界の農業用フィルム市場における主要な機会の1つとなっています。

当レポートでは、世界の農業用フィルムの市場を調査し、市場概要、市場への各種影響因子の分析、進行中のプログラム、特許動向、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 市場

- 産業の見通し

- 市場の定義

- サプライチェーン分析

- 進行中のプログラム

- 特許分析

- 事業力学

- 事業成長要因

- 事業上の課題

- 事業戦略

- 企業戦略

- 事業機会

- 主要な新興企業

- COVID-19の影響

第2章 用途

- 世界の農業用フィルム市場(用途別)

- 家畜・飼料生産

- 作物生産

- 世界の農業用フィルム市場の需要分析(用途別)

第3章 製品

- 世界の農業用フィルム市場(製品別)

- 温室フィルム

- マルチフィルム

- サイレージフィルム

- その他

- 世界の農業用フィルム市場の需要分析(製品別)

- 世界の農業用フィルム市場(材料別)

- LLDPE

- LDPE

- EVA

- HDPE

- 再生PE

- その他

- 世界の農業用フィルム市場の需要分析(材料別)

第4章 地域

- 中国

- アジア太平洋および日本

- 北米

- 欧州

- 中東・アフリカ

- 南米

- 英国

第5章 市場:競合ベンチマーキング・企業プロファイル

- 競合ベンチマーキング

- 市場シェア分析

- 公開企業

- BASF SE

- Berry Global Inc

- Dow

- Exxon Mobil Corporation

- Imaflex Inc.

- KURARAY CO., LTD

- Novamont S.p.A.

- PLASTIKA KRITIS S.A.

- スタートアップ

- Cornext

- FILMORGANIC

- GROWiT

- Hydrox Technologies Inc (Solar Shrink)

- LLEAF PTY LTD

- 非公開企業

- Coveris

- Groupe Barbier

- Kalliomuovi Oy

- POLIFILM GROUP

- Rani Group

- RKW Group

- Trioworld

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: Global Agricultural Films Market, $Billion, 2021-2027

- Figure 2: Global Agricultural Films Market Dynamics

- Figure 3: Global Agricultural Films Market (by Application), $Million, 2021-2027

- Figure 4: Global Agricultural Films Market (by Product), $Million, 2021-2027

- Figure 5: Global Agricultural Films Market (by Material), $Million, 2021-2027

- Figure 6: Global Agricultural Films Market (by Region), $Million, 2021

- Figure 7: Global Agricultural Films Market Coverage

- Figure 8: Supply Chain Analysis of Global Agricultural Films Market

- Figure 9: Agricultural Films Patent Trend, 2019-2021

- Figure 10: Patent Analysis (by Status), 2019-2021

- Figure 11: Patent Analysis (by Status), 2019-2021

- Figure 12: Patents Analysis (by Patent Office), 2019-2021

- Figure 13: Share of Key Market Strategies and Developments, January 2019-March 2022

- Figure 14: Product Developments and Innovations (by Company), January 2019-March 2022

- Figure 15: Market Developments (by Company), January 2019-March 2022

- Figure 16: Mergers and Acquisitions (by Company), January 2019-March 2022

- Figure 17: Partnerships, Collaborations, Joint Ventures, and Alliances (by Company), January 2019-March 2022

- Figure 18: Competitive Benchmarking Matrix for Key Raw Material Providers

- Figure 19: Market Share Analysis of Global Agricultural Films Market, 2021

- Figure 20: Global Agricultural Films Market: Research Methodology

- Figure 21: Top-Down and Bottom-Up Approach

List of Tables

- Table 1: Government Initiatives

- Table 2: Key Consortium and Associations in Global Agricultural Films Market

- Table 3: Government Initiatives for Sustainable Food Production

- Table 4: Analyzing the Harmful Effects of Agricultural Plastic Films on the Environment

- Table 5: Key Start-Ups in the Global Agricultural Films Market

- Table 6: Types of Agricultural Films

- Table 7: Benefits of Different Agricultural Films in Crop Production

- Table 8: Global Agricultural Films Market (by Application), $Million, 2021-2027

- Table 9: Global Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 10: Types of Agricultural Films and Average Yield Rates

- Table 11: Global Agricultural Films Market (by Product), $Million, 2021-2027

- Table 12: Global Agricultural Films Market (by Product), Kiloton, 2021-2027

- Table 13: Key Materials Used in Manufacturing Different Types of Agricultural Films

- Table 14: Global Agricultural Films Market (by Material), $Million, 2021-2027

- Table 15: Global Agricultural Films Market (by Material), Kiloton, 2021-2027

- Table 16: Global Agricultural Films Market (by Region), $Million, 2021-2027

- Table 17: Global Agricultural Films Market (by Region), Kiloton, 2021-2027

- Table 18: China Agricultural Films Market (by Region), $Million and Kiloton, 2021-2027

- Table 19: China Agricultural Films Market (by Application), $Million, 2021-2027

- Table 20: China Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 21: China Agricultural Films Market (by Product), $Million, 2021-2027

- Table 22: China Agricultural Films Market (by Product), Kiloton, 2021-2027

- Table 23: China Agricultural Films Market (by Material), $Million, 2021-2027

- Table 24: China Agricultural Films Market (by Material), Kiloton, 2021-2027

- Table 25: Asia-Pacific and Japan Agricultural Films Market (by Region), $Million and Kiloton, 2021-2027

- Table 26: Asia-Pacific and Japan Agricultural Films Market (by Application), $Million, 2021-2027

- Table 27: Asia-Pacific and Japan Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 28: Asia-Pacific and Japan Agricultural Films Market (by Product), $Million, 2021-2027

- Table 29: Asia-Pacific and Japan Agricultural Films Market (by Product), Kiloton, 2021-2027

