|

|

市場調査レポート

商品コード

1102619

自動車用コーティング剤の世界市場と技術Automotive Coatings: Technologies and Global Markets |

||||||

| 自動車用コーティング剤の世界市場と技術 |

|

出版日: 2022年07月08日

発行: BCC Research

ページ情報: 英文 230 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界の自動車用コーティング剤の市場規模は、2022年に206億米ドルとなりました。

同市場は、2022年~2027年の予測期間中に3.2%のCAGRで拡大し、2027年には242億米ドルに達すると予測されています。

当レポートでは、世界の自動車用コーティング剤市場について調査し、市場の概要とともに、技術別、コーティング層別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 イントロダクション

第2章 まとめとハイライト

第3章 市場概要

- バリューチェーン

- 自動車コーティングプロセスの説明

- 自動車用コーティング層

- 自動車用コーティング技術

- 自動車用コーティング樹脂

- 自動車用コーティングの種類

- 自動車用コーティング用途

- 金属

- プラスチック

- 現在の自動車用コーティング剤市場

第4章 ロシア・ウクライナ戦争の市場への影響

第5章 世界の自動車用コーティング剤市場

第6章 世界の自動車OEM用コーティング剤市場

- 概要

- 自動車OEM用コーティング剤市場、技術別

- 世界の自動車OEM用コーティング剤市場、コーティング層別

- 世界の自動車OEMコーティング剤市場、地域別

第7章 世界の自動車補修用コーティング剤市場

第8章 市場指標

第9章 特許レビュー

第10章 競合情勢

第11章 企業プロファイル

- AKZONOBEL N.V.

- AXALTA COATING SYSTEMS LTD.

- BASF SE

- DIAMOND VOGEL

- HEMPEL A/S

- LIQUIGUARD TECHNOLOGIES INC.

- PPG INDUSTRIES INC.

- RPM INTERNATIONAL INC.

- THE SHERWIN-WILLIAMS CO.

第12章 付録:頭字語

List of Tables

- Summary Table : Global Market for Automotive Coatings, by Type, Through 2027

- Table 1 : Global Market for Automotive Coatings, by Type, Through 2027

- Table 2 : Global Market Volume of Automotive Coatings, by Type, Through 2027

- Table 3 : Global Market for Automotive OEM Coatings, by Technology, Through 2027

- Table 4 : Global Market Volume of Automotive OEM Coatings, by Technology, Through 2027

- Table 5 : Global Market for Automotive OEM Coatings, by Coating Layer, Through 2027

- Table 6 : Global Market Volume of Automotive OEM Coatings, by Coating Layer, Through 2027

- Table 7 : Global Market for Automotive OEM Coatings, by Region, Through 2027

- Table 8 : Global Market Volume of Automotive OEM Coatings, by Region, Through 2027

- Table 9 : North American Market for Automotive OEM Coatings, by Country, Through 2027

- Table 10 : North American Market Volume of Automotive OEM Coatings, by Country, Through 2027

- Table 11 : European Market for Automotive OEM Coatings, by Country, Through 2027

- Table 12 : European Market Volume of Automotive OEM Coatings, by Country, Through 2027

- Table 13 : Asia-Pacific Market for Automotive OEM Coatings, by Country, Through 2027

- Table 14 : Asia-Pacific Market Volume of Automotive OEM Coatings, by Country, Through 2027

- Table 15 : South American Market for Automotive OEM Coatings, by Country, Through 2027

- Table 16 : South American Market Volume of Automotive OEM Coatings, by Country, Through 2027

- Table 17 : Global Market for Automotive OEM E-Coatings, by Region, Through 2027

- Table 18 : Global Market Volume of Automotive OEM E-Coatings, by Region, Through 2027

- Table 19 : Global Market for Automotive OEM Primers, by Region, Through 2027

- Table 20 : Global Market Volume of Automotive OEM Primers, by Region, Through 2027

- Table 21 : Global Market for Automotive OEM Base Coatings, by Region, Through 2027

- Table 22 : Global Market Volume of Automotive OEM Base Coatings, by Region, Through 2027

- Table 23 : Global Market for Automotive OEM Clear Coatings, by Region, Through 2027

- Table 24 : Global Market Volume of Automotive OEM Clear Coatings, by Region, Through 2027

- Table 25 : Global Market for Automotive OEM Solvent Coatings, by Region, Through 2027

- Table 26 : Global Market Volume of Automotive OEM Solvent Coatings, by Region, Through 2027

- Table 27 : Global Market for Automotive OEM Water-Borne Coatings, by Region, Through 2027

- Table 28 : Global Market Volume of Automotive OEM Water-Borne Coatings, by Region, Through 2027

