|

|

市場調査レポート

商品コード

1302351

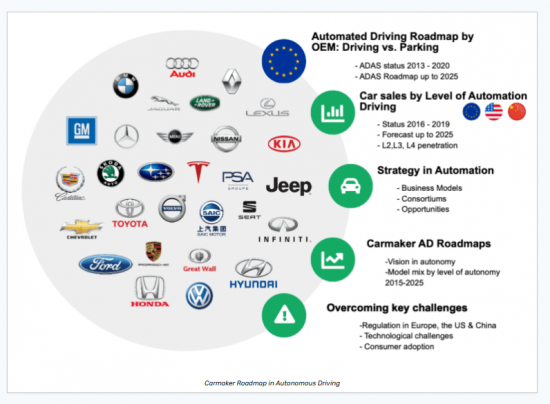

主要自動車メーカー30社の自動運転ロードマップレベル1~4(~2030年)Autonomous Driving Roadmaps Level 1-4 of 30 Major Carmakers by 2030 |

||||||

| 主要自動車メーカー30社の自動運転ロードマップレベル1~4(~2030年) |

|

出版日: 2023年05月04日

発行: Auto2x

ページ情報: 英文 220 Pages; 230 Tables & Graphs

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

主要自動車サプライヤーのADASと自動運転による収益は、センサーの装備の増加とクルージングと駐車の新機能により、2025年に350億ユーロに達する見込みです。

当レポートでは、世界の自動車市場について調査分析し、自動運転における世界の自動車メーカーグループ主要30社(45を超える乗用車ブランドを含む)の市場戦略、技術革新、市場ポジショニングを考察しています。

サンプルビュー

目次

エグゼクティブサマリー

- 自動車メーカーの自動運転構成比(2022年 vs. 2025年・2030年)

- 自動車メーカーのレベル2~レベル4の自動運転準備レベル

- 勝者 vs. ラガード

- 主なパートナーシップ(2022年・2023年第1四半期)

- 投資ハイライト(2022年~2023年第1四半期)

第1章 自動運転展開状況:レベル別(2023年)

- SAEレベル4の更新

- レベル3機能の新発売:何を、いつ、どのように

- レベル3自律性に対するLiDARの適合:サプライチェーンの概要

- 安全義務を満たすためにADASの民主化が加速しているが、レベル3の技術経済的展開の課題は依然として残っている

- 欧州のSAEレベル2ステータス(2023年):TJA、SP、RPの利用可能性

- 欧州のSAEレベル1(2023):ACC、AEB、PA、LKAの利用可能性

- 欧州のレベル0の普及(2023年):BSM、DDM、FCW、LDW、TSR

- レベル3のテスト/パイロット:誰が何をどこでテストするか

- HMIにおける条件付き自動運転の影響

第2章 自動運転展開状況:レベル0~4別(~2030年)

- 規制が自動運転の展開に課題を与える理由を読む

- 主要地域におけるADの規制と法的地位の概要

- Reg.79の改正により、2021年1月からUNECEでL3が許可された

- L3における責任とADのイベントデータレコーダーの役割

- 自動車メーカーにとって車両のサイバーセキュリティが優先事項になる

第3章 自動運転におけるOEMの戦略とビジネスモデル(~2030年)

- 高度自動運転を実現するためのインクリメンタルアプローチとスキップアプローチ

- 独自の自動運転プラットフォームと提携の構築

- デジタル化によりパーソナライゼーションと新しいモビリティサービスが可能になります

- L4/5を商業化する使用事例とビジネスモデル

- サービスとしてのモビリティ(MaaS)

第4章 支援型から自律型へ:主要OEMのL2~L4ロードマップ

- L2~L4運転・駐車ロードマップの概要:初期実装時のOEM別

- 自動運転技術ロードマップ:ADAS機能・センサーセット

- EU・米国・中国のL2- D~L4運転機能による総売上予測(2013年・2025年)

- 欧州のADの予測:運転・駐車機能(~2025年)

- 米国の運転機能に対する自動運転の予測(~2025年)

