|

|

市場調査レポート

商品コード

1089691

建設のマレーシア市場 - 市場規模、動向、予測:セクター別 - 商業、工業、インフラ、エネルギー・ユーティリティ、施設、住宅(2022年~2026年)Malaysia Construction Market Size, Trends and Forecasts by Sector - Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential Market Analysis, 2022-2026 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 建設のマレーシア市場 - 市場規模、動向、予測:セクター別 - 商業、工業、インフラ、エネルギー・ユーティリティ、施設、住宅(2022年~2026年) |

|

出版日: 2022年07月26日

発行: GlobalData

ページ情報: 英文 50 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

マレーシアの建設の市場規模は、2023年から2026年の予測期間中に6.3%の年平均成長率が予想されています。市場の成長を後押しする主な要因には、輸送とエネルギープロジェクトへの投資などが挙げられます。

当レポートでは、マレーシアの建設市場を調査しており、概要、市場の見通し、セクター別の分析など、包括的な情報を提供しています。

目次

目次

第1章 エグゼクティブサマリー

第2章 建設業界:概要

第3章 コンテキスト

- 経済的実績

- 政治環境と政策

- 人口統計

- COVID-19の状況

- リスクプロファイル

第4章 建設の見通し

- すべての建設

- 見通し

- 最新のニュースと開発

- 建設プロジェクトモメンタムインデックス

- 商業建設

- 見通し

- プロジェクト分析

- 最新のニュースと開発

- 工業建設

- 見通し

- プロジェクト分析

- 最新のニュースと開発

- インフラ建設

- 見通し

- プロジェクト分析

- 最新のニュースと開発

- エネルギー・ユーティリティ建設

- 見通し

- プロジェクト分析

- 最新のニュースと開発

- 施設建設

- 見通し

- プロジェクト分析

- 最新のニュースと開発

- 住宅建設

- 見通し

- プロジェクト分析

- 最新のニュースと開発

第5章 主要な業界参加者

- 請負業者

- コンサルタント

第6章 建設市場データ

第7章 付録

List of Tables

List of Tables

- Table 1: Construction Industry Key Data

- Table 2: Malaysia, Key Economic Indicators

- Table 3: Malaysia, Commercial Construction Output by Project Type (Real % Change), 2017-26

- Table 4: Malaysia, Top Commercial Construction Projects by Value

- Table 5: Malaysia, Industrial Construction Output by Project Type (Real % Change), 2017-26

- Table 6: Malaysia, Top Industrial Construction Projects by Value

- Table 7: Malaysia, Infrastructure Construction Output by Project Type (Real % Change), 2017-26

- Table 8: Malaysia, Top Infrastructure Construction Projects by Value

- Table 9: Malaysia, Energy and Utilities Construction Output by Project Type (Real % Change), 2017-26

- Table 10: Malaysia, Top Energy and Utilities Construction Projects by Value

- Table 11: Malaysia, Institutional Construction Output by Project Type (Real % Change), 2017-26

- Table 12: Malaysia, Top Institutional Construction Projects by Value

- Table 13: Malaysia, Residential Construction Output by Project Type (Real % Change), 2017-26

- Table 14: Malaysia, Top Residential Construction Projects by Value

- Table 15: Malaysia, Key Contractors

- Table 16: Malaysia, Key Consultants

- Table 17: Malaysia, Construction Output Value (Real, $ Million)

- Table 18: Malaysia, Construction Output Value (Nominal, MYR Million)

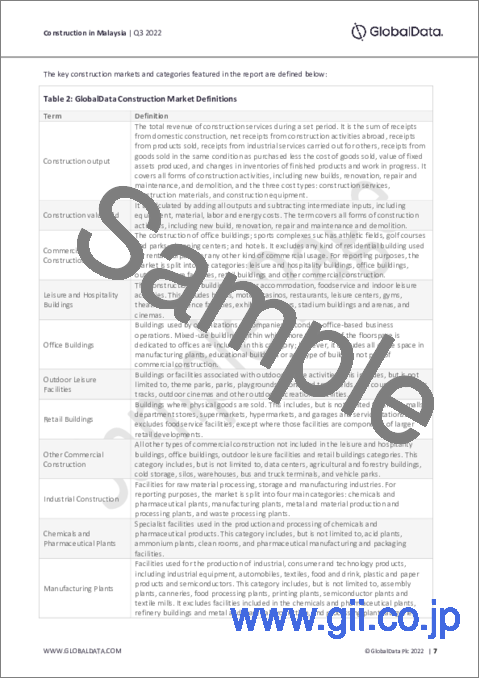

- Table 19: GlobalData Construction Market Definitions

- Table 20: Risk Dimensions

- Table 21: Ratings, Scores and Definitions

List of Figures

List of Figures

- Figure 1: South and South-East Asia, Construction Output (Real % Change), 2020-26