- Table 29 : Global Market for Automotive OEM Powder Coatings, by Region, Through 2027

- Table 30 : Global Market Volume of Automotive OEM Powder Coatings, by Region, Through 2027

- Table 31 : Global Market for Other Automotive OEM Coatings, by Region, Through 2027

- Table 32 : Global Market Volume of Other Automotive OEM Coatings, by Region, Through 2027

- Table 33 : Global Market for Automotive OEM E-Coatings, by Technology, Through 2027

- Table 34 : Global Market Volume of Automotive OEM E-Coatings, by Technology, Through 2027

- Table 35 : Global Market for Automotive OEM Primers, by Technology, Through 2027

- Table 36 : Global Market Volume of Automotive OEM Primers, by Technology, Through 2027

- Table 37 : Global Market for Automotive OEM Base Coating, by Technology, Through 2027

- Table 38 : Global Market Volume of Automotive OEM Base Coating, by Technology, Through 2027

- Table 39 : Global Market for Automotive OEM Clear Coating, by Technology, Through 2027

- Table 40 : Global Market Volume of Automotive OEM Clear Coating, by Technology, Through 2027

- Table 41 : Global Market for Automotive Refinish Coatings, by Technology, Through 2027

- Table 42 : Global Market Volume of Automotive Refinish Coatings, by Technology, Through 2027

- Table 43 : Global Market for Automotive Refinish Coatings, by Coating Layer, Through 2027

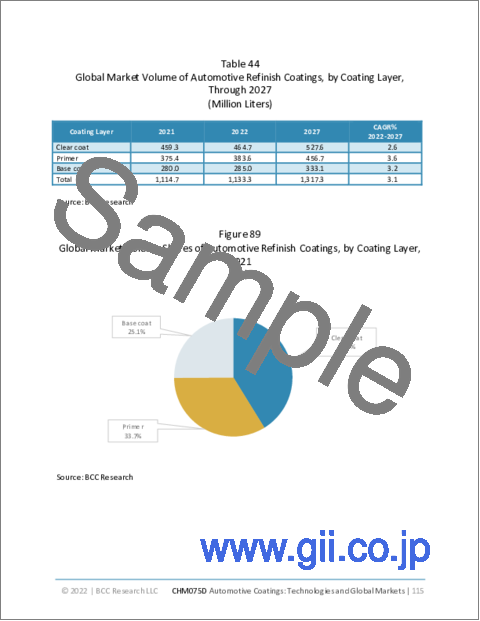

- Table 44 : Global Market Volume of Automotive Refinish Coatings, by Coating Layer, Through 2027

- Table 45 : Global Market for Automotive Refinish Coatings, by Region, Through 2027

- Table 46 : Global Market Volume of Automotive Refinish Coatings, by Region, Through 2027

- Table 47 : North American Market for Automotive Refinish Coatings, by Country, Through 2027

- Table 48 : North American Market Volume of Automotive Refinish Coatings, by Country, Through 2027

- Table 49 : European Market for Automotive Refinish Coatings, by Country, Through 2027

- Table 50 : European Market Volume of Automotive Refinish Coatings, by Country, Through 2027

- Table 51 : Asia-Pacific Market for Automotive Refinish Coatings, by Country, Through 2027

- Table 52 : Asia-Pacific Market Volume of Automotive Refinish Coatings, by Country, Through 2027

- Table 53 : South American Market for Automotive Refinish Coatings, by Country, Through 2027

- Table 54 : South American Market Volume of Automotive Refinish Coatings, by Country, Through 2027

- Table 55 : Global Market for Automotive Refinish Primers, by Region, Through 2027

- Table 56 : Global Market Volume of Automotive Refinish Primers, by Region, Through 2027

- Table 57 : Global Market for Automotive Refinish Base Coatings, by Region, Through 2027

- Table 58 : Global Market Volume of Automotive Refinish Base Coatings, by Region, Through 2027

- Table 59 : Global Market for Automotive Refinish Clear Coatings, by Region, Through 2027

- Table 60 : Global Market Volume of Automotive Refinish Clear Coatings, by Region, Through 2027

- Table 61 : Global Market for Automotive Refinish Solvent Coatings, by Region, Through 2027

- Table 62 : Global Market Volume of Automotive Refinish Solvent Coatings, by Region, Through 2027

- Table 63 : Global Market for Automotive Refinish Water-Borne Coatings, by Region, Through 2027

- Table 64 : Global Market Volume of Automotive Refinish Water-Borne Coatings, by Region, Through 2027

- Table 65 : Global Market for Automotive Refinish Powder Coatings, by Region, Through 2027

- Table 66 : Global Market Volume of Automotive Refinish Powder Coatings, by Region, Through 2027