- 中国の自動運転の予測:L2-D~L4-D (2013年~2030年)

- 乗用車におけるLiDARの予測(2030年)

第5章 自動車メーカーのADASと自動運転のロードマップと見通し

- 1. Audi

- 2. BAIC Motors

- 3. Bentley

- 4. BMW

- 5. Mini

- 6. BYD

- 7. CHANGAN

- 8. Chery

- 9. Mercedes-Benz

- 10. Ford

- 11. Geely

- 12. General Motors: Cadillac and Chevy-Cruise

- 13. Great Wall

- 14. GUANGZHOU AUTOMOBILE GROUP (GAC)

- 15. Honda

- 16. Hyundai, KIA, and Genesis

- 17. Jaguar Land Rover's AD outlook: feature roadmap & AD level mix

- 18. Lucid

- 19. NIO

- 20. Porsche

- 21. PSA

- 22. Renault-Nissan-Mitsubishi Alliance

- 1. Nissan & Infiniti

- 2. Renault

- 23. SAIC

- 24. Stellantis

- 25. FCA: Focus on Alfa Romeo, Fiat, Maserati & Jeep

- 26. PSA

- 27. Subaru

- 28. Tesla Motors

- 29. Toyota Motors: Lexus and Toyota

- 30. Volvo

- 31. VW's strategy & model range by Level of Automated Driving

- 32. XPeng

第6章 付録

第7章 用語集

第8章 免責事項

Revenues of Major Automotive Suppliers from ADAS & Automated Driving will reach €35 Billion in 2025 due to the increase in fitment of sensors and new Cruising and Parking features, Auto2x

Our 220-page report examines the go-to-market strategy, technology & innovation, and market positioning of the world's Top-30 Carmaker Groups which includes more than 45 passenger car brands in Autonomous Driving.

SAMPLE VIEW

Our analysis unveils the fitment rates of different levels of vehicle automation (SAE Level 1-4) across the carlines of carmakers and their roadmap for 2030. This includes driving and parking features, sensors like radar, camera, HD maps, and the supply chain.

Finally, we assess the deployment and readiness of leading automakers in Automated Driving across Europe, the US, Japan, and China.

Passenger Car Brands covered in our analysis include:

|

|

Learn about the status of autonomous driving in 2023 and the outlook for 2030 in the major car markets

- What is the availability of key ADAS features, such as AEB, TSR, ACC, LKA, TJA, in leading carmakers in Europe, the US and China? We provide in-depth segmentation by SAE Level of Automated Driving;

- What is the penetration rate of SAE Level 0-3 in European, U.S & Chinese car sales?

- Which OEMs lead L2-3 deployment and why? Which are the most prominent features?

- What are the emerging trends in sensor fitment strategies, architectures, and supply chains?

- What changes are coming in terms of the deployment of Lv.2 and L3-4 by 2025?

Understand the regulatory and engineering challenges carmakers face for the deployment of a higher level of vehicle autonomy

- What is the status of Autonomous Driving Regulation in major car markets?

- What are the differences in the legal and regulatory framework between Europe, the United States and China? How will these differences in policy affect Level 3-Level 5 deployment?

- Which geography presents the most favourable environment for deployment of Level 3?

- What breakthroughs are required in the area of SW/HW and validation for L3-4?

Read how carmakers, Tier-1s and new entrants, including tech giants Apple and Google (Waymo), plan to overcome the challenges and commercialize automated driving

- How do leading OEMs plan to achieve Level 4/5 capabilities? By when?

- Analysis of OEM strategy, new business models and key collaborations

- Learn why leading Tier-1s are well-positioned to monetize ADAS growth

Who will lead and who will follow in the autonomous vehicle race by 2030?

- Discover when leading carmakers will launch capabilities of L2, L3, and L4, segmented into Driving (L2-TJA vs L3-TJP) and Parking features (e.g. L2-Self Park, L4-Valet Parking)

- What are the trends by ADAS levels in Top Premium OEMs' model range during 2016-25?