- Table 30: Asia-Pacific and Japan Agricultural Films Market (by Material), $Million, 2021-2027

- Table 31: Asia-Pacific and Japan Agricultural Films Market (by Material), Kiloton, 2021-2027

- Table 32: Asia Pacific and Japan Agricultural Films Market (by Country), $Million, 2021-2027

- Table 33: Asia Pacific and Japan Agricultural Films Market (by Country), Kiloton, 2021-2027

- Table 34: Water-Saving Benefits of Different Types of Agricultural Films in India

- Table 35: India Agricultural Films Market (by Application), $Million, 2021-2027

- Table 36: India Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 37: Japan Agricultural Films Market (by Application), $Million, 2021-2027

- Table 38: Japan Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 39: South Korea Agricultural Films Market (by Application), $Million, 2021-2027

- Table 40: South Korea Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 41: Rest-of-Asia-Pacific and Japan Agricultural Films Market (by Application), $Million, 2021-2027

- Table 42: Rest-of-Asia-Pacific and Japan Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 43: North America Agricultural Films Market (by Region), $Million and Kiloton, 2021-2027

- Table 44: North America Agricultural Films Market (by Application), $Million, 2021-2027

- Table 45: North America Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 46: North America Agricultural Films Market (by Product), $Million, 2021-2027

- Table 47: North America Agricultural Films Market (by Product), Kiloton, 2021-2027

- Table 48: North America Agricultural Films Market (by Material), $Million, 2021-2027

- Table 49: North America Agricultural Films Market (by Material), Kiloton, 2021-2027

- Table 50: North America Agricultural Films Market (by Country), $Million, 2021-2027

- Table 51: North America Agricultural Films Market (by Country), Kiloton, 2021-2027

- Table 52: U.S. Agricultural Films Market (by Application), $Million, 2021-2027

- Table 53: U.S. Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 54: Canada Agricultural Films Market (by Application), $Million, 2021-2027

- Table 55: Canada Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 56: Mexico Agricultural Films Market (by Application), $Million, 2021-2027

- Table 57: Mexico Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 58: Rest-of-North America Agricultural Films Market (by Application), $Million, 2021-2027

- Table 59: Rest-of-North America Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 60: Europe Agricultural Films Market (by Region), $Million and Kiloton, 2021-2027

- Table 61: Europe Agricultural Films Market (by Application), $Million, 2021-2027

- Table 62: Europe Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 63: Europe Agricultural Films Market (by Product), $Million, 2021-2027

- Table 64: Europe Agricultural Films Market (by Product), Kiloton, 2021-2027

- Table 65: Europe Agricultural Films Market (by Material), $Million, 2021-2027

- Table 66: Europe Agricultural Films Market (by Material), Kiloton, 2021-2027

- Table 67: Europe Agricultural Films Market (by Country), $Million, 2021-2027

- Table 68: Europe Agricultural Films Market (by Country), Kiloton, 2021-2027

- Table 69: Spain Agricultural Films Market (by Application), $Million, 2021-2027

- Table 70: Spain Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 71: Italy Agricultural Films Market (by Application), $Million, 2021-2027

- Table 72: Italy Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 73: Germany Agricultural Films Market (by Application), $Million, 2021-2027

- Table 74: Germany Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 75: Rest-of-Europe Agricultural Films Market (by Application), $Million, 2021-2027

- Table 76: Rest-of-Europe Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 77: Middle East and Africa Agricultural Films Market (by Region), $Million and Kiloton, 2021-2027

- Table 78: Middle East and Africa Agricultural Films Market (by Application), $Million, 2021-2027

- Table 79: Middle East and Africa Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 80: Middle East and Africa Agricultural Films Market (by Product), $Million, 2021-2027

- Table 81: Middle East and Africa Agricultural Films Market (by Product), Kiloton, 2021-2027

- Table 82: Middle East and Africa Agricultural Films Market (by Material), $Million, 2021-2027

- Table 83: Middle East and Africa Agricultural Films Market (by Material), Kiloton, 2021-2027

- Table 84: Middle East and Africa Agricultural Films Market (by Country), $Million, 2021-2027

- Table 85: Middle East and Africa Agricultural Films Market (by Country), Kiloton, 2021-2027

- Table 86: U.A.E. Agricultural Films Market (by Application), $Million, 2021-2027

- Table 87: U.A.E. Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 88: South Africa Agricultural Films Market (by Application), $Million, 2021-2027

- Table 89: South Africa Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 90: Rest-of-Middle East and Africa Agricultural Films Market (by Application), $Million, 2021-2027

- Table 91: Rest-of-Middle East and Africa Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 92: South America Agricultural Films Market (by Region), $Million and Kiloton, 2021-2027

- Table 93: South America Agricultural Films Market (by Application), $Million, 2021-2027

- Table 94: South America Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 95: South America Agricultural Films Market (by Product), $Million, 2021-2027

- Table 96: South America Agricultural Films Market (by Product), Kiloton, 2021-2027

- Table 97: South America Agricultural Films Market (by Material), $Million, 2021-2027

- Table 98: South America Agricultural Films Market (by Material), Kiloton, 2021-2027

- Table 99: South America Agricultural Films Market (by Country), $Million, 2021-2027

- Table 100: South America Agricultural Films Market (by Country), Kiloton, 2021-2027

- Table 101: Brazil Agricultural Films Market (by Application), $Million, 2021-2027

- Table 102: Brazil Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 103: Argentina Agricultural Films Market (by Application), $Million, 2021-2027

- Table 104: Argentina Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 105: Rest-of-South America Agricultural Films Market (by Application), $Million, 2021-2027

- Table 106: Rest-of-South America Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 107: U.K. Agricultural Films Market (by Region), $Million and Kiloton, 2021-2027