- Table 67 : Global Market for Other Automotive Refinish Coatings, by Region, Through 2027

- Table 68 : Global Market Volume of Other Automotive Refinish Coatings, by Region, Through 2027

- Table 69 : Global Market for Automotive Refinish Primers, by Technology, Through 2027

- Table 70 : Global Market Volume of Automotive Refinish Primers, by Technology, Through 2027

- Table 71 : Global Market for Automotive Refinish Base Coatings, by Technology, Through 2027

- Table 72 : Global Market Volume of Automotive Refinish Base Coatings, by Technology, Through 2027

- Table 73 : Global Market for Automotive Refinish Clear Coatings, by Technology, Through 2027

- Table 74 : Global Market Volume of Automotive Refinish Clear Coatings, by Technology, Through 2027

- Table 75 : Passenger & Commercial Vehicle Production, by Country, 2017-2020

- Table 76 : Global Passenger & Commercial Vehicle Production, Y-0-Y, 2017-2020

- Table 77 : Road Fatality Data for 2020 Compared to the Average 2017-2019

- Table 78 : Important Patents on Coatings, 1998-2022

- Table 79 : Recent Developments

- Table 80 : AkzoNobel N.V.: Company Overview, 2021

- Table 81 : AkzoNobel N.V.: Product Portfolio

- Table 82 : AkzoNobel N.V.: Recent Developments

- Table 83 : AXALTA Coating Systems Ltd.: Company Overview, 2021

- Table 84 : AXALTA Coating Systems Ltd.: Product Portfolio

- Table 85 : AXALTA Coating Systems Ltd.: Recent Developments

- Table 86 : BASF SE: Company Overview, 2021

- Table 87 : BASF SE: Product Portfolio

- Table 88 : BASF SE: Recent Developments

- Table 89 : Diamond Vogel: Company Overview, 2021

- Table 90 : Diamond Vogel: Product Portfolio

- Table 91 : Diamond Vogel: Recent Developments

- Table 92 : Hempel A/S: Company Overview, 2021

- Table 93 : Hempel A/S: Product Portfolio

- Table 94 : Hempel A/S: Recent Developments

- Table 95 : Liquiguard Technologies Inc.: Company Overview, 2021

- Table 96 : Liquiguard Technologies Inc.: Product Portfolio

- Table 97 : PPG Industries Inc.: Company Overview, 2021

- Table 98 : PPG Industries Inc.: Product Portfolio

- Table 99 : PPG Industries Inc.: Recent Developments

- Table 100 : RPM International: Company Overview, 2020

- Table 101 : RPM International: Product Portfolio

- Table 102 : The Sherwin-Williams Co.: Company Overview, 2021

- Table 103 : The Sherwin-Williams Co.: Product Portfolio

- Table 104 : The Sherwin-Williams Co.: Recent Developments

- Table 105 : Acronyms Used in This Report

List of Figures

Figure A : Research Methodology: Top-Down Approach

- Summary Figure A : Global Market Shares of Automotive Coatings, by Type, 2021

- Summary Figure B : Global Market for Automotive Coatings, by Type, 2021-2027

- Figure 1 : Value Chain for Automotive Coatings

- Figure 2 : Crude Oil Prices, December 2021 to March 2022

- Figure 3 : Global Market Shares of Automotive Coatings, by Type, 2021

- Figure 4 : Global Market Shares of Automotive Coatings, by Type, 2027

- Figure 5 : Global Market Volume Shares of Automotive Coatings, by Type, 2021

- Figure 6 : Global Market Volume Shares of Automotive Coatings, by Type, 2027

- Figure 7 : Global Market Shares of Automotive OEM Coatings, by Technology, 2021

- Figure 8 : Global Market Shares of Automotive OEM Coatings, by Technology, 2027

- Figure 9 : Global Market Volume Shares of Automotive OEM Coatings, by Technology, 2021

- Figure 10 : Global Market Volume Shares of Automotive OEM Coatings, by Technology, 2027

- Figure 11 : Global Market Shares of Automotive OEM Coatings, by Coating Layer, 2021

- Figure 12 : Global Market Shares of Automotive OEM Coatings, by Coating Layer, 2027

- Figure 13 : Global Market Volume Shares of Automotive OEM Coatings, by Coating Layer, 2021

- Figure 14 : Global Market Volume Shares of Automotive OEM Coatings, by Coating Layer, 2027

- Figure 15 : Global Market Shares of Automotive OEM Coatings, by Region, 2021

- Figure 16 : Global Market Shares of Automotive OEM Coatings, by Region, 2027

- Figure 17 : Global Market Volume Shares of Automotive OEM Coatings, by Region, 2021