- Learn about the penetration of different levels of autonomy in European car sales.

Benchmark competition

- Strengths and weaknesses of ADAS & Autonomous Driving product portfolio, suppliers, and competitiveness

- Shares in automation in key markets and roadmap of deployment by key carline

By 2025, "Connected Collaborative Driving" rather than automated driving will be prevalent

Auto2x assesses that ADAS Level 0 to Level 2+, which accounted for 99% of new car sales across the 4 major car markets in 2022 due to the regulatory block in Level 3, will hold circa 85% share of the Autonomous Driving market by 2025. This showcases the opportunity in driver assistance systems to be the predominant solution for this decade.

ADAS revenues from the Top Automotive Suppliers of sensors such as radars, cameras, and ultrasonics, will increase with CAGR 12.6% between 2020 and 2025 to reach €35 Billion, incl. revenues from components, systems and env. model.

ADAS feature penetration is rising due to the fitment of ADAS sensors to meet safety regulations

EuroNCAP requirements for 5-star safety rating, the General Safety Regulation 2 which came into effect in Europe in 2022 and brand competition push ADAS penetration in the EU car sales as part of optional or standard equipment.

Vision-based fusion technologies will experience strong demand as the rating scheme evolves to incorporate ever more sophisticated functionality.

Parking assistance, emergency braking,and lane assist systems are the most popular ADAS in the U.K, the NL, Belgium, & France (Bosch survey).

Roadmaps to Level 4-Autonomous Driving: Winner-Changan

- Changan offers Level 3-Conditional Automated Driving since 2020 and plans Level 4 in 2025

Changan Auto's Lv.3 Traffic Jam Pilot in UNI-T and Level 2 iACC: In March 2020, Zhu Huarong, President of Changan Automobile, demonstrated the Level 3 autonomous driving function of the UNI-T SUV.

Equipped with L3-TJP, the UNI-T vehicle monitors the traffic conditions on a continuous basis and conducts fully autonomous driving at speeds up to 40 km/h; when the speed is above 40 km/h, the driver only has to keep eyes on the road information.

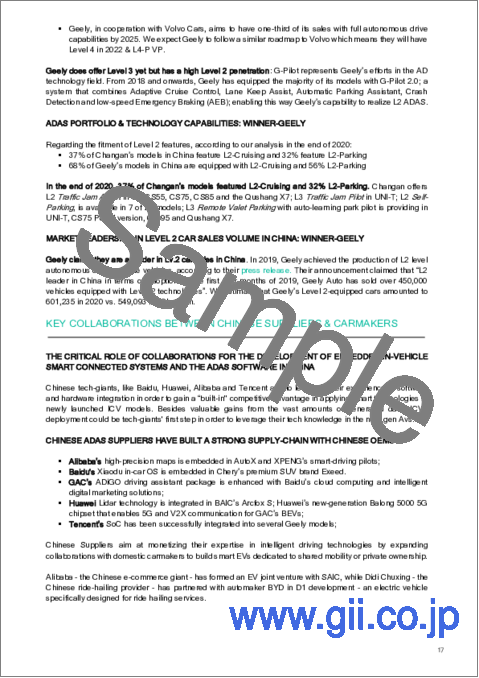

- Geely, in cooperation with Volvo Cars, aims to have one-third of its sales with full autonomous drive capabilities by 2025. We expect Geely to follow a similar roadmap to Volvo which means they will have Level 4 in 2022 & L4-P VP.

Geely does offer Level 3 yet but has a high Level 2 penetration: G-Pilot represents Geely's efforts in the AD technology field. From 2018 and onwards, Geely has equipped the majority of its models with G-Pilot 2.0; a system that combines Adaptive Cruise Control, Lane Keep Assist, Automatic Parking Assistant, Crash Detection and low-speed Emergency Braking (AEB); enabling this way Geely's capability to realize L2 ADAS.