- Table 108: U.K. Agricultural Films Market (by Application), $Million, 2021-2027

- Table 109: U.K. Agricultural Films Market (by Application), Kiloton, 2021-2027

- Table 110: U.K. Agricultural Films Market (by Product), $Million, 2021-2027

- Table 111: U.K. Agricultural Films Market (by Product), Kiloton, 2021-2027

- Table 112: U.K. Agricultural Films Market (by Material), $Million, 2021-2027

- Table 113: U.K. Agricultural Films Market (by Material), Kiloton, 2021-2027

- Table 114: BASF SE: Product Portfolio

- Table 115: BASF SE: Business Model Analysis

- Table 116: BASF SE: Market Developments

- Table 117: BASF SE : Product Developments

- Table 118: BASF SE: Mergers and Acquisitions

- Table 119: Berry Global Inc: Product Portfolio

- Table 120: Berry Global Inc: Business Model Analysis

- Table 121: Berry Global Inc: Market Developments

- Table 122: Berry Global Inc: Product Developments

- Table 123: Berry Global Inc: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 124: Berry Global Inc: Mergers and Acquisitions

- Table 125: Dow: Product Portfolio

- Table 126: Dow: Product Developments

- Table 127: Dow: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 128: Exxon Mobil Corporation: Product Portfolio

- Table 129: Exxon Mobil Corporation: Business Model Analysis

- Table 130: Exxon Mobil Corporation: Product Developments

- Table 131: Exxon Mobil Corporation: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 132: Imaflex Inc.: Product Portfolio

- Table 133: Imaflex Inc.: Market Developments

- Table 134: KURARAY CO., LTD: Product Portfolio

- Table 135: KURARAY CO., LTD: Product Developments

- Table 136: KURARAY CO., LTD: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 137: Novamont S.p.A.: Product Portfolio

- Table 138: Novamont S.p.A. Inc.: Product Developments

- Table 139: Novamont S.p.A.: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 140: Novamont S.p.A.: Mergers and Acquisitions

- Table 141: PLASTIKA KRITIS S.A.: Product Portfolio

- Table 142: PLASTIKA KRITIS S.A.: Business Model Analysis

- Table 143: PLASTIKA KRITIS S.A.: Market Developments

- Table 144: PLASTIKA KRITIS S.A.: Product Developments

- Table 145: Cornext: Product Portfolio

- Table 146: Cornext: Business Model Analysis

- Table 147: FILMORGANIC: Product Portfolio

- Table 148: FILMORGANIC: Business Model Analysis

- Table 149: GROWiT: Product Portfolio

- Table 150: GROWiT: Business Model Analysis

- Table 151: Hydrox Technologies Inc (Solar Shrink): Product Portfolio

- Table 152: Hydrox Technologies Inc(Solar Shrink): Business Model Analysis

- Table 153: LLEAF PTY LTD: Product Portfolio

- Table 154: LLEAF PTY LTD: Business Model Analysis

- Table 155: Coveris: Product Portfolio

- Table 156: Coveris: Product Developments

- Table 157: Coveris: Mergers and Acquisitions

- Table 158: Groupe Barbier: Product Portfolio

- Table 159: Groupe Barbier: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 160: Kalliomuovi Oy: Product Portfolio

- Table 161: POLIFILM GROUP: Product Portfolio

- Table 162: POLIFILM GROUP: Business Model Analysis

- Table 163: POLIFILM GROUP: Market Developments

- Table 164: POLIFILM GROUP: Product Developments

- Table 165: POLIFILM GROUP: Merger and Acquisitions

- Table 166: Rani Group: Product Portfolio

- Table 167: Rani Group: Market Developments

- Table 168: Rani Group: Product Developments

- Table 169: RKW Group: Product Portfolio

- Table 170: RKW Group: Market Developments

- Table 171: RKW Group: Product Developments

- Table 172: Trioworld : Product Portfolio

- Table 173: Trioworld: Product Developments

- Table 174: Trioworld: Partnerships, Joint Ventures, Collaborations, and Alliances

- Table 175: Trioworld: Mergers and Acquisitions

- Table 176: Other Key Players in the Global Agricultural Films Market

“Global Agricultural Films Market to Reach $16.09 Billion by 2027.”

Global Agricultural Films Market Industry Overview

The global agricultural films market was valued at $11.38 billion in 2021 and is projected to reach $16.09 billion in 2027, following a CAGR of 5.94% during the forecast period 2022-2027. The growth in the Global Agricultural Films Market is expected to be driven by increasing demand for agricultural output and growing Controlled Agricultural Practices.

Market Lifecycle Stage

The Global Agricultural Films Market is still in the growth phase in developing countries and reached maturity in developed countries. Increased research and development activities are underway to develop high productive, sustainable, and economical agricultural films. The demand for such films is expected to increase in the future as the government across the nations are planning for sustainable agricultural production.

Increasing demand for biodegradable films is one of the major opportunities in the global agricultural films market. The constant demand for effectual food production is propelling the usage of agricultural films, particularly in developing countries with difficult climatic circumstances. Because it is more economical and productive than any other smart farming technology.

Impact

- Reducing crop loss and wastage in the field and improving food production without agricultural land expansion is the possible solution to reduce the significant gap between the amount of food produced today and the amount required to feed everyone in 2050. This in turn is expected to increase the requirements for efficient and affordable crop protection solutions to address various problems such as weed and pest attacks and changing climatic conditions.

- Furthermore, the initiatives from various governments in agriculture production are increasing the demand for biodegradable or recyclable plastic films in agriculture production. Many manufacturers in Global Agriculture Film Market are continuously investing in the development of biodegradable or recyclable plastic film in their product portfolio. In September 2020, Trioworld launched a manual stretch film that is made up of 75% recyclable plastic for agriculture applications.