- Figure 2: Malaysia, Construction Output by Sector (Real % Change), 2020-22 and 2023-26

- Figure 3: Malaysia, COVID-19 Confirmed Cases

- Figure 4: Malaysia, Risk Summary

- Figure 5: Malaysia, Risk Regional Comparison

- Figure 6: Malaysia, Construction Output Value (Real, $ Billion, 2017 Prices and Exchange Rate), 2017-26

- Figure 7: Malaysia, Construction Output Value, by Sector (Real, $ Million), 2017-26

- Figure 8: Malaysia, Construction Value Add, 2015 Constant Prices, in MYR Million

- Figure 9: Malaysia, Value of Construction Work Done, % Change YoY

- Figure 10: Malaysia, Gross Fixed Capital Formation, 2015 Constant Prices, in MYR Billion

- Figure 11: Malaysia, Loans Disbursed for the Construction Sector, in MYR Million

- Figure 12: Malaysia, Construction Projects Momentum Index

- Figure 13: Region, Construction Projects Momentum Index

- Figure 14: Malaysia, Commercial Construction Output by Project Type (Real, $ Million), 2017-26

- Figure 15: Malaysia, Commercial Construction Projects Pipeline, Value by Stage ($ Million)

- Figure 16: Malaysia, Tourist arrivals, in thousands

- Figure 17: Malaysia, Wholesale and Retail Sales, % Change YoY

- Figure 18: Malaysia, Construction Loans Disbursed for Wholesale and Retail Trade and Restaurants and Hotels, % Change Year-on-year

- Figure 19: Malaysia, Industrial Construction Output by Project Type (Real, $ Million), 2017-26

- Figure 20: Malaysia, Industrial Construction Projects Pipeline, Value by Stage ($ Million)

- Figure 21: Malaysia, Manufacturing Value Add, 2015 Constant Prices, in MYR Million

- Figure 22: Malaysia, Industrial and Manufacturing Production Indices, 2015=100, % Change YoY

- Figure 23: Malaysia, Total Exports, in MYR Million

- Figure 24: Malaysia, Infrastructure Construction Output by Project Type (Real, $ Million), 2017-26

- Figure 25: Malaysia, Infrastructure Construction Projects Pipeline, Value by Stage ($ Million)

- Figure 26: Malaysia, Value of Civil Engineering Construction Work Done, in MYR Million

- Figure 27: Malaysia, Energy and Utilities Construction Output by Project Type (Real, $ Million), 2017-26

- Figure 28: Malaysia, Energy and Utilities Construction Projects Pipeline, Value by Stage ($ Million)

- Figure 29: Malaysia, Institutional Construction Output by Project Type (Real, $ Million), 2017-26

- Figure 30: Malaysia, Institutional Construction Projects Pipeline, Value by Stage ($ Million)

- Figure 31: Malaysia, Private Health Services Value Add, 2015 Constant Prices, in MYR Million

- Figure 32: Malaysia, Private Education Services Value Add, 2015 Constant Prices, in MYR Million

- Figure 33: Malaysia, Residential Construction Output by Project Type (Real, $ Million), 2017-26

- Figure 34: Malaysia, Residential Construction Projects Pipeline, Value by Stage ($ Million)

- Figure 35: Malaysia, Real Estate Value Add, 2015 Constant Prices, in MYR Million

- Figure 36: Malaysia, Value of Residential Construction Work Done, in MYR Billion

- Figure 37: Malaysia, Loans Disbursed for the Purchase of Residential Property, in MYR Million

- Figure 38: Malaysia, Headquarters of Key Contractors (% of Total Project Pipeline)