ADAS Portfolio & Technology Capabilities: Winner-Geely

Regarding the fitment of Level 2 features, according to our analysis in the end of 2020:

- 37% of Changan's models in China feature L2-Cruising and 32% feature L2-Parking

- 68% of Geely's models in China are equipped with L2-Cruising and 56% L2-Parking

In the end of 2020, 37% of Changan's models featured L2-Cruising and 32% L2-Parking. Changan offers L2 Traffic Jam Assist in the CS55, CS75, CS85 and the Qushang X7; L3 Traffic Jam Pilot in UNI-T; L2 Self-Parking, is available in 7 of 22 models; L3 Remote Valet Parking with auto-learning park pilot is providing in UNI-T, CS75 Petrol version, CS 95 and Qushang X7.

Market leadership in Level 2 car sales volume in China: Winner-Geely

Geely claims they are a leader in Lv.2 car sales in China. In 2019, Geely achieved the production of L2 level autonomous drive capable vehicles, according to their press release. Their announcement claimed that "L2 leader in China in terms of adoption. In the first four months of 2019, Geely Auto has sold over 450,000 vehicles equipped with Level 2 technologies". We estimate that Geely's Level 2-equipped cars amounted to 601,235 in 2020 vs. 549,093 for Changan.

10 new ADAS features with high market potential and high technological maturity

Auto2x analyzed the patent filings of major carmakers and automotive suppliers, the academic research publications and investments to unveils new features for ADAS which hold strong potential to add value to customers and create new revenue pools for carmakers and suppliers.

Top new Autonomous Driving features include:

- 1. "Level 4-Teleoperation" of autonomous vehicles, i.e. remote access for safety movements, e.g. Vay

- 2. "Level 4-Autonomous Driver DNA" that reflects the brand's unique driving characteristics in the automated driving mode. This feature could enhance the driving experience for brands with sports and racing branding, such as Lotus, Alfa Romeo, Ferrari and more.

- 3. "Level 4-Autonomous Guardian", for enhanced safety, e.g. tele-operation for safe maneuvers in city or highway scenarios;

- 4. "Level 4-Self-charging autonomous electric cars". The Level 3/4 - capable vehicle navigates autonomously to the EV charging station in a private parking space or Lv.4-Valet Parking Garage.

- 5. "Level 4-AVP (Autonomous Valet Parking) without V2X, Road-Side units or support from infrastructure"

- 6. "Level 2-Acoustic Traffic Monitoring" uses Machine Listening to interpret road noise from pedestrians and other road users to support blind-spot monitoring.

- 7. "Level 3-System take-over using Web3 applications". Already, some carmakers have filled patents for automated driving systems which could take-over control of the vehicle when the driver is unable to take-back control.

- 8. "ADAS GenerativeAI applications" which can enhance self-learning capabilities and behavioural analysis. The ChatGPT frenzy expands to autonomous driving features to improve Level 2-4 functionality.

- 1. Chinese startup Haomo.ai unveiled its DriveGPT, which applies Reinforced Learning with Human Feedback (RLHF) into the generative pre-trained transformer. The company, which is backed by Great Wall Motors and is a supplier of three carmakers including Wey, claims that by introducing data about situations in which human drivers take over, the model continuously optimizes autonomous vehicles' real-time decision-making ability on roads.

- 2. In May 2023, Faraday Future unveiled its Generative AI stack for in-vehicle usage.

- 9. There are promising new applications of the Metaverse in Mobility spanning across in-vehicle features for ADAS-HMI and entertainment

- 10. Automated door-opening with sensors for object detection

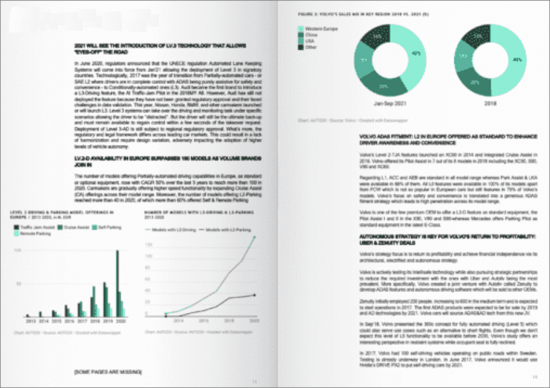

Level 3 Update: 2021 saw the introduction of SAE Level 3 technology that allows "eyes off" the road

In June 2020, regulators announced that the UNECE regulation Automated Lane Keeping Systems will come into force from January 2021 allowing the deployment of Level 3-Conditional Autonomy in signatory countries.