Impact of COVID-19

The outbreak of COVID-19 followed by the global nation's lockdown in 2020 had disrupted the function of the Global Agriculture Film Market. It affected the production process and supply chain networks and resulted in losses for the agricultural film manufacturers. Unavailability of labor and lack of raw materials were the key factors that limited the production. The shortage in agriculture film production causes delays in customer projects and badly affected the number order intake of agriculture film manufacturers during 2020.

Market Segmentation:

Segmentation 1: by Application

- Livestock or Fodder production

- Crop production

The global agricultural films market in the application segment is expected to be dominated by the livestock or fodder production segment. Growing livestock production in the countries such as China, Brazil, and India is expected to contribute to the growth of the livestock or fodder production segment.

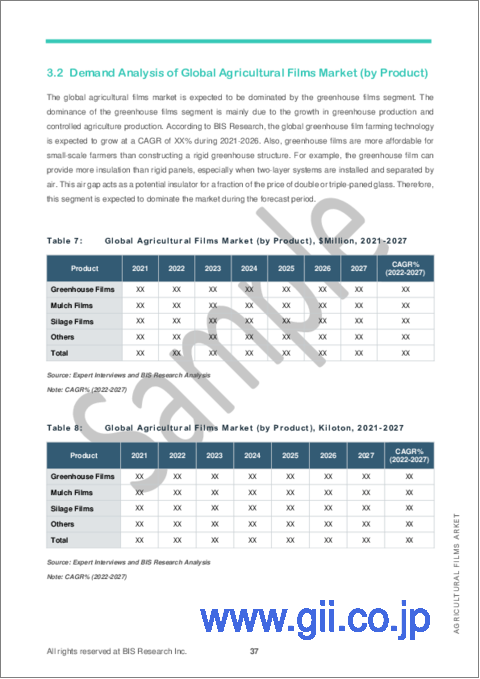

Segmentation 2: by Product

- Greenhouse Films

- Mulch Films

- Silage Films

- Others

The global agricultural films market is slightly more dominated by the greenhouse film segment. This is due to increasing greenhouse utilization across global nations.

Segmentation 3: by Material

- LLDPE

- LDPE

- EVA

- HDPE

- Reclaim PE

- Others

The LLDPE films segment dominates the global agricultural films market during the forecast period. LLDPE is primarily utilized in the production of agricultural films, such as greenhouse and low tunnel films. The growing demand for light and safe greenhouse structures is driving the growth of the LLDPE segment across worldwide countries.

Segmentation 4: by Region

- China

- Asia-Pacific and Japan - India, Japan, South Korea, and Rest-of-Asia-Pacific and Japan

- North America - U.S., Canada, Mexico, and Rest-of-North America

- Europe - Spain, Italy, Germany, and Rest-of-Europe

- South America - Brazil, Argentina, and Rest-of-South America

- Middle East and Africa - U.A.E., South Africa, and Rest-of- Middle East and Africa

- U.K.

China generated the highest revenue of $4.26 Billion in 2021. The market has been experiencing a rapid growth rate in the past few years owing to rising development in greenhouse farming and increasing demand for other controlled agricultural practices.

Recent Developments in Global Agricultural Films Market

- In January 2022, Coveris. launched a new silage bale wrapping film named Unterland R where 30% of its raw materials are recycled content.

- In January 2021, Rani Group launched an agricultural bale wrap named RaniWrap Ecol which is made up of 30% recycled raw materials.

- In January 2021, Novamont S.p.A. acquired BioBag International AS. to expand its business into Northern/Eastern Europe, North America, and Australia.

- In February 2021, Dow and Lucro signed a memorandum of understanding to develop polyethylene film that is made up of post-consumer recycled plastics in India.

Demand - Drivers and Limitations

Following are the demand drivers for the agricultural films market:

- Need for High Agriculture Output

- Increasing Government Initiatives for Sustainable Food Production

- Growing Need for Controlled Agriculture Practices

The market is expected to face some limitations too due to the following challenges:

- Harmful Effects Pertaining to the Use of Plastic Films

- Stringent Government Regulation on Plastic Usage

How Can This Report Add Value to an Organization?

- Product/Innovation Strategy: The product segment helps the reader understand the different types of agricultural film products available for deployment in livestock or fodder production, and crop production, and their potential globally. Moreover, the study provides the reader with a detailed understanding of the different agricultural film products by product (Greenhouse films, Mulch films, Silage films, and others), by material (LLDPE, LDPE, EVA, HDPE, Reclaim PE and others). Agricultural films generate higher revenues when compared to other crop production technologies. Therefore, agricultural films in crop production are a low-investment and high-revenue generating agricultural model.

- Growth/Marketing Strategy: The agricultural films market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been product launches to strengthen their position in the agricultural films market. For instance, in June 2020, Groupe Barbier. and Carbiolice collaborates to develop biodegradable mulch film using Evanesto that contains a higher quantity of bio-based plastics.

- Competitive Strategy: Key players in the global agricultural films market analyzed and profiled in the study involve agricultural film based product manufacturers that provide raw or processed products. Moreover, a detailed competitive benchmarking of the players operating in the global agricultural films market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent names established in this market are:

Company Type 1: Public Companies

- BASF SE

- Berry Global Inc

- Dow

- Exxon Mobil Corporation

- Imaflex Inc.

- KURARAY CO., LTD

- Novamont S.p.A.

- PLASTIKA KRITIS S.A.