- Figure 18 : Global Market Volume Shares of Automotive OEM Coatings, by Region, 2027

- Figure 19 : North American Market Shares of Automotive OEM Coatings, by Country, 2021

- Figure 20 : North American Market Shares of Automotive OEM Coatings, by Country, 2027

- Figure 21 : North American Market Volume Shares of Automotive OEM Coatings, by Country, 2021

- Figure 22 : North American Market Volume Shares of Automotive OEM Coatings, by Country, 2027

- Figure 23 : European Market Shares of Automotive OEM Coatings, by Country, 2021

- Figure 24 : European Market Shares of Automotive OEM Coatings, by Country, 2027

- Figure 25 : European Market Volume Shares of Automotive OEM Coatings, by Country, 2021

- Figure 26 : European Market Volume Shares of Automotive OEM Coatings, by Country, 2027

- Figure 27 : Asia-Pacific Market Shares of Automotive OEM Coatings, by Country, 2021

- Figure 28 : Asia-Pacific Market Shares of Automotive OEM Coatings, by Country, 2027

- Figure 29 : Asia-Pacific Market Volume Shares of Automotive OEM Coatings, by Country, 2021

- Figure 30 : Asia-Pacific Market Volume Shares of Automotive OEM Coatings, by Country, 2027

- Figure 31 : South American Market Shares of Automotive OEM Coatings, by Country, 2021

- Figure 32 : South American Market Shares of Automotive OEM Coatings, by Country, 2027

- Figure 33 : South American Market Volume Shares of Automotive OEM Coatings, by Country, 2021

- Figure 34 : South American Market Volume Shares of Automotive OEM Coatings, by Country, 2027

- Figure 35 : Global Market Shares of Automotive OEM E-Coatings, by Region, 2021

- Figure 36 : Global Market Shares of Automotive OEM E-Coatings, by Region, 2027

- Figure 37 : Global Market Volume Shares of Automotive OEM E-coatings, by Region, 2021

- Figure 38 : Global Market Volume Shares of Automotive OEM E-Coatings, by Region, 2027

- Figure 39 : Global Market Shares of Automotive OEM Primers, by Region, 2021

- Figure 40 : Global Market Shares of Automotive OEM Primers, by Region, 2027

- Figure 41 : Global Market Volume Shares of Automotive OEM Primers, by Region, 2021

- Figure 42 : Global Market Volume Shares of Automotive OEM Primers, by Region, 2027

- Figure 43 : Global Market Shares of Automotive OEM Base Coatings, by Region, 2021

- Figure 44 : Global Market Shares of Automotive OEM Base Coatings, by Region, 2027

- Figure 45 : Global Market Volume Shares of Automotive OEM Base Coatings, by Region, 2021

- Figure 46 : Global Market Volume Shares of Automotive OEM Base Coatings, by Region, 2027

- Figure 47 : Global Market Shares of Automotive OEM Clear Coatings, by Region, 2021

- Figure 48 : Global Market Shares of Automotive OEM Clear Coatings, by Region, 2027

- Figure 49 : Global Market Volume Shares of Automotive OEM Clear Coatings, by Region, 2021

- Figure 50 : Global Market Volume Shares of Automotive OEM Clear Coatings, by Region, 2027

- Figure 51 : Global Market Shares of Automotive OEM Solvent Coatings, by Region, 2021

- Figure 52 : Global Market Shares of Automotive OEM Solvent Coatings, by Region, 2027

- Figure 53 : Global Market Volume Shares of Automotive OEM Solvent Coatings, by Region, 2021

- Figure 54 : Global Market Volume Shares of Automotive OEM Solvent Coatings, by Region, 2027

- Figure 55 : Global Market Shares of Automotive OEM Water-Borne Coatings, by Region, 2021

- Figure 56 : Global Market Shares of Automotive OEM Water-Borne Coatings, by Region, 2027

- Figure 57 : Global Market Volume Shares of Automotive OEM Water-Borne Coatings, by Region, 2021

- Figure 58 : Global Market Volume Shares of Automotive OEM Water-Borne Coatings, by Region, 2027

- Figure 59 : Global Market Shares of Automotive OEM Powder Coatings, by Region, 2021

- Figure 60 : Global Market Shares of Automotive OEM Powder Coatings, by Region, 2027

- Figure 61 : Global Market Volume Shares of Automotive OEM Powder Coatings, by Region, 2021

- Figure 62 : Global Market Volume Shares of Automotive OEM Powder Coatings, by Region, 2027

- Figure 63 : Global Market Shares of Other Automotive OEM Coatings, by Region, 2021

- Figure 64 : Global Market Shares of Other Automotive OEM Coatings, by Region, 2027

- Figure 65 : Global Market Volume Shares of Other Automotive OEM Coatings, by Region, 2021