Deployment of Level 3-Autonomous Driving is still subject to regional regulatory approval. What's more, the regulatory and legal framework differs across leading car markets. This could result in a lack of harmonisation and require design variation, adversely impacting the adoption of higher levels of vehicle autonomy.

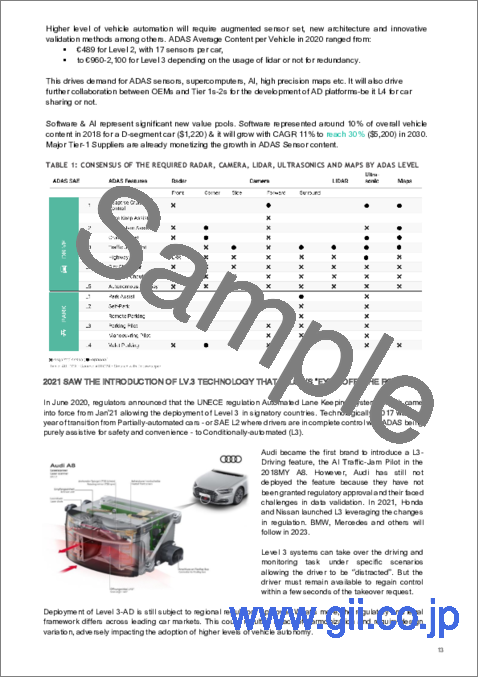

Technologically, 2017 was the year of transition from Partially-automated cars (SAE L2), where drivers are in complete control with ADAS being purely assistive for safety and convenience, to Conditionally-automated ones (L3), with Audi becoming the first to introduce an Lv.3-Driving feature, the AI Traffic-Jam Pilot in the 2018MY A8. However, Audi has still not deployed the feature because they have not been granted regulatory approval and incomplete data validation.

Is Mercedes-Benz's Level 3-Autonomy worth the 5.000 euro premium?

Level 3 systems can take over the driving and monitoring task under specific scenarios allowing the driver to be ''distracted''. But the driver will still be the ultimate back-up and must remain ''available'' to regain control within a few seconds of the takeover request.

Level 3 and L4 require augmented sensing capabilities thus additional front sensors are expected to become part of the ADAS sensor set to enhance robustness. Lidar and/or high-definition radars are expected to become the norm for this, as Audi A8's lidar above, but not everybody is going in this direction.

For example, Tesla's Hardware for the Enhanced Autopilot, which claims L3-4 capability does not include a lidar. The figures below present a representative (but not exclusive) set of building blocks, i.e., supporting ADAS driving and parking features, to enable higher levels of autonomy. Another key component for these feature roadmaps is the required sensor set for each level of automation presented below.

Some of the latest launches of Level 3-Cruising features include:

- BMW: In April 2022, BMW announced the fitment of Level 3 in the latest 7-Series & iX launched in 2023, which come equipped with solid-state Lidar with Innoviz whose order book is $4 Billion

- Changan's UNI series is equipped with Lv.3 Traffic Jam Pilot;

- General Motors will introduce its Ultra Cruise from 2023 in Cadillac models

- Honda Legend is equipped with lidar-based Sensing Elite

- Genesis: Level 3 in the new Genesis G90, since Q4 2022

- Mercedes-Benz: In December 2021, the brand announced that they meet legal requirements for Level 3 and set to launch it the capability in the EQS, & S-Class. The vehicles will be equipped with lidar from Valeo (and later from Luminar)

- Polestar's upcoming E- SUV, Polestar 3, will offer a Level 3-4 based on Volvo's Ride Pilot.