Company Type 2: Private Companies

- Coveris

- Groupe Barbier

- Kalliomuovi Oy

- POLIFILM GROUP

- Rani Group

- RKW Group

- Trioworld

Company Type 3: Start-ups

- Cornext

- FILMORGANIC

- GROWiT

- Hydrox Technologies Inc

- LLEAF PTY LTD

Table of Contents

1 Market

- 1.1 Industry Outlooks

- 1.1.1 Market Definition

- 1.1.2 Supply Chain Analysis

- 1.1.3 Ongoing Programs

- 1.1.3.1 Government Initiatives

- 1.1.3.2 Key Consortium and Associations

- 1.1.4 Patent Analysis

- 1.1.4.1 Patent Analysis (by Status)

- 1.1.4.2 Patents Analysis (by Patent Office)

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Need for High Agriculture Output

- 1.2.1.2 Increasing Government Initiatives for Sustainable Food Production

- 1.2.1.3 Growing Need for Controlled Agriculture Practices

- 1.2.2 Business Challenges

- 1.2.2.1 Harmful Effects Pertaining to the Use of Plastic Films

- 1.2.2.2 Stringent Government Regulation on Plastic Usage

- 1.2.3 Business Strategies

- 1.2.3.1 Product Developments and Innovations

- 1.2.3.2 Market Developments

- 1.2.4 Corporate Strategies

- 1.2.4.1 Mergers and Acquisitions

- 1.2.4.2 Partnerships, Collaborations, Joint Ventures, and Alliances

- 1.2.5 Business Opportunities

- 1.2.5.1 Increasing Demand for Biodegradable Films

- 1.2.5.2 Scope of Growth through Alternate Farming Techniques

- 1.2.1 Business Drivers

- 1.3 Key Start-Ups in the Market

- 1.4 Impact of COVID-19 on the Global Agricultural Films Market

2 Application

- 2.1 Global Agricultural Films Market (by Application)

- 2.1.1 Livestock or Fodder Production

- 2.1.2 Crop Production

- 2.2 Demand Analysis of Global Agricultural Films Market (by Application)

3 Product

- 3.1 Global Agricultural Films Market (by Product)

- 3.1.1 Greenhouse Films

- 3.1.2 Mulch Films

- 3.1.3 Silage Films

- 3.1.4 Others

- 3.2 Demand Analysis of Global Agricultural Films Market (by Product)

- 3.3 Global Agricultural Films Market (by Material)

- 3.3.1 LLDPE

- 3.3.2 LDPE

- 3.3.3 EVA

- 3.3.4 HDPE

- 3.3.5 Reclaim PE

- 3.3.6 Others

- 3.4 Demand Analysis of Global Agricultural Films Market (by Material)

4 Region

- 4.1 China

- 4.1.1 Markets

- 4.1.1.1 Buyer Attributes

- 4.1.1.2 Key Providers in China

- 4.1.1.3 Business Challenges

- 4.1.1.4 Business Drivers

- 4.1.2 Application

- 4.1.2.1 China Agricultural Films Market (by Application)

- 4.1.3 Product

- 4.1.3.1 China Agricultural Films Market (by Product)

- 4.1.3.2 China Agricultural Films Market (by Material)

- 4.1.1 Markets

- 4.2 Asia-Pacific and Japan

- 4.2.1 Market

- 4.2.1.1 Buyer Attributes

- 4.2.1.2 Key Providers in Asia-Pacific and Japan

- 4.2.1.3 Business Challenges

- 4.2.1.4 Business Drivers

- 4.2.2 Application

- 4.2.2.1 Asia-Pacific and Japan Agricultural Films Market (by Application)

- 4.2.3 Product

- 4.2.3.1 Asia-Pacific and Japan Agricultural Films Market (by Product)

- 4.2.3.2 Asia-Pacific and Japan Agricultural Films Market (by Material)

- 4.2.4 Asia-Pacific and Japan (by Country)

- 4.2.4.1 India

- 4.2.4.1.1 Market

- 4.2.4.1.1.1 Buyer Attributes

- 4.2.4.1.1.2 Business Challenges

- 4.2.4.1.1.3 Business Drivers

- 4.2.4.1.2 Application

- 4.2.4.1.2.1 India Agricultural Films Market (by Application)

- 4.2.4.1.1 Market

- 4.2.4.2 Japan

- 4.2.4.2.1 Market

- 4.2.4.2.1.1 Buyer Attributes

- 4.2.4.2.1.2 Business Challenges

- 4.2.4.2.1.3 Business Drivers

- 4.2.4.2.2 Application

- 4.2.4.2.2.1 Japan Agricultural Films Market (by Application)

- 4.2.4.2.1 Market

- 4.2.4.3 South Korea

- 4.2.4.3.1 Market

- 4.2.4.3.1.1 Buyer Attributes

- 4.2.4.3.1.2 Business Challenges

- 4.2.4.3.1.3 Business Drivers

- 4.2.4.3.2 Application

- 4.2.4.3.2.1 South Korea Agricultural Films Market (by Application)

- 4.2.4.3.1 Market

- 4.2.4.4 Rest-of-Asia-Pacific and Japan

- 4.2.4.4.1 Market

- 4.2.4.4.1.1 Buyer Attributes

- 4.2.4.4.1.2 Business Challenges

- 4.2.4.4.1.3 Business Drivers

- 4.2.4.4.2 Application

- 4.2.4.4.2.1 Rest-of-Asia-Pacific and Japan Agricultural Films Market (by Application)

- 4.2.4.4.1 Market

- 4.2.4.1 India

- 4.2.1 Market

- 4.3 North America

- 4.3.1 Markets

- 4.3.1.1 Buyer Attributes

- 4.3.1.2 Key Providers in North America

- 4.3.1.3 Business Challenges

- 4.3.1.4 Business Drivers

- 4.3.2 Application

- 4.3.2.1 North America Agricultural Films Market (by Application)

- 4.3.3 Product

- 4.3.3.1 North America Agricultural Films Market (by Product)

- 4.3.3.2 North America Agricultural Films Market (by Material)

- 4.3.4 North America (by Country)

- 4.3.4.1 U.S.