- Figure 66 : Global Market Volume Shares of Other Automotive OEM Coatings, by Region, 2027

- Figure 67 : Global Market Shares of Automotive OEM E-Coatings, by Technology, 2021

- Figure 68 : Global Market Shares of Automotive OEM E-Coatings, by Technology, 2027

- Figure 69 : Global Market Volume Shares of Automotive OEM E-Coatings, by Technology, 2021

- Figure 70 : Global Market Volume Shares of Automotive OEM E-Coatings, by Technology, 2027

- Figure 71 : Global Market Shares of Automotive OEM Primers, by Technology, 2021

- Figure 72 : Global Market Shares of Automotive OEM Primers, by Technology, 2027

- Figure 73 : Global Market Volume Shares of Automotive OEM Primers, by Technology, 2021

- Figure 74 : Global Market Volume Shares of Automotive OEM Primers, by Technology, 2027

- Figure 75 : Global Market Shares of Automotive OEM Base Coating, by Technology, 2021

- Figure 76 : Global Market Shares of Automotive OEM Base Coating, by Technology, 2027

- Figure 77 : Global Market Volume Shares of Automotive OEM Base Coating, by Technology, 2021

- Figure 78 : Global Market Volume Shares of Automotive OEM Base Coating, by Technology, 2027

- Figure 79 : Global Market Shares of Automotive OEM Clear Coating, by Technology, 2021

- Figure 80 : Global Market Shares of Automotive OEM Clear Coating, by Technology, 2027

- Figure 81 : Global Market Volume Shares of Automotive OEM Clear Coating, by Technology, 2021

- Figure 82 : Global Market Volume Shares of Automotive OEM Clear Coating, by Technology, 2027

- Figure 83 : Global Market Shares of Automotive Refinish Coatings, by Technology, 2021

- Figure 84 : Global Market Shares of Automotive Refinish Coatings, by Technology, 2027

- Figure 85 : Global Market Volume Shares of Automotive Refinish Coatings, by Technology, 2021

- Figure 86 : Global Market Volume Shares of Automotive Refinish Coatings, by Technology, 2027

- Figure 87 : Global Market Shares of Automotive Refinish Coatings, by Coating Layer, 2021

- Figure 88 : Global Market Shares of Automotive Refinish Coatings, by Coating Layer, 2027

- Figure 89 : Global Market Volume Shares of Automotive Refinish Coatings, by Coating Layer, 2021

- Figure 90 : Global Market Volume Shares of Automotive Refinish Coatings, by Coating Layer, 2027

- Figure 91 : Global Market Shares of Automotive Refinish Coatings, by Region, 2021

- Figure 92 : Global Market Shares of Automotive Refinish Coatings, by Region, 2027

- Figure 93 : Global Market Volume Shares of Automotive Refinish Coatings, by Region, 2021

- Figure 94 : Global Market Volume Shares of Automotive Refinish Coatings, by Region, 2027

- Figure 95 : North American Market Shares of Automotive Refinish Coatings, by Country, 2021

- Figure 96 : North American Market Shares of Automotive Refinish Coatings, by Country, 2027

- Figure 97 : North American Market Volume Shares of Automotive Refinish Coatings, by Country, 2021

- Figure 98 : North American Market Volume Shares of Automotive Refinish Coatings, by Country, 2027

- Figure 99 : European Market Shares of Automotive Refinish Coatings, by Country, 2021

- Figure 100 : European Market Shares of Automotive Refinish Coatings, by Country, 2027

- Figure 101 : European Market Volume Shares of Automotive Refinish Coatings, by Country, 2021

- Figure 102 : European Market Volume Shares of Automotive Refinish Coatings, by Country, 2027

- Figure 103 : Asia-Pacific Market Shares of Automotive Refinish Coatings, by Country, 2021

- Figure 104 : Asia-Pacific Market Shares of Automotive Refinish Coatings, by Country, 2027

- Figure 105 : Asia-Pacific Market Volume Shares of Automotive Refinish Coatings, by Country, 2021

- Figure 106 : Asia-Pacific Market Volume Shares of Automotive Refinish Coatings, by Country, 2027

- Figure 107 : South American Market Shares of Automotive Refinish Coatings, by Country, 2021

- Figure 108 : South American Market Shares of Automotive Refinish Coatings, by Country, 2027

- Figure 109 : South American Market Volume Shares of Automotive Refinish Coatings, by Country, 2021

- Figure 110 : South American Market Volume Shares of Automotive Refinish Coatings, by Country, 2027

- Figure 111 : Global Market Shares of Automotive Refinish Primers, by Region, 2021

- Figure 112 : Global Market Shares of Automotive Refinish Primers, by Region, 2027