- Tesla is still testing the FSD Beta which will deliver Level 3-4 Autonomous Driving

ADAS Level 2-Driving feature availability is rising as Volume brands join in

The number of models offering Partially-automated driving capabilities in Europe, as standard or optional equipment, rose with CAGR of 71% over the last 5 years to 73 in 2018.

Carmakers are gradually offering higher-speed functionality by expanding Cruise Assist (CA) offerings across their model range. Moreover, the number of models offering L2-Parking reached 18 in 2018, of which 13 offered Self & Remote Parking.

Partially automated (SAE Level 2) model offerings expand to the compact segment

At the same time, more carmakers are introducing Level 2 parking & driving capabilities and are expanding feature availability across their model range. What's more important though is that L2 expands from premium large cars to the compact car segment.

This breakthrough is another indicator that ADAS is no longer the privilege of flagships, premium large cars, and luxurious SUVs since regulations, consumer requirements, and competition drives the fitment of ADAS.

Autonomous Driving regulation shifts from testing to deployment but standardisation will be a challenge

In SAE Level 4-Autonomous Driving, there is no need for a human driver to monitor the driving task or take back vehicle control in the operational domain of the system.

The transition from driver-centric regulation to Autonomous Driving Systems is necessary for the deployment of higher levels of vehicle autonomy. Amendment of international regulations as well as national traffic laws will soon give the green light for deployment but will there be regional inconsistencies between what's legal and what's not?

Clear guidance on the safe and secure development, testing, and deployment of AV technologies are necessary as well as harmonisation of homologation standards or vehicle certification in order to comply with safety standards.

Germany's new legislation covers the operation of fully autonomous vehicles falling under SAE Level 4

"(3) Technical supervision of a motor vehicle with autonomous driving functions within the meaning of this law is the person who can deactivate this motor vehicle during operation in accordance with paragraph 2 number 8 and release driving maneuvers for this motor vehicle in accordance with 1e paragraph 2 number 4 and paragraph 3".

Autonomous Driving start-up funding is concentrated on Level 4 Software development

Early-stage start-ups working on autonomous vehicles secured $6 Billion funding in the 2-year period between Q1 2021 and Q1 2023, from $3.5 Billion in 2021 to $2 Billion in 2022 and just $90 Million in Q1 2023, Auto2x

The Top-3 automotive start-up funding rounds in Autonomous Driving / Autonomous Vehicles came from Chinese start-ups working on Level 4 autonomy which provides un-supervised driving.

- Chinese autonomous driving start-up Deeproute.ai raised $300 Million in Series B in September 2021 to expand its Level-4 Autonomous Driving for Robotaxis and Trucks to urban logistics and fleet operation;

- Didi Woya secured $300 Million for L4 Autonomous Driving Robotaxis in a Series B round in July 2021. In April 2023, Didi Global announced its intention to develop its own robotaxis by 2025.

- WeRide raised $300 Million in Series C funding for its L4 Autonomous Driving Robotaxis in June 2021.

European Autonomous Driving start-ups secured $0.71 Billion funding since 2021, across 87 rounds.

- Wayve, a UK start-up working on Level 4 Autonomous Driving Software), raised $200 million in Series B from investors including Microsoft.

- Einride, a Swedish start-up working on Level 4 Autonomous Trucks, raised $110 Million in May 2021 to expand in Europe and the U.S

- Germany's Vay raised $95 million to develop Tele-operation,

- EasyMile (Level 4 Autonomous Driving Software) and

- Oxbotica (Level 4 Autonomous Driving Software)

- London-based insurTech company Flock raised $38 Million to provide digital insurance for autonomous vehicles.

Half of the early-stage funding raised by European start-ups is supporting the development of Level 4 Autonomous Driving Software, while 17% is for Autonomous Trucks, Auto2x analysis

Innovative Start-ups working on the future of perception and computing

Recogni is tackling the need for real-time, high-performance computation with small power budget for Level 2 and Level 3 autonomous driving systems.

Today's solutions need +7,000 TOPS and have power consumption of 26kW. Recogni launched a Peta-Scale, high-performance computing platform withlow power consumption of 25 Watts.