- Figure 39: Malaysia, Headquarters of Key Consultants (% of Total Project Pipeline)

The Malaysian construction industry registered a contraction of 5.3% in real terms in 2021, due to the impact of the restrictions imposed amid a severe outbreak of the Delta variant of coronavirus (COVID-19) in Q3 2021. This year, with most restrictions lifted, activity in the construction industry is expected to improve from its 2021 levels, although the industry is not expected to surpass its pre-pandemic levels until 2026. According to the Department of Statistics Malaysia (DOSM), the construction value add fell by 6.2% year on year (YoY) in Q1 2022 (the latest data available at the time of writing), following Y-o-Y declines of 12.3% in Q4 and 20.6% in Q3 2021. Although downside risks have risen on the global front, including global supply chain disruptions and the Russia-Ukraine war, the Bank of Malaysia (Bank Negara Malaysia) projected no risk of any recession in Malaysia this year.

The construction industry is expected to register an annual average growth rate of 6.3% between 2023 and 2026, supported by investment in transportation and energy projects. In September 2021, the government announced its plan to establish the Public Private Partnership (PPP) 3.0 model, a specialized mechanism to fund infrastructure projects under the 12th Malaysia (12MP) plan between 2021 and 2025. In June 2021, the government unveiled its energy transition plans until 2040, aiming to increase the proportion of renewable energy in the total energy mix from 2% in 2019 to 31% by 2025 and 40% by 2035. As part of the 12MP, the government announced its goal of developing 120 cities to achieve sustainable city status by 2025, by providing additional support to private sector projects implementing strategic development programs. The government also intends to construct 500,000 affordable houses by 2025.

The report provides detailed market analysis, information, and insights into the Malaysian construction industry, including -

- The Malaysian construction industry's growth prospects by market, project type and construction activity

- Critical insight into the impact of industry trends and issues, as well as an analysis of key risks and opportunities in the Malaysian construction industry

- Analysis of the mega-project pipeline, focusing on development stages and participants, in addition to listings of major projects in the pipeline.

Scope

This report provides a comprehensive analysis of the construction industry in Malaysia. It provides -

- Historical (2017-2021) and forecast (2022-2026) valuations of the construction industry in Malaysia, featuring details of key growth drivers.

- Segmentation by sector (commercial, industrial, infrastructure, energy and utilities, institutional and residential) and by sub-sector

- Analysis of the mega-project pipeline, including breakdowns by development stage across all sectors, and projected spending on projects in the existing pipeline.

- Listings of major projects, in addition to details of leading contractors and consultants

Reasons to Buy

- Identify and evaluate market opportunities using GlobalData's standardized valuation and forecasting methodologies.

- Assess market growth potential at a micro-level with over 600 time-series data forecasts.

- Understand the latest industry and market trends.

- Formulate and validate strategy using GlobalData's critical and actionable insight.

- Assess business risks, including cost, regulatory and competitive pressures.

- Evaluate competitive risk and success factors.

Table of Contents

Table of Contents

1 Executive Summary

2 Construction Industry: At-a-Glance

3 Context

- 3.1 Economic Performance

- 3.2 Political Environment and Policy

- 3.3 Demographics

- 3.4 COVID-19 Status

- 3.5 Risk Profile

4 Construction Outlook

- 4.1 All Construction

- Outlook

- Latest news and developments

- Construction Projects Momentum Index

- 4.2 Commercial Construction

- Outlook

- Project analytics

- Latest news and developments

- 4.3 Industrial Construction

- Outlook

- Project analytics

- Latest news and developments

- 4.4 Infrastructure Construction

- Outlook

- Project analytics

- Latest news and developments

- 4.5 Energy and Utilities Construction

- Outlook

- Project analytics

- Latest news and developments

- 4.6 Institutional Construction

- Outlook

- Project analytics

- Latest news and developments

- 4.7 Residential Construction

- Outlook

- Project analytics

- Latest news and developments

5 Key Industry Participants

- 5.1 Contractors

- 5.2 Consultants

6 Construction Market Data

7 Appendix

- 7.1 What is this Report About?

- 7.2 Definitions

- 7.3 CRI Methodology

- 7.4 GlobalData Construction

- Contact Us