- Figure 113 : Global Market Volume Shares of Automotive Refinish Primers, by Region, 2021

- Figure 114 : Global Market Volume Shares of Automotive Refinish Primers, by Region, 2027

- Figure 115 : Global Market Shares of Automotive Refinish Base Coatings, by Region, 2021

- Figure 116 : Global Market Shares of Automotive Refinish Base Coatings, by Region, 2027

- Figure 117 : Global Market Volume Shares of Automotive Refinish Base Coatings, by Region, 2021

- Figure 118 : Global Market Volume Shares of Automotive Refinish Base Coatings, by Region, 2027

- Figure 119 : Global Market Shares of Automotive Refinish Clear Coatings, by Region, 2021

- Figure 120 : Global Market Shares of Automotive Refinish Clear Coatings, by Region, 2027

- Figure 121 : Global Market Volume Shares of Automotive Refinish Clear Coatings, by Region, 2021

- Figure 122 : Global Market Volume Shares of Automotive Refinish Clear Coatings, by Region, 2027

- Figure 123 : Global Market Shares of Automotive Refinish Solvent Coatings, by Region, 2021

- Figure 124 : Global Market Shares of Automotive Refinish Solvent Coatings, by Region, 2027

- Figure 125 : Global Market Volume Shares of Automotive Refinish Solvent Coatings, by Region, 2021

- Figure 126 : Global Market Volume Shares of Automotive Refinish Solvent Coatings, by Region, 2027

- Figure 127 : Global Market Shares of Automotive Refinish Water-Borne Coatings, by Region, 2021

- Figure 128 : Global Market Shares of Automotive Refinish Water-Borne Coatings, by Region, 2027

- Figure 129 : Global Market Volume Shares of Automotive Refinish Water-Borne Coatings, by Region, 2021

- Figure 130 : Global Market Volume Shares of Automotive Refinish Water-Borne Coatings, by Region, 2027

- Figure 131 : Global Market Shares of Automotive Refinish Powder Coatings, by Region, 2021

- Figure 132 : Global Market Shares of Automotive Refinish Powder Coatings, by Region, 2027

- Figure 133 : Global Market Volume Shares of Automotive Refinish Powder Coatings, by Region, 2021

- Figure 134 : Global Market Volume Shares of Automotive Refinish Powder Coatings, by Region, 2027

- Figure 135 : Global Market Shares of Other Automotive Refinish Coatings, by Region, 2021

- Figure 136 : Global Market Shares of Other Automotive Refinish Coatings, by Region, 2027

- Figure 137 : Global Market Volume Shares of Other Automotive Refinish Coatings, by Region, 2021

- Figure 138 : Global Market Volume Shares of Other Automotive Refinish Coatings, by Region, 2027

- Figure 139 : Global Market Shares of Automotive Refinish Primers, by Technology, 2021

- Figure 140 : Global Market Shares of Automotive Refinish Primers, by Technology, 2027

- Figure 141 : Global Market Volume Shares of Automotive Refinish Primers, by Technology, 2021

- Figure 142 : Global Market Volume Shares of Automotive Refinish Primers, by Technology, 2027

- Figure 143 : Global Market Shares of Automotive Refinish Base Coatings, by Technology, 2021

- Figure 144 : Global Market Shares of Automotive Refinish Base Coatings, by Technology, 2027

- Figure 145 : Global Market Volume Shares of Automotive Refinish Base Coatings, by Technology, 2021

- Figure 146 : Global Market Volume Shares of Automotive Refinish Base Coatings, by Technology, 2027

- Figure 147 : Global Market Shares of Automotive Refinish Clear Coatings, by Technology, 2021

- Figure 148 : Global Market Shares of Automotive Refinish Clear Coatings, by Technology, 2027

- Figure 149 : Global Market Volume Shares of Automotive Refinish Clear Coatings, by Technology, 2021

- Figure 150 : Global Market Volume Shares of Automotive Refinish Clear Coatings, by Technology, 2027

- Figure 151 : Global All Vehicle Sale, 2019 and 2020

- Figure 152 : Global Sales: Passenger Cars, 2019 and 2020

- Figure 153 : Global Sale: Commercial Vehicles, 2019 and 2020

- Figure 154 : Global All Vehicle Production, 2020 and 2021

- Figure 155 : Global All Vehicle Production, 2021-2030

- Figure 156 : Global Metallic Powder Coating Market Share, by Region

- Figure 157 : Global Auto Color Preference Share, by Color Type, 2021

- Figure 158 : North American Auto Color Preference Share, by Color Type, 2021

- Figure 159 : European Auto Color Preference Share, by Color Type, 2021

- Figure 160 : Asia-Pacific Auto Color Preference Share, by Color Type, 2021

- Figure 161 : South American Auto Color Preference Share, by Color Type, 2021

- Figure 162 : African Auto Color Preference Share, by Color Type, 2021

- Figure 163 : Roads Deaths during the Pandemic, by Age Group (Aggregated 2020 Fatalities for 19 Countries, % change on 2017-19 Average)