The California-based company counts Toyota Ventures, BMW i Ventures, Faurecia, Bosch and Continental among its investors. Listen to the interview with Recogni's Founder and CPO R K Anand to understand their value propositionto solve the data challenges for autonomy.

Recogni has the world's highest performing AI inference device at the edge for vision processing, the first Peta-Op class (one quadrillion operations per second) device. The combination of computing performance and low power consumption allows us to achieve sensing capabilities that are getting close to real human perception," continues RK Anand.

PreAct Technologies is bringing software-defined, near-field lidars to replace ultrasonics in ADAS. The company is working with ZF, Sony and Qualcomm, among other suppliers.

"PreAct's market is already a $30 billion a year. But existing technologies are holding back the industry fromreaching self-driving functionality. We want to replace other sensors with ourshort range lidar that could enable better functionality and convenience at thesame cost", Paul Drysch, Founder and CEO, PreAct Technologies.

TABLE OF CONTENTS

EXECUTIVE SUMMARY

- Carmakers' Automated Driving Mix in 2022 vs. 2025 & 2030

- Level 2-Level 4 Autonomy Readiness Level of Carmakers

- Winners vs. laggards

- Top partnership in 2022 & Q1 2023

- Investment highlights in 2022-Q1 2023

1. THE STATUS OF AUTOMATED DRIVING DEPLOYMENT BY LEVEL IN 2023

- SAE Level 4 update:

- Level 4 Roadmaps by 2030

- Favourable regulations and policy in the U.S and Germany open opportunities for robotaxis

- New launches of Level 3 features: What, What, When, How

- Lidar fitment for Level 3-Autonomy: Overview of supply chain

- Democratization of ADAS accelerates to meet safety mandates but techno-economic deployment challenges of Level 3 still persist

- Regulation finally allowed Level 3 "conditional eyes-off the road'' in signatories of UNECE regulation N.79 after years of delays

- Germany's attempt to gain a competitive advantage was hindered by a slow regulatory update for Level 3 deployment

- Level 2 model availability in Europe between 2016 & 2023

- L2-D is expanding across carlines reaching the compact segment

- ADAS content is increasing to meet safety regulatory mandates and bridge the technological gap for higher levels of autonomy

- SAE Level 2 status in Europe 2023: TJA, SP & RP availability (%)

- L2-Driving feature status in Europe in 2023: e.g. Traffic Jam Assist availability

- Comparison of L2-D technology: speeds, lane change, hands-on detection, stop-in-lane, and naming strategy

- EuroNCAP's 2025 rating of Highway Assist / SAE Lv.2 features

- L2-P in Europe 2023 Self-Park & Remote Parking availability

- Level 2 penetration in European car sales in 2023

- Level 2 OEM ranking in 2017 vs 2023: leaders and followers

- SAE Level 1 in Europe 2023: ACC, AEB, PA, & LKA availability

- Level 0 penetration in Europe 2023: BSM, DDM, FCW, LDW & TSR

- Marketing names for ADAS L0/L1 features in Top-6 Premium OEMs

- Level 3 testing/pilots: who tests what and where

- The implications of Conditionally-automated driving on HMI

2. THE STATUS OF AUTOMATED DRIVING DEPLOYMENT BY LEVEL 0-4 BY 2030

- Read why regulation challenges Autonomous Driving deployment

- Overview of AD regulatory & legal status in key geographics

- The amendment of Reg.79 allowed L3 in UNECE from Jan 2021

- ADAS are assistive and hands-on the wheel is always required

- Reg.79 amendment is the critical step toward self-steering systems

- Three concerns arising from Reg.79's amendment

- Automated Lane-Keeping System (ALKS) Regulation for Lv3

- The USA has opened up the road to HAVs with guidelines

- State of AV testing in the United States

- Concerns over U.S policy on Automated Driving Systems

- L3 automated driving is legal in Germany from autumn'17

- The impact of AD regulation on L3 deployment

- Technical challenges for deployment affecting AD adoption

- Liability in L3 and the role of Event Data Recorders for AD

- Vehicle Cybersecurity becomes a priority for carmakers

- OEM and regulatory activity heats up in major car markets

- What regulatory/legal action is needed to secure Connected Cars?