- 4.3.4.1.1 Market

- 4.3.4.1.1.1 Buyer Attributes

- 4.3.4.1.1.2 Business Challenges

- 4.3.4.1.1.3 Business Drivers

- 4.3.4.1.2 Application

- 4.3.4.1.2.1 U.S. Agricultural Films Market (by Application)

- 4.3.4.1.1 Market

- 4.3.4.2 Canada

- 4.3.4.2.1 Market

- 4.3.4.2.1.1 Buyer Attributes

- 4.3.4.2.1.2 Business Challenges

- 4.3.4.2.1.3 Business Drivers

- 4.3.4.2.2 Application

- 4.3.4.2.2.1 Canada Agricultural Films Market (by Application)

- 4.3.4.2.1 Market

- 4.3.4.3 Mexico

- 4.3.4.3.1 Market

- 4.3.4.3.1.1 Buyer Attributes

- 4.3.4.3.1.2 Business Challenges

- 4.3.4.3.1.3 Business Drivers

- 4.3.4.3.2 Application

- 4.3.4.3.2.1 Mexico Agricultural Films Market (by Application)

- 4.3.4.3.1 Market

- 4.3.4.4 Rest-of-North America

- 4.3.4.4.1 Market

- 4.3.4.4.1.1 Buyer Attributes

- 4.3.4.4.1.2 Business Challenges

- 4.3.4.4.1.3 Business Drivers

- 4.3.4.4.2 Application

- 4.3.4.4.2.1 Rest-of-North America Agricultural Films Market (by Application)

- 4.3.4.4.1 Market

- 4.3.4.1 U.S.

- 4.3.1 Markets

- 4.4 Europe

- 4.4.1 Markets

- 4.4.1.1 Buyer Attributes

- 4.4.1.2 Key Providers in Europe

- 4.4.1.3 Business Challenges

- 4.4.1.4 Business Drivers

- 4.4.2 Application

- 4.4.2.1 Europe Agricultural Films Market (by Application)

- 4.4.3 Product

- 4.4.3.1 Europe Agricultural Films Market (by Product)

- 4.4.3.2 Europe Agricultural Films Market (by Material)

- 4.4.4 Europe (by Country)

- 4.4.4.1 Spain

- 4.4.4.1.1 Market

- 4.4.4.1.1.1 Buyer Attributes

- 4.4.4.1.1.2 Business Challenges

- 4.4.4.1.1.3 Business Drivers

- 4.4.4.1.2 Application

- 4.4.4.1.2.1 Spain Agricultural Films Market (by Application)

- 4.4.4.1.1 Market

- 4.4.4.2 Italy

- 4.4.4.2.1 Market

- 4.4.4.2.1.1 Buyer Attributes

- 4.4.4.2.1.2 Business Challenges

- 4.4.4.2.1.3 Business Drivers

- 4.4.4.2.2 Application

- 4.4.4.2.2.1 Italy Agricultural Films Market (by Application)

- 4.4.4.2.1 Market

- 4.4.4.3 Germany

- 4.4.4.3.1 Market

- 4.4.4.3.1.1 Buyer Attributes

- 4.4.4.3.1.2 Business Challenges

- 4.4.4.3.1.3 Business Drivers

- 4.4.4.3.2 Application

- 4.4.4.3.2.1 Germany Agricultural Films Market (by Application)

- 4.4.4.3.1 Market

- 4.4.4.4 Rest-of-Europe

- 4.4.4.4.1 Market

- 4.4.4.4.1.1 Buyer Attributes

- 4.4.4.4.1.2 Business Challenges

- 4.4.4.4.1.3 Business Drivers

- 4.4.4.4.2 Application

- 4.4.4.4.2.1 Rest-of-Europe Agricultural Films Market (by Application)

- 4.4.4.4.1 Market

- 4.4.4.1 Spain

- 4.4.1 Markets

- 4.5 Middle East and Africa

- 4.5.1 Markets

- 4.5.1.1 Buyer Attributes

- 4.5.1.2 Key Providers in the Middle East and Africa

- 4.5.1.3 Business Challenges

- 4.5.1.4 Business Drivers

- 4.5.2 Application

- 4.5.2.1 Middle East and Africa Agricultural Films Market (by Application)

- 4.5.3 Product

- 4.5.3.1 Middle East and Africa Agricultural Films Market (by Product)

- 4.5.3.2 Middle East and Africa Agricultural Films Market (by Material)

- 4.5.4 Middle East and Africa (by Country)

- 4.5.4.1 U.A.E.

- 4.5.4.1.1 Market

- 4.5.4.1.1.1 Buyer Attributes

- 4.5.4.1.1.2 Business Challenges

- 4.5.4.1.1.3 Business Drivers

- 4.5.4.1.2 Application

- 4.5.4.1.2.1 U.A.E. Agricultural Films Market (by Application)

- 4.5.4.1.1 Market

- 4.5.4.2 South Africa

- 4.5.4.2.1 Market

- 4.5.4.2.1.1 Buyer Attributes

- 4.5.4.2.1.2 Business Challenges

- 4.5.4.2.1.3 Business Drivers

- 4.5.4.2.2 Application

- 4.5.4.2.2.1 South Africa Agricultural Films Market (by Application)

- 4.5.4.2.1 Market

- 4.5.4.3 Rest-of-Middle East and Africa

- 4.5.4.3.1 Market

- 4.5.4.3.1.1 Buyer Attributes

- 4.5.4.3.1.2 Business Challenges

- 4.5.4.3.1.3 Business Drivers

- 4.5.4.3.2 Application

- 4.5.4.3.2.1 Rest-of-Middle East and Africa Agricultural Films Market (by Application)

- 4.5.4.3.1 Market

- 4.5.4.1 U.A.E.