- Figure 164 : Roads Deaths during the Pandemic, by Transport Mode (Aggregated 2020 Fatalities for 20 Countries, % Change on 2017-19 average)

- Figure 165 : Global Market Shares of Automotive Coatings, by Company, 2021

- Figure 166 : AkzoNobel N.V.: Company Revenue, 2020 and 2021

- Figure 167 : AkzoNobel N.V.: Revenue Share, by Segment, 2021

- Figure 168 : AkzoNobel N.V.: Revenue Share, by Region, 2021

- Figure 169 : AXALTA Coating Systems Ltd.: Company Revenue, 2020 and 2021

- Figure 170 : AXALTA Coating Systems Ltd.: R&D Expenditures, 2020 and 2021

- Figure 171 : AXALTA Coating Systems Ltd.: Revenue Share, by Segment, 2021

- Figure 172 : AXALTA Coating Systems Ltd.: Revenue Share, by Region, 2021

- Figure 173 : BASF SE: Company Revenue, 2020 and 2021

- Figure 174 : BASF SE: R&D Expenditure, 2020 and 2021

- Figure 175 : BASF SE: Revenue Share, by Segment, 2021

- Figure 176 : BASF SE: Revenue Share, by Region, 2021

- Figure 177 : Hempel A/S: Company Revenue, 2020 and 2021

- Figure 178 : Hempel A/S: R&D Expenditures, 2020 and 2021

- Figure 179 : Hempel A/S: Revenue Share, by Segment, 2021

- Figure 180 : Hempel A/S: Revenue Share, by Geography, 2021

- Figure 181 : PPG Industries Inc.: Company Revenue, 2020 and 2021

- Figure 182 : PPG Industries Inc.: R&D Expenditures, 2020 and 2021

- Figure 183 : PPG Industries Inc.: Revenue Share, by Segment, 2021

- Figure 184 : PPG Industries Inc.: Revenue Share, by Region, 2021

- Figure 185 : RPM International: Company Revenue, 2019 and 2020

- Figure 186 : RPM International: R&D Expenditures, 2019 and 2020

- Figure 187 : RPM International: Revenue Share, by Segment, 2020

- Figure 188 : RPM International: Revenue Share, by Region, 2020

- Figure 189 : The Sherwin-Williams Co.: Company Revenue, 2020 and 2021

- Figure 190 : The Sherwin-Williams Co.: Revenue Share, by Segment, 2021

Highlights:

The global automotive coatings market should reach $24.2 billion by 2027 from $20.6 billion in 2022 at a compound annual growth rate (CAGR) of 3.2% for the forecast period of 2022 to 2027.

The refinish segment of the global automotive coatings market is expected to grow from $10.2 billion in 2022 to $12.1 trillion in 2027 at a CAGR of 3.5% for the forecast period of 2022 to 2027.

The OEM segment of the global automotive coatings market is expected to grow from $10.5 billion in 2022 to $12.1 billion in 2027 at a CAGR of 2.9% for the forecast period of 2022 to 2027.

Report Scope:

This report provides an updated review of the automotive coatings market, focusing on its types, technologies, layers and regional demand.

The report provides detailed analyses of key trends and opportunities impacting the market's growth. It also analyzes the challenges faced by automotive coating companies and producers of passenger and commercial vehicles.

The report has a separate section highlighting the impact of COVID-19 on the automotive coatings market at the global level.

The market sizes and estimations are provided in terms of volume (million liters) and value ($ millions), considering 2021 as base year, with a market forecast for the period from 2022 to 2027. Regional market sizes, with respect to OEM and refinish types by technology and by layer, are also provided. The impact of COVID-19 was considered while estimating market sizes.

Report Includes:

- 75 data tables and 31 additional tables

- An overview of the global market for automotive coatings

- Estimation of the market size and analyses of global market trends, both in terms of value and volume, with data from 2021, estimates for 2022, with projections of compound annual growth rates (CAGRs) through 2027

- Details on the technical and commercial aspects of various layers of automotive coating, and advantages of automotive coating technologies

- Information on the technological innovation, the environmental concerns and the regulatory pressures that are currently faced by coating suppliers

- Identification of market drivers, restraints and other forces impacting the global market and evaluation of current market trends, market size, and forecast

- Market share analysis of the key companies of the industry and coverage of their proprietary technologies, strategic alliances, and other key market strategies

- Comprehensive company profiles of the leading players, including AkzoNobel N.V., BASF SE, PPG Industries Inc., RPM International and The Sherwin-Williams Co.