3. OEM STRATEGIES & BUSINESS MODELS IN AUTOMATED DRIVING BY 2030

- Incremental vs skip approach to reach Highly-automated driving

- Build your own Automated Driving platform vs collaboration

- Consortiums for L3-5 platforms, AMoD, and HD maps

- Why ADAS Suppliers are well-positioned to monetize ADAS growth

- Digitalization unlocks personalisation & new mobility services

- Use cases and business models to commercialise L4/5

- Mobility-as-a-Service (MaaS)

4. FROM ASSISTED TO AUTONOMOUS: L2-L4 ROADMAP FROM LEADING OEMS

- Overview of L2-L4 Driving & Parking roadmap by OEM at earliest implementation

- Automated Driving technology roadmap: ADAS feature & sensor set

- Aggregate sales forecast by L2-D to L4-Driving features in EU, USA, China 2013 & 2025

- Aggregate L2-D car & LV sales forecast in EU, USA & China 2013-25

- Learn which geographies will lead Level 3 deployment

- Aggregate Level 3-Driving equipped car sales forecast up to 2025

- Aggregate sales of cars & LV with L4-Driving features by 2025

- European AD forecast up to 2025: Driving vs Parking features

- European AD roadmap for driving features: L2-D to L4-D

- The impact of EuroNCAP's 2025 roadmap

- Market shares in Europe's car sales by level of automation 2015-25

- Partial automation (L2-D) forecast in Europe 2013-25

- Conditional automation (L3-D) forecast in Europe 2018-25

- L4-Driving forecast in European car sales 2018-25

- European AD roadmap for parking features up to '21: L2-P to L4-P

- Market shares of OEMs by Level of Automated Driving in Europe: L2-Driving, L3/4-D

- USA Autonomous Driving Forecast for Driving features up to 2025

- USA LV Sales & Penetration by L2-D to L4-D between 2013 & 2025

- USA forecast of Light Vehicle sales for L2-Driving features 2013-25

- USA forecast of Light Vehicle sales with L3-Driving features by 2025

- USA forecast of LV sales with L4-Driving features by 2025

- China Automated Driving Forecast: L2-D to L4-D 2013 to 2030

- Lidar forecast up to 2030 in passenger cars

5. CARMAKER ADAS & AUTOMATED DRIVING ROADMAP & OUTLOOK

- 1. Audi

- 2. BAIC Motors

- 3. Bentley

- 4. BMW

- 5. Mini

- 6. BYD

- 7. CHANGAN

- 8. Chery

- 9. Mercedes-Benz

- 10. Ford

- 11. Geely

- 12. General Motors: Cadillac and Chevy-Cruise

- 13. Great Wall

- 14. GUANGZHOU AUTOMOBILE GROUP (GAC)

- 15. Honda

- 16. Hyundai, KIA, and Genesis

- 17. Jaguar Land Rover's AD outlook: feature roadmap & AD level mix

- 18. Lucid

- 19. NIO

- 20. Porsche

- 21. PSA

- 22. Renault-Nissan-Mitsubishi Alliance

- 1. Nissan & Infiniti

- 2. Renault

- 23. SAIC

- 24. Stellantis

- 25. FCA: Focus on Alfa Romeo, Fiat, Maserati & Jeep

- 26. PSA

- 27. Subaru

- 28. Tesla Motors

- 29. Toyota Motors: Lexus and Toyota

- 30. Volvo

- 31. VW's strategy & model range by Level of Automated Driving

- 32. XPeng

6. APPENDIX

- Model availability by level of automation in Europe, 2015-2025

- Models with Level 2-Driving features in Europe, 2015-2025

- Models with Level 2-Parking features in Europe, 2015-2025

- Models with Level 3-Driving features in Europe, 2015-2025

- Models with Level 4 features in Europe, 2015-2025