- 4.5.1 Markets

- 4.6 South America

- 4.6.1 Markets

- 4.6.1.1 Buyer Attributes

- 4.6.1.2 Key Providers in South America

- 4.6.1.3 Business Challenges

- 4.6.1.4 Business Drivers

- 4.6.2 Application

- 4.6.2.1 South America Agricultural Films Market (by Application)

- 4.6.3 Product

- 4.6.3.1 South America Agricultural Films Market (by Product)

- 4.6.3.2 South America Agricultural Films Market (by Material)

- 4.6.4 South America (by Country)

- 4.6.4.1 Brazil

- 4.6.4.1.1 Market

- 4.6.4.1.1.1 Buyer Attributes

- 4.6.4.1.1.2 Business Challenges

- 4.6.4.1.1.3 Business Drivers

- 4.6.4.1.2 Application

- 4.6.4.1.2.1 Brazil Agricultural Films Market (by Application)

- 4.6.4.1.1 Market

- 4.6.4.2 Argentina

- 4.6.4.2.1 Market

- 4.6.4.2.1.1 Buyer Attributes

- 4.6.4.2.1.2 Business Challenges

- 4.6.4.2.1.3 Business Drivers

- 4.6.4.2.2 Application

- 4.6.4.2.2.1 Argentina Agricultural Films Market (by Application)

- 4.6.4.2.1 Market

- 4.6.4.3 Rest-of- South America

- 4.6.4.3.1 Market

- 4.6.4.3.1.1 Buyer Attributes

- 4.6.4.3.1.2 Business Challenges

- 4.6.4.3.1.3 Business Drivers

- 4.6.4.3.2 Application

- 4.6.4.3.2.1 Rest-of-South America Agricultural Films Market (by Application)

- 4.6.4.3.1 Market

- 4.6.4.1 Brazil

- 4.6.1 Markets

- 4.7 U.K.

- 4.7.1 Markets

- 4.7.1.1 Buyer Attributes

- 4.7.1.2 Key Providers in the U.K.

- 4.7.1.3 Business Challenges

- 4.7.1.4 Business Drivers

- 4.7.2 Application

- 4.7.2.1 U.K. Agricultural Films Market (by Application)

- 4.7.3 Product

- 4.7.3.1 U.K. Agricultural Films Market (by Product)

- 4.7.3.2 U.K. Agricultural Films Market (by Material)

- 4.7.1 Markets

5 Market - Competitive Benchmarking & Company Profiles

- 5.1 Competitive Benchmarking

- 5.2 Market Share Analysis

- 5.3 Public Companies

- 5.3.1 BASF SE

- 5.3.1.1 Company Overview

- 5.3.1.2 Role of BASF SE in the Global Agricultural Films Market

- 5.3.1.2.1 Product Portfolio

- 5.3.1.3 Business Model of BASF SE

- 5.3.1.4 Business Strategies

- 5.3.1.4.1 Market Developments

- 5.3.1.4.2 Product Developments

- 5.3.1.4.3 Merger and Acquisitions

- 5.3.1.5 Analyst View

- 5.3.2 Berry Global Inc

- 5.3.2.1 Company Overview

- 5.3.2.2 Role of Berry Global Inc in the Global Agricultural Films Market

- 5.3.2.2.1 Product Portfolio

- 5.3.2.3 Business Model of Berry Global Inc

- 5.3.2.4 Business Strategies

- 5.3.2.4.1 Market Developments

- 5.3.2.4.2 Product Developments

- 5.3.2.5 Corporate Strategies

- 5.3.2.5.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.3.2.5.2 Mergers and Acquisitions

- 5.3.2.6 Analyst View

- 5.3.3 Dow

- 5.3.3.1 Company Overview

- 5.3.3.2 Role of Dow in the Global Agricultural Films Market

- 5.3.3.2.1 Product Portfolio

- 5.3.3.3 Business Strategies

- 5.3.3.3.1 Product Developments

- 5.3.3.4 Corporate Strategies

- 5.3.3.4.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.3.3.5 Analyst View

- 5.3.4 Exxon Mobil Corporation

- 5.3.4.1 Company Overview

- 5.3.4.2 Role of Exxon Mobil Corporation in the Global Agricultural Films Market

- 5.3.4.2.1 Product Portfolio

- 5.3.4.3 Business Model of Exxon Mobil Corporation

- 5.3.4.4 Business Strategies

- 5.3.4.4.1 Product Developments

- 5.3.4.5 Corporate Strategies

- 5.3.4.5.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.3.4.6 Analyst View

- 5.3.5 Imaflex Inc.

- 5.3.5.1 Company Overview

- 5.3.5.2 Role of Imaflex Inc. in the Global Agricultural Films Market

- 5.3.5.2.1 Product Portfolio

- 5.3.5.3 Business Strategies

- 5.3.5.3.1 Market Developments

- 5.3.5.4 Analyst View

- 5.3.6 KURARAY CO., LTD

- 5.3.6.1 Company Overview

- 5.3.6.2 Role of KURARAY CO., LTD in the Global Agricultural Films Market

- 5.3.6.2.1 Product Portfolio

- 5.3.6.3 Business Strategies

- 5.3.6.3.1 Product Developments

- 5.3.6.4 Corporate Strategies

- 5.3.6.4.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.3.6.5 Analyst View

- 5.3.7 Novamont S.p.A.

- 5.3.7.1 Company Overview

- 5.3.7.2 Role of Novamont S.p.A. in the Global Agricultural Films Market

- 5.3.7.2.1 Product Portfolio

- 5.3.7.3 Business Strategies

- 5.3.7.3.1 Product Developments

- 5.3.7.4 Corporate Strategies

- 5.3.7.4.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.3.7.4.2 Mergers and Acquisitions

- 5.3.7.5 Analyst View

- 5.3.8 PLASTIKA KRITIS S.A.

- 5.3.8.1 Company Overview

- 5.3.8.2 Role of PLASTIKA KRITIS S.A. in the Global Agricultural Films Market

- 5.3.8.2.1 Product Portfolio

- 5.3.8.3 Business Model of PLASTIKA KRITIS S.A.

- 5.3.8.4 Business Strategies

- 5.3.8.4.1 Market Developments

- 5.3.8.4.2 Product Developments

- 5.3.8.5 Analyst View

- 5.3.1 BASF SE

- 5.4 Start-Ups

- 5.4.1 Cornext

- 5.4.1.1 Company Overview

- 5.4.1.2 Role of Cornext in the Global Agricultural Films Market

- 5.4.1.2.1 Product Portfolio

- 5.4.1.3 Business Model of Cornext

- 5.4.1.4 Analyst View

- 5.4.2 FILMORGANIC

- 5.4.2.1 Company Overview

- 5.4.2.2 Role of FILMORGANIC in the Global Agricultural Films Market

- 5.4.2.2.1 Product Portfolio

- 5.4.2.3 Business Model of FILMORGANIC

- 5.4.2.4 Analyst View

- 5.4.3 GROWiT

- 5.4.3.1 Company Overview

- 5.4.3.2 Role of GROWiT in the Global Agricultural Films Market

- 5.4.3.2.1 Product Portfolio

- 5.4.3.3 Business Model of GROWiT

- 5.4.3.4 Analyst View

- 5.4.4 Hydrox Technologies Inc (Solar Shrink)

- 5.4.4.1 Company Overview

- 5.4.4.2 Role of Hydrox Technologies Inc (Solar Shrink) in the Global Agricultural Films Market

- 5.4.4.2.1 Product Portfolio

- 5.4.4.3 Business Model of Hydrox Technologies Inc (Solar Shrink)

- 5.4.4.4 Analyst View

- 5.4.5 LLEAF PTY LTD

- 5.4.5.1 Company Overview

- 5.4.5.2 Role of LLEAF PTY LTD in the Global Agricultural Films Market

- 5.4.5.2.1 Product Portfolio

- 5.4.5.3 Business Model of LLEAF PTY LTD

- 5.4.5.4 Analyst View

- 5.4.1 Cornext

- 5.5 Private Companies

- 5.5.1 Coveris

- 5.5.1.1 Company Overview

- 5.5.1.2 Role of Coveris in the Global Agricultural Films Market

- 5.5.1.2.1 Product Portfolio

- 5.5.1.3 Business Strategies

- 5.5.1.3.1 Product Developments

- 5.5.1.4 Corporate Strategies

- 5.5.1.4.1 Mergers and Acquisitions

- 5.5.1.5 Analyst View

- 5.5.2 Groupe Barbier

- 5.5.2.1 Company Overview

- 5.5.2.2 Role of Groupe Barbier in the Global Agricultural Films Market

- 5.5.2.2.1 Product Portfolio

- 5.5.2.3 Corporate Strategies

- 5.5.2.3.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.5.2.4 Analyst View

- 5.5.3 Kalliomuovi Oy

- 5.5.3.1 Company Overview

- 5.5.3.2 Role of Kalliomuovi Oy in the Global Agricultural Films Market

- 5.5.3.2.1 Product Portfolio

- 5.5.3.3 Analyst View

- 5.5.4 POLIFILM GROUP

- 5.5.4.1 Company Overview

- 5.5.4.2 Role of POLIFILM GROUP in the Global Agricultural Films Market

- 5.5.4.2.1 Product Portfolio

- 5.5.4.3 Business Model of POLIFILM GROUP

- 5.5.4.4 Business Strategies

- 5.5.4.4.1 Market Developments

- 5.5.4.4.2 Product Developments

- 5.5.4.5 Corporate Strategies

- 5.5.4.5.1 Merger and Acquisitions

- 5.5.4.6 Analyst View

- 5.5.5 Rani Group

- 5.5.5.1 Company Overview

- 5.5.5.2 Role of Rani Group in the Global Agricultural Films Market

- 5.5.5.2.1 Product Portfolio

- 5.5.5.3 Business Strategies

- 5.5.5.3.1 Market Developments

- 5.5.5.3.2 Product Developments

- 5.5.5.4 Analyst View

- 5.5.6 RKW Group

- 5.5.6.1 Company Overview

- 5.5.6.2 Role of RKW Group in the Global Agricultural Films Market

- 5.5.6.2.1 Product Portfolio

- 5.5.6.3 Business Strategies

- 5.5.6.3.1 Market Developments

- 5.5.6.3.2 Product Developments

- 5.5.6.4 Analyst View

- 5.5.7 Trioworld

- 5.5.7.1 Company Overview

- 5.5.7.2 Role of Trioworld in the Global Agricultural Films Market

- 5.5.7.2.1 Product Portfolio

- 5.5.7.3 Business Strategies

- 5.5.7.3.1 Product Developments

- 5.5.7.4 Corporate Strategies

- 5.5.7.4.1 Partnerships, Joint Ventures, Collaborations, and Alliances

- 5.5.7.4.2 Mergers and Acquisitions

- 5.5.7.5 Analyst View

- 5.5.1 Coveris

- 5.6 Other Key Players