Table of Contents

Chapter 1 Introduction

- Market Definition

- Study Goals and Objectives

- Reasons for Doing This Study

- What's New in This Report?

- Intended Audience

- Scope of Report

- Methodology

- Geographical Breakdown

- Analyst's Credentials

- BCC Custom Research

- Related BCC Research Reports

Chapter 2 Summary and Highlights

Chapter 3 Market Overview

- Value Chain

- Description of Automobile Coating Processes

- Automotive Coating Layers

- E-coating

- Primer

- Base Coat

- Clear Coat

- Automotive Coating Technology

- Water-borne

- Powder Coating

- Solvent-Borne

- Others

- Automotive Coating Resins

- Polyurethane

- Epoxy

- Acrylic

- Others

- Automotive Coating Types

- Automotive OEMs

- Automotive Refinish

- Automotive Coating Applications

- Metals

- Plastics

- Present Automotive Coating Market

Chapter 4 Impact of the Russian-Ukrainian War on the Market

- Overview

Chapter 5 Global Market for Automotive Coatings

- Overview

Chapter 6 Global Market for Automotive OEM Coatings

- Overview

- Automotive OEM Coating Market by Technology

- Global Automotive OEM Coating Market by Coating Layer

- Global Market for Automotive OEM Coatings by Region

- Global Market forAutomotive OEM E-Coatings by Region

- Global Market for Automotive OEM Primers by Region

- Global Market for Automotive OEM Base Coatings by Region

- Global Market for Automotive OEM Clear Coatings by Region

- Global Market for Automotive OEM Solvent Coatings by Region

- Global Market for Automotive OEM Water-Borne Coatings by Region

- Global Market for Automotive OEM Powder Coatings by Region

- Global Market for Other Automotive OEM Coatings by Region

- Global Market for Automotive OEM E-Coatings by Technology

- Global Market for Automotive OEM Primers by Technology

- Global Market for Automotive OEM Base Coating Technology

- Global Market for Automotive OEM Clear Coating Technology

Chapter 7 Global Market for Automotive Refinish Coatings

- Overview

- Global Market for Automotive Refinish Coating Technology

- Global Market for Automotive Refinish Coatings by Coating Layer

- Global Market for Automotive Refinish Coating by Region

- Global Market for Automotive Refinish Primers by Region

- Global Market for Automotive Refinish Base Coatings by Region

- Global Market for Automotive Refinish Clear Coating by Region

- Global Market for Automotive Refinish Solvent Coating by Region

- Global Market for Automotive Refinish Water-Borne Coating by Region

- Global Market for Automotive Refinish Powder Coating by Region

- Global Market for Other Automotive Refinish Coatings by Region

- Global Market for Automotive Refinish Primer by Technology

- Global Market for Automotive Refinish Base Coating by Technology

- Global Market for Automotive Refinish Clear Coating by Technology

Chapter 8 Market Indicators

- Automotive Industry (2020 to 2022)

- Growth in Electric Vehicles

- Increasing Demand for Metallic Coating

- Ultraviolet (UV) Technology

- Exploring UV Attributes

- Automotive Forward Lighting

- Exterior Plastic Parts

- SMC Body Panels

- OEM Clear Coating

- Other Applications

- Technological Changes: Integrated Solutions, Anti-collision Systems, Color Innovation and Reliability

- PixelPaint Non-Overspray Technology

- Robots for Detailed Surface Painting

- Robot Control to Process Control

- Dense Phase Technology

- Shifting Consumer Preferences: Paint Color and Vehicle Weight

- North American Color Preference

- European Color Preference

- Asia-Pacific Color Preference

- South American Color Preference

- African Color Preference

- Decrease in Accident Rates Restrain Refinishing Market in 2020

- Road Deaths by Age Group in 2020

- Road Deaths by Transport Mode in 2020

- Conclusion

- Insurance Industry Driving Demand for Auto Refinish Market

- Recent Trends in Auto Insurance

Chapter 9 Patent Review

- Recent Patents on Automotive Coatings

Chapter 10 Competitive Landscape

- Competitive Landscape: Global

- Major Developments

Chapter 11 Company Profiles

- AKZONOBEL N.V.

- AXALTA COATING SYSTEMS LTD.

- BASF SE

- DIAMOND VOGEL

- HEMPEL A/S

- LIQUIGUARD TECHNOLOGIES INC.

- PPG INDUSTRIES INC.

- RPM INTERNATIONAL INC.

- THE SHERWIN-WILLIAMS